Table of Contents

Introduction

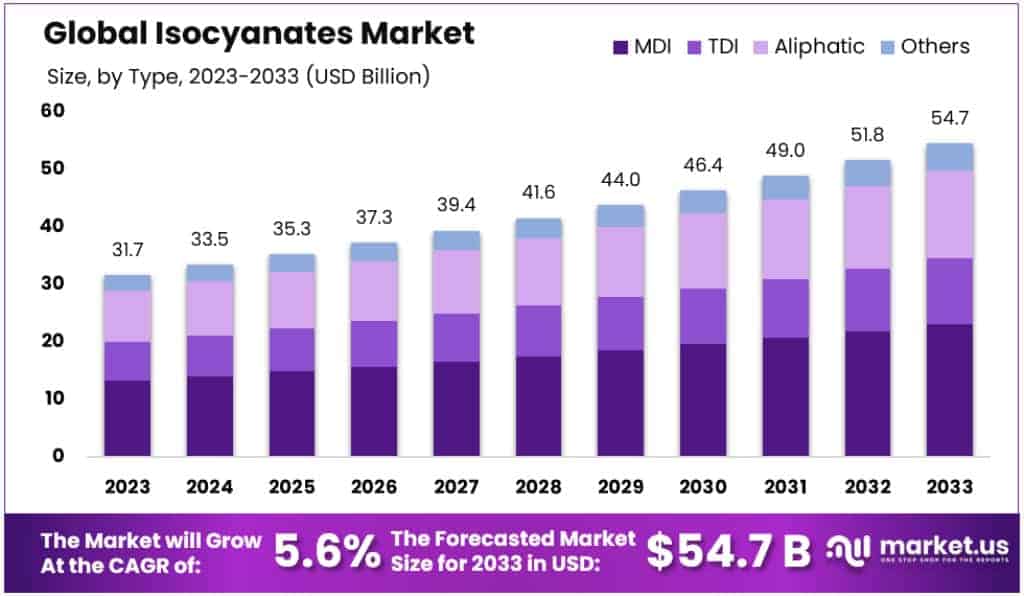

The global Isocyanates Market, valued at approximately USD 31.7 Billion in 2023, is projected to reach USD 54.7 Billion by 2033, exhibiting a compound annual growth rate (CAGR) of 5.6% during the forecast period.

This growth is primarily driven by the increasing demand for polyurethane products across various industries, including construction, automotive, and electronics. Isocyanates serve as essential components in the production of polyurethane foams, coatings, adhesives, and sealants, which are extensively utilized for their durability and versatility. The construction sector’s expansion, particularly in emerging economies, has led to a heightened need for insulation materials and coatings, thereby boosting isocyanate consumption. Similarly, the automotive industry’s focus on lightweight and energy-efficient materials has spurred the adoption of isocyanate-based products.

Additionally, advancements in manufacturing technologies and the development of bio-based isocyanates present significant opportunities for market expansion. However, challenges such as fluctuating raw material prices and stringent environmental regulations may impact market dynamics. Nonetheless, the overall outlook remains positive, with sustained demand anticipated across key application areas.

Key Takeaways

- The Global Isocyanates Market is expected to reach a value of approximately USD 54.7 Billion by 2033, up from USD 31.7 Billion in 2023.

- The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period from 2023 to 2033.

- In 2023, MDI held the dominant market position, accounting for more than 42.3% of the isocyanates market.

- Rigid Foam was the leading application segment, capturing over 26.8% of the market share, in 2023.

- In 2023, the Building & Construction sector held the largest share in the end-user industry, at 35.6%.

- APAC is dominating Isocyanates Market with 39.5% share, with USD 12.5 Billion in 2023.

Isocyanates Statistics

- The melting points of the majority of commercially available isocyanates, including Modified MDI, Polymeric MDI, PMDI or PMPPI, TDI isomer combinations, TDI+MDI, or HDI mixes, range from +10 to 20°C, although they are typically found in the +10 to +12°C range.

- The precise makeup of PMPPI (polymethylene polyphenyl isocyanate) derivatives varies. 40–60% of the constituents are 4,4′-MDI; the rest are trimeric species, higher molecular weight oligomers, and various isomers of MDI.

- Since isocyanates have very low vapour pressures (<0.05 6 9 18 mm of Hg relative to water) and large vapour densities, they are not typically regarded as very dangerous, even if their TLV is 0.005 ppm.

- Even those who have never been exposed to isocyanates before but are prone to allergies show symptoms as low as 0.0014 ppm.

- Even though there was no direct skin contact, several patients who inhaled isocyanates suffered skin rashes. At 0.1 ppm, respiratory discomfort may become apparent.

- If TDI is heated over 177°C for a brief time or above 45°C for an extended length of time, it may polymerize (CCOHS).

- If MDI is subjected to temperatures higher than 175°C (SPI) or 204°C (CCOHS), it may polymerize.

- Toluene 2,6-diisocyanate and 2,4-toluene diisocyanate (TDI) are currently the most widely utilized isocyanates.

- After being exposed to extremely low amounts of isocyanates, often less than 0.02 ppm, people who have grown sensitive may react with severe asthma symptoms.

Emerging Trends

- Shift Towards Bio-Based Isocyanates: There is a growing emphasis on developing isocyanates derived from renewable resources, such as vegetable oils and biomass, to reduce environmental impact and meet stringent regulations. This trend aligns with the increasing consumer preference for sustainable and eco-friendly products.

- Advancements in Non-Phosgene Production Processes: Innovations are being made to produce isocyanates without using phosgene, a toxic substance traditionally employed in their synthesis. These alternative methods aim to enhance safety, reduce environmental hazards, and comply with stricter environmental regulations.

- Increased Demand in Emerging Economies: Rapid industrialization and urbanization in countries like China and India are driving the demand for isocyanates, particularly in the construction and automotive sectors. This surge is attributed to the need for insulation materials and lightweight components in these industries.

- Focus on Energy-Efficient Materials: The push for energy conservation has led to a higher demand for isocyanate-based products, such as polyurethane foams, which offer superior insulation properties. This trend is especially prominent in the construction industry, where energy-efficient building materials are increasingly sought after.

- Technological Innovations in Application Methods: Developments in application technologies, including advanced spraying techniques and improved curing processes, are enhancing the performance and efficiency of isocyanate-based products. These innovations contribute to better product quality and expanded application possibilities across various industries.

Use Cases

- Polyurethane Foams: Isocyanates are essential in producing both flexible and rigid polyurethane foams. Flexible foams are commonly used in furniture, bedding, and automotive seating, providing comfort and support. Rigid foams serve as effective insulation materials in construction and refrigeration, enhancing energy efficiency.

- Coatings and Adhesives: Isocyanates are utilized in the formulation of durable coatings and adhesives. They contribute to the development of protective finishes for automotive exteriors, industrial equipment, and flooring, offering resistance to abrasion and environmental factors. In adhesives, isocyanates provide strong bonding capabilities for materials like wood, plastics, and metals.

- Elastomers: Isocyanates are used in manufacturing elastomers, which are flexible, rubber-like materials. These elastomers are applied in products such as seals, gaskets, and wheels, where elasticity and durability are crucial. Their ability to withstand mechanical stress makes them suitable for various industrial applications.

- Spandex Fibers: Isocyanates are involved in producing spandex fibers, known for their exceptional elasticity. These fibers are widely used in textiles, including sportswear, undergarments, and medical apparel, providing comfort and flexibility. The unique properties of spandex make it a preferred material in applications requiring stretchability.

- Sealants: Isocyanates are key components in formulating sealants used in construction and automotive industries. They provide effective sealing solutions for joints, seams, and gaps, preventing the ingress of water, air, and other environmental elements. Isocyanate-based sealants offer durability and flexibility, accommodating structural movements and ensuring long-lasting protection.

- Thermal Insulation: Isocyanates are critical in producing thermal insulation materials used in buildings and refrigeration systems. These materials, such as rigid polyurethane foams, offer excellent insulating properties, reducing energy consumption and improving thermal efficiency. Their lightweight and durable nature makes them an ideal choice for modern energy-efficient constructions.

- Automotive Applications: Isocyanates are used in creating lightweight and durable components for automobiles, including bumpers, dashboards, and interior panels. Their properties enhance vehicle performance by reducing weight and improving fuel efficiency. Additionally, polyurethane foams made from isocyanates are used in car seating for comfort and safety.

Major Challenges

- Health and Safety Concerns: Isocyanates are associated with health risks, including respiratory issues and skin irritation. Occupational exposure can lead to conditions such as asthma and dermatitis, necessitating stringent safety protocols and protective measures in workplaces to safeguard employees.

- Environmental Regulations: The production and use of isocyanates are subject to strict environmental regulations due to their potential environmental impact. Compliance with these regulations can increase operational costs and require continuous monitoring and adaptation to evolving standards.

- Volatile Raw Material Prices: The cost of raw materials used in isocyanate production is subject to fluctuations, influenced by factors such as crude oil prices and supply chain disruptions. These price variations can affect profit margins and pose challenges in maintaining consistent pricing for end products.

- Competition from Bio-Based Alternatives: There is a growing demand for sustainable and eco-friendly materials, leading to increased interest in bio-based alternatives to traditional isocyanates. This shift presents a competitive challenge, as companies may need to invest in research and development to innovate and adapt to changing market preferences.

- Technological Barriers in Production: The synthesis of isocyanates involves complex chemical processes that require advanced technology and expertise. Developing efficient and cost-effective production methods, especially for bio-based isocyanates, remains a challenge, necessitating ongoing research and technological advancements.

- Toxicity and Disposal Issues: Isocyanates are highly reactive chemicals, and improper handling or disposal can lead to environmental contamination and toxicity concerns. Ensuring safe disposal practices and minimizing environmental harm require significant investment, posing challenges for manufacturers and users.

- Limited Awareness and Training: In some industries, limited awareness about the safe handling and application of isocyanates can lead to improper usage, increasing risks to health and safety. Training programs and educational initiatives are necessary to bridge this gap, but implementing them universally can be resource-intensive.

- Supply Chain Disruptions: The isocyanate market is susceptible to supply chain challenges, including transportation issues and raw material shortages. Global economic uncertainties and geopolitical tensions further exacerbate supply inconsistencies, impacting production timelines and costs.

Market Growth Opportunities

- Expansion in Emerging Economies: Rapid industrialization and urbanization in countries such as China and India are driving demand for isocyanate-based products, particularly in construction and automotive sectors. The increasing need for infrastructure development and consumer goods in these regions offers significant market expansion potential.

- Advancements in Bio-Based Isocyanates: Developing bio-based isocyanates derived from renewable resources addresses environmental concerns and aligns with the global shift towards sustainable materials. Investing in research and development of these alternatives can open new market segments and meet the growing demand for eco-friendly products.

- Innovations in Application Technologies: Enhancing application methods, such as advanced spraying techniques and improved curing processes, can increase the efficiency and performance of isocyanate-based products. These innovations can lead to broader adoption across industries, including automotive, construction, and electronics, thereby driving market growth.

- Rising Demand for Energy-Efficient Materials: The global emphasis on energy conservation has increased the demand for isocyanate-based insulation materials, such as rigid polyurethane foams. These materials are essential in constructing energy-efficient buildings and appliances, presenting opportunities for market growth in the construction and appliance manufacturing sectors.

- Growth in Automotive Lightweighting: The automotive industry’s focus on reducing vehicle weight to improve fuel efficiency and reduce emissions has led to increased use of isocyanate-based materials. Polyurethane components, derived from isocyanates, are favored for their lightweight and durable properties, offering growth prospects in automotive manufacturing.

- Increased Adoption in Electronics and Appliances: Isocyanates are gaining traction in the electronics and home appliance sectors due to their use in protective coatings, adhesives, and thermal insulation materials. The growing demand for durable, lightweight, and energy-efficient products in these industries creates substantial opportunities for market expansion.

- Infrastructure Development in Emerging Markets: Infrastructure development initiatives in developing regions are driving demand for construction materials, including isocyanate-based products like insulation foams and coatings. These projects, supported by government investments, offer opportunities for isocyanates to capture a significant share in the construction sector.

Key Players Analysis

Dow Chemicals is a prominent player in the isocyanates sector, producing key compounds like methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI). These chemicals are essential in manufacturing polyurethane products used across industries such as construction, automotive, and consumer goods. Dow’s extensive global production and distribution network ensures a reliable supply of isocyanates to meet diverse market demands. The company emphasizes innovation and sustainability, focusing on developing advanced isocyanate formulations that enhance performance while reducing environmental impact.

BASF SE, headquartered in Germany, is a leading chemical company extensively involved in the production of isocyanates, particularly MDI and TDI. These compounds are integral to manufacturing polyurethane foams, coatings, adhesives, and sealants, serving industries such as construction, automotive, and furniture. BASF’s isocyanate operations are characterized by a global production network, ensuring a consistent supply to meet diverse market demands. The company’s commitment to innovation is evident in its research and development efforts aimed at enhancing product performance and sustainability.

Evonik Industries, based in Germany, is a significant player in the specialty chemicals sector, including the production of isocyanates. The company’s isocyanate products are utilized in various applications, such as coatings, adhesives, and elastomers, catering to industries like automotive, construction, and electronics. Evonik operates a comprehensive global network of production and research facilities, ensuring efficient supply and innovation in the isocyanate market. The company focuses on developing high-performance isocyanate products that meet stringent environmental and safety standards.

Tosoh Corporation, headquartered in Japan, is a diversified chemical company with a notable presence in the isocyanates market. The company produces MDI and TDI, which are essential in manufacturing polyurethane products used in industries such as construction, automotive, and consumer goods. Tosoh’s isocyanate production is supported by advanced manufacturing facilities and a robust distribution network, ensuring a reliable supply to meet global demand. The company emphasizes innovation and sustainability, focusing on developing eco-friendly isocyanate products and processes.

Mitsui Chemicals Inc., a Japanese chemical company, is actively engaged in the production of isocyanates, including MDI and TDI, which are crucial in the synthesis of polyurethane materials. These isocyanates are applied in various industries, such as automotive, construction, and electronics, for products like foams, coatings, and adhesives. Mitsui Chemicals operates a well-established production and distribution network, ensuring efficient delivery to meet market needs. The company is dedicated to sustainability and innovation, focusing on developing environmentally friendly isocyanate products and processes.

Huntsman International LLC, based in the United States, is a global chemical company with a significant presence in the isocyanates market, particularly in the production of MDI. Huntsman’s isocyanates are utilized in creating polyurethane products for applications in insulation, automotive seating, and footwear. The company’s operations are marked by a comprehensive manufacturing and distribution network, facilitating a reliable supply to various industries. Huntsman is committed to innovation, focusing on developing advanced isocyanate formulations that enhance performance and sustainability.

LANXESS, a German specialty chemicals company, is involved in the production of isocyanates, particularly MDI and TDI, which are essential in manufacturing polyurethane products. These products serve industries such as automotive, construction, and electronics, providing materials for foams, coatings, and adhesives. LANXESS operates a global network of production facilities, ensuring a consistent supply of isocyanates to meet market demands. The company emphasizes innovation and sustainability, focusing on developing high-performance isocyanate products with reduced environmental impact.

Asahi Kasei Corporation, headquartered in Japan, is a diversified chemical company with activities in the isocyanates sector. The company produces MDI and TDI, which are utilized in manufacturing polyurethane products for applications in automotive, construction, and consumer goods industries. Asahi Kasei’s isocyanate production is supported by advanced manufacturing technologies and a robust distribution network, ensuring efficient supply to meet global demand. The company focuses on innovation and sustainability, developing eco-friendly isocyanate products and processes.

Bayer AG, a German multinational, has historically been a significant player in the isocyanates market through its former subsidiary, Covestro AG. Covestro, formerly Bayer MaterialScience, specializes in producing MDI and TDI, essential for polyurethane products used in industries like automotive, construction, and electronics. In recent years, Bayer has divested its stake in Covestro, focusing more on its core life sciences businesses. However, Covestro continues to operate independently as a leading producer in the isocyanates sector, maintaining a strong global presence and commitment to innovation and sustainability in its product offerings.

Chemtura Corporation, prior to its acquisition by LANXESS in 2017, was a U.S.-based specialtychemicals company with activities in the isocyanates market. Chemtura’s portfolio included specialty isocyanates used in applications such as coatings, adhesives, and elastomers, catering to diverse industrial needs. Following the acquisition, LANXESS integrated Chemtura’s expertise and product lines into its own operations, enhancing its capabilities in the isocyanate sector.

VENCOREX, a joint venture between PTT Global Chemical and Perstorp Group, specializes in the production of aliphatic isocyanates, which are widely used in high-performance coatings, adhesives, and elastomers. The company’s product portfolio includes HDI (hexamethylene diisocyanate) and its derivatives, serving industries such as automotive, aerospace, and construction. VENCOREX emphasizes sustainability by developing eco-friendly solutions and reducing the environmental impact of its production processes.

Conclusion

In Conclusion, the Isocyanates Market is poised for significant growth, driven by increasing demand across various industries such as construction, automotive, and electronics. This expansion is attributed to the rising utilization of polyurethane products, advancements in manufacturing technologies, and the development of bio-based isocyanates.

However, challenges such as environmental concerns and regulatory constraints necessitate ongoing innovation and adaptation within the industry. Companies that invest in sustainable practices and technological advancements are expected to maintain a competitive edge in this evolving market