Table of Contents

Introduction

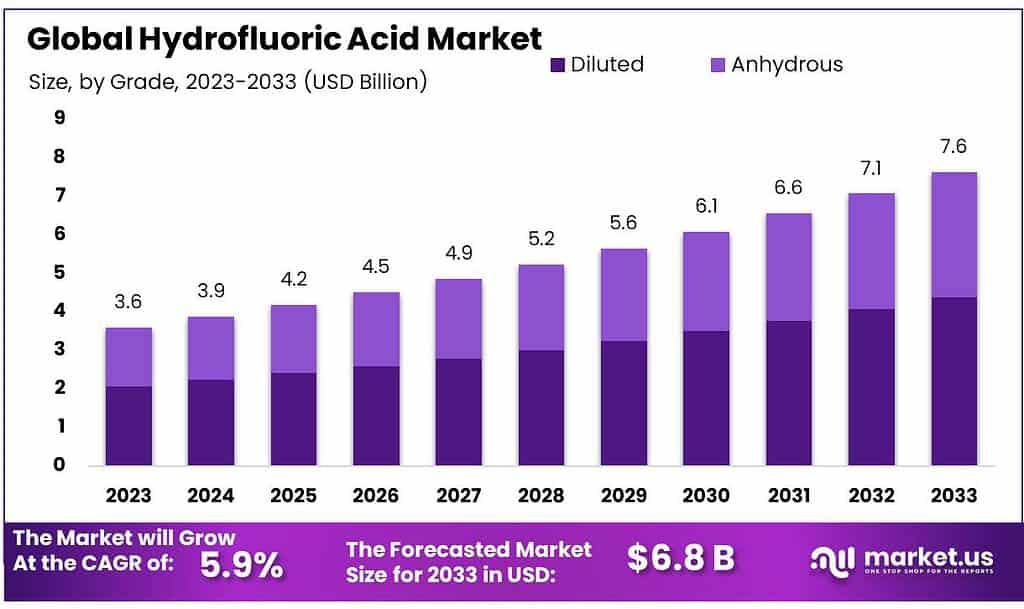

The Global Hydrofluoric Acid Market is set to experience robust growth, projected to expand from USD 3.6 billion in 2023 to an estimated USD 6.3 billion by 2033, with a steady CAGR of 5.9% throughout the forecast period from 2024 to 2033. This market’s growth is primarily driven by the extensive use of hydrofluoric acid in various critical industrial applications, including the manufacture of fluorocarbons for refrigerants and its pivotal role in aluminum production.

Additionally, its application in the petrochemical sector for alkylation processes underlines its indispensability. Despite these growth factors, the market faces significant challenges, notably the corrosive nature of hydrofluoric acid and the rigorous environmental and safety regulations that govern its use. These regulations necessitate the implementation of advanced safety protocols and technology, potentially escalating operational costs.

Recent strides in the industry aim at enhancing safety measures and developing more sustainable and efficient production techniques to reduce the environmental footprint. Innovations in safety and handling procedures, aimed at minimizing risks and complying with strict regulations, are crucial for sustaining the market’s growth trajectory. These developments not only address the immediate challenges but also align with global trends towards safer and more environmentally friendly industrial practices, ensuring the long-term viability and expansion of the hydrofluoric acid market.

Solvay recently entered into a joint venture with Orbia to create North America’s largest production facility for PVDF, a material used in battery markets. This venture is partially funded by a substantial grant from the U.S. Department of Energy, indicating significant investment in capacities that likely utilize hydrofluoric acid in production processes.

Koura Global is involved in the production of fluorspar and hydrofluoric acid, holding a significant portion of the global supply, which is integral for various industrial uses, including refrigeration and manufacturing.

These developments reflect the ongoing strategic initiatives and investments by leading companies to expand their capabilities and adapt to evolving market demands and regulatory environments. Each player’s actions contribute to the broader trends of increasing application versatility and compliance with stringent environmental standards in the hydrofluoric acid market.

Key Takeaways

- Market Worth by 2033: Expected to reach USD 6.3 billion, a significant increase from USD 3.6 billion in 2023. At a (CAGR) of 5.9% from 2023 to 2033.

- Grade Analysis Anhydrous Grade Dominance accounted for over 57.5% of the market share in 2023.

- Application Analysis Fluorocarbons Lead Usage Represented 54.5% of the market share in 2023 due to their wide use in refrigerants, air conditioning, and manufacturing.

- Regional Analysis Asia Pacific Dominance: Accounted for over 43% of revenue in 2023, driven by fluorocarbon manufacturers, particularly in China, impacting electronics and metal industries.

Hydrofluoric Acid Statistics

- It typically exists in concentrations around 49%, though stronger solutions like 70% are also used.

- Manufacturing Range: DDF produces Aqueous Hydrofluoric Acid in grades ranging from 20% to 75% concentration, tailored for enhanced performance in stainless steel pickling.

- In 2022, global exports of Hydrogen fluoride (hydrofluoric acid) totaled over $750 million, up from $661 million in the previous year.

- China led the exports with 66%, amounting to $499 million, followed by Germany (17.1% at $128 million), and the USA (4.83% at $36 million).

- Significant export flows included China to Japan (20% of global exports, $157 million), and China to Korea (22% of global exports, $166 million).

- On the import side, global imports of Hydrogen fluoride reached over $1.02 billion in 2022, up from $851 million in the previous year.

- Korea was the largest importer, accounting for 22% ($227 million), followed by the USA (20% at $205 million) and Japan (16.6% at $170 million).

- Notably, major import flows included Japan from China (16.4% of global imports, $167 million) and Korea from China (18.1% of global imports, $185 million).

- Evacuation and Exposure: Approximately 3,000 people were evacuated after 24,036 kg (53,000 lb) of hydrofluoric acid was released in Texas.

- Demographic Affected: Most affected individuals were female (56%) and black (60%), with an average age of 33.9 years.

- Common symptoms included eye irritation (41.5%), burning throat (21%), headache (20.6%), and shortness of breath (19.4%).

- Hospitalization: About 10% (94 cases) of those exposed required hospitalization.

- Health Impacts: Pulmonary function tests showed reduced lung capacity (forced expiratory volume in the first second, less than 80% of predicted value, in 42.3% of cases).

Emerging Trends

Emerging trends in the hydrofluoric acid market point towards several key developments that are shaping its future. One prominent trend is the increased demand for hydrofluoric acid in the production of fluorocarbons and fluorinated derivatives. This is largely driven by its applications in refrigerants and industrial chemicals, where hydrofluoric acid is crucial for the manufacturing process.

Another significant trend is the rising utilization of hydrofluoric acid in sectors such as electronics and automotive, particularly in cleaning and etching processes. This demand is supported by the growing electronics industry, which relies on hydrofluoric acid for intricate etching processes required in semiconductor manufacturing.

Additionally, there is a noticeable shift towards the development of more environmentally friendly and safer production technologies. This includes advancements in handling and storage solutions to mitigate the highly toxic nature of hydrofluoric acid, addressing major safety and environmental concerns associated with its use.

Moreover, regions like Asia Pacific are witnessing a surge in demand, supported by robust industrial growth, particularly in China, India, and Japan. These countries are becoming key players in the global market due to their extensive industrial bases and increased production capacities.

These trends suggest a dynamic growth path for the hydrofluoric acid market, driven by technological advancements, increasing industrial applications, and regional economic development. As industries continue to evolve and new technologies emerge, the demand for hydrofluoric acid is expected to remain strong, supporting its critical role in various industrial processes.

Use Cases

- Glass Manufacturing: Hydrofluoric acid is essential in the glass manufacturing industry where it is used to etch and polish glass. The acid helps in achieving a smooth and clear finish on glass products by dissolving silica, which is a primary component of glass.

- Semiconductor and Electronics: In the semiconductor industry, hydrofluoric acid is used for etching silicon wafers during the manufacturing of electronic components. This process is crucial for developing intricate designs on semiconductors.

- Chemical Production: HF acts as a precursor to almost all fluorine compounds, including refrigerants like fluorocarbons. It is also used in the production of high-octane gasoline, plastics, and aluminum.

- Petrochemicals: Within the petrochemical sector, hydrofluoric acid is used as a catalyst in alkylation processes. This enhances the yield and quality of petroleum products, making the process more efficient and cost-effective.

- Pharmaceuticals: HF is involved in the synthesis of fluorochemicals, which are integral in various pharmaceutical applications. It is used to manufacture antidepressants such as fluoxetine (Prozac) and other fluorine-containing medicinal products.

- Agriculture: Hydrofluoric acid is used in the preparation of pesticides, herbicides, and insecticides that are rich in fluorine, helping improve soil efficiency and supporting plant growth.

Key Players Analysis

Daikin has made significant strides in the hydrofluoric acid sector, particularly with the development of new technologies to decrease reliance on imports from China. In March 2022, Daikin introduced a technology that utilizes Mexican fluorite crystals, which are less pure but reduce dependency on Chinese materials for chip-making. This move is part of Daikin’s broader strategy to enhance its supply chain for critical manufacturing inputs and improve its market position in the global hydrofluoric acid market.

Sinochem, another major player in the hydrofluoric acid market, has been expanding its production capacities to meet growing global demand. In February 2021, Sinochem Lantian, a subsidiary of Sinochem Group, completed the construction of a new hydrofluoric acid production plant in China. This facility is designed to support the rising demand for hydrofluoric acid in various industries, including electronics and automotive, which are significant consumers of hydrofluoric acid.

Dongyue Group, a significant player in the hydrofluoric acid sector, leverages its chemical engineering prowess to cater to global markets. The company is recognized for its impactful presence in the Asia-Pacific region, which is the largest and fastest-growing market for hydrofluoric acid. This region’s demand is driven by its extensive use in chemical processing, pharmaceuticals, and the electronics industry, where Dongyue Group plays a vital role by supplying essential chemicals used in various applications, including the production of semiconductor devices.

Solvay is another prominent entity in the hydrofluoric acid market, known for its strategic initiatives aimed at enhancing production efficiency and safety. The company focuses on developing new grades of hydrofluoric acid to meet the diverse needs of industries like fluorocarbon production and semiconductor manufacturing. Solvay’s commitment to sustainable practices and high-quality standards positions it as a key supplier in the competitive hydrofluoric acid landscape, which is characterized by continuous innovation and environmental safety considerations.

Koura Global stands out as a key player in the hydrofluoric acid market, primarily due to its status as the world’s largest producer of fluorspar, which is integral to hydrofluoric acid production. The company leverages a robust mine-to-market structure, ensuring a secure supply chain for diverse industries across the globe. This strategic approach not only solidifies Koura’s market position but also supports its expansion into various applications, from refrigerants to medical propellants, highlighting its versatile chemical expertise.

Lanxess, a major competitor in the hydrofluoric acid sector, is recognized for its comprehensive product portfolio that supports a wide range of industrial applications. The company focuses on high standards of safety and sustainability, which are critical due to the hazardous nature of hydrofluoric acid. Lanxess’s strategic emphasis on regulatory compliance and technological innovation positions it as a reliable supplier in the global market, ensuring steady growth and customer trust in a highly competitive environment.

Yingpeng Chemical, a prominent player in the hydrofluoric acid market, is well-regarded for its extensive operations in China, a leading region for the industry. The company specializes in producing anhydrous hydrofluoric acid, which is extensively used in applications such as metal pickling and fluorocarbon production. Yingpeng’s strategic market position is supported by its role in a region that dominates the global market share, driven by high demand across various end-use industries.

Stella Chemical Corp, headquartered in Japan, is another significant name in the hydrofluoric acid sector. It specializes in high-purity hydrofluoric acid essential for the semiconductor industry. The company’s focus on producing and supplying acid for critical applications such as electronic cleaning and etching processes has solidified its reputation as a reliable supplier in the global market. Stella Chemifa’s strategic initiatives and emphasis on quality and safety standards cater to the stringent requirements of high-tech industries, contributing to its strong market presence.

Honeywell International Inc. is a notable player in the hydrofluoric acid market, recognized for its comprehensive range of high-purity hydrofluoric acid products. These products are integral to various applications including chemical derivatives, metal pickling, and glass etching, underscoring Honeywell’s pivotal role in supporting key industrial processes. The company’s commitment to rigorous safety standards and specialized treatments for exposure incidents is crucial given the highly hazardous nature of hydrofluoric acid.

Conclusion

The hydrofluoric acid market, with its extensive applications across diverse industries, showcases substantial growth prospects and pivotal shifts in usage patterns. In 2023, the market size was valued at approximately USD 3.33 billion and is projected to reach USD 5.05 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.35%. This growth is driven by its critical role in various sectors including semiconductor manufacturing, chemical processing, and the production of fluorocarbons used in refrigerants and aerosol sprays.

Despite these opportunities, the hydrofluoric acid market faces challenges due to the corrosive and highly toxic nature of the acid, necessitating stringent handling and safety protocols. These properties limit its use in some industries without extensive safety measures. However, ongoing research into safer handling methods and alternative materials that mimic the properties of hydrofluoric acid without the associated risks could present new growth avenues.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)