Table of Contents

Introduction

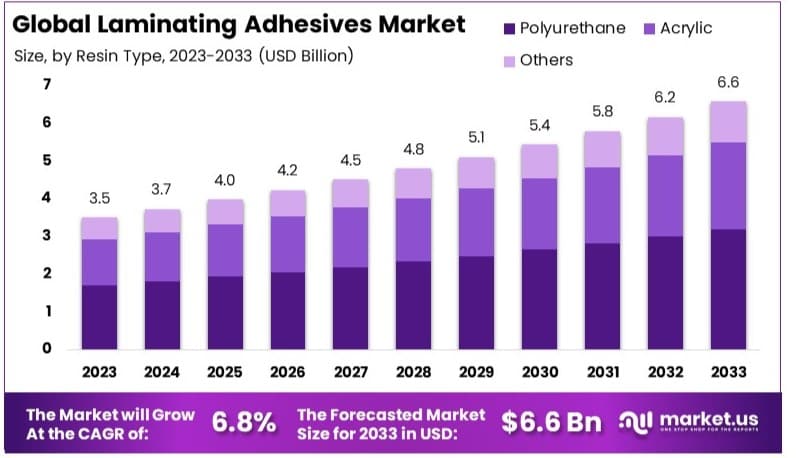

The Global Laminating Adhesives Market is anticipated to experience robust growth, with its value forecasted to nearly double from USD 3.5 billion in 2023 to about USD 6.6 billion by 2033. This market is expanding at a CAGR of 6.8% during the period from 2024 to 2033. The escalation in market size is primarily fueled by the increasing demand in sectors such as automotive, packaging, and electronics, where adhesives are essential for bonding and laminating various materials.

Despite the optimistic growth projections, the industry faces notable challenges including stringent environmental regulations concerning volatile organic compound (VOC) emissions from adhesives, which compel manufacturers to innovate and develop eco-friendlier solutions. In response, recent developments have seen a shift towards water-based and solvent-free adhesives, which are gaining traction due to their lower environmental impact and compliance with regulatory standards.

Additionally, advancements in adhesive technologies that offer enhanced performance characteristics such as better bond strength and durability under extreme conditions are driving their adoption across various applications. These innovations and adaptations are critical in supporting the sustained growth of the laminating adhesives market in an increasingly environmentally conscious and technologically demanding global landscape.

Recent developments in the laminating adhesives market have shown significant strategic moves among key players such as Henkel AG & Co. KGaA, 3M Company, Dow Chemical Company, and H.B. Fuller Company. Each of these companies has been making notable advancements, particularly in terms of acquisitions, product innovations, and sustainability initiatives.

Arkema’s acquisition of this business from Dow enhances its position in the flexible packaging market, contributing approximately $250 million in annual sales. This move allows Arkema to expand its product offerings in food and medical applications, supporting growth in a market driven by sustainable and recyclable solutions.

Henkel AG & Co. KGaA has made notable strides in its laminating adhesives segment, emphasizing both organizational restructuring and innovation. In 2023, Henkel optimized the structure of its Adhesive Technologies business unit to enhance efficiency and customer proximity. This reorganization grouped the unit into three focused areas: Mobility & Electronics, Packaging & Consumer Goods, and Craftsmen, Construction & Professional, aiming to better address market and consumer needs.

Key Takeaways

- Market Value: The Laminating Adhesives Market was valued at USD 3.5 billion in 2023, and is expected to reach USD 6.6 billion by 2033, with a CAGR of 6.8%.

- Resin Type Analysis: Polyurethane dominated with 48.6%; significant for its strong bonding and durability.

- Technology Analysis: Solvent-Based technology led with 51.6%; crucial for its wide applications and performance.

- End-Use Industry Analysis: Packaging dominated with 62.5%; essential for its extensive use in food, pharmaceuticals, and consumer products.

- Dominant Region: APAC held 41.2%; significant due to high manufacturing and packaging activities.

- Analyst Viewpoint: The laminating adhesives market is moderately competitive with strong growth potential. Future trends suggest increased demand in packaging and industrial applications.

Laminating Adhesives Statistics

- Laminating adhesives exhibit high adhesion strength, with typical shear strength values ranging from 20 to 30 MPa.

- Laminating adhesives can withstand temperatures up to 150°C without degradation.

- The volume of the U.S. laminate flooring market grew by 4.5% in 2022, reaching roughly 1.098 billion square feet.

- In 2022, Self-adhesive plastic products wider than 20 cm accounted for $19.1 billion of the total trade, while those less than 20 cm wide accounted for $8.13 billion.

- The largest growth in exports of Self-adhesive Plastics between 2021 and 2022 was seen in China, with an increase of $850 million.

- In 2022, China had the highest net exports of Self-adhesive Plastics, with a trade surplus of $2.96 billion.

- The cost of mild steel drums, used as packing material in the laminating adhesives industry, has increased by over 50% due to record-high global steel prices.

- The overall cost of production for laminating adhesives has increased by over 50% due to rising raw material prices, increased energy and packaging material costs, and escalating freight rates.

- The use of solvent-free laminating adhesives can achieve savings of over 50% compared to solvent-based technology, due to the elimination of volatile organic compounds (VOCs) and reduced heat input requirements.

- The Japanese lamination industry annually discharges hundreds of thousands of tons of carbon dioxide (CO2) and other greenhouse gases throughout the life cycles of its products.

- Toyo-Morton estimates that CO2 emissions related to inks and laminating adhesives in packaging can be reduced by up to 70% by substituting solvent-based products with solvent-free ones.

- Solvent-free adhesives are more popular in countries such as the United States, Europe, and Southeast Asia (especially the Philippines), while Japan lags behind in terms of environmental responsiveness.

- Toyo-Morton has set a target of increasing the proportion of solvent-free adhesives in its product mix in Japan to 30% by 2030 and 100% by 2050.

- Solvent-free lamination adhesives are currently used for OPP/CPP, OPP/VMCPP, and PET/VMCPP packaging structures for snack foods.

- Solvent-based adhesives are typically used for applications requiring superior physical properties such as content resistance, heat resistance, and retort resistance.

- Using water-based inks in conjunction with solvent-free adhesives can significantly reduce CO2 emissions directly related to ink and adhesives.

- Toyo-Morton overcame long-standing shortcomings with EA-N6802 and EA-N5802 by designing polymers capable of minimizing the impact of residual moisture specific to water-based inks during hot and humid seasons, making these laminates suitable for refill and retort packaging.

- The Toyo Ink Group released EA-N373A and EA-N6173, an adhesive system containing more than 10% biomass content, compatible with the LP BIO ink series.

- The biomass adhesive system is compatible with continuous inline lamination methods for three-layer packaging structures, achieving improved curing speeds and high cohesive force.

- Results of inline/continuous lamination tests conducted by Toyo-Morton show that adhesives are laminatable after being left at room temperature for only 60 minutes, allowing for immediate second lamination.

- Toyo-Morton aims to further popularize solvent-free lamination adhesives and contribute to the realization of a sustainable society through ongoing research and development.

Emerging Trends

- Eco-friendly Adhesives: There is a growing demand for environmentally friendly laminating adhesives. Manufacturers are focusing on developing products that are solvent-free and made from renewable resources to reduce environmental impact and meet regulatory standards.

- Improved Performance at Lower Costs: Advancements in technology are enabling the production of adhesives that offer enhanced performance characteristics such as higher heat resistance and greater durability, while also being cost-effective.

- Increased Use in Automotive and Aerospace: The automotive and aerospace industries are increasingly using laminating adhesives to reduce vehicle weight, which improves fuel efficiency and lowers emissions. This trend is driven by the need for lightweight materials that do not compromise on strength or safety.

- Enhanced Bonding Technologies: New technologies are being developed to improve the bonding capabilities of adhesives. These include UV-curing adhesives, which offer rapid curing times and strong bonds, making them suitable for high-speed production lines.

- Expansion in Asia-Pacific Market: The Asia-Pacific region is witnessing rapid growth in the use of laminating adhesives, driven by expanding manufacturing sectors and growing economies. This region is becoming a hub for innovation and development in adhesive technologies.

- Regulatory Impact: Increasingly strict environmental regulations worldwide are shaping the development and use of laminating adhesives. Manufacturers are being prompted to innovate with safer, low-VOC (volatile organic compound) adhesive formulations to comply with these new standards.

- Smart Adhesives: There is a rising interest in ‘smart’ adhesives that can change properties in response to external stimuli such as temperature, light, or pressure. These adhesives are finding applications in industries where adaptable bonding solutions are required, such as in responsive textiles and smart packaging solutions.

Use Cases

- Packaging Industry: Laminating adhesives are extensively used in the packaging sector to bond multiple layers of materials in flexible packaging. This application enhances the barrier properties, preserving the freshness and extending the shelf life of packaged goods. These adhesives are critical in food packaging, where strong, durable seals are required to ensure product safety and quality.

- Automotive Manufacturing: In automotive production, laminating adhesives are vital for assembling composite parts, enhancing interior cabin aesthetics, and improving sound insulation. They are applied in door panels, headliners, and trim parts, contributing to lighter, safer, and more energy-efficient vehicles.

- Construction and Building: These adhesives are crucial in the construction industry for laminating panels and flooring, roofing materials, and insulation. Their strong bonding properties help in creating durable, weather-resistant structures which are essential for building integrity and energy efficiency.

- Electronics: Laminating adhesives are used in the electronics industry to secure layers in screens and touch panels, particularly in smartphones and tablets. They help in the assembly of layers in LCD screens, ensuring clarity, performance, and durability of the display components.

- Textiles and Footwear: In the textile industry, laminating adhesives are used to bond fabrics in performance apparel and footwear. This allows for the design of complex, multi-layered garments that are durable and comfortable, catering to the needs of fashion and function.

- Medical Devices: These adhesives are used in medical device manufacturing, particularly in the lamination of films, foils, and fabrics. They provide essential properties such as biocompatibility, sterilization stability, and chemical resistance, which are critical in medical environments.

- Furniture Manufacturing: In the furniture sector, laminating adhesives are used to affix veneers and high-pressure laminates to substrates, enhancing aesthetic appeal and durability. They are preferred for their ability to form strong bonds with a variety of materials, contributing to the longevity and quality of the furniture.

Key Players Analysis

Henkel AG & Co. KGaA has shown strong performance in the laminating adhesives sector, particularly through its Adhesive Technologies business unit. In 2023, this unit reported an organic sales growth of 3.3%, driven by the Mobility & Electronics and Craftsmen, Construction & Professional sectors. Henkel’s commitment to sustainability is evident in its recent audited sustainability assessment of its adhesive products. The company recorded overall sales of 21.5 billion euros, with a notable adjusted operating profit increase of 10.2% to 2.6 billion euros, reflecting its strategic pricing and efficiency measures.

3M Company continues to innovate in the laminating adhesives market with products like the 3M™ Hi-Strength Laminating Adhesive 92 and 3M™ Laminating Adhesive 932FL. These products are designed for high-temperature resistance and immediate handling applications, catering to industries such as automotive, electronics, and general manufacturing. In 2023, 3M’s adhesives segment contributed significantly to the company’s revenue, underlining its leadership in providing high-performance adhesive solutions. 3M’s strategic focus remains on enhancing product durability and versatility, ensuring a strong market presence.

Dow Chemical Company has recently agreed to sell its flexible packaging laminating adhesives business to Arkema for $150 million. This sale aligns with Dow’s strategy to focus on high-value downstream businesses and supports its Decarbonize & Grow and Transform the Waste strategies. The business, which generates annual sales of around $250 million, includes well-known brands such as ADCOTE™ and MOR-FREE™, and five production sites across Italy, the United States, and Mexico. Dow will retain its water-based and acrylic adhesives businesses.

H.B. Fuller Company, a key player in the laminating adhesives market, has made significant strides with the recent acquisition of Fourny nv, a Belgian adhesives company, enhancing its capabilities in the construction adhesives sector. In 2023, H.B. Fuller reported strong financial performance, with a notable increase in revenue driven by its robust adhesives portfolio. The company continues to innovate, focusing on sustainable solutions to meet the growing demand in various industrial applications.

Bostik, a leader in adhesive solutions, recently introduced Bostik SF10M, the world’s first RecyClass-approved laminating adhesive, at the 10th Specialty Films & Flexible Packaging Global Summit in Mumbai. This solvent-free aromatic polyurethane-based adhesive is designed for mono-material structures, enhancing the recyclability of polyethylene and polypropylene films. Bostik SF10M supports high-quality recycling and aligns with sustainable packaging trends. The company continues to drive innovation in the laminating adhesives sector with a strong focus on sustainability and environmental impact reduction.

Ashland Global Holdings Inc. is a key player in the laminating adhesives market, known for its innovative products and focus on high-performance materials. Recently, Ashland launched a new line of laminating adhesives designed for flexible packaging applications, emphasizing improved bond strength and durability. The company reported a solid financial performance in 2023, with its adhesives segment contributing significantly to overall revenue growth. Ashland’s continued investment in research and development ensures it remains at the forefront of adhesive technology advancements.

Sika AG has experienced robust growth in the laminating adhesives sector, bolstered by its acquisition of MBCC, which contributed to a 12.4% increase in sales for the first nine months of 2023, reaching CHF 8,449.2 million. The company continues to expand its product offerings and market presence, notably with the launch of new plants in India and the USA. Sika’s strategic focus on high-performance and sustainable adhesive solutions supports its strong market position and future growth prospects.

Avery Dennison Corporation is advancing in the laminating adhesives sector with innovative solutions tailored for various applications. In 2023, the company launched a new range of eco-friendly laminating adhesives that enhance the sustainability of packaging. Avery Dennison reported solid financial performance, with adhesive solutions contributing significantly to its revenue growth. The company’s commitment to sustainability and innovation continues to drive its leadership in the laminating adhesives market.

Arkema S.A. has significantly expanded its laminating adhesives portfolio by acquiring Dow’s flexible packaging laminating adhesives business, which generates annual sales of approximately $250 million. This acquisition, expected to close in the fourth quarter of 2024, will enhance Arkema’s market position and product offerings, especially in food and medical applications. The integration of Dow’s advanced technologies and well-recognized brands like ADCOTE™ and MOR-FREE™ will enable Arkema to capture new growth opportunities and achieve cost synergies of around $30 million in EBITDA within five years.

Parker Hannifin Corporation, a leader in motion and control technologies, has been strengthening its presence in the laminating adhesives sector. The company’s recent advancements include the introduction of high-performance adhesives designed for industrial applications, offering superior bond strength and durability. Parker Hannifin reported robust financial performance, with the adhesives segment contributing significantly to its revenue growth. The company’s focus on innovation and high-quality solutions continues to drive its success in the competitive laminating adhesives market.

Eastman Chemical Company recently divested its adhesives resins business to Synthomer plc for $1 billion, focusing on hydrocarbon resins, pure monomer resins, and polyolefin polymers. This strategic move is part of Eastman’s plan to enhance the performance of its Additives & Functional Products segment. Despite this sale, Eastman remains committed to innovation within its remaining specialty materials businesses. In 2023, Eastman demonstrated robust financial performance with significant contributions from its specialty materials segment.

Toyo-Morton, Ltd., a subsidiary of Toyo Ink Group, is a prominent player in the laminating adhesives sector. Known for its advanced adhesive solutions, Toyo-Morton focuses on sustainable and high-performance products. The company recently launched a new series of eco-friendly laminating adhesives that cater to the growing demand for sustainable packaging solutions. These innovations have bolstered Toyo-Morton’s market position, contributing to the overall growth and revenue of the Toyo Ink Group.

Wacker Chemie AG continues to innovate in the laminating adhesives sector with its GENIOSIL and VINNAPAS product lines. The company offers high-performance, environmentally friendly adhesives, including silane-modified polymers and vinyl acetate-ethylene (VAE) polymer dispersions. These solutions provide high strength and elasticity, making them suitable for various industrial applications. Despite facing a challenging market environment in 2023, Wacker remains committed to expanding its product offerings and maintaining a strong market presence.

DIC Corporation, a global leader in printing inks and organic pigments, is also a significant player in the laminating adhesives market. The company focuses on developing innovative adhesive solutions that cater to the packaging industry, particularly flexible packaging. DIC’s recent advancements include high-performance laminating adhesives that offer enhanced bond strength and environmental benefits. These innovations are part of DIC’s broader strategy to expand its market share and address the growing demand for sustainable packaging solutions.

Vimasco Corporation specializes in the production of protective coatings and adhesives, including those used in laminating applications. Known for its quality and reliability, Vimasco’s adhesive products are designed to meet the stringent requirements of industrial applications. The company focuses on providing solutions that offer excellent adhesion, durability, and environmental compliance. Vimasco continues to innovate and adapt its product offerings to meet the evolving needs of its customers.

Conclusion

The market for laminating adhesives is positioned for robust growth, driven by the expanding packaging industry and the rising demand for durable and flexible adhesive solutions. These adhesives are critical for producing multi-layer composites across various applications, including food packaging, industrial, and automotive sectors.

Innovations in adhesive technology that improve performance and environmental sustainability are likely to propel market growth further. As consumer preferences continue to shift towards more sustainable packaging solutions, the demand for eco-friendly laminating adhesives is expected to surge. Consequently, market participants should focus on innovation and sustainability to capitalize on the emerging opportunities within this dynamic industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)