Table of Contents

Introduction

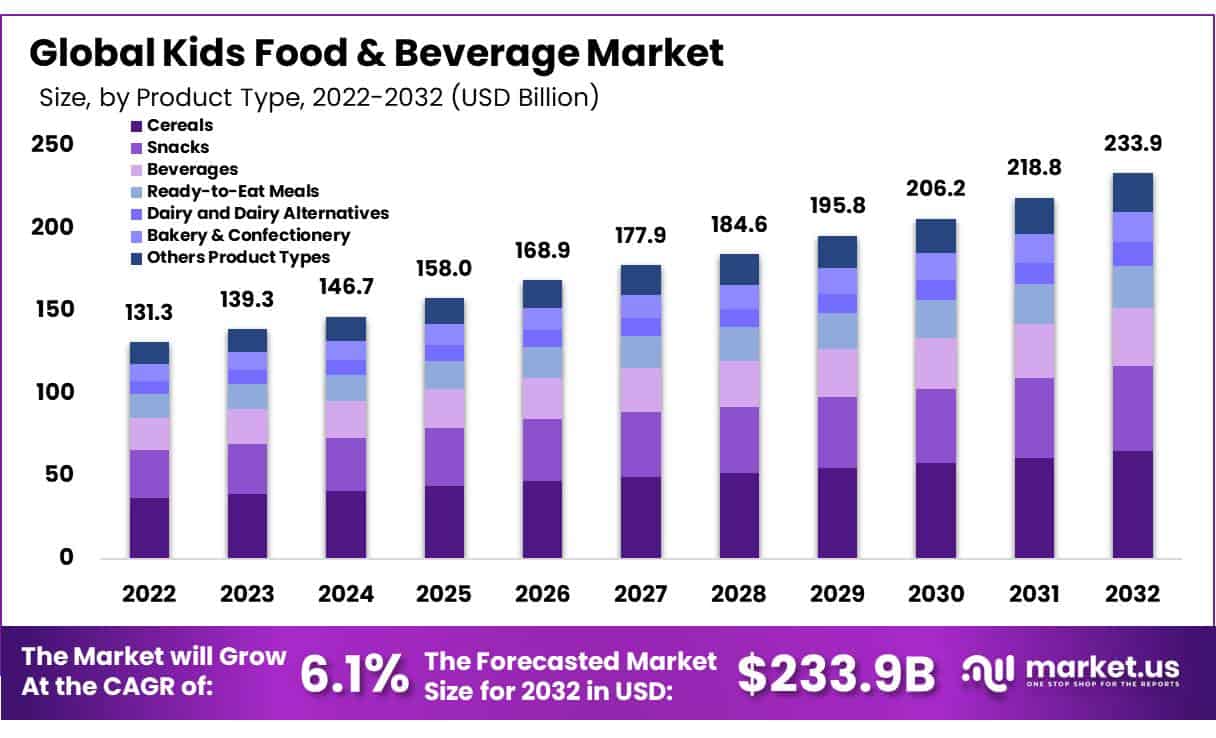

The global Kid’s Food and Beverages Market was valued at USD 131.3 billion in 2022 and is projected to reach around USD 233.9 billion by 2032, with a compound annual growth rate (CAGR) of 6.1% during the forecast period. This significant growth is driven by evolving consumer demands and increasing focus on child-specific nutritional products. The market covers a wide range of items, including snacks, dairy products, cereals, and beverages, which are often designed to cater to the dietary needs and preferences of children.

Several factors contribute to the rapid expansion of the market. Rising health consciousness among parents is pushing the demand for nutritious, low-sugar, and fortified products tailored to children’s developmental needs. This has spurred product innovation, particularly in plant-based foods, such as almond milk and soy-based snacks, as parents look for healthier and more environmentally sustainable options. Additionally, attractive packaging and strategic marketing campaigns, often featuring child-friendly designs and popular characters, are boosting the appeal of these products to young consumers and their parents.

However, the market faces certain challenges. Increasing health concerns regarding childhood obesity have led to tighter regulations around the nutritional content of children’s food, particularly limiting sugar and fat content. Many governments are introducing stricter guidelines, and some are banning high-sugar beverages and snacks in schools, which could limit the availability and demand for certain products. Furthermore, price-sensitive consumers, especially in developing regions, may opt for cheaper, private-label alternatives, presenting additional competition for established brands.

Geographically, North America is the largest market for kids’ food and beverages, driven by higher disposable incomes and strong health awareness. However, regions like Asia-Pacific are expected to see faster growth due to rising urbanization and increasing awareness of child nutrition. In countries like China and India, the growing middle class is contributing significantly to the market’s expansion.

Recent developments include the increased use of e-commerce platforms, enabling brands to reach a broader audience, especially in remote areas. Online sales channels are expected to grow as consumers increasingly opt for convenience in shopping. In response to consumer demands, companies are increasingly offering organic and fortified options, and the dairy segment, in particular, remains a dominant product category due to its essential nutrient profile, accounting for about 38% of the market share in 2022.

In May 2021, Britvic expanded its plant-based beverage portfolio with the acquisition of Plenish, a leading brand in the plant-based milk and juice sector in the UK. This acquisition strengthened Britvic’s presence in the fast-growing plant-based drinks market, which is expected to exceed retail sales of £500 million by 2024. Plenish’s focus on organic, low-sugar, and sustainably sourced ingredients aligns with Britvic’s goal of offering healthier beverage options for children and families.

Brothers International has not announced major mergers or acquisitions recently. The company focuses on expanding its line of freeze-dried fruit snacks, catering to health-conscious parents looking for nutritious and convenient snacks for their children. It continues to grow its distribution network, both in retail stores and online, to reach a broader audience.

In March 2024, Campbell completed a $2.7 billion acquisition of Sovos Brands, Inc., adding premium products like Rao’s pasta sauce and Noosa yogurt to its portfolio. This acquisition bolsters Campbell’s offering in the premium, kid-friendly food segment, particularly with products that emphasize quality and nutrition. Campbell also announced plans to create a new business unit, “Distinctive Brands,” to drive growth in these premium categories.

Kid’s Food and Beverages Statistics

- To examine the frequency of television (TV) food and beverage advertisements (F&B ads) to which children (4-11 years) are likely exposed and the nutrient profile of products advertised.

- TV broadcasting between September and November 2016 was recorded (288 hours of children’s programming; and 288 hours of family programming) resulting in 8980 advertisements, of which 1862 were F&B ads.

- 1473 could be classified into one of the seventeen food groups, and into permitted/non-permitted according to the WHO-EU nutrient profile model.

- We received 45 minutes of internet exposure recordings from 348 children and adolescents. Overall, 45% of children and adolescents were exposed to food and beverage DM.

- Most of the DM was made of unhealthy food categories: fast food 17%, sweet snacks 10%, cakes and pastries 7%, among others.

- From the food and beverage advertising, 38% had at least one element to attract children, and 43% attracted adolescents. Brand characters were displayed on 10% of the ads; while licensed characters were displayed on 3.6%.

- Addressing a family clientele allows you to develop your turnover. Indeed, being identified as “Kid-friendly” can attract up to 25% more customers.

- A recent 2021 survey of Indian children from ages 9–14 reported that 93% ate packaged UPF/SSBs and 68% drank sugary beverages every week, including 53% consuming them one or more times a day.

- In 2019, a group of child health experts also published healthy drink guidelines, recommending that children younger than 5 years of age should drink plain water and cow’s milk, limit 100% juice, and avoid all beverages with added sugar.

- However, U.S. toddlers’ diets often deviate from these expert recommendations. Data from the 2016 Feeding Infants and Toddlers Study (FITS) indicate that, on a given day, 25% of 1-year-olds and 45% of 2- and 3-year-olds consume a sugar-sweetened beverage, primarily fruit-flavored drinks.

- Moreover, more than 20% do not consume any fruit, and 40% do not consume any vegetables.

- Moreover, sweetened foods (including bakery products, other desserts, and candy) contributed 53% of the added sugars consumed as snacks, while sugary drinks (including soda and fruit drinks) contributed another 25%

- However, cookies and crackers also ranked among the top five foods consumed as snacks, and the consumption of chips and other salty snacks increased with age, from 11.5% of 12- to 24-month-olds to 18% of 36- to 47-month-olds.

- About a third of 2-year-olds and a quarter of 3-year-olds consumed whole milk at least once a day. About 70% of 2- and 3-year-olds consumed vegetables as a distinct food item at least once in day.

- Almost three-quarters of children (73%) consumed fruit as a distinct food item at least once in a day, and 59% consumed 100% juice. Fresh fruit was the most commonly consumed type of fruit.

Emerging Trends

- Healthier Snacks and Reformulation: Parents are increasingly concerned about the nutritional content of the food their children consume. As a result, companies are focusing on low-sugar, low-calorie, and fortified food options. Products like probiotic gummies and snacks enriched with vitamins and minerals are becoming more popular. There is also a shift toward sugar reduction in drinks and snacks, driven by rising concerns over childhood obesity and new regulations targeting high-fat, sugar, and salt (HFSS) products.

- Plant-Based and Clean Label: The demand for plant-based products is growing rapidly. Companies are offering familiar kid-friendly formats, such as plant-based finger foods and ready meals, to appeal to both children and parents. Additionally, there is a move toward clean-label products, where food is made from natural ingredients without artificial additives. Parents are increasingly scrutinizing labels for transparency about ingredients, seeking healthier and more natural options.

- Convenience and On-the-Go Formats: With busy lifestyles, parents are looking for convenient, nutritious, and easy-to-prepare meals and snacks for their children. Ready-to-eat snacks and portable meal options are in high demand. Products that offer ease of use without compromising on nutritional value are especially appealing.

- Functional Ingredients: There is a growing emphasis on functional foods that provide additional health benefits, such as immunity-boosting vitamins or gut-health-enhancing probiotics. For instance, products enriched with Vitamin C or high in protein are increasingly sought after, as parents focus on ensuring their children’s long-term well-being.

- Sustainability and Local Sourcing: Consumers are also prioritizing environmental impact, leading to increased demand for products with sustainable packaging and locally sourced ingredients. Many companies are embracing regenerative agriculture and promoting environmentally friendly farming practices to align with consumer values.

Use Cases

- School Lunch Programs: One of the significant use cases for kids’ food and beverages is in school meal programs. Governments and schools globally are incorporating healthier meal options that comply with nutrition guidelines set by local authorities. For example, school cafeterias in the U.S. are focusing on meals rich in fruits, vegetables, and whole grains. In the UK, new regulations on high-fat, sugar, and salt (HFSS) foods have led schools to eliminate certain snacks and sugary drinks from their menus. These initiatives aim to tackle childhood obesity while ensuring that children get the necessary vitamins and nutrients for healthy growth.

- Health-Conscious Parents: Many parents are opting for clean-label or organic food products for their children. This trend includes the purchase of plant-based snacks and beverages that cater to growing dietary preferences like vegetarianism or veganism. For instance, plant-based milk alternatives like almond and oat milk are gaining popularity among parents, with sales rising by over 9% annually. These products offer a healthier alternative to traditional dairy while meeting children’s calcium needs.

- Convenience for Busy Families: The growing demand for convenient meal options is evident in the surge of ready-to-eat meals and snacks for children. Products such as pre-packaged lunch kits or snack boxes offer busy parents an easy way to provide balanced meals without the need for preparation. For example, sales of such items grew by 12% in 2022, reflecting the shift towards convenience. These products often include healthier ingredients such as whole grains, fruits, and lean proteins to meet nutritional standards while offering ease of use.

- Food for Special Diets: Another use case focuses on children with specific dietary requirements, such as those with food allergies or intolerances. The market has seen a rise in gluten-free and lactose-free products tailored for kids, with companies innovating to ensure these products are not only safe but also appealing in taste and packaging. Sales of gluten-free products for children have grown by 8% year-over-year due to increased awareness and diagnosis of food sensitivities.

- Sports and Active Lifestyle: Sports beverages and energy-boosting snacks for children participating in sports and physical activities have also seen growth. Products aimed at hydration and recovery, such as electrolyte-infused drinks or protein bars, are increasingly marketed to young athletes. These products are designed to support energy levels during physical exertion and promote muscle recovery.

Major Challenges

- Health Concerns: One of the major challenges is addressing the increasing awareness about childhood obesity and unhealthy diets. Governments and health organizations are implementing stricter regulations to limit high-sugar and high-fat content in children’s foods, making it difficult for manufacturers to continue producing certain popular products. For instance, many countries have introduced laws that limit the advertising of sugary snacks and beverages to children, especially on television and online.

- Regulatory Pressure: Regulatory frameworks around nutritional content, labeling, and advertising pose a challenge for companies. Laws requiring reduced sugar, fat, and artificial additives are becoming more common, forcing companies to reformulate their products. In markets like the UK, high-fat, sugar, and salt (HFSS) regulations restrict how and where these products can be sold.

- Price Sensitivity: Despite the demand for healthier and organic options, these products often come at a higher price point. Many parents, especially in developing regions, may opt for cheaper alternatives, limiting the market share of premium brands. This creates a challenge for companies trying to offer both nutritious and affordable products.

- Sustainability and Packaging: As sustainability becomes a priority for consumers, there is increasing pressure to reduce plastic packaging and improve environmental practices. However, creating eco-friendly packaging that still appeals to children can be costlier and technically challenging.

Market Growth Opportunities

- Rising Demand for Healthier Products: There is a growing demand for healthier food options among parents, leading to a surge in products with reduced sugar, fat, and calories. Companies that innovate with organic and fortified foods—those enriched with essential vitamins, minerals, and probiotics—are positioned to capture a significant share of this market. For example, offering more plant-based and allergen-free products can cater to health-conscious families.

- Sustainable and Eco-Friendly Options: Sustainability is increasingly influencing purchasing decisions. Brands that focus on sustainable packaging and environmentally friendly production methods, such as using recyclable packaging or sourcing ingredients responsibly, have a strong opportunity to resonate with modern parents. Products that communicate their sustainability efforts clearly on the packaging are likely to attract eco-conscious consumers.

- E-commerce Expansion: The rise of e-commerce offers a vast growth opportunity for the Kid’s Food and Beverages market. Online shopping has become a preferred option for many parents, especially for bulk purchases of snacks and beverages. Companies that invest in strong digital platforms and partnerships with online retailers can tap into a broader, tech-savvy customer base.

- Personalized Nutrition: The trend toward personalized nutrition is another opportunity. As more parents seek tailored food solutions for their children’s specific dietary needs (e.g., gluten-free, lactose-free), companies that provide customizable meal options or specific health-focused products are likely to see growth. This aligns with the rising interest in gut health, immune support, and specialized diets for children.

Key Player Analysis

Atkins Nutritionals, Inc. has steadily expanded its presence in the Kid’s Food and Beverages sector, particularly in the development of healthier snack options that align with the growing demand for low-carb, nutritious products. In 2023, Atkins saw a 3.4% rise in sales, largely driven by its introduction of low-carb cookies and chips, which now account for around 30% of its product portfolio.

In 2023, Britvic plc continued to strengthen its position in the Kid’s Food and Beverages sector by expanding its production capabilities and launching new product lines. A major development was the £22.5 million investment in its Beckton facility, which added a new bottling line, increasing production capacity by 30%. This investment responded to growing demand for its popular kid-friendly beverages such as Fruit Shoot and Robinsons.

In 2023, Brothers International Food Holdings, LLC made significant strides in the Kid’s Food and Beverages sector with its acquisition of Hosh International LLC in April. This acquisition expanded Brothers International’s capabilities in providing high-quality fruit and vegetable juice concentrates and purees to global companies. Building on this momentum, in March 2024, Brothers All Natural, a division of the company, launched new Infused Freeze-Dried Fruit Crisps at Expo West. These crisps, made from 100% fruit, target health-conscious parents looking for nutritious snacks for their children.

In 2023, Campbell Soup Company made notable moves in the Kid’s Food and Beverages sector, particularly with its Goldfish crackers brand, which saw an increase in sales of 5% driven by new flavor offerings and strategic marketing efforts targeting both kids and parents. Additionally, Campbell Soup Company focused on expanding its snacks portfolio, which includes other kid-friendly brands like Pepperidge Farm and Snyder’s of Hanover, resulting in a 9% organic net sales growth in its Snacks division during the fourth quarter of 2023. These snacks have been popular among families looking for healthier, convenient options for children. As of October 2023, Campbell was working to finalize the acquisition of Sovos Brands, which includes kid-favorite Rao’s sauces, further strengthening its presence in family-oriented meal solutions.

In 2023, Conagra Brands, Inc. continued to grow its presence in the Kid’s Food and Beverages market through key product innovations and strategic expansions. A highlight of this year was the success of the Snack Pack brand, which introduced healthier, kid-friendly snack options like reduced-sugar puddings. Additionally, the company saw a 6.8% increase in net sales within its Grocery & Snacks segment, driven by inflationary pricing adjustments and a focus on meeting consumer demands for more nutritious and convenient snack options. This segment includes several popular products for children, such as microwave popcorn and meat snacks. Conagra also expanded its frozen food offerings, which include kid-friendly meals, leading to a 10.5% growth in refrigerated and frozen product sales in the same period.

In 2023, The Kraft Heinz Company continued to strengthen its presence in the Kid’s Food and Beverages sector with innovative approaches that integrate both food and educational elements. One major initiative was the launch of the FUNdamental Textbooks campaign in September 2023, which combined beloved kid-friendly brands like Kraft Mac & Cheese, Jell-O, and Capri Sun with fun, interactive books designed to make learning more engaging for children. This effort was aimed at boosting engagement and addressing parents’ concerns that their children might not enjoy school as much post-summer.

In 2023, Nestlé S.A. saw growth in its Kid’s Food and Beverages sector, particularly with its Gerber brand, which reported mid-single-digit growth driven by increased demand for healthy snacks. Nestlé’s strategy focused on providing nutritious options tailored to infants and young children, aligning with consumer preferences for healthier food. The company’s fortified milk brand Nido also recorded double-digit growth, boosted by distribution expansion. Nestlé’s Infant Nutrition segment, including premium infant formulas and specialty products, achieved high single-digit growth, demonstrating the strong demand for premium, health-focused products for children

In 2023, Danone S.A. delivered a strong performance in its Food and Beverages sector, achieving 7% like-for-like sales growth to reach €27.6 billion. This growth was led by increased pricing to offset rising commodity and supply chain costs, as well as solid contributions from key brands such as Activia, Alpro, and Danonino. In the fourth quarter of 2023, sales increased by 5.1%, driven by continued demand in its Essential Dairy and Plant-Based segment. Despite lower volumes in some areas, Danone’s Specialized Nutrition and Waters divisions also contributed to the overall positive growth. Looking ahead to 2024, the company remains confident, forecasting like-for-like sales growth between 3% and 5%, with further improvements in operating margins.

In 2023, Mondelez International, Inc. made significant strides in the Kid’s Food and Beverages sector through its strong performance across various snack categories, including iconic brands like Oreo, Ritz, and Sour Patch Kids. The company reported a 14.4% increase in net revenues for the year, driven by its focus on organic growth and strategic acquisitions. Mondelez also expanded its “mindful snacking” initiative, promoting healthier snack options for children by reducing sugar and enhancing ingredient transparency. In April 2024, the company highlighted its commitment to sustainability, with validated goals to achieve net-zero emissions by 2050, underscoring its long-term vision for both environmental and consumer health.

In 2023, General Mills, Inc. focused heavily on promoting accessible and nutritious food options for children through its popular brands like Cheerios, Cinnamon Toast Crunch, and Trix. One key initiative was the enhancement of its Big G Cereals by doubling the Vitamin D content, helping to meet 20% of children’s daily nutritional needs. Additionally, the company strengthened its partnership with No Kid Hungry, raising over $255,000 to provide meals for children across the U.S. General Mills also achieved significant financial milestones, with total net sales reaching $20.1 billion, a 6% increase from the previous year. Looking ahead, the company plans to continue supporting child nutrition and expanding its portfolio in the Kid’s Food and Beverages sector.

Conclusion

The Kid’s Food and Beverages market is experiencing steady growth, driven by increasing demand for healthier, more nutritious options that cater to both children and their parents. Companies are focusing on reformulating products with reduced sugar, clean labels, and fortification with essential nutrients to address growing concerns around childhood health issues like obesity and malnutrition. Innovation in packaging, convenience-driven meals, and the rising trend of plant-based and organic products further highlight the potential for growth in this sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)