Table of Contents

Introduction

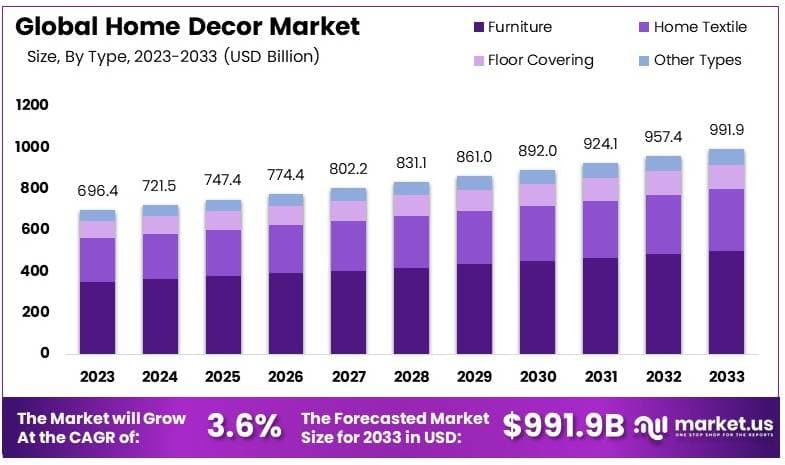

The Global Home Decor Market is witnessing steady growth, projected to expand from USD 696.4 billion in 2023 to approximately USD 991.9 billion by 2033, at a CAGR of 3.6%.

This growth can be attributed to several key factors, including rising disposable incomes, urbanization, and the increasing trend of enhancing residential spaces with personalized and sustainable decor solutions. The shift towards e-commerce platforms has also revolutionized consumer purchasing behavior, offering a wider selection and convenience, which in turn supports market expansion.

Companies are leveraging these platforms to reach new demographics, particularly in emerging markets such as Asia-Pacific, where rapid urbanization and an expanding middle class are driving demand for contemporary and Western-style decor. Moreover, innovations in smart home technology and sustainable materials present significant opportunities for growth, as consumers become more conscious of both aesthetics and environmental impact

The Home Decor Market encompasses products designed to enhance the aesthetic appeal and functionality of residential spaces. This includes furniture, textiles, lighting, floor coverings, wall decor, and various accessories that contribute to the overall ambiance and style of homes. The market is highly diverse, catering to multiple consumer preferences and price points, from luxury and premium offerings to more affordable, mass-market solutions.

The market’s growth is primarily driven by increasing consumer spending on home improvement and renovation, particularly in developed regions such as North America and Europe. Urbanization in developing markets, especially in Asia-Pacific, is also accelerating demand, as rising disposable incomes and evolving lifestyles lead to greater investment in home decor products. Additionally, the shift towards sustainable and eco-friendly options has pushed manufacturers to innovate and expand their product lines to meet evolving consumer preferences

Home decor products is growing due to the increasing focus on creating comfortable and personalized living spaces. The popularity of online shopping platforms has significantly enhanced market access, allowing consumers to explore and purchase a wide variety of products easily. Moreover, the rise in interior design trends on social media platforms has influenced consumers, encouraging more frequent updates to home interiors, further boosting market demand

The Home Decor Market presents substantial opportunities, particularly in emerging economies like India, China, and other Southeast Asian countries. The rapid pace of urban development and a growing middle-class population in these regions are creating new avenues for market expansion. Moreover, the integration of technology in home decor, such as smart lighting and automated systems, represents a lucrative opportunity as consumers increasingly seek innovative solutions that combine functionality with aesthetics.

Key Takeaways

- The Home Decor Market was valued at USD 696.4 billion in 2023 and is projected to reach USD 991.9 billion by 2033, expanding at a CAGR of 3.6%.

- In 2023, the furniture segment led the market with a 50.4% share, driven by consumers prioritizing comfort and multifunctional design in home environments.

- Specialty stores commanded 45% of the market in 2023, indicating a strong consumer preference for curated, high-quality home decor products.

- The e-commerce segment exhibited significant growth in 2023, reflecting the rising trend of online shopping and its convenience for consumers.

- North America held the largest market share of 39.7% in 2023, supported by robust consumer spending and a focus on home renovation and improvement activities.

Home Decor Statistics

- In 2023, 35% of Americans planned to redecorate their homes, showing a strong interest in home improvement.

- On average, American households spend $1,891 per year on home furnishings.

- Online sales represent 14% of the home decor market as of 2023, highlighting the importance of e-commerce.

- Millennials, making up 37% of the market, are the largest group buying home decor products.

- Sales of indoor plants as decor grew by 18% in 2023 compared to 2022.

- Smart home devices are gaining popularity, with 42% of homeowners planning to integrate them into their decor.

- Vintage and second-hand furniture sales rose by 15% in 2023.

- In the United States, the average cost of renovating a living room was $8,790 in 2023.

- Customizable and modular furniture sales increased by 22% in 2023, showing demand for flexible design options.

- By 2024, 65% of homeowners prefer a minimalist aesthetic.

- Eco-friendly home decor products saw a 25% sales rise in 2023, reflecting a shift toward sustainability.

- In 2024, 53% of homeowners plan to use natural materials like wood and stone in their decor.

- About 39% of homeowners are expected to add bold, statement pieces to their spaces in 2024.

- Women make up 72.7% of all interior designers, while men account for 22.4%.

- The U.S. employs over 119,778 interior designers.

- The average age of an interior designer is 42 years.

- Interior designers earn about $57,060 annually or $27.43 hourly.

- Female interior designers earn 95 cents for every dollar earned by men.

- The interior design sector in the U.K. is valued at £6.4 billion.

- White interior designers comprise 83.9%, while Hispanic/Latino and Asian groups make up 7.3% and 4.3%, respectively.

- The home decor market is growing steadily, with certain segments seeing 10% annual growth.

- E-commerce held 17.1% of the home furnishings market in 2022 but may drop to 15.7% by 2025.

- Eleven brands hold 55% of the home furnishings market, leaving room for new entrants.

- Around 70% of consumers prefer personalized home decor reflecting their unique styles.

- About 60% of consumers seek eco-friendly and sustainable options in home decor.

- North American spending on home furnishings could reach $98.3 billion by 2025.

- Approximately 90% of interior designers are women, with most being over 40 years old.

- Caucasians make up about 73% of interior designers in the U.S., with ongoing efforts to increase diversity.

- The average American home has around 300,000 items, indicating rising clutter.

- Around 10% of Americans use storage units, showing a trend toward accumulating more belongings.

- Americans spend about $1.2 trillion annually on nonessential goods, including home decor.

- The interior design industry is expected to grow by 13% over the next decade, with specialized areas growing at 20%.

- Interior designers in architectural engineering earn about $60,910 yearly, while those in specialized design earn around $54,710.

- Many American homes have more televisions than people, highlighting spending patterns.

- Although American children represent a small percentage of the global population, they own 40% of the world’s toys.

- The average American discards about 65 pounds of clothing annually, raising environmental concerns.

Emerging Trends

- Warm and Earthy Color Palettes: 2024 sees a shift toward warm, nature-inspired hues like browns, greens, and muted pastels. These shades are replacing bolder jewel tones, creating calm, grounded spaces that align with eco-friendly and biophilic design trends. Interior designers are increasingly using these tones to foster soothing environments, especially for smaller rooms needing a sense of spaciousness and light.

- Organic Modern Style: The organic modern style, which combines minimalistic aesthetics with natural elements such as wood, cotton, and linen, continues to grow in popularity. This trend emphasizes sustainability and comfort, integrating curved furniture and natural textures for a cohesive, serene look.

- Vintage and Upcycled Decor: Reflecting the push towards sustainability, there is a rising preference for vintage furniture and repurposed items. Homeowners are increasingly opting for thrifted finds or heirloom pieces, transforming older items through modern refurbishments rather than purchasing new products.

- Outdoor Wellness Spaces: Integrating wellness into home spaces is a key focus, with features like small pools, cold plunge baths, saunas, and meditation areas becoming popular. These additions not only enhance personal well-being but also emphasize a strong connection between indoor and outdoor environments

- Retro Influences and Dark Maximalism: Nostalgia is making a comeback with a revival of 1970s-inspired designs, including abstract patterns and bold wallpapers. Additionally, dark maximalism embraces rich, saturated colors like deep greens and burgundies, combined with varied textures for a dramatic, cozy effect

Use Cases

- Living Room Redesigns: Approximately 40% of home improvement projects in 2024 focus on living rooms, integrating soft furnishings, curved sofas, and warm, neutral palettes to create inviting spaces that prioritize comfort and socialization.

- Sustainable Kitchen Renovations: Eco-friendly kitchens, featuring reclaimed wood cabinets and natural stone countertops, are on the rise. These projects account for 35% of kitchen renovations, with homeowners seeking both functionality and sustainable design.

- Outdoor Entertainment Areas: Creating outdoor entertainment zones, such as garden dining areas or lounges with fire pits, is popular, representing 20% of outdoor renovation spending. This aligns with the trend of merging indoor and outdoor living spaces.

- Bedroom Comfort Upgrades: The “quiet luxury” trend has led to increased spending on bedrooms, including high-quality bedding and calming color schemes. Nearly 25% of bedroom redesigns aim to enhance comfort and relaxation.

- Bathroom Wellness Enhancements: Spa-like bathrooms with features such as saunas, freestanding tubs, and rain showers make up 15% of home decor projects, driven by the desire for at-home wellness experiences.

Major Challenges

- Supply Chain Disruptions: Ongoing logistics issues have led to delays in furniture production and material shortages, affecting 30% of home decor businesses. The industry is experiencing prolonged lead times and higher costs as a result.

- Sustainability vs. Cost: While demand for eco-friendly products rises, their higher price points (averaging 20-30% more than non-sustainable options) deter price-sensitive consumers.

- Shifts in Consumer Preferences: Rapid changes in decor trends create a challenge for brands to keep up with diverse styles while maintaining inventory flexibility. About 22% of businesses struggle with overstock of outdated designs.

- Economic Uncertainty: Inflation and economic fluctuations are causing consumers to delay large-scale renovations, with 40% of homeowners opting for smaller, incremental upgrades instead.

- Technology Integration: While smart home features are in demand, 35% of consumers find integrating these technologies daunting, citing high installation costs and compatibility concerns.

Top Opportunities

- Expansion in E-commerce: The online home decor market is growing at an annual rate of 15%, driven by convenience and the ability to customize products digitally. Investment in augmented reality (AR) tools to visualize decor enhances the customer experience.

- Sustainability-Focused Product Lines: Brands that focus on sustainable furniture and eco-friendly materials can capture the expanding market segment prioritizing environmental responsibility, estimated to grow by 12% annually.

- Affordable Luxury Segments: There’s an opportunity to tap into the “quiet luxury” trend, where brands offer affordable yet high-quality and timeless pieces, targeting consumers looking for value-driven elegance.

- Modular and Multifunctional Designs: As living spaces shrink, the demand for adaptable furniture, such as foldable desks and modular sofas, is projected to grow by 20%, making this a lucrative area for manufacturers.

- Outdoor Living Enhancements: Outdoor decor products are gaining traction, particularly in regions with mild climates. The market for weather-resistant furnishings is expected to expand by 18% over the next few years.

Recent Developments

- In 2023, IKEA expanded its sustainable offerings by partnering with the recycled materials startup, EcoBark. This collaboration focuses on integrating eco-friendly options into IKEA’s furniture lines, with a target to boost sustainable product sales by 20% by 2025. The initiative aligns with the rising consumer demand for greener solutions within the home decor sector.

- In 2024, Havenly, a leading interior design service and home furnishings company, announced a definitive agreement to acquire The Citizenry as part of its ongoing strategy to build a portfolio of home brands and technologies tailored to the next generation of consumers. This acquisition, Havenly’s third in 24 months, highlights the company’s rapid growth and its efforts to expand offerings for digital-first home shoppers.

- In mid-2024, Thibaut, a well-known textile and wallpaper company, acquired Rosemary Hallgarten, a brand renowned for its luxury handwoven rugs and textiles. This acquisition is designed to enhance Thibaut’s premium product line and capitalize on high-net-worth clients seeking bespoke decor solutions. The move underscores the trend of vertical integration and product diversification among home decor brands.

- In 2023, Wayfair Inc. (NYSE: W), one of the world’s largest home retail platforms, launched Decorify, an innovative tool that leverages generative AI to help shoppers explore and personalize their spaces. This pilot initiative uses AI to create shoppable, photorealistic images, allowing consumers to reimagine their interiors by simply uploading a picture of their space, tapping into the growing demand for customized, tech-driven home design solutions.

- In 2024, Hooker Furnishings Corporation (HFC), a global leader in the design, production, and marketing of home furnishings for over 100 years, reported its fiscal 2024 fourth-quarter and full-year results, ending January 28, 2024. The company’s continued performance reflects its enduring market leadership and adaptability in the evolving home furnishings sector.

Conclusion

The home decor market is experiencing significant transformation driven by consumer demand for sustainability, personalization, and digital innovation. As brands like IKEA and Wayfair incorporate eco-friendly materials and cutting-edge technologies such as AI-powered design tools, they are setting new standards for the industry.

Additionally, the trend of acquisitions, as seen with Havenly and Thibaut, reflects a strategic focus on expanding product offerings and reaching high-value, digitally savvy consumers. Companies are increasingly adopting vertical integration and diversifying their portfolios to capture niche markets and build loyal customer bases. Overall, the market is evolving toward a more holistic, tech-enabled, and environmentally conscious approach, aligning with the preferences of modern consumers seeking both style and sustainability in their home decor choices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)