Table of Contents

Introduction

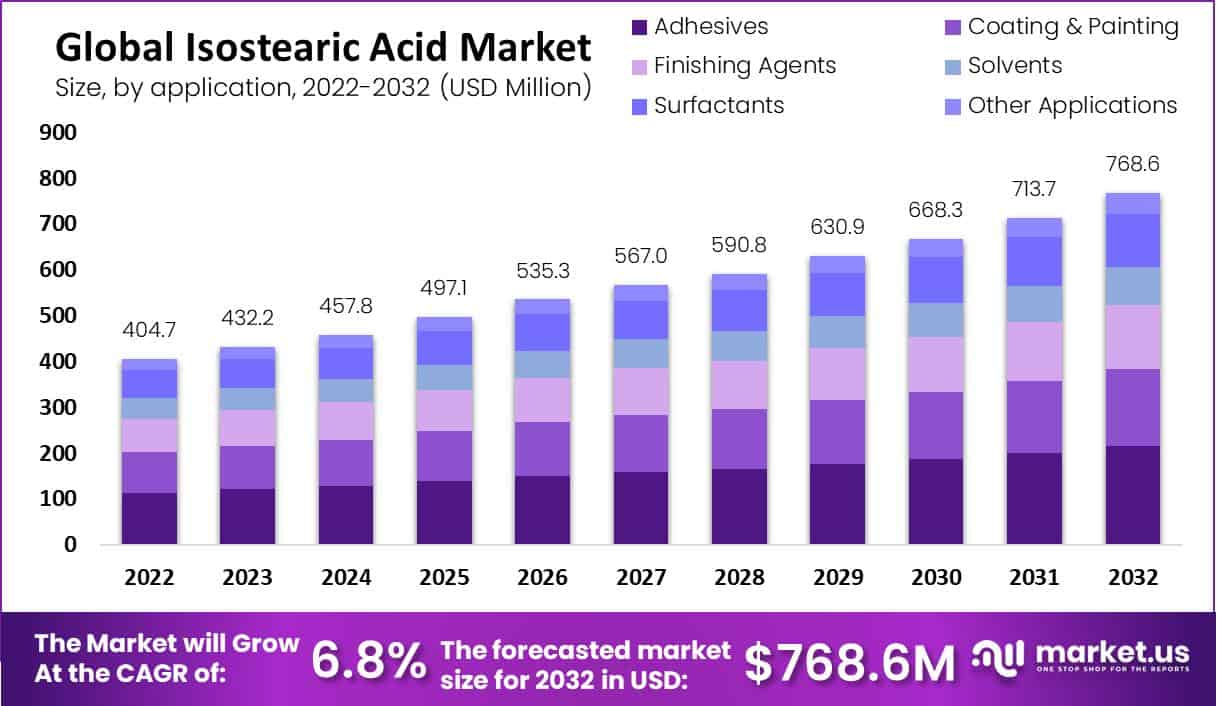

The global isostearic acid market, valued at USD 404.7 million in 2022, is projected to escalate to USD 768.6 million by 2032, expanding at a compound annual growth rate (CAGR) of 6.8% during the forecast period from 2023 to 2032. Isostearic acid, a branched-chain fatty acid derived predominantly from plant-based oils such as castor oil, is extensively utilized in the personal care and cosmetics industry.

Its applications span a variety of products including soaps, shampoos, and skin creams, where it is cherished for its exceptional stability and resistance to oxidation. These properties make isostearic acid a preferred substitute over other fatty acids that are less stable or more susceptible to oxidation.

The market’s growth is propelled by several factors, including increasing demand for natural and sustainable cosmetic products and the versatility of isostearic acid in enhancing product consistency and moisturizing effects. However, the market faces challenges such as fluctuations in raw material prices and the stringent regulatory environment concerning the sourcing and processing of plant-based oils.

Recent developments in the industry have seen advancements in production techniques aimed at improving the yield and purity of isostearic acid, thereby enhancing its appeal to cosmetic manufacturers globally. These innovations are likely to foster market growth by enabling producers to meet the rising demand more effectively. As the industry continues to evolve, the market is poised for significant expansion, driven by both technological advancements and shifting consumer preferences towards more natural and effective ingredients.

Croda International Plc: In September 2022, Croda International released the inaugural “Biotechnology: Personal Care Market Report.” This report is part of a series aimed at helping businesses capitalize on biotechnology in the personal care industry, highlighting sustainable practices. Additionally, in 2021, Croda enhanced its position in the market for natural-based ingredients by acquiring Algaia, which specializes in natural marine-based ingredients derived from seaweed.

Arizona Chemical Company LLC: Arizona Chemical, a key player in the market, expanded its bio-refinery in Almere, the Netherlands, in 2019. This expansion was aimed at increasing the production of isostearic acid and other bio-based chemicals, reinforcing its commitment to sustainability. Oleon NV: Oleon NV has been actively participating in the market with its robust product portfolio and has made significant achievements in the industry, although specific recent developments in 2023 are not detailed, their ongoing contributions continue to support market growth.

Nissan Chemical Corporation: While specific recent developments for 2023 were not highlighted, Nissan remains a significant contributor to the market through its diverse chemical offerings, including those in the isostearic acid segment.

Key Takeaways

- Market Size: It is projected that the global isostearic acid market will experience a compound annual growth rate (CAGR) of 6.8% between 2023-2032.

- Application Analysis: Adhesives represented 28% of total revenues in 2022 and were predominantly utilized as additives within adhesive products, paint lubricants, and personal care items.

- End User Analysis: By end-use industry segment, chemical esters are projected to hold the largest revenue share at 37% over time and an expected compound annual growth rate of 6.5% during forecasted years.

Isostearic Acid Statistics

- Stearic acid, also known as stearate or 18:0, belongs to the class of organic compounds known as long-chain fatty acids. These are fatty acids with an aliphatic tail that contains between 13 and 21 carbon atoms.

- The first two principal components (PCs) were PC1 (69.4%) and PC2 (15.8%) of the total variances, which could explain the variation in the fatty acid components in two varieties of Z. bungeanum.

- According to the KEGG functional annotation of transcriptome sequencing and previous reports, 20 genes involved in the key steps of the fatty acid synthesis pathway were selected for expression pattern analysis.

- The gene network was constructed using the top 150 core genes in each module

- Furthermore, the changing trend in fatty acids varied in the two varieties, increasing from 0 h to 24 h in FG, and increasing from 0 h to 12 h then decreasing in FX.

- Furthermore, the changing trend in fatty acids varied in the two varieties, increasing from 0 h to 24 h in FG, and increasing from 0 h to 12 h then decreasing in FX.

- This substance is registered under the REACH Regulation and is manufactured in and/or imported to the European Economic Area, at ≥ 10 tonnes per annum.

- For histopathology, skin biopsies were fixed in 4% Histofix® solution (Carl Roth, Karlsruhe, Germany), embedded in paraffin, and cut into 6 μm sections.

- RNA concentrations were measured by Nanodrop 2000c spectrophotometer.

- The cycling conditions were 50°C for 2 min, 95°C for 2 min, followed by 40 cycles each of 95°C for 15 sec, and 60°C for 1 min each.

- A non-targeted analysis based on high-resolution mass spectrometry was used to analyze placental tissues from a cohort of 35 patients with preeclampsia (n = 18) and normotensive (n = 17) pregnancies.

- low-temperature properties, good lubricity, and high viscosity index number, 45 000 tons of isostearic acids.

Emerging Trends

- Emerging trends in the isostearic acid market indicate a significant shift towards sustainability and the increasing application of this substance in diverse industries. Here are some of the key trends:

- Sustainability and Bio-based Products: There is a growing inclination towards sustainable and bio-based products across various sectors, notably in cosmetics and personal care. Isostearic acid, often derived from renewable sources like plant oils, is favored for its environmental benefits and is increasingly used in formulations that require stable and effective ingredients.

- Technological Advancements in Manufacturing: Automation and process optimization are becoming more prevalent in the production of isostearic acid. The adoption of advanced process control systems and automated equipment is aimed at enhancing product quality, reducing costs, and improving manufacturing efficiency.

- Expansion in Cosmetic Applications: Isostearic acid is highly valued in the cosmetics industry due to its emollient, thickening, and stabilizing properties, which make it an ideal ingredient in products such as creams, lotions, sunscreens, and lipsticks. The demand for isostearic acid in this sector is boosted by its ability to improve the texture and spreadability of cosmetic products.

- Growing Demand in Lubricants and Greases: The lubricant sector is witnessing increased use of isostearic acid due to its excellent lubricity and low-temperature performance. It’s also being explored as a potential gasoline detergent and pour-point depressant, useful particularly in colder climates.

- Regional Growth Dynamics: The Asia-Pacific region is projected to dominate the market, driven by rising demand in emerging economies like China and India. This demand is fueled by increasing disposable incomes and growing consumer awareness about the benefits of bio-based products.

- Chemical Esters Applications: Chemical esters of isostearic acid are leading the market in applications due to their properties that enhance the dispersion, absorption, and adhesion of various formulations. These esters are integral in products ranging from plasticizers to pigment adhesion promoters, further diversifying the use of isostearic acid across industries.

Use Cases

- Cosmetics and Personal Care Products: Isostearic acid is extensively used in the manufacture of cosmetics and personal care products. It acts as an emollient, thickening agent, and stabilizer in formulations such as skin creams, lotions, sunscreens, and lipsticks. Its ability to improve texture and spreadability while providing moisturizing properties makes it a preferred ingredient in these products.

- Lubricants and Greases: Due to its excellent lubrication properties and oxidation resistance, isostearic acid is used in the production of industrial lubricants and greases. It is particularly effective in applications requiring low-temperature performance and high stability, such as in automotive lubricants and industrial greases.

- Chemical Esters and Surfactants: Isostearic acid is a key raw material in the synthesis of various chemical esters and surfactants used in detergents, fabric softeners, and other cleaning agents. These esters enhance the performance of cleaning products by improving their consistency and enabling better dirt and oil removal.

- Paints and Coatings: In the coatings industry, isostearic acid is used to produce resins and binders that improve the gloss, adhesion, and water resistance of paints and coatings. Its oxidative stability also helps prolong the shelf life of these products.

- Paper and Textile Industries: Isostearic acid serves as a sizing agent and a softening agent in the paper and textile industries. It helps in providing a smoother finish to fabrics and papers, enhancing their resistance to water and grease.

- Pharmaceuticals: In pharmaceutical applications, isostearic acid is used in the formulation of topical ointments and creams due to its skin conditioning and barrier-forming properties, which help in drug delivery and moisture retention.

Major Challenges

- High Production Costs: The production of isostearic acid, particularly from plant sources like castor oil, involves complex processing and purification steps. These processes can be costly due to the need for specialized equipment and technology, which can drive up the overall production costs and affect pricing in the global market.

- Availability of Raw Materials: Isostearic acid production heavily relies on the availability of raw materials such as oleic acid, which is derived from vegetable oils. Fluctuations in the supply of these oils, due to agricultural variables like weather conditions and crop yields, can lead to volatility in isostearic acid production levels and prices.

- Regulatory and Environmental Challenges: The chemical industry, including the production of isostearic acid, is subject to stringent environmental regulations. Ensuring compliance with these regulations, particularly in terms of waste management and emissions, can be challenging and costly for manufacturers.

- Competition from Alternatives: Isostearic acid competes with other fatty acids like stearic acid and oleic acid, which are often available at lower costs. These alternatives are used in similar applications, and their lower price points can make them more attractive to consumers, especially in cost-sensitive markets.

- Market Penetration and Consumer Awareness: While isostearic acid offers significant benefits in various applications, achieving widespread market penetration remains a challenge. Increased consumer awareness and understanding of the unique properties of isostearic acid, compared to other fatty acids, are crucial for driving demand.

Market Growth Opportunities

- Expansion in Cosmetic and Personal Care Industries: Isostearic acid is increasingly being used in cosmetic formulations for its emollient and stabilizing properties, which enhance the texture and longevity of products such as lotions, sunscreens, and lipsticks. The growing consumer preference for natural and organic beauty products offers a substantial opportunity for isostearic acid as a preferred ingredient, particularly due to its plant-based origin and excellent oxidative stability.

- Growth in the Bio-lubricants Sector: There is a rising demand for environmentally friendly lubricants, particularly in industries such as automotive and industrial machinery, where sustainability is becoming increasingly important. Isostearic acid’s exceptional lubricity and stability at low temperatures make it an ideal component for bio-lubricants, positioning it as a sustainable alternative to petroleum-based products.

- Technological Advancements in Production: Innovations in the processing and manufacturing of isostearic acid can lead to more efficient production methods, reducing costs and minimizing environmental impact. This can enhance market competitiveness against more traditional fatty acids and increase its appeal in both new and existing markets.

- Development in Niche Markets: Isostearic acid has potential growth opportunities in niche applications such as ink solvents and corrosion inhibitors in industrial settings. Its properties can be harnessed to improve product performance in specialized areas, opening up new revenue streams.

- Geographical Expansion: Increasing market penetration in emerging economies, where there is growing industrial activity and a rising middle class, can provide significant opportunities for isostearic acid. These regions offer untapped potential due to their increasing demand for personal care products and industrial chemicals.

Key Player Analysis

Croda International maintained a steady involvement in the isostearic acid sector, particularly focusing on product innovation and sustainable practices. They introduced the Super Refined™ Isostearic Acid, designed to improve the feel and performance of skin care products by offering low viscosity and compatibility with cold processing. Croda has been actively engaged in improving their product offerings to meet the needs of the cosmetics and pharmaceutical industries, leveraging their expertise in creating formulations that enhance user experience while adhering to environmental sustainability standards.

Oleon NV made significant strides in the isostearic acid sector by announcing the expansion of their isostearic acid and dimer production capacity at their Ertvelde facility in Belgium. This expansion, set to double the unit’s capacity, is aimed at enhancing Oleon’s growth and competitiveness, particularly in industrial markets like lubricants. The completion of this expansion is projected for 2024, signaling Oleon’s commitment to meeting increasing market demand and maintaining a strong position in the global market.

For Nissan Chemicals, specific month-wise updates for 2023 or 2024 in the isostearic acid sector were not available. However, the company is known for its broad chemical production capabilities, including contributions to the oleochemicals market. For the latest developments, checking their official publications or industry updates would provide the most current information.

Emery Oleochemicals, Inc. has been active in the isostearic acid sector, focusing on sustainable chemical solutions. In 2023, they continued to market EMERSOL 3875, a product noted for its use in producing emollients and lubricants due to its favorable properties like cold temperature endurance and oxidation resistance. Emery Oleochemicals emphasizes sustainable sourcing and application across various industries, including personal care and industrial lubricants, which align with the growing demand for environmentally friendly and efficient products.

Jarchem Industries, Inc. has been identified as a key player in the isostearic acid market. Their product, Jaric, is a cosmetic-grade isostearic acid known for enhanced stability as a long-chain acid. It’s utilized in various applications, particularly in the personal care industry, where its properties such as improved emollient and stabilizing effects are valued. Jarchem’s focus on innovative, high-quality ingredients has helped them maintain a significant position in the market through 2023 and into 2024, catering to the needs of a dynamic industry.

KLK EMMERICH GmbH, a significant player in the oleochemical industry, expanded its market presence by acquiring Temix Oleo, an Italian producer known for its esters derived from renewable resources. This strategic move aimed to enhance KLK EMMERICH’s product range and extend its geographical reach while emphasizing sustainability and innovation in products such as isostearic acid, which is used across various industries including lubricants, cosmetics, and plastics. This acquisition reflects KLK EMMERICH’s ongoing commitment to growth and sustainability within the oleochemical sector, securing its position as a leader in the European market.

Santa Cruz Biotechnology, Inc., a recognized entity in the biochemical sector, has been actively involved in the isostearic acid market throughout 2023 and 2024. They offer high-purity isostearic acid, primarily used in the synthesis of biosurfactants, showcasing their commitment to providing essential research materials. Their isostearic acid product, noted for its greater than 97% purity, caters to a broad spectrum of scientific and industrial applications, emphasizing its utility in the cosmetics and personal care industries where it enhances the texture and efficacy of various products. This focus aligns with the increasing demand for high-quality, specialty chemicals in research and commercial sectors, underscoring Santa Cruz Biotechnology’s role in supporting advanced scientific endeavors and product innovations in the market .

Arizona Chemicals has been actively involved in the isostearic acid market, with a notable focus on sustainability and the expansion of production capacities. They enhanced their bio-refinery in Almere, the Netherlands, to increase the production of isostearic acid and other bio-based chemicals. This strategic move aligns with their commitment to sustainability and aims to cater to the growing demand for renewable chemicals. The company’s approach not only emphasizes the importance of sustainable practices but also positions Arizona Chemicals to take advantage of the expanding market for eco-friendly products.

Conclusion

In conclusion, the isostearic acid market is poised for substantial growth driven by its versatile applications across various industries, particularly in personal care, cosmetics, and lubricants. Its unique properties, such as high oxidative stability and excellent emollient features, make it a preferred choice for formulations requiring enhanced performance and stability.

The increasing consumer preference for natural and sustainable products further bolsters the demand for isostearic acid, emphasizing its role in future market expansions. Additionally, ongoing innovations in production technologies and processes are likely to enhance the efficiency and sustainability of isostearic acid production, ensuring its competitive edge in the global market. As industries continue to seek bio-based and environmentally friendly alternatives, isostearic acid stands out as a key ingredient capable of meeting these demands while supporting the shift towards greener and more sustainable manufacturing practices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)