Table of Contents

Introduction

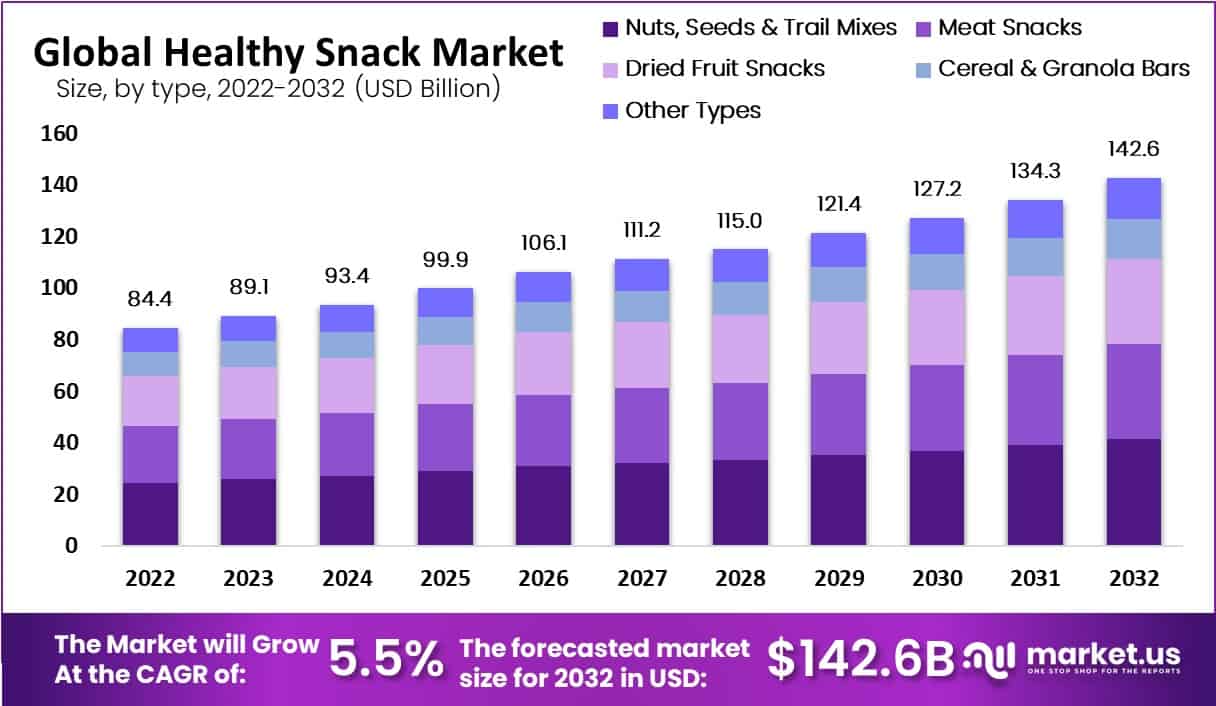

The global healthy snack market is poised for substantial growth, with an expected increase from USD 84.4 billion in 2022 to USD 142.6 billion by 2032, at a compound annual growth rate (CAGR) of 5.5%. This growth is driven by several key factors including rising consumer awareness of health benefits associated with snack choices, the expanding food industry, and shifting lifestyle trends favoring healthier eating habits.

However, the market faces challenges such as intense competition among brands, evolving consumer preferences that demand constant innovation, and complexities in sourcing high-quality, sustainable ingredients. Despite these hurdles, the market has witnessed significant developments, such as an increasing trend towards organic and natural ingredients. This led to the introduction of snacks free from artificial additives and preservatives. Moreover, regulatory changes in food labeling laws influence market dynamics, necessitating manufacturers stay agile and informed about compliance standards.

Recent market trends also indicate a shift towards plant-based and vegan snack options, driven by consumer demand for sustainable and ethical food choices. The online sales channel is experiencing rapid growth, offering convenience and a broad array of consumer products, which is expected to contribute significantly to market expansion.

Regionally, North America currently leads the market, driven by high consumer health consciousness and demand for convenience foods. However, the Asia Pacific region is anticipated to experience the highest growth rate during the forecast period due to increasing urbanization, rising disposable incomes, and growing consumer health awareness.

Healthy Snack Statistics

- Share of Organic Food Sales: Organic food sales represent over 4% of total U.S. food sales, which were valued at $850 billion in 2020.

- Consumer Motivations: 76% of adults buy organic foods for health reasons, driven by perceptions of organic foods being healthier than conventional options.

- Availability: Organic food is now found in nearly 20,000 natural food stores and three out of four conventional grocery stores.

- Top-Selling Organic Produce: Berries have exceeded $1 million in sales in 2022, leading among organic fresh produce items.

- Cadmium Concentration: Organic foods contain 48% lower cadmium concentrations on average compared to conventional crops, potentially reducing health risks.

- Genetically Engineered Ingredients: Approximately 75% of processed foods contain genetically engineered ingredients, with common items including soup, soda, crackers, and condiments.

- Snack Contribution to Energy Intake: Snacks account for 28% of total energy intake among 2- to 5-year-old children in the United States.

- Carbohydrate Intake from Snacks: Snacks contribute to 32% of total carbohydrate intake for the day.

- Added Sugars from Snacks: About 39% of added sugars in children’s diets come from snacks.

- Total Fat Intake from Snacks: Snacks contribute to 26% of total fat intake among young children.

- Dietary Fiber Intake from Snacks: Snacks provide 26% of dietary fiber intake for the day.

- Beverages Consumed as Snacks: Snacking occasions account for 46.6% of all beverages consumed by children.

- Leading Snack Food Sources of Energy: The snacks and sweets category, including cookies and pastries, contributes to 44% of energy intake during snacking.

- Leading Sources of Total Fat from Snacks: Snacks like cookies and pastries contribute to 52% of total fat consumed during snacking.

- Leading Sources of Added Sugars from Snacks: Sweetened beverages such as fruit and sports drinks contribute to 25% of added sugars obtained from snacks.

Emerging Trends

- Increased Demand for Functional Snacks: There’s a growing consumer interest in snacks that satisfy hunger and offer additional health benefits. This includes snacks that support gut health, immunity, and even mental well-being. Functional ingredients such as prebiotics, probiotics, and plant-based proteins are becoming increasingly popular.

- Natural and Clean Label Products: Consumers are increasingly seeking snacks made from natural ingredients, with minimal processing and no artificial additives. This trend is driving the demand for clean-label products, which are perceived as healthier.

- Innovative Formats: Snack formats are evolving beyond traditional bars and chips. New, fun formats like bites, balls, and even mini-versions of popular snacks are on the rise. These not only cater to the demand for portion-controlled eating but also add an element of novelty to snacking.

- Rise of Plant-Based Snacks: The shift towards plant-based diets is influencing the snack market as well. Snacks that incorporate plant-based proteins and dairy alternatives are gaining traction. This trend is also reflected in the success of products like dairy-free ice creams and meat-alternative snacks.

- Snacking as Meal Replacements: With busy lifestyles, consumers are increasingly turning to snacks as substitutes for traditional meals. This is particularly evident in the popularity of protein-rich snacks that are intended to be filling enough to replace a meal, catering to the needs for convenience and nutrition.

- Sustainability and Ethical Sourcing: Consumers are becoming more conscious of the environmental impact of their food choices. This has led to a preference for snacks that are not only healthy but also produced in an environmentally sustainable and ethically responsible manner.

Use Cases

- On-the-Go Nutrition: Healthy snacks like nuts, granola bars, and fruit packs are increasingly favored by consumers who lead busy lives and require quick, nutritious options that can be consumed on the move. This trend caters to professionals, students, and anyone else needing easy-to-carry and energy-boosting snacks.

- Weight Management and Healthy Eating: Low-calorie, nutrient-dense snacks such as vegetables, Greek yogurt, and air-popped popcorn are popular among consumers focused on weight management. These snacks provide fulfilling and flavorful options without excessive calorie intake, supporting healthy dieting habits.

- Workplace and School Snacking: Nutritious snacks are becoming staples in workplaces and educational institutions where there is a growing emphasis on the importance of nutrition for productivity and cognitive function. Pre-portioned snack packs, whole fruits, and veggie sticks are among the preferred choices to promote healthier eating behaviors in these settings.

- Indulgent yet Healthful Snacking: There is a significant demand for snacks that not only satisfy hunger but also offer a guilt-free indulgence. This includes options like dark chocolate, low-sugar yogurts, and savory snacks with healthful twists, catering to a more health-conscious consumer base.

Key Players Analysis

PepsiCo Inc. in the Healthy Snack Sector: PepsiCo is intensively focusing on expanding its healthier snack options in response to growing consumer demand for nutritious products. The company has set ambitious targets to increase the sales of its healthier snacks significantly by 2025, with plans to grow this segment into a $1 billion portfolio by 2030. PepsiCo is leveraging its experience in reducing sugars in its beverage sector to drive similar reformulations in its snack portfolio, introducing products like Lay’s Oven Baked and PopWorks, a new popped corn crisps range, that aligns with its commitment to offer more nutritious options.

Nestlé S.A. in the Healthy Snack Sector: Nestlé is actively expanding its footprint in the healthy snack market, capitalizing on its broad product portfolio and innovation capabilities. The company’s strategy includes enhancing its existing products and introducing new ones that meet the nutritional needs and preferences of today’s health-conscious consumers. Nestlé focuses on leveraging innovative food technologies and ingredients to offer better-for-you snack options that do not compromise on taste or quality, aiming to cater to a global audience increasingly inclined towards nutritious and convenient snacking options.

Unilever PLC has made significant strides in the healthy snack sector, notably through its acquisition of Graze, a leading UK brand known for its range of snack bars, seeds, and nuts. This acquisition, valued at £150 million, represents a strategic move to expand Unilever’s footprint in the fast-growing healthy snacking market. Graze, known for its commitment to offering convenient, nutritious, and personalized snacking options, complements Unilever’s existing health-focused brand portfolio. This partnership is expected to leverage Graze’s strong e-commerce capabilities and innovative approach to meet the evolving needs of modern consumers, particularly millennials who prioritize health and convenience.

Tyson Foods Inc. has been expanding its presence in the healthy snack sector by enhancing its portfolio of prepared foods, which includes a variety of protein-rich and conveniently packaged snacks. This move is part of Tyson’s broader strategy to cater to the growing consumer demand for nutritious and easy-to-consume options. Their efforts in the healthy snack market are supported by their continuous investment in product innovation, ensuring that their offerings not only meet the nutritional needs but also match the taste preferences of health-conscious consumers.

Kellogg Company is actively redefining its presence in the healthy snack sector through its spin-off entity, Kellanova, which focuses on leveraging and expanding its well-known snack brands like Pringles, Cheez-It, and Pop-Tarts. This strategic shift emphasizes innovation, smaller package offerings, and enhanced marketing strategies aimed at driving growth in both established and developing markets. Kellanova aims to capitalize on the increasing consumer demand for convenient and healthier snack options, underpinning its strategy with investments in infrastructure modernization and merchandising to boost market share and consumer engagement.

B & G Foods Inc. has been actively expanding its presence in the healthy snack sector, leveraging its diverse portfolio of brands to meet growing consumer demand for nutritious and convenient snack options. The company focuses on strategic acquisitions and innovation to diversify and strengthen its product offerings in the healthy snack category. This strategy includes enhancing existing products and introducing new ones that align with consumer trends towards healthier eating. B & G Foods aims to capitalize on these trends by continuously improving and expanding its snack product lines, ensuring they meet the modern consumer’s needs for both health and convenience.

Mondelēz International is actively advancing its position in the healthy snack sector by emphasizing “mindful snacking” and catering to evolving consumer preferences. The company’s initiatives include portion-controlled snack options and an emphasis on sustainable snacking practices, aiming to reduce environmental impact and improve nutritional content across its product range. This approach is part of their broader “Snacking Made Right” agenda, which integrates environmental, social, and governance (ESG) goals to create long-term value and meet their 2025 targets. Mondelēz’s focus on innovation and global consumer trends ensures it remains a key player in the snack market by continuously adapting to and anticipating consumer needs.

Select Harvest Almond Snacks is making significant strides in the healthy snack sector with its innovative almond-based products. Focused on sustainability and health, they offer a variety of snacks like the Monk Crunch series, which features almonds sweetened naturally with monk fruit, catering to health-conscious consumers looking for low-glycemic index options. Their commitment to environmental responsibility is evident in their orchard management practices and efforts to reduce water usage, manage dust, and enhance soil health. Select Harvest’s approach not only meets the growing demand for quality and sustainability but also positions them well within the competitive healthy snack market.

Happytizers Pvt. Ltd, based in Bengaluru, operates under the brand Lil’ Goodness, focusing on producing snacks specifically tailored for children. They recently raised Rs 5 crore in a seed funding round led by Beyond Next Ventures and other investors, emphasizing their commitment to expanding their product range and distribution. The company’s offerings include a variety of healthy snacks designed to enhance immunity in children, using ingredients like vegetables, cereals, and milk. Their products, available in numerous retail outlets and online platforms, aim to provide nutritious snacking options for children, aligning with the growing demand for health-conscious food choices.

Conclusion

In conclusion, the healthy snack market is demonstrating robust growth, driven by a global shift towards health-conscious eating habits and the increasing demand for convenient, nutritious options. As consumers continue to prioritize health and wellness, the industry is responding with innovative product offerings that cater to diverse dietary preferences and lifestyles. The rise of functional snacks, clean label products, and sustainable practices further reflect the evolving market dynamics. With significant growth anticipated in various regions, particularly in North America and the Asia Pacific, the healthy snack market is poised to expand its reach and influence, offering substantial opportunities for industry players and new entrants alike. This market’s future looks promising as it aligns with ongoing trends towards healthier living and mindful consumption.