Table of Contents

Introduction

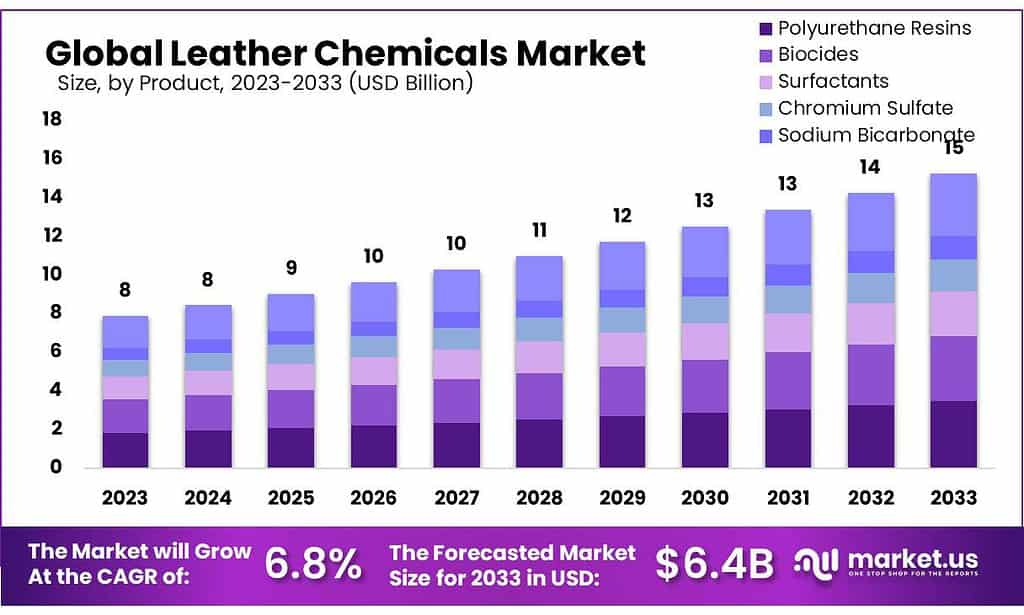

The global Leather Chemicals Market is poised for robust growth, projected to nearly double from USD 7.9 billion in 2023 to USD 15.2 billion by 2033, advancing at a compound annual growth rate (CAGR) of 6.8%. This growth is driven by a surge in demand for leather products across various sectors, including automotive, footwear, and furniture, necessitating extensive use of leather chemicals for processing and finishing.

Key growth factors include the increasing adoption of advanced manufacturing technologies, which enhance the efficiency of leather production, and the rising global demand for quality leather products. These factors are bolstered by a growing middle-class population with higher disposable income, especially in emerging markets, which has expanded the customer base for luxury leather goods.

However, the market faces challenges such as the fluctuating costs of raw materials and increasing regulatory scrutiny regarding the environmental impact of leather processing chemicals. These challenges are compounded by the volatile nature of fashion trends, which can significantly affect demand patterns.

Recent developments in the industry reflect a focus on sustainability and innovation. Companies are exploring bio-based and less environmentally damaging chemical alternatives to traditional tanning and processing chemicals. For instance, advancements in tanning technology aim to reduce the environmental footprint by minimizing the use of harmful substances like chromium and promoting cleaner production practices.

Stahl International B.V. has been focusing on sustainable production methods. This aligns with industry trends where companies are increasingly adopting environmentally friendly practices to meet consumer and regulatory expectations. Lanxess AG recently entered into a collaboration with TotalEnergies in January 2023 to supply bio-circular styrene, emphasizing sustainability by offering products with a reduced carbon footprint. This move is part of a broader strategy to integrate eco-friendly resources into their production processes.

Key Takeaways

Market Growth: The leather chemicals market is projected to reach around USD 15.2 billion by 2033, exhibiting a robust CAGR of 6.8% from USD 7.9 billion in 2023.

Polyurethane resins dominated the market in 2023, representing 22.9% of total revenue. Their versatility and eco-friendly nature are expected to further boost demand.

Surfactants are also projected to grow at 7.0%, playing a significant role as surface-active agents in leather-making processes.

Process Analysis: Tanning & dyeing processes accounted for over 48.0% of revenue in 2023.

The beamhouse segment is expected to grow at a CAGR of 6.6%, driven by operations involved in preparing hides and skins for preservation.

Application Insights: Footwear dominates the market with over 51% revenue share in 2023, attributed to increased leather demand.

Upholstery follows with a projected CAGR of 6.5%, especially driven by its use in the automotive and furniture industries.

The Asia Pacific was the dominant market for leather chemicals, accounting for a revenue share of over 50.0% in 2021.

Leather Chemicals Statistics

- Raw Material: The leather industry uses animal skins from the meat industry, converting waste into valuable products. Approximately 20% of raw materials become finished leather.

- Chromium Use: 1 metric ton of raw material generates 200 kg of usable leather and 50,000 kg of chromium-containing wastewater.

- Pollution: Leather tanning involves chemicals that produce toxic pollutants. One metric ton of raw material yields 60% solid and liquid waste, including carcinogenic chromium.

- Exports 70% of production to over 25 countries on four continents.

- Products are renewable, 100% biodegradable, compostable, and part of the circular economy.

- Bio-Sourced Products: Some traditional vegetable-tanned leathers are 95% bio-sourced and only 5% fossil fuel-based.

- Automotive Leather: Typically, 65% bio-sourced and 35% fossil fuel-based.

- General Leather Types: On average, leather is about 80% bio-sourced and 20% fossil fuel-based.

- Artificial Textiles: Approximately 70-80% fossil fuel-based and 20-30% bio-sourced.

- Annual Leather Production: Bihar produced 1500 metric tons of leather in 2022.

- Year-on-Year Growth: The leather industry in Bihar grew by 5% from 2021 to 2022.

- Export Volume: In 2022, Bihar exported 500 metric tons of leather products.

- Export Revenue: Leather exports generated $5 million for Bihar in 2022.

- Employment: The leather industry in Bihar employed 10,000 workers in 2022.

- Number of Leather Units: There are 150 registered leather manufacturing units in Bihar.

- FDI Inflows: The leather sector in Bihar received $1 million in foreign direct investment in 2022.

- Domestic Market Share: Bihar holds a 10% share of India’s domestic leather market.

- Leather Chemicals Usage: Bihar used 200 metric tons of leather chemicals in 2022.

- Growth Forecast: The leather industry in Bihar is expected to grow by 7% in 2023.

Emerging Trends

Emerging trends in the Leather Chemicals Market reflect a significant shift towards sustainability and innovation. A notable trend is the rise of synthetic and plant-based materials as alternatives to traditional animal-derived leather. This shift is driven by increasing consumer interest in veganism and ethical consumerism, prompting manufacturers to explore vegan leather options that are both eco-friendly and sustainable. This trend not only meets consumer demands for ethical products but also influences production processes as manufacturers adopt new materials that require different chemical treatments.

Another significant trend is the focus on enhancing the aesthetic and functional quality of leather through advanced finishing chemicals. These chemicals are crucial for improving the durability, appearance, and texture of leather, making it suitable for high-end applications in the fashion, automotive, and furniture industries. Innovations in finishing treatments, such as the use of polyurethane resins, are pivotal as they provide leather with enhanced resistance to water, stains, and wear while maintaining flexibility and aesthetic appeal.

Furthermore, the industry is seeing a growing emphasis on transparency and traceability in the leather supply chain. Consumers increasingly demand to know the origin of leather products and the chemicals used in their production. In response, companies are adopting more transparent practices and obtaining certifications to reassure customers of their commitment to ethical and sustainable practices.

Use Cases

- Tanning and Retanning: Chemicals used in tanning and retaining are crucial for transforming raw animal hides into durable and long-lasting leather. This process stabilizes the collagen fibers in the hides, making the leather resistant to decomposition. Tanning agents include chrome tanning agents, vegetable tanning agents, and synthetic alternatives like Zeology, which offers a more sustainable option.

- Fatliquoring: This process involves the use of fatliquors, which are typically made from natural oils. Fatliquors are crucial for softening and enhancing the flexibility of leather, making it less prone to cracking. They are applied at different stages depending on the desired characteristics of the final product and can also impart water resistance, particularly useful in outdoor footwear.

- Dyeing: Dyestuffs play a significant role in the aesthetic aspect of leather production. They are used to impart color to the leather through processes that can occur at various stages of production. The two main types of dyestuffs are aniline dyes, which provide a natural appearance and deep penetration, and pigment dyes, which sit on the surface and offer uniform color.

- Finishing: Finishing chemicals are applied to enhance the appearance, feel, and durability of leather. These include resins and polishes that create a protective coating and glossy finish. Finishing processes are crucial for improving resistance to water, stains, and wear, affecting the leather’s gloss, softness, and colorfastness.

- Environmental and Safety Considerations: The use of leather chemicals must consider environmental compliance and chemical safety. Advanced facilities utilize solar energy to reduce carbon footprints, and companies are required to adhere to strict environmental regulations regarding the handling and disposal of chemicals. It’s also important for the safety of workers handling these chemicals, requiring proper training and safety measures.

Key Players Analysis

Bayer AG in the leather chemicals sector is recognized for its comprehensive range of specialty chemicals that cater to high-quality leather production, from the beam house to finishing. Bayer focuses on innovative solutions including NMP-free polyurethane dispersions for leather finishing, contributing to safer and more environmentally friendly products. They are also leaders in chrome tanning materials and polymer tanning materials, reflecting their strong position as a top supplier in the global market.

Elementis plc has not been detailed specifically in recent sources regarding their activities in the leather chemicals sector. For updated and specific information regarding Elementis plc’s involvement, direct inquiries or a detailed look at their corporate publications might be necessary.

tahl International B.V. is a leader in the leather chemicals sector, offering advanced leather finishing solutions that prioritize environmental responsibility and safety. Their product portfolio includes solutions for every stage of leather finishing, from upgrading to color finishing, while adhering to international environmental standards. Stahl’s commitment to sustainability is evident in their Stahl Neo® portfolio, which features low-impact, high-performance products designed to meet the strictest environmental criteria.

Lanxess AG is renowned in the leather chemicals market for its broad range of products that cater to the leather tanning, dyeing, and finishing processes. They are particularly noted for their innovation in sustainable leather management, focusing on less environmentally damaging practices within the industry. Lanxess is committed to enhancing the efficiency and sustainability of leather production through its advanced chemical solutions and has a significant presence in global markets, consistently driving advancements in leather technology.

Texapel has established itself as a key player in the leather chemicals sector, holding over 80 years of expertise. Texapel specializes in developing chemical solutions that cater to various needs in the leather industry, including tanning, dyeing, and finishing. The company is recognized for its commitment to sustainable practices, evidenced by its achievement of ZDHC Level 3 certification. This certification underscores Texapel’s dedication to eliminating hazardous chemicals in their production processes, aligning with global sustainability standards.

Chemtan Company Inc., although not detailed in the latest sources, is known for its role in the leather chemicals industry. Typically, companies like Chemtan provide specialized formulations that assist in the tanning, retaining, and finishing processes in leather manufacturing. Firms in this sector focus on enhancing the quality and durability of leather, ensuring that their products meet the technical requirements of various leather goods manufacturers. For specific, recent developments or detailed information about Chemtan’s current activities in the leather chemicals market, direct contact with the company or access to their latest corporate releases would be necessary.

Lawrence Industries Limited, a UK-based specialty chemicals distributor, has a long-standing presence in the chemical industry with over five decades of experience. The company specializes in distributing high-quality additives, minerals, and catalysts across a variety of markets in the UK and Ireland. Their approach is deeply technical, with a team skilled in providing bespoke solutions to complex chemical challenges. This expertise makes them a valuable partner in various sectors, including leather chemicals, where their products contribute to the processing and enhancement of leather goods. Their commitment to understanding and addressing the specific needs of their customers highlights their role as a key player in the specialty chemicals distribution field.

Conclusion

In conclusion, the leather chemicals market is undergoing significant transformations driven by advancements in chemical technology and a growing emphasis on sustainability. With the increasing demand for high-quality leather products across various industries including fashion, automotive, and furniture, the need for efficient and eco-friendly leather processing chemicals continues to rise. Companies are innovating with sustainable practices, such as developing non-toxic tanning agents and recycling waste, to meet environmental standards and consumer expectations. The shift towards synthetic and plant-based alternatives is also reshaping the market, reflecting broader trends in consumer preferences towards vegan and cruelty-free products. These trends not only ensure the industry’s compliance with stringent environmental regulations but also open up new opportunities for growth and innovation in leather chemical production.