Table of Contents

Introduction

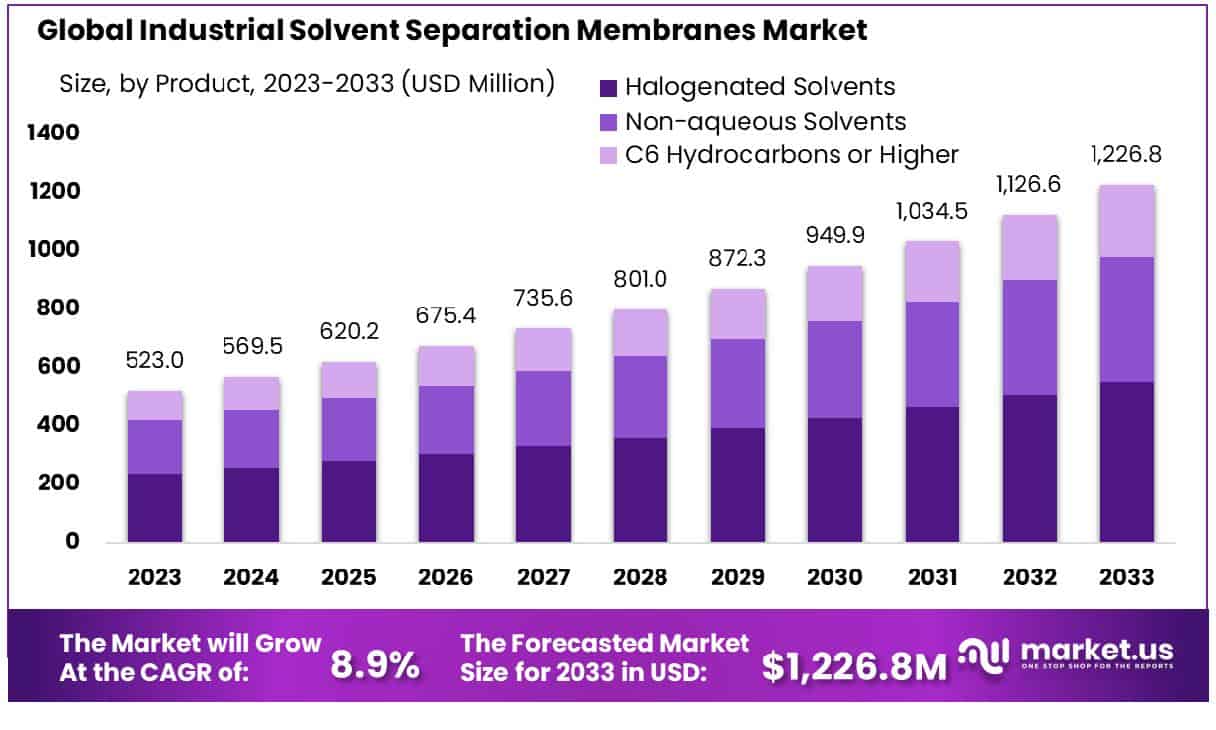

The Global Industrial Solvent Separation Membranes Market is poised for significant growth over the next decade, projected to expand from USD 523.0 million in 2023 to approximately USD 1,226.8 million by 2033. This market is expected to register a Compound Annual Growth Rate (CAGR) of 8.9% from 2024 to 2033.

This robust growth can be attributed to several key factors including advancements in membrane technology, increasing regulatory pressures for environmental compliance, and the rising demand for more efficient industrial processes. However, the market faces challenges such as high costs associated with the development and implementation of advanced membrane technologies and potential operational issues related to membrane fouling and maintenance.

Recent developments have shown promising trends, such as innovations in membrane materials that enhance separation efficiency and durability, addressing some of the key obstacles in the industry. These factors collectively underscore the dynamic nature of the Industrial Solvent Separation Membranes Market, highlighting both its potential and the hurdles it must overcome.

Asahi Kasei Corporation has recently expanded its production capacity for solvent separation membranes, signaling a robust response to growing demand in sectors such as pharmaceuticals and food processing. This strategic expansion aims to solidify Asahi Kasei’s position as a leader in high-performance membrane solutions.

Evonik Industries AG has introduced a new line of high-selectivity membranes designed to offer superior performance in harsh chemical environments. This product launch not only diversifies Evonik’s portfolio but also caters to the increasingly stringent environmental standards requiring more efficient industrial separations.

Hawach Scientific Co., Ltd. has engaged in partnerships with academic institutions to co-develop next-generation membrane technologies. These collaborations are expected to accelerate the integration of innovative materials that enhance the efficiency and durability of solvent separation membranes.

Membrane Solutions, LLC. announced a significant investment into research and development. This funding boost is directed toward creating more scalable and cost-effective membrane technologies, which are critical for maintaining a competitive advantage in the market.

Novamem Ltd. has launched a series of new membrane products that feature enhanced solvent resistance and operational stability. These advancements are designed to meet the specific needs of the chemical industry, where solvent recovery and reuse are key to operational efficiency and sustainability.

Key Takeaways

- Market Growth: The Global Industrial Solvent Separation Membranes Market is projected to grow at a CAGR of 8.9%, reaching approximately USD 1,226.8 million by 2033 from USD 523.0 million in 2023.

- North America captured 38.2% of the market, worth USD 199.7 million.

- By Product: Halogenated solvents dominate the market, comprising 45% of products.

- By Material: PA (Polyamide) accounts for 45.4% of the materials utilized.

- By Technology: Reverse osmosis technology leads with a 53.3% adoption rate.

Industrial Solvent Separation Membranes Market Statistics

- Organophilic Nanofiltration (NF) membranes have a high affinity for organic solvents and retain soluted molecules in the range of 200 to 1.000 g/mol.

- In the industrial field of chemical process, 80% of the process involves solvents and harsh environments such as high temperatures, and the chemical wastewater is generally acidic or alkaline and contains organic solvents and other special properties

- Results clearly indicated the improved characteristic features of 97.5% CA – 2.5% AC blend membrane in comparison with other synthesized UF membranes. Subsequently, a performance study on the 97.5% CA – 2.5% AC blend membrane was carried out by subjecting the blend membrane

- Eggshell membranes (ESM) contain 90% protein, 3% lipids, 2% sugars, and small amounts of minerals such as calcium and magnesium.

- Of the 90% of proteins present, 472 protein species have been identified.

- The protein molecules and the cross-linking of lysine-derived and heterochain chains between the eggshell membrane, make the membrane very difficult to dissolve, with a maximum solubility rate of only 62%.

- In the humic acid fouling experiment, the POMs-modified membrane exhibited the best antifouling performance, with a flux recovery rate of up to 91.3%.

- The PAN membranes have two different structures, the surface layer is a finger pore structure, below layer is a cavernous pore structure with a porosity is 85.92%.

- The flux of PAN membranes is 1952.63 L•m−2• H−1 • bar−1, the oil retention ability is 99.14% when the film thickness was 100 μm, the PAN concentration was 7%, and the alkali treatment time was 1 h.

- Gas-liquid membrane contactors have been created on their basis. It is shown that with their use in the vacuum mode, up to 60% of dissolved oxygen can be removed from the model solvent.

- Consequently, an outlet gas quality of 98% methane could be achieved within a single microporous module at 4.5 bar, meeting the industrial standard for biomethane whilst reducing solvent requirements, separation energy, and methane losses.

- At the industrial scale, separation/purification processes represent from 40% to 70% of the operational costs (not including the cost of raw materials).

Emerging Trends

- Increased Adoption of Green Technologies: There is a growing trend towards the use of environmentally friendly materials in solvent separation membranes. Companies are developing membranes that reduce environmental impact, such as those that are recyclable or made from biodegradable materials. This shift is driven by stricter environmental regulations and a growing corporate commitment to sustainability.

- Integration of Smart Technologies: The market is witnessing the integration of smart technologies with membrane systems. Sensors and IoT (Internet of Things) technologies are being embedded in membrane systems to provide real-time data on performance, efficiency, and maintenance needs. This enables predictive maintenance, enhances operational efficiency, and minimizes downtime.

- Hybrid Membrane Development: Innovation in hybrid membranes that combine the properties of different materials is on the rise. These hybrids aim to optimize performance, offering high resistance to harsh chemicals and temperature extremes while maintaining selectivity and permeability. This trend is crucial in expanding the application range of membranes in industries such as pharmaceuticals, food and beverage, and petrochemicals.

- Focus on Energy Efficiency: As energy costs continue to rise, there is an increasing focus on developing energy-efficient membrane technologies. Advances in membrane design are reducing the energy required for separation processes, thus decreasing operational costs and enhancing the overall sustainability of industrial operations.

- Expansion in Emerging Markets: The solvent separation membrane market is expanding in emerging economies due to industrial growth, urbanization, and increased regulatory focus on environmental compliance. Companies are investing in these regions, setting up new production facilities, and expanding their distribution networks to capitalize on these growing markets.

Use Cases

- Pharmaceutical Manufacturing: In the pharmaceutical industry, solvent separation membranes are used to purify active pharmaceutical ingredients (APIs) from organic solvents. This is crucial for meeting stringent regulatory standards for drug purity and efficacy. The use of membranes can reduce solvent consumption by up to 30%, significantly lowering production costs and environmental impact.

- Food and Beverage Processing: Membranes play a vital role in the concentration and clarification of food and beverage products, such as fruit juices and dairy items. They help remove unwanted solvents and contaminants, ensuring product safety and quality while retaining nutritional value. Membrane technology can increase production efficiency by approximately 25%, reducing energy usage and processing time.

- Chemical Industry: In chemical synthesis and processing, membranes are used to separate and recycle solvents, which is essential for sustainable operations. This application not only minimizes waste and emissions but also recovers valuable solvents for reuse. Industries can achieve solvent recovery rates exceeding 90%, enhancing both economic and environmental performance.

- Water Treatment and Reuse: Solvent separation membranes assist in treating industrial wastewater, removing hazardous organic compounds and solvents before discharge or reuse. This application is critical for complying with environmental regulations and reducing water consumption. Implementing membrane systems can reduce pollutant levels by up to 99%, significantly lowering the risk of environmental contamination.

- Petrochemical Refining: In petrochemical refining, membranes are used to separate, purify, and concentrate solvents used in the production of plastics and other synthetic materials. This improves the efficiency of petrochemical processes and reduces the reliance on thermal and chemical treatments, which are energy-intensive and costly.

Key Players Analysis

Asahi Kasei Corporation is prominent in the industrial solvent separation membranes sector through its Microza brand, offering advanced ultrafiltration (UF) and microfiltration (MF) technologies. These technologies are pivotal for the purification and concentration processes across various industries including pharmaceuticals, food, and chemicals. Asahi Kasei’s membranes are designed with a unique double-skin structure that enhances durability and performance, making them suitable for stringent applications such as water recycling and wastewater treatment from industrial processes.

Evonik Industries AG excels in the industrial solvent separation membranes sector through its PURAMEM® product line, focusing on Organic Solvent Nanofiltration (OSN). This technology offers efficient, energy-saving solutions for separating and purifying chemicals at near-ambient temperatures, which significantly reduces operating costs and environmental impact. Evonik’s membranes are specially designed for chemical process industries, offering advantages such as high solvent stability and excellent performance in non-aqueous solvents.

Hawach Scientific Co., Ltd. is recognized in the industrial solvent separation membranes market for its comprehensive range of membrane filters, including microfiltration and vacuum membrane filters. They offer a variety of materials like PVDF and PTFE, tailored for applications such as protein recovery and the removal of microbes from organic solvents. Hawach’s approach combines advanced manufacturing capabilities with a commitment to quality and client-specific solutions.

Membrane Solutions, LLC specializes in the production and provision of microporous membrane products utilized across various industries, including solvent separation processes. Their technologies enable efficient filtration and purification in applications such as laboratory testing, food and beverage production, electronics, and water treatment. The company’s offerings are distinguished by their compatibility with commonly used solvents and chemicals, ensuring reliable and consistent performance.

Novamem Ltd. is recognized for its innovative approach in the industrial solvent separation membranes sector, leveraging advanced nanotechnology to produce high-performance ultrafiltration and microfiltration membranes. These membranes are particularly effective due to their high flux rates and enhanced durability, making them ideal for demanding applications in industries like biotechnology and pharmaceuticals.

Pall Corporation is a leader in the industrial solvent separation membranes sector, particularly noted for its Membralox® ceramic membranes. These products are renowned for their high durability and efficiency in various applications, including harsh industrial processes involving aggressive solvents and high temperatures. Pall’s ceramic membranes are used extensively for wastewater treatment, food and beverage processing, and the pharmaceutical industry, offering reliable separation and purification solutions that support sustainable operations.

Sartorius AG excels in the industrial solvent separation membranes market, leveraging advanced filtration technologies across various sectors. Their offerings include high-performance polyethersulfone (PES) membrane filters, known for their hydrophilic properties, chemical resistance, and suitability for aqueous solutions and solvent processes. These membranes cater to a broad spectrum of industrial applications, ensuring efficient separation and purification processes.

SolSep BV specializes in the production of ultrafiltration and nanofiltration membranes tailored for use with organic solvents. These membranes are integral to various industrial applications such as solvent recovery in oleochemistry, extraction operations, and polymer synthesis. With a focus on improving economic and environmental efficiencies, SolSep’s technology supports robust solvent recovery processes, helping industries minimize their ecological footprint while enhancing productivity.

Air Products and Chemicals, Inc. is recognized as a global leader in the production of gas separation and purification membranes, specifically their PRISM® Membrane Separators. These separators are essential for on-site gas generation, contributing significantly to industrial applications including biogas production and energy transition technologies. Their recent initiatives include a focus on sustainable energy sources, marked by the introduction of the PRISM® GreenSep membrane for bio-LNG production.

Air Liquide, a leader in the industrial gases sector, has significantly advanced the technology of solvent separation membranes through its Air Liquide Advanced Separations (ALaS) division. Their high-performance membrane technology is characterized by a robust portfolio that includes MEDAL™, PoroGen, and IMS membranes, supporting diverse applications like nitrogen generation, hydrogen recovery, and natural gas treatment. This technology leverages advanced hollow fiber membranes and a proprietary polymer blend, ensuring efficient gas separation and purification with a focus on operational cost-efficiency and reduced environmental impact.

UBE Corporation is expanding its capabilities in the industrial solvent separation membranes sector, focusing on the production of polyimide hollow fiber membranes. These membranes are used primarily for CO2 separation, enhancing biogas to biomethane conversion, crucial for renewable energy applications. UBE’s expansion aims to meet the rising global demand, particularly in Europe and North America, by enhancing the production facilities in Japan, scheduled to be operational by the first half of fiscal 2025. This strategic move is part of UBE’s broader vision to support environmental sustainability and energy solutions.

Honeywell UOP excels in the industrial solvent separation membranes sector with its innovative PolySep Membrane Systems, which are utilized globally for hydrogen recovery and CO2 capture. These systems integrate advanced composite membrane technology and are designed for high partial-pressure CO2 capture in industrial applications, reflecting Honeywell’s commitment to sustainability and emission reduction efforts. This technology is part of a broader strategy to support clean energy solutions across various industries, including petrochemicals, refining, and power generation.

Fujifilm Manufacturing Europe B.V. is enhancing its presence in the industrial solvent separation membranes sector by producing advanced gas separation membranes. These membranes, specially designed for carbon dioxide removal from natural gas, utilize Fujifilm’s proprietary spiral wound and semi-permeable polymeric membrane technologies. This innovation supports high flux and selectivity in gas separation, contributing significantly to environmental sustainability by improving gas purification processes across various industries.

Conclusion

The Industrial Solvent Separation Membranes market is poised for significant growth, driven by its critical role in enhancing efficiency, compliance, and sustainability across diverse industries. As companies increasingly focus on reducing environmental impact and improving cost efficiency, the demand for advanced membrane technologies continues to rise.

With ongoing innovations in material science and process engineering, these membranes are set to play an even more pivotal role in ensuring the purity, safety, and sustainability of industrial processes. The future of industrial solvent separation membranes looks promising, with the potential for substantial market expansion and technological advancements that align with global sustainability goals.