Table of Contents

Introduction

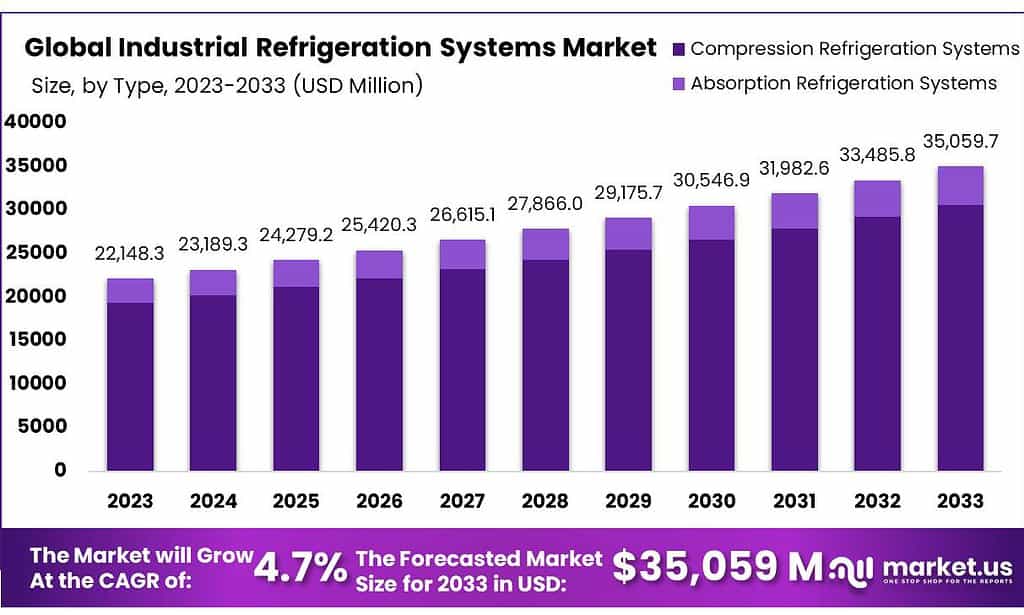

The Global Industrial Refrigeration Systems Market is poised for steady growth, expected to rise from USD 22,148.3 Million in 2023 to around USD 35,059.7 Million by 2033, with a compound annual growth rate (CAGR) of 4.7%. This growth is propelled by several key factors, including the expanding demand for processed and packaged food and beverages which require advanced refrigeration to prevent spoilage. Significant advancements are occurring in the sector, such as the development of energy-efficient systems that use natural refrigerants over traditional, environmentally harmful coolants due to increasing environmental concerns.

However, the industry faces challenges like the high initial costs associated with deploying modern refrigeration systems and the need for replacing or upgrading older systems to accommodate new, more environmentally friendly technologies. Recent innovations in the market include the introduction of sophisticated cooling systems designed to improve energy utilization and reduce operational costs, which are crucial in sectors like food processing and pharmaceuticals.

In recent developments within the industrial refrigeration systems market, key players like Mitsubishi Electric Corporation, Daikin Industries, Ltd., Johnson Controls International plc, Carrier Global Corporation, Emerson Electric Co., and Danfoss A/S have been actively advancing their technological and market positions through various strategies including expansions, new product launches, and investments.

Mitsubishi Electric is expanding its global footprint by investing in new production facilities in India and Turkey to boost its manufacturing capabilities for air conditioners and compressors, enhancing their capacity to meet growing demand.

Daikin Industries has shown commitment to innovation in battery technology for HVAC systems by investing in TeraWatt Technology Inc., which is developing lithium-ion battery materials. This move is intended to advance Daikin’s battery technologies and expand its international reach.

Moreover, regulatory pressures continue to shape the market dynamics by enforcing stringent standards on the use of specific refrigerants and the overall energy efficiency of systems. This regulatory environment is driving the rapid adoption of advanced technologies in the industrial refrigeration space.

Key Takeaways

- The global industrial refrigeration systems market was valued at USD 22,148.3 Million in 2023.

- The global industrial refrigeration systems market is projected to reach US$ 35,059.7 Million by 2033.

- Among system types, Compression Refrigeration Systems accounted for the largest market share of 3%.

- Among components, the Compressors accounted for the majority of the market share with 3%.

- Based on refrigerant type, Ammonia accounted for the largest market share in 2023 with 8%.

- By applications, the Food and beverage industry is anticipated to dominate the market in the coming years. Moreover, in 2023, it accounted for the majority of the share of 6%.

- North America is expected to hold the largest global industrial refrigeration systems market share with 9% of the market share.

- Asia-Pacific is anticipated to register a higher CAGR of 0% with a revenue share of 31.2% in 2023.

Industrial Refrigeration Systems Statistics

- Japan’s Import of Combined Refrigerator-Freezers, Fitted with Separate External Doors was up 21% in 2019, from a year earlier.

- In 2019 United States was ranked number 1 in the Import of Parts of Refrigerating or Freezing Equipment.

- Since 2014 United States Import of Compression Type Household Refrigerators grew 7.3% year on year attaining $520,256,474.13.

- In 2017 Suriname was number 101 in Import of Compression Refrigeration Equipment with Heat Exchange to $314,520.75, from 155 in 2016.

- Regular maintenance can account for 12 to 18% return annually in the form of energy savings.

- Predictive maintenance on industrial refrigeration systems can save as much as 40%.

- They are rated to be up to 50% more energy efficient than synthetic refrigerants

- Ammonia (NH3) used as a refrigerant is anhydrous ammonia, which is at least 99.5% pure ammonia

Emerging Trends

- Sustainability and Natural Refrigerants: There’s a growing shift towards using natural refrigerants like CO2 and ammonia due to their lower environmental impact. This shift is driven by increasing regulatory pressures and a broader industry focus on reducing carbon footprints.

- Energy Efficiency: Enhancements in energy efficiency are critical, with many new systems incorporating advanced technologies that reduce electricity usage and operational costs. This includes the development of high-efficiency compressors and the integration of energy recovery systems.

- Smart Systems and IoT Integration: The industrial refrigeration sector is increasingly adopting smart systems that integrate with the Internet of Things (IoT). These systems offer enhanced monitoring and management capabilities, leading to improved energy management, predictive maintenance, and overall operational efficiency.

- Advanced Cooling Technologies: Innovations such as two-phase immersion cooling (2-PIC) are emerging, which are more efficient and have less environmental impact than traditional cooling methods. This technology is particularly becoming relevant in high-heat generating industries like data centers.

- Sector-Specific Adaptations: Refrigeration systems are being tailored to meet the specific needs of industries such as pharmaceuticals, food processing, and beverages, where precision in temperature control is crucial for product quality and safety.

Use Cases

- Food Processing and Storage: Industrial refrigeration is crucial in the food industry, where maintaining specific temperatures is necessary for the safety and quality of perishable goods. Systems are tailored to handle large volumes of products such as meat, dairy, and produce during processing and long-term storage.

- Pharmaceuticals: The pharmaceutical industry relies on precise cooling to store sensitive materials and medications, ensuring their efficacy and safety. This includes maintaining critical low temperatures for vaccines, which require specific conditions to remain viable.

- Cold Storage Warehousing: As e-commerce continues to grow, there is a higher demand for temperature-controlled warehouses. These facilities use industrial refrigeration to store various goods that require cooling, from food products to tech devices, ensuring they are preserved until they reach consumers.

- Beverage Production: Breweries, wineries, and soft drink manufacturers use industrial refrigeration systems to control fermentation and storage conditions, critical for product quality and flavor consistency.

- Chemical Industry: In the chemical sector, refrigeration systems help in managing the temperatures of reactive materials, preventing overheating and ensuring stable conditions for various chemical processes.

Key Players Analysis

Mitsubishi Electric Corporation has significantly enhanced its industrial refrigeration offerings by investing in new production facilities in India and Turkey, aiming to meet the growing demand in these regions. This expansion supports their strategy to increase the production of air conditioners and compressors, crucial components of refrigeration systems. Mitsubishi’s commitment to innovation in refrigeration technology emphasizes energy efficiency and sustainability, aligning with global environmental standards.

Daikin Industries, Ltd. is advancing in the industrial refrigeration market by focusing on energy-efficient and environmentally friendly solutions. Recently, Daikin supported TeraWatt Technology to develop innovative battery technology for HVAC systems, highlighting their commitment to sustainability. Daikin’s efforts in the sector also include developing high-efficiency refrigeration systems that utilize advanced refrigerants to reduce environmental impact, aiming to meet the increasing global demands for eco-friendly cooling solutions.

Johnson Controls International Plc is actively enhancing its capabilities in the industrial refrigeration sector, focusing on delivering high-performance and efficient solutions tailored for a range of processing industries. Their FRICK® Industrial Refrigeration solutions and YORK® Process Systems are known for robust performance, particularly in food and beverage applications. The company also emphasizes sustainability, aiming to reduce energy consumption through innovative refrigeration design and technology.

Carrier Global Corporation, a key player in the industrial refrigeration market, is recognized for its broad range of cooling solutions that cater to various sectors including food preservation and pharmaceuticals. Carrier’s commitment to sustainability is evident in its development of energy-efficient systems and use of environmentally friendly refrigerants, which align with global standards for reducing environmental impact. Their technological innovations are geared towards improving system efficiency and reducing operational costs, making them a leader in the industrial refrigeration industry.

Emerson Electric Co. is a leader in the industrial refrigeration market, particularly noted for its Copeland™ brand compressors which are integral to refrigeration reliability. Emerson focuses on advancing refrigeration technology by developing energy-efficient and sustainable systems, such as their purpose-built subcritical CO2 compressors under the Vilter™ brand. These systems are designed to meet the heavy-duty requirements of industrial applications, ensuring robust and reliable operation while supporting sustainability initiatives.

Danfoss A/S is highly recognized in the industrial refrigeration sector for offering a wide range of products and solutions that cater to various needs, from food processing to climate control. Danfoss is committed to innovation and sustainability, often integrating natural refrigerants in their systems to reduce environmental impact. Their comprehensive approach includes advanced technologies for improving energy efficiency and optimizing system performance, making them a key player in the global refrigeration market.

Ingersoll Rand Inc. has demonstrated robust growth in the industrial refrigeration sector through strategic acquisitions, enhancing its capabilities and market reach. In 2022, the company acquired Everest Group and Airmax Groupe, strengthening its product portfolio in blowers, vacuum, and compressed air systems. Additionally, in 2024, Ingersoll Rand expanded its air treatment capabilities with the acquisition of Friulair, which specializes in chillers and dryers. These strategic moves have significantly broadened Ingersoll Rand’s offerings in the industrial refrigeration market, positioning it for further growth and innovation.

GEA Group AG is a prominent player in the industrial refrigeration systems market, known for its comprehensive solutions that cater to a variety of sectors including food and beverages, pharmaceuticals, and more. GEA Group emphasizes sustainability and efficiency in its product offerings, employing advanced technology to meet the stringent requirements of industrial refrigeration. The company’s focus on innovative solutions and a strong global presence solidify its role as a key contributor to the advancement of industrial refrigeration technologies.

SPX Technologies, Inc. has actively expanded its role in the industrial refrigeration systems market through SPX Cooling Technologies. They offer a broad range of evaporative cooling products, including Marley® Cooling Towers and Cube™ Evaporative Condensers. These products are designed to meet rigorous industrial demands and emphasize sustainable operation using ammonia and other natural refrigerants. Their systems are noted for their energy efficiency and ease of installation, making them a suitable choice for large-scale industrial applications.

Bitzer SE is renowned for its specialized refrigeration solutions, particularly its compressors, which are a cornerstone of its product offerings. Bitzer emphasizes innovation in compressor technology, catering to a variety of cooling needs across the commercial and industrial refrigeration sectors. Their products are designed for reliability and versatility, supporting a wide range of refrigeration temperatures and settings, which is critical for industries requiring precise temperature control.

Baltimore Aircoil Company, Inc. is highly active in the industrial refrigeration systems market, specializing in evaporative cooling technology. Their products are designed to meet the cooling needs of a variety of industries, including power generation, industrial processing, and HVAC systems. Baltimore Aircoil Company emphasizes energy efficiency and sustainable operation in their systems, offering solutions that are both cost-effective and environmentally friendly.

Frick India Limited has been a significant player in the industrial refrigeration sector since 1962, providing a wide array of products including screw and reciprocating compressors, air cooling units, and evaporative condensers. Their offerings cater to diverse industries such as dairy, seafood, meat processing, and beverages, emphasizing customization and energy efficiency. Frick India is known for its robust research and development focus, which supports its commitment to innovative and energy-efficient refrigeration solutions.

Conclusion

Industrial refrigeration systems play a crucial role across multiple sectors, providing essential cooling solutions that support the quality and safety of perishable goods, pharmaceuticals, and various industrial processes. As technology advances, these systems are increasingly incorporating sustainable practices, energy efficiency, and smart technology integration, addressing environmental concerns while enhancing operational efficiency. The integration of natural refrigerants and IoT connectivity, in particular, reflects the industry’s adaptation to regulatory demands and its commitment to reducing carbon footprints. Looking ahead, the future of industrial refrigeration will likely focus on further innovations in energy efficiency and sustainable practices, making these systems more crucial than ever in a rapidly evolving global market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)