Table of Contents

Introduction

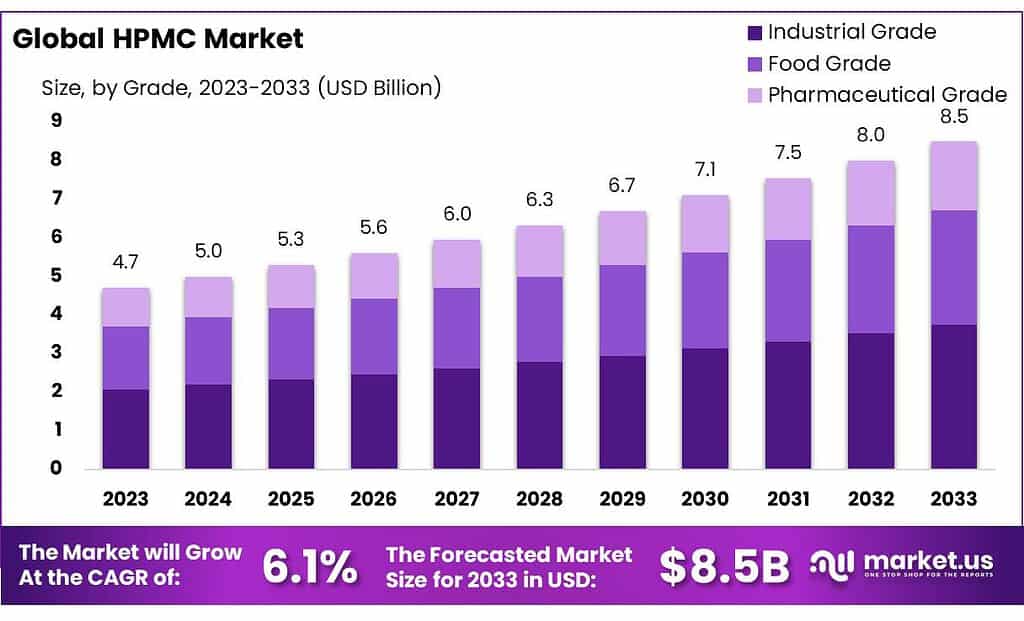

The Hydroxypropyl Methylcellulose (HPMC) market is projected to experience substantial growth in the coming years, with its market size estimated to reach USD 8.5 billion by 2033, up from USD 4.7 billion in 2023, reflecting a compound annual growth rate (CAGR) of 6.1%. This growth is primarily driven by the increasing use of HPMC in industries such as pharmaceuticals, food, and construction.

HPMC, a plant-derived polymer, plays a pivotal role in the pharmaceutical industry, where it is used as a binder and controlled-release agent in tablets. The demand in this sector is fueled by the rise in drug development and the growth of generic medicines. In the construction industry, HPMC is crucial for improving water retention and workability in cement and plaster, with the construction segment holding over 39% of the market in 2023. The rising demand for infrastructure development globally is contributing significantly to HPMC’s application in this area.

In the food industry, HPMC is employed as a thickener and stabilizer, especially in gluten-free and vegan products, responding to the growing consumer demand for healthier and alternative dietary options. This sector is further supported by the expanding demand for processed foods and the increased awareness of dietary restrictions like gluten intolerance.

Despite these growth drivers, the market faces certain challenges. Fluctuations in the prices of raw materials such as cellulose, impacted by agricultural production and geopolitical factors, pose a risk to manufacturers, potentially leading to supply chain disruptions and increased production costs. These pricing challenges could affect the stability of the market, particularly in cost-sensitive industries like food and pharmaceuticals.

Regionally, the Asia-Pacific market leads due to strong demand from the food and pharmaceutical industries, particularly in China. The Middle East and Africa are also expected to grow significantly, supported by demand from the construction and mining sectors. Competitive players in the market, such as Ashland, DuPont, and Shin-Etsu Chemical, are heavily investing in research and development to enhance their product offerings and maintain market positions.

Key Takeaways

- Projected Market Growth: The global HPMC market is projected to grow from USD 4.7 billion in 2023 to USD 8.5 billion by 2033, at a CAGR of 6.1%.

- Industrial Grade Dominance: In 2023, the Industrial Grade segment leads with over 44.3% market share, driven by its application in construction and textiles.

- Viscosity Insights: Medium-viscosity HPMC dominates with a 54.3% share in 2023, preferred for its balance of flow and stability in pharmaceuticals and food.

- End-use in Construction: The construction sector, using HPMC to enhance cement and plaster properties, held a 39.4% market share in 2023.

- Asia Pacific Market Share: The Asia Pacific region accounted for 38.2% of the global HPMC market in 2023, driven by rapid industrialization and urbanization.

Hydroxypropyl Methylcellulose (HPMC) Statistics

- Notably, when the addition of HPMC increased to 6% of κ-carrageenan (w:w), the κCHM-6 film not only effectively improved water resistance. including lower water solubility, water vapor permeability, and higher water contact angle, but also made the structure of the κCHM-6 film more compact.

- It is a linear sulfated polysaccharide composed of alternating units of D-galactose and 3,6-anhydrogalactose connected by α-1,3- and β-1,4-glycosidic linkages.

- Hydroxypropyl methylcellulose (HPMC, CAS:9004-65-3, molecular weight ~22 kDa, 2% aqueous solution viscosity at 20 °C: 40–60 cP) was purchased from Sigma-Aldrich Trading Co., Ltd. (Shanghai, China).

- κ-carrageenan solution under stirring at 40 °C for 1 h. Subsequently, different proportions of HPMC (0%, 3%, 6%, 9%, and 12% of κ-carrageenan, w/w) were blended into the above solution and continuously stirred for 3 h at 40 °C.

- The prepared films were labeled as κCHM-0, κCHM-3, κCHM-6, κCHM-9, and κCHM-12 film separately according to the additive proportion of HPMC. All films were equilibrated at 25 °C and 50% relative humidity (RH) for at least 48 hours before characterization.

- The viscoelastic behavior was recorded with the angular frequency ranging from 0.1 to 100 rad/s at a fixed strain of 0.1% under 25 °C. The relationship between the viscosity and the shear rate was studied by increasing the shear rate from 0.01 to 100 s−1 at a constant temperature of 25 °C [12,17].

- The oxygen permeability (OP) of films was measured using the differential pressure method with a gas permeability tester at 23 °C and 0% RH (Labthink, Perme VAC-V2, Jinan, China) according to the Chinese National Standard GB/T 1038-2000.

- HPMC had a dominant influence on the viscosity, spreadability, and adhesiveness of the gel. The optimum formula of gel HPMC is 5, 00%, and tween 80 1,00%.

- HPMC is a hydrocolloid produced artificially from natural substances. It consists of 28-30% methoxyl content and 7-12% of hydroxypropoxyl content.

- The preferred method is to begin by heating approximately 1/3 of the total formulation water to 167°F (75°C) or higher. Add the HPMC to the vortex of agitated and heated water. Mix until fully dispersed.

Emerging Trends

- Vegan and Gluten-Free Applications: There is a notable rise in the demand for HPMC as a plant-based ingredient in vegan and gluten-free food products. HPMC is used as a stabilizer and thickener, replacing gluten in baked goods and animal-based gelatin in vegan products. This trend is driven by increasing health consciousness and the rise of ethical eating choices among consumers.

- Clean Label and Functional Foods: Consumers are seeking clean-label products, and HPMC is increasingly being used to improve texture and shelf stability without adding synthetic additives, supporting this trend.

- Eco-Friendly Production: There is a shift toward more sustainable and bio-based production methods for HPMC. Manufacturers are focusing on reducing the environmental impact of HPMC production by using renewable raw materials such as wood pulp and plant cellulose.

- Biodegradable Materials: HPMC’s role as a biodegradable alternative in industries like construction and packaging is also gaining attention, aligning with the global move towards reducing plastic waste and adopting environmentally friendly practices.

- Extended-Release Medications: In the pharmaceutical industry, HPMC is increasingly used in the formulation of controlled-release drugs. Its ability to modulate the release of active ingredients over time is crucial in producing medications that act throughout the day, improving patient compliance and efficacy.

- Growing Demand for Generic Drugs: As the demand for affordable generic drugs grows worldwide, HPMC is becoming more essential in the formulation of these medicines due to its low cost and effective binding properties.

- Improved Workability in Cement and Plaster: In the construction industry, HPMC is gaining traction due to its water retention and improved workability in cement and plaster applications. This enhances the quality and durability of construction materials, particularly in large-scale infrastructure projects.

- Energy Efficiency: The role of HPMC in improving insulation materials is also being explored, especially as energy-efficient construction methods become more important in reducing environmental footprints.

- Innovations in Manufacturing Processes: Manufacturers are investing in new technologies to improve the efficiency and sustainability of HPMC production. This includes advancements in raw material processing, reducing waste, and minimizing the use of non-renewable resources.

- Customizable Viscosity Grades: There is a growing trend toward developing customized HPMC grades with varying viscosities to meet specific industrial needs, ranging from pharmaceutical formulations to heavy-duty construction applications.

Use Cases

- Pharmaceutical Industry: HPMC is widely used in the pharmaceutical industry as a binder for tablets and as a controlled-release agent. It helps ensure that medications dissolve over time, allowing for consistent, long-lasting effects. For example, in extended-release formulations, HPMC’s gel-forming properties ensure a gradual release of active ingredients. With the global pharmaceutical market expanding at a CAGR of around 6-7%, the demand for HPMC in drug formulation is growing significantly. HPMC is a popular alternative to gelatin in vegetarian capsules, driven by the demand for plant-based products. With the rising consumer preference for vegan and vegetarian supplements, the use of HPMC in capsule production is increasing.

- Food Industry HPMC is critical in gluten-free baking as it replicates the binding properties of gluten. It is commonly used in bread, pastries, and other baked goods to enhance texture and maintain moisture, leading to better quality in gluten-free products. The global gluten-free food market is expected to reach USD 6.47 billion by 2027, driving the demand for HPMC. In products such as ice creams, sauces, and dressings, HPMC serves as a thickener and stabilizer, ensuring smooth textures and preventing separation. The growing processed food sector, expected to expand at a CAGR of 4.3%, is pushing the use of HPMC to maintain product quality.

- Construction Industry: HPMC is heavily used in the construction sector as an additive in cement, plaster, and mortars. It improves water retention, increases workability, and enhances the strength of these materials. This use case is critical in infrastructure projects globally, with the construction industry estimated to grow by 3.5% annually. Additionally, HPMC improves the adhesion of tiles, making it a key ingredient in tile cement and wall putty formulations.

- Personal Care and Cosmetics: In personal care products, HPMC is commonly used as a thickening and emulsifying agent. It ensures stability in lotions, creams, and shampoos, preventing ingredients from separating. With the global personal care industry valued at over USD 500 billion, the demand for stabilizers like HPMC continues to rise. HPMC is also used in hair gels and sprays due to its ability to form transparent films, providing hold without flaking or stiffness. This has made it a preferred ingredient in modern hair care products, as consumers increasingly demand non-toxic, plant-based formulations.

- Paints and Coatings: HPMC is used in paints and coatings as a thickening and stabilizing agent. It helps improve the viscosity of water-based paints and ensures even application. As the global paints and coatings industry grows at an annual rate of 5.4%, HPMC’s application in this sector is increasing. It also enhances the workability and texture of decorative plasters and adhesives used in construction.

Major Challenges

- Raw Material Price Volatility: HPMC is derived from plant-based cellulose, primarily sourced from wood pulp and cotton. The prices of these raw materials can fluctuate significantly due to factors like changing agricultural output, weather conditions, and geopolitical issues. This volatility in cellulose pricing affects production costs, making it difficult for manufacturers to maintain stable pricing for HPMC products. For example, disruptions in the global supply chain during the COVID-19 pandemic increased raw material costs, squeezing profit margins for HPMC producers.

- High Production Costs: The production process of HPMC involves several chemical treatments and purification steps, which can be energy-intensive and costly. Additionally, compliance with environmental regulations adds to production expenses. These high costs can limit smaller manufacturers’ ability to compete with larger companies that benefit from economies of scale.

- Environmental Impact: Though HPMC is biodegradable, the environmental impact of its production process remains a concern. The reliance on chemical processing and significant water usage raises sustainability issues, especially as industries shift towards greener production methods. Pressure from environmental groups and governments may lead to stricter regulations, further increasing production costs.

- Competition from Alternatives: As industries look for more cost-effective and sustainable alternatives, HPMC faces competition from other polymers and cellulose derivatives. In food applications, for example, alternative thickeners like guar gum and xanthan gum can serve as substitutes, potentially affecting HPMC’s market share.

Market Growth Opportunities

- Rising Demand for Vegan and Gluten-Free Foods: The food industry is witnessing a significant shift towards plant-based and gluten-free products, driven by rising health awareness and lifestyle changes. HPMC, as a plant-based alternative to animal-derived ingredients like gelatin, plays a crucial role in vegan and gluten-free formulations, particularly in baked goods and processed foods. The global gluten-free food market, projected to grow by over 9% annually, offers a substantial opportunity for HPMC to be utilized in new product formulations.

- Increased Use of Sustainable Construction Materials: The construction industry is moving towards greener and more sustainable materials. HPMC is increasingly used in cement, mortar, and plaster formulations for its ability to improve water retention, workability, and durability. With global infrastructure development booming, particularly in emerging markets like Asia-Pacific, the demand for construction additives like HPMC is expected to grow at a steady pace. The construction industry’s focus on energy-efficient and sustainable building materials is further propelling this opportunity.

- Growth in Pharmaceutical Applications: The pharmaceutical industry is a significant market for HPMC, especially in tablet formulations where it acts as a binder and controlled-release agent. As the global demand for affordable generic medications rises, HPMC’s role in improving the stability and release profiles of drugs becomes more critical. The pharmaceutical market is projected to grow at around 6-7% annually, providing a robust platform for the continued expansion of HPMC in drug delivery systems.

Key Player Analysis

Celotech Chemicals Co., Ltd. is a key player in the HPMC sector, primarily focusing on producing high-quality cellulose ether products, including Hydroxypropyl Methylcellulose (HPMC). The company serves various industries such as construction, food, pharmaceuticals, and personal care. In 2023, Celotech expanded its production capacity to meet growing demand, especially from the construction and pharmaceutical sectors. The company has a production base in Shandong, China, with a capacity of 15,000 MT of HPMC annually. In May 2024, the company announced a price increase for its HPMC products due to rising raw material costs. Celotech also actively engages in research and development to enhance product performance, particularly in applications like dry mix mortar and tile adhesives, which are crucial for construction.

Changzhou Guoyu Environmental S&T Co., Ltd., founded in 1984, specializes in producing Hydroxypropyl Methylcellulose (HPMC), alongside other cellulose derivatives like Carboxymethyl Cellulose (CMC). The company has established a strong reputation, particularly in the construction, food, and pharmaceutical sectors, where its HPMC products are widely used for their thickening, stabilizing, and binding properties.

Chemcolloid Limited, founded in 1990, is a well-established supplier of Hydroxypropyl Methylcellulose (HPMC) and other hydrocolloids, catering primarily to the food, pharmaceutical, and industrial sectors. In 2023, the company focused on enhancing its HPMC product offerings, especially in the food and pharmaceutical industries, where demand for plant-based and stable binding agents has been growing. Throughout March 2024, Chemcolloid introduced improved formulations of HPMC, aimed at providing better emulsification and stability in vegan and gluten-free food products. Additionally, they upgraded their production capacity in July 2023 to meet the increasing demand from global markets. Chemcolloid continues to work closely with its partners to innovate and create tailored solutions, particularly for emerging health and sustainable food markets.

CP Kelco U.S., Inc., a global leader in nature-based ingredient solutions, has been actively expanding its HPMC and other hydrocolloid offerings. In 2023, the company focused on leveraging its existing hydrocolloid portfolio, including HPMC, which is used across various industries such as food, pharmaceuticals, and personal care. By April 2024, CP Kelco had completed a $60 million expansion of its citrus fiber product line, including Nutrava® Citrus Fiber and Kelcosens™, further strengthening its position in natural ingredients for clean-label applications.

In 2023, Dow Chemical continued to expand its focus on Hydroxypropyl Methylcellulose (HPMC), particularly through its CELLOSIZE™ Texture K100M product line. This water-soluble HPMC polymer, widely used in industries like construction, pharmaceuticals, and personal care, has gained traction for its film-forming, thickening, and stabilizing properties. Dow’s HPMC applications are critical in enhancing the texture and stability of products ranging from paints to body washes. By July 2024, Dow emphasized the role of sustainable, eco-friendly polymers like HPMC in its product offerings, aligning with global trends toward more sustainable and high-performance materials across sectors.

In 2023 and 2024, DuPont de Nemours, Inc. has continued to develop its Hydroxypropyl Methylcellulose (HPMC) sector with a strong emphasis on sustainability and innovation. The company integrates HPMC into several industries, including pharmaceuticals, food, and construction. DuPont’s HPMC products, which offer thickening, stabilizing, and film-forming properties, are critical in these sectors, especially as demand for sustainable materials rises globally. By March 2024, DuPont strengthened its focus on sustainable chemical solutions, ensuring that HPMC products align with its 2030 sustainability goals. Additionally, DuPont’s advancements in eco-friendly production methods and ongoing R&D efforts in high-performance materials are set to expand the market for HPMC in various applications.

Gomez Chemical plays an active role in the HPMC (Hydroxypropyl Methylcellulose) market, focusing on supplying industrial-grade HPMC for various applications, particularly in the construction and pharmaceutical sectors. In 2023, the company saw increased demand for its HPMC products, driven by global infrastructure development and the growing need for improved building materials. Gomez Chemical’s HPMC offerings are widely used in cement and mortar formulations for their water retention and workability-enhancing properties.

Hebei Yibang Building Materials Co., Ltd. specializes in the production of high-quality Hydroxypropyl Methylcellulose (HPMC), primarily serving the construction industry. In 2023, the company expanded its HPMC product line, focusing on applications like cement mortars and tile adhesives. By June 2024, Yibang plans to further enhance its production capacity to meet the growing demand for water retention and adhesion-enhancing additives in construction materials. Their HPMC is widely recognized for improving workability, water retention, and overall performance in construction applications.

Henan Tiansheng Chemical Industry Co., Ltd. is actively engaged in the production of Hydroxypropyl Methylcellulose (HPMC), primarily catering to the construction, pharmaceutical, and food sectors. In 2023, the company focused on expanding its HPMC offerings, which are valued for their thickening, water retention, and stabilizing properties in cement mortars and tile adhesives. By June 2024, Henan Tiansheng plans to increase its production capacity to meet rising market demand, especially in infrastructure projects and industrial applications.

Hercules-Tianpu Chemicals, a joint venture, specializes in the production of Hydroxypropyl Methylcellulose (HPMC), catering to industries such as construction, coatings, and pharmaceuticals. In 2023, the company increased its focus on expanding production capacity at its facilities in China, producing over 24,000 tons annually. By July 2024, Hercules-Tianpu plans to further enhance its HPMC offerings, particularly targeting the growing demand in the construction sector, where HPMC’s water retention and adhesive properties are essential for cement and mortar formulations.

Hopetop Pharmaceutical is a significant player in the Hydroxypropyl Methylcellulose (HPMC) market, focusing on its use in pharmaceutical applications. Their HPMC products are used as thickening agents, film formers, and stabilizers, particularly in tablet formulations and controlled-release medications. In 2023, Hopetop expanded its HPMC offerings, improving its grades for pharmaceutical use, and emphasizing high viscosity and enhanced solubility. By May 2024, the company plans further expansion to meet growing demand in the global pharmaceutical industry.

Conclusion

In conclusion, the Hydroxypropyl Methylcellulose (HPMC) market is set for robust growth across various industries, including pharmaceuticals, construction, and food. This versatile compound is highly valued for its thickening, stabilizing, and water retention properties, making it indispensable in modern formulations. The market is driven by increasing demand for sustainable and plant-based products, particularly in the food and pharmaceutical sectors. As industries continue to innovate, the global HPMC market is expected to grow steadily, with significant investments in production and technology.