Table of Contents

Introduction

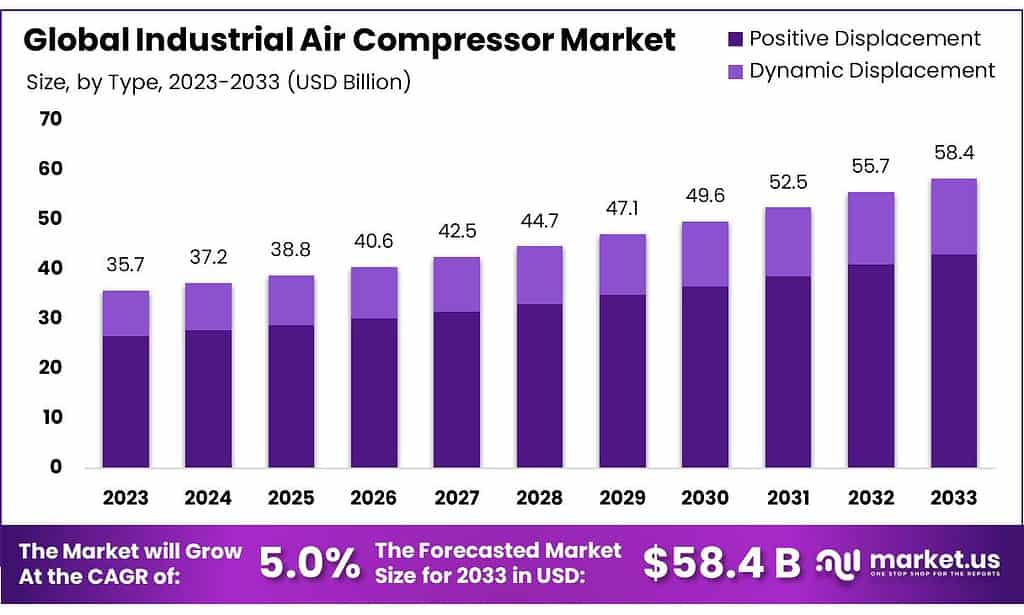

The global industrial air compressor market is poised for significant growth, with its value projected to rise from USD 35.7 billion in 2023 to USD 58.4 billion by 2033, at a compound annual growth rate (CAGR) of 5.0% during the forecast period. This growth is driven by several key factors, including the increasing demand for high-capacity air compressors across various industries.

High-capacity units, particularly those above 501 kW, are crucial in sectors that depend on a high volumetric flow of air for heavy-duty equipment, which is essential for maintaining optimal operations and product quality in manufacturing processes. The market is also experiencing a trend towards smaller, more energy-efficient models in the 101-200 kW range. These models are gaining popularity due to their compact size, reduced noise levels, and flexibility, making them suitable for a variety of industrial environments, including those where noise reduction is essential.

Recent technological advancements and innovations have further bolstered the market growth. For instance, developments in rotary and screw compressors have made them more reliable and efficient, appealing to industries that require continuous fluid flow at high pressures. The integration of modern technologies has enabled these compressors to meet the rigorous demands of diverse sectors such as manufacturing, food and beverage, and oil and gas.

The industrial air compressor market has seen several recent developments, driven by major players like Siemens AG, Hitachi, Ltd, Mitsubishi Electric Corporation, and Baker Hughes Company, each focusing on expanding their technological capabilities and market presence through strategic initiatives.

Siemens AG, in collaboration with Mitsubishi Electric, signed a Memorandum of Understanding to enhance the development of gas solutions with zero global warming potential in the high-voltage power transmission industry. This partnership emphasizes their commitment to sustainable technology solutions in industrial applications, including air compressors.

Hitachi, Ltd has been active through its joint ventures, notably with Mitsubishi Heavy Industries, forming Primetals Technologies. This venture aims to serve the iron, steel, and aluminum industries with advanced technology solutions, potentially including developments in air compression systems used within these sectors.

Despite these positive growth indicators, the market faces challenges such as the need for continuous technological innovation and the management of operational costs, which are critical to maintaining a competitive edge and market share in a rapidly evolving industrial landscape.

Key Takeaways

- The global industrial air compressor market will be valued at USD 35.7 billion in 2023.

- The global industrial air compressor market is projected to reach USD 58.4 billion by 2033.

- Among types, positive displacement accounted for the largest market share of 74.6%.

- Among designs, stationary industrial air compressors accounted for the majority of the market share with 62.5%.

- Among coolant types, air-cooled held the majority of the market share at 79.0%.

- Among end-users, chemicals & petrochemicals accounted for the majority of revenue share in 2023.

- Asia Pacific held the largest market share, with 37.0% in industrial air compressors in 2023.

Industrial Air Compressor Statistics

- One horsepower equals 550 foot-pounds per second.

- A well-designed compressor should yield 4 CFM at 100 PSIG per unit of power.

- The lifespan of air compressors can range from 10 to 15 years with proper care.

- Cost of HVAC system compressors: $800 to $3,000.

- Air compressors revolutionized industries in 150 years.

- Integral to industries, like manufacturing, consuming around 10% of industrial electricity.

Emerging Trends

The industrial air compressor market is experiencing several emerging trends shaping its future growth and development. A key trend is the increasing focus on energy efficiency and sustainability. As industries strive to reduce operational costs and comply with stringent environmental regulations, there is a growing demand for energy-efficient air compressors. Modern compressors with variable speed technology and energy recovery systems are becoming popular as they offer significant energy savings and lower carbon footprints. This trend aligns with global efforts to enhance energy efficiency and reduce greenhouse gas emissions.

Another notable trend is the integration of smart technologies and IoT (Internet of Things) into air compressor systems. This advancement allows for real-time monitoring, predictive maintenance, and enhanced operational efficiency. IoT-enabled compressors can provide valuable data on performance metrics, helping industries optimize their operations and prevent downtime through proactive maintenance strategies. This technology also supports remote monitoring and control, increasing the flexibility and responsiveness of industrial processes.

The market is also witnessing a shift towards oil-free compressors, particularly in industries where air purity is critical, such as food and beverage, pharmaceuticals, and electronics manufacturing. Oil-free compressors eliminate the risk of oil contamination, ensuring a high-quality, clean air supply, which is essential for maintaining product integrity and complying with strict industry standards. This shift is driven by the increasing demand for high-purity applications and the benefits of reduced maintenance and environmental impact associated with oil-free technology.

In addition, the trend towards customization and modular designs is gaining traction. Manufacturers are developing compressors that can be tailored to specific industrial needs, offering modular components that can be easily configured and scaled. This approach enhances flexibility, allowing businesses to adapt their air compressor systems to changing operational requirements without significant overhauls or investments.

Furthermore, there is a growing emphasis on hybrid systems that combine different types of compressors to optimize performance and efficiency. For example, integrating rotary and centrifugal compressors can leverage the strengths of both technologies, providing a more versatile and efficient solution for varying industrial demands. This trend reflects the industry’s move towards more comprehensive and adaptive air compressor solutions.

Use Cases

Manufacturing: Industrial air compressors are essential in manufacturing, supporting tasks like powering pneumatic tools, welding, metal cutting, and surface stripping. They facilitate precise operations such as blowing bottles for packaging and operating hydraulic machinery, ensuring efficient production processes in factories

Food and Beverage Industry: In the food and beverage sector, air compressors play a crucial role in filling drinks, refrigeration, dehydration, and packaging. They help maintain product quality by providing clean, dry air essential for packaging and preserving food items, thus extending shelf life and ensuring hygiene.

Pharmaceuticals: Air compressors are vital in pharmaceuticals for packaging, transportation, and spray cleaning. They ensure that medicines and medical products are securely packaged and free from contaminants, supporting the stringent hygiene standards required in this industry.

Agriculture: In agriculture, compressors are used for spraying crops, operating dairy machines, and running conveyors for feed and crop processing. They provide reliable power for various farming equipment, enhancing productivity and efficiency in agricultural operations.

Oil and Gas: The oil and gas industry relies heavily on industrial air compressors for drilling, pipeline transportation, and refining processes. Compressors are used to power tools, compress gases, and maintain pressure in pipelines, ensuring smooth and efficient operations.

Construction: In construction, compressors are indispensable for powering pneumatic tools like jackhammers and drills, as well as for sandblasting and painting. Their portability and robust performance make them ideal for demanding construction environments.

Automotive: Air compressors are used in the automotive industry for spray painting, tire inflation, and operating pneumatic tools for assembly and maintenance tasks. They provide consistent air pressure essential for precision and efficiency in automotive manufacturing and repair.

Electronics: In the electronics industry, clean, dry air is crucial for the manufacturing and assembly of sensitive electronic components. Air compressors provide the necessary air quality to prevent contamination and ensure the integrity of electronic products.

Key Players Analysis

Siemens AG has a notable presence in the healthcare furniture sector through its advanced technological solutions that enhance the functionality and efficiency of healthcare environments. Siemens focuses on integrating smart technologies and digital solutions into healthcare furniture, aiming to improve patient care and operational efficiency in medical facilities. Their innovations include intelligent hospital beds and modular furniture systems that facilitate better patient monitoring and data integration, contributing to a more connected and responsive healthcare infrastructure.

Hitachi, Ltd. is actively involved in the healthcare furniture sector, emphasizing the integration of advanced medical technologies with ergonomic furniture designs. Through its subsidiary, Hitachi High-Tech, the company has consolidated its healthcare business to focus on developing innovative solutions that combine diagnosis, treatment, and digital healthcare. This includes the development of furniture systems that support high-tech medical equipment like proton therapy systems and automated cell culture equipment, enhancing the efficiency and effectiveness of healthcare delivery

Mitsubishi Electric Corporation is actively involved in the healthcare furniture sector, focusing on integrating advanced automation and smart technologies to enhance healthcare facilities. The company’s innovations include the HealthCam system, which uses facial recognition and thermal detection to monitor vital health indicators such as heart rate, blood oxygen levels, and temperature. This technology is designed to improve patient monitoring in hospitals and assisted living facilities, enhancing safety and response times. Mitsubishi Electric’s emphasis on combining healthcare needs with smart technology showcases its commitment to advancing medical environments.

Baker Hughes Company does not have a direct presence in the healthcare furniture sector but significantly contributes to healthcare through its advanced technology solutions in the oil and gas sector, which indirectly supports healthcare infrastructure. Their technologies ensure a reliable supply of energy, critical for powering healthcare facilities and medical equipment, thus playing a vital role in maintaining the operational stability of hospitals and clinics.

KOBELCO COMPRESSORS CORPORATION has made significant strides in integrating advanced air compression technologies with healthcare furniture applications. Their focus is on enhancing the operational efficiency and reliability of medical air systems used in hospitals and clinics. Kobelco’s compressors are known for their durability and low maintenance, which are critical for maintaining a sterile and continuous air supply in medical environments, thereby supporting the functionality of healthcare furniture like surgical tables and patient beds.

Atlas Copco AB is a key player in the healthcare furniture sector, emphasizing innovation in air treatment and ergonomic solutions. They provide advanced air compressors and vacuum solutions that are integral to the operation of medical equipment and clean room environments. Atlas Copco’s technology enhances the performance of healthcare furniture by ensuring a clean and controlled air supply, crucial for patient care and the operation of sensitive medical devices.

Doosan Group is actively involved in the healthcare furniture sector through its subsidiary Doosan Robotics, which develops collaborative robots used in various applications including healthcare. These robots are designed to assist in settings that require precision and reliability, such as patient care and medical equipment handling. Doosan’s technological innovations enhance the functionality and safety of healthcare furniture, contributing to more efficient and effective healthcare environments.

Danfoss A/S, while primarily known for its climate and energy solutions, extends its expertise to the healthcare furniture sector by providing advanced heating, ventilation, and air conditioning (HVAC) systems. These systems are crucial for maintaining controlled environments in healthcare facilities, ensuring optimal conditions for both patients and medical equipment. Danfoss’s solutions are integral to the comfort and safety standards in healthcare furniture settings, supporting better patient care and operational efficiency.

Ingersoll Rand Inc. enhances the healthcare furniture sector by integrating advanced air treatment and fluid management technologies. Through its acquisitions of companies like Controlled Fluidics and Ethafilter, Ingersoll Rand expands its capabilities in sterile filtration and custom plastic assembly, essential for medical applications. These technologies improve the performance and hygiene of healthcare furniture, contributing to safer and more efficient healthcare environments.

Sulzer Ltd. supports the healthcare furniture sector through its subsidiary medmix, which specializes in high-precision delivery devices. Medmix produces innovative products like dental mixing systems and drug delivery injectors, crucial for medical applications. These devices enhance the functionality and reliability of healthcare furniture by ensuring precise and hygienic application of medical substances, supporting better patient care.

Kirloskar Pneumatic Co Ltd enhances the healthcare furniture sector by offering advanced air conditioning and refrigeration systems. Their technology ensures precise temperature control and efficient air distribution, which are critical in maintaining sterile and comfortable healthcare environments. These systems are integral to the functionality of healthcare furniture, improving patient comfort and safety.

FS-Curtis, known for its robust air compressors, supports the healthcare furniture industry by providing reliable compressed air solutions. These compressors are essential for operating pneumatic tools and equipment used in healthcare settings, enhancing the performance and durability of healthcare furniture. FS-Curtis’s technology ensures consistent and efficient operation, crucial for maintaining high standards in healthcare environments.

Conclusion

The global industrial air compressor market is poised for substantial growth, with its value expected to increase from USD 35.7 billion in 2023 to USD 58.4 billion by 2033, growing at a CAGR of 5.0% during the forecast period. This market expansion is primarily driven by the rising demand for energy-efficient and high-capacity air compressors across various industries, such as manufacturing, oil and gas, and food and beverage.

Recent advancements have focused on enhancing energy efficiency and integrating smart technologies, such as IoT and remote monitoring systems, to optimize performance and maintenance. Innovations in compressor designs, including oil-free and variable-speed compressors, are gaining traction due to their benefits in reducing operational costs and improving environmental compliance. Additionally, there is a significant trend toward the development of hybrid systems that combine different compressor technologies to enhance overall efficiency and reliability.

However, the market faces challenges, including high initial setup costs and the need for continuous technological innovation to address efficiency and maintenance issues. Despite these challenges, the ongoing emphasis on sustainable industrial practices and the increasing adoption of advanced compressor technologies are expected to drive the market’s growth in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)