Table of Contents

Introduction

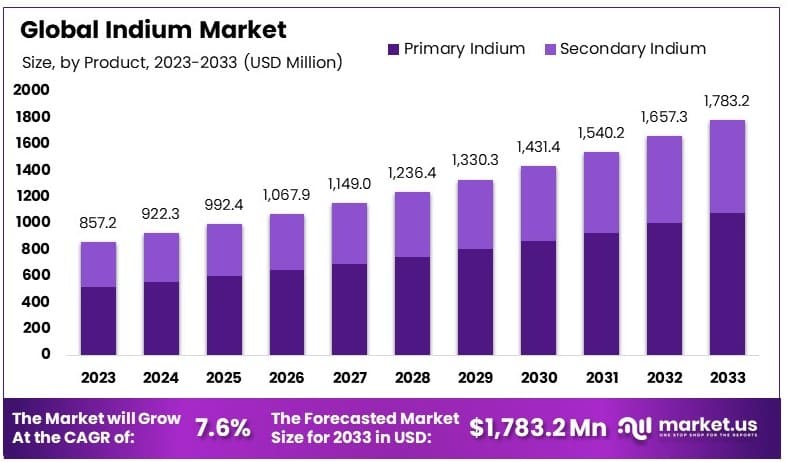

The global indium market is poised for substantial growth, projected to escalate from USD 857.2 million in 2023 to USD 1,783.2 million by 2033, advancing at a compound annual growth rate (CAGR) of 7.6% during the forecast period from 2024 to 2033. This expansion is driven by several key factors, including the increasing demand for indium in the electronics industry, particularly for LCD displays and touchscreens, as well as its applications in photovoltaic cells which contribute to renewable energy solutions.

However, the market faces significant challenges, such as the scarcity of indium resources and fluctuations in its price, which could hinder market growth. Recent innovations have shown promising advancements in recycling technologies, which may mitigate resource scarcity by enabling more efficient indium recovery from electronic waste. These technological innovations, coupled with increasing investments in renewable energy, are expected to further influence the market dynamics and support its growth trajectory over the coming decade.

Recent developments in the indium market have highlighted strategic advancements through acquisitions, mergers, and product innovations, particularly among key industry players such as Indium Corporation and PPM Pure Metals GmbH.

China Germanium is a significant player in the indium market, primarily due to China’s dominance in indium production. In 2021, China produced approximately 595 tons of indium, representing more than half of the world’s refined indium output. This company’s strategic position in the global supply chain underscores its importance in meeting the growing demand for indium in electronics and renewable energy sectors.

PPM Pure Metals GmbH, a European company, is a key player known for its high-purity indium products. The company focuses on producing indium for specialized applications in electronics and photovoltaic industries. PPM’s emphasis on quality and innovation positions it as a reliable supplier in the competitive indium market.

Teck Cominco, a major mining company based in Canada, contributes to the indium market through its zinc mining operations. Indium is often extracted as a byproduct of zinc refining. Teck Cominco’s advancements in mining technology and efficient extraction processes have enhanced its ability to produce significant quantities of indium, thereby supporting the global supply chain.

Key Takeaways

- Market Value: The Indium Market was valued at USD 857.2 million in 2023, and is expected to reach USD 1,783.2 million by 2033, with a CAGR of 7.6%.

- Product Analysis: Primary Indium dominated with 60.2%; important for its high purity and critical applications.

- Application Analysis: Indium Tin Oxide led with 45.1%; significant for its use in electronic displays and touchscreens.

- End-Use Industry Analysis: Electronics dominated with 30.6%; crucial for its role in various electronic devices and components.

- Dominant Region: APAC held 38.6%; significant due to its strong electronics manufacturing base.

- Analyst Viewpoint: The indium market is moderately competitive with strong growth potential. Future trends indicate increased demand driven by advancements in electronics and renewable energy technologies.

Indium Statistics

- Indium is a soft white metal with a hardness of 1.2, ductile and malleable, with a melting point of 115°C, specific heat of 0.0598 cal/g, and density of 7.3 g/cc. It has a long half-life and is slightly radioactive.

- Indium is extensively used in indium tin oxide films, alloys, and semiconductor materials for flat panel displays, solders, PV cells, thermal interface materials, batteries, and LEDs.

- Indium reduces operating temperatures of high-end devices by up to 10°C.

- In2O3 is important in industrial applications such as cathode ray tubes, catalysis in electrooxidation, energy-efficient windows, sensors, and solar cells.

- Indium forms compounds in oxidation states I, II, and III, with trivalent state coordination compounds being the most common.

- The US imported indium in 2017 from Canada, China, France, and the Republic of Korea, with global production at 760 tonnes.

- US indium import data for 2017 showed 120 tonnes imported and a net import reliance of 100%. The price averaged $360 per kilogram.

- Global refined indium production in 2017 included 310 tonnes from China, 215 tonnes from the Republic of Korea, and 70 tonnes from Japan, totaling approximately 720 tonnes.

- Indium recovery from metallurgical wastes totals 15,000 tonnes, with an annual generation of 500 tonnes and an average recovery rate of 50%.

- Indium is most commonly recovered from the zinc-sulfide ore mineral sphalerite, with indium content in zinc deposits ranging from less than 1 part per million to 100 parts per million.

- Indium metal is used for sealing in cryogenic applications, remaining malleable and ductile below -150°C.

- Indium alloys melt at temperatures ranging from 6.5°C to 310°C, making them suitable for soldering or fusing applications.

- In 2019, indium was not recovered from ores in the United States.

- Estimated domestic consumption of refined indium in 2019 was 110 tons.

- The estimated value of refined indium consumed domestically in 2019 was about $43 million.

- From 2015 to 2019, annual average prices for indium in Rotterdam were $410, $240, $225, $291, and $210 per kilogram, respectively.

- Net import reliance for indium as a percentage of estimated consumption was 100% from 2015 to 2019.

- Indium recycling mostly concentrates on scrap processing rather than the recycling of end-of-life products.

- Recycling of indium is most commonly done from ITO scrap in Japan and the Republic of Korea.

- Import sources for indium from 2015 to 2018 were China (36%), Canada (22%), Republic of Korea (11%), Taiwan (7%), and others (24%).

- In January 2019, the Fanya Metal Exchange attempted to auction 37.41 tons of indium at $170 per kilogram but received no bids.

- A second auction in April 2019 for 34.64 tons of indium sold for about $5.5 million ($161 per kilogram).

- The Fanya Metal Exchange reportedly held 3,600 tons of indium before closing in 2015.

- China exported 421 tons of indium in the first 8 months of 2022, a 13% increase compared with the same period in 2021.

- World refinery production of indium in 2021 and 2022 included: Belgium (20 tons each year), Canada (60 tons and 55 tons), China (540 tons and 530 tons), France (38 tons and 20 tons), Japan (66 tons each year), Republic of Korea (190 tons and 200 tons), Peru (12 tons and 0 tons), Russia (5 tons each year), and Uzbekistan (1 ton each year).

- World total refinery production of indium was 932 tons in 2021 and 900 tons in 2022.

- An indium-producing zinc smelter in Auby, France, was placed on care-and-maintenance status in January 2022 and resumed production at a reduced rate in March 2022.

- The Utah Geological Survey received a Federal grant to research the genesis and geology of the zinc-copper-indium West Desert deposit in Juab County, UT.

- Import reliance for indium in the European Union is 100%, with an end-of-life recycling input rate of 14%.

- The majority of the European Union’s indium is sourced from France (31%), Belgium (26%), and the United Kingdom (12%).

- World refinery production of indium in 2018 and 2019 included: Belgium (22 tons and 20 tons), Canada (58 tons and 60 tons), China (300 tons each year), France (40 tons and 50 tons), Japan (70 tons and 75 tons), Republic of Korea (235 tons and 240 tons), Peru (11 tons and 10 tons), and Russia (5 tons each year).

- World total refinery production of indium was 741 tons in 2018 and 760 tons in 2019.

- The estimated value of refined indium consumed domestically in 2022 was about $40 million.

- From 2018 to 2022, annual average U.S. warehouse prices for indium were $285, $182, $161, $223, and $250 per kilogram, respectively.

- Net import reliance for indium as a percentage of estimated consumption was 100% from 2018 to 2022.

- Indium imports for consumption in the United States were 125 tons in 2018, 95 tons in 2019, 115 tons in 2020, 158 tons in 2021, and 160 tons in 2022.

- Indium was first investigated by Dr. William S. Murray in 1924.

- Indium is the best calibration metal standard, with a melting point of 156.6 °C and a heat of fusion of 28.66 J/g.

- The main producers of indium are China, Korea, Japan, and Canada.

- Indium is most commonly recovered from the zinc-sulfide ore mineral sphalerite, with indium content in zinc deposits ranging from less than 1 part per million to 100 parts per million.

- Indium recovery from metallurgical wastes totals 15,000 tonnes, with an annual generation of 500 tonnes and an average recovery rate of 50%.

Emerging Trends

- Increased Demand in Display Technologies: The demand for indium is rising due to its critical role in manufacturing LCD displays. As consumer electronics proliferate, the need for high-quality displays drives indium consumption, impacting global supply chains and pricing dynamics.

- Growth in Photovoltaic Applications: Indium’s use in thin-film solar cells, particularly in copper indium gallium selenide (CIGS) photovoltaic cells, is expanding. This growth is fueled by the global shift towards renewable energy sources, positioning indium as a vital component in sustainable technology development.

- Recycling Innovations: Recycling technologies for indium are becoming more sophisticated and widespread, addressing both environmental concerns and the risk of supply shortages. These advancements not only promote sustainability but also stabilize indium supply by recovering it from obsolete electronics.

- Fluctuating Prices Due to Supply Instability: Indium prices are subject to significant fluctuations due to its scarce supply and the geopolitical complexities of major producing countries. This volatility affects industries reliant on indium, prompting them to seek alternatives or improve recycling methods.

- Emergence of Transparent Conductive Oxides: Transparent conductive oxides made with indium are gaining traction for applications beyond displays, including smart windows and optoelectronic devices. This trend highlights indium’s versatility and its potential to unlock new market segments.

- Impact of Technological Advancements: Technological breakthroughs in electronics manufacturing, where indium is used for soldering and thermal management, are creating more efficient and miniaturized devices. These advancements elevate the performance requirements and, consequently, the demand for high-purity indium.

- Strategic Stockpiling by Countries: Some countries are beginning to stockpile indium as a strategic resource, anticipating future shortages and securing supply for high-tech industries. This trend reflects growing recognition of indium’s strategic importance in the global technology landscape.

Use Cases

- LCD Screens: Indium tin oxide (ITO) is a key component in LCD screens, providing the necessary transparency and conductivity to display images. Its application in smartphones, tablets, and televisions underscores its critical role in consumer electronics.

- Thin-Film Solar Cells: Indium is used in the production of thin-film solar cells, particularly in copper indium gallium selenide (CIGS) panels. This application harnesses indium’s excellent photovoltaic properties, contributing to the renewable energy sector by enabling efficient solar energy conversion.

- Touchscreen Technology: Indium’s role in touchscreen technology is pivotal due to its use in indium tin oxide coatings. These coatings allow touchscreens to register user input by conducting electricity while remaining transparent, essential for devices like smartphones and interactive kiosks.

- Solder and Alloys: Indium is used in various solder and alloy compositions due to its low melting point and ability to bond well with metals. These properties make it ideal for creating strong, reliable joints in electronics, particularly in high-end, temperature-sensitive applications.

- LED Lights: Indium gallium nitride is a material used in the production of light-emitting diodes (LEDs). Indium’s inclusion improves the efficiency and color range of LEDs, making them suitable for displays and energy-efficient lighting solutions.

- Thermal Interface Materials: Indium is employed in thermal interface materials (TIMs) used in electronics to enhance heat dissipation from components like processors to heat sinks. This use is critical for maintaining the reliability and performance of high-performance electronic devices.

- Semiconductors: Indium phosphide is used in high-speed and high-frequency semiconductor applications. Its properties are essential for telecommunications and networking technology, contributing significantly to the functionality and development of advanced communication infrastructure.

Key Players Analysis

China Germanium has been actively involved in the indium sector, focusing on refining and producing high-purity indium. The company reported significant revenue growth, reaching $2.8 billion in recent years. Their strategic efforts include optimizing their production processes and expanding their market presence. Recent developments indicate China Germanium’s focus on maintaining its leadership in the indium market through technological advancements and strategic acquisitions.

China Tin Group is a notable player in the indium sector, leveraging its extensive experience in metal refining and production. The company focuses on producing high-quality indium and has seen steady revenue growth due to increased demand in electronics and semiconductors. Recent efforts include expanding their production capabilities and enhancing their product portfolio to meet market needs.

PPM Pure Metals GmbH specializes in the production of high-purity indium and other specialty metals. The company has seen consistent revenue growth due to its focus on ultra-pure indium, used in various high-tech applications such as semiconductors and solar cells. Recent developments include expanding their product offerings to meet the increasing demand for high-purity indium in the electronics industry. PPM Pure Metals remains a key player in the global indium market, continually enhancing its production capabilities and technological innovations.

Teck Cominco, a prominent player in the indium sector, has focused on producing high-quality indium for use in advanced electronics and photovoltaic applications. The company reported robust revenue growth, driven by strong demand for indium in flat-panel displays and other electronic devices. Teck’s recent efforts include optimizing its production processes and expanding its market reach, ensuring a steady supply of high-purity indium to meet global demand.

Nyrstar is actively involved in the indium sector, focusing on high-purity indium production for advanced technological applications. The company has reported significant revenue growth, driven by strong demand for indium in electronics and renewable energy sectors. In 2023, Nyrstar invested in expanding its production capabilities and optimizing its smelting operations to enhance efficiency. Their efforts include the reopening of their Budel plant in the Netherlands, which had been on care and maintenance due to high energy costs.

Yuguang Gold & Lead Co., Ltd. has established a strong presence in the indium sector by producing high-purity indium for various industrial applications. The company has reported a steady increase in revenue, benefiting from the rising demand for indium in electronics and photovoltaic industries. Recently, Yuguang expanded its production facilities to increase output and meet global market needs. Their strategic focus on enhancing production processes has positioned them as a key player in the indium market.

AXT Inc. is a prominent player in the indium sector, primarily focusing on manufacturing high-performance indium phosphide (InP) semiconductor substrates. In the first quarter of 2024, AXT reported a revenue of $22.7 million, surpassing previous guidance. This growth was driven by increased demand for indium phosphide substrates used in applications such as data center connectivity and 5G infrastructure. AXT continues to invest in its production capabilities and technological advancements to meet the rising market demand.

Wafer World Inc. specializes in producing indium phosphide wafers, among other semiconductor materials. The company has established strong relationships with Fortune 100 companies and research institutions, ensuring a steady demand for its high-quality products. Wafer World reported significant growth in its market share, driven by the increasing use of indium phosphide in optoelectronic devices and 5G technologies. The company continues to enhance its manufacturing processes to deliver superior quality wafers efficiently.

Logitech Ltd. is a significant player in the indium sector, focusing on high-purity indium production used in advanced electronics and optoelectronic applications. The company has maintained robust market presence and technological advancement, contributing to the growth of the indium phosphide wafer market. Logitech Ltd. has emphasized innovation in manufacturing processes to enhance product quality and meet the rising demand in the semiconductor industry. Their efforts have positioned them among the top manufacturers in the indium sector.

Western Minmetals (SC) Corporation specializes in producing high-purity indium, offering grades ranging from 5N to 7N5 purity. This high-purity indium is crucial for applications in liquid crystal displays, flat-panel displays, and photovoltaic fields. The company has seen steady revenue growth due to increasing demand for high-purity indium in these advanced technological applications. Western Minmetals continues to enhance its production capabilities and maintain strict quality control measures to meet global market needs.

Conclusion

In conclusion, the market for indium is poised for significant growth in the coming years. This growth can be attributed to the increasing demand for indium in various industries, including electronics, solar energy, and the production of flat-panel displays. The unique properties of indium, such as its ability to form transparent and conductive films, make it an essential material for advanced technology applications.

Furthermore, ongoing research and development are expected to enhance the efficiency and applications of indium, thereby expanding its market potential. However, it is crucial to monitor the supply chain and recycling processes to ensure sustainable and stable availability. Overall, the indium market presents promising opportunities for stakeholders, driven by technological advancements and growing industrial applications.