Table of Contents

Introduction

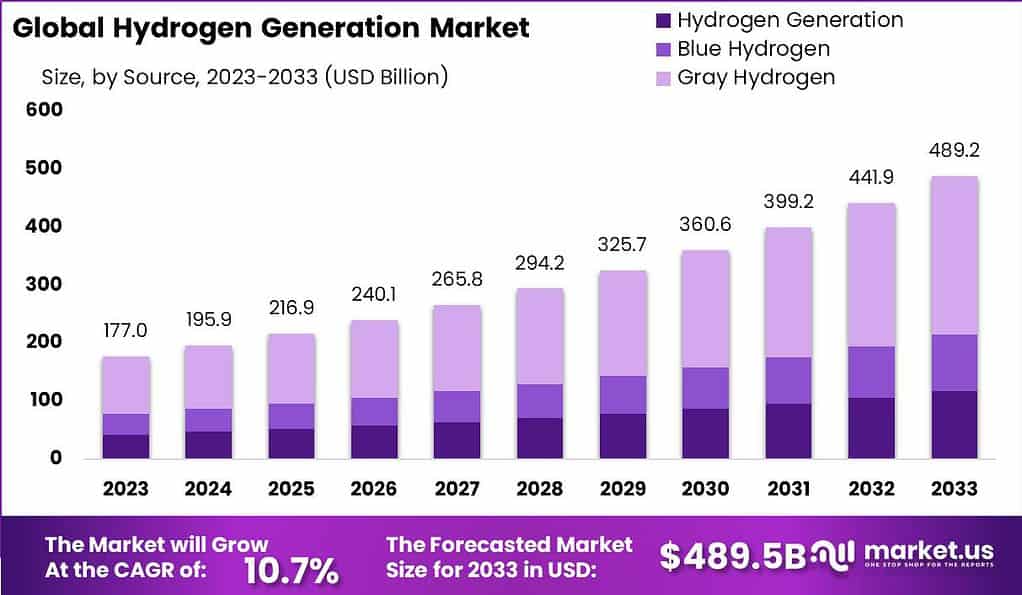

The global Hydrogen Generation Market is poised for significant growth, with its market size expected to increase from USD 177.0 billion in 2023 to USD 489.2 billion by 2033, reflecting a robust CAGR of 10.7% during this period. This growth trajectory underscores the increasing importance of hydrogen as a clean and efficient energy source.

Several key factors drive this expansion. The global push towards cleaner energy solutions and stringent government policies aimed at reducing greenhouse gas emissions are major catalysts. Hydrogen, which can be produced from both renewable and non-renewable sources, stands out as a carbon-neutral fuel. Its combustion results in only water vapor, making it a pivotal solution in addressing climate change and reducing dependency on fossil fuels.

The application spectrum of hydrogen is broad, encompassing transportation, power generation, ammonia production, and petroleum refining. Among these, the transportation sector is expected to witness the fastest growth, driven by the increasing adoption of fuel-cell electric vehicles (FCEVs). Governments and private entities are investing heavily in hydrogen infrastructure to support this transition. For instance, Air Products and Chemicals, Inc. has partnered with Edmonton International Airport to introduce hydrogen fuel cell passenger vehicles.

Regionally, the Asia Pacific dominates the market, with China leading in hydrogen demand due to its extensive refinery operations and proactive adoption of hydrogen technologies in transportation and power generation. Europe and North America also contribute significantly, with numerous projects aimed at integrating hydrogen into existing energy systems and transportation networks.

Technological advancements and strategic investments are pivotal to market growth. Recent developments include Linde plc’s long-term agreement to supply green hydrogen to Evonik, and Air Liquide’s substantial investments in large-scale electrolysis projects to produce renewable hydrogen. These advancements are essential for making hydrogen production more cost-effective and scalable.

However, the market faces challenges such as high production costs, the need for substantial infrastructure investments, and competition from other clean technologies. The transition from gray hydrogen (produced from fossil fuels) to green hydrogen (produced from renewable sources) is particularly critical and requires active government support through subsidies and favorable policies.

Hydrogen Generation Statistics

- Blue hydrogen generates CO2 and manages it downstream but can capture only up to 90% of the CO2 generated.

- Scotland is currently pioneering over 50 renewable and low-carbon hydrogen projects spanning generation.

- Scotland has a huge offshore wind resource and 10% of Europe’s tidal energy flows around our coastline, meaning we have an abundance of low-cost wind and marine energy.

- 74% of industry leaders consider Scotland as one of the world’s best training grounds, as our skilled workforce is trained to best-in-class Offshore Petroleum Industry Training Organisation (OPITO) standards.

- The Energy Transition Index benchmarks 120 countries on their current energy system performance and the readiness of their enabling environment.

- The numerical model was developed in TRNSYS and consists of PV panels supplying a PEM electrolyzer of 63.6% measured stack efficiency and hydrogen storage in metal hydride cylinders for household distribution.

- By 2030, the market share of hybrid or electric vehicles is expected to increase from 1% to 30%. By 2035, 450 million electric cars will be on the market.

- Currently, the majority of hydrogen around the world is produced from fossil fuels (76% from natural gas, and 23% from coal). This is known as grey and black hydrogen, respectively.

- Canada ranks in the top 10 global hydrogen producers and produces some 3 million tonnes of hydrogen annually for industrial use—approximately 4% of the global total (69 million tonnes per year).

- Market analysts Frost and Sullivan expect hydrogen production to more than double to over 168 million tons by 2030 from about 70 million tons in 2020.

- ABB is developing a high-power hydrogen fuel cell concept capable of generating 3 megawatts (4,000 HP) of electrical power for application onboard a wide range of ships.

- More than 30 public retail hydrogen fueling stations are online in California, with plans to install 100.

- Fossil fuel-based hydrogen generation emits 830 million tons of CO2 annually, which corresponds to 2% of global CO2 emissions.

- According to the International Energy Agency (IEA), 90.36 million tons (Mts) of low-carbon hydrogen production was achieved in 2019.

- When annual global hydrogen generation is considered (69 Mts/year), it can be realized that clean hydrogen corresponds to around 0.52% of global hydrogen generation.

- A 250kW hydrogen electrolysis facility was recently installed at the Natural Energy Laboratory of Hawaii Authority’s (NELHA’s) campus.

- Last year, the European Commission released a Hydrogen Strategy, which reported that “analysts estimate that clean hydrogen could meet 24 percent of world energy demand by 2050

- Hydrogen needs to be cooled to -253˚C to liquefy it, or it needs to be compressed to 700 times atmospheric pressure so it can be delivered as a compressed gas.

Emerging Trends

- Shift Towards Green Hydrogen: One of the most prominent trends is the growing focus on green hydrogen, which is produced using renewable energy sources such as wind and solar power through water electrolysis. This method emits no carbon dioxide, making it an essential component of global decarbonization efforts. Despite green hydrogen currently making up a small fraction of total production, its share is expected to increase significantly as renewable energy costs decline and electrolyzer technologies advance.

- Increased Investments and Projects: The hydrogen sector has seen a surge in global investments, with a reported $570 billion invested in hydrogen projects in 2023 alone, a 31% increase from the previous year. This influx of capital is aimed at expanding production capacity and developing infrastructure to support hydrogen distribution and usage.

- Expansion of Electrolyser Capacity: There is a concerted effort to scale up electrolyzer manufacturing capacity. Currently, global capacity is around 14 GW, with ambitious plans to reach 155 GW by 2030. This expansion is crucial for meeting the anticipated demand for green hydrogen and achieving cost reductions similar to those seen in wind and solar power industries.

- Policy and Regulatory Support: Governments worldwide are implementing supportive policies and funding initiatives to boost hydrogen production and usage. Notable examples include the U.S. Hydrogen Production Tax Credit and the EU’s Important Projects of Common European Interest (IPCEI) scheme. These policies are essential for making low-emission hydrogen economically viable and competitive with fossil fuel-based hydrogen.

- Diversification of Hydrogen Applications: Hydrogen is finding new applications across various sectors, including transportation, power generation, and industrial processes. For instance, hydrogen fuel cells are becoming more common in vehicles, and hydrogen is being explored as a means to store renewable energy and provide grid stability. This diversification is expected to drive further demand and integration of hydrogen into the energy mix.

- Challenges in Infrastructure and Supply Chain: Despite the positive momentum, the hydrogen market faces significant challenges, particularly in infrastructure development and supply chain management. High production costs, primarily due to expensive electrolyzer technology and the need for robust distribution networks, are major barriers. Additionally, the slow implementation of support schemes and regulatory frameworks can delay project timelines and impact overall market growth.

- Technological Innovations: Continuous innovation is critical for the hydrogen market. New production methods, such as solar-driven photolysis and biological processes, are being explored to enhance efficiency and reduce costs. Similarly, advancements in hydrogen storage solutions, such as metal hydrides and advanced compression techniques, are essential for addressing storage and transportation challenges.

Use Cases

- Transportation: Hydrogen is increasingly used as a fuel for vehicles, including cars, buses, trucks, and trains. Hydrogen fuel cells convert hydrogen into electricity to power electric motors. According to the International Energy Agency (IEA), there are over 470 hydrogen refueling stations worldwide as of 2023, with numbers rapidly increasing to support the growing fleet of hydrogen fuel cell vehicles (FCVs). In Japan, for example, the government aims to have 200,000 FCVs on the road by 2025.

- Power Generation: Hydrogen can be used in power plants to generate electricity, either through combustion or fuel cells. It is also a promising solution for storing excess renewable energy. The World Economic Forum reports that using hydrogen for power generation could contribute significantly to decarbonizing the energy sector. A notable project is the H2H Saltend in the UK, aiming to produce 100 megawatts of low-carbon hydrogen by 2026, enough to power thousands of homes.

- Industrial Processes: Hydrogen is crucial in various industrial applications, such as refining petroleum, producing ammonia for fertilizers, and manufacturing methanol. The IEA states that hydrogen is currently used in 55% of ammonia production and 40% of methanol production globally. The transition to green hydrogen in these processes could drastically reduce carbon emissions. For instance, the steel industry, which is responsible for about 7% of global CO2 emissions, can significantly benefit from hydrogen as a reducing agent instead of coal.

- Aviation and Maritime: Hydrogen-based fuels are being developed for aviation and shipping, sectors that are challenging to decarbonize. According to the McKinsey report, hydrogen could account for 50 million tonnes per annum (Mtpa) in aviation and 15 Mtpa in maritime by 2050. Projects like ZeroAvia’s hydrogen-electric aircraft and Maersk’s plans to explore hydrogen fuels for ships are pioneering efforts in this direction.

- Residential and Commercial Heating: Hydrogen can be blended with natural gas or used in pure form for heating buildings. In places like the UK, pilot projects are testing hydrogen boilers and blends in existing gas networks. Hydrogen could replace natural gas in heating, significantly lowering greenhouse gas emissions. The UK’s HyDeploy project, for instance, is blending up to 20% hydrogen into the natural gas grid, aiming to reduce CO2 emissions by millions of tonnes annually.

- Energy Storage: Hydrogen can store surplus electricity generated by renewable sources like wind and solar. This stored hydrogen can later be converted back into electricity or used in other applications, making it a key player in balancing supply and demand in renewable energy systems. According to the IEA, the global electrolyzer capacity for producing hydrogen from renewables reached 8 GW in 2022 and is expected to grow significantly to meet future energy storage needs.

Major Challenges

- High Production Costs: Producing hydrogen, especially green hydrogen from renewable sources, remains expensive. The cost of electrolyzers, which are critical for green hydrogen production, is high. Although there are efforts to scale up production and reduce costs, achieving cost parity with fossil fuels is still a significant hurdle. The IEA reports that fuel costs alone account for 45-75% of hydrogen production costs, heavily influenced by gas prices.

- Infrastructure Development: The existing infrastructure for hydrogen production, storage, and distribution is inadequate. Building a comprehensive hydrogen infrastructure requires substantial investment and time. For example, the development of hydrogen refueling stations is lagging, which is essential for the adoption of hydrogen fuel cell vehicles. As of 2023, there are only around 470 hydrogen refueling stations globally, which is insufficient to support a large-scale rollout of hydrogen-powered vehicles.

- Energy Efficiency: Hydrogen production, particularly through electrolysis, is energy-intensive. The process of converting electricity into hydrogen and then back into electricity through fuel cells or combustion involves energy losses. This inefficiency makes hydrogen less attractive compared to the direct use of electricity from renewables in some applications.

- Regulatory and Policy Uncertainty: There is a lack of consistent global standards and regulatory frameworks for hydrogen. This uncertainty hampers investment and development. While some regions have made progress, such as the European Union’s Clean Hydrogen Joint Undertaking, inconsistencies, and slow policy implementation continue to pose challenges.

- Environmental Impact of Hydrogen Production: Most hydrogen is currently produced from natural gas through a process that emits significant amounts of CO2. Transitioning to low-carbon hydrogen production methods, like blue and green hydrogen, is crucial but challenging due to technological and economic barriers. As of 2021, only about 0.1% of global hydrogen production is from green hydrogen.

Market Growth Opportunities

- Expansion of Green Hydrogen: With the declining costs of renewable energy sources like wind and solar power, the production of green hydrogen through electrolysis is becoming more economically viable. The International Energy Agency (IEA) notes that producing hydrogen using renewable energy can significantly reduce greenhouse gas emissions, making it an attractive option for countries aiming to meet their climate goals.

- Government Support and Policies: Governments worldwide are increasingly implementing policies and providing financial incentives to promote hydrogen production. For instance, the U.S. Department of Energy’s Hydrogen Production Tax Credit and the European Union’s Clean Hydrogen Joint Undertaking are designed to encourage investment in hydrogen technologies. Such policies are crucial for reducing the cost gap between hydrogen and conventional fuels.

- Industrial Applications: Hydrogen is already used extensively in industries like ammonia production, refining, and methanol production. The shift towards low-carbon hydrogen can help these industries reduce their carbon footprint. The steel industry, which contributes significantly to global CO2 emissions, presents a major opportunity for hydrogen adoption as a reducing agent instead of coal.

- Transportation Sector: Hydrogen fuel cells are gaining traction in the transportation sector, especially for heavy-duty vehicles such as trucks, buses, and trains. With countries like Japan targeting the deployment of 200,000 fuel cell vehicles by 2025, the transportation sector offers substantial growth potential for hydrogen.

- Energy Storage and Grid Stability: Hydrogen can play a critical role in energy storage, balancing supply and demand in renewable energy systems. By storing excess electricity generated from renewables and converting it back to power when needed, hydrogen can enhance grid stability and energy security.

- International Collaboration and Trade: As countries develop hydrogen production capabilities, international trade in hydrogen could emerge, similar to the current trade in oil and natural gas. Regions with abundant renewable resources, like the Middle East and Australia, could become major exporters of green hydrogen.

Recent Developments

Air Liquide International S.A. has been actively expanding its footprint in the hydrogen generation sector with several key projects and investments. In 2023, notable achievements included the inauguration of a hydrogen gigafactory in Berlin in November, and a joint venture with Siemens Energy to produce large-scale proton exchange membrane (PEM) electrolyzers. This facility aims to ramp up to 3 GW of electrolysis capacity by 2025, significantly boosting green hydrogen production capabilities. In June, Air Liquide and Iveco Group launched Europe’s first high-pressure hydrogen refueling station for heavy-duty trucks in Fos-sur-Mer, France, as part of the HyAMMED project.

Furthermore, in October 2023, Air Liquide became a partner in six out of seven regional Clean Hydrogen Hubs announced by the U.S. Department of Energy, aiming to develop a comprehensive hydrogen infrastructure across the United States. The company also opened the world’s largest liquid hydrogen production facility in North Las Vegas in May 2023, capable of producing 30 tons of liquid hydrogen per day, primarily to support the clean mobility market in California. These efforts are part of Air Liquide’s strategic plan to invest €8 billion in the low-carbon hydrogen value chain by 2035, underscoring its commitment to driving the hydrogen economy forward.

In 2023, INOX Air Products Ltd. made significant strides in the hydrogen generation sector, particularly through its collaboration with Asahi India Glass Ltd. (AIS). This partnership involves a 20-year agreement to supply green hydrogen to AIS’s greenfield float glass facility in Chittorgarh, Rajasthan. The project is set to be commissioned by July 2024 and represents India’s first green hydrogen plant for the float glass industry. The plant will have an annual capacity of 190 tonnes of green hydrogen, with 95 tonnes supplied in the initial phase. The hydrogen will be produced using solar-powered electrolysis, aligning with AIS’s sustainability strategy to decarbonize its operations and use 94% of its power from renewable sources.

In 2023 and 2024, Air Products and Chemicals Inc. has been significantly advancing its hydrogen generation initiatives. In April 2023, the company announced the construction of the first commercial-scale hydrogen refueling station in Edmonton, Alberta, Canada. This station, supported by a $1 million grant from Natural Resources Canada, is part of Air Products’ broader strategy to develop hydrogen infrastructure and promote clean energy solutions across the country.

In June 2023, Air Products revealed plans for a $4 billion green hydrogen plant in Texas, in collaboration with AES, which aims to produce substantial amounts of green hydrogen for various uses, including transportation and industrial applications. By October 2023, Air Products had also secured involvement in multiple U.S. Department of Energy Hydrogen Hubs, emphasizing its commitment to creating a robust hydrogen network.

Linde Plc has been significantly active in the hydrogen generation sector throughout 2023 and 2024. In April 2023, Linde announced a $1.8 billion investment to supply clean hydrogen to OCI’s blue ammonia project in the U.S. Gulf Coast. This project, expected to commence in 2025, will significantly enhance hydrogen production capacity and support large-scale decarbonization efforts. By December 2023, Linde increased its liquid hydrogen production capacity at its McIntosh, Alabama facility, now producing up to 30 tons per day to meet growing demand.

Conclusion

The future of hydrogen generation holds immense promise as a cornerstone of the global clean energy transition. Hydrogen, once sidelined, is now at the forefront of efforts to decarbonize various sectors, including transportation, industry, and power generation. As of 2023, significant investments and technological advancements are propelling the hydrogen economy forward. Governments worldwide have implemented policies and funding initiatives to support hydrogen projects, with North America and Europe leading these efforts.