Table of Contents

Introduction

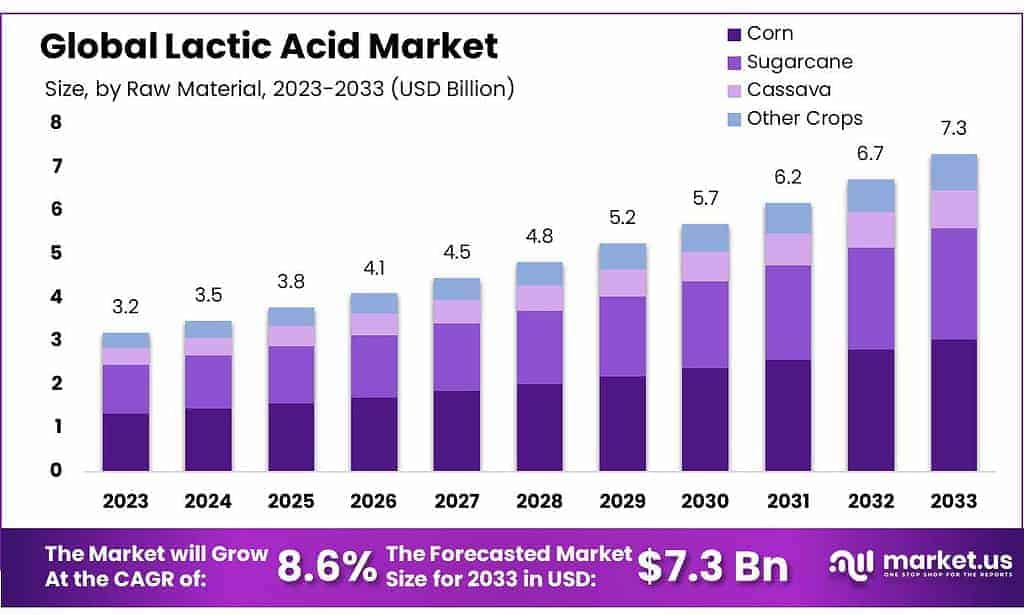

The global lactic acid market is on a trajectory of significant growth, projected to expand from USD 3.2 billion in 2023 to around USD 7.3 billion by 2033, achieving a compound annual growth rate (CAGR) of 8.6%. This growth is largely fueled by the increasing adoption of sustainable and biodegradable materials across various industries, including food & beverages, pharmaceuticals, personal care, and bioplastics.

A key factor driving this market is the rising demand for eco-friendly packaging solutions and the growing popularity of probiotics that use lactic acid. Additionally, the versatility of lactic acid in applications such as flavor enhancement, preservation, and pH regulation in food products, as well as its use in cosmetic formulations for skin moisturization and exfoliation, supports its widespread use.

However, the market faces challenges, including the high cost of production and volatility in raw material prices, which can affect the stability of lactic acid supply and pricing. Despite these challenges, opportunities for market expansion remain robust, especially with ongoing advancements in fermentation technologies and the development of genetically engineered microorganisms aimed at enhancing production efficiency and yield.

BASF is undergoing a significant restructuring process that could see the company exit several sectors, including agrochemicals, battery materials, coatings, and more. This restructuring is part of a broader strategy to adapt to changing market demands and focus on more profitable and sustainable segments.

Key Takeaways

- The global lactic acid market size is expected to be worth around USD 7.3 billion by 2033, from USD 3.2 billion in 2023, growing at a CAGR of 8.6% during the forecast period from 2023 to 2033.

- Over the forecast period, the corn segment will see a 38.6.9% CAGR. Because of its low cost and sustainability, it has become a popular raw material.

- The market for polylactic acid was dominated by the end-user segment and represented the largest revenue share at 30% in 2023.

- North America was the dominant market for lactic acids and had the highest revenue share of 42% in 2021. This can be attributed to the expanding personal care, pharmaceutical, food, and beverage industries.

Lactic Acid Statistics

Global Lactic Acid Production Trends

- Lactobacillus delbrueckii is widely used in industrial applications and can produce up to 62 g/L of lactic acid from lignocellulosic biomass after 72 hours of fermentation.

- A biorefinery can have an annual lactic acid production capacity of 100,000 tons.

- The total production cost of lactic acid depends on the starting raw substrate materials, as these materials constitute 40–70% of the total cost of the production.

- According to ADM, global demand for lactic acid, which is also broadly used by the food, feed, and cosmetics industries, was valued at $2.9 billion last year, with an expected annual growth rate of 8 percent.

- ADM and LG Chem in August 2022 announced the launch of two U.S.-based joint ventures (JVs), GreenWise Lactic and LG Chem Illinois Biochem. GreenWise Lactic aimed to produce up to 150,000 tons annually of high-purity corn-based lactic acid.

Optimized Lactic Acid Production Methods

- In a three-step cross-current operation, the extraction efficiency for lactic acid was increased from 37.0 ± 0.4 % without feed pH adjustment to 76.2 ± 0.9 % with continuously adjusting the pH value to 2.05 ± 0.02.

- The sugar content of sugarcane juice is very high, with a sugar content of up to 17–18%. The bacteria and yeasts will cause the sugarcane juice to ferment rapidly in the juice, leading to changes in its color, taste, and flavor.

- Lactic acid (LA) can be produced from sugarcane juice, and the process can be optimized using ion-exchange resins. In one study, the highest LA production was 113.74 g/L in 96 hours, with a productivity of 1.18 g LA/L∙h.

- 98% of WSC in sugarcane bagasse was converted to d-lactic acid before pretreatment.

- One study found that this strain produced lactic acid from sugar-cane juice with a yield of 96% and a productivity of 2.8 g l(-1 )h(-1).

Emerging Trends

- Growth in Biodegradable Packaging: Consumers are increasingly choosing biodegradable packaging options, particularly those made from polylactic acid (PLA), thanks to growing environmental awareness and stricter regulations promoting sustainable materials.

- Increased Use in Cosmetic Products: The cosmetic industry is using more lactic acid due to its hydrating and antimicrobial properties that enhance skin quality. The shift towards natural and effective cosmetic ingredients is driving higher demand in this sector.

- Medical Sector Innovations: In the medical field, lactic acid is featured in the development of sustainable products like biodegradable sutures and implants. These applications align with the demand for environmentally friendly and effective medical solutions.

- Fermentation Technology Breakthroughs: Advances in fermentation technology are improving the efficiency and cost-effectiveness of lactic acid production. Innovations include the use of genetically engineered microbes and continuous fermentation techniques to boost output and reduce resource waste.

- Broader Use in Food and Beverage: Lactic acid is becoming more popular in the food and beverage industry, where it serves as a preservative and flavor enhancer. It’s valued for its ability to prolong shelf life and enhance the safety of dairy products and other perishable items.

Use Cases

- Food Industry: Lactic acid is extensively used in the food sector as a preservative and flavor enhancer, especially in dairy products like yogurts and cheeses, as well as in pickled vegetables and sauerkraut. Its role in improving taste and extending shelf life makes it a staple in many culinary applications.

- Pharmaceuticals: In the medical field, lactic acid plays a crucial role in drug formulation and delivery systems. It is used in making biodegradable sutures, dialysis solutions, and controlled-release pharmaceuticals, where it helps in drug solubility and stability.

- Cosmetics: Lactic acid is a popular ingredient in the cosmetic industry due to its moisturizing, exfoliating, and pH-regulating properties. It is found in a variety of skincare products, including moisturizers, peels, and acne treatments, enhancing skin hydration and texture.

- Bioplastics: Lactic acid is a key raw material in the production of polylactic acid (PLA), a biodegradable polymer used in eco-friendly packaging solutions. PLA is utilized in a wide range of applications, from disposable tableware to agricultural films, catering to the growing demand for sustainable materials.

- Industrial Applications: In industries such as leather tanning, textile dyeing, and biodegradable solvents, lactic acid is valued for its properties as a mordant and a descaling agent. It’s also used in antifreeze as a more efficient and cost-effective alternative to ethylene glycol.

Major Challenges

- Elevated Production Expenses: The production of lactic acid via microbial fermentation often involves high costs due to the price of raw materials and the energy consumed in the process. These economic factors make it difficult to produce lactic acid on a large scale affordably.

- Challenges in the Fermentation Process: As lactic acid accumulates during fermentation, it can inhibit further production, thus reducing the yield and efficiency of the process. Additionally, substances that inhibit the fermentation may be released during the preparation of feedstocks, further complicating production.

- Demand for High Purity: For uses in food and pharmaceuticals, lactic acid must meet high standards of optical purity. Consistently achieving and maintaining this level of purity is challenging and can impact the suitability of lactic acid for these sensitive applications.

- Environmental Impact and Sustainability: Although lactic acid is biodegradable, its production, especially from non-renewable sources, raises significant environmental and sustainability issues. The industry faces pressure to adopt more sustainable and eco-friendly practices, including leveraging renewable resources and minimizing waste.

- Limitations of Current Technologies: The technologies currently employed for lactic acid production are limited in their scalability and efficiency. There is a pressing need for technological advancements that can enhance production capabilities and decrease the costs related to the purification and utilization of lactic acid.

Market Growth Opportunities

- Biodegradable Plastics: The market for polylactic acid (PLA), a sustainable polymer made from lactic acid, is expanding due to its use in eco-friendly products like packaging, automotive parts, and clothing materials. The push towards environmental sustainability and the reduction of harmful emissions are key factors contributing to PLA’s rising popularity.

- Food and Beverage Industry: Lactic acid is gaining traction for its role in improving food taste and extending product shelf life without altering flavors. It is increasingly used as a natural additive in the preservation and flavor enhancement of meats, dairy, and bakery items.

- Pharmaceutical Sector: The pharmaceutical industry is increasingly utilizing lactic acid, especially in drug formulations and as a component in IV solutions where it acts as an electrolyte. The shift towards ingredients that are more natural and less synthetic is likely to increase its usage.

- Cosmetics and Personal Care: Known for its hydrating and rejuvenating effects on the skin, lactic acid is becoming a staple in the cosmetic industry. It is incorporated more frequently in products aimed at enhancing skin texture and moisture.

- Industrial Uses: As a versatile natural solvent, lactic acid is employed in various industrial applications, including metal cleaning and machinery maintenance. Its effectiveness in these areas continues to create new uses and market demand.

Key Players Analysis

- BASF SE is actively involved in the lactic acid sector through partnerships and joint ventures aimed at developing sustainable biobased chemicals. One of their notable collaborations was with Corbion, focusing on the sales and marketing of food emulsifiers and performance systems in North America, emphasizing BASF’s role in providing high-performance ingredients for various applications.

- Galactic is a key player in the lactic acid market, renowned for using fermentation processes to produce a wide range of natural antimicrobials and lactic acid derivatives. These products find applications across the food, pharmaceutical, and biodegradable plastics industries, underscoring Galactic’s commitment to sustainability and innovation in natural products.

- Dow is involved in the lactic acid sector through its production of TERGITOL™ L-61 Surfactant. This product is utilized as a foam control agent in various processes, including the fermentation of lactic acid. It is designed to operate effectively under low foam conditions and is recognized for its thermal and chemical stability, which makes it particularly suitable for applications in food, dairy, and brewery cleaning processes.

- Jungbunzlauer Suisse AG operates in the lactic acid sector, utilizing renewable resources for lactic acid production via fermentation. Their L(+)-lactic acid serves various applications, enhancing flavor and offering antibacterial properties across food, beverages, and personal care products.

- NatureWorks LLC is expanding its operations in the lactic acid sector through the construction of a new, fully integrated Ingeo™ polylactic acid (PLA) manufacturing complex in Thailand. This facility will incorporate the production of lactic acid, lactide, and Ingeo biopolymers, enhancing their capacity for sustainable biopolymer production from renewable resources.

- Futerro, a Belgian biotechnology company, has been a leader in the lactic acid and PLA (Poly-Lactic Acid) sector since 1992, focusing on sustainable bioplastic solutions. They operate the world’s second-largest PLA production facility and are advancing with plans to establish Europe’s first fully integrated biorefinery in Normandy, aiming to boost the circular economy through advanced recycling processes and sustainable production methods.

- Corbion is a leading provider in the lactic acid sector, emphasizing the production of natural L-lactic acid through advanced fermentation processes. This acid is integral across various applications, notably in food preservation and flavor enhancement, thanks to its multifunctional properties. Corbion’s innovations also extend to sustainable practices, such as a circular lactic acid technology that enhances resource efficiency and reduces waste by recycling nearly all chemicals used in the production process.

- Henan Jindan Lactic Acid Technology Co., Ltd. is a high-tech enterprise focusing on the production of L-lactic acid through modern microbial fermentation. With over 30 years of development, the company is a leader in China’s lactic acid market, dedicated to efficient, energy-saving, and environmentally friendly production technologies.

- ThyssenKrupp AG has invested significantly in industrial biotechnology, developing efficient processes for producing bio-based chemicals, including lactic acid, which is used to create bioplastic polylactic acid (PLA). Their innovative approach integrates fermentation and PLA production processes to enhance economic and environmental efficiency, demonstrating their commitment to reducing reliance on petrochemicals.

- Cellulac has pioneered the continuous production of optically pure lactic acid from deproteinized lactose whey. This innovation, central to their operations in Dundalk, Ireland, leverages second-generation feedstocks like lactose whey, reducing production costs significantly by minimizing energy and enzyme expenses.

- Vaishnavi Bio Tech International is a major player in the industrial fermentation sector, focusing on producing a variety of biotechnology products including lactic acid. Their work spans enhancing food preservation, improving nutritional supplements, and developing organic and bio-fertilizers, leveraging their extensive R&D capabilities to innovate within the agricultural and nutritional fields.

- Teijin Limited has advanced its efforts in the lactic acid sector by developing a new type of polylactic acid (PLA) resin, which is highly biodegradable in natural environments like oceans and soil. This innovation enhances the biodegradation rate of PLA without compromising its strength and moldability, making it practical for a wide range of applications, from textiles to non-woven fabrics.

- Danimer Scientific utilizes polylactic acid (PLA) in its biopolymer resins, creating products like extrusion coatings and additives to enhance PLA’s performance in various applications.

Conclusion

Lactic acid’s versatile applications across industries like bioplastics, food and beverages, and pharmaceuticals highlight its significant market potential. Driven by sustainability trends and the shift towards natural ingredients, the industry is poised for continued growth, leveraging innovations to overcome challenges such as production costs and process efficiencies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)