Table of Contents

Introduction

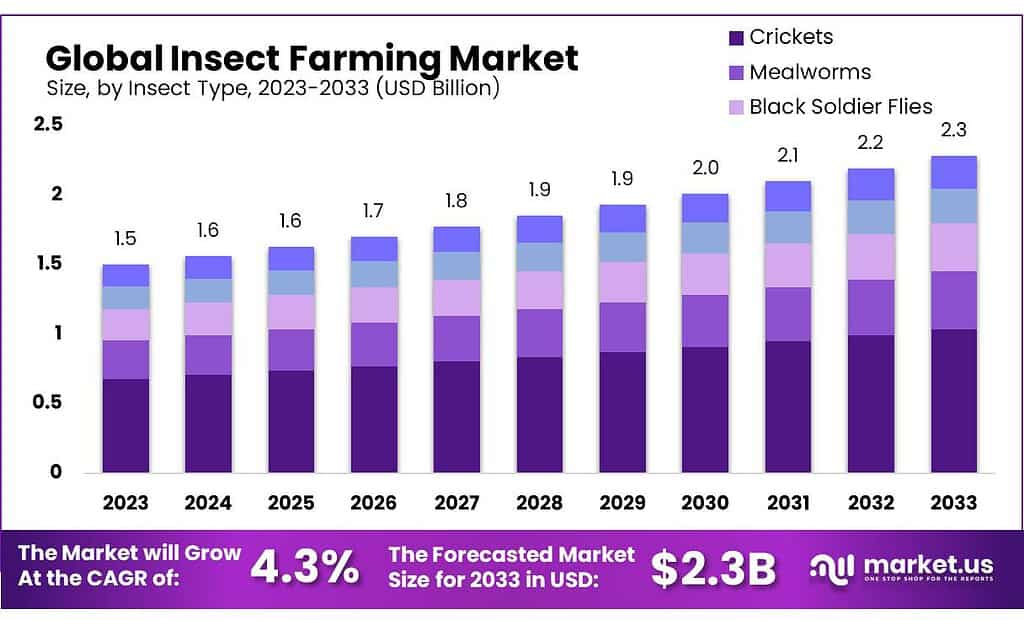

The insect farming market is witnessing notable growth as it gains traction as a sustainable and alternative source of protein and other valuable nutrients. The market size is anticipated to reach approximately USD 2 billion by 2033, up from USD 1.5 billion in 2023, reflecting a compound annual growth rate (CAGR) of 4.3% over the forecast period from 2023 to 2033. This growth is driven by the increasing demand for sustainable food sources and the need to address food security challenges.

Insect farming offers an eco-friendly solution to traditional livestock farming, requiring fewer resources such as water and feed while producing lower greenhouse gas emissions. However, the market faces challenges including regulatory hurdles, consumer acceptance issues, and the need for advanced farming technologies to ensure large-scale production and quality control.

Bayer has made strides in the insect farming sector through its focus on innovation and sustainability. The company is investing in research to improve insect farming technologies and explore their potential in various applications, such as animal feed and organic fertilizers. Bayer’s expertise in agricultural science supports the development of more efficient and sustainable insect farming practices, contributing to the sector’s growth.

Ynsect is a leading player in the insect farming sector, specializing in the production of mealworms and other insects for animal feed and plant fertilizers. The company utilizes advanced technologies to enhance the efficiency and scalability of insect farming, aiming to address global food and agricultural challenges. Ynsect’s facilities are designed to optimize insect growth and sustainability, making significant contributions to the industry’s expansion.

Key takeaways

- The insect farming market is expected to grow from USD 1.5 billion in 2023 to USD 2 billion by 2033, with a 4.3% CAGR.

- Crickets dominate with over 46.7% market share in 2023, followed by mealworms and black soldier flies.

- Animal feed leads with over 37.5% market share in 2023, followed by fertilizer, protein, and biofuels.

- Food and feed industries hold over 41.6% market share in 2023, followed by agriculture, pharmaceuticals, and biotechnology.

- Asia Pacific dominates with a 40.9% market share, driven by the adoption of animal feed, pharmaceuticals, and sustainable agriculture.

Investment and Industry Insights Statistics

- Investors have pumped $1.65 billion into insect farming over the past decade, a tiny percentage of the $205 billion pumped into agrifood tech startups over the same period according to AgFunder data.

- Mohammed Ashour at Aspire Food Group is commissioning a 12,000/ton/year cricket processing facility in London, Ontario.

- France is the world’s largest importer of carmine, a red dye made from cochineal insects, requiring about 100,000 insects to produce one kilogram of dye.

- The protein count of 100 g of cricket is nearly equivalent to the amount in 100 g of lean ground beef.

- The energy, feed, and labor margin for the production of H. illucens ranges from € -798 to 15,576 per tonne of dried larvae.

Insect Farming Details Statistics

- For the farming of mealworms, the larvae form a species of darkling beetles (Coleoptera). The optimum incubation temperature is 25°C – 27°C and its embryonic development lasts 4 – 6 days. It has a long larval period of about half a year with the optimum temperature and low moisture terminates.

- For the farming of Buffaloworms, also called lesser mealworms, is the common name of Alphitobius diaperinus. Its larvae superficially resemble small wireworms or true mealworms (Tenebrio spp.). They are approximately 7 to 11 mm in length at the last instar. Freshly emerged larvae are a milky color.

- Crickets mature rather quickly and are typically full-grown within 3 weeks to a month and an individual female can lay from 1,200 to 1,500 eggs in three to four weeks. Cattle, however, become adults at 2 years, and the breeding ratio is four breeding animals for each market animal produced.

- Insects are abundant in other nutrients. Locusts, for example, contain between 8 and 20 mg of iron in every 100 grams of raw locust so it plays an important role in insect farming.

- Insects at different life stages can be collected by sieving followed by water cleaning when it is necessary to remove biomass or excretion. Before processing, the insects are sieved and stored alive at 4°C for about one day without any feed.

Economic and Operational Aspects Statistics

- The feed and labor margin for the production of T. molitor ranges from € 7,620 to 13,770 per tonne of fresh larvae.

- For production of A. domesticus the feed margin ranges from € 12,268 to 78,676 per tonne of larvae meal.

- The supermarket adapted its operating model to launch this innovative concept in 13 stores, sending surplus produced and bakery products to black soldier flies, which are then turned into insect protein and used as animal feed.

- The energy, feed, and labor margin for the production of H. illucens ranges from € -798 to 15,576 per tonne of dried larvae.

- The protein count of 100 g of cricket is nearly equivalent to the amount in 100 g of lean ground beef.

Emerging Trends

Sustainable Protein Source: Insect farming is being increasingly recognized as a sustainable alternative to traditional protein sources. Insects require less land, water, and feed compared to livestock, making them an eco-friendly option.

Regulatory Support: Governments and regulatory bodies are beginning to support insect farming through favorable policies and frameworks. This support helps in standardizing production processes and ensuring safety, which boosts consumer confidence.

Technological Advancements: Innovations in farming technologies, such as automated feeding systems and climate control, are improving the efficiency and scalability of insect farming. These advancements make it easier to produce insects on a large scale.

Diverse Applications: Beyond animal feed, insect farming is expanding into other areas such as pet food, human consumption, and organic fertilizers. This diversification is opening up new markets and revenue streams for insect farmers.

Increased Investment: There is growing interest from investors in the insect farming industry. Venture capitalists and large agricultural companies are funding startups and research initiatives, driving further development and innovation in the sector.

Consumer Acceptance: Efforts to increase consumer awareness and acceptance of insect-based products are gaining momentum. Educational campaigns and marketing efforts are helping to normalize the idea of consuming insects as part of a sustainable diet.

Use Cases

Animal Feed: Insects are increasingly being used as a high-protein ingredient in animal feed. For instance, the Black Soldier Fly larvae are rich in protein and fat, making them an excellent feed for poultry, pigs, and fish. The global market for insect-based animal feed is projected to reach USD 1.3 billion by 2027, driven by the need for sustainable feed alternatives.

Human Consumption: Edible insects are becoming a popular protein source for humans, particularly in regions like Asia and Africa. Products such as cricket flour are being used in snacks, protein bars, and baked goods. The edible insect market is expected to grow from USD 112 million in 2023 to USD 1.4 billion by 2029, reflecting increased consumer acceptance and awareness.

Organic Fertilizers: Insect farming byproducts, such as frass (insect manure), are used as organic fertilizers. These byproducts are rich in nutrients and help improve soil health and crop yields. The demand for organic fertilizers is rising, with the market expected to grow at a CAGR of 7.5% from 2023 to 2030, driven by the shift towards sustainable agriculture.

Pet Food: Insects are also used in the production of pet food, offering a sustainable and nutritious alternative to traditional meat-based products. Insect-based pet foods are gaining popularity, particularly among environmentally conscious pet owners. The pet food market is anticipated to reach USD 100 million by 2025, with insect-based options growing rapidly.

Pharmaceuticals and Cosmetics: Insects like silkworms and bees are used in pharmaceuticals and cosmetics for their beneficial properties. Chitosan, derived from insect exoskeletons, is used in wound dressings and skin care products due to its antimicrobial and healing properties. The global chitosan market is expected to reach USD 1.5 billion by 2030, driven by its diverse applications.

Key Players

Bayer has made strides in the insect farming sector through its focus on innovation and sustainability. The company is investing in research to improve insect farming technologies and explore their potential in various applications, such as animal feed and organic fertilizers. Bayer’s expertise in agricultural science supports the development of more efficient and sustainable insect farming practices, contributing to the sector’s growth.

Ynsect is a leading player in the insect farming sector, specializing in the production of mealworms and other insects for animal feed and plant fertilizers. The company utilizes advanced technologies to enhance the efficiency and scalability of insect farming, aiming to address global food and agricultural challenges. Ynsect’s facilities are designed to optimize insect growth and sustainability, making significant contributions to the industry’s expansion.

Beta Hatch is a pioneering company in the insect farming sector, focusing on mealworm production for animal feed. Founded by entomologist Virginia Emery, Beta Hatch operates the largest mealworm production facility in North America, located in Cashmere, Washington. The facility utilizes renewable energy and waste heat from a nearby data center, emphasizing sustainable practices and zero-waste systems. Beta Hatch’s innovative approach converts mealworms and their waste into high-value proteins, oils, and fertilizers, aiming to industrialize insect farming within a regenerative food system.

Farmers Business Network (FBN) is primarily known for its digital farmer-to-farmer network, providing data-driven insights and support to its members. Although not directly involved in insect farming, FBN has shown interest in sustainable agriculture and innovative farming practices. FBN helps farmers access information, technology, and markets that can support sustainable practices, including potentially integrating insect farming into broader agricultural systems to improve efficiency and sustainability.

Flourish Farm is a leading entity in the insect farming sector, particularly focused on sustainable practices and innovation. Founded by Kevin Bachhuber, Flourish Farm aims to produce edible insects, primarily crickets, for human consumption. Their approach reduces the environmental footprint by using significantly less water and land compared to traditional livestock farming. They also play a crucial role in promoting the benefits of edible insects as a sustainable protein source, aligning with global food security goals and reducing greenhouse gas emissions.

Bioag Pty Ltd is an innovative company in the insect farming sector based in Australia. They specialize in utilizing black soldier fly larvae to convert organic waste into high-protein animal feed. This approach not only addresses the problem of organic waste disposal but also provides a sustainable alternative to traditional animal feeds. Bioag Pty Ltd’s operations contribute to reducing environmental impact by promoting a circular economy, making them a key player in sustainable agriculture and waste management.

Hargol FoodTech, based in Israel, specializes in farming grasshoppers to produce a high-quality protein alternative. The company’s innovative methods involve raising grasshoppers in climate-controlled environments, which ensures efficient production and sustainability. Hargol’s products are aimed at providing protein supplements for human consumption and animal feed, promoting environmental benefits and health advantages. The company has received recognition for its contributions to sustainable food solutions and continues to expand its market presence globally.

Innovafeed, a leading company in the insect farming sector, focuses on producing sustainable insect-based ingredients for animal feed, pet food, and plant nutrition. The company recently expanded to the U.S. with its North American Insect Innovation Center in Decatur, Illinois. Innovafeed’s innovative process involves breeding black soldier flies and repurposing agricultural by-products from its partner, ADM, to create insect meal, oil, and soil amendments.

Growmark, a leading agricultural cooperative, is making strides in the insect farming sector. They are focusing on integrating insect farming into sustainable agriculture practices. By leveraging their extensive network and expertise in crop nutrition and protection, Growmark aims to develop innovative solutions for using insects as an alternative protein source and for waste recycling. Their initiatives are directed towards reducing environmental impact and enhancing farm productivity through sustainable insect farming practices.

Walters Gardens, Inc., a prominent horticultural company, is exploring the potential of insect farming within their operations. They are particularly interested in utilizing insects for natural pest control and soil enhancement. Walters Gardens aims to incorporate insect farming techniques to create a more eco-friendly approach to plant cultivation, thereby reducing reliance on chemical pesticides and improving soil health through natural composting processes.

Grubbly Farms focuses on producing sustainable, insect-based protein for pet and livestock feed. They primarily use black soldier fly grubs, which are grown on pre-consumer food waste, helping to reduce landfill impact. Their products are rich in protein, calcium, and essential nutrients, promoting healthier pets and livestock while minimizing environmental footprint. By avoiding fishmeal and soy, Grubbly Farms provides an eco-friendly alternative that supports ocean health and reduces deforestation associated with soybean cultivation.

Hexafly specializes in insect farming to create high-protein, sustainable feed solutions. They utilize black soldier fly larvae to convert organic waste into valuable protein, oil, and fertilizer. Hexafly’s innovative approach addresses environmental issues by recycling waste and reducing reliance on traditional feed sources like fishmeal and soy. Their products are used in agriculture and aquaculture, promoting circular economy practices and supporting global food sustainability.

Protenga has developed a next-generation Smart Insect Farm™ system that makes insect innovation accessible to valorise a range of agricultural and food manufacturing by-products into fully traceable insect protein. Our unique technology makes insect innovation simple, reliable, profitable and worry-free for you.

Aspire Food Group is a key player in the insect farming industry, specializing in the production of edible insects for human consumption. They operate one of the world’s largest cricket farms and focus on using crickets as a sustainable protein source. Aspire is dedicated to advancing food security and sustainability by leveraging the nutritional benefits of insects. Their operations involve advanced farming techniques and technologies to ensure high efficiency and product quality. Aspire’s mission is to make insect protein a mainstream and environmentally friendly food choice.

Conclusion

As research advances and market acceptance grows, insect farming is likely to play a crucial role in global food systems. Continued investment and innovation will be key to unlocking its full potential.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)