Table of Contents

Introduction

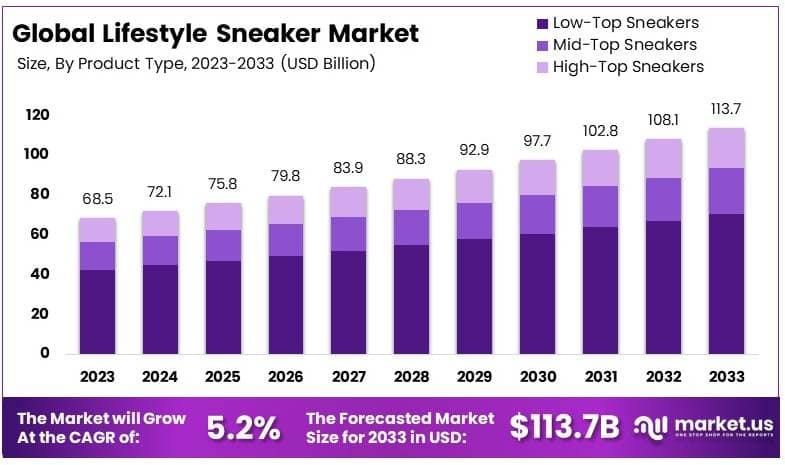

The Global Lifestyle Sneaker Market is projected to reach approximately USD 113.7 billion by 2033, up from USD 68.5 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 5.2% over the forecast period from 2024 to 2033.

Lifestyle sneakers are footwear designed with a focus on casual wear rather than athletic performance. Unlike traditional sports sneakers crafted for specific physical activities, lifestyle sneakers blend fashion, comfort, and style, targeting everyday use.

Typically, these sneakers incorporate both contemporary and classic design elements, often drawing inspiration from streetwear and pop culture to appeal to a broad consumer base. Materials, colors, and comfort-enhancing technologies are frequently prioritized, reflecting a shift in consumer behavior where versatility and style have become essential.

The lifestyle sneaker market refers to the global industry dedicated to designing, producing, and selling these versatile sneakers. This market encompasses a diverse range of brands, from luxury and heritage labels to fast fashion and sportswear companies. Key players in the lifestyle sneaker market include global athletic giants, designer brands, and niche streetwear companies. With substantial interest from Gen Z and Millennial consumers, the market has seen rapid growth in recent years, driven by increasing consumer demand for athleisure and multifunctional footwear options that fit both casual and semi-formal occasions.

Several factors are fueling growth in the lifestyle sneaker market. First, the rise of athleisure as a dominant fashion trend has blurred the line between athletic and everyday wear, making comfortable yet stylish footwear essential.

Additionally, the influence of social media and celebrity endorsements has propelled sneakers into the luxury and high-fashion sectors, capturing aspirational buyers. Innovation in materials, such as sustainable and eco-friendly options, has also expanded the market as brands respond to environmentally conscious consumers. Finally, increased disposable income in emerging economies has widened the market’s geographic reach, allowing brands to penetrate new demographics and regions.

Demand for lifestyle sneakers continues to be robust and is expected to grow as consumers increasingly seek products that offer a balance of style, comfort, and sustainability. The consumer shift toward a more casual approach to fashion, driven partly by remote work trends and the pandemic’s lasting effects, has led to a growing preference for sneakers over traditional footwear options.

Younger generations, particularly Millennials and Gen Z, are fueling demand with a focus on individual expression and brand storytelling. In addition, limited-edition releases and collaborations with artists or designers continue to generate hype and exclusivity, further driving demand within this competitive market.

The lifestyle sneaker market is rich with opportunities for growth, particularly in the realms of sustainability, customization, and digital innovation. Sustainability is one of the most promising areas, as brands that prioritize environmentally friendly materials and transparent production practices are well-positioned to attract eco-conscious consumers.

The rise of digital platforms and virtual try-ons also offers a means for brands to enhance customer engagement and streamline online purchasing experiences. Additionally, collaborations and limited-edition releases remain a valuable strategy for brands to generate excitement and foster consumer loyalty. As the market continues to evolve, companies that leverage technology, cultural relevance, and sustainable practices are likely to see sustained success and differentiation in a crowded field.

Key Takeaways

- The lifestyle sneaker market was valued at USD 68.5 billion in 2023 and is projected to reach USD 113.7 billion by 2033, growing at a CAGR of 5.2%.

- Low-top sneakers dominated the product segment in 2023, accounting for 62.1% of the market, driven by their casual style and versatility.

- Sneakers priced under $50 led the market in 2023 with a 32.5% share, reflecting strong demand for affordable options in the mass market.

- Men represented 56.3% of the end-user segment in 2023, indicating a notable preference for lifestyle sneakers among male consumers.

- Offline retail channels held a 69.2% market share in 2023, underscoring the ongoing significance of physical stores in sneaker sales.

- North America led the market in 2023 with a 34.2% share, driven by robust consumer demand for lifestyle-oriented athletic footwear.

Lifestyle Sneaker Statistics

- 72% of consumers are willing to pay more for sustainable sneaker options.

- Sneaker enthusiasts spend an average of $392 annually on sneakers.

- Social media drives around 50% of all sneaker purchases.

- Nike will manufacture over 800 million pairs of shoes in 2023, a 2.6% increase from 2022’s 780 million pairs.

- Nike sells an estimated 26 pairs of shoes every second.

- The average weight of a Nike shoe is 440 grams, totaling 880 grams per pair.

- Nike sneakers generally last 1-3 years or about 200-300 miles, depending on usage.

- The average resale profit margin for sneakers was 54% in 2023.

- Instagram influencer posts featuring sneakers generated approximately $1.2 billion in media value in 2023.

- The average consumer owns about 4.7 pairs of sneakers.

- Collaborations made up 35% of premium sneaker releases, indicating high consumer interest.

- Vegan sneakers experienced an 89% increase in demand, reflecting a shift towards sustainable options.

- Mobile shopping accounted for 73% of all online sneaker purchases.

- Running sneakers adapted for lifestyle wear saw a 56% growth in popularity.

- Secondary market sneaker prices declined by an average of 9% in 2023.

- Direct-to-consumer sales for major sneaker brands rose by 40%.

- Basketball-inspired lifestyle sneakers grew by 28% in sales.

- Customizable sneaker options increased by 67%, showing high consumer interest in personalization.

- Sneaker collections owned by enthusiasts are valued at an average of $4,200.

- White sneakers maintained a 40% share of casual sneaker sales, proving their popularity as a staple.

- Women’s exclusive sneaker colorways saw an 89% increase in demand.

- Limited-edition sneaker releases decreased by 15%, though their values increased by 34%.

- Sneaker photography services grew by 145%, driven by demand for high-quality social media visuals.

- Adoption of digital sneaker design tools surged by 234%, reflecting a trend toward virtual creativity.

Emerging Trends

- Retro Revivals with Modern Flair: Vintage-inspired sneakers, such as the Adidas Samba and New Balance 990v4, are resurging with contemporary twists. Consumers are gravitating towards designs that evoke nostalgia but incorporate updated materials or unique details, like contrasting stitching or eco-friendly fabrics. This blend of past and present resonates especially with younger audiences who value both history and innovation in their fashion choices.

- Bold Colors and Pattern Play: Bright, statement-making colorways and eye-catching patterns are defining sneaker aesthetics this year. Vibrant hues like neon green, bold pinks, and multicolored patchworks are especially popular, driven by consumers’ desire for self-expression. Brands like Saucony and New Balance are launching collaborations that highlight dynamic color combinations and textures, catering to the growing trend of “maximalist” fashion.

- Chunky, Cloud-Like Soles for Comfort: Chunky soles continue to gain traction, emphasizing both comfort and style. Often referred to as “cloud” or “dad” sneakers, these designs offer ample cushioning and are increasingly seen as versatile enough for both streetwear and semi-casual settings. This focus on comfort aligns with the broader “athleisure” movement, appealing to consumers who seek functionality without sacrificing fashion.

- Nature-Inspired and Earthy Tones: Neutral and earthy tones, such as beige, olive, and brown, are also becoming a staple in lifestyle sneakers. These subdued colors lend themselves well to a range of styles and are part of a broader sustainability focus, with brands using organic materials and eco-friendly production practices. Sneakers in these shades, like the New Balance x Stone Island collaborations, offer an understated aesthetic that appeals to eco-conscious and style-savvy consumers.

- Hybrid Hiking-Inspired Designs: The “Gorpcore” trend is infusing elements of outdoor wear into urban sneakers. Hiking-inspired details, such as reinforced soles, rugged materials, and waterproofing, are being incorporated into lifestyle sneaker designs. This trend caters to the crossover between city and outdoor lifestyles, meeting consumer demand for versatile footwear that transitions seamlessly from nature trails to city streets

Top Use Cases

- Everyday Comfort and Versatility: Lifestyle sneakers are favored for daily wear due to their comfortable designs and flexible style. They provide support for people on the move throughout the day, making them ideal for casual settings, errands, or even low-key office environments. Their design and cushioning make them a top choice for people seeking both comfort and style.

- Fashion and Self-Expression: Lifestyle sneakers serve as a fashion statement, enabling consumers to express their personal style. Models like the Adidas Gazelle and Nike Air Force 1, which cost from $100 to $200, are popular choices for their aesthetic appeal and alignment with current fashion trends. Sneakers make up nearly 25% of footwear sales in fashion-oriented demographics.

- Athleisure and Multi-Functional Wear: These sneakers fit seamlessly into the athleisure trend, allowing consumers to transition from workouts to casual settings without changing footwear. High-performing models, such as the New Balance 990 series, priced around $330, exemplify this trend by offering technical features in a casual design.

- Sustainable and Ethical Consumer Choice: Lifestyle sneakers are increasingly produced using eco-friendly materials, appealing to environmentally conscious consumers. Brands like Adidas and Allbirds, known for their sustainable approaches, have influenced the market, which saw a 30% increase in demand for sustainable models. This segment is expected to grow, with sustainability-oriented consumers making up a larger portion of sneaker buyers.

- Collector’s Item and Investment: Limited-edition lifestyle sneakers have become collectible items, with resale markets often surpassing initial retail prices by 200% or more. For example, collaborations like Nike x Travis Scott sell out instantly and are resold for up to $1,000 per pair. The resale market for collectible sneakers is now valued at over $2 billion globally, underscoring the investment potential of exclusive sneaker models

Major Challenges

- Market Saturation and Product Overlap: As the market for lifestyle sneakers has expanded, saturation has become a notable issue, particularly with the rapid frequency of new releases across brands. Consumers are increasingly experiencing “sneaker fatigue,” reducing demand for the latest models due to a surplus of similar offerings in style and function. For instance, brands are challenged to distinguish their products amidst a crowded market, with low-top sneakers alone accounting for 62% of sales, largely because of their versatility and universal appeal.

- Pricing Pressure and Affordability: While premium-priced sneakers ($100-$200) capture a significant market share, affordability remains a key challenge as nearly 32% of consumers favor sneakers under $50. This trend is driven by budget-conscious buyers, particularly in emerging markets, where price sensitivity is high. The increase in sneaker prices—due in part to inflationary pressures on materials and production—forces brands to balance quality with affordability while still meeting consumer expectations for style.

- Distribution Shift Toward E-Commerce: Though brick-and-mortar stores still account for roughly 69% of sneaker sales, the shift to e-commerce is accelerating, presenting logistical and customer experience challenges. Brands must ensure a seamless online shopping experience with accurate sizing, fast delivery, and easy returns. Adapting to this digital-first approach also involves integrating online and offline channels, as customers value the ability to try before buying, which is challenging to replicate online.

- Sustainability Concerns and Brand Responsibility: Growing consumer demand for sustainable products places pressure on brands to improve their environmental practices. This includes using eco-friendly materials, reducing waste in production, and offering recyclable or long-lasting footwear options. While consumers, especially in regions like Europe, prioritize sustainability, aligning with these expectations requires significant investment and adaptation in production processes, which can be costly and complex.

- Competitive Intensity and Consumer Expectations: The lifestyle sneaker market is highly competitive, with established brands like Nike and Adidas constantly innovating to retain their market share. Additionally, new entrants such as Salomon and ON are attracting attention with niche, performance-oriented designs. This dynamic forces established brands to maintain innovation in design and technology to meet high consumer expectations, as sneaker enthusiasts increasingly seek both style and unique functionality in their footwear

Top Opportunities

- Expansion of E-Commerce and Direct-to-Consumer Channels: As digital channels gain prominence, brands are increasingly able to reach consumers directly through online stores. This shift allows companies to offer exclusive products, online-only drops, and personalized experiences that drive consumer loyalty. The convenience and accessibility of e-commerce provide a strong growth pathway, particularly as more consumers favor the flexibility of online shopping over in-store options

- Expansion in Sustainable and Eco-Friendly Sneakers: Consumer demand for sustainable products is growing, with eco-conscious choices influencing purchase decisions in major markets like North America and Europe. Brands that invest in eco-friendly materials, like recycled fabrics or plant-based alternatives, are positioned to capture a larger share of this market. In fact, 72% of consumers indicate sustainability as a key factor in their purchasing choices, creating significant opportunity for brands to differentiate through green practices

- Increasing Focus on Women’s Market: The demand for women’s sneakers is growing, driven by a shift toward athleisure and style-driven comfort. Brands can capitalize on this by introducing women-specific designs and size ranges, with an emphasis on fashion-forward elements that appeal to both casual wearers and active users. Meeting the needs of this segment not only expands market reach but also supports brand differentiation

- Growth in Asia-Pacific: The lifestyle sneaker market in Asia-Pacific, particularly in countries like China and India, presents strong growth potential due to rising incomes, urbanization, and a burgeoning interest in fitness. Tailoring collections to suit local tastes and partnering with regional influencers can help brands capture the attention of this growing consumer base, making Asia-Pacific a strategic region for market expansion

- Leveraging the Resale and Collector Market: The sneaker resale market is thriving as limited-edition releases and exclusive collaborations generate high demand among collectors and fashion enthusiasts. Brands can capitalize on this trend by creating limited runs, partnering with resale platforms, or launching dedicated collector’s series. This approach not only drives revenue through direct sales but also boosts brand equity by enhancing the perceived exclusivity of products

Key Player Analysis

- Nike, Inc. : Nike leads the global lifestyle sneaker market with an estimated 18% market share as of 2022, driven by popular lines like Air Max and Air Force 1. In fiscal 2023, Nike reported $51.2 billion in revenue, with footwear accounting for nearly 67%. Nike’s strong digital strategy and frequent limited-edition drops contribute to its leadership.

- Adidas AG: Adidas holds a significant position with about 12% market share in the global sneaker market. Known for models like the Adidas Superstar and Gazelle, Adidas reported €22.5 billion in revenue in 2022. Recent collaborations, such as with Gucci, have bolstered its premium offerings. Adidas continues to focus on sustainability by expanding its recycled-material products.

- Vans (VF Corporation): Vans, a subsidiary of VF Corporation, generated approximately $4 billion in revenue for VF in 2022. Known for its classic and skate-inspired designs, Vans dominates among youth and streetwear consumers. Vans is expanding into international markets, focusing on Asia, where urban fashion is rapidly growing.

- New Balance Athletics, Inc.: New Balance has gained popularity with models like the 574 and 990 series. With an estimated revenue of $5.3 billion in 2022, it holds a solid position in lifestyle and performance footwear markets. Known for its “Made in the USA” series, New Balance appeals to consumers seeking quality and craftsmanship.

- Skechers USA, Inc.: Skechers reported $7.4 billion in revenue in 2022, growing primarily in the casual and comfort-focused lifestyle segment. Its extensive product range and competitive pricing appeal to a broad demographic. Skechers is expanding internationally, particularly in Asia, and investing in sustainability with eco-friendly lines

Recent Developments

- In 2024, JD Sports completed its acquisition of Marketing Investment Group (MIG), a Polish footwear and clothing retailer, solidifying its presence in Central and Eastern Europe. This transaction gives JD Sports full ownership of MIG, following its previous 40% minority stake. JD Sports stated that the acquisition supports its European expansion by enabling a streamlined approach and faster rollout of the JD brand across the region.

- In 2023, PUMA introduced Black Station 2, a metaverse platform that blends digital and physical retail experiences, allowing users to buy “phygital” footwear. Building on the original Black Station launched during New York Fashion Week in 2022, Black Station 2 offers an immersive environment with two unique worlds that showcase exclusive footwear designs, connecting virtual experiences with tangible products.

- In 2023, Authentic Brands Group acquired the intellectual property of British brand Hunter Boot Limited, strengthening its portfolio with Hunter’s iconic outdoor footwear heritage.

Conclusion

The lifestyle sneaker market is set for consistent growth as consumer preferences shift toward footwear that combines comfort, style, and versatility. With athleisure and casual wear gaining popularity, lifestyle sneakers have become essential for both everyday and semi-formal use. The demand for sustainable options is also rising, pushing brands to innovate with eco-friendly materials and ethical practices. Digital channels, particularly e-commerce and virtual try-ons, are expanding consumer reach, while collaborations and limited-edition releases help brands build exclusivity and loyalty. Despite challenges like market saturation and price sensitivity, the market holds strong opportunities for growth, especially through digital engagement, sustainable practices, and targeted demographic expansion in regions like Asia-Pacific.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)