Table of Contents

Introduction

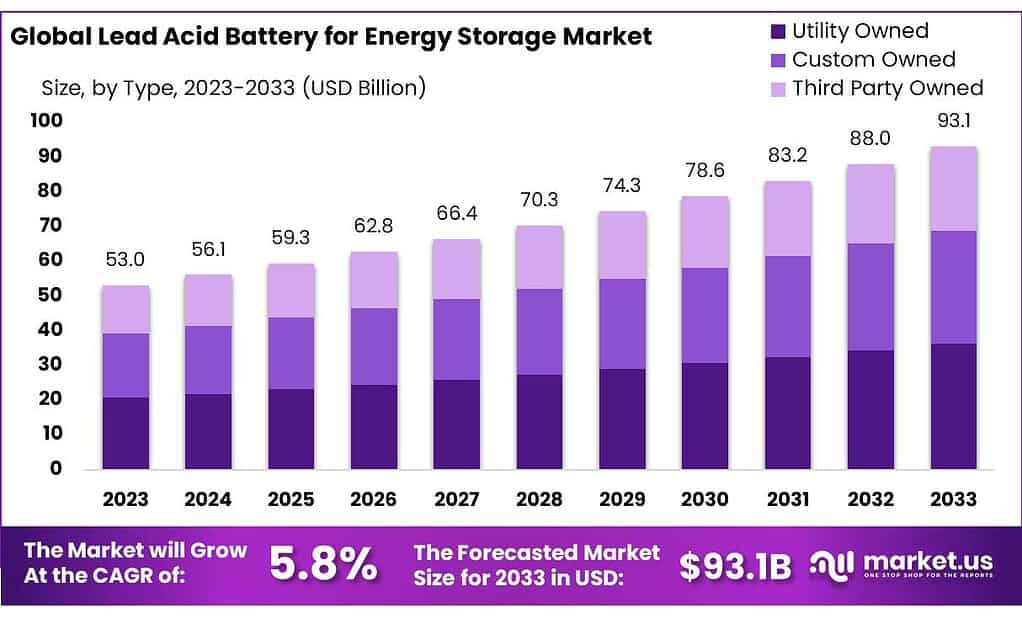

The global Lead Acid Battery for Energy Storage Market is projected to grow from USD 53.0 billion in 2023 to USD 93.1 billion by 2033, with a compound annual growth rate (CAGR) of 5.8% over the forecast period. This growth is fueled by increasing demand for reliable power storage solutions across various applications including microgrids, industrial uses, and military operations. The integration of renewable energy sources like solar and wind into power grids is a significant driver, as these batteries are utilized to stabilize power supply by storing excess energy generated during peak production times.

However, the market faces challenges, particularly from the rising competition from alternative technologies like lithium-ion batteries, which offer higher efficiency and longer life cycles. This competition has compelled lead-acid battery manufacturers to enhance their offerings by focusing on advancements in battery life, maintenance requirements, and overall performance.

Recent developments in the market include the certification of lead-acid battery systems for energy storage by standards organizations, reflecting advancements in safety and performance. Companies are also expanding geographically, particularly into regions like Africa, the Middle East, and Southeast Asia, aiming to capitalize on emerging market opportunities. This expansion is supported by continuous investments in research and development to improve product quality and adapt to the specific needs of these new markets.

Furukawa has also ventured into new business domains through acquisitions, as seen in their takeover of Maxell, Ltd.’s laminated lithium-ion battery business, aiming to leverage this technology in rapidly growing markets such as drones and industrial robots.

Furukawa Electric Co., Ltd has made significant advancements in the lead-acid battery sector, focusing on the development of innovative battery technologies and expanding their applications. Recent developments highlight their engagement with new generation batteries like the bipolar lead-acid batteries, which are poised to compete in the renewable energy sector against lithium-ion counterparts due to their enhanced capabilities

Key Takeaways

- Lead Acid Battery for Energy Storage Market size is expected to be worth around USD 93.1 Bn by 2033, from USD 53.0 in 2023, growing at a CAGR of 5.8%.

- Utility Owned lead-acid batteries for energy storage held a dominant market position, capturing more than a 39.3% share.

- 200-500 Ah segment of the lead-acid battery market for energy storage held a dominant position, capturing more than a 27.4% share.

- 12V batteries held a dominant market position in the lead acid battery for energy storage market, capturing more than a 42.3% share.

- Flooded lead-acid batteries maintained a dominant position in the energy storage market, capturing more than a 48.3% share.

- Utilities and Grid Storage held a dominant market position in the lead acid battery for energy storage market, capturing more than a 36.7% share.

- Asia Pacific region dominated the lead acid battery market for energy storage, commanding a 44.3% share.

Lead Acid Battery for Energy Storage Statistics

- The elements are then properly oriented and inserted into the battery case and welded together. Elements are typically arranged in series, in order for the two volt cell to reach six, 12 or whatever the intended voltage of the final battery.

- A deep-cycle battery will have depth of discharge greater than 50%, and may go as high as 80%. To achieve the same useable capacity, a shallow-cycle battery bank must have a larger capacity than a deep-cycle battery bank.

- Battery capacity falls by about 1% per degree below about 20°C. However, high temperatures are not ideal for batteries either as these accelerate aging, self-discharge and electrolyte usage.

- A deep-cycle lead acid battery should be able to maintain a cycle life of more than 1,000 even at DOD over 50%.

- Constant current discharge curves for a 550 Ah lead acid battery at different discharge rates, with a limiting voltage of 1.85V per cell. Longer discharge times give higher battery capacities.

- Lead acid batteries typically have coloumbic efficiencies of 85% and energy efficiencies in the order of 70%.

- To calculate the C-rate, the capability is divided by the capacity. For example, if a fully charged battery with a capacity of 100 kWh is discharged at 50 kW, the process takes two hours, and the C-rate is 0.5C or C/2.

- For example, if a lithium-ion battery has an energy efficiency of 96% it can provide 960 watt-hours of electricity for every kilowatt-hour of electricity absorbed.

- According to a common industry standard, a BESS is considered to have reached the end of its service life when its actual charging capacity falls below 80% of the original nominal capacity.

- The optimum operating temperature for most BESS is around 20 degrees Celsius.

- However, they tolerate temperatures between 5 and 30 degrees Celsius.

- Depending on the operating temperature of the system, battery life can vary from 5 to 15 years. In fact, high operating temperatures, up to 45°C, can improve battery performance in terms of increased capacity, but equally capacity, but still greatly reduce the life time of the system of the system.

- Thanks to their low daily self-discharge, which is reported to be less than 0.1%, lead acid batteries are suitable for energy storage over long periods of time.

- The world’s largest installation of this type is located in California, USA, which with a capacity of 40 MWh is capable of operating for 4 hours at a power of 10 MW.

- The main drawback of Ni-Cd batteries is their relatively high cost, around 800 €/kWh, which is due to their expensive manufacturing process and the need for recycling, which has led to their limited success in the market.

- The obligation to recycle at least 75% of their components, imposed by the European Union since 2003, is motivated by the presence of heavy metals in these batteries, nickel and cadmium, which are highly toxic to humans and the environment.

- Their charging and discharging capacity is very fast, reaching 90% of the nominal power in approximately 200 ms.

Emerging Trends

The lead acid battery market for energy storage market is experiencing several emerging trends that reflect its evolving role in global energy solutions. One notable trend is the increasing integration of lead-acid batteries with renewable energy sources. This application is driven by the need for cost-effective and reliable energy storage solutions that support grid stability and enhance the integration of intermittent renewable sources such as solar and wind power.

lead acid batteries for energy storage market are also gaining traction in various high-demand sectors such as utilities, telecommunications, and data centers, primarily due to their affordability and reliability. These sectors require uninterrupted power supply for critical operations, making lead-acid batteries a preferred choice for backup power systems.

Another significant trend is the technological advancements within the lead-acid battery segment. Innovations such as the development of Valve Regulated Lead Acid (VRLA) batteries, which are sealed and maintenance-free, are making lead-acid batteries more appealing in applications where reduced maintenance is crucial. Additionally, there are enhancements in battery designs to increase their efficiency and lifecycle, making them more competitive with other battery technologies like lithium-ion.

Regionally, Asia-Pacific is projected to be the largest market for lead-acid batteries for energy storage, driven by rapidly growing industrial and automotive sectors, especially in emerging economies like China and India. The market growth in these regions is attributed to the increasing demand for energy storage solutions paired with the economic growth and expansion of infrastructure.

The lead-acid battery market’s expansion is also stimulated by its critical role in applications ranging from automotive to backup power systems, where the demand for reliable and economical battery solutions remains high.

Use Cases

- Utility and Grid Storage: Lead-acid batteries are extensively used in grid storage systems to stabilize power supplies and enhance the integration of renewable energy sources like solar and wind. For instance, they help manage peak loads, provide emergency backup during power outages, and balance the grid by storing excess power generated during low demand periods.

- Renewable Energy Systems: In renewable energy setups, particularly solar and wind farms, lead-acid batteries store the energy generated during peak production times. This stored energy can later be used when production is low, such as during nighttime for solar or calm days for wind. This application is crucial for ensuring a steady and reliable energy supply from renewable sources.

- Telecommunications: Telecom infrastructure often relies on lead-acid batteries for backup power to ensure uninterrupted service during power failures. The reliability and cost-effectiveness of lead-acid batteries make them suitable for maintaining critical communication services, which require constant power availability.

- Data Centers: Data centers require continuous power to prevent data loss and service interruptions. Lead-acid batteries provide a fail-safe power backup solution, supporting operations during electrical interruptions until emergency generators can take over or the main power supply is restored.

- Backup Power Systems: Both commercial and residential buildings use lead-acid batteries as part of uninterruptible power supply (UPS) systems to provide immediate power during outages. This application is vital for safety systems, medical facilities, and any infrastructure that cannot tolerate power interruptions.

- Transportation and Motive Power: Lead-acid batteries are employed in electric vehicles, forklifts, and industrial machinery. They provide the necessary power for starting, lighting, and ignition (SLI) and also support motive functions in electric vehicles and other transport equipment

Major Challenges

- Environmental Concerns: Lead-acid batteries pose significant environmental risks due to the toxicity of lead and the sulfuric acid electrolyte they contain. Improper disposal can lead to lead contamination, which poses serious health risks. Recycling is mandatory in many regions, but the recycling process itself is energy-intensive and must be carefully managed to prevent environmental contamination.

- Limited Life Cycle and Deterioration: Lead-acid batteries typically have shorter life cycles compared to other battery technologies like lithium-ion. They generally last for about 500-1000 charge cycles before their capacity begins to degrade significantly. This shorter lifespan can lead to higher long-term costs and more frequent replacements, making them less suitable for applications requiring long-term energy storage solutions.

- Low Energy Density: Lead-acid batteries have a lower energy density compared to other battery types, which means they store less energy per unit of weight. This makes them less efficient for modern applications that demand compact and lightweight energy storage solutions, such as electric vehicles and portable electronics.

- Performance in Extreme Temperatures: Lead-acid batteries are sensitive to temperature extremes. Their performance and lifespan can be severely affected by very cold or very hot conditions. In cold weather, their capacity can decrease significantly, while high temperatures can accelerate corrosion inside the battery, further reducing its lifespan and efficiency.

- Charging Efficiency and Maintenance: Lead-acid batteries require regular maintenance to ensure optimal performance, including water top-ups for flooded types and equalization charges to prevent sulfation. They also have slower charge rates and lower charging efficiency compared to alternatives like lithium-ion batteries. These factors can increase operational costs and reduce usability in more demanding or less accessible applications.

- Market Competition: The rise of alternative technologies such as lithium-ion and solid-state batteries, which offer higher energy densities, longer lifespans, and faster charging times, is steadily eroding the market share of lead-acid batteries. These alternatives are becoming more cost-effective and are preferred in new energy storage applications, which is a significant competitive pressure on the lead-acid battery market.

Market Growth Opportunities

- Renewable Energy Integration: There’s a significant opportunity for lead-acid batteries in renewable energy systems, particularly as cost-effective storage solutions to enhance the reliability of solar and wind power. These batteries can effectively store excess energy produced during peak periods for later use, helping to stabilize power grids in off-grid and remote areas.

- Advanced Manufacturing: Improvements in manufacturing processes and materials are enhancing the performance and lifespan of lead-acid batteries. More efficient and durable batteries can be produced, which remain competitive with newer technologies in automotive and stationary storage applications.

- Recycling Innovations: Advances in recycling technologies for lead-acid batteries help mitigate environmental concerns and enhance sustainability. These technologies not only recover a higher percentage of materials but also reduce waste and production costs, contributing to a more sustainable supply chain.

- Market Expansion in Developing Regions: Rapid industrialization and urbanization in emerging economies are creating vast opportunities for lead-acid batteries. There is an increasing demand for reliable and cost-effective battery solutions in sectors such as telecommunications, transportation, and energy storage, particularly in Asia-Pacific, which is expected to be a lucrative market during the forecast period.

- Electric Vehicle Market: While the electric vehicle (EV) market is currently dominated by lithium-ion batteries, lead-acid batteries are finding niche applications in start-stop systems and mild hybrids, where cost and reliability are more critical than high energy density. This segment provides a steady demand for lead-acid batteries despite the growing penetration of lithium-ion technologies.

Key Players Analysis

Furukawa Electric Co., Ltd. continues to innovate in the energy storage sector, particularly with lead-acid batteries. In 2023, they have emphasized developments in their bipolar lead-acid battery technology, which they believe could rival lithium-ion batteries in the renewable energy market. This advancement is part of their broader strategy to enhance energy resilience and support community development through reliable power supply solutions.

Zhejiang Narada Power Source Co., Ltd. specializes in comprehensive energy storage solutions and is recognized for its robust research and development in the lead-acid battery field. The company focuses on producing high-quality, high-performance batteries that are used across various applications, including renewable energy systems and large-scale industrial energy storage, making it a significant player in the global energy storage market.

In 2024, Clarios announced significant investments in expanding its production capacity for AGM vehicle batteries in Europe. This investment, amounting to approximately €200 million, aims to increase the annual production capacity by 50% by 2026, with major expansions planned for their Hanover plant in Germany. This expansion underscores Clarios’ commitment to advancing lead-acid battery technology and its application in the automotive sector.

Leoch International Technology Ltd continues to focus on the development and manufacturing of lead-acid batteries, catering to a wide range of applications including telecommunications, renewable energy systems, and transportation. The company is recognized for its comprehensive approach to battery solutions, emphasizing product reliability and innovation to meet the growing demands of global energy storage markets.

Yokohama Batteries Sdn. Bhd is actively involved in the lead-acid battery market, particularly noted for their production capabilities within the automotive sector. As of 2024, the company is a part of the broader market dynamics that are driven by significant growth in automotive production and advancements in battery technology. The lead-acid battery market itself is expected to experience substantial growth, with a projected increase in market size influenced by the demand across various industries, including automotive and renewable energy storage.

EnerSys, a global leader in industrial batteries, has been expanding its influence and operations significantly. In 2024, the company announced acquisitions that strengthen its business, particularly in Southeast Asia and Australia, enhancing its capabilities and reach in the lead-acid battery market. These strategic moves are set to bolster EnerSys’s position in the global market, tapping into the increasing demand for reliable energy storage solutions across critical applications such as telecommunications, UPS systems, and the automotive industry.

Exide Industries Limited is progressing towards becoming a $2 billion company, driven by substantial investments in lead-acid and lithium-ion battery technologies. In 2023, the company increased its investment in advanced AGM VRLA batteries, which are set to hit the market in 2024, aimed at the automotive sector. This move aligns with their strategy to strengthen their foothold in the burgeoning Indian EV market and expand their global presence in 60 countries.

GS Yuasa Corporation continues to enhance its lead-acid and lithium-ion battery offerings. In 2023, the company focused on expanding its manufacturing capacities, particularly in Turkey and introduced a new series of valve-regulated stationary lead-acid batteries. These initiatives are part of GS Yuasa’s ongoing efforts to cater to the increasing global demand for reliable and efficient energy storage solutions, especially in the automotive sector.

Hoppecke Batterien GmbH & Co. KG is recognized for its broad portfolio of lead-acid and other types of industrial batteries, catering to a wide array of applications including emergency power supply systems (UPS), railway infrastructure, and energy supply for critical applications. In 2023, they continued to innovate within their grid | power V M line, a vented, stationary lead-acid battery designed for safety-critical systems, showcasing their commitment to high-quality energy solutions and sustainability. Their efforts focus on providing reliable energy with high current compatibility and long service life, suited for industrial and safety-critical uses.

Crown Battery Corporation specializes in the manufacturing of high-quality lead-acid batteries, offering products across various sectors including automotive, solar, and industrial applications. With a strong emphasis on sustainability and recycling, Crown Battery is committed to providing dependable and eco-friendly energy solutions. Their batteries are known for durability and performance, making them a preferred choice for heavy-duty and renewable energy applications. As of 2024, Crown continues to enhance its product lines to meet the growing demands of the energy storage and automotive sectors, emphasizing innovation and customer satisfaction in its operations.

C&D Technologies, Inc. has been actively advancing its presence in the lead-acid battery market, focusing on a diverse range of valve-regulated lead-acid (VRLA) batteries. Throughout 2023 and into 2024, the company continues to innovate with its AGM, Pure Lead AGM, Gel, and Nano-Carbon technologies, catering to demands across various applications such as telecommunications, UPS systems, and other energy storage solutions. C&D’s offerings are particularly noted for their robust cycling capabilities and extended lifespans, which are a result of their advanced paste and grid technologies. These developments ensure that C&D Technologies remains a key player in the stationary and motive power battery markets, poised for continued growth and adaptation in response to evolving industry needs.

Coslight Technology International Group Co. Ltd specializes in the manufacture of various battery types, including lead-acid batteries for a wide array of applications. This company has been recognized for its innovation and capacity to supply high-quality battery products that are integral to telecommunications, electric vehicles, and renewable energy storage systems. As of 2023, Coslight continues to expand its technology and production capabilities, focusing on enhancing product performance and meeting the growing global demand for efficient and reliable energy storage solutions.

East Penn Manufacturing Co. has solidified its position in the lead-acid battery market by focusing on sustainable manufacturing practices and innovative battery solutions, particularly noted in 2023. The company has been leveraging advanced technology to enhance the efficiency and lifespan of their batteries, catering to a wide range of applications from automotive to industrial uses. East Penn’s commitment to environmental stewardship is reflected in their comprehensive recycling programs, which are integral to their operational ethos.

Chaowei Power Holdings Limited, a key player in the lead-acid battery market, experienced significant growth in 2023, with revenue increasing by 26.4% to RMB 40.4 billion. This growth was driven by robust sales in lead-acid and lithium-ion batteries, particularly for electric bikes and electric vehicles. Chaowei’s advancements in battery technology and production efficiency have bolstered their market position, particularly in the competitive Chinese market, where they continue to expand their influence and capabilities in energy storage solutions.

Zhangzhou Huawei Power Supply Technology Co., Ltd. has been actively expanding its product range and enhancing its capabilities in the lead-acid battery market for energy storage. In 2023, the company continued to focus on developing high-quality VRLA, AGM, and gel batteries tailored for various applications including solar power systems, UPS, and other energy storage needs. Their commitment to innovation and quality has solidified their position as a reliable supplier in the global market, particularly noted for their deep-cycle batteries which are essential for renewable energy systems and backup power solutions.

B.B. Battery Co., Ltd. is recognized for its extensive range of lead-acid batteries, serving a wide array of applications from portable devices to large-scale energy systems. The company’s products are well-regarded for their reliability and performance, particularly in UPS systems and other backup power applications. As of 2024, B.B. Battery continues to leverage its advanced manufacturing techniques and rigorous quality control measures to enhance product longevity and performance, ensuring they meet the evolving demands of both traditional and emerging markets.

Camel Group Co., Ltd., headquartered in Asia, stands as the region’s largest lead-acid battery manufacturer as of 2023. The company specializes in the R&D, production, sales, and recycling of advanced batteries, embracing both lead-acid and emerging lithium-ion technologies. With a firm commitment to the green energy transition, Camel Group has strategically positioned itself with extensive production bases and R&D centers to innovate within the automotive and energy storage sectors. Their proactive approach in advancing battery technology continues to fortify their market presence and cater to a growing global demand for sustainable and efficient energy solutions.

Conclusion

In conclusion, the lead-acid battery market for energy storage remains robust due to its established technology and cost-effectiveness, particularly in applications requiring reliable and economical energy storage solutions. Despite facing competition from emerging battery technologies such as lithium-ion, lead-acid batteries continue to be indispensable in areas like renewable energy integration, telecommunications, and transportation, especially in emerging economies.

Opportunities for growth are bolstered by advancements in recycling and manufacturing processes that enhance the performance and sustainability of these batteries. As the global energy landscape evolves towards more renewable sources, the adaptability and economic advantages of lead-acid batteries ensure they retain a significant role in the future of energy storage.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)