Table of Contents

Introduction

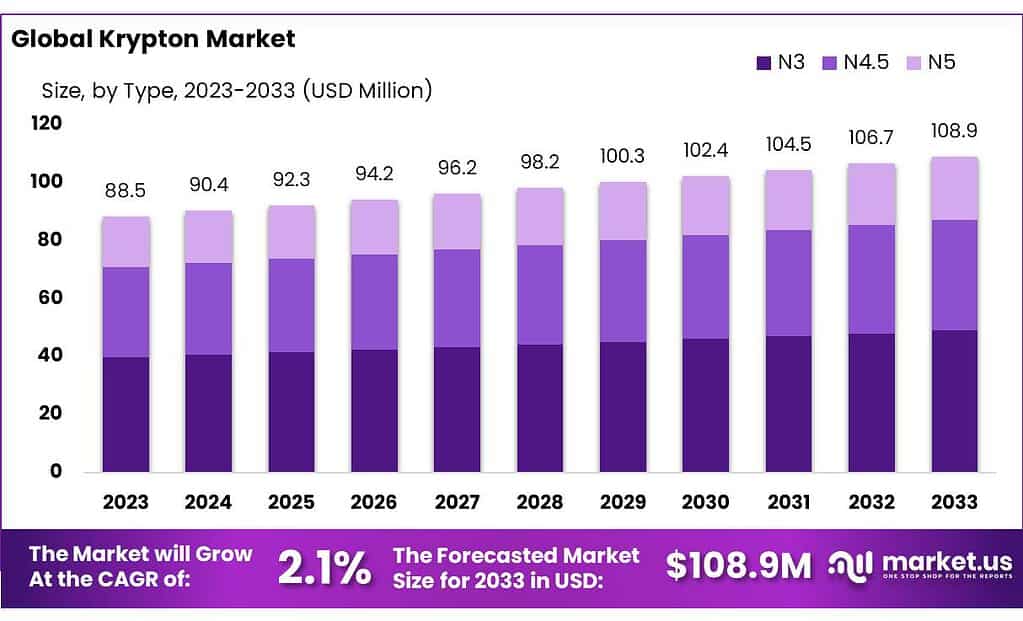

The global Krypton market, valued at USD 88.5 million in 2023, is projected to grow to USD 108.9 million by 2033, achieving a compound annual growth rate (CAGR) of 2.1% over the forecast period. This growth is fueled by several factors, including advancements in lighting and insulation applications where Krypton gas is utilized for its superior insulative properties. The market is also driven by increasing demand in high-tech industries for laser applications and semiconductor manufacturing where Krypton’s inert properties are crucial.

However, the market faces significant challenges such as price volatility and the complexity of Krypton gas extraction, which impacts overall production costs and market supply. Additionally, geopolitical tensions and economic uncertainties, such as those influenced by the Russia-Ukraine conflict, continue to pose risks to stable market growth by affecting the global supply chain dynamics.

Recent developments in the Krypton market include technological advancements in gas extraction and purification techniques that have improved efficiency and reduced environmental impacts. Companies leading the market, such as Air Liquide, Linde PLC, and Air Products & Chemicals, are focusing on expanding their global footprint and enhancing their production capabilities to meet the growing demand across various regions including Asia Pacific, North America, and Europe.

Air Products & Chemicals Inc. continues to focus on expanding its footprint and capabilities in the industrial gases market, aiming to leverage its technological advances to support sustainable industry practices. The company has not recently reported specific developments directly related to Krypton but remains a significant player in the overall rare gases market, impacting the industry with its broad range of gas production technologies and sustainability initiatives.

Key Takeaways

- The global krypton market is projected to grow from USD 88.5 million in 2023 to USD 108.9 million by 2033, growing at a CAGR of 2.1% during the forecast period

- In 2023, N3 krypton captured 45.6% of the market share due to its widespread use in lighting and window insulation, balancing performance and cost.

- Krypton delivered in cylinders held a dominant market position in 2023, accounting for 55.4% of the supply, favored for portability and small-scale applications.

- The lighting sector held 43.2% of the krypton market share in 2023, driven by krypton’s use in high-efficiency fluorescent and high-intensity discharge lamps.

- The construction industry accounted for 30.2% of the krypton market in 2023, driven by the increasing demand for energy-efficient double and triple-glazed windows.

- North America held 34.4% of the total krypton market in 2023, valued at USD 30.4 million, driven by advanced aerospace and lighting industries.

Krypton Statistics

- Krypton hydride (Kr(H2)4) crystals can be grown at pressures above 5 GPa. They have a face-centered cubic structure where krypton octahedra are surrounded by randomly oriented hydrogen molecules.

- In experimental particle physics, liquid krypton is used to construct quasi-homogeneous electromagnetic calorimeters. A notable example is the calorimeter of the NA48 experiment at CERN containing about 27 tonnes of liquid krypton.

- Those facilities were detected in the early 2000s and were believed to be producing weapons-grade plutonium.

- Krypton-85 is a medium lived fission product and thus escapes from spent fuel when the cladding is removed.

- Although traces are present in meteorites and minerals, krypton is more plentiful in Earth’s atmosphere, which contains 1.14 parts per million by volume of krypton.

- Adam traveled 200 years back in time to find Superman’s grandfather Seg-El to give him a message ”That someone from the future is coming to destroy Krypton and that he needs to find the fortress” he also gives him a Sunstone.

- After it has been stored a few days, krypton obtained by nuclear fission contains only one radioactive isotope, krypton-85, which has a half-life of 10.7 years, because all the other radioactive isotopes have half-lives of 3 hours or less.

Emerging Trends

Emerging trends in the Krypton market are shaping the industry’s future, influenced by advancements in technology and shifting market demands. The Krypton market is experiencing a steady growth, driven by its expanding application in energy-efficient lighting and advanced insulation technologies. There is a rising demand for Krypton in sectors such as construction, particularly in green building practices, which emphasizes energy-efficient materials.

Technological innovations are paving the way for new uses of Krypton, especially in high-efficiency lighting systems and as an insulating medium in windows that significantly enhance energy conservation in architectural applications. These advancements are aligning with global trends towards sustainability and reduction of energy consumption.

Moreover, the market is seeing a strategic increase in investments directed towards the procurement of advanced technologies, which are crucial for maintaining competitive advantage and meeting the stringent environmental standards set by governments worldwide. This includes investments in production facilities that adhere to eco-friendly practices and contribute to the circular economy.

The increased use of Krypton in the semiconductor industry, due to its effective insulation properties, and in aerospace for satellite and laser technologies, further underscores the gas’s critical role in high-tech applications. These factors collectively suggest a promising growth trajectory for the Krypton market, powered by both technological and environmental factors.

Use Cases

- Lighting: Krypton is used in various lighting applications, including flashbulbs for photography, high-intensity discharge lamps, and airport runway lights. It is valued for its strong white light emission, which enhances the quality of illumination in these applications.

- Windows Insulation: In the construction industry, krypton is used as an insulating gas between window panes, especially in energy-efficient windows. Its superior insulating properties compared to argon make it ideal for use in double or triple-glazed windows, helping to reduce energy costs significantly.

- Medical Applications: In healthcare, isotopes of krypton are used in diagnostic imaging, such as lung function studies and blood flow analysis. Krypton lasers are employed in eye surgeries to treat conditions like retinal tears and glaucoma.

- Environmental Monitoring: Krypton’s ability to detect atmospheric changes makes it useful in environmental monitoring, assessing air quality, and tracing gas emissions.

- Semiconductor Manufacturing: Krypton is used in the semiconductor industry, particularly in the manufacturing of 3D NAND chips, where it aids in etching processes, enhancing the production capabilities of these devices.

- Aerospace and Defense: Krypton finds applications in aerospace for satellite propulsion and as a pressurizing agent in fuel tanks.

- Scientific Research: Due to its stable isotopes, krypton is utilized in various scientific research applications, including nuclear fusion studies and as a tracer in geological and hydrological studies.

Major Challenges

- The Krypton gas market is encountering several challenges that could affect its growth trajectory. One of the primary challenges is the high cost of production, which stems from the complex process of extracting Krypton from the atmosphere, where it is found in only trace amounts. This not only increases the production costs but also limits the market’s ability to scale up quickly in response to rising demand.

- Another significant challenge is the availability of substitutes such as argon, which shares many similar properties with Krypton but is typically more cost-effective. This availability can make argon a more attractive option for applications where cost is a critical factor, thereby potentially limiting Krypton’s market share in areas like insulation and lighting.

- Additionally, geopolitical tensions and supply chain disruptions also pose risks to the stable supply of Krypton. These factors can lead to price volatility and may impact the consistent availability of Krypton for industrial use, affecting sectors that rely on it, such as lighting, aerospace, and medical imaging.

- Despite these challenges, the market for Krypton continues to grow, supported by its applications in energy-efficient lighting and advanced insulating materials, which align with global energy efficiency and sustainability trends. The ongoing development of new applications and improvements in extraction and purification technologies also offer opportunities to overcome some of these obstacles.

Market Growth Opportunities

- The Krypton market is poised for significant growth, fueled by its diverse applications across various sectors. One major growth area is the construction industry, where Krypton is extensively used in energy-efficient windows, particularly in regions with stringent energy regulations. This usage is expected to expand as more countries implement policies to reduce energy consumption in buildings.

- Another significant growth opportunity for Krypton lies in the lighting industry, driven by the rising demand for energy-efficient lighting solutions. Krypton’s application in LED lighting is particularly notable due to its efficiency and the move towards more sustainable technologies. This trend is supported by favorable government policies promoting energy-efficient products.

- The aerospace sector also presents a burgeoning market for Krypton, especially with its increasing use in ion thrusters for space missions, which highlights the advanced technological applications of this noble gas.

- Furthermore, the electronics industry continues to drive demand for Krypton, particularly in semiconductor manufacturing where its properties are crucial for enhancing the production of microchips and displays. This is most evident in Asia Pacific, which dominates the market due to its robust semiconductor and electronics sectors.

- The market’s expansion is underpinned by continuous innovation and the adoption of Krypton in high-performance applications across various industries.

Key Players Analysis

In 2023, Air Liquide showcased strong performance within the Krypton sector, emphasizing its innovative capabilities and strategic expansions. The company focused on enhancing its technologies and services, especially in advanced gas production for high-tech industries like electronics and aerospace. Notably, Air Liquide has been active in developing krypton supply solutions tailored to meet the precise needs of these sectors. Their strategic initiatives also included the signing of new multi-year contracts aimed at bolstering their presence in global markets, reflecting a clear commitment to supporting industries that rely on high-purity gases like krypton.

Air Products & Chemicals Inc. continues to be a significant player in the Krypton market, focusing on the expansion of their high-performance gas production capabilities to meet the growing demand across various high-tech industries. Although specific updates for 2023 were not detailed, the company’s ongoing commitment to technological advancements and market expansion strategies likely sustains its strong position in the sector, contributing to the broader growth trends in the use of rare gases like krypton.

In 2023, Air Water Inc. focused on expanding its Krypton-related operations, particularly emphasizing innovation and sustainability within its diverse business sectors, including industrial gases and energy solutions. The company’s commitment to addressing social issues through technological advancements has positioned it effectively within the Krypton market. Air Water Inc. has leveraged its comprehensive expertise to enhance its product offerings and operational efficiencies, aligning with environmental sustainability goals and the growing demand for Krypton in high-tech applications.

Akela-P Medical Gases P. Ltd, while detailed information specific to 2023 or 2024 was not available during this search, generally operates in the medical gases sector, offering products that likely include Krypton for various medical applications. The company is known for providing specialized medical gases to healthcare providers, supporting clinical needs with a focus on quality and compliance. This positions Akela-P as a crucial player in the medical sector, where Krypton can be used in imaging and other medical technologies.

In 2023, American Gas Products did not feature prominently in specific updates within the Krypton sector. This may indicate that their activities in this area, if any, remain within a typical operational scope without significant new developments or changes reported during the year.

On the other hand, BASF SE continued to invest heavily in research and technological advancements across various sectors, including their work with rare gases like Krypton. BASF has been focusing on enhancing their production technologies and expanding their market presence, particularly through innovative applications in areas requiring high-purity gases. These efforts are part of BASF’s broader strategic goals to integrate sustainability into their operations and reduce emissions across their value chain, aiming for significant reductions by 2030 and achieving net-zero by 2050.

Coregas Pty Ltd. has been active in the Krypton sector by leveraging its extensive experience in industrial gases to meet the needs of various high-tech industries, including lighting and electronics. In 2023, Coregas continued to supply high-purity Krypton, essential for applications requiring precise and stable environmental conditions. The company’s commitment to quality and customer service remains a cornerstone of its operations, positioning it as a reliable supplier in the competitive Krypton market.

Electronic Fluorocarbons, LLC, now known as EFC Gases and Advanced Materials, has made significant strides in the Krypton sector in 2023. This year, they have been involved in pivotal developments within the semiconductor industry, where Krypton is used in manufacturing processes. EFC’s commitment to providing high-purity gases has bolstered its reputation as a leader in the supply of specialty gases for critical applications, including those in the semiconductor and aerospace industries. This rebranding reflects their broadened capabilities and commitment to innovation in supplying advanced materials and rare gases like Krypton.

Iceblick Ltd. has been significantly impacted by geopolitical tensions, particularly due to the conflict in Ukraine where it is based. As one of the major global producers of noble gases, including krypton, Iceblick faced disruptions in production starting in 2022 due to the war. These disruptions led to significant increases in the prices of krypton and other gases. Despite these challenges, Iceblick remains a key player in the supply of krypton, used in energy-efficient lighting and other high-tech applications.

Linde PLC has been actively expanding its capabilities in the krypton market. In 2023, Linde opened one of the world’s largest facilities for the production and filling of krypton and xenon in Leuna, Germany. This strategic move is expected to strengthen Linde’s position in the European noble gas market and enhance its ability to meet growing demand across various industries including lighting, window insulation, and lasers.

In 2023, Matheson Tri-Gas, Inc. continued to strengthen its position in the Krypton sector by focusing on the supply of high-purity gases for critical applications. Although specific year-wise data for 2023 was not detailed, the company’s ongoing commitment to technological advancements and market expansion strategies likely sustains its strong position in the sector, contributing to the broader growth trends in the use of rare gases like krypton.

Messer Group GmbH demonstrated robust performance in 2023, achieving a 7.1% increase in total sales to approximately €4,391 million, with EBITDA rising by 9.1% to about €1,284 million. These results reflect Messer’s resilience and strategic focus on sustainable growth and decarbonization efforts, reinforcing its leadership in the industrial, medical, and specialty gases markets, including its activities in the Krypton sector.

Proton Gases Pvt. Ltd. continues to play a notable role in the Krypton market. Although specific updates for 2023 are limited, their ongoing efforts in the industrial gases sector and participation in the expanding Krypton market highlight their strategic focus on meeting the growing demand for rare gases, particularly in the semiconductor and lighting industries.

The Linde Group has significantly bolstered its position in the Krypton market by opening one of the world’s largest production and filling facilities for Krypton and Xenon in Leuna, Germany, in 2023. This development is set to enhance Linde’s capacity to meet the increasing demand across Europe, further strengthening their leadership in the global market for noble gases.

In 2023, Taiyo Nippon Sanso Corporation continued to enhance its presence in the Krypton market by leveraging its extensive expertise in industrial gases. The company focuses on meeting the growing demand for high-purity gases across various high-tech industries, such as electronics and aerospace, where Krypton is increasingly utilized. Their commitment to innovation and quality ensures they remain competitive in the specialized gases sector.

Axcel Gases has established itself as a key player in the industrial gases market, including Krypton, particularly noted for their commitment to providing high-purity gases. The company caters to a broad range of industries, offering products that meet stringent quality standards required for diverse applications, from manufacturing to healthcare. Axcel Gases prides itself on its innovative approach and robust supply chain, ensuring reliable gas delivery to clients, enhancing their operational efficiency and adherence to environmental standards.

Conclusion

In conclusion, the Krypton market is positioned for steady growth, driven by its diverse and essential applications across several critical industries. As we look towards 2032, the market is expected to capitalize on increasing demands in sectors like construction for energy-efficient windows, aerospace for advanced propulsion systems, and electronics for semiconductor manufacturing. Moreover, the ongoing shift towards energy-efficient and environmentally friendly technologies bolsters the use of Krypton, particularly in LED lighting and high-performance insulation materials.

Although the market faces challenges such as high production costs and competition from alternative gases, the unique properties and emerging applications of Krypton are likely to continue opening new avenues for growth. This makes Krypton an integral component in the advancement of various high-tech and sustainable solutions, reflecting its growing importance in the global market.