Table of Contents

Introduction

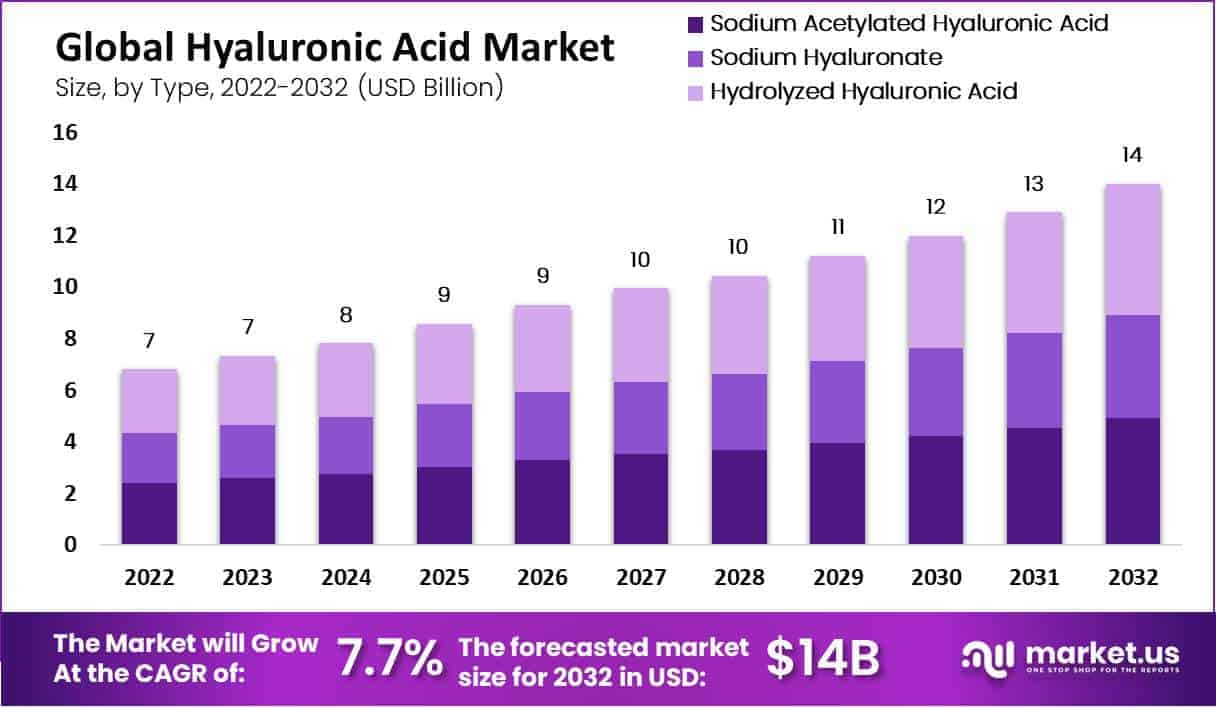

The global hyaluronic acid market, with a valuation of USD 6.8 billion in 2022, is expected to surge to USD 14 billion by 2032, progressing at a CAGR of 7.7%. This market growth is primarily driven by increased demand in areas like osteoarthritis care, cosmetic enhancements, and skincare, where hyaluronic acid’s benefits in moisture retention and joint pain relief are highly sought after.

Despite these advantages, the market encounters hurdles such as elevated costs associated with the sophisticated extraction and purification needed for production, as well as stringent regulatory standards. The usage of hyaluronic acid, particularly in injectables, can lead to side effects like swelling and allergic reactions, which may dissuade potential users.

On the innovation front, the market has seen significant developments, including the introduction of new hyaluronic acid formulations aimed at the beauty sector, enhancements in production technologies that improve both quality and production scale, and strategic partnerships intended to broaden market reach.

Notably, companies like KiOmed Pharma are expanding their geographic footprint in Europe and the Middle East, while DSM has launched new product lines designed to provide less invasive and more effective beauty solutions. These innovations and expansions are crucial, as they help address both existing and emerging market needs.

In December 2021, Allergan Aesthetics expanded its capabilities in non-invasive treatments by acquiring Soliton, Inc., adding technologies like the RESONIC™ device to its portfolio, which is used for tattoo removal and cellulite appearance improvement. This acquisition aligns with their strategy to diversify and enhance their product offerings in the aesthetic field

Key Takeaways

- In 2022, the global hyaluronic acid market size was valued at USD 6.8 Bn, and this market is estimated to reach USD 14 billion registering the highest CAGR of 7.7% during the forecast period of 2023 and 2032.

- By type, the market can be segmented into sodium acetylated hyaluronic acid, sodium hyaluronate, and hydrolyzed hyaluronic acid; hydrolyzed hyaluronic acid recorded the highest sales share in 2022.

- Osteoarthritis was one of the top contributors to total revenue worldwide in 2022, contributing over 43.8% of it. Growth for this market can be expected with increasing elderly population numbers as well as a preference shift towards minimally invasive surgical procedures.

- With respect to end-use analysis, the market can be divided into personal care products (moisturizers), cosmetics products, food & agriculture items, as well as pharmaceuticals utilizing Hyaluronic acid as the active ingredient for their production; such as moisturizers and face masks that utilize Hyaluronic Acid’s moisturizing ability and elasticizing power in order to increase skin hydration while decreasing wrinkle visibility.

- North America holds an estimated 42.4% market share with USD 2.88 Bn or Hyaluronic acid products, and their use is anticipated to expand, driven by both higher disposable incomes and greater awareness among its population of their aging.

Hyaluronic Acid Statistics

Hyaluronic Acid Skin Benefits

- Clinical studies indicate that topical application of hyaluronic acid can improve skin elasticity by approximately 20% over a period of 8 weeks.

- In 2018, there were 810,240 treatments performed using hyaluronic acid dermal fillers in the United States, indicating its significant role in aesthetic medicine.

- The effects of hyaluronic acid as a dermal filler typically last between 6 to 12 months, depending on the product used and the area treated.

- The half-life of injected hyaluronic acid can range from approximately 17 hours to 1.5 days, with longer half-lives observed for larger molecular weight preparations.

- Approximately 57% of patients respond positively to hyaluronic acid injections, defined as a significant reduction in pain and improvement in function based on the Osteoarthritis Research Society International (OARSI) criteria.

- Skin content in Hyaluronic Acid represents 50% of the total body content in Hyaluronic Acid. Almost all cell types can produce it, unfortunately, its synthesis slows down with time and its amount in the skin decreases leading to dehydration and loss of plumpness.

Hyaluronic Acid Clinical Efficacy

- The beneficial effects of HA injections typically peak around 6 to 8 weeks after administration, with some patients experiencing relief lasting up to 6 months or longer.

- A study indicated that patients receiving a series of HA injections (usually 3 to 5) had a higher likelihood of experiencing pain relief compared to those receiving fewer injections, with some reporting sustained benefits for up to 3 years.

- Surveys indicate that around 80% of patients report satisfaction with their HA treatment outcomes, particularly regarding pain relief and improved mobility.

- HA injections account for about 16.4% of all knee osteoarthritis-related payments in healthcare settings, indicating their significant utilization despite ongoing debates about their cost-effectiveness compared to other treatments.

- Among patients undergoing total knee arthroplasty (TKA), approximately 14.7% had received at least one HA injection in the year before surgery, highlighting its role in managing knee osteoarthritis before more invasive procedures are considered.

- Clinical trials indicate that HA injections provide significant pain relief, particularly in the first month after injection, with an effect size of approximately −4.24 on pain scores compared to baseline. Over a year, the effect size remains significant at −1.63 for ongoing pain relief.

Emerging Trends

- Sustainability Initiatives: The shift towards sustainable production techniques and eco-friendly packaging is gaining momentum. This trend is supported by consumers’ increasing demand for products that are kind to the environment.

- Advances in Technology for Product Development: The adoption of cutting-edge technologies such as artificial intelligence for facial analysis is enhancing the customization and effectiveness of hyaluronic acid treatments. These technological advancements are refining how treatments are tailored to individual needs and improving their outcomes.

- Expansion of Market Reach: Hyaluronic acid is making strides in both established and emerging markets. The industry is branching out into new regions and introducing innovative products to capture a broader audience.

- Focus on Regenerative Aesthetics: The industry is evolving from merely addressing aging signs to promoting skin health restoration. New products are emerging that combine hyaluronic acid with other active ingredients to rejuvenate the skin more holistically.

- Broader Applications: The use of hyaluronic acid is extending beyond cosmetic applications to therapeutic uses, such as in treating joint disorders like osteoarthritis and aiding in wound healing, showcasing its wide-ranging benefits.

Use Cases

- Skin Hydration and Anti-Aging: Hyaluronic acid is frequently used in skincare products like serums and moisturizers to help retain skin moisture and reduce the appearance of fine lines and wrinkles. It can absorb up to 1,000 times its weight in water, making it highly effective for keeping skin hydrated and plump.

- Joint Health: In supplement form, hyaluronic acid can help reduce pain and discomfort in joints by maintaining lubrication, which is especially beneficial for individuals suffering from arthritis.

- Eye Health: Hyaluronic acid is also found in eye drops where it serves to lubricate dry eyes, providing relief from irritation and discomfort.

- Wound Healing: Due to its hydrating properties and ability to promote skin regeneration, hyaluronic acid is used in various topical formulations to accelerate the healing process of skin wounds.

- Cosmetic Procedures: It is widely used as a dermal filler in cosmetic procedures to help restore volume to the face, smooth out skin, and provide a more youthful appearance. Hyaluronic acid fillers are popular for their safety profile and effectiveness in enhancing facial features such as lips and cheeks.

Major Challenges

- Adverse Effects and Risks: Although widely regarded as safe, hyaluronic acid can cause side effects, particularly from injections, such as inflammation and discoloration at the treatment site. Severe issues might include allergic reactions and lumpy skin texture. Incorrect injection methods might also result in serious complications like blocked blood vessels, potentially leading to tissue death or blindness.

- Regulatory Hurdles: The industry confronts strict regulatory challenges that can hinder the timely introduction of new products and affect overall market expansion. Compliance with all safety and performance regulations demands substantial investments in clinical trials and quality assurance processes.

- Intense Market Competition: The market is crowded with numerous competitors, creating a highly competitive environment that can pose difficulties, especially for new market entrants. Standing out in this saturated market necessitates innovative product development and aggressive marketing strategies.

- Production Expenses: Producing hyaluronic acid, particularly of high purity and quality, is an expensive process. These high costs can be prohibitive, especially for smaller firms or those new to the market, challenging their ability to compete with more established companies.

- Consumer Education and Market Preferences: Awareness of hyaluronic acid’s benefits beyond dermatological applications, such as its medical uses, remains low. Furthermore, consumer preference for natural and organic products is reshaping market demand, influencing the dynamics for synthetic or animal-based hyaluronic acid products.

Market Growth Opportunities

- Expansion in Pharmaceutical Applications: There’s a growing use of hyaluronic acid in various medical fields such as ophthalmology, osteoarthritis treatment, and wound healing. With an aging global population and the rising prevalence of these conditions, the demand within these segments is likely to increase significantly.

- Innovations in Dermal and Cosmetic Applications: The cosmetic segment, particularly for dermal fillers, continues to see robust growth driven by the popularity of non-invasive aesthetic procedures. Innovations and enhancements in product formulations that promise longer-lasting and more effective results are likely to attract more consumers.

- Technological Advancements: Investment in technology, such as the development of hyaluronic acid-based nanogels and new drug delivery systems, opens up new possibilities for the use of hyaluronic acid in pharmaceuticals and skincare, potentially improving the effectiveness and range of applications.

- Increasing Awareness and Accessibility: Efforts to boost consumer awareness about the benefits of hyaluronic acid, particularly in hydration and anti-aging, through educational campaigns and broadening distribution channels can enhance market reach and penetration. Initiatives like National Hyaluronic Acid Day help in educating consumers about its benefits and use.

- Market Development in Emerging Regions: There is significant growth potential in Asia-Pacific and Latin American regions due to increasing awareness of personal care and rising disposable incomes. Tapping into these emerging markets with localized strategies and product offerings can provide substantial growth opportunities for companies in the hyaluronic acid market.

Key Players Analysis

- Allergan, Inc. is now part of AbbVie and does not operate in the solar power windows sector. Instead, AbbVie focuses on developing and marketing pharmaceuticals and medical products, with no public involvement in solar technology or energy-generating windows.

- Sanofi S.A. is actively pursuing renewable energy initiatives, notably solar power, as part of its commitment to achieving carbon neutrality by 2030. The company has installed large solar power plants in locations like Australia, France, Italy, and India, which together save over 5,372 tons of CO2 annually. Sanofi’s broad approach to renewable energy also includes solar power installations at its sites which contribute significantly to its energy needs, further underscoring its environmental commitments.

- Genzyme Corporation, now part of Sanofi, has not directly engaged in the solar power windows sector. Their focus has primarily been on biotechnology and medical research, as seen in their environmentally conscious design of the Genzyme Center. The center incorporates green technologies and building practices aimed at energy conservation and sustainable operation but does not specifically deal with solar power windows.

- Anika Therapeutics, Inc. is not involved in the solar power windows sector. The company specializes in orthopedic care, particularly in joint preservation and pain management using hyaluronic acid-based products. Their main focus areas include osteoarthritis pain management and regenerative solutions aimed at improving mobility and quality of life for patients.

- Salix Pharmaceuticals does not have any involvement in the solar power windows sector. The company, a subsidiary of Bausch Health Companies, is focused on developing and marketing products for gastrointestinal diseases.

- Seikagaku Corporation is not involved in the solar power windows sector. Instead, their focus is on glycoscience research, particularly in creating pharmaceuticals and medical devices for orthopedic and ophthalmic conditions. The company emphasizes sustainable practices like using renewable energy and enhancing energy efficiency but does not manufacture or develop solar power windows.

- F. Hoffmann-La Roche AG is not engaged in the solar power windows sector. Their focus is primarily on healthcare, including pharmaceuticals and diagnostics, with a commitment to sustainability through various eco-friendly practices and technologies in their buildings but no involvement in solar window production or related technologies.

- Galderma Laboratories L.P. is not involved in the solar power windows sector. The company specializes in dermatology, focusing on manufacturing dermatological products for skin health, and operates manufacturing plants using renewable energy sources, but there is no indication of work specifically related to solar power windows.

- Zimmer Biomet does not work directly in the solar power windows sector. Instead, the company has engaged in sustainability efforts by securing a 12-year agreement to source 100% renewable energy for its operations in Spain from a solar power plant, demonstrating its commitment to renewable energy and reducing carbon emissions.

- Smith & Nephew Plc does not operate within the solar power windows sector. Instead, the company focuses on medical technologies, including orthopedics, wound management, and endoscopy, with a strong commitment to sustainability and environmental responsibility, aiming for net zero emissions by 2040.

- Bioxis Pharmaceuticals does not engage in work related to the solar power windows sector. The company is focused on developing innovative regenerative medical products, particularly in the field of aesthetic dermatology, using advanced biomaterials like chitosan and hyaluronic acid.

Conclusion

Hyaluronic acid is gaining popularity for its moisturizing and anti-aging properties. It is expected to see robust growth in the market, estimated to reach significant values over the next few years due to its high demand for skincare and medical treatments. This growth is mainly driven by the aging population seeking non-invasive treatments for skin hydration and elasticity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)