Table of Contents

- Introduction

- Editor’s Choice

- History of Karaoke

- Karaoke Market Statistics

- Karaoke Market Dynamics Specific to Japan Statistics

- Karaoke Sales Statistics

- Karaoke Bar Industry Statistics

- Karaoke Apps Statistics

- Age-associated Dynamics of Karaoke Users and Participants

- Gender-associated Dynamics of Karaoke Users and Participants

- User Preferences and Dynamics

- Innovations and Developments in Karaoke

- Recent Developments

- Conclusion

- FAQs

Introduction

Karaoke Statistics: Karaoke is a popular form of entertainment that allows individuals to sing along with recorded music using a microphone, and it originated in Japan in the 1970s.

It involves selecting songs from a catalog, with lyrics displayed on a screen while instrumental versions play.

Equipment typically includes a microphone, sound system, and a karaoke machine or software.

There are various types of karaoke, including traditional settings in bars, private rooms, home setups, and online platforms.

Karaoke fosters social engagement, builds confidence, and provides stress relief. Making it a beloved pastime that continues to evolve with technology and culture.

Editor’s Choice

- The global karaoke market revenue reached $5.4 billion in 2023.

- In the global karaoke market, the division by end-use reveals a significant disparity between commercial and home-use segments. As of the latest data, commercial use dominates the market, accounting for 71% of the total market share.

- In fiscal year 2023, the market size for karaoke machine distribution in Japan varied considerably by type of facility, as denoted in billion Japanese yen. Drinking places led the distribution with a significant market size of 112.2 billion yen. Reflecting the high demand for karaoke entertainment in such settings.

- In Japan, the karaoke app market in 2023 showcased a wide range of preferences. As evidenced by the number of downloads for each leading app. Pokekara emerged as the top app with an impressive 1,692.27 thousand downloads, signaling its dominant position in the market.

- In December 2021, a survey among high school students in Japan revealed distinct gender differences in attitudes towards karaoke. High school girls showed a stronger preference for karaoke. With 68% stating they liked it and an additional 20% indicating they rather like it.

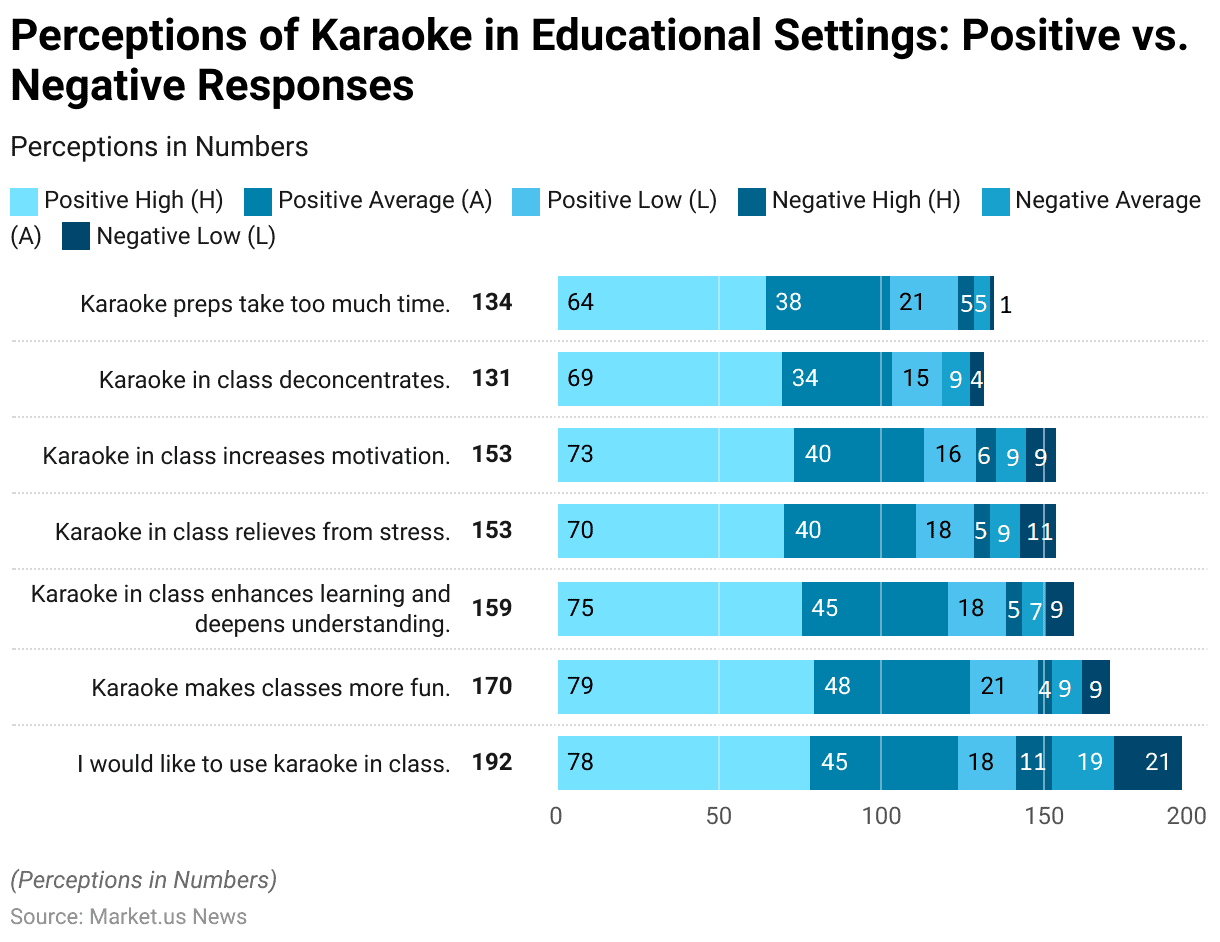

- A survey on student perceptions of karaoke revealed varied responses regarding its impact on educational experiences. A significant majority, 62.94%, strongly agreed that karaoke makes classes more fun, with another 24.12% agreeing.

- The distribution of responses concerning the use of karaoke in educational settings. This reveals varying degrees of positive and negative perceptions among participants. A significant number of respondents expressed strong positive feelings: 78% stated the desire to use karaoke in class. 79% stated that karaoke makes classes more fun, and 75% believed it enhances learning and understanding.

History of Karaoke

- The history of karaoke, an enduring global entertainment form, traces back to the early 1970s in Japan.

- The concept was pioneered by Daisuke Inoue, who developed the first karaoke machine in Kobe in 1971. This machine, known as the “8 Juke,” enabled users to sing along to a track without the original vocal line. A novelty that quickly caught on in local bars and leisure venues.

- Despite its popularity, Inoue never patented his invention. Which allowed numerous companies to enter the market and contribute to the evolution and spread of karaoke technology.

- The expansion of karaoke saw significant milestones over the decades. By the late 1970s, major Japanese corporations began producing karaoke machines, fostering its popularity across the country.

- The trend reached the Philippines, where Roberto del Rosario patented his version of the karaoke machine in 1983, further advancing the technology.

- The introduction of LaserDiscs by Pioneer in 1982 and CD+Graphics by Philips and Sony in the mid-1980s expanded the karaoke experience, offering visuals alongside lyrics.

- Karaoke’s international spread accelerated in the 1990s with the advent of more accessible home karaoke systems. These advancements coincided with the digital age. Allowing for online karaoke platforms and apps that transformed smartphones and computers into personal karaoke machines.

- This accessibility helped propel karaoke into a mainstream pastime celebrated worldwide. From private rooms in Asia to competitive stages such as the Karaoke World Championships established in Finland in 2003.

(Sources: Singa, How to Karaoke, Karaoke Secrets, Singing Bell, HOME, KaraFun Business)

Karaoke Market Statistics

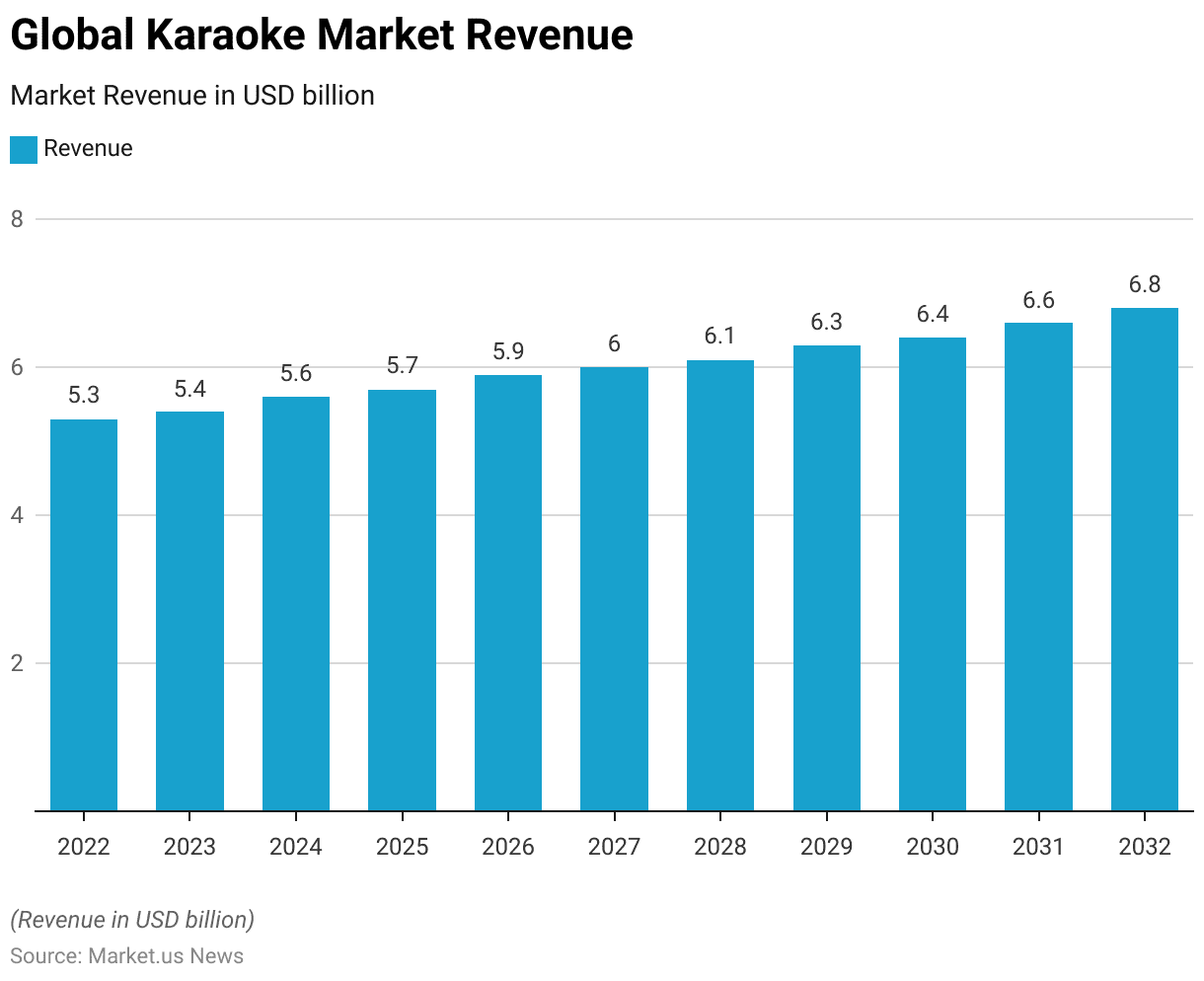

Global Karaoke Market Size Statistics

- The global karaoke market has exhibited a steady growth trajectory, with revenue figures increasing progressively from $5.3 billion in 2022 at a CAGR of 2.60%.

- In 2023, the market revenue slightly increased to $5.4 billion, followed by $5.6 billion in 2024.

- The upward trend continued, with revenues reaching $5.7 billion in 2025 and further rising to $5.9 billion by 2026.

- The growth persisted into the latter part of the decade, with the market achieving a revenue of $6.0 billion in 2027, and a slight increment was noted in 2028 with $6.1 billion.

- The growth pattern maintained its momentum, reaching $6.3 billion in 2029, followed by $6.4 billion in 2030.

- The market is anticipated to expand further to $6.6 billion in 2031 and is expected to reach $6.8 billion by 2032.

- This consistent increase underscores the sustained interest and investment in the karaoke industry over the forecast period.

(Source: market.us)

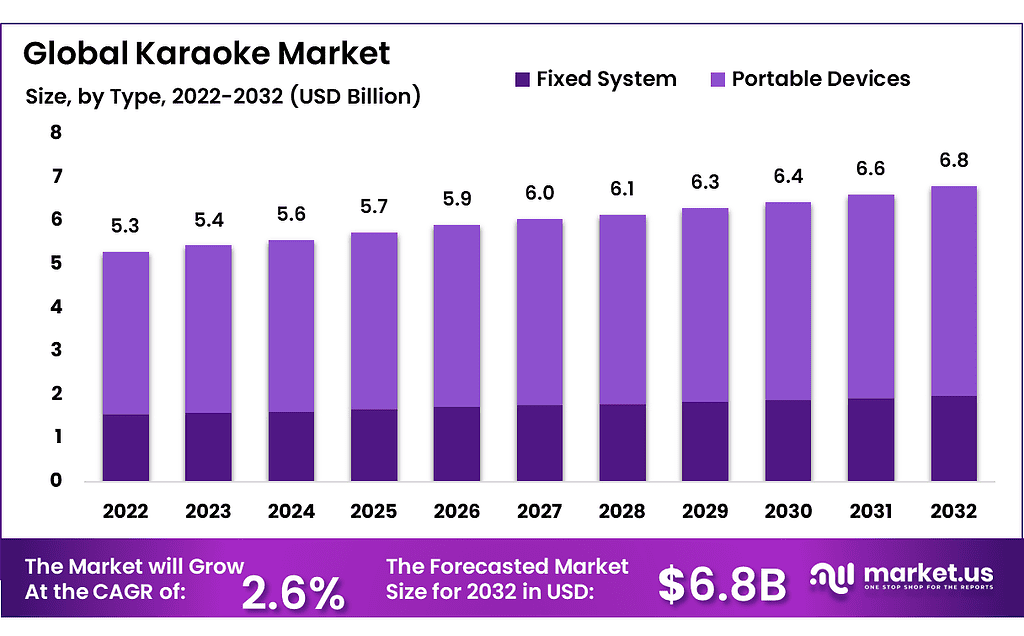

Karaoke Market Size – By Type Statistics

- The global karaoke market size, categorized by device type, has shown incremental growth across both portable devices and fixed systems from 2022 to 2032.

- In 2022, the total market revenue was $5.3 billion, of which portable devices accounted for $3.76 billion and fixed systems contributed $1.54 billion.

- The market revenue increased to $5.4 billion in 2023, with portable devices generating $3.83 billion and fixed systems $1.57 billion.

- This upward trend continued in subsequent years, with portable devices gradually increasing their revenue from $3.98 billion in 2024 to $4.83 billion by 2032, while fixed systems saw a rise from $1.62 billion in 2024 to $1.97 billion in 2032.

- By 2032, the total market revenue for karaoke reached $6.8 billion, reflecting sustained growth in both segments, with portable devices consistently maintaining a larger share of the market revenue compared to fixed systems.

- This data highlights a robust expansion of the karaoke market, driven by both portable and fixed karaoke systems.

(Source: market.us)

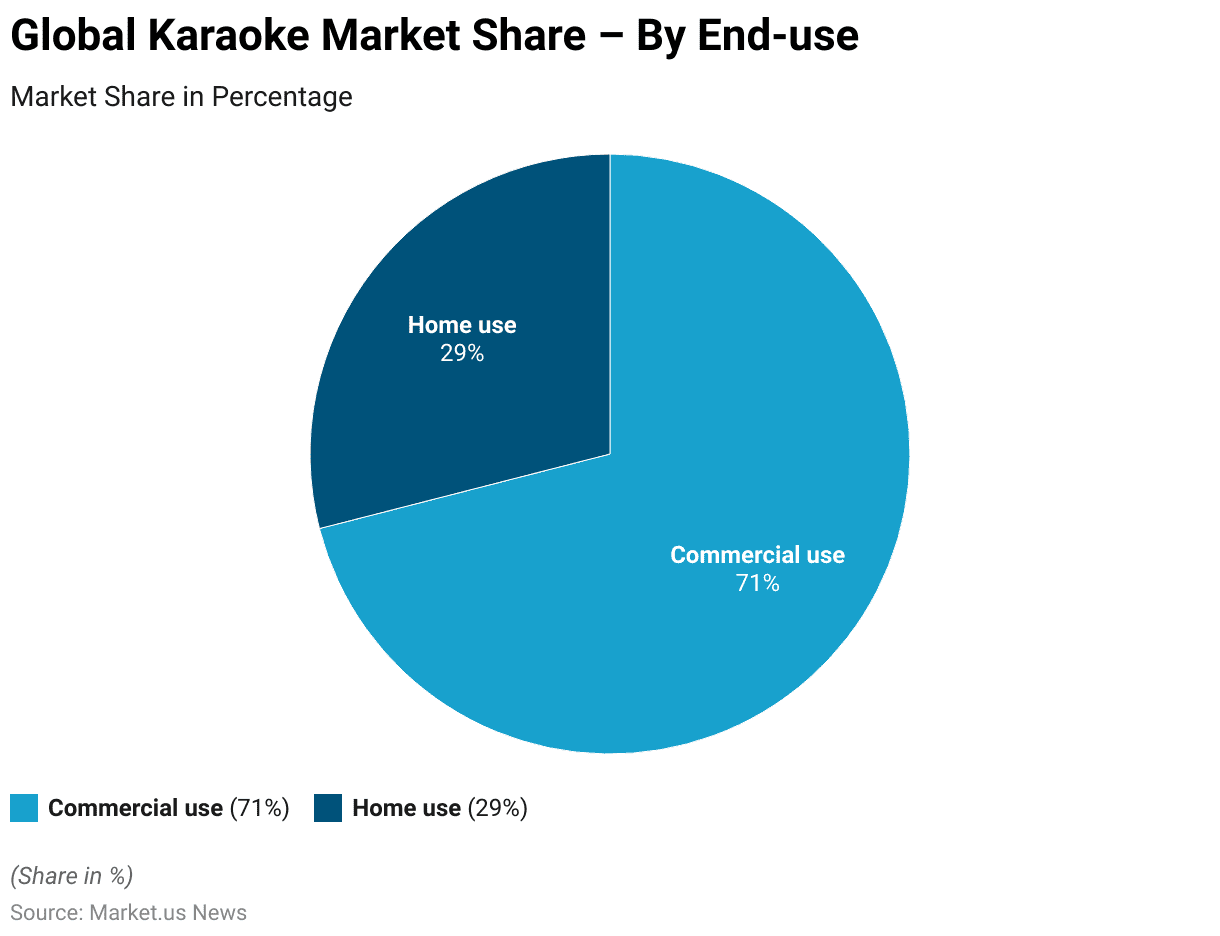

Global Karaoke Market Share – By End-use Statistics

- In the global karaoke market, the division by end-use reveals a significant disparity between commercial and home-use segments.

- As of the latest data, commercial use dominates the market, accounting for 71% of the total market share.

- This substantial portion underscores the preference and reliance on karaoke systems within commercial venues such as bars, entertainment spots, and public events where karaoke is a popular activity.

- Conversely, home use constitutes 29% of the market, indicating a robust, albeit smaller, consumer base that enjoys karaoke in a private setting.

- This distribution highlights the varied applications and appeal of karaoke systems, catering to both vibrant commercial environments and more intimate home settings.

(Source: market.us)

Karaoke Market Dynamics Specific to Japan Statistics

Size of the Karaoke User Market in Japan Statistics

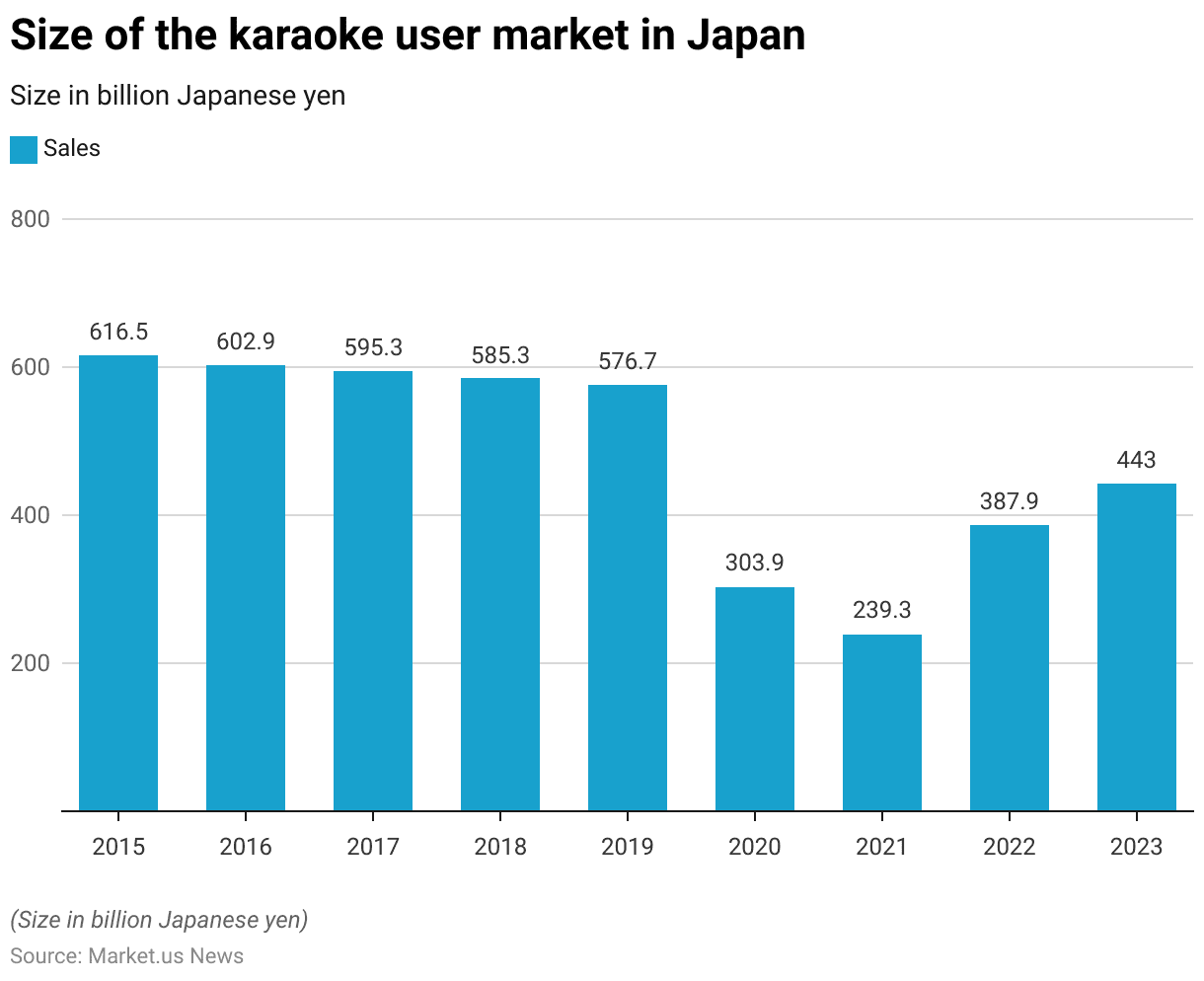

- The karaoke user market in Japan experienced significant fluctuations in market size from fiscal year 2015 to 2023, measured in billion Japanese yen.

- Initially, the market size was at its peak in 2015 with a value of 616.5 billion yen, followed by a gradual decline over the next few years—602.9 billion yen in 2016, 595.3 billion yen in 2017, 585.3 billion yen in 2018, and 576.7 billion yen in 2019, indicating a slow but steady downward trend in the pre-pandemic period.

- The most pronounced drop occurred in 2020, when the market size halved to 303.9 billion yen, likely due to the impacts of COVID-19.

- In 2021, the market further contracted to its lowest point at 239.3 billion yen.

- However, a recovery commenced in 2022 with an increase to 387.9 billion yen, and this positive trend continued into 2023 when the market size rose to 443 billion yen.

- This recovery phase reflects a resilient rebound as the market adjusted and possibly benefited from the lifting of pandemic-related restrictions and renewed consumer interest in karaoke entertainment.

(Source: Statista)

Karaoke User Market Size in Japan – By Segment Statistics

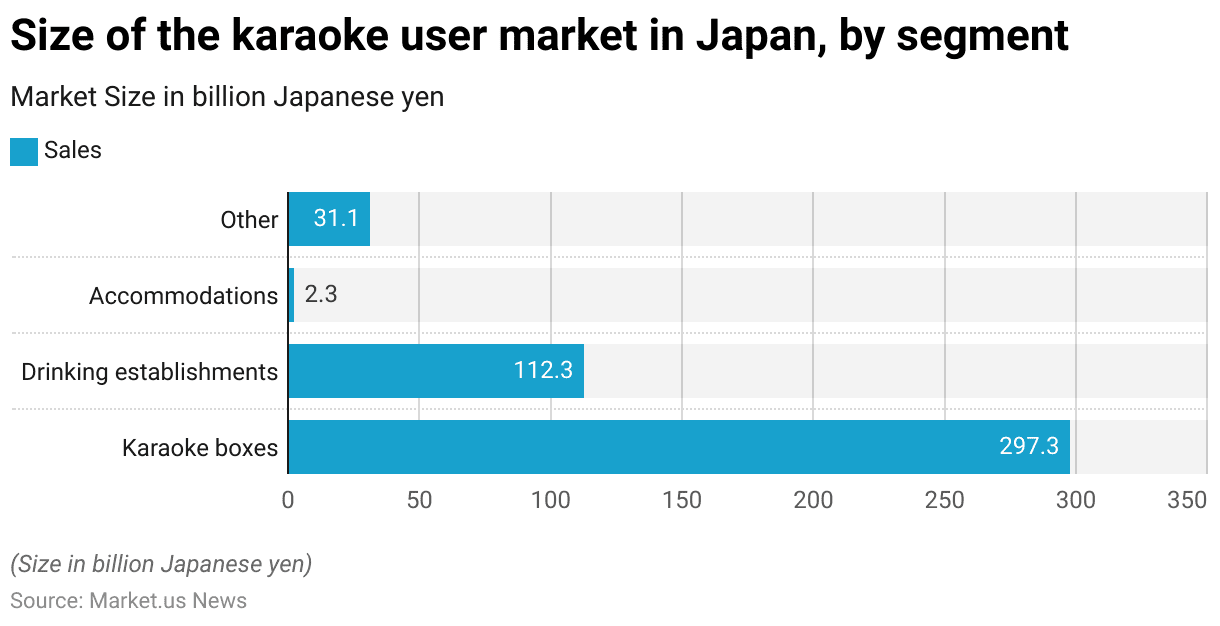

- In 2023, the size of the karaoke user market in Japan, segmented by types of establishments, demonstrated substantial variation in sales revenues.

- Karaoke boxes led the market with a significant revenue of 297.3 billion Japanese yen, highlighting their dominant role in the karaoke industry within Japan.

- Drinking establishments, which also incorporate karaoke as a popular entertainment offering, generated a considerable revenue of 112.3 billion Japanese yen.

- In contrast, accommodations such as hotels and inns, where karaoke facilities are less prevalent, contributed much less, with sales amounting to only 2.3 billion Japanese yen.

- Other venues and establishments that offer karaoke services accounted for 31.1 billion Japanese yen in sales.

- This segmentation underscores the widespread appeal and integration of karaoke in various social and commercial settings in Japan.

(Source: Statista)

Single Karaoke Market Size in Japan Statistics

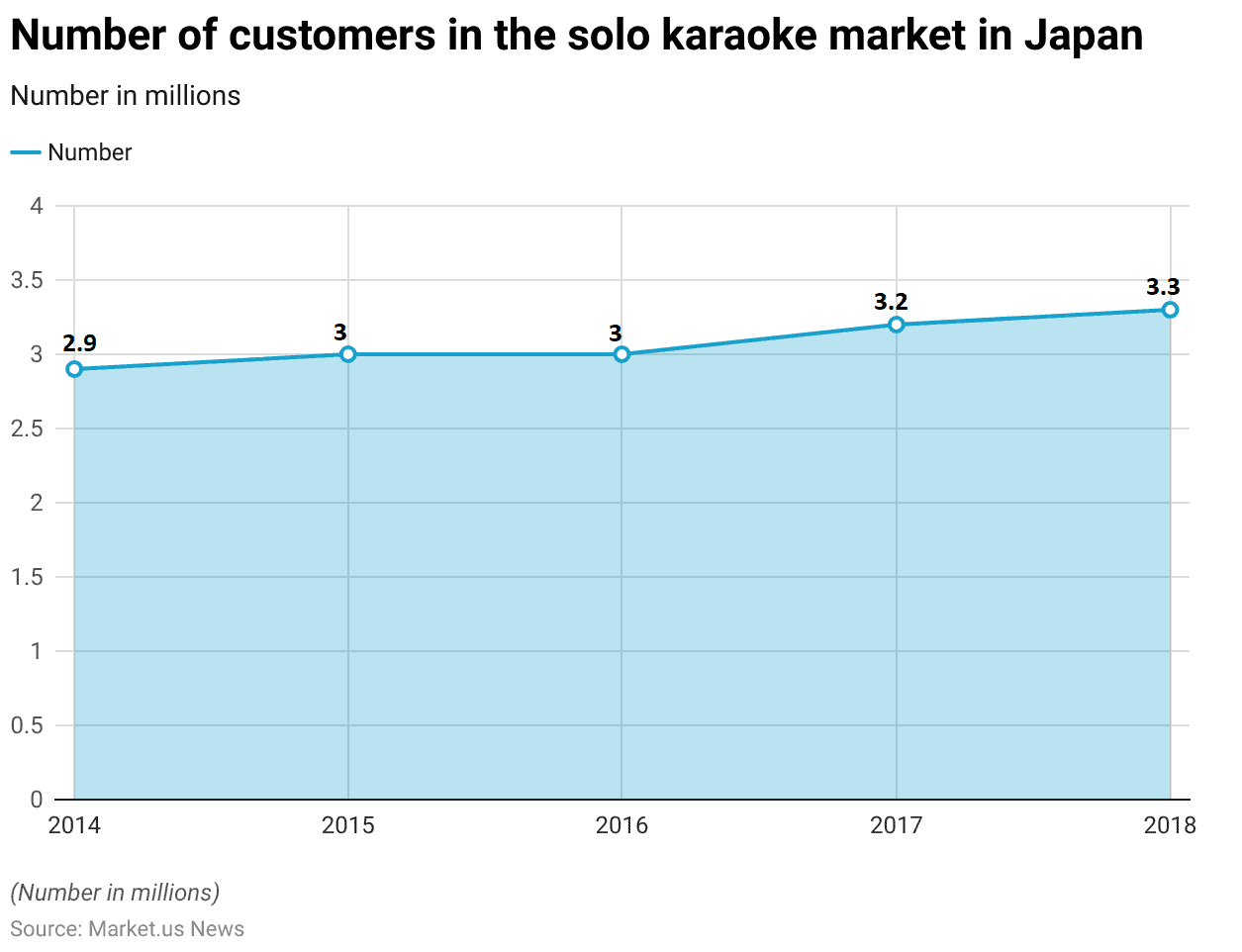

- From fiscal year 2014 to 2018, the solo karaoke market in Japan exhibited a steady growth in the number of customers.

- Starting with 2.9 million customers in 2014, the market saw a slight increase to 3 million in both 2015 and 2016.

- By 2017, the number of customers had grown to 3.2 million, indicating a growing interest in solo karaoke experiences.

- This upward trend continued into 2018, with an estimated 3.3 million customers participating in solo karaoke.

- This consistent growth highlights the increasing popularity of solo karaoke as an entertainment option among the Japanese populace.

(Source: Statista)

Market Size of Karaoke Machine Distribution in Japan – By Type of Facility Statistics

- In fiscal year 2023, the market size for karaoke machine distribution in Japan varied considerably by type of facility, as denoted in billion Japanese yen.

- Drinking places led the distribution with a significant market size of 112.2 billion yen, reflecting the high demand for karaoke entertainment in such settings.

- Karaoke boxes followed, though at a much lower scale, with 13.3 billion yen, signifying their targeted niche.

- Welfare facilities for older people also showed notable adoption of karaoke machines, accounting for 11.1 billion yen, illustrating the broader use of karaoke as a recreational activity in such environments.

- Hotels generated 8.3 billion yen from karaoke machines, supporting the view that these facilities cater to both leisure and business travelers seeking entertainment amenities.

- Other miscellaneous facilities contributed 5.7 billion yen, while corporate entities from the company constituted the smallest segment with 3.2 billion yen, indicating specialized uses of karaoke equipment in varied business and casual contexts.

- This distribution underscores the diverse appeal and application of karaoke machines across different commercial and recreational settings in Japan.

(Source: Statista)

Karaoke Sales Statistics

Karaoke Machine Sales Statistics

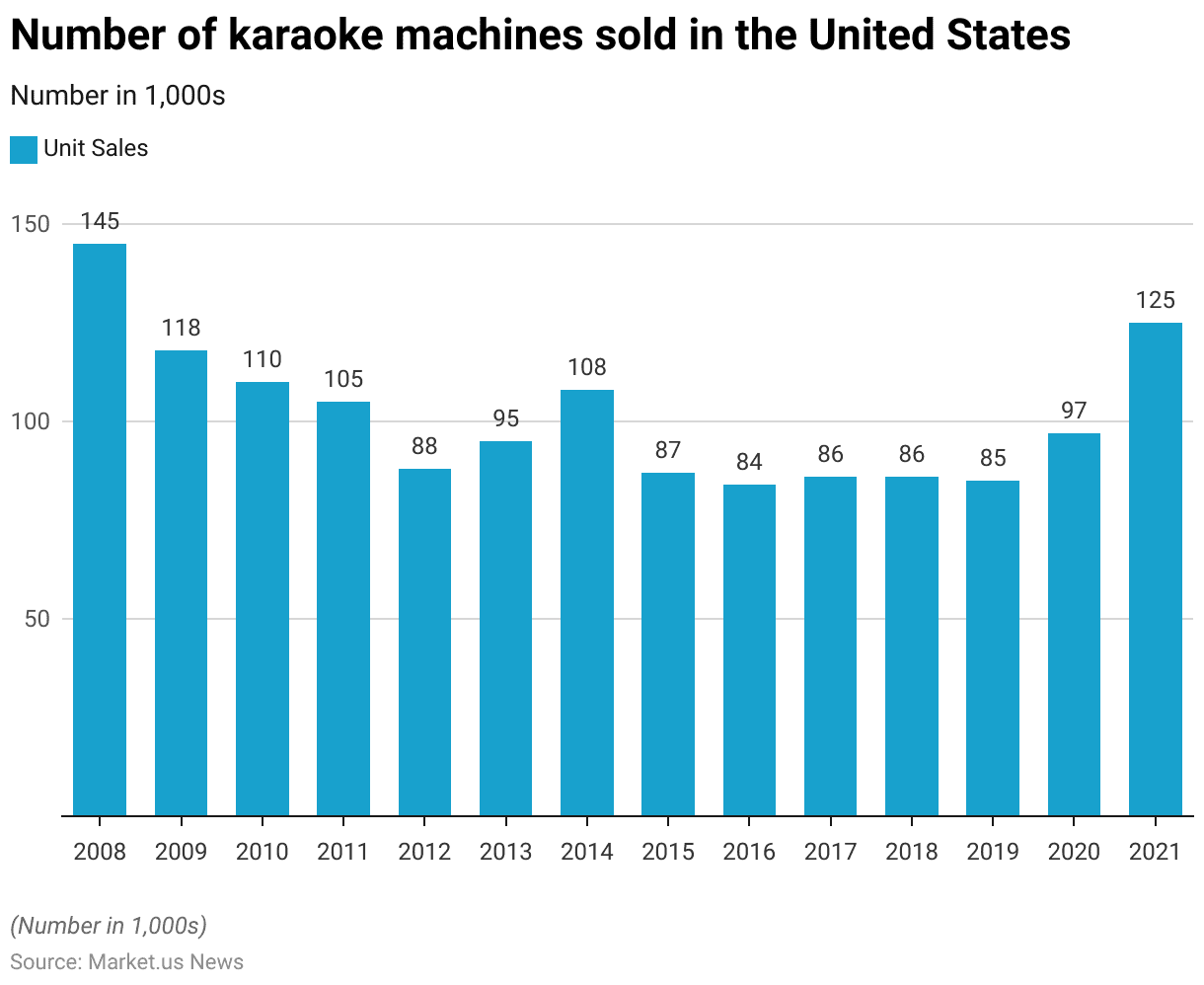

- The sales of karaoke machines in the United States over the period from 2008 to 2021 exhibited varied trends, as measured in thousands of units sold annually.

- In 2008, sales peaked at 145,000 units, demonstrating strong market interest. However, the following years saw a gradual decline, with sales dropping to 118,000 in 2009, 110,000 in 2010, and further to 105,000 in 2011.

- The decline continued more sharply to 88,000 units in 2012. There was a slight rebound in 2013, with sales rising to 95,000 units, and a more significant recovery in 2014 when sales reached 108,000 units.

- Post-2014, the market experienced another downtrend, with sales decreasing to 87,000 in 2015 and reaching a low of 84,000 by 2016.

- Stability was observed from 2017 to 2019, with sales hovering around 86,000 to 85,000 units.

- The year 2020 saw an uptick to 97,000 units, likely influenced by the increased home entertainment demand amid pandemic lockdowns.

- Remarkably, 2021 marked a significant recovery and growth, with sales surging to 125,000 units, possibly driven by the easing of COVID-19 restrictions and renewed consumer spending in entertainment sectors.

(Source: Statista)

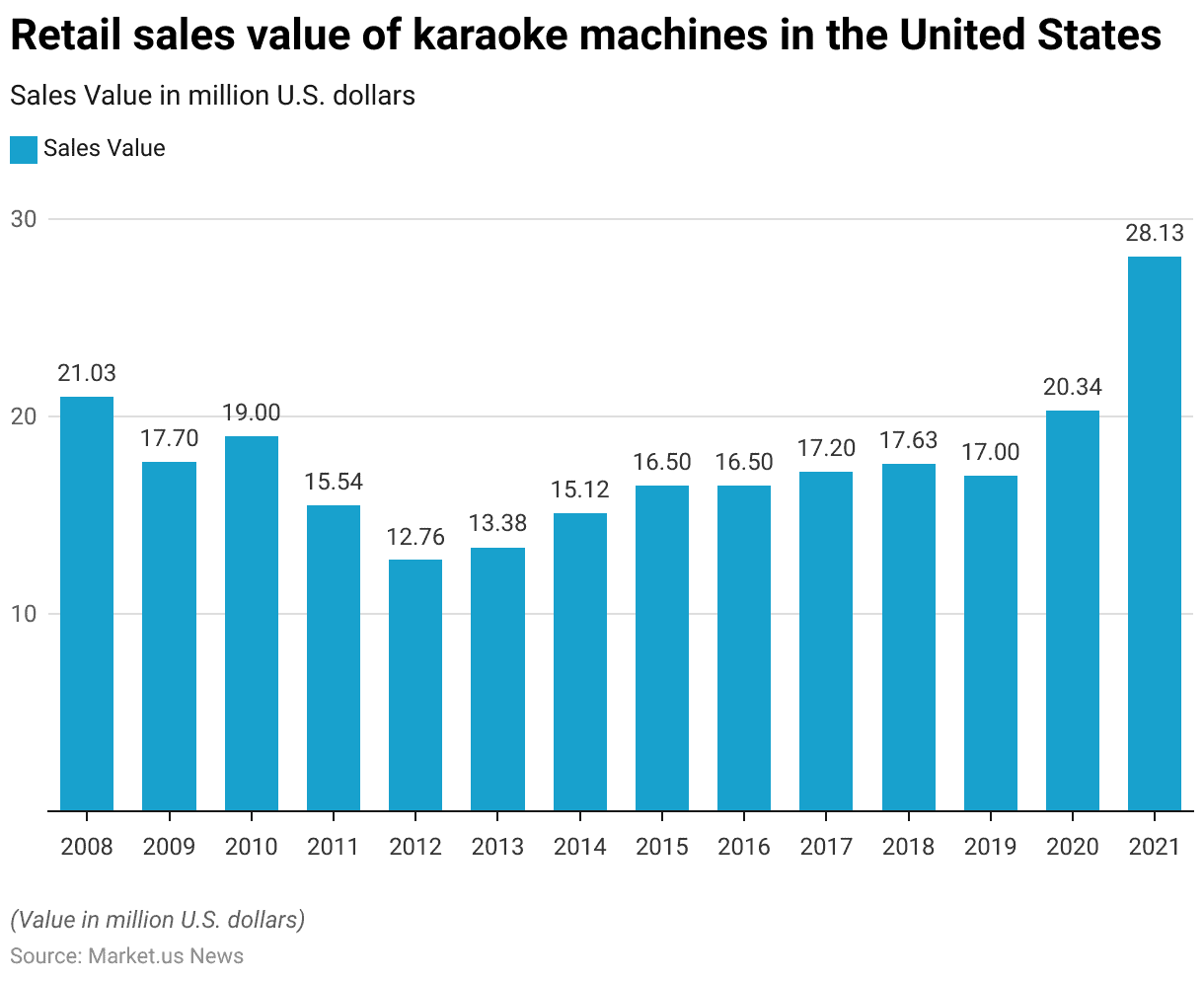

Retail Sales Value of Karaoke Machines Statistics

- The retail sales value of karaoke machines in the United States demonstrated notable fluctuations between 2008 and 2021.

- In 2008, the market was relatively robust, recording sales of $21.03 million. However, there was a noticeable decrease in 2009, with sales dropping to $17.7 million.

- The following year saw a slight recovery to $19 million in 2010, but this was followed by a gradual decline over the next two years, reaching $15.54 million in 2011 and further decreasing to $12.76 million by 2012.

- A modest rebound occurred in 2013, with sales values rising to $13.38 million and continuing to improve to $15.12 million in 2014 and $16.5 million in 2015, a level that has been maintained through 2016.

- The market experienced mild growth in 2017 and 2018, achieving $17.2 million and $17.63 million, respectively.

- Sales plateaued around $17 million in 2019 but surged in 2020 to $20.34 million, likely driven by the increased demand for home entertainment during the pandemic.

- The upward trajectory continued into 2021, when sales reached their peak at $28.13 million, reflecting a robust recovery and increased consumer engagement with karaoke as an entertainment option.

(Source: Statista)

Karaoke Bar Industry Statistics

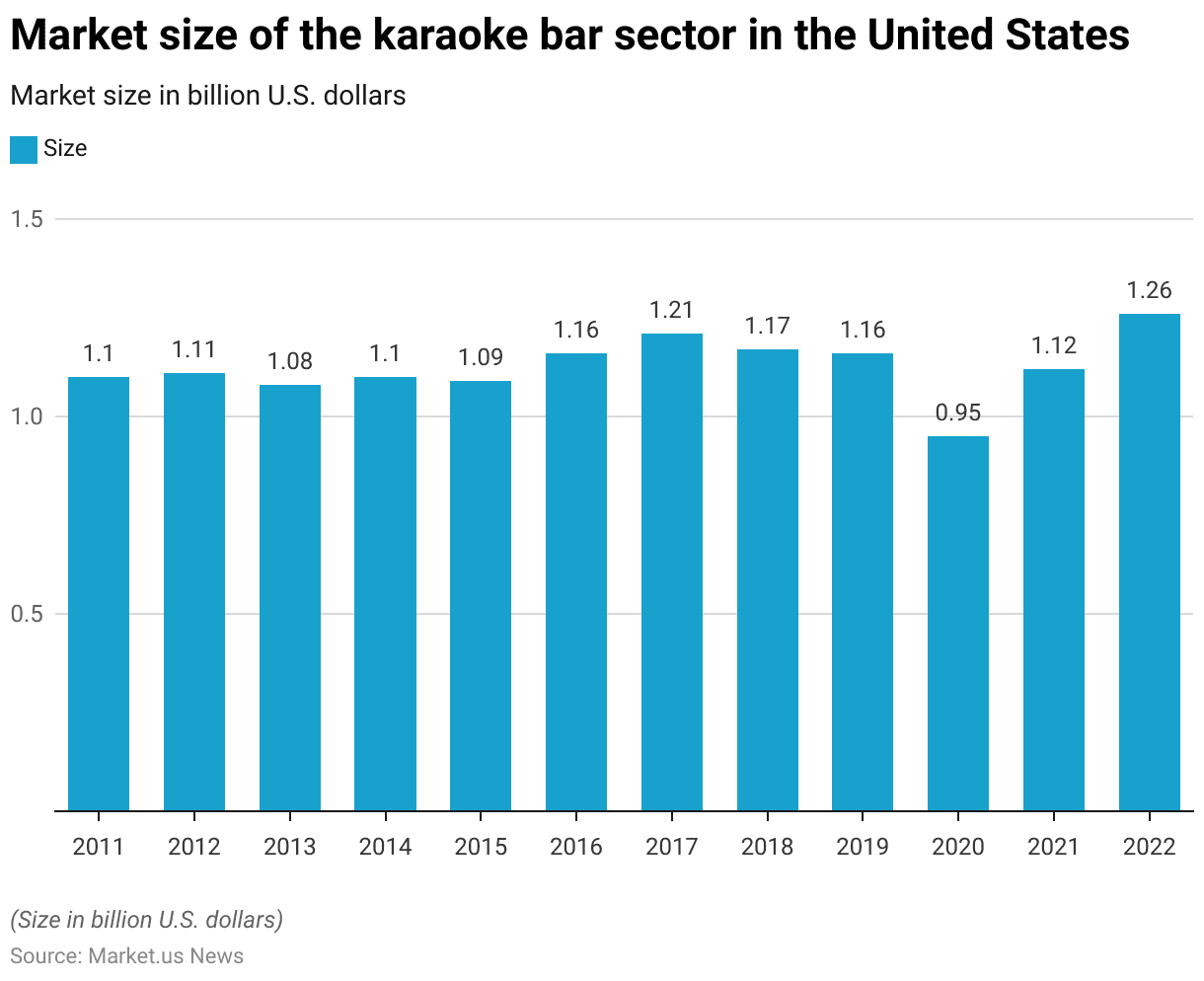

U.S. Karaoke Bar Industry Market Size Statistics

- The market size of the karaoke bar sector in the United States from 2011 to 2022 has seen varied performance over the years, expressed in billion U.S. dollars.

- The sector started at $1.1 billion in 2011, experiencing slight fluctuations in the following years: $1.11 billion in 2012, decreasing slightly to $1.08 billion in 2013, and returning to $1.1 billion in 2014.

- It saw a minor dip to $1.09 billion in 2015 but rebounded to $1.16 billion in 2016 and peaked at $1.21 billion in 2017.

- However, it slightly decreased to $1.17 billion in 2018 and remained steady at $1.16 billion in 2019.

- The year 2020 witnessed a significant drop to $0.95 billion, likely impacted by the global pandemic’s restrictions on social gatherings and entertainment venues.

- Nonetheless, the market showed signs of recovery in 2021, rising to $1.12 billion, with a forecast to further increase to $1.26 billion in 2022, indicating a positive trajectory as the sector adapted to new norms and possibly benefited from renewed consumer interest in social entertainment.

(Source: Statista)

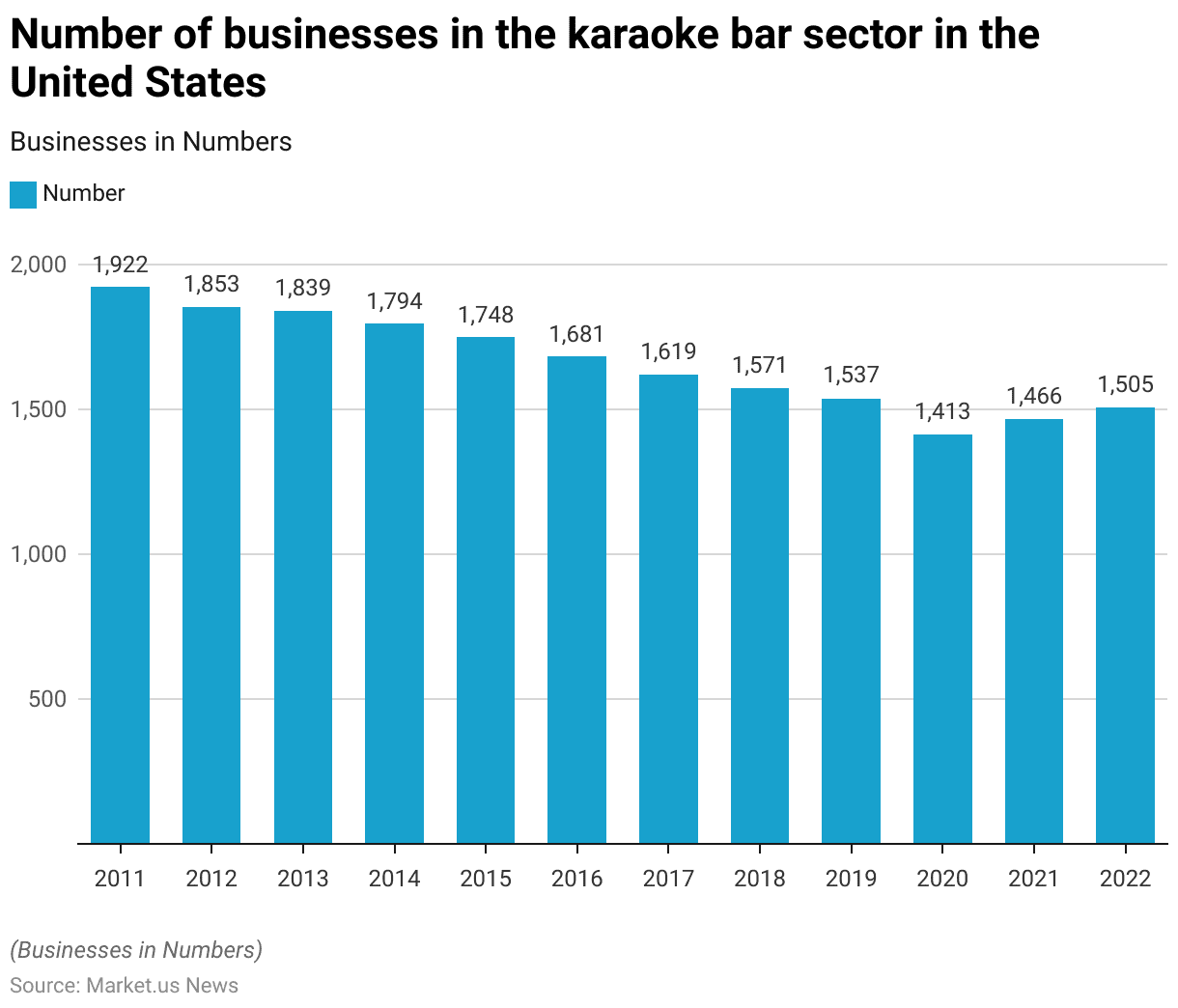

Karaoke Bar Industry Business Count in the U.S. Statistics

- From 2011 to 2022, the number of businesses in the karaoke bar sector in the United States experienced a general decline, with a slight recovery forecast towards the end of the period.

- In 2011, the sector was robust, with 1,922 businesses operating nationwide.

- However, a gradual decrease ensued: the count dropped to 1,853 in 2012 and continued to decline steadily to 1,839 in 2013, 1,794 in 2014, and 1,748 in 2015.

- This downward trend persisted through the following years, with the number reducing further to 1,681 in 2016, 1,619 in 2017, and 1,571 in 2018.

- The decline became more pronounced by 2019, with only 1,537 businesses remaining, and the impact of the COVID-19 pandemic in 2020 accelerated this reduction to 1,413 businesses.

- However, there was a slight recovery observed in 2021, with an increase to 1,466 businesses and a forecast for further recovery in 2022 to 1,505 businesses.

- This trajectory indicates the challenges and subsequent resilience within the sector, suggesting a capacity to rebound from economic and external disruptions.

(Source: Statista)

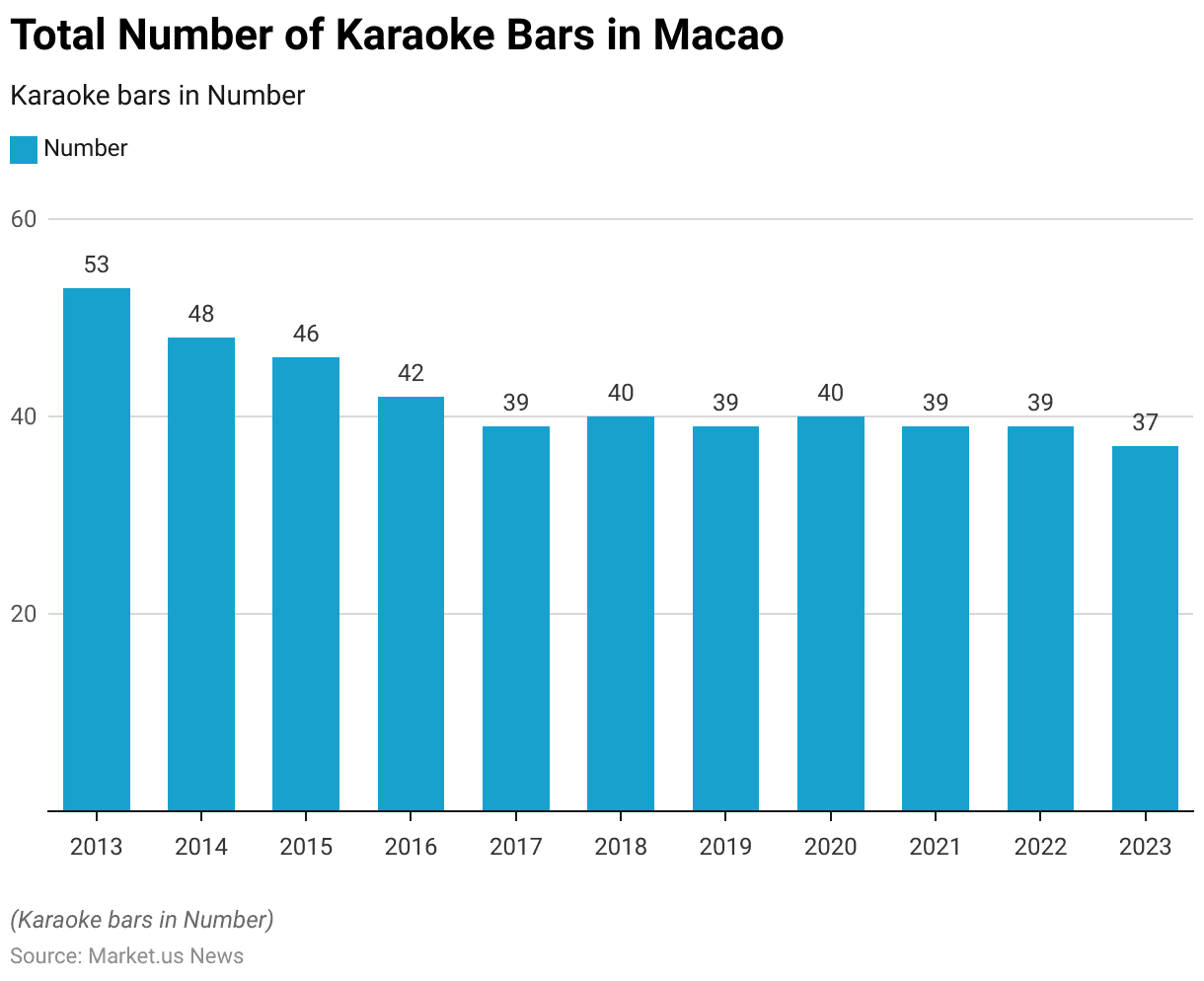

Total Number of Karaoke Bars in Macao Statistics

- From 2013 to 2023, the total number of karaoke bars in Macao displayed a declining trend.

- In 2013, 53 karaoke bars were operating in the region.

- This number began to decrease over the subsequent years, falling to 48 by 2014 and further to 46 in 2015.

- The decline continued more steadily, with the number of bars reducing to 42 in 2016 and reaching a low of 39 in 2017.

- There was a slight increase to 40 in 2018, but this was short-lived as the count reverted to 39 in 2019.

- The number remained stable at 40 in 2020 despite the challenges posed by the COVID-19 pandemic.

- However, the number of karaoke bars reduced slightly again to 39 in 2021 and 2022, ultimately dropping to 37 by 2023.

- This gradual reduction over the decade reflects shifting business dynamics, possibly influenced by changing entertainment preferences, regulatory challenges, or economic factors in the region.

(Source: Statista)

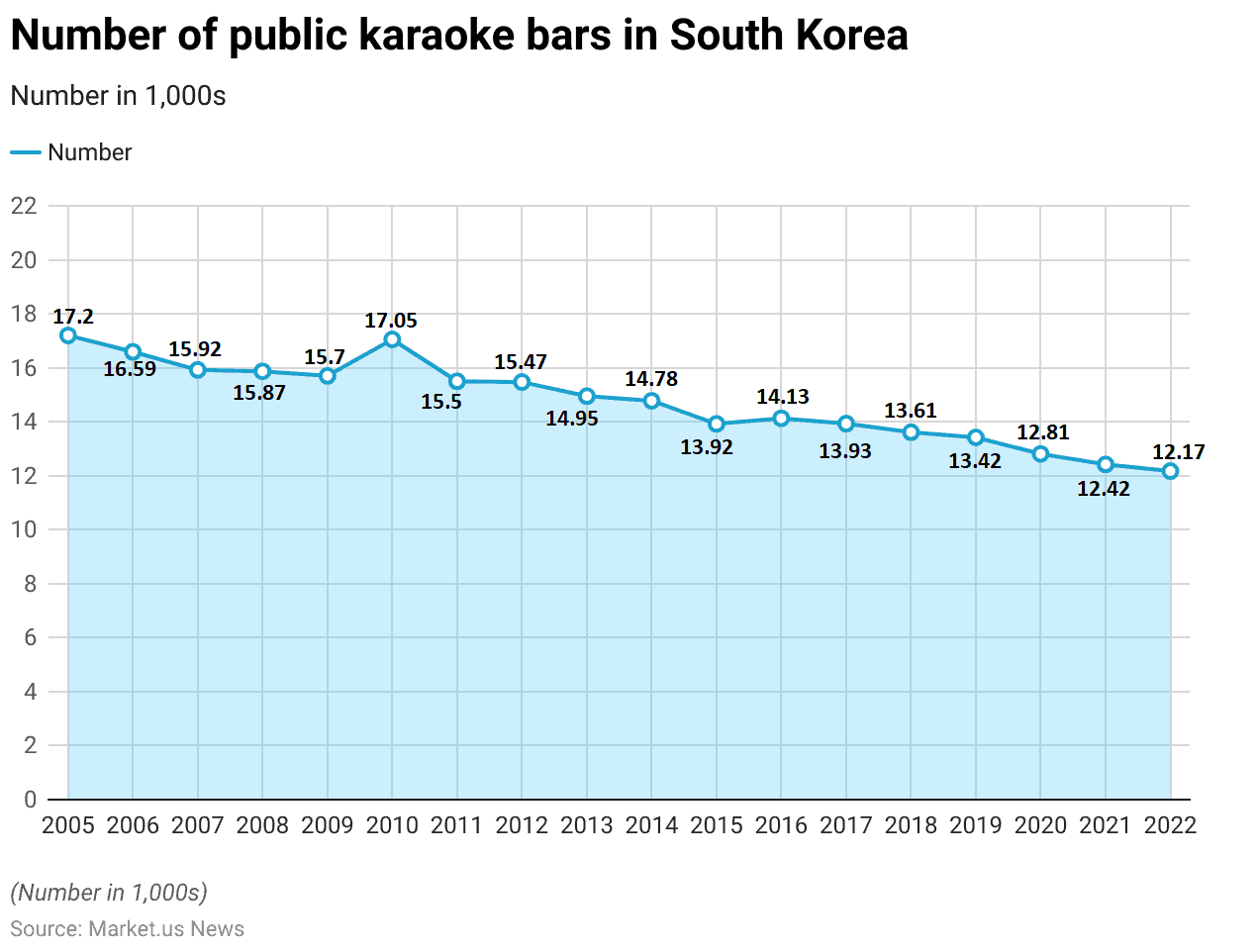

Number of Public Karaoke Bars in South Korea Statistics

- The number of public karaoke bars in South Korea has shown a general decline from 2005 to 2022.

- In 2005, there were approximately 17.2 thousand karaoke bars across the country. This number experienced a gradual decrease over the next few years, with figures dropping to 16.59 thousand in 2006, 15.92 thousand in 2007, and slightly lower to 15.87 thousand by 2008.

- The decline continued marginally to 15.7 thousand in 2009. However, there was a temporary increase in 2010, when the number rose to 17.05 thousand, but it fell again to 15.5 thousand in 2011.

- From 2012 onward, the number remained fairly steady, slightly decreasing each year from 15.47 thousand in 2012 to 14.95 thousand in 2013, 14.78 thousand in 2014, and continuing to decline to 13.92 thousand by 2015.

- The trend of decreasing numbers continued with minor fluctuations, reaching 14.13 thousand in 2016 and gradually falling to 13.93 thousand in 2017, 13.61 thousand in 2018, and further to 13.42 thousand in 2019.

- The onset of the COVID-19 pandemic in 2020 likely exacerbated the decline, reducing the number of karaoke bars to 12.81 thousand that year, with a continued decrease to 12.42 thousand in 2021 and 12.17 thousand in 2022.

- This overall downward trend indicates a shifting landscape in the karaoke bar industry in South Korea, possibly due to changes in social habits, economic pressures, and regulatory changes affecting the entertainment sector.

(Source: Statista)

Karaoke Apps Statistics

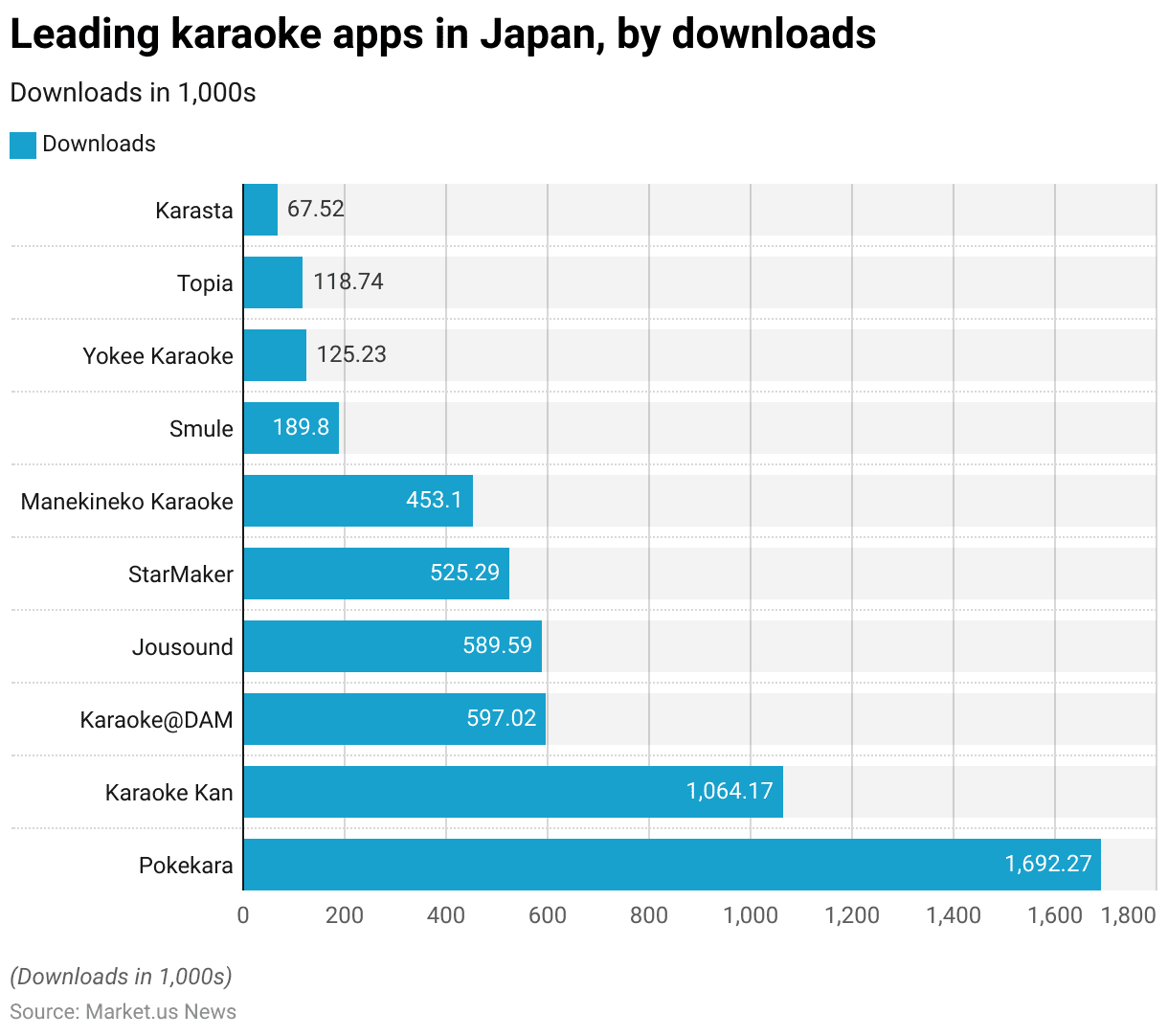

Leading Karaoke Apps – By Downloads Statistics

- In Japan, the karaoke app market in 2023 showcased a wide range of preferences, as evidenced by the number of downloads for each leading app.

- Pokekara emerged as the top app with an impressive 1,692.27 thousand downloads, signaling its dominant position in the market.

- Following closely was Karaoke Kan, which secured 1,064.17 thousand downloads, indicating its strong presence among karaoke enthusiasts.

- Karaoke@DAM and Jousound also demonstrated significant popularity with 597.02 thousand and 589.59 thousand downloads, respectively, closely trailed by StarMaker with 525.29 thousand downloads.

- Further down the list, Manekineko Karaoke recorded 453.1 thousand downloads, reflecting a robust following.

- Smule, known globally, managed to capture the attention of 189.8 thousand users in Japan. Smaller apps like Yokee Karaoke and Topia also carved out their niches with 125.23 thousand and 118.74 thousand downloads, respectively.

- Karasta, although the least downloaded in this grouping, still attracted 67.52 thousand users, underscoring the diverse preferences within the Japanese karaoke app market.

- This distribution highlights the competitive landscape and varying consumer choices in digital karaoke entertainment within the region.

(Source: Statista)

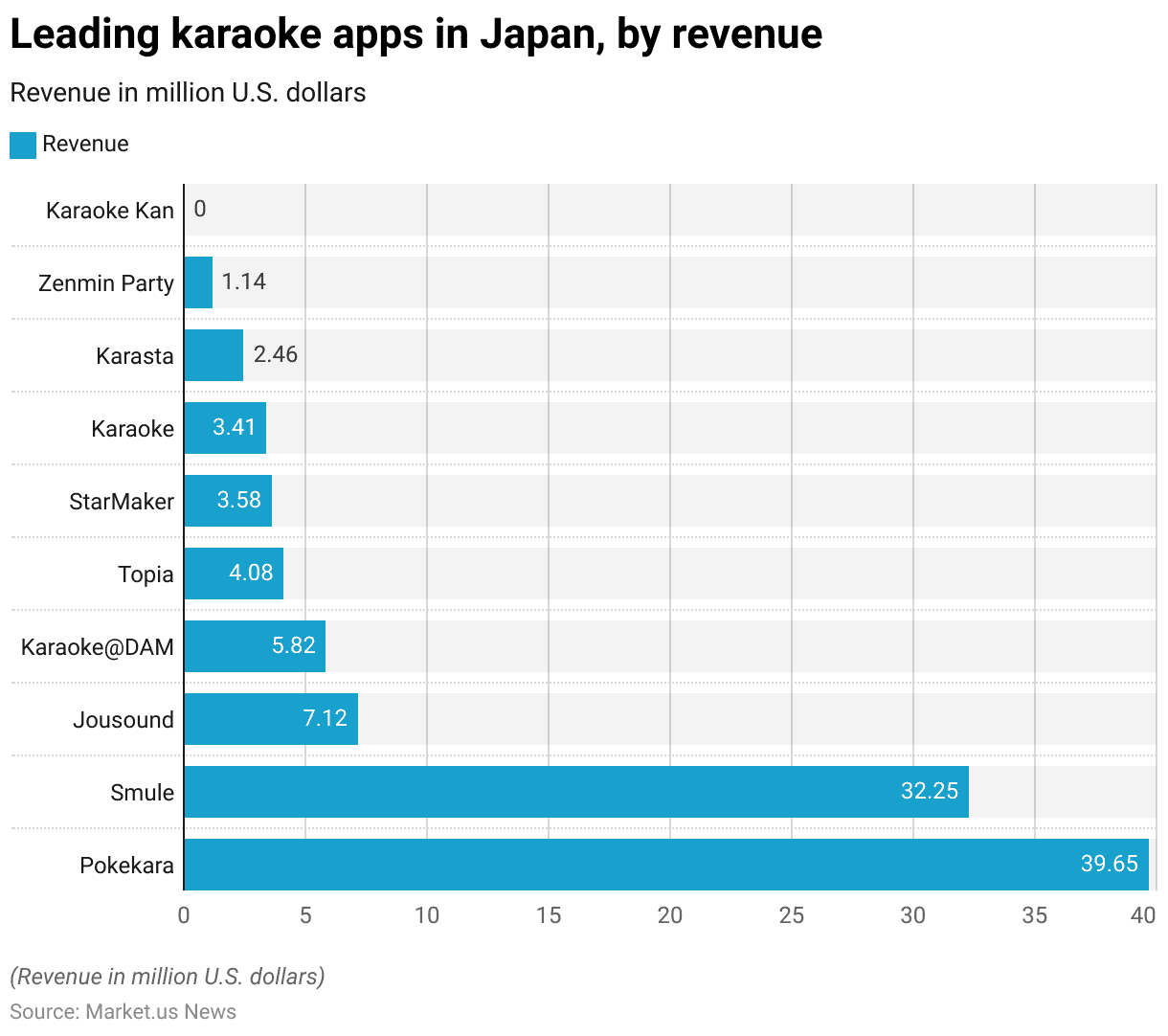

Leading Karaoke Apps – By Revenue Statistics

- Between 2015 and 2022, the revenue generated by leading karaoke apps in Japan varied significantly, reflecting diverse levels of market penetration and user monetization.

- Pokekara led the revenue charts with a substantial $39.65 million, highlighting its popularity and effective revenue models.

- Smule was followed by $32.25 million, demonstrating its strong global brand presence and successful adaptation to the Japanese market.

- Jousound also generated a notable $7.12 million, positioning it as a significant player in the niche market.

- Karaoke@DAM earned $5.82 million, suggesting a solid foothold among karaoke enthusiasts. Topia, with $4.08 million, and StarMaker, earning $3.58 million, showcased moderate success, indicating their appeal among a smaller, targeted user base.

- The app listed as “Karaoke” brought in $3.41 million, while Karasta earned $2.46 million, both reflecting smaller yet viable segments of the market.

- Zenmin Party, generating $1.14 million, and Karaoke Kan, surprisingly recording no revenue, complete the landscape of karaoke app earnings in Japan during this period.

- This distribution underscores not only the competitive dynamics of the karaoke app market but also the varying strategies apps have employed to capitalize on Japan’s vibrant digital entertainment culture.

(Source: Statista)

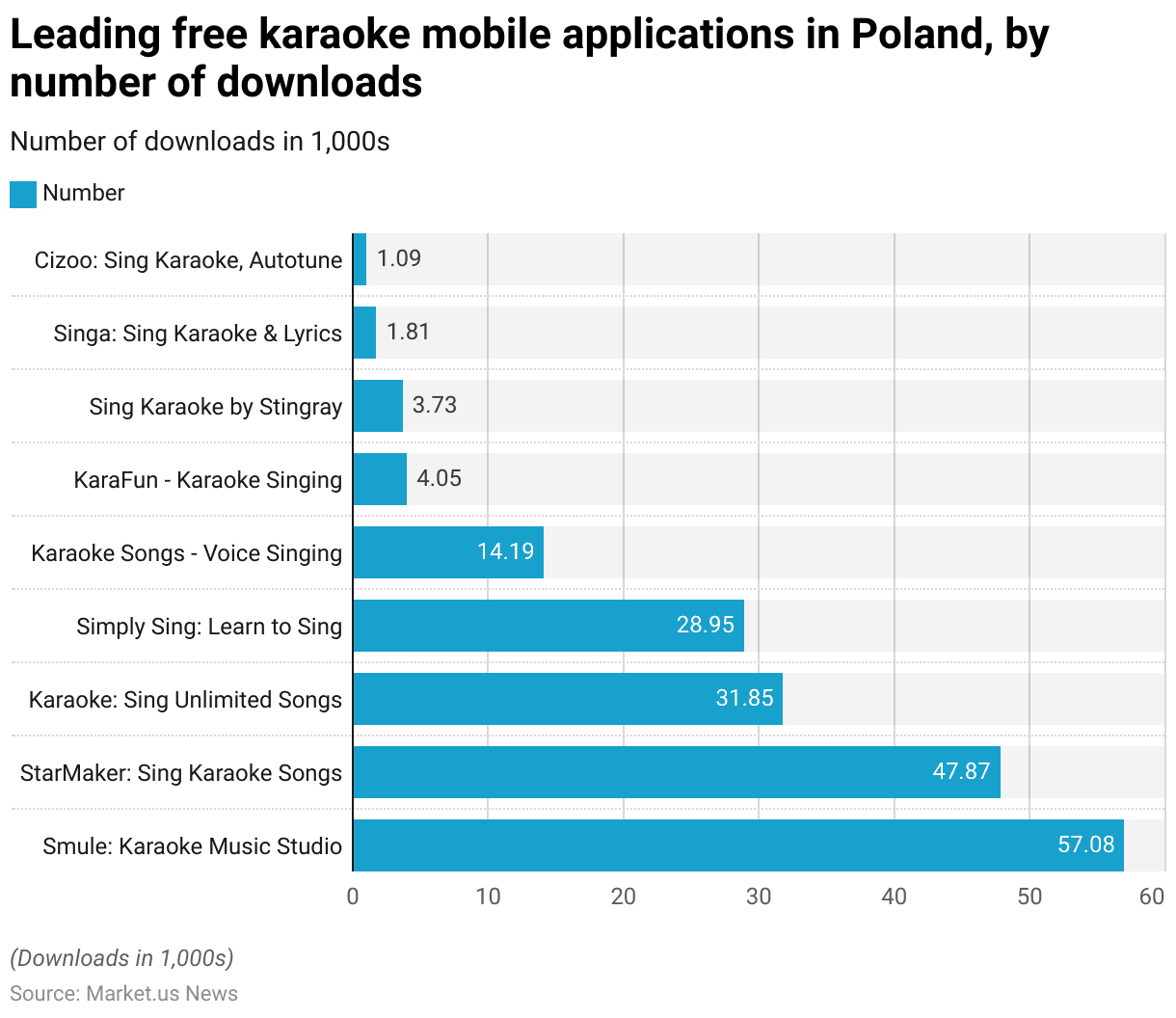

Free Karaoke Leading Mobile Applications – By Number of Downloads Statistics

- In Poland, the landscape of free karaoke mobile applications in 2023 showcases a range of popular choices, as indicated by the number of downloads.

- Leading the market is “Smule: Karaoke Music Studio”, with a significant 57.08 thousand downloads, reflecting its strong appeal among karaoke enthusiasts.

- Following closely is “StarMaker: Sing Karaoke Songs”, with 47.87 thousand downloads, underscoring its popularity for singing and entertainment.

- “Karaoke: Sing Unlimited Songs” also shows notable presence with 31.85 thousand downloads, while “Simply Sing: Learn to Sing” has garnered 28.95 thousand downloads, appealing to users looking to improve their singing skills.

- Other apps in the market include “Karaoke Songs – Voice Singing” with 14.19 thousand downloads and “KaraFun – Karaoke Singing” with 4.05 thousand downloads, both offering dedicated platforms for karaoke lovers.

- “Sing Karaoke by Stingray” follows with 3.73 thousand downloads, whereas “Singa: Sing Karaoke & Lyrics” and “Cizoo: Sing Karaoke, Autotune” have lower traction with 1.81 thousand and 1.09 thousand downloads, respectively.

- These figures highlight a diverse range of karaoke apps catering to various user preferences and singing styles in the Polish market.

(Source: Statista)

Age-associated Dynamics of Karaoke Users and Participants

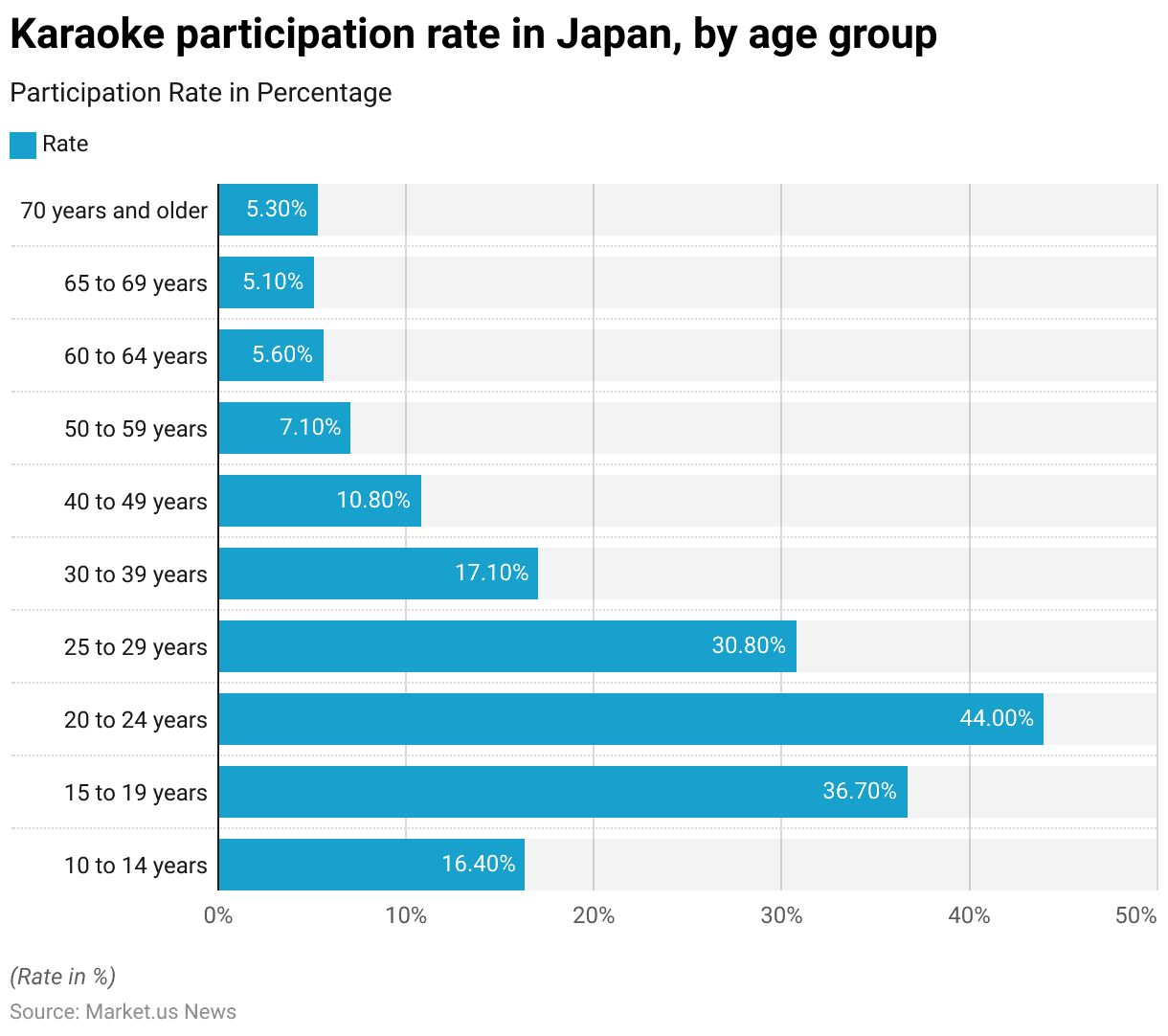

Karaoke Participation Rate – By Age Group Statistics

- As of October 2021, the participation rates in karaoke across different age groups in Japan exhibited notable diversity.

- The most active participants were in the 20 to 24-year age group, with a significant 44% engagement rate, reflecting the popularity of karaoke among young adults.

- This was closely followed by the 15 to 19-year age group at 36.70%, indicating that karaoke is also a popular pastime among teenagers.

- The 25 to 29-year-olds also showed strong participation, with a rate of 30.80%.

- However, as the age increases, the participation rates tend to decline. Those aged 30 to 39 years participated at a rate of 17.10%, and this decreased further in the 40 to 49-year age group to 10.80%.

- For individuals aged 50 to 59 years, the rate dropped to 7.10%, and it continued to decrease in the older age brackets, with 60 to 64 years at 5.60%, 65 to 69 years at 5.10%, and those 70 years and older slightly higher at 5.30%.

- The younger demographics, particularly those between 10 and 14 years old, had a participation rate of 16.40%, showing a moderate interest in karaoke activities.

- These statistics highlight how karaoke is especially favored by the younger population, with diminishing interest as age increases.

(Source: Statista)

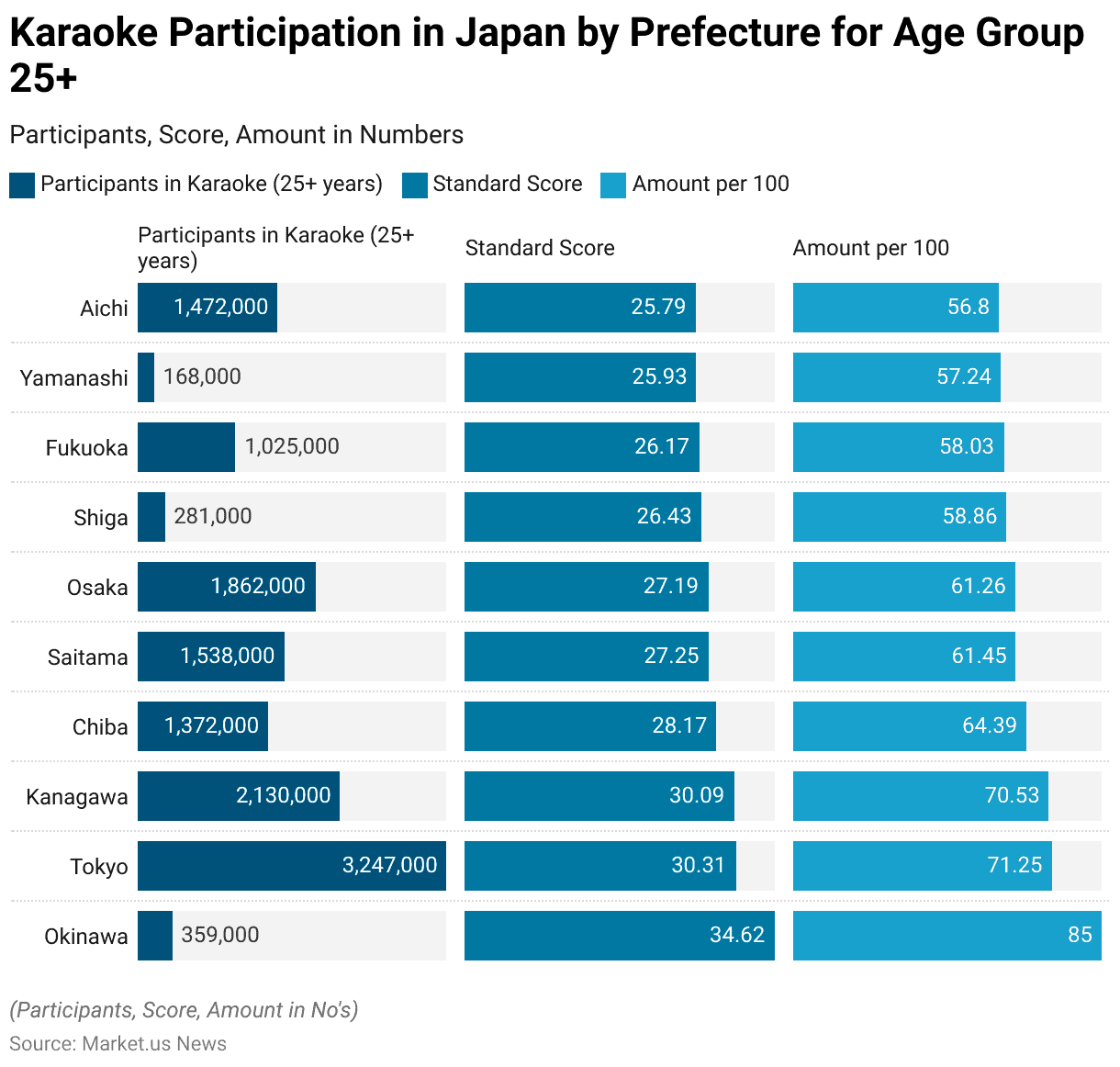

Karaoke Participation for Age Group 25+ Statistics

- In 2021, karaoke participation among individuals aged 25 and older varied significantly across Japanese prefectures.

- Okinawa led with 359,000 participants, reflecting the highest engagement with a standard score of 34.62 and 85 per 100 people.

- Tokyo and Kanagawa followed with substantial figures, recording 3,247,000 and 2,130,000 participants, respectively.

- Other prefectures like Chiba, Saitama, and Osaka also showed high participation rates, each with over a million active participants.

- On the other hand, less populated regions such as Tottori, Kochi, and Shimane reported much lower numbers, with Tottori having the smallest at just 90,000 participants.

- The data reveals a diverse landscape of karaoke popularity, ranging from metropolitan areas with high engagement to more rural areas with less participation.

(Source: Statistics Japan)

Gender-associated Dynamics of Karaoke Users and Participants

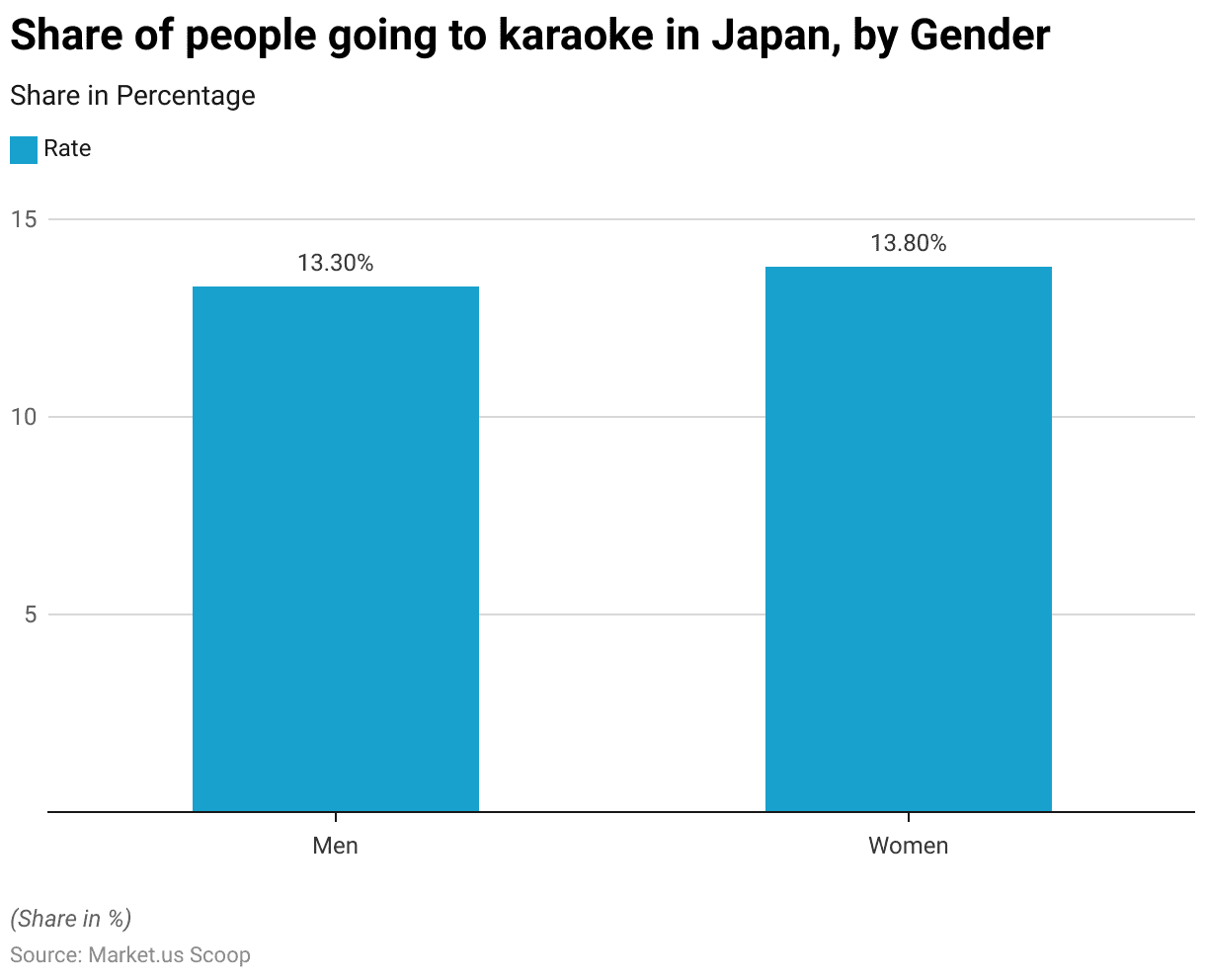

People Participating in Karaoke – By Gender Statistics

- As of October 2021, the participation rate in karaoke activities in Japan showed a slight variation between genders.

- Women participated slightly more in karaoke, with a participation rate of 13.80%, compared to men, who had a participation rate of 13.30%.

- This marginal difference underscores a nearly equal level of engagement with karaoke among both genders, highlighting its widespread popularity across demographics in Japan.

(Source: Statista)

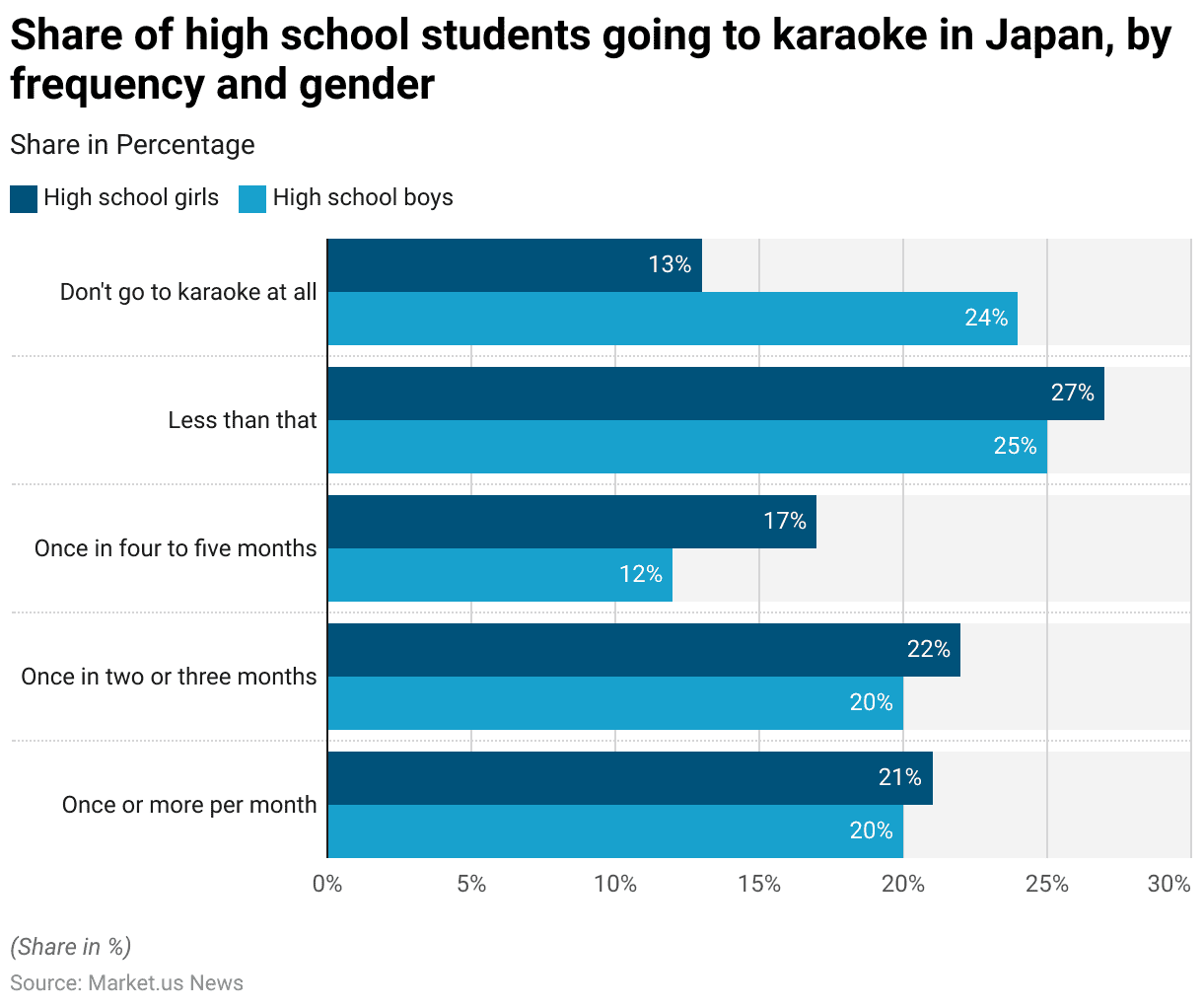

Karaoke Goers Among High Schoolers – By Frequency and Gender Statistics

- As of December 2021, a survey of high school students in Japan highlighted varying frequencies of karaoke attendance based on gender.

- Among high school girls, 21% reported going to karaoke once or more per month, closely matched by 20% of boys.

- A slightly higher percentage of girls, 22%, attended once every two or three months, compared to 20% of boys.

- Attendance every four to five months was noted by 17% of girls and only 12% of boys.

- A larger portion, 27% of girls and 25% of boys went less frequently than once every five months.

- Notably, fewer girls (13%) than boys (24%) reported never going to karaoke at all.

- These figures indicate that while a significant number of students from both genders engage in karaoke, boys are more likely to abstain from the activity altogether.

(Source: Statista)

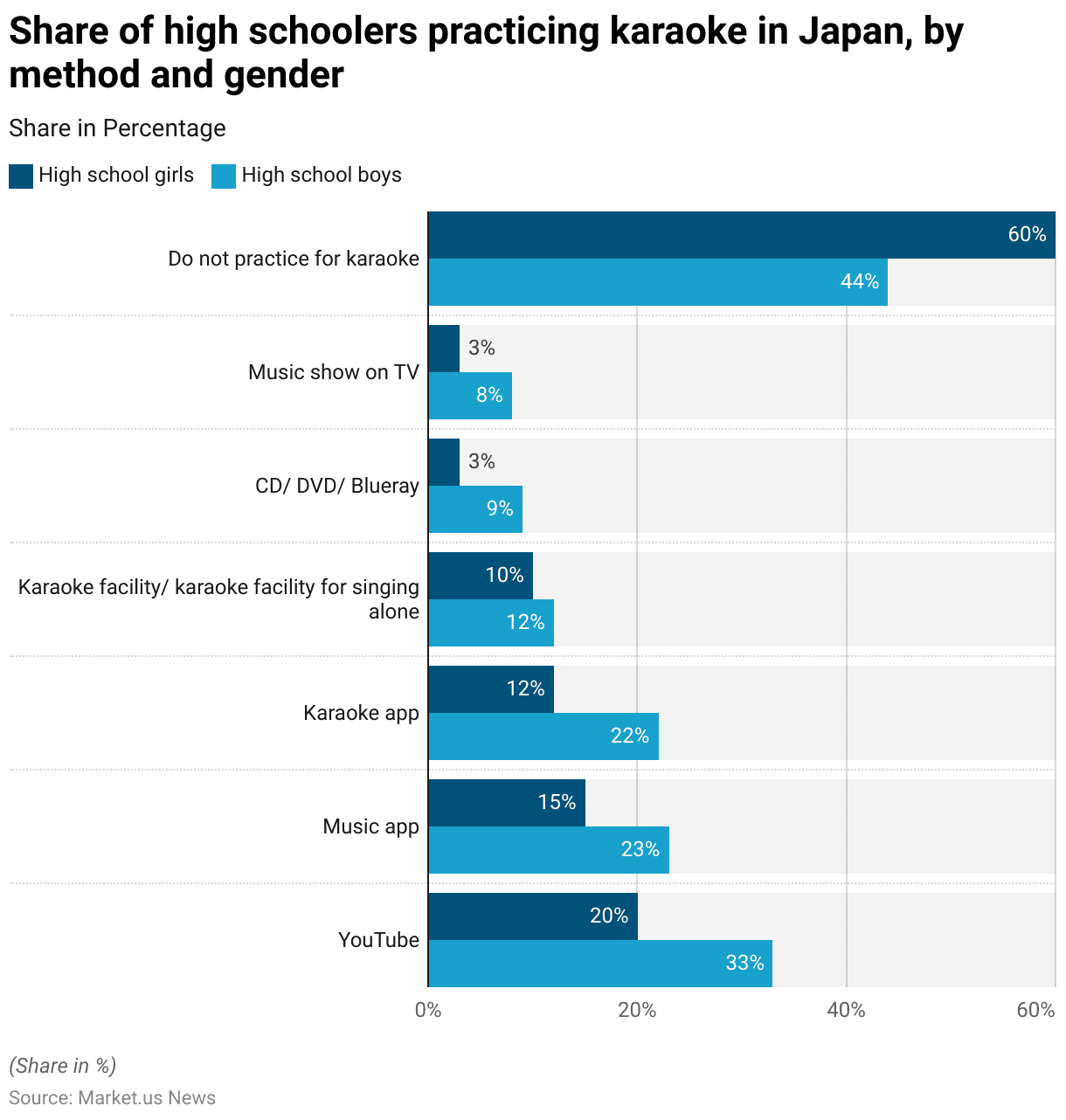

High Schoolers Practicing for Karaoke – By Method and Gender

- In December 2021, a survey among high school students in Japan revealed the methods they use to practice karaoke, showing notable differences between genders.

- High school boys tended to use digital platforms more frequently than girls, with 33% using YouTube compared to 20% of girls.

- Music apps were used by 23% of boys and 15% of girls, while karaoke apps saw 22% usage among boys and 12% among girls.

- Traditional karaoke facilities were utilized by 12% of boys and 10% of girls.

- Fewer students practiced using CDs, DVDs, or Blu-rays, with 9% of boys and only 3% of girls opting for these, and music shows on TV were used by 8% of boys and 3% of girls.

- Interestingly, a significant proportion of girls (60%) reported that they do not practice karaoke at all, compared to 44% of boys.

- This data highlights a gender disparity in preparation methods for karaoke, with boys engaging more with various digital and traditional media to enhance their singing skills.

(Source: Statista)

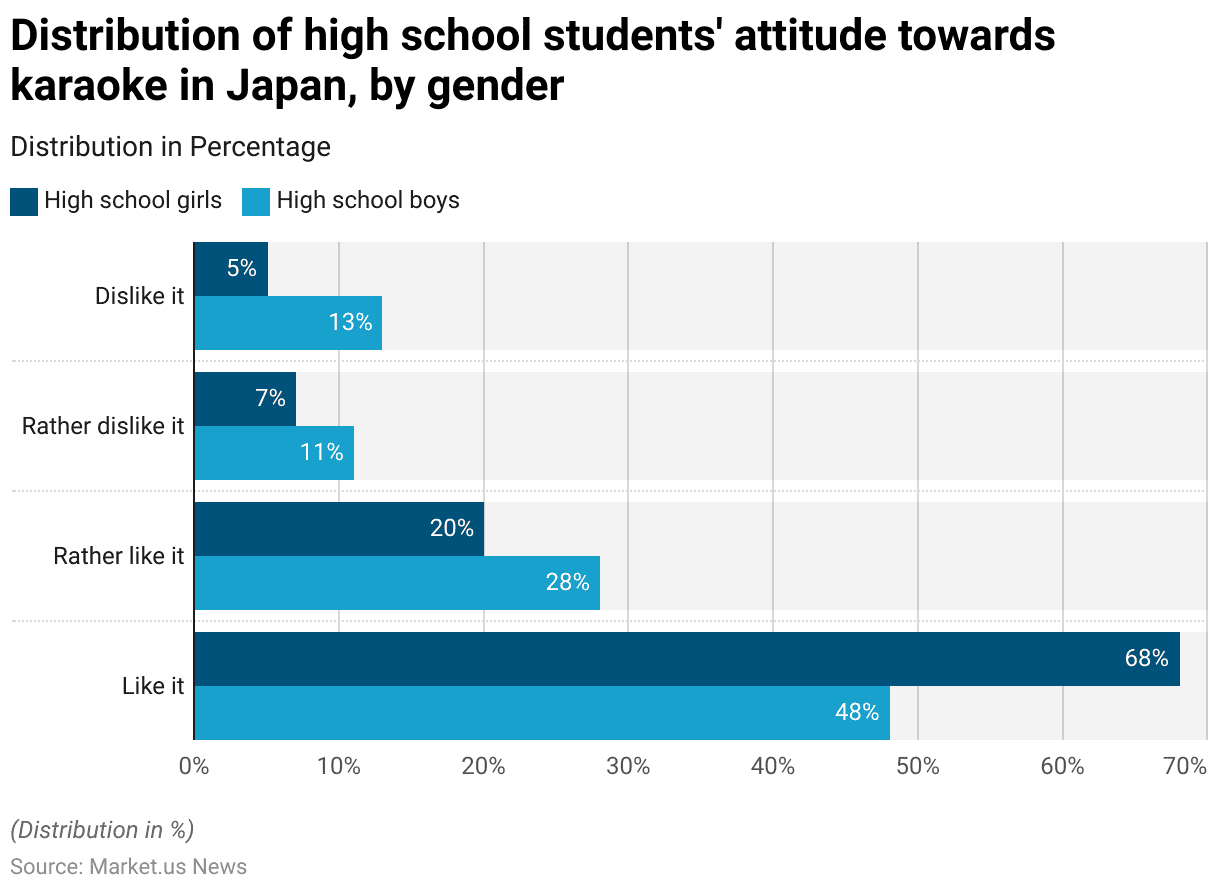

Attitude of High Schoolers Regarding Karaoke – By Gender

- In December 2021, a survey among high school students in Japan revealed distinct gender differences in attitudes towards karaoke.

- High school girls showed a stronger preference for karaoke, with 68% stating they liked it and an additional 20% indicating they rather like it.

- In contrast, only 48% of high school boys reported they liked karaoke, with 28% stating they rather like it.

- Dislike for karaoke was more pronounced among boys, with 11% rather disliking it and 13% outright disliking it, compared to 7% and 5% among girls, respectively.

- This data highlights a notable gender disparity in the perception and enjoyment of karaoke among Japanese high school students.

(Source: Statista)

User Preferences and Dynamics

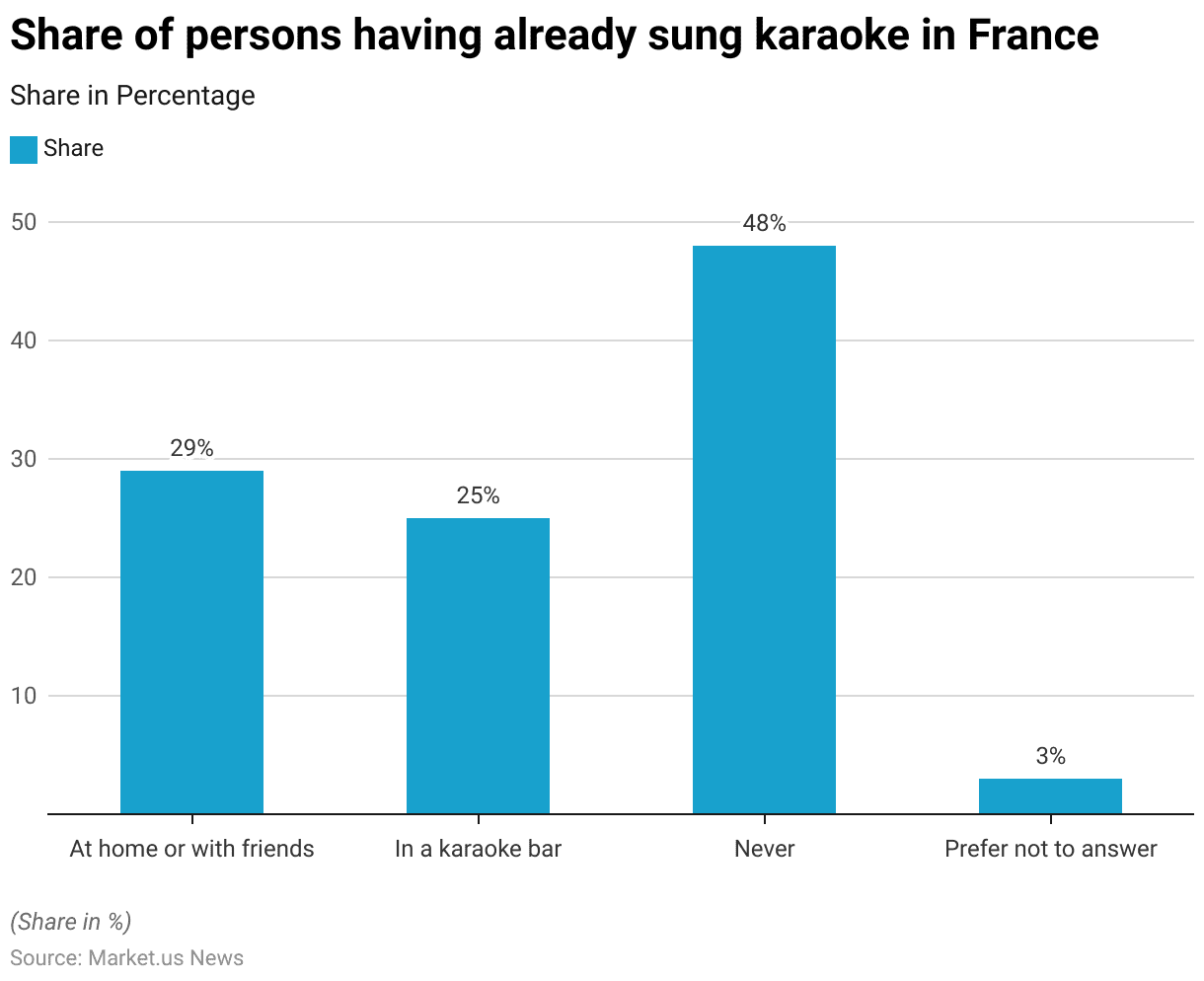

Persons Having Already Sung Karaoke

- In a 2017 survey conducted in France regarding karaoke participation, the results revealed varied preferences for where and how often individuals engaged in karaoke.

- Nearly half of the respondents, 48%, reported that they had never participated in karaoke.

- Meanwhile, 29% of the participants indicated that they had sung karaoke at home or with friends, and 25% had experienced singing in a karaoke bar.

- A small fraction, 3%, preferred not to answer the question.

- This distribution underscores a significant portion of the population that remains unengaged in karaoke activities, while a majority of those who do participate prefer informal settings over public venues.

(Source: Statista)

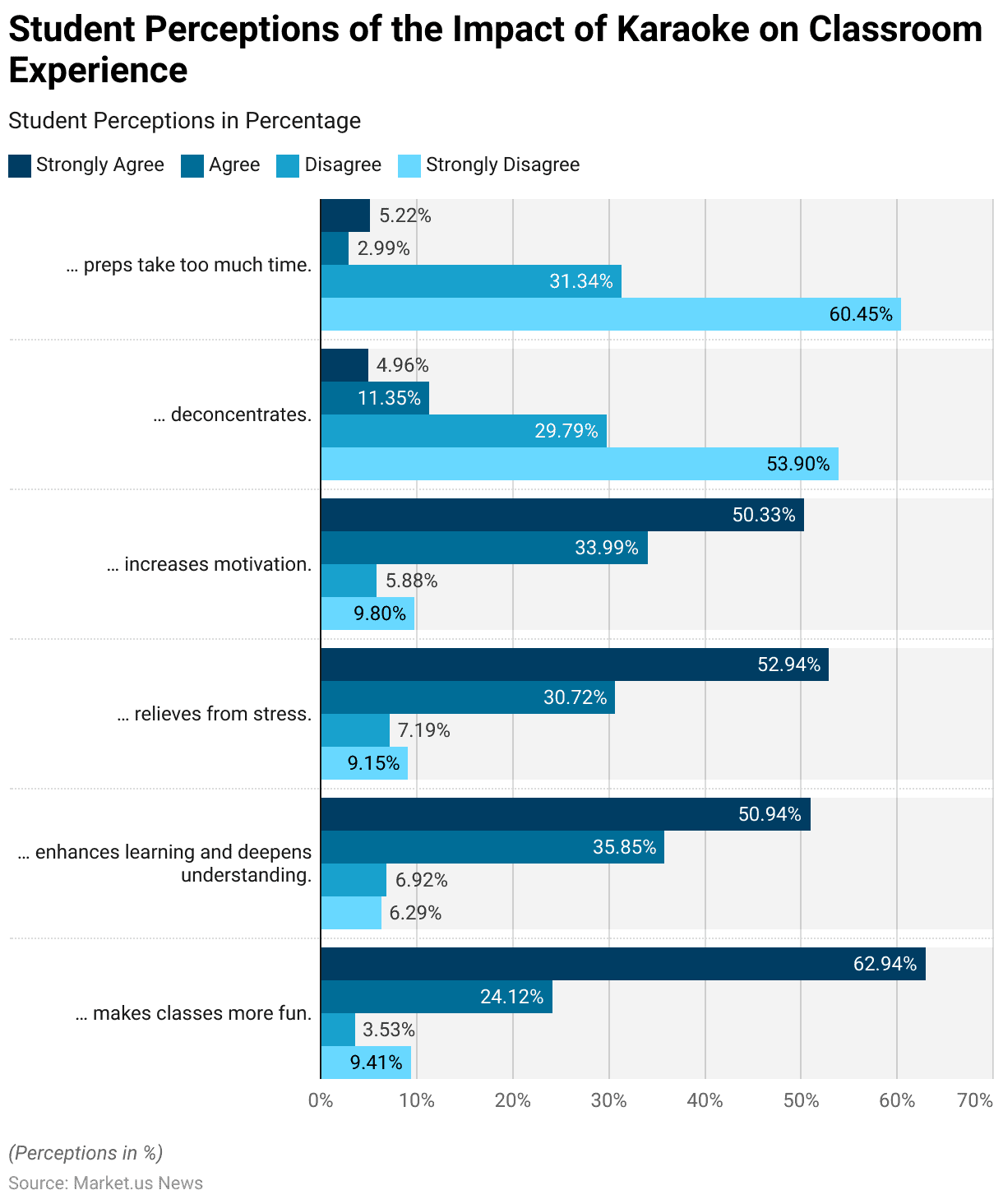

Student Perceptions of Karaoke

- A survey on student perceptions of karaoke revealed varied responses regarding its impact on educational experiences.

- A significant majority, 62.94%, strongly agreed that karaoke makes classes more fun, with another 24.12% agreeing.

- Regarding its effectiveness in enhancing learning, 50.94% strongly agreed, and 35.85% agreed.

- Similarly, 52.94% strongly felt that karaoke relieves stress, with 30.72% in agreement.

- Motivation also saw positive responses, with 50.33% strongly agreeing that karaoke increases motivation, complemented by 33.99% who agreed.

- However, opinions differed concerning focus, with 53.90% strongly disagreeing that karaoke leads to deconcentration and a further 29.79% disagreeing.

- Moreover, a majority found that preparation for karaoke sessions takes too much time, with 60.45% strongly disagreeing and 31.34% disagreeing that the preparation time was reasonable.

- This data highlights the generally positive reception of karaoke as an engaging and stress-relieving classroom activity, although concerns about its impact on concentration and prep time persist.

(Source: The Turkish Online Journal of Educational Technology)

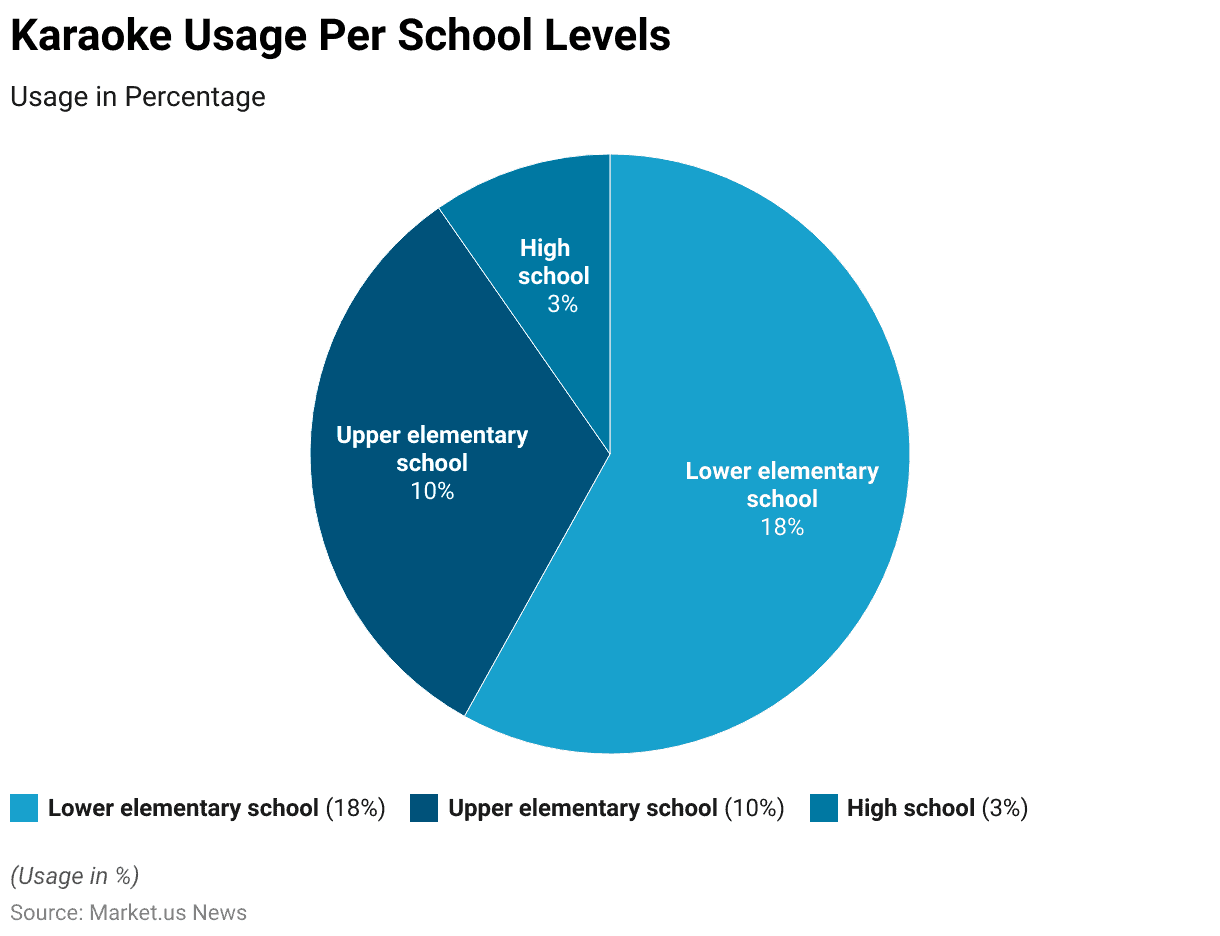

Karaoke Usage Per School Levels

- Karaoke usage among different school levels shows a decreasing trend as students progress through higher educational stages.

- In lower elementary schools, karaoke usage is relatively high at 18%, suggesting that younger students engage more frequently with this activity.

- This interest diminishes in upper elementary schools, where only 10% of students use karaoke.

- By the time students reach high school, karaoke usage drops significantly to just 3%, indicating a marked decline in engagement with karaoke as students age and possibly shift their interests to other activities.

- This pattern underscores the varying appeal of karaoke across different educational levels.

(Source: The Turkish Online Journal of Educational Technology)

Perceptions of Karaoke in Educational Settings: Positive vs. Negative Responses

- The distribution of responses concerning the use of karaoke in educational settings reveals varying degrees of positive and negative perceptions among participants.

- A significant number of respondents expressed strong positive feelings: 78% stated the desire to use karaoke in class, 79% stated that karaoke makes classes more fun, and 75% believed it enhances learning and understanding.

- Relieving stress and increasing motivation were also seen positively, with 70% and 73% respectively expressing high agreement.

- Conversely, 69% indicated that karaoke could deconcentrate classes, although this was the lowest of the positive responses.

- Preparation time was considered too long by 64%, indicating some concerns about the practicality of implementing karaoke in class.

- Negative responses were generally lower, though not insignificant, with the highest negative sentiment (21%) related to the desire to use karaoke, indicating some resistance or skepticism about its value in educational environments.

(Source: The Turkish Online Journal of Educational Technology)

Innovations and Developments in Karaoke

- In 2023, the karaoke industry has witnessed significant technological advancements, primarily driven by major electronics companies and shifts towards more integrated and user-friendly systems.

- Singing Machine, a leader in consumer karaoke products, launched the world’s first globally available in-car karaoke system at CES 2023.

- This system, developed in partnership with Stingray, is designed to integrate seamlessly with vehicle entertainment systems, offering over 100,000 music videos, pitch correction, and other vocal enhancements.

- Additionally, in the restaurant sector, touchscreen karaoke systems are becoming increasingly popular.

- These systems allow for instant access to extensive song libraries, reducing the need for traditional DJ-hosted karaoke nights and offering a significant boost in business for restaurants during slow periods.

- Overall, the integration of advanced technologies and the shift towards more user-centric and accessible systems signify a dynamic period of growth and transformation in the karaoke industry, making it an exciting area for both market entry and investment.

(Source: GlobeNewswire, 101 Karaoke)

Recent Developments

Acquisitions and Mergers:

- Smule acquires Ultimate Guitar: In 2023, Smule, a leading karaoke app company, acquired Ultimate Guitar, a music app that provides guitar tabs and chords, for an estimated $100 million. This acquisition aims to enhance Smule’s music content offerings and integrate more features for karaoke enthusiasts and musicians alike.

- Karaoke One merges with Singing Machine: In early 2024, Karaoke One, a popular karaoke streaming service, merged with Singing Machine, a hardware manufacturer specializing in karaoke machines. This merger is valued at $50 million and focuses on combining software and hardware to provide a more seamless karaoke experience.

New Product Launches:

- Spotify launches karaoke feature: In late 2023, Spotify introduced a new karaoke mode within its app, allowing users to sing along to their favorite songs with on-screen lyrics and scoring features. This move aims to tap into the growing popularity of karaoke among younger audiences.

- Karaoke One introduces VR karaoke: In March 2024, Karaoke One launched a virtual reality (VR) karaoke platform, enabling users to sing and perform in immersive virtual environments. This product is expected to drive interest in new technologies for the karaoke market.

Funding:

- KaraFun secures $20 million for expansion: In 2024, KaraFun, a popular online karaoke platform, raised $20 million in funding to expand its song library and improve its streaming services. The funding will be used to enhance user experiences and increase global market presence.

- Smule raises $30 million for AI-driven karaoke technology: In mid-2023, Smule raised $30 million to develop AI-driven karaoke features, including real-time vocal enhancement and personalized song recommendations.

Technological Advancements:

- AI-powered vocal enhancements: By 2025, 35% of karaoke platforms are expected to incorporate AI technology for real-time vocal tuning and enhancements, improving user performance and engagement.

- Augmented Reality (AR) integration: Augmented Reality is becoming more common in karaoke experiences. By 2026, it’s projected that 20% of karaoke apps will feature AR capabilities, allowing users to perform with virtual effects and backdrops.

Conclusion

Karaoke enjoys varying levels of popularity worldwide, embraced enthusiastically by some while ignored by others.

This form of entertainment is enjoyed both in lively public settings like karaoke bars and in the privacy of the home, depending on individual preferences.

Its role extends into educational realms, perceived by students as a tool that makes learning fun, enhances understanding, and relieves stress.

However, it’s not without its drawbacks, such as potential distractions and extensive preparation times. Younger demographics typically show greater engagement, particularly in places like Japan, where karaoke is deeply embedded in the culture.

Contrastingly, in France, a considerable number of people have never participated in karaoke, reflecting broader cultural variances in entertainment preferences.

Overall, karaoke stands out as a culturally significant activity that offers a creative outlet across generations and cultures, allowing people to express themselves and enjoy music, irrespective of their vocal prowess.

FAQs

Karaoke is a form of entertainment where individuals sing along to recorded music using a microphone and public address system. The lyrics are typically displayed on a screen to help the singer keep track of the song.

Karaoke systems typically consist of a music player that can display lyrics on a screen and play background music. Singers use a microphone to sing over the instrumental tracks of their chosen songs.

Karaoke is a popular choice for parties and social gatherings because it allows guests to entertain each other, create memorable moments, and enjoy music interactively.

Typical karaoke etiquette includes choosing appropriate songs for the venue, not hogging the microphone, being supportive of other singers, and maintaining a positive and respectful attitude.

Some timeless karaoke favorites include “Bohemian Rhapsody” by Queen, “Dancing Queen” by ABBA, and “Living on a Prayer” by Bon Jovi. Pop hits like “Shake It Off” by Taylor Swift and “Uptown Funk” by Mark Ronson featuring Bruno Mars are also popular choices.