Table of Contents

Introduction

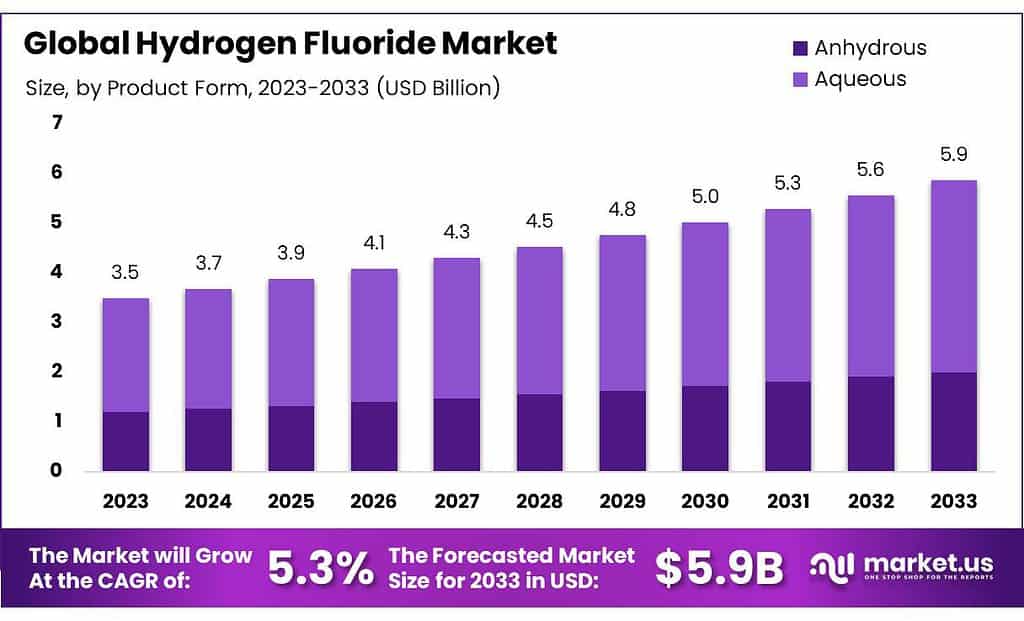

The global hydrogen fluoride market is projected to expand significantly, with its value anticipated to rise from USD 3.5 billion in 2023 to USD 5.9 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 5.3%. This growth is driven by several factors including the increasing demand for refrigerants and advancements in the semiconductor industry, where hydrogen fluoride is a critical etching and cleaning agent.

However, the market faces challenges such as environmental concerns due to the toxic and corrosive nature of hydrogen fluoride, which necessitates stringent regulations and compliance measures. These regulations impact the market dynamics, influencing strategic decisions of stakeholders. Additionally, supply chain disruptions and price volatility of raw materials such as fluorspar also pose significant challenges, affecting production and market stability.

Recent developments in the market include investments in green technologies, as companies seek to develop eco-friendly production methods that align with global sustainability goals. For instance, significant investments have been made in research and development to explore innovative applications of hydrogen fluoride in clean energy and advanced material sectors. Another notable development is the increasing use of aqueous hydrogen fluoride due to its versatility and lower environmental impact compared to anhydrous forms, making it particularly attractive for industries like semiconductor manufacturing, where it is used extensively for cleaning processes.

Solvay has launched a dedicated hydrogen platform aimed at enhancing its offerings in the burgeoning hydrogen economy. This platform focuses on advancing membrane technology crucial for hydrogen production and fuel cells, underscoring Solvay’s commitment to supporting clean energy transitions. This move positions Solvay at the forefront of supplying essential components for the hydrogen market and complements its broader sustainability goals under its One Planet initiative.

Arkema has entered into a strategic partnership to secure the supply of anhydrous hydrogen fluoride, a critical input for the production of fluoropolymers and fluorogases. This partnership not only ensures a stable supply of essential raw materials but also supports Arkema’s expansion in high-value polymer segments, which are crucial for various industrial applications including water management and renewable energy technologies.

Key Takeaways

- In 2023, the global hydrogen fluoride market was valued at US$ 3.5 Billion and is expected to register a CAGR of 5.3% during the forecast period.

- By source, the synthetic held a major market share of 78.5% in 2023.

- By product form, the aqueous segment dominated the global market with a 65.8% market share in 2023.

- By application, in 2023, refrigerants held a significant revenue share of 60.5%.

- In 2023, Asia Pacific dominated the market with the highest revenue share of 46.5%.

- China stands as the foremost global exporter of hydrogen fluoride, having exported more than 272 thousand metric tons of the chemical in 2021, equating to an estimated value of around 423 million U.S. dollars.

Hydrogen Fluoride Statistics

- About 20% of manufactured HF is a byproduct of fertilizer production, which generates hexafluorosilicic acid. This acid can be degraded to release HF thermally.

- The HF molecules, with a short covalent H–F bond of 95 pm length, are linked to neighboring molecules by intermolecular H–F distances of 155 pm.

- Hydrogen fluoride does not boil until 20 °C in contrast to the heavier hydrogen halides, which boil between −85 °C (−120 °F) and −35 °C (−30 °F).

- As much as 60 percent of hydrogen fluoride in industrial settings is used to make refrigerants.

- A common concentration is 49% (48-52%) but there are also stronger solutions (e.g. 70%) and pure HF has a boiling point near room temperature.

- HF has a boiling point of 19.5°C, and exists as a gas at room temperature (25°C).

- It is HF. Further, the molar mass of the same is 20.01 g/mol. Moreover, hydrogen fluoride is the gaseous form whereas the hydrofluoric acid is the solution of HF in water.

- Hydrogen fluoride is a gas which is colourless and has got a density of 1.15 g/L which is at room temperature or it remains a colourless liquid below the temperature of 20°C having a density of 0.99 g/mL.

- Hydrogen fluoride gas in the temperature range of 500-1000 K in hydrogen ambient is experimentally shown to be nonreactive with silicon dioxide.

- At temperatures above 873 K, hydrogen fluoride gas can react to roughen the surface of the silicon substrate.

- France rose 7.1% of Import of Hydrogen Fluoride (Hydrofluoric Acid) in 2019, compared to the previous year.

- Since 2014 China Import of Hydrogen Fluoride (Hydrofluoric Acid) increased 25.2% year on year close to $30,984,051.67.

- In 2019 South Korea was number 1 in Import of Hydrogen Fluoride (Hydrofluoric Acid).

- In 2016 Panama was ranked number 82 in Import of Hydrogen Fluoride (Hydrofluoric Acid) to $19,573, from 130 in 2015.

- Germany Import of Hydrogenated, Sulphonated, Nitrated Aldehydes rose 7.2% in 2019, compared to a year earlier.

- Since 2014 China Export of Hydrogenated, Esterified Animal Fats, Oils, Fractions increased 608% year on year reaching $24,068,052.61.

- In 2019 Canada was ranked number 1 in Export of Hydrogen.

- In 2017 Republic of the Congo was number 51 in Import of Hydrogen totalising $53,592.91, moving from 134 in 2016

- In 2019 New Zealand was ranked number 1 in Import of Hydrogenated, Esterified Animal Fats, Oils, Fractions.

Emerging Trends

Emerging trends in the hydrogen fluoride market highlight several dynamic shifts, primarily driven by technological advancements and changing industry needs. The growing adoption of green and sustainable practices is one of the significant trends reshaping the industry. This shift is particularly evident in the increasing use of aqueous hydrogen fluoride, which offers a more environmentally friendly alternative to anhydrous forms due to lower toxicity and compliance with stringent safety standards.

Another key trend is the rising demand for hydrogen fluoride in the semiconductor industry, propelled by its critical role as an etching and cleaning agent. This trend is fueled by the expansion of the electronics sector in major manufacturing hubs such as South Korea, Taiwan, and China, and is also supported by similar growth in the United States and parts of Europe.

The market is also seeing a significant push towards the development of applications in fluorine chemistry, including in the production of fluoropolymers and fluorogases. These applications benefit from hydrogen fluoride’s unique properties, such as high resistance to solvents and acids, and its ability to withstand high temperatures. The development and use of fluoropolymers are being driven by their extensive applications in industries like automotive, construction, and electronics, where their attributes such as low friction and non-adhesive surfaces are highly valued.

Use Cases

- Semiconductor Manufacturing: HF is crucial in the semiconductor industry for etching silicon wafers, a process essential for manufacturing semiconductor devices. This usage underscores the acid’s ability to handle precise and delicate operations necessary for electronics manufacturing.

- Glass and Metal Etching: Hydrofluoric acid is used for etching processes in both the glass and metal industries. It can break silicon-oxygen bonds in glass, making it valuable for detailed glass artwork and fabricating electronic components. Similarly, its ability to dissolve metals, except for nickel and its alloys, makes it useful in metal surface preparation.

- Petrochemical Processes: In the petrochemical sector, HF acts as a catalyst in alkylation processes. This use is critical for refining crude oil into high-octane gasoline, enhancing both the yield and quality of petroleum products.

- Refrigeration: HF is transformed into various refrigerants used in cooling and air conditioning systems. These refrigerants are essential for maintaining comfortable indoor environments in residential, commercial, and automotive settings.

- Chemical Synthesis: HF is involved in producing fluorocarbons and in the synthesis of organofluorine compounds used in pharmaceuticals, agrochemicals, and polymers like Teflon. These applications highlight HF’s role in creating high-performance materials and effective pharmaceuticals.

- Cleaning and Rust Removal: Diluted hydrofluoric acid is employed in cleaning agents for rust removal and polishing applications, particularly in automotive and construction settings. It is valued for its effectiveness in removing tough stains and spots.

Major Challenges

- Supply Chain Disruptions: The HF industry, like many others, has been affected by global supply chain disruptions which have led to shortages of essential components. These disruptions impact the production schedules and availability of HF gas detection systems, crucial for safety in industries using HF.

- Economic Uncertainties: Economic downturns and geopolitical tensions lead to fluctuations in raw material costs and can dampen economic growth, posing challenges for the HF market. Companies need to navigate these economic uncertainties while maintaining supply chain integrity and managing costs effectively.

- Regulatory Compliance: HF is subject to stringent regulatory requirements due to its hazardous nature. Compliance with these regulations can be costly and complex, requiring continuous updates and adherence to safety standards across different regions.

- Technological Advancements and Skilled Labor: The integration of advanced technologies like IoT and data analytics in HF gas detection systems demands highly skilled professionals for effective operation and maintenance. There is a growing need for specialized training and knowledge to manage these sophisticated systems.

- Health and Safety Risks: HF is highly corrosive and toxic, making its handling and use in various industrial applications a significant health risk. Ensuring worker safety and minimizing exposure to HF require rigorous safety measures and reliable detection systems in place.

Market Growth Opportunities

- Green Technologies: As industries increasingly focus on sustainability, there is a growing demand for eco-friendly production methods of hydrogen fluoride. Innovations that minimize environmental impact and align with green practices are likely to gain traction and open new markets, especially in sectors focused on reducing chemical hazards.

- Electronics and Semiconductors: HF is crucial in the manufacturing of semiconductors and other electronic components due to its use in etching and cleaning processes. The expanding electronics industry, driven by innovations in consumer technology and the automotive sector, particularly with the rise of electric vehicles, suggests a robust demand trajectory for HF.

- Research and Development: There is significant potential for growth through the investment in R&D activities aimed at discovering new applications of HF in emerging fields such as advanced materials and clean energy solutions. This could also include the development of improved or novel HF-based products.

- Infrastructure Development: With rapid global urbanization, there is an increased need for HF in construction and transportation infrastructure projects. HF’s role in producing materials like fluoropolymers and coatings that are essential for these projects points to expanding market opportunities.

- Supply Chain Optimization: Enhancing supply chain efficiencies can lead to cost reductions and improved market competitiveness. Companies that innovate in their supply chain processes to ensure a steady and reliable supply of HF could gain a significant competitive advantage

Recent Developments

In 2023, Solvay continued to innovate in the hydrogen fluoride sector by focusing on environmental sustainability. The company is progressing with its initiative to phase out the use of fluorosurfactants in its processes by 2026, showcasing its commitment to responsible innovation. This aligns with Solvay’s broader strategic efforts to reduce environmental impact across its operations, emphasizing the development of safer, more sustainable chemical solutions.

Honeywell International, Inc. actively participates in the hydrogen fluoride sector through its production of high-performance fluorine products used in a variety of applications, including refrigerants, blowing agents for foams, and electrical components. Honeywell’s expertise in integrating technology and focusing on efficient manufacturing processes underscores its role as a key player in this market. However, specific year-wise details for 2023 or 2024 were not found in the sources consulted.

In 2023, Stella Chemifa Corp remained a leading supplier of ultra-high purity hydrofluoric acid, essential for the semiconductor industry. The company has been focusing on refining its production processes to meet the growing demands of high-purity chemical products, which are crucial for the production of semiconductors and other electronic devices.

Arkema Group has been proactive in the hydrogen fluoride sector, especially with its recent initiatives to expand its footprint in the fluorine chemistry space. In 2024, Arkema established a partnership with Nutrien to construct a novel facility in North Carolina for anhydrous hydrogen fluoride (AHF), using by-product fluorine-containing minerals instead of traditional mined fluorspar. This strategic move not only secures a more sustainable raw material source but also enhances Arkema’s production capabilities in the fluoropolymers and fluorogases markets.

Lanxess AG in the hydrogen fluoride sector in 2023 faced a challenging economic environment, which led to a reduction in their first-quarter earnings compared to the previous year. Despite this, the company is optimistic about improving its results in 2024, forecasting a 10 to 20 percent increase in EBITDA over the previous year. This improvement is expected due to structural savings from their “FORWARD!” action plan, which aims to enhance efficiency across operations.

Navin Fluorine International Limited has been focusing on expanding its specialty chemicals portfolio, which includes a significant emphasis on the hydrogen fluoride market. The company is known for its production of high-performance fluoroproducts and reagents, contributing to its strong positioning in the sector. Navin Fluorine continues to leverage its expertise in complex fluoride production to serve diverse industries, including pharmaceuticals and agrochemicals, enhancing its market presence and financial performance.

Foosung Co Ltd has made significant strides in the hydrogen fluoride sector, particularly noted in 2023 and 2024. As a key player in the production of anhydrous hydrogen fluoride, Foosung has capitalized on the robust demand in the electronics and automotive industries, where hydrogen fluoride is critical for various manufacturing processes. The company’s strategic focus on enhancing production capabilities and expanding its market reach has positioned it well within the competitive landscape of the global hydrogen fluoride market, especially in Asia where demand continues to surge.

Fluorchemie Dohna GmbH remains a prominent figure in the hydrogen fluoride industry, primarily serving the European market. The company specializes in the production of high-purity anhydrous hydrogen fluoride, which is pivotal for a range of applications including refrigerants, pharmaceuticals, and metallurgical processes. Fluorchemie Dohna GmbH’s strategic initiatives and consistent production quality ensure its strong position in the market, catering to the rigorous demands of both industrial and consumer product sectors.

Orbia has been actively engaging in the hydrogen fluoride sector, focusing on the production and supply of fluorine-based products which are pivotal for various industrial applications, including refrigeration and pharmaceuticals. In 2023, Orbia aimed to enhance its market presence by leveraging its extensive material science expertise to innovate within the fluorine chemistry space, addressing the growing demands across multiple sectors.

Derivados Del Fluor, based in Spain, remains a prominent player in the hydrogen fluoride industry, particularly noted for its robust production capabilities and extensive product range that includes anhydrous and aqueous hydrogen fluoride. The company has been focusing on expanding its global footprint through strategic collaborations and enhancing its production techniques to meet the stringent quality requirements of industries like pharmaceuticals and electronics. In 2024, Derivados Del Fluor continues to capitalize on the growing demand for high-purity fluorine chemicals, driving forward innovations in applications ranging from metal processing to complex chemical syntheses.

Sinochem Lantian Co., Ltd. has positioned itself as a key player in the hydrogen fluoride market by leveraging its extensive resources and technological expertise. In 2023 and 2024, the company focused on optimizing its production processes and expanding its capacity to meet the growing demand for high-purity hydrogen fluoride, essential for industries such as electronics and refrigeration. Sinochem Lantian’s strategic initiatives are aimed at enhancing product quality and ensuring a stable supply to its global clientele.

Fluorsid S.p.A. has been actively involved in restructuring its business portfolio, focusing more on its core operations in the hydrogen fluoride sector. In 2023, Fluorsid sold its subsidiary Alkeemia, which specialized in hydrofluoric acid production, to concentrate on its primary market of fluoride derivatives for the aluminum industry. This move is part of Fluorsid’s broader strategy to streamline its operations and reinforce its position as a leading producer in the European fluorine market.

Conclusion

In conclusion, the hydrogen fluoride (HF) market is set for significant growth driven by its essential role in various industrial applications, particularly in electronics and semiconductor manufacturing due to its effectiveness in etching and cleaning processes. The push towards sustainable and green technologies presents new opportunities for eco-friendly HF production methods, aligning with global environmental goals. Furthermore, developments in infrastructure and the ongoing expansion of the automotive and electronics industries are likely to boost demand for HF-related products.

However, the industry faces challenges such as supply chain disruptions, regulatory compliance, and the need for continuous innovation to maintain competitiveness. As the market navigates these hurdles, strategic investments in research and development, supply chain optimization, and adherence to environmental regulations will be crucial for leveraging growth opportunities and sustaining market expansion.