Table of Contents

Introduction

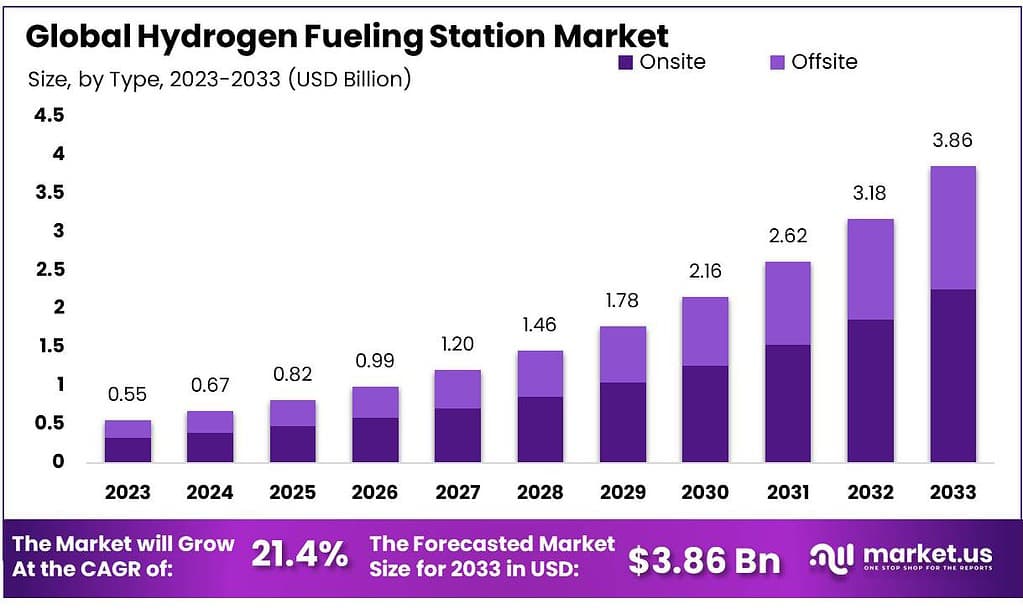

The hydrogen fueling station market is set to grow significantly, with its value projected to increase from USD 0.55 billion in 2023 to USD 3.86 billion by 2033, reflecting a compound annual growth rate (CAGR) of 21.4%. This growth is driven by a global push towards sustainable energy solutions and the increasing adoption of hydrogen-powered vehicles. As of recent data, there are about 700 hydrogen fueling stations worldwide, and this number is expected to rise as countries work towards achieving carbon neutrality goals.

Substantial public and private investments heavily support the market expansion. For instance, the European Union has committed to enhancing its hydrogen refueling infrastructure as part of its strategy to cut greenhouse gas emissions by 55% by 2030. Similarly, the United States, through initiatives like the Infrastructure Investment and Jobs Act, is allocating funds to develop clean hydrogen hubs, including fueling stations.

Technological advancements, particularly in electrolysis, are making hydrogen production more cost-effective and environmentally friendly. This technology splits water into hydrogen and oxygen using renewable energy, producing “green hydrogen.” Such advancements are critical in making hydrogen fueling stations more viable economically.

However, the market faces challenges, including high operational costs and safety concerns related to hydrogen storage and handling. Despite these hurdles, continuous technological innovations and increasing governmental support are expected to drive substantial market growth.

Key Takeaways

- Market Growth: Projected to expand from USD 0.55 billion in 2023 to USD 3.86 billion by 2033, growing at a CAGR of 21.4%.

- Type: Onsite stations dominate with over 58.6% share, valued for their convenience and efficiency.

- Pressure: High-pressure stations lead the market, capturing more than a 76.3% share.

- Mobility: Fixed stations are predominant, capturing more than a 65.2% share.

- Commercial vehicles are the largest segment, capturing more than a 44.6% share.

- Asia Pacific leads with a 63.6% market share in 2023.

Hydrogen Fueling Station Statistics

- It is designed to route highly pressured hydrogen to the nozzle for purposes of refueling the vehicle with up to 700 bar or, in other cases, 350 bar.

- The refueling process stops once the pressure reaches 700 bar (H70) respectively 350 bar (H35).

- There are generally two standards for gas hydrogen stations – hydrogen refilling at 700 bar (H70) or 350 bar (H35). Passenger cars generally use the H70 technology.

- During the first half of 2021, Hyundai sold around 4,700 hydrogen-based vehicles to the global market and topped the list in hydrogen vehicle sales, while Toyota remained second with about 3,700 units.

- Governments are also providing funds for the development of hydrogen fuelling stations network. In June 2021, the Government of Queensland, Australia, announced approximately US$ 1.5 billion for the development of infrastructure across renewable and hydrogen industries

- In December 2020 the U.S. Department of Energy (DoE) also launched US$ 33 million of new funding for the development of hydrogen fueling infrastructure, fuel cell R&D, and cost analysis initiatives.

- As of the first half of 2021, there were around 550 active hydrogen stations worldwide and nearly 200 planned hydrogen fueling stations. Japan has the most active hydrogen stations as compared to other countries around the world.

- The alliance is named Win4H2. Under the alliance, partners agreed to develop around 50 hydrogen stations across Spain.

- It is observed that when STSF attains lower values of 30.52, 0.41, and 0.8 for residential, highway, and tourist areas, NPC increases by 8, 16 and 31%, respectively. This is associated with a lower level of coordination between the hydrogen demand and solar potential.

- Historically hydrogen has been produced by fossil-fuel-intensive processes known as grey hydrogen, which currently accounts for 2% of global CO2 emissions.

- According to the International Energy Agency, this process could save 830 million tonnes of CO2 being emitted annually from grey hydrogen.

- Greenhouse gases trap heat and contribute to climate change, and the transportation sector is responsible for 29% of this emission.

- While the current price of hydrogen is higher than gasoline, fuel cells are approximately 2.5 times more efficient than gasoline engines.

- California is leading the way in producing 100% renewable hydrogen fuel

- The Clean Vehicle Rebate Project offers its largest standard rebate for fuel-cell electric vehicles at $5,000.

- The US is providing $8 bn in subsidies as part of its infrastructure bill, and others like Australia are gearing up to become hydrogen exporters.

- Measurements of these emissions are rare, but they are estimated at 1-10%. For comparison, emissions of methane – a much larger molecule – in the natural gas industry are estimated at 1-3%.

- The IEA reports that the currently proposed capacity for hydrogen production would, in the longer term, require 475GW of wind and solar power – about one-third of the current global capacity.

- The greenhouse gas footprint of blue hydrogen is more than 20% greater than burning natural gas or coal for heat and 60% greater than burning diesel oil for heat.

- China has already built over 30,000km to connect its remotest wind and solar plants in the west of the country to its vast eastern industrial heartlands.

Emerging Trends

- Technological Advancements: Significant progress is being made in hydrogen production and fueling technologies. Advances in electrolysis, which uses electricity to split water into hydrogen and oxygen, are making hydrogen production more cost-effective and sustainable. This method, especially when powered by renewable energy sources, is pivotal in reducing the carbon footprint of hydrogen production.

- Infrastructure Development: A critical factor for the growth of hydrogen fueling stations is the expansion of the necessary infrastructure. Governments and private sectors are investing heavily in building new hydrogen refueling stations. For example, the European Union aims to establish a comprehensive network of hydrogen stations to support the widespread adoption of hydrogen vehicles. The U.S. is also ramping up its infrastructure investments, highlighted by initiatives like the National Clean Hydrogen Strategy and Roadmap.

- Green Hydrogen Production: There is a strong shift towards green hydrogen, which is produced using renewable energy. Green hydrogen is expected to dominate the hydrogen supply mix by 2050, making up 50-65% of the global production. This transition is driven by decreasing costs of renewable energy and electrolysis technology, making green hydrogen more competitive compared to traditional fossil-fuel-based hydrogen.

- Mobile Hydrogen Stations: To meet the immediate and flexible hydrogen demand, mobile hydrogen fueling stations are gaining popularity. These stations can be deployed quickly and are particularly useful for temporary needs at events, construction sites, or areas where permanent infrastructure is not yet feasible. This trend supports the wider adoption of hydrogen fuel in diverse applications.

- Sector-Specific Adoption: Different sectors are adopting hydrogen at varying paces. Heavy transport sectors, such as trucking, shipping, and aviation, are increasingly turning to hydrogen as a viable alternative to traditional fuels. Hydrogen’s high energy density makes it suitable for these applications, which require long-range and heavy-load capabilities. Additionally, hydrogen is being integrated into industrial processes and power generation, further broadening its usage.

- Regulatory Support and Policies: Governments worldwide are implementing policies to foster the growth of hydrogen technologies. For instance, subsidies, tax incentives, and grants are being offered to encourage investment in hydrogen infrastructure. Regulatory frameworks, such as the U.S. Clean Hydrogen Production Standard, aim to reduce the carbon intensity of hydrogen production, further promoting the adoption of clean hydrogen.

- Global Collaborations and Investments: The hydrogen market is seeing a surge in collaborations between countries and companies to build and expand hydrogen infrastructure. For example, significant investments have been made globally, with over 1,400 hydrogen projects announced in 2023 alone, totaling $570 billion in investments. These collaborations are essential for scaling up hydrogen production and distribution networks.

Use Cases

Hydrogen fueling stations play a crucial role in the growing adoption of hydrogen as a clean energy source, particularly in transportation. These stations provide the necessary infrastructure to refuel vehicles powered by hydrogen fuel cells, which are increasingly seen as a key solution for reducing carbon emissions and combating climate change.

In the transportation sector, hydrogen fueling stations are essential for refueling passenger cars, commercial vehicles, and even buses. For instance, hydrogen-powered vehicles, known as Fuel Cell Electric Vehicles (FCEVs), are becoming more popular due to their environmental benefits, such as zero emissions and the ability to drive long distances on a single tank.

In addition to supporting road vehicles, hydrogen fueling stations are also used in other industries, such as marine and rail transport. For example, hydrogen trains are already operating in Germany, supported by specialized hydrogen refueling infrastructure. Mobile hydrogen fueling stations are also gaining popularity, especially for use in remote areas, construction sites, and during large events where temporary refueling solutions are needed.

Regionally, the Asia-Pacific region is leading the market, with countries like China, Japan, and South Korea investing heavily in hydrogen infrastructure. This region accounted for 65.79% of the global market share in 2023. In North America, the market is expected to grow rapidly due to government incentives and a strong push for sustainable infrastructure. Similarly, Europe is expanding its hydrogen fueling network, particularly in Germany and France, where government initiatives are driving significant growth.

Major Challenges

- High Operational Costs: The cost of building and maintaining hydrogen fueling stations is substantial. Establishing a single station can range from $1 million to $2 million due to the need for specialized equipment and safety measures. Operational expenses are also high because hydrogen must be stored at high pressures or very low temperatures.

- Infrastructure Development: The current infrastructure for hydrogen fueling is limited, with only around 700 stations globally. This scarcity hinders the growth of hydrogen-powered vehicles, as drivers need assurance of accessible refueling options. To meet future demands, extensive infrastructure development is needed, including pipelines and distribution networks.

- Safety Concerns: Hydrogen is highly flammable and requires stringent safety protocols for storage and handling. Ensuring the safety of both the infrastructure and users poses a significant challenge. Incidents, although rare, can have severe consequences and impact public perception.

- Economic Viability: The production of hydrogen, especially green hydrogen, is still costly. While technological advancements are reducing these costs, hydrogen remains more expensive than conventional fuels. The high cost of hydrogen production, coupled with the expense of establishing fueling stations, makes it economically challenging for widespread adoption without substantial subsidies and incentives.

- Technological Maturity: Many hydrogen technologies, including storage and transportation, are still developing. For instance, the efficient compression and liquefaction of hydrogen are critical for its economic viability but remain technically challenging. Advances in fuel cell technology are needed to make hydrogen a more competitive energy source.

- Policy and Regulatory Hurdles: The regulatory environment for hydrogen fueling stations varies significantly across regions, affecting the pace of development. Consistent policies and standards are required to facilitate the growth of hydrogen infrastructure. Current regulations often lag behind technological advancements, creating barriers to implementation.

Market Growth Opportunities

- Government Initiatives and Policies: Governments worldwide are increasingly supporting hydrogen infrastructure through policies and financial incentives. For instance, the European Union aims to install 40,000 kilometers of hydrogen pipelines by 2050, which will significantly boost hydrogen fueling station networks. Similarly, the U.S. Department of Energy’s National Clean Hydrogen Strategy and Roadmap is set to foster extensive hydrogen infrastructure development.

- Technological Advancements: Advances in hydrogen production technologies, particularly electrolysis powered by renewable energy, are making hydrogen more affordable and sustainable. Innovations in fuel cell technology are also enhancing the efficiency and performance of hydrogen-powered vehicles. This technological progress is expected to lower costs and improve the feasibility of hydrogen fueling stations.

- Expansion in the Transportation Sector: The transportation sector presents a significant growth opportunity for hydrogen fueling stations. Heavy-duty trucks, buses, and trains powered by hydrogen fuel cells are gaining traction due to their lower emissions and longer range compared to battery electric vehicles. Countries like Japan and South Korea are leading in this area, with ambitious plans to expand their hydrogen vehicle fleets and corresponding fueling infrastructure.

- Industrial Applications: Hydrogen is increasingly being used in industrial applications, such as steel production and chemical manufacturing, where it can replace carbon-intensive processes. The demand for clean hydrogen in these sectors is driving the need for more fueling stations to support industrial operations.

- Investment and Collaboration: Significant investments and collaborations between governments and private companies are accelerating the development of hydrogen infrastructure. In 2023, global investments in hydrogen projects reached $570 billion, a 31% increase from the previous year. Partnerships, such as those between automotive companies and energy providers, are crucial for building a robust hydrogen economy.

- Global Demand and Export Opportunities: Regions like Asia-Pacific are projected to lead in hydrogen demand, driven by countries like China and Japan. This growing demand presents export opportunities for hydrogen-producing countries, fostering international trade and further infrastructure development.

Recent Developments

Air Liquide has been making significant strides in the hydrogen fueling station sector, with several key projects and initiatives in 2023 and 2024. In June 2023, Air Liquide inaugurated the first high-pressure hydrogen refueling station for long-haul trucks in Europe, located in Fos-sur-Mer, France. This station, part of the HyAMMED project, can refuel up to 20 trucks per day and aims to reduce CO2 emissions by more than 1,500 metric tons annually.

Air Products and Chemicals Inc. has been actively expanding its hydrogen fueling station network throughout 2023 and 2024, focusing on key projects in North America. In May 2024, Air Products announced plans to build a network of commercial-scale multi-modal hydrogen refueling stations connecting Northern and Southern California. These stations will serve both heavy-duty trucks and light-duty vehicles, with each station capable of fueling up to 200 trucks or 2,000 cars per day. This initiative is part of their commitment to invest $15 billion in clean energy projects globally by 2027.

Linde plc has been actively expanding its hydrogen fueling station infrastructure globally in 2023 and 2024. In March 2023, Linde started supplying liquid hydrogen to the world’s first hydrogen-powered ferry in Norway, showcasing its commitment to innovative hydrogen applications. In mid-2023, Linde LienHwa, a subsidiary of Linde, completed the construction of Taiwan’s first hydrogen refueling station at Tree Valley Park, supporting the country’s net-zero emission strategy.

Nel ASA, a leading company in the hydrogen sector, has been actively expanding its hydrogen fueling station network throughout 2023 and 2024. In December 2022, Nel signed a Capacity Reservation Agreement (CRA) with an undisclosed U.S. energy company to deliver 16 hydrogen fueling stations in California. The project, valued at approximately USD 24 million, includes installation and commissioning services. The first deliveries began in Q4 2023 and will continue into 2024, reflecting Nel’s commitment to enhancing the hydrogen infrastructure in the U.S.

Conclusion

The future of hydrogen fueling stations is promising, with significant advancements and investments driving the sector forward. Hydrogen is poised to play a crucial role in the global transition to clean energy, supported by declining production costs, particularly for green hydrogen produced via renewable sources like solar and wind energy. Government policies and substantial investments are accelerating the development of hydrogen infrastructure, making it more accessible and cost-effective. For instance, investments in hydrogen fueling technology and infrastructure have seen a notable increase, with projects in regions like California and Alberta focusing on creating extensive hydrogen refueling networks.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)