Table of Contents

- Introduction

- Editor’s Choice

- Lingerie Market Statistics

- Value of the Global Lingerie Retail Market Statistics

- Revenue of the Night Apparel & Underwear for Women Industry Worldwide

- Bras Market Overview

- Leading Markets for Women’s Night and Underwear

- Lingerie Sales and Shipments Statistics

- Lingerie Imports Statistics

- Lingerie Exports Statistics

- Lingerie Price Trends Statistics

- Lingerie Preferences and Trends Statistics

- Lingerie Brand Preferences Statistics

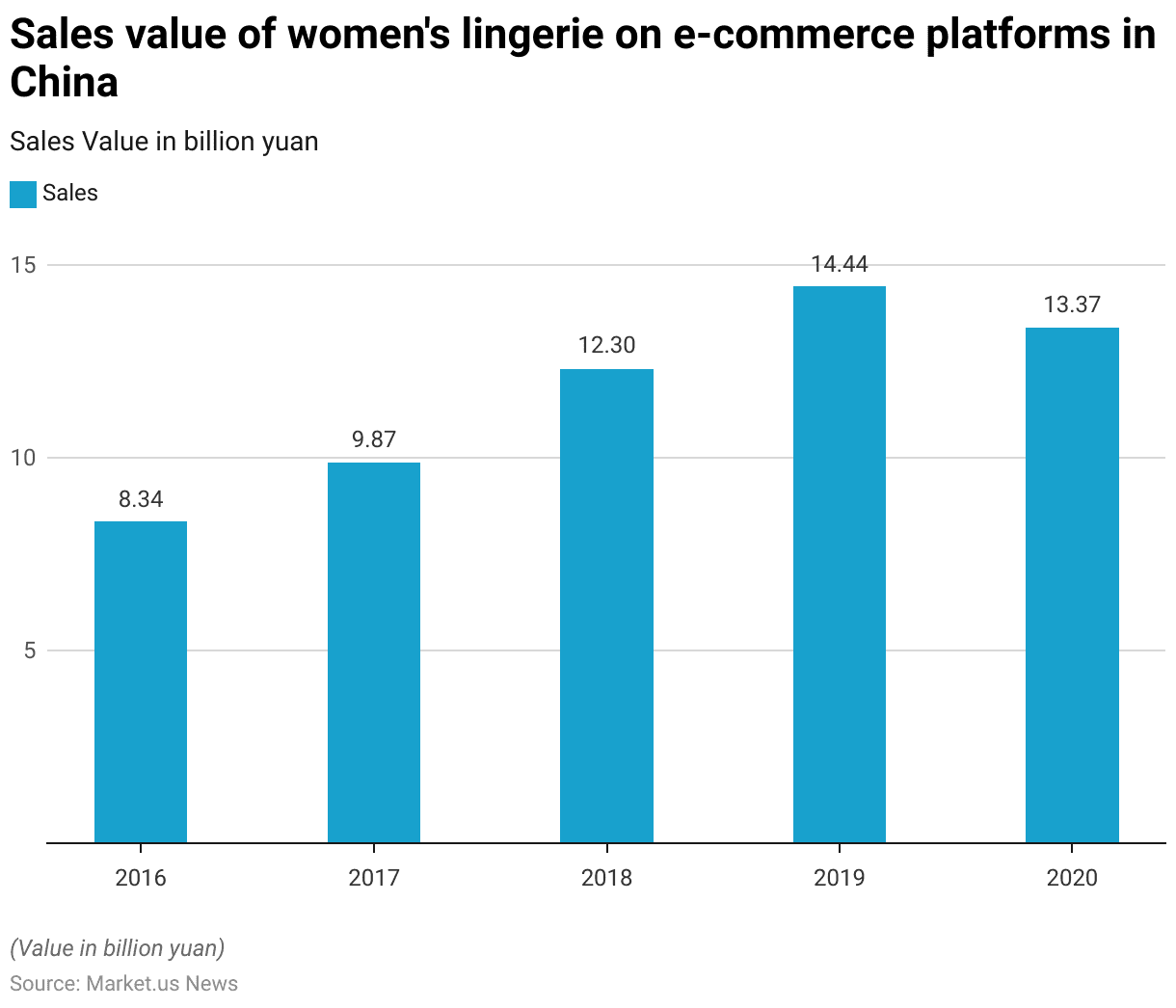

- Sales Value of Women’s Lingerie on E-commerce Platforms Statistics

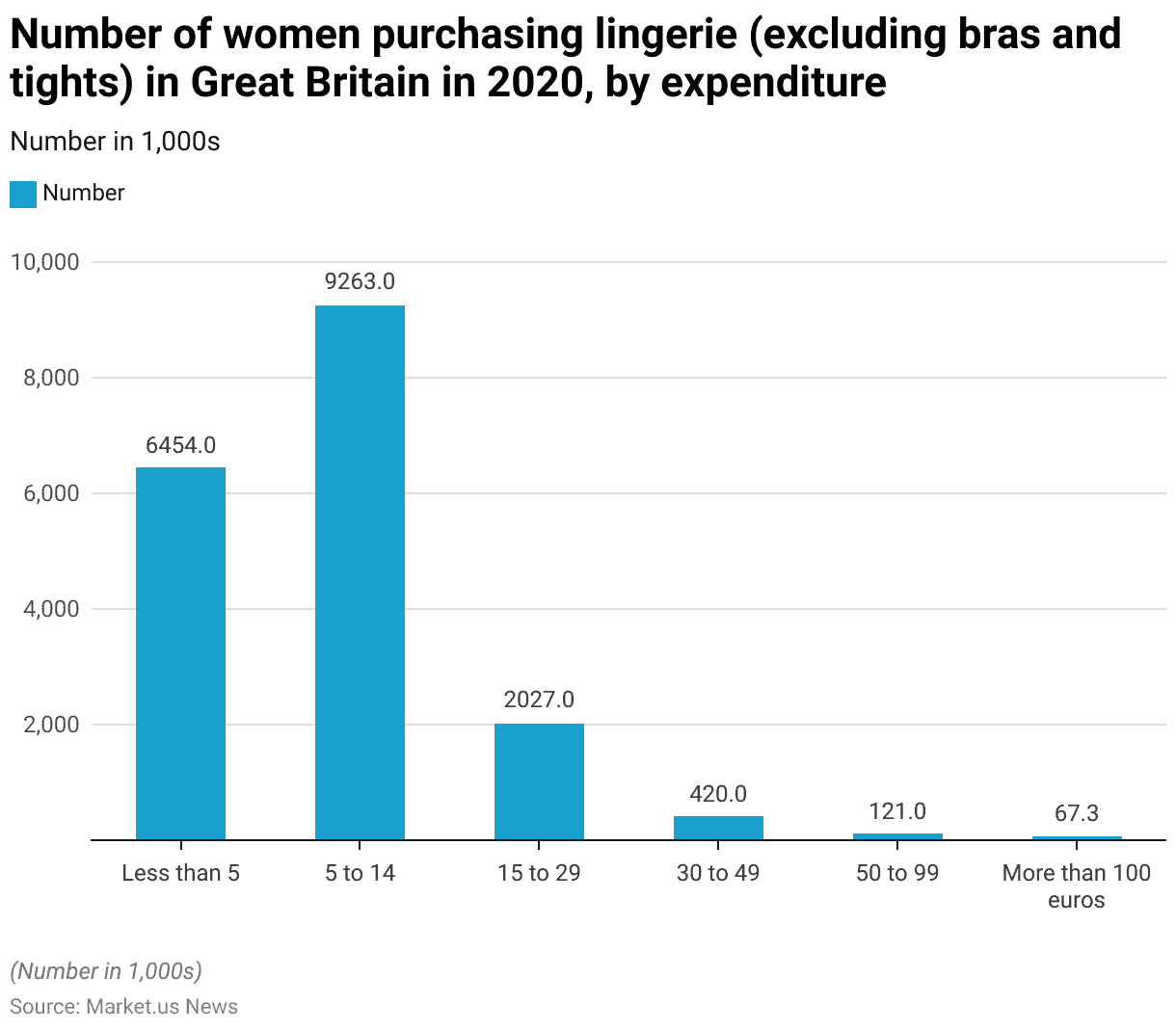

- Expenditure on Women’s Lingerie Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Lingerie Statistics: Lingerie is a vital component of women’s apparel, encompassing various undergarments designed for both function and aesthetics.

Key types include bras—such as T-shirts, push-ups, and sports bras—and panties, which range from briefs to thongs.

Materials like cotton, lace, and satin contribute to comfort and style. While proper fit is essential for support, necessitates accurate measurements and adjustable features.

Current trends highlight inclusivity, sustainability, and the influence of athleisure, with brands offering extended sizing and eco-friendly options.

Understanding these elements helps consumers select lingerie that aligns with their personal preferences and lifestyles.

Editor’s Choice

- The global lingerie market revenue is projected to reach USD 77.4 billion in 2033.

- In 2022, the competitive landscape of the global lingerie market was dominated by several key players. Each holds substantial market shares that reflect their prominence and consumer preference. Jockey International Inc. led the market with a 15% share, indicating a strong brand presence and widespread consumer trust.

- In 2022, the global lingerie market shares were distinctly distributed across different regions. Each showcases unique market dynamics and consumer preferences. Europe emerged as the leader in the lingerie market, holding the largest share at 35.0%.

- By 2027, the worldwide market value of women’s lingerie is anticipated to achieve a value of USD 78.66 billion.

- In 2022, the United States led the global market for women’s nightwear and underwear with a substantial revenue of USD 22,730.68 million, underscoring its dominant market position.

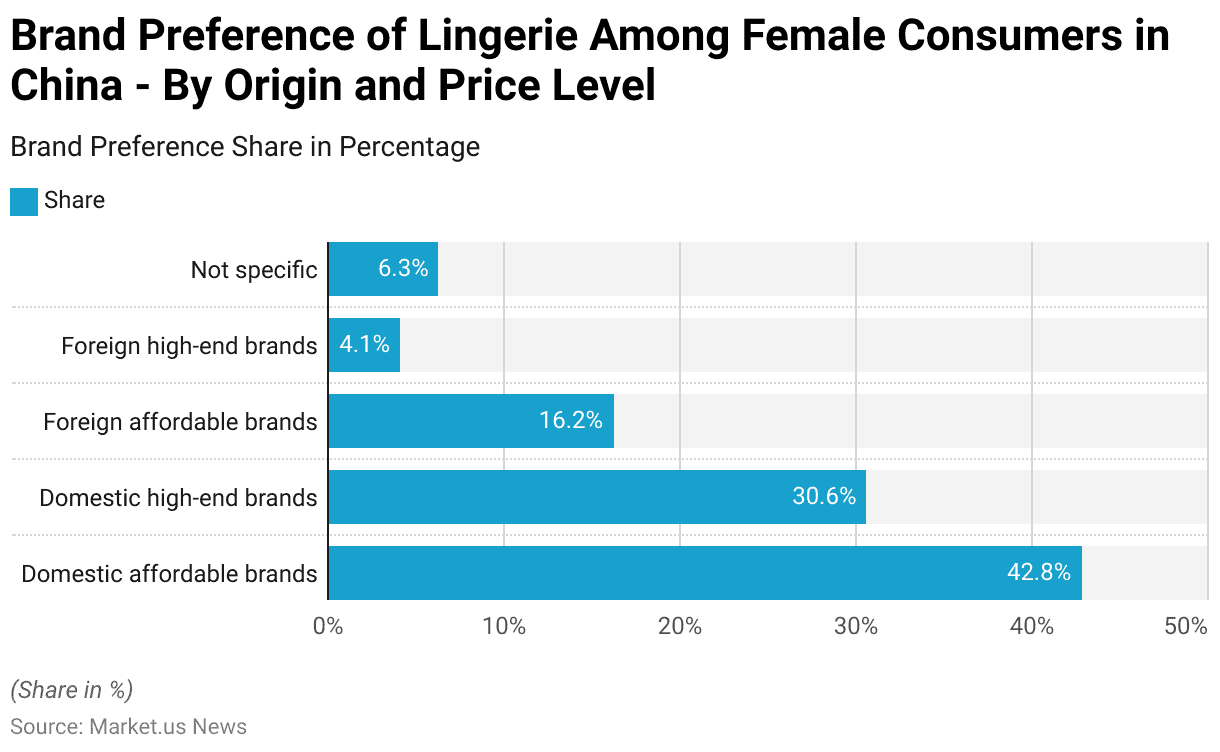

- In 2020, the brand preference for lingerie among female consumers in China was strongly oriented toward domestic brands. The largest share of consumers, 42.8%, preferred domestic affordable brands, indicating a significant demand for locally produced, budget-friendly options.

- In 2020, the purchasing behavior of women in Great Britain. Specifically for lingerie excluding bras and tights, varied significantly by expenditure. The majority of women, approximately 9.26 million, spent between 5 to 14 euros on lingerie. Indicating a preference for affordable options.

Lingerie Market Statistics

Global Lingerie Market Size Statistics

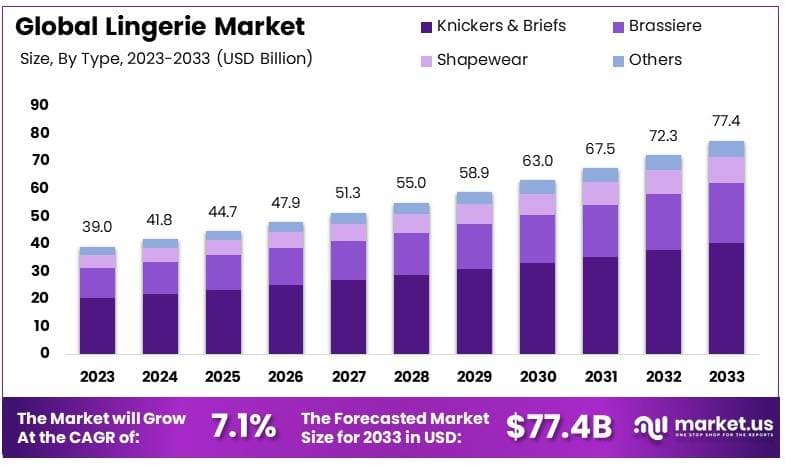

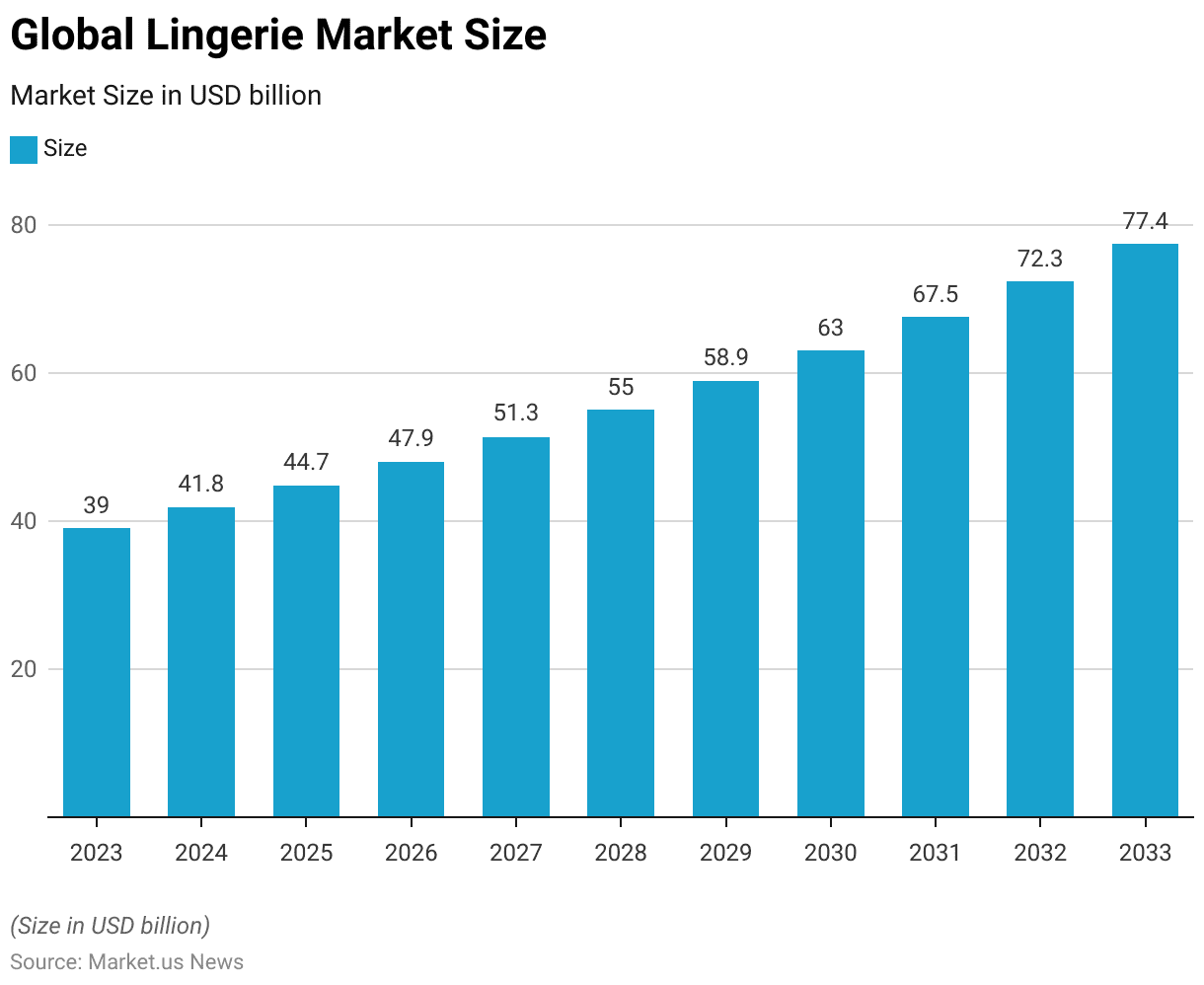

- The global lingerie market has demonstrated steady growth over the period from 2023 to 2033 at a CAGR of 7.1%.

- In 2023, the market revenue was recorded at USD 39.0 billion.

- This figure is expected to rise to USD 41.8 billion in 2024, marking a continued upward trajectory.

- By 2025, the market is projected to generate USD 44.7 billion in revenue. Further advancing to USD 47.9 billion in 2026.

- The consistent expansion of the market is forecasted to persist, with revenue reaching USD 51.3 billion in 2027 and USD 55.0 billion by 2028.

- Looking ahead, the growth trend is expected to accelerate, with the market size increasing to USD 58.9 billion by 2029.

- By 2030, global lingerie sales are projected to reach USD 63.0 billion.

- The market’s upward momentum is forecasted to continue through 2031, with revenues of USD 67.5 billion, followed by further growth to USD 72.3 billion in 2032.

- The market is expected to conclude this period at USD 77.4 billion in 2033.

- This sustained growth reflects a combination of evolving consumer preferences. Rising demand for premium lingerie products, and increased awareness of fashion trends globally.

(Source: market.us)

Competitive Landscape of the Global Lingerie Market Statistics

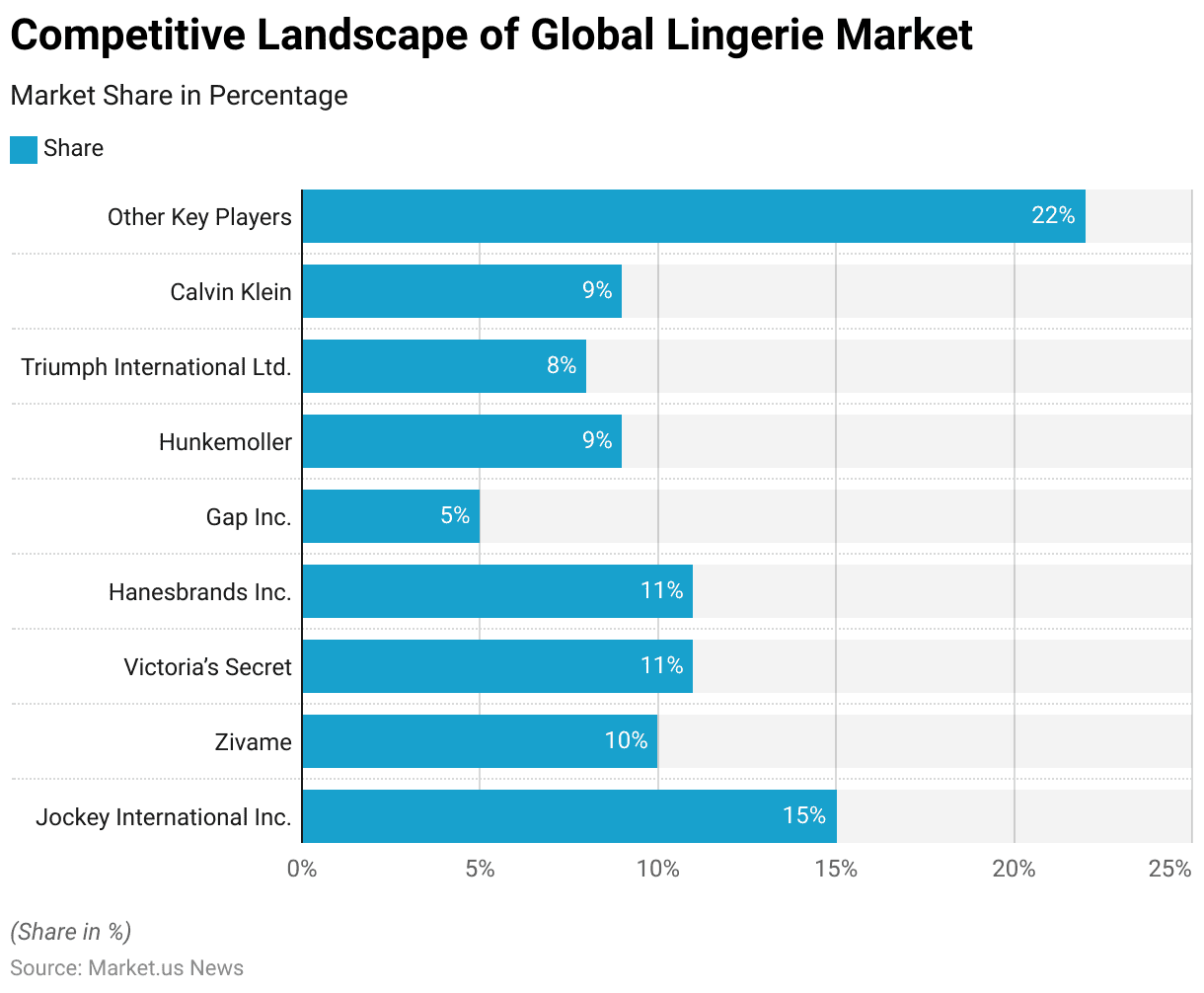

- In 2022, the competitive landscape of the global lingerie market was dominated by several key players. Each holds substantial market shares that reflect their prominence and consumer preference.

- Jockey International Inc. led the market with a 15% share, indicating a strong brand presence and widespread consumer trust.

- Zivame followed with a 10% market share, carving out a significant niche.

- Victoria’s Secret and Hanesbrands Inc. each held 11% of the market, demonstrating their enduring popularity and extensive global reach.

- Other notable competitors included Gap Inc., which held a 5% share of the market. Pointing to its strategic positioning within the affordable and accessible segment of the lingerie industry.

- Hunkemoller and Calvin Klein each captured 9% of the market, highlighting their strong brand identities and dedicated customer bases.

- Triumph International Ltd. accounted for 8% of the market. Underlining its role as a key player with a focus on quality and innovation.

- Additionally, a considerable 22% of the market was held by other key players. Emphasizing the diverse and fragmented nature of the industry where numerous smaller and specialized brands compete effectively.

- This segmentation reflects a highly competitive environment where brands strive to innovate and tailor their offerings to meet the evolving preferences and needs of consumers worldwide.

(Source: market.us)

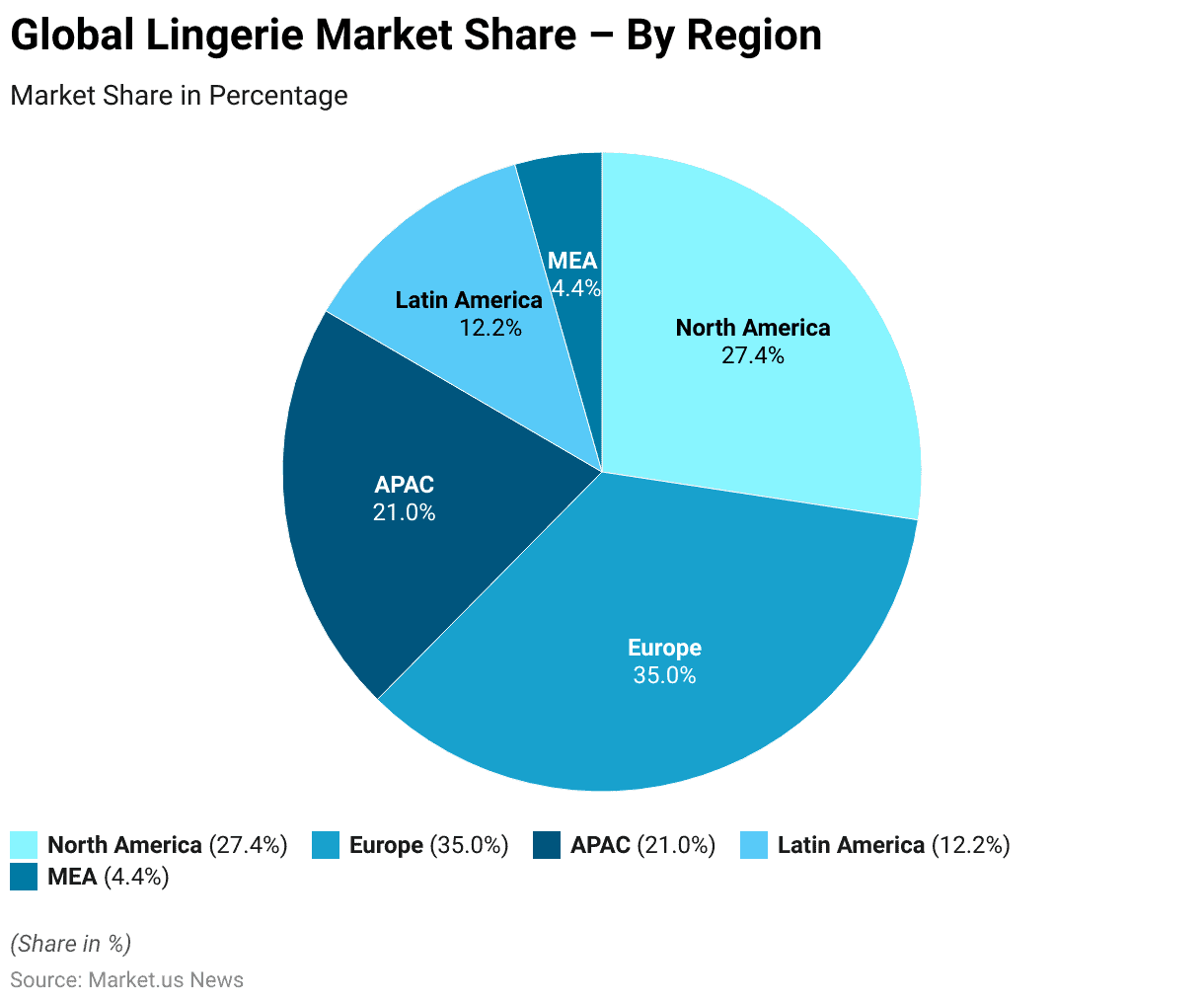

Regional Analysis of the Global Lingerie Market Statistics

- In 2022, the global lingerie market shares were distinctly distributed across different regions. Each showcases unique market dynamics and consumer preferences.

- Europe emerged as the leader in the lingerie market, holding the largest share at 35.0%. This can be attributed to the region’s strong fashion industry presence and high consumer spending power on luxury and high-quality garments.

- North America also represented a significant portion of the market, accounting for 27.4% of the global share. This is indicative of the region’s robust retail infrastructure and a strong trend toward personalization and comfort in apparel choices.

- The Asia-Pacific (APAC) region held a 21.0% share, reflecting its rapidly growing consumer base and increasing disposable income. Which are driving demand for premium and diverse lingerie options.

- Latin America accounted for 12.2% of the market. Where evolving fashion trends and growing awareness about different lingerie styles are influencing purchases.

- The Middle East and Africa (MEA) region, while having the smallest share at 4.4%. It is still a noteworthy market due to its developing retail sectors and an increasing number of global brands entering these markets to tap into the growing middle-class consumer segment.

- The overall distribution of market shares highlights the global reach and cultural diversity influencing the lingerie industry.

(Source: market.us)

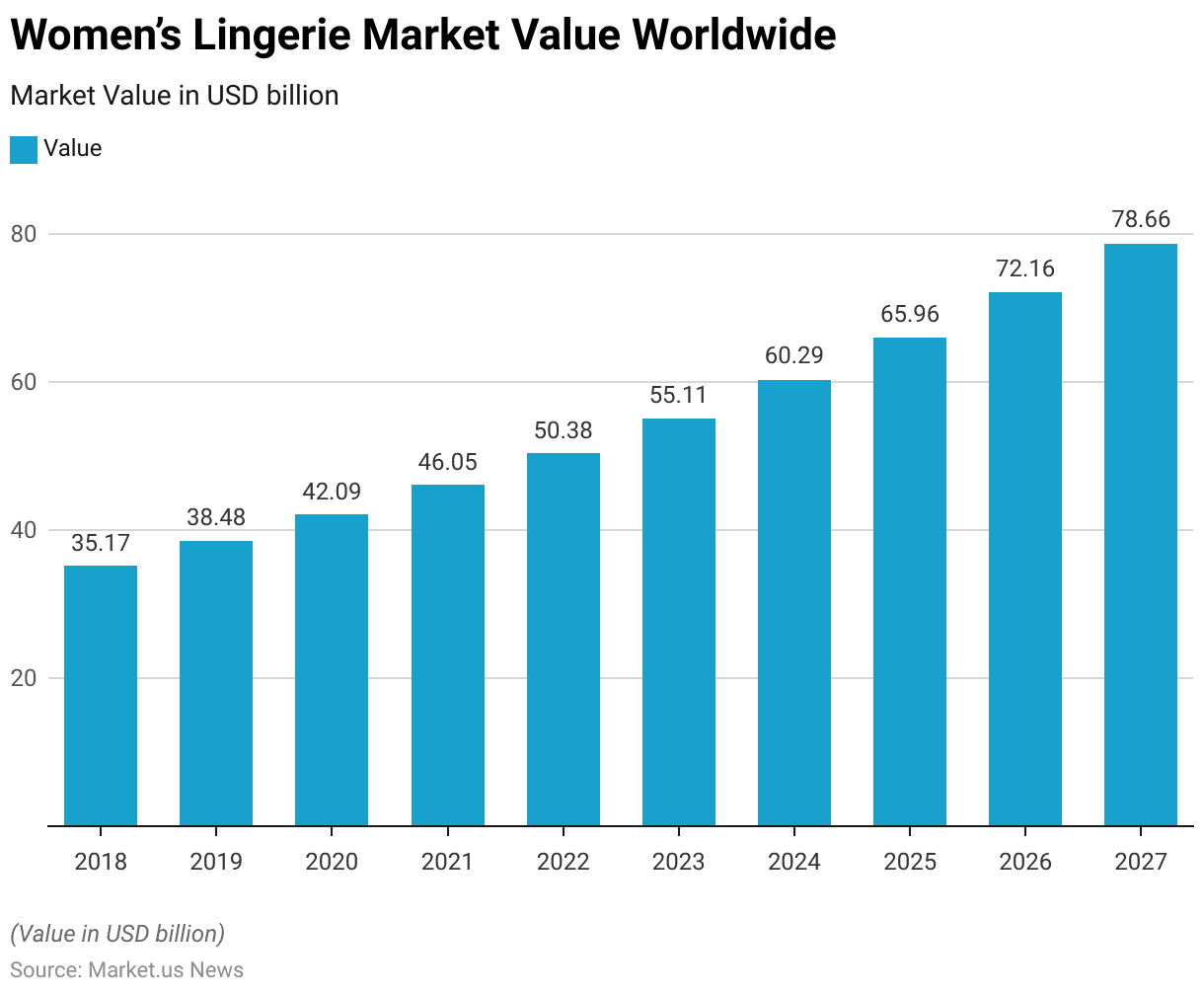

Value of the Global Lingerie Retail Market Statistics

- The worldwide market value of women’s lingerie has experienced substantial growth from 2018 to 2027.

- Starting in 2018, the market was valued at USD 35.17 billion.

- This value increased consistently over the following years, rising to USD 38.48 billion in 2019.

- The growth trend continued through 2020, when the market value reached USD 42.09 billion, despite global economic uncertainties.

- In 2021, the market expanded further to USD 46.05 billion. Followed by an increase to USD 50.38 billion in 2022, demonstrating a robust demand for women’s lingerie.

- By 2023, the market is projected to grow to USD 55.11 billion, and this upward trajectory is expected to persist, with the market value reaching USD 60.29 billion in 2024.

- The market is forecasted to continue its expansion, with projected values of USD 65.96 billion in 2025 and USD 72.16 billion in 2026.

- By the end of the forecast period in 2027, the market is anticipated to achieve a value of USD 78.66 billion.

- This sustained growth is indicative of the increasing consumer interest in lingerie products. Influenced by factors such as fashion trends, increasing purchasing power, and a growing emphasis on personal style and comfort in apparel.

(Source: Statista)

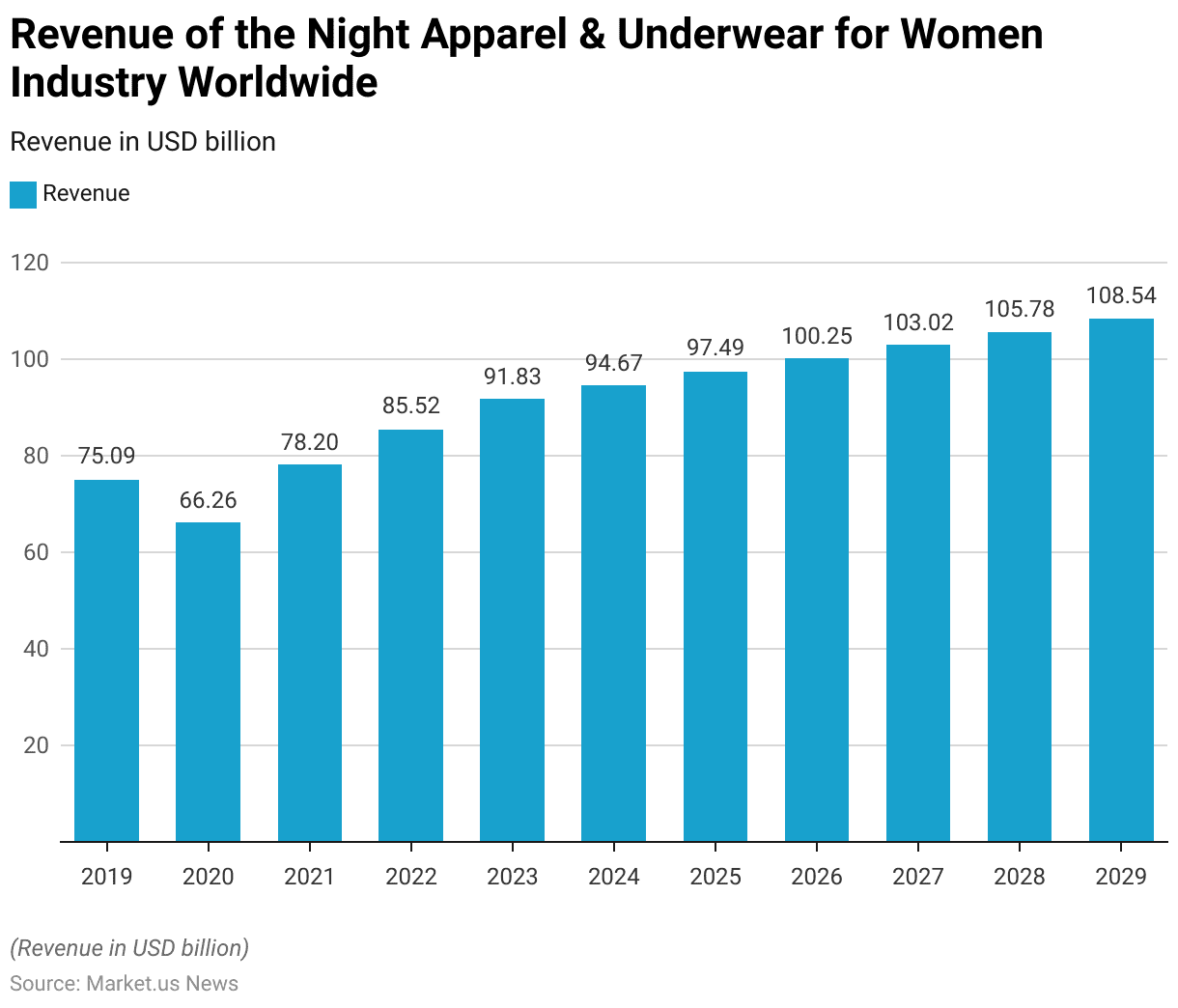

Revenue of the Night Apparel & Underwear for Women Industry Worldwide

- The revenue of the global market for women’s night apparel and underwear has shown significant fluctuations and growth from 2019 to 2029.

- In 2019, the market generated USD 75.09 billion.

- However, there was a noticeable decline in 2020 when revenue dropped to USD 66.26 billion, likely impacted by global economic conditions.

- Following the decline, there was a rebound in 2021, with revenue increasing to USD 78.2 billion.

- This recovery trend continued into 2022, with market revenue rising further to USD 85.52 billion.

- The growth trajectory was maintained in 2023, with revenues reaching USD 91.83 billion.

- A steady increase was observed over the subsequent years; in 2024, the market generated USD 94.67 billion, and this upward trend continued into 2025 with revenues of USD 97.49 billion.

- By 2026, the market surpassed the USD 100 billion mark, recording revenues of USD 100.25 billion.

- The growth persisted into the latter part of the decade, with revenues increasing to USD 103.02 billion in 2027, USD 105.78 billion in 2028, and projected to reach USD 108.54 billion by 2029.

- This consistent growth underscores an expanding demand for women’s night apparel and underwear, driven by evolving fashion trends. Rising disposable incomes, and the increasing prioritization of comfort and style in consumer choices.

(Source: Statista)

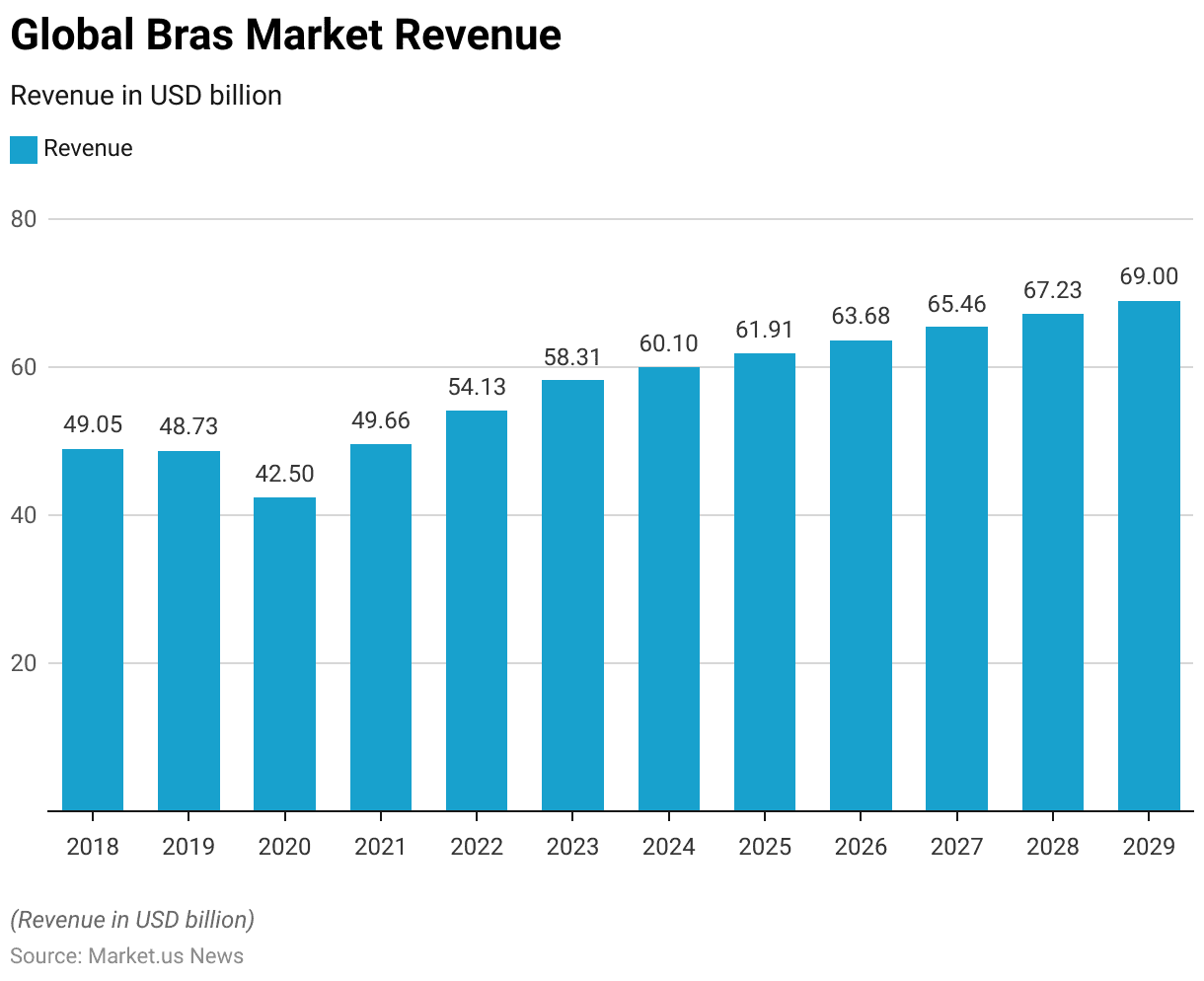

Bras Market Overview

Global Bras Market Revenue

- The global bras market has exhibited a dynamic revenue trajectory from 2018 to 2029 at a CAGR of 2.80%.

- In 2018, the market was valued at USD 49.05 billion.

- It experienced a slight decline in 2019, dropping to USD 48.73 billion.

- The most significant reduction occurred in 2020, when revenue fell to USD 42.50 billion, likely due to global economic disruptions.

- However, the market began to recover in 2021, with revenue increasing to USD 49.66 billion.

- This recovery trend strengthened further in 2022, with the market value reaching USD 54.13 billion.

- By 2023, the revenue had risen to USD 58.31 billion, demonstrating robust growth and a rebound in consumer spending.

- The market continued to expand steadily in the following years. In 2024, revenue was recorded at USD 60.10 billion, followed by USD 61.91 billion in 2025 and USD 63.68 billion in 2026.

- The upward trend is projected to continue, with market revenues expected to reach USD 65.46 billion in 2027, USD 67.23 billion in 2028, and finally, USD 69.00 billion by 2029.

- This consistent growth reflects an increasing global demand for bras. Driven by evolving fashion trends, growing awareness about different styles and fits, and an expanding consumer base interested in diverse lingerie products.

(Source: Statista)

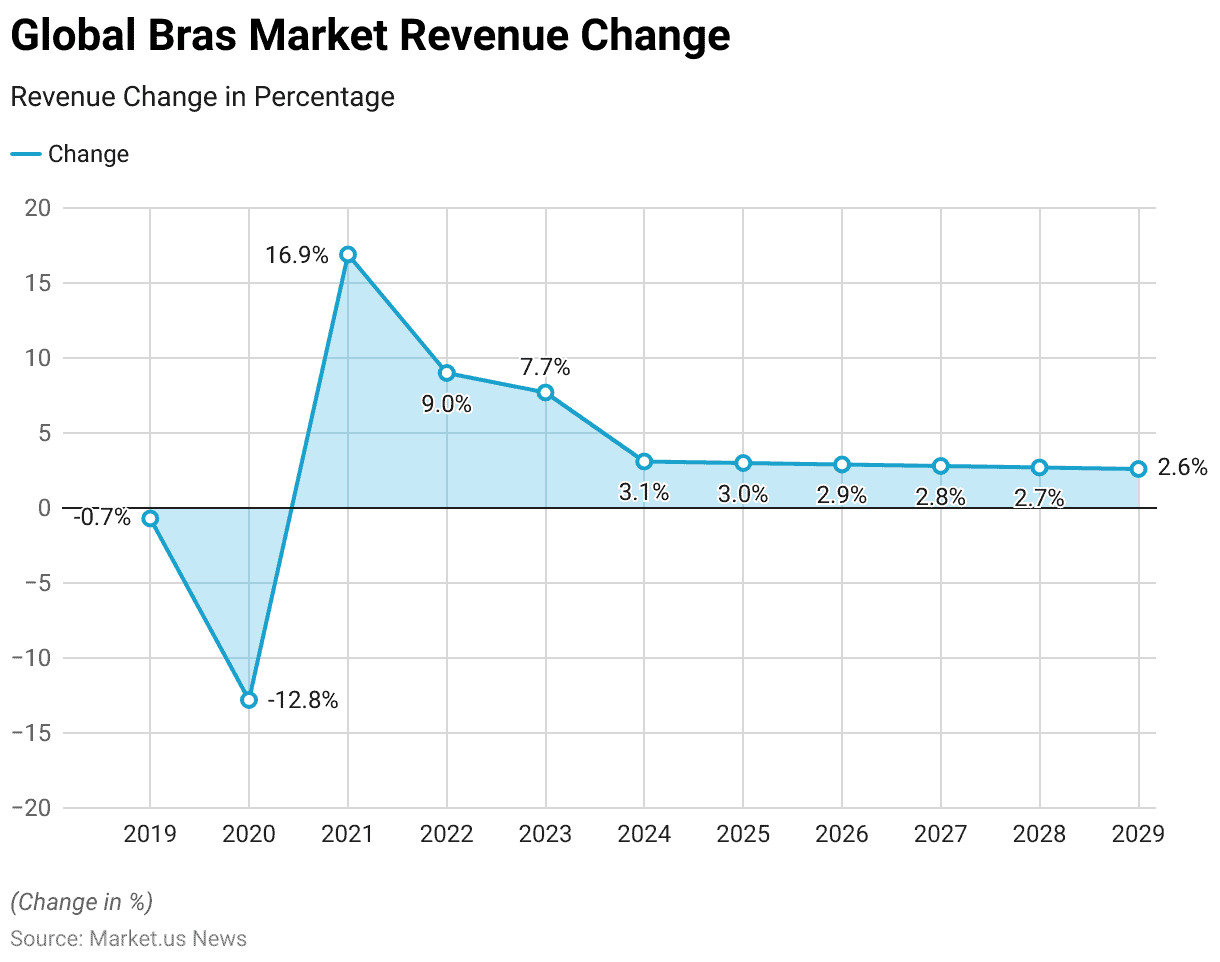

Global Bras Market Revenue Change

- The percentage change in revenue for the global bras market from 2019 to 2029 showcases a trajectory of recovery and stabilization after initial fluctuations.

- In 2019, the market experienced a slight decline of 0.7%.

- This downturn was exacerbated in 2020 when the market faced a sharp decrease of 12.8%. Likely due to the economic impact of global disruptions.

- However, the market showed remarkable resilience in 2021, rebounding strongly with a significant revenue increase of 16.9%.

- This positive trend continued into 2022, although at a moderated pace, with a 9.0% growth.

- By 2023, the growth rate settled further to 7.7%, indicating a stabilization in market conditions.

- From 2024 onwards, the rate of revenue increase began to stabilize at a lower but steady rate. In 2024, the market saw a growth of 3.1%, closely followed by 3.0% in 2025, and continuing to decrease through the subsequent years gradually—2.9% in 2026, 2.8% in 2027, 2.7% in 2028, and finally reaching 2.6% in 2029.

- This consistent, albeit slower, growth rate in the later years suggests a maturing market that continues to expand at a steady, sustainable rate. Reflecting ongoing consumer demand and market saturation.

(Source: Statista)

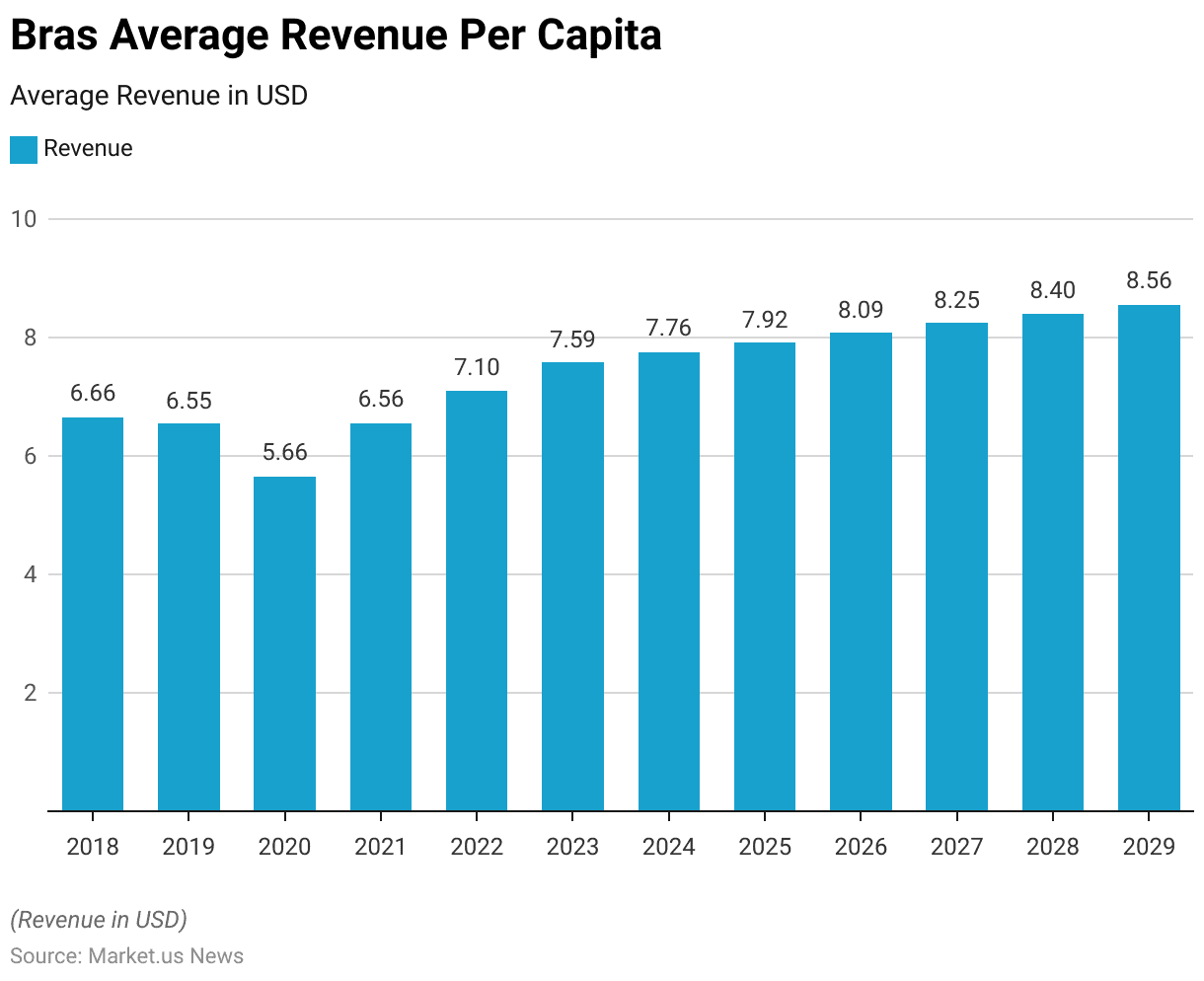

Average Revenue Per Capita

- From 2018 to 2029, the average revenue per capita from bras displayed both fluctuations and growth. Reflecting varying consumer spending patterns in the bras market.

- In 2018, the average revenue per capita was USD 6.66, slightly declining to USD 6.55 in 2019.

- A more noticeable decrease occurred in 2020, where the average revenue per capita dropped to USD 5.66, likely influenced by the economic downturn during that period.

- In 2021, there was a recovery to USD 6.56, closely aligning with pre-pandemic figures.

- This recovery trend strengthened in the following years, with the average revenue per capita rising to USD 7.10 in 2022 and then to USD 7.59 in 2023. The growth continued at a gradual pace, reaching USD 7.76 in 2024 and USD 7.92 in 2025.

- Each subsequent year saw consistent increases, with the average revenue per capita climbing to USD 8.09 in 2026, USD 8.25 in 2027, USD 8.40 in 2028, and ultimately reaching USD 8.56 by 2029.

- These figures indicate a resilient and growing willingness among consumers to spend more on bras over the years. Possibly driven by a combination of factors such as increasing quality, variety, and consumer awareness about the importance of proper fit and comfort in bras.

- This steady upward trend in spending per capita suggests a healthy market environment where consumer preferences evolve towards higher-value products.

(Source: Statista)

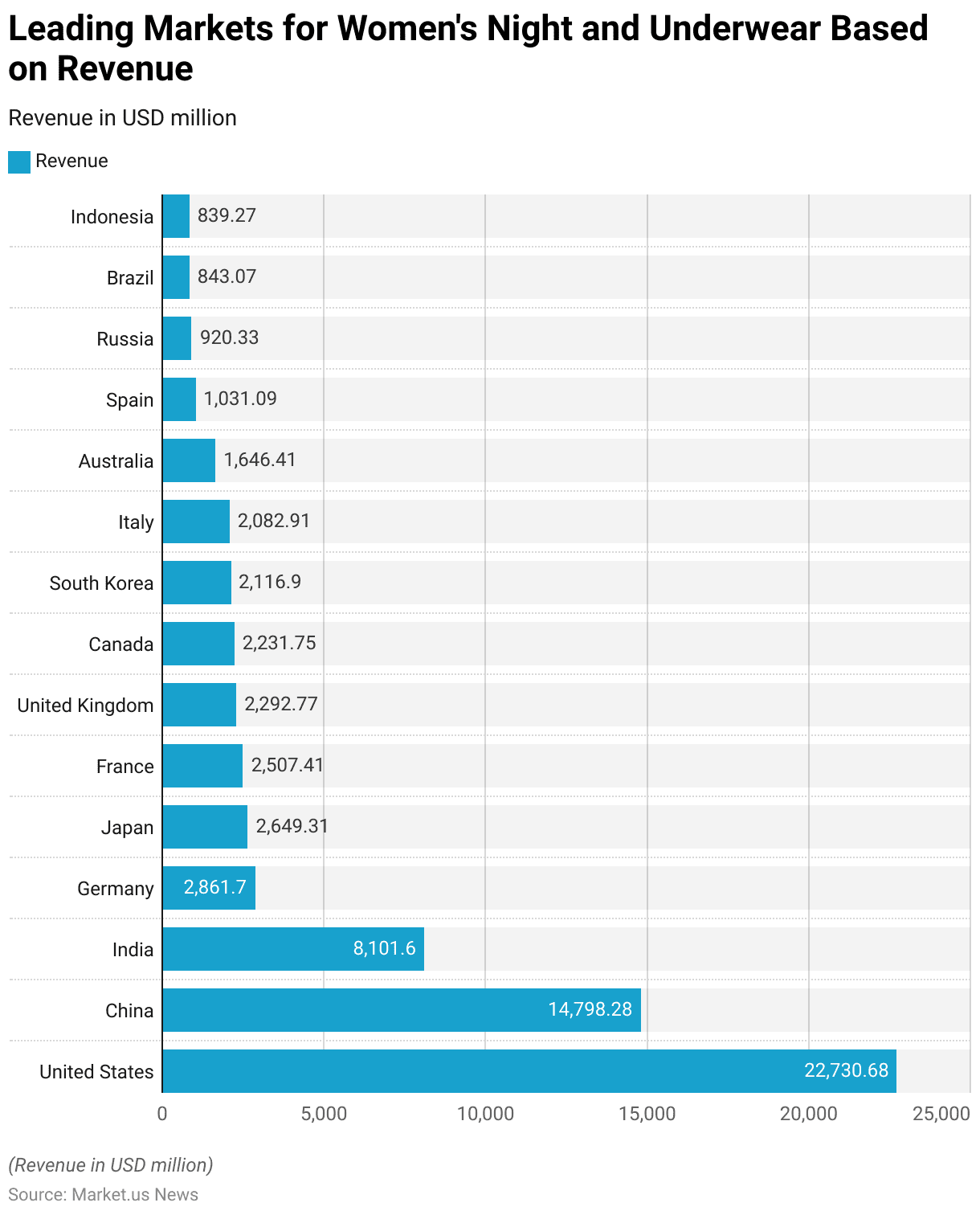

Leading Markets for Women’s Night and Underwear

- In 2022, the United States led the global market for women’s nightwear and underwear with a substantial revenue of USD 22,730.68 million. Underscoring its dominant market position.

- China followed as the second largest market, generating USD 14,798.28 million, reflecting its vast consumer base and growing middle class.

- India ranked third with revenues of USD 8,101.6 million, indicative of its rapidly expanding retail sector and increasing consumer expenditure on apparel.

- European countries also featured prominently in the top markets. Germany, with a revenue of USD 2,861.7 million, and France, at USD 2,507.41 million, represented significant European markets.

- The United Kingdom and Italy generated USD 2,292.77 million and USD 2,082.91 million, respectively, highlighting their strong retail sectors.

- Japan and South Korea were major Asian markets with revenues of USD 2,649.31 million and USD 2,116.9 million, respectively.

- Other noteworthy markets included Canada at USD 2,231.75 million, Australia at USD 1,646.41 million, and Spain at USD 1,031.09 million.

- Emerging markets such as Russia, Brazil, and Indonesia also contributed with revenues of USD 920.33 million, USD 843.07 million, and USD 839.27 million, respectively.

- These figures reflect the widespread global demand for women’s nightwear and underwear. Driven by diverse cultural preferences, economic growth, and changes in consumer lifestyle across these regions.

(Source: Statista)

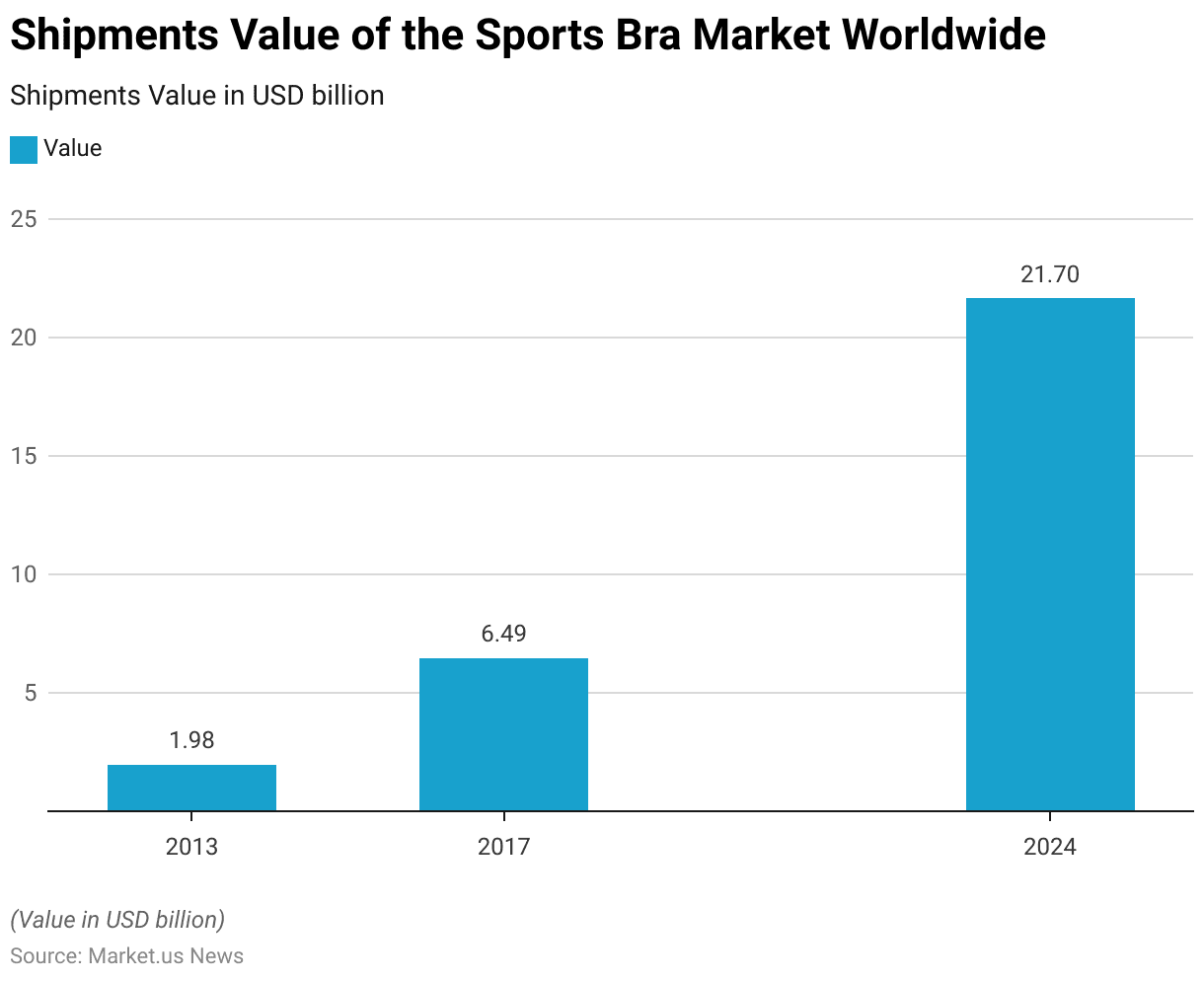

Lingerie Sales and Shipments Statistics

Shipments Value of the Sports Bra Market Worldwide

- The worldwide sports bra market has shown significant growth in shipment value over the years, as evidenced by the data for 2013, 2017, and 2024.

- In 2013, the shipments were valued at USD 1.98 billion. Which reflected the initial stages of growing awareness and demand for sports-specific apparel among women.

- By 2017, this value had more than tripled to USD 6.49 billion, highlighting a rapid increase in the adoption of sports bras driven by a surge in fitness consciousness and the expanding athleisure trend.

- The projected value for 2024 indicates an even more pronounced growth, with shipments expected to reach USD 21.7 billion.

- This substantial increase can be attributed to continuous innovations in sports bra design and materials. The growing participation of women in sports and fitness activities, and a broader acceptance of athleisure wear as a part of everyday attire.

- These factors collectively underscore the expanding market and evolving consumer preferences that are likely to sustain the demand for sports bras well into the future.

(Source: Statista)

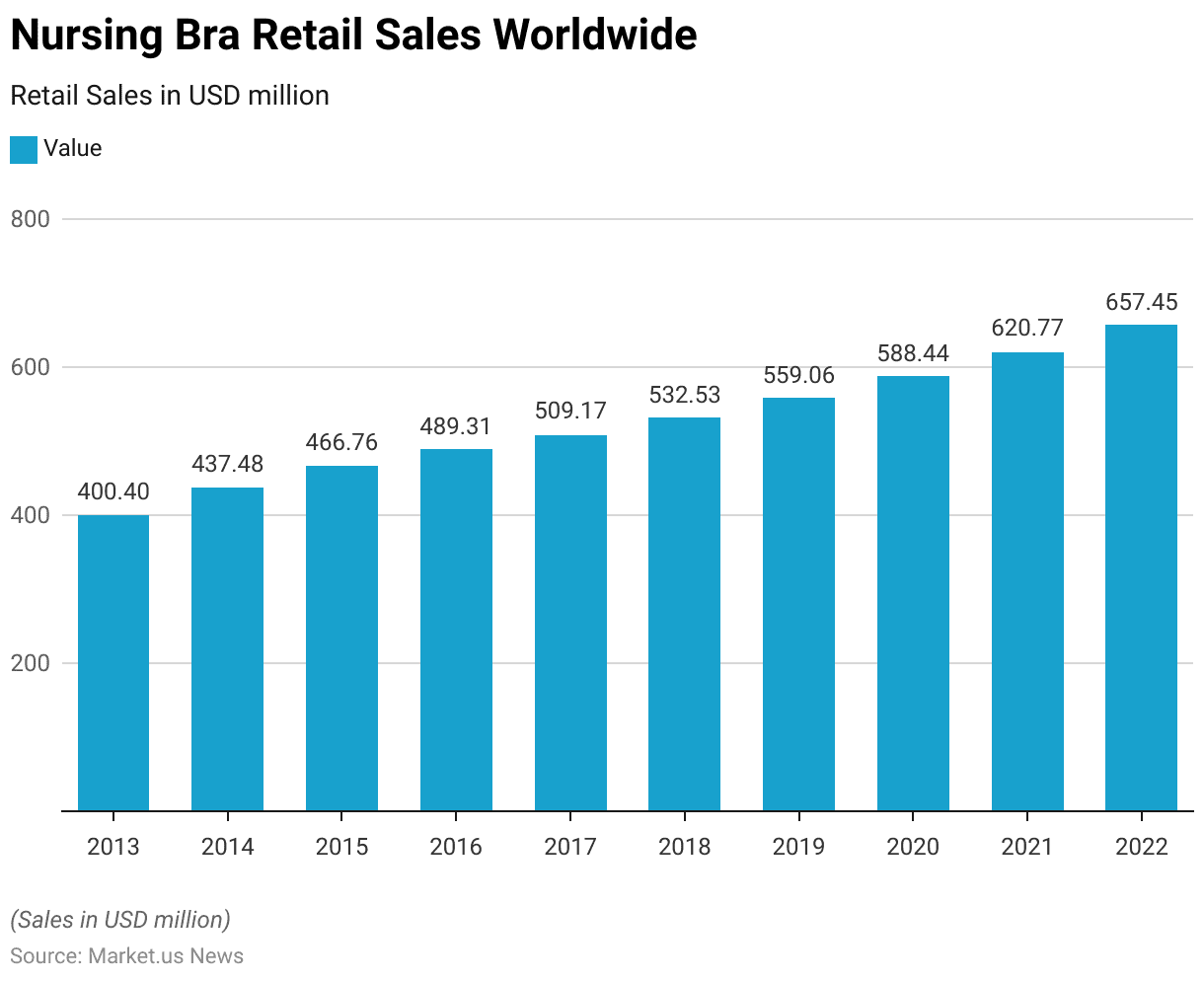

Nursing Bra Retail Sales Worldwide

- The global retail sales of nursing bras from 2013 to 2022 demonstrate consistent growth, highlighting an increasing market demand over the decade.

- In 2013, the market value began at USD 400.4 million.

- The following year, 2014, saw an increase to USD 437.48 million. Marking the beginning of a steady upward trend in sales.

- By 2015, this growth continued, reaching a market value of USD 466.76 million.

- The year 2016 saw further growth to USD 489.31 million, with 2017 following suit at USD 509.17 million, indicating a stable demand among new mothers for nursing bras.

- The growth trend persisted into 2018 and 2019, with market values reaching USD 532.53 million and USD 559.06 million, respectively.

- The year 2020 saw a significant jump to USD 588.44 million. This can be attributed to an increase in health awareness and possibly more focused marketing efforts targeting new parents.

- This upward trajectory continued into 2021 and 2022, with values rising to USD 620.77 million and USD 657.45 million, respectively.

- This decade-long growth reflects the increasing recognition of the importance of comfort and convenience for breastfeeding mothers. Alongside a broader trend of support for maternal health and wellness products.

(Source: Statista)

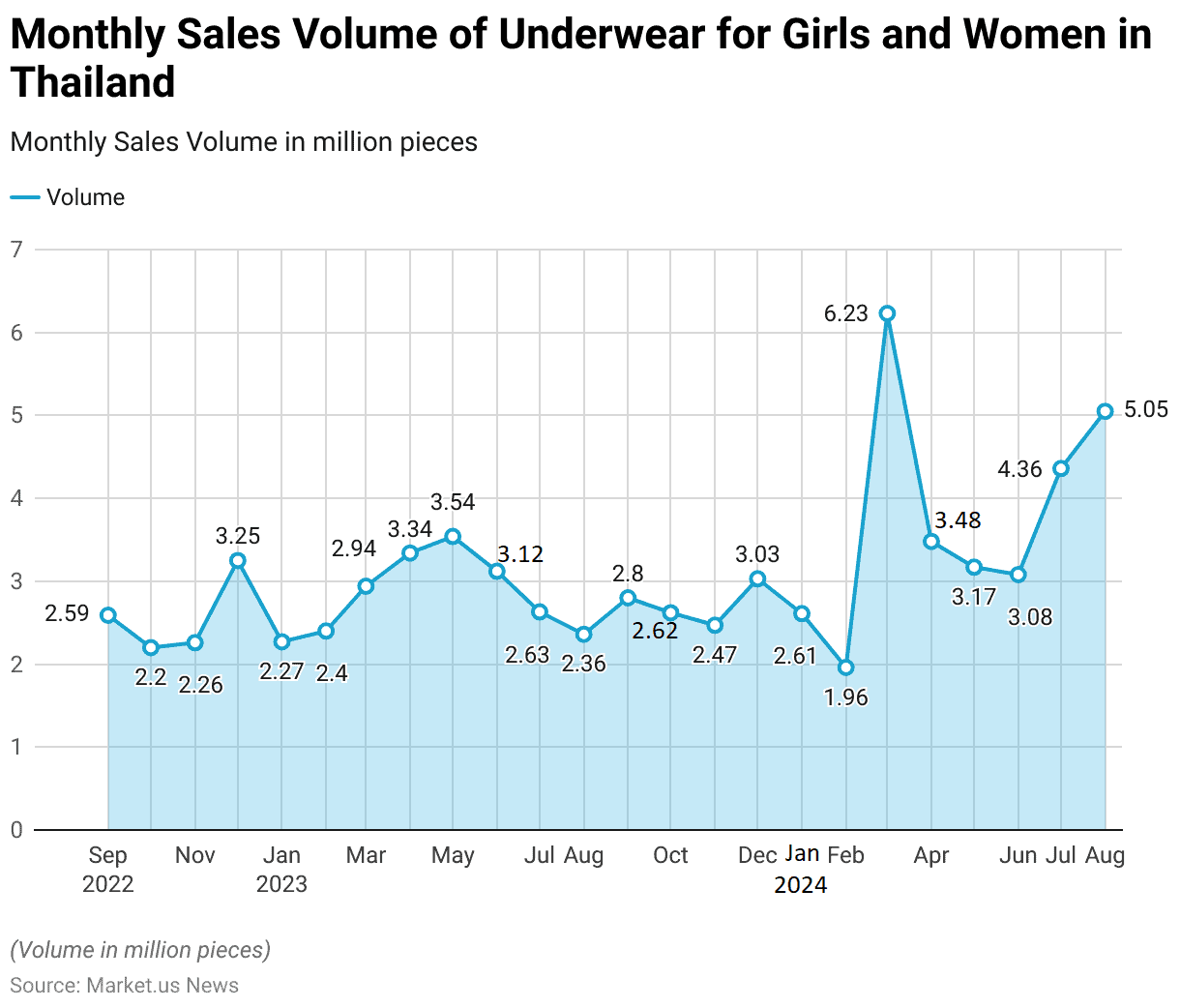

Monthly Sales Volume of Underwear for Girls and Women in Thailand

- From September 2022 to August 2024, the sales volume of women’s and girls’ underwear in Thailand exhibited both steady growth and fluctuations. Reflecting market trends and consumer demand.

- In September 2022, the sales volume stood at 2.59 million pieces. Followed by a slight decrease in October to 2.2 million pieces. Sales saw a moderate increase in November 2022 to 2.26 million pieces and a substantial jump in December 2022 to 3.25 million pieces. Likely influenced by seasonal holiday demand.

- The trend remained stable in early 2023, with January recording 2.27 million pieces and February slightly increasing to 2.4 million pieces. March 2023 saw a further rise to 2.94 million pieces, with continued growth into April and May 2023, reaching 3.34 million and 3.54 million pieces, respectively.

- Sales in June 2023 were recorded at 3.12 million pieces before slightly dipping in July (2.63 million) and August 2023 (2.36 million).

- The second half of 2023 showed more consistent sales figures. September sales increased to 2.8 million pieces, while October saw a slight decline to 2.62 million pieces. November and December 2023 recorded 2.47 million and 3.03 million pieces, respectively, marking a positive end to the year.

- In January 2024, sales reached 2.61 million pieces, with a decline in February to 1.96 million pieces. However, March 2024 witnessed a sharp spike in sales volume to 6.23 million pieces. The highest in the observed period, followed by 3.48 million in April.

- Sales volumes remained strong in May (3.17 million), June (3.08 million), and July 2024 (4.36 million). Culminating in August 2024 with a substantial 5.05 million pieces sold.

- This data reveals fluctuation driven by seasonal trends, promotions, and shifts in consumer preferences, with notable peaks in sales during key months of 2022 and 2024.

(Source: Statista)

Lingerie Imports Statistics

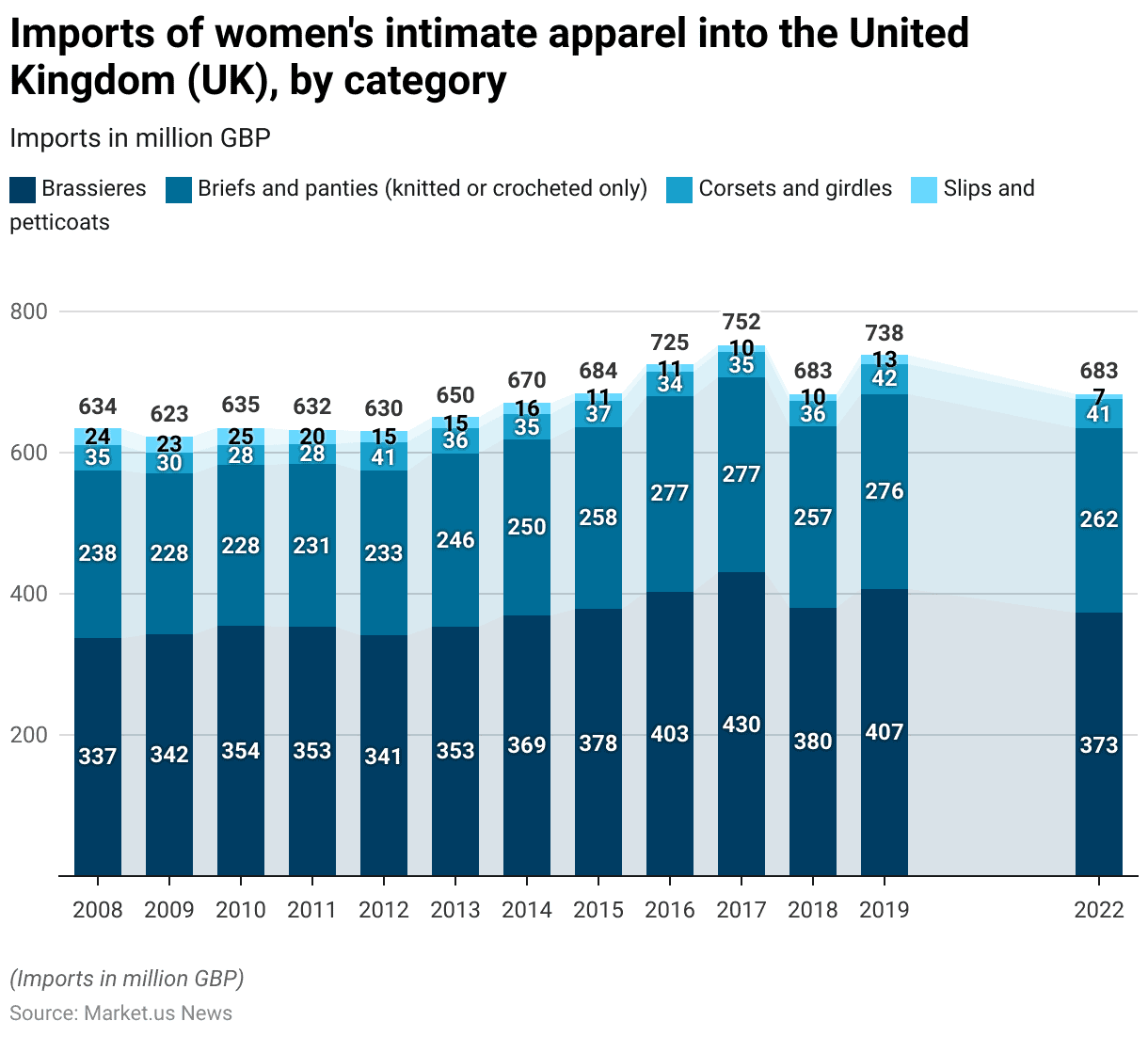

Imports of Women’s Intimate Apparel into the United Kingdom (UK) – By Category

- From 2008 to 2022, the imports of women’s intimate apparel into the United Kingdom exhibited various trends across different categories.

- Brassieres consistently represented the largest category by import value. Starting at £337 million in 2008 and peaking at £430 million in 2017 before settling at £373 million by 2022.

- Briefs and panties followed a similar trend, with the import values beginning at £238 million in 2008, experiencing fluctuations, and concluding at £262 million in 2022.

- Corsets and girdles saw an intriguing spike in imports, starting from £35 million in 2008. Dipping to £28 million in 2010 and 2011, then surging to £41 million in 2012.

- After another decrease, this category saw a rise again to £42 million in 2019. Finishing at £41 million in 2022.

- Slips and petticoats, however, demonstrated a general decline over the period. Starting from £24 million in 2008 and sharply decreasing to £7 million by 2022.

- These shifts in import values reflect changing fashion trends, consumer preferences, and possibly the economic conditions affecting consumer spending on intimate apparel in the UK over these years.

(Source: Statista)

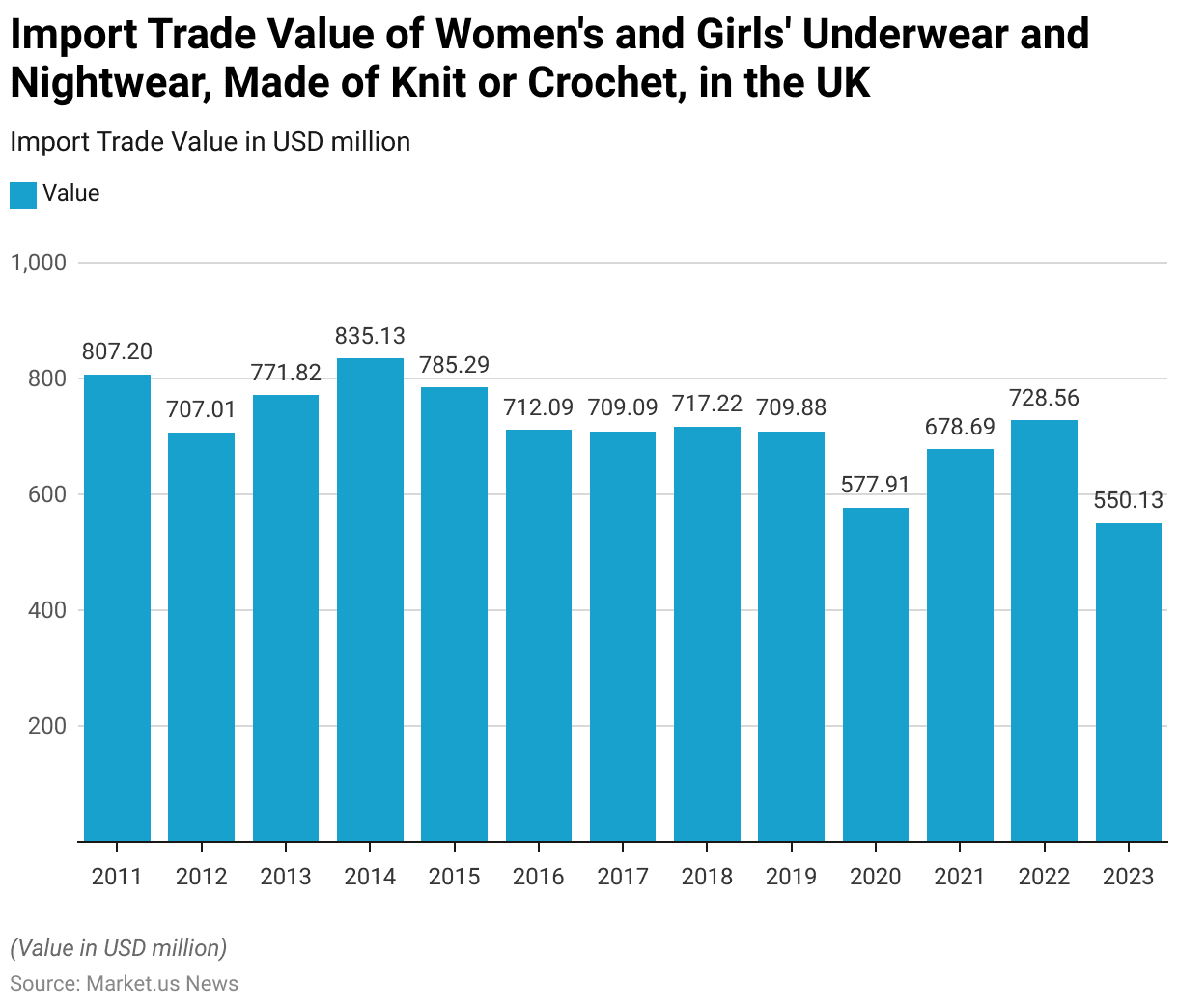

Import Trade Value of Women’s and Girls’ Underwear and Nightwear, Made of Knit or Crochet, in the United Kingdom (UK)

- The import trade value of women’s and girls’ underwear and nightwear made of knit or crochet in the United Kingdom (UK) experienced notable fluctuations from 2011 to 2023.

- In 2011, the import value stood at USD 807.2 million, the highest figure in the observed period. However, this was followed by a significant decline in 2012 to USD 707.01 million.

- The market recovered somewhat in 2013, with an import value of USD 771.82 million, and then saw another peak in 2014, reaching USD 835.13 million, marking the highest value over the 13 years.

- The subsequent years saw declines, with the import value falling to USD 785.29 million in 2015 and further decreasing to USD 712.09 million in 2016.

- This trend of fluctuations continued as the import trade value hovered around similar levels, with USD 709.09 million in 2017, USD 717.22 million in 2018, and USD 709.88 million in 2019.

- The most significant drop occurred in 2020. When the import value fell to USD 577.91 million, possibly impacted by global supply chain disruptions and economic challenges.

- In 2021, the market showed signs of recovery, with imports reaching USD 678.69 million, followed by a further increase to USD 728.56 million in 2022.

- However, 2023 witnessed a sharp decline, with the import trade value dropping to USD 550.13 million, the lowest figure in the period from 2011 to 2023.

- This reduction could be attributed to ongoing market adjustments, changes in consumer behavior, and broader economic factors impacting the demand and supply of intimate apparel in the UK.

(Source: Statista)

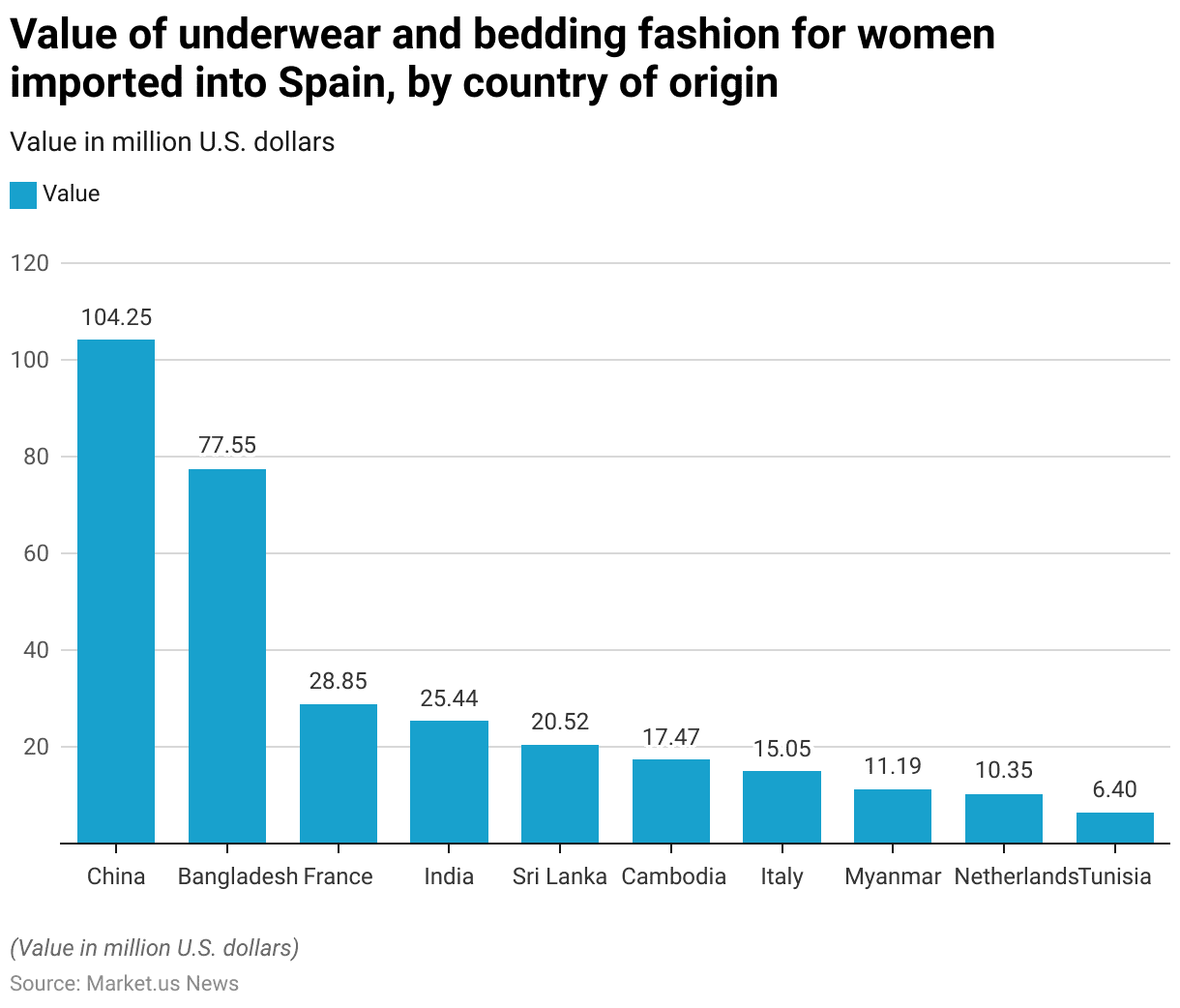

Value of Underwear and Bedding Fashion for Women Imported into Spain – By Country of Origin By Lingerie Statistics

- In 2023, the import values for women’s underwear and bedding fashion into Spain were led by several countries, with China being the largest exporter at USD 104.25 million. This high figure underscores China’s significant role in the global textiles market, particularly in supplying to European markets.

- Bangladesh followed as the second-largest source, contributing USD 77.55 million. This reflects its strong position in the textile industry due to cost-effective labor and production capabilities.

- France and India also played notable roles, with import values of USD 28.85 million and USD 25.44 million, respectively. Indicating a diverse sourcing strategy that includes both high-end and volume-based suppliers.

- Other significant contributors included Sri Lanka and Cambodia, with imports valued at USD 20.52 million and USD 17.47 million, showcasing their growing textiles sectors.

- Italy, known for its luxury textile products, exported USD 15.05 million worth of goods to Spain. At the same time, Myanmar and the Netherlands had smaller but significant shares at USD 11.19 million and USD 10.35 million, respectively.

- Tunisia, although the smallest among the listed countries, still contributed USD 6.4 million. Highlighting its involvement in the European fashion supply chain.

- These figures demonstrate Spain’s reliance on a global network of suppliers for its fashion industry. Encompassing both mass-produced and high-quality specialty items.

(Source: Statista)

Lingerie Exports Statistics

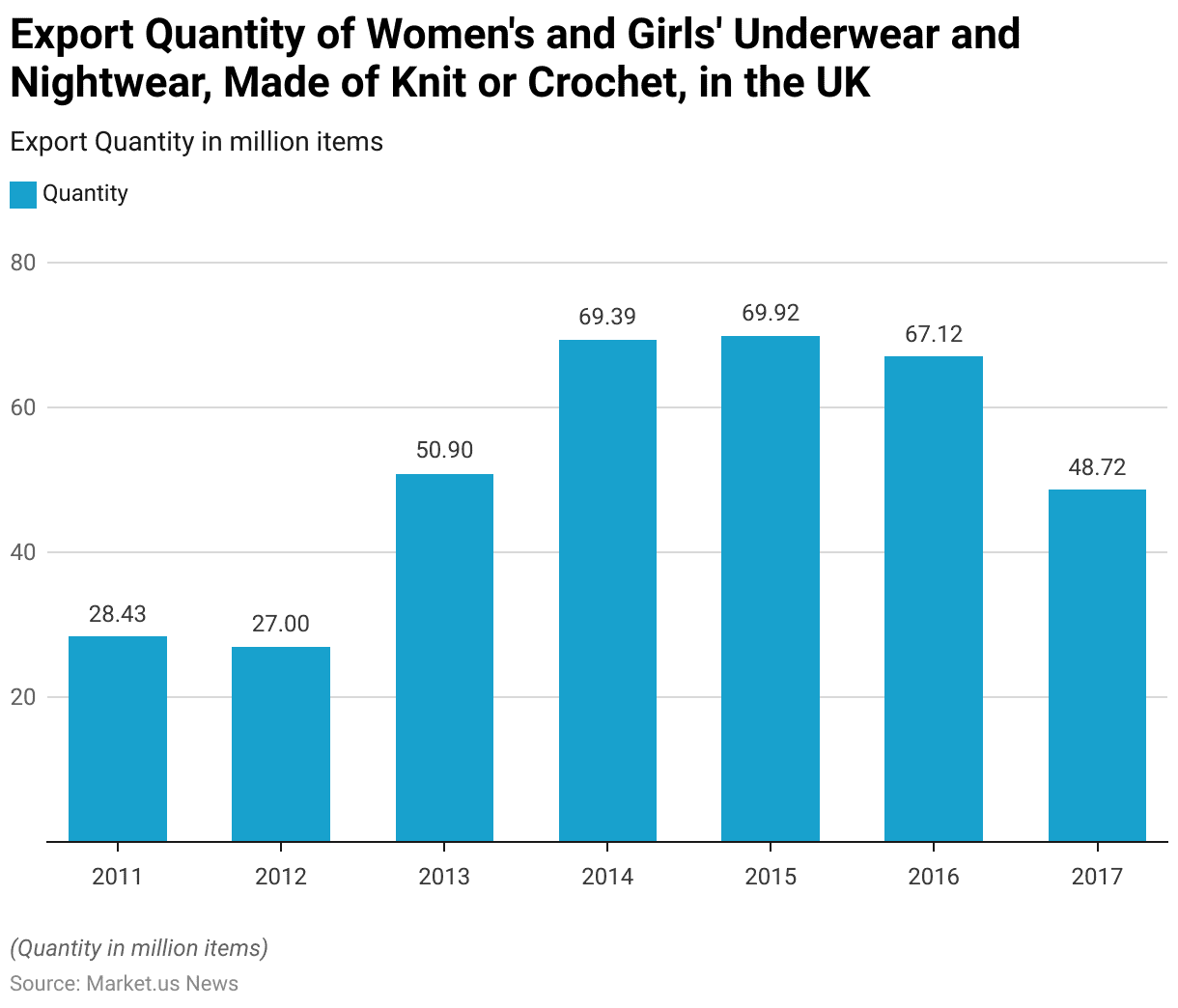

Export Quantity of Women’s and Girls’ Underwear and Nightwear, Made of Knit or Crochet, in the United Kingdom (UK) By Lingerie Statistics

- The export quantity of women’s and girls’ underwear and nightwear made of knit or crochet from the United Kingdom exhibited notable fluctuations between 2011 and 2017.

- In 2011, the export quantity stood at 28.43 million items. However, this figure slightly declined in 2012 to 27 million items.

- The export market saw a substantial increase in 2013, with quantities more than doubling to 50.9 million items. Signaling a significant boost in demand or enhanced trade relationships.

- This upward trend continued into 2014 when exports reached 69.39 million items, the highest volume in the observed period.

- The year 2015 saw a marginal increase to 69.92 million items, maintaining the high export levels.

- However, 2016 marked the beginning of a decline, with the export quantity falling to 67.12 million items. By 2017, the export volume had dropped further to 48.72 million items.

- Despite the strong performance in the mid-2010s, the latter years reflect a contraction in the volume of exports. Potentially influenced by market shifts, production changes, or international competition.

- These variations highlight the dynamic nature of the UK’s export market for intimate apparel during this period.

(Source: Statista)

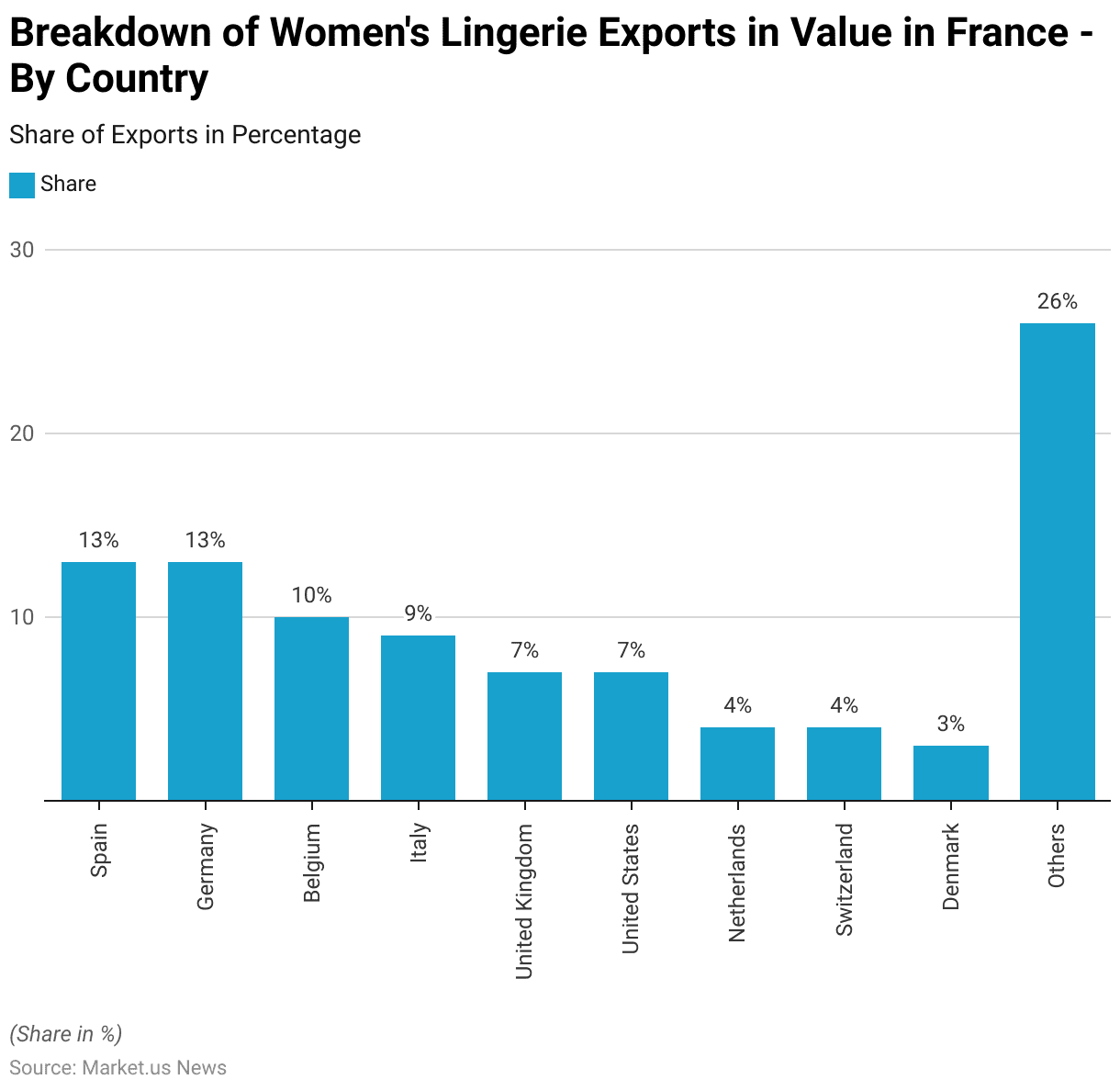

Breakdown of Women’s Lingerie Exports in Value in France – By Country Statistics

- In 2019, France’s women’s lingerie exports were distributed across various countries, with Spain and Germany sharing the top spot as the largest recipients, each accounting for 13% of the total export value.

- These two markets demonstrated a strong demand for French lingerie. Likely driven by close geographical proximity and established trade relationships within the European Union.

- Belgium followed with a 10% share of French lingerie exports. Reflecting its importance as a key European market for French textile products.

- Italy also represented a significant share, receiving 9% of the export value. Underscoring the close trade ties and fashion influence between the two countries.

- The United Kingdom and the United States each accounted for 7% of the export value. Indicating robust demand for French lingerie in these regions despite the geographical distance from France. Both markets are known for their high demand for premium fashion products, including lingerie.

- Other European countries, such as the Netherlands and Switzerland. Each represented 4% of the export value, while Denmark accounted for 3%. Collectively, these markets illustrate the strong intra-European demand for French lingerie.

- The remaining 26% of exports were distributed among other countries. Reflecting the global reach and appeal of French lingerie in diverse international markets.

- This breakdown highlights France’s prominent role in the global lingerie industry and the strong demand for its products across a range of European and international markets.

(Source: Statista)

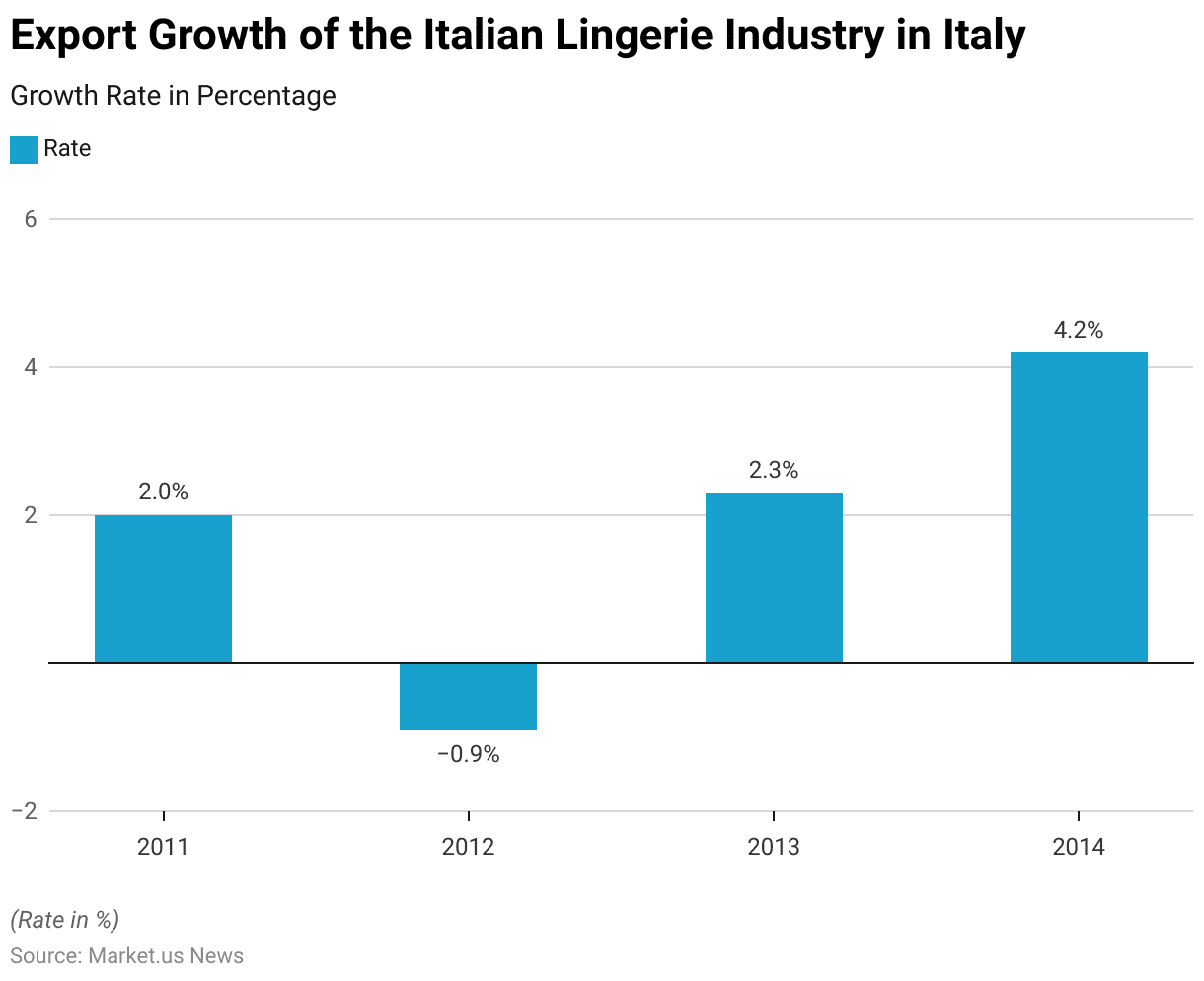

Export Growth of the Italian Lingerie Industry in Italy Statistics

- Between 2011 and 2014, the Italian lingerie industry experienced varying rates of export growth. Reflecting the dynamic nature of the market during this period.

- In 2011, the industry saw a modest growth rate of 2%. Indicating steady demand for Italian lingerie products in international markets.

- However, this was followed by a slight contraction in 2012, with the export growth rate declining by 0.9%. This downturn may have been influenced by broader economic conditions or shifts in global demand.

- The industry rebounded in 2013, with a positive growth rate of 2.3%, signaling renewed interest in Italian lingerie exports.

- This upward trend continued in 2014, when the industry achieved its highest growth rate over the four years, expanding by 4.2%.

- This marked improvement may be attributed to Italy’s strong fashion reputation. Innovation in lingerie designs, and increasing global demand for high-quality lingerie products.

- Overall, the data reflects both challenges and recovery within the Italian lingerie export sector. Demonstrating its resilience and ability to adapt to shifting market conditions.

(Source: Statista)

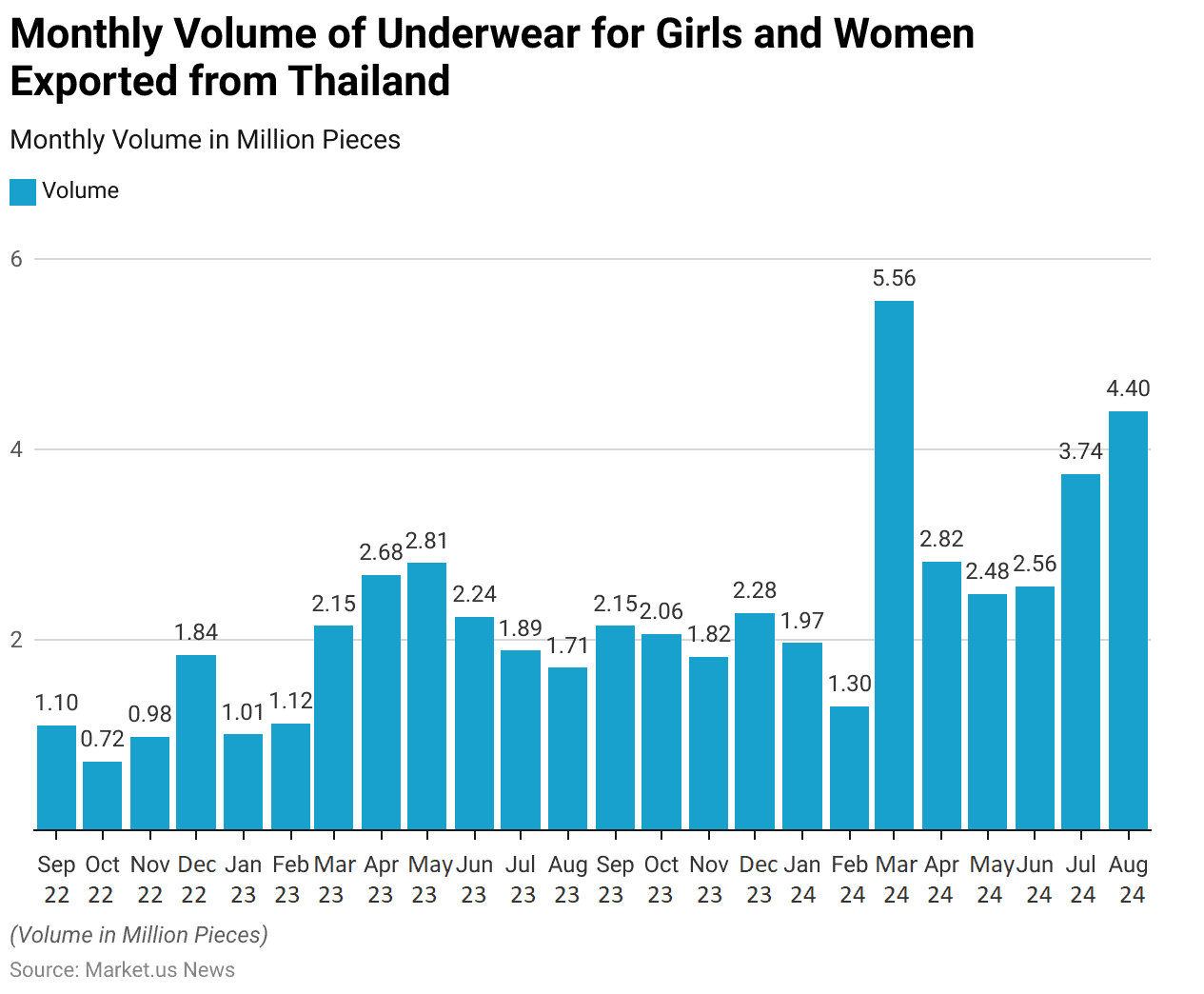

Monthly Volume of Underwear for Girls and Women Exported from Thailand By Lingerie Statistics

- From September 2022 to August 2024, the export volume of women’s and girls’ underwear from Thailand demonstrated significant fluctuations. Reflecting varying demand patterns over the period.

- In September 2022, the export volume was recorded at 1.1 million pieces, followed by a dip to 0.72 million in October 2022.

- November 2022 saw a slight increase to 0.98 million pieces, and a significant rise occurred in December 2022, with exports reaching 1.84 million pieces. The export volume in early 2023 remained relatively stable, with January recording 1.01 million pieces and February at 1.12 million pieces.

- However, March 2023 marked a significant jump to 2.15 million pieces. Continuing the upward trend into April and May 2023, with volumes of 2.68 million and 2.81 million pieces, respectively. By June 2023, the exports reached 2.24 million pieces, followed by a slight decline in July (1.89 million) and August 2023 (1.71 million).

- The export volume picked up again in September 2023, reaching 2.15 million pieces, and remained strong in the following months, with October at 2.06 million and November at 1.82 million. December 2023 saw an increase to 2.28 million pieces.

- The first quarter of 2024 showed some variability, with January at 1.97 million pieces and February dipping to 1.3 million. Still, March saw a sharp spike to 5.56 million pieces, the highest figure in the period.

- The months following March 2024 saw exports stabilize, with April recording 2.82 million pieces. May at 2.48 million, and June at 2.56 million pieces.

- July and August 2024 exhibited substantial increases, with export volumes of 3.74 million and 4.4 million pieces, respectively, marking a strong end to the period. These fluctuations in export volumes likely reflect seasonal demands, market conditions, and changes in global supply chains during this time.

(Source: Statista)

Lingerie Price Trends Statistics

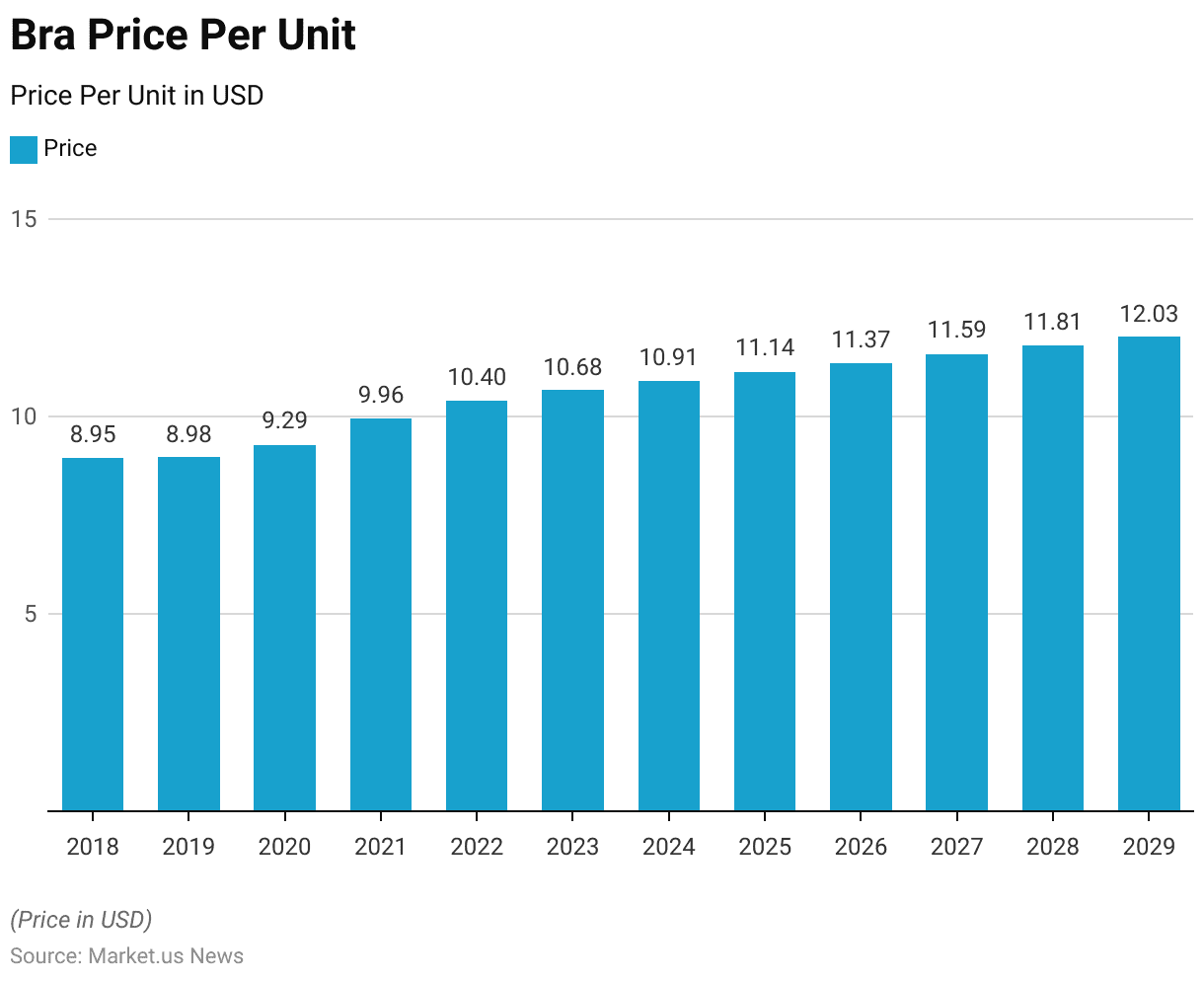

Global Bra Price Trends By Lingerie Statistics

- The price per unit of bras has shown a consistent upward trend from 2018 to 2029. Reflecting increasing production costs, market demand, and consumer preferences for higher-quality products.

- In 2018, the average price per unit stood at USD 8.95. A slight increase was observed in 2019, with prices reaching USD 8.98.

- The following year, in 2020, the price rose to USD 9.29, and by 2021, it had climbed to USD 9.96, marking a substantial increase.

- This trend continued in 2022 when the price per unit crossed the USD 10 threshold, reaching USD 10.4.

- The year 2023 saw the price rise further to USD 10.68, and projections for 2024 suggest a continued increase to USD 10.91.

- In 2025, the price is expected to rise to USD 11.14, followed by USD 11.37 in 2026 and USD 11.59 in 2027.

- The upward momentum is set to persist, with prices forecasted to reach USD 11.81 in 2028 and, ultimately, USD 12.03 by 2029.

- This steady increase over the years highlights inflationary pressures and the growing emphasis on innovation, design, and premium materials in the bra market.

(Source: Statista)

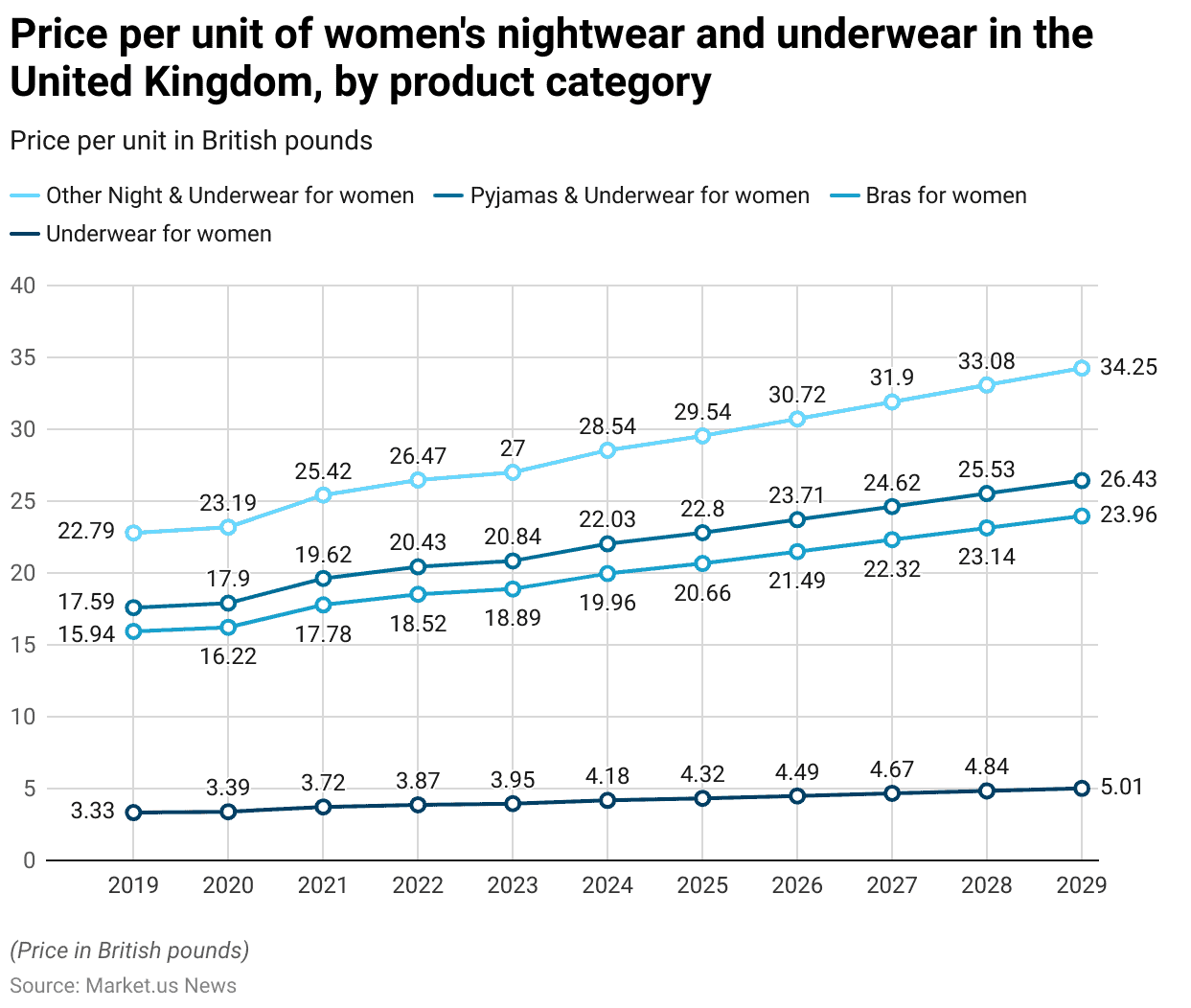

Price Per Unit of Women’s Nightwear and Underwear in the United Kingdom – By Product Category by Lingerie Statistics

- Between 2019 and 2029, the price per unit of women’s nightwear and underwear in the United Kingdom across various product categories has shown a steady upward trend.

- In 2019, the price for “Other Nightwear & Underwear” stood at £22.79, “Pyjamas & Underwear” at £17.59, “Bras for women” at £15.94, and “Underwear for women” at £3.33.

- By 2020, there was a slight increase across all categories, with “Other Nightwear & Underwear” rising to £23.19, “Pyjamas & Underwear” reaching £17.90, “Bras for women” climbing to £16.22, and “Underwear for women” at £3.39.

- The trend continued in 2021, where prices further increased, with “Other Nightwear & Underwear” at £25.42, “Pyjamas & Underwear” at £19.62, “Bras for women” at £17.78, and “Underwear for women” at £3.72.

Moreover

- The rising trajectory persisted through 2022, with prices reaching £26.47 for “Other Nightwear & Underwear,” £20.43 for “Pyjamas & Underwear,” £18.52 for “Bras,” and £3.87 for “Underwear.”

- In 2023, prices continued to climb, albeit at a slower pace, with “Other Nightwear & Underwear” priced at £27, “Pyjamas & Underwear” at £20.84, “Bras” at £18.89, and “Underwear” at £3.95.

- Projections for 2024 show the price for “Other Nightwear & Underwear” rising to £28.54, “Pyjamas & Underwear” to £22.03, “Bras” to £19.96, and “Underwear” to £4.18.

- By 2025, prices are expected to increase further, with “Other Nightwear & Underwear” at £29.54, “Pyjamas & Underwear” at £22.80, “Bras” at £20.66, and “Underwear” at £4.32.

- This pattern of growth continues through to 2029, where the price for “Other Nightwear & Underwear” is projected to reach £34.25, “Pyjamas & Underwear” to £26.43, “Bras” to £23.96, and “Underwear” to £5.01. These consistent increases reflect rising costs. Consumer demand for quality products, and potential inflationary factors affecting the market.

(Source: Statista)

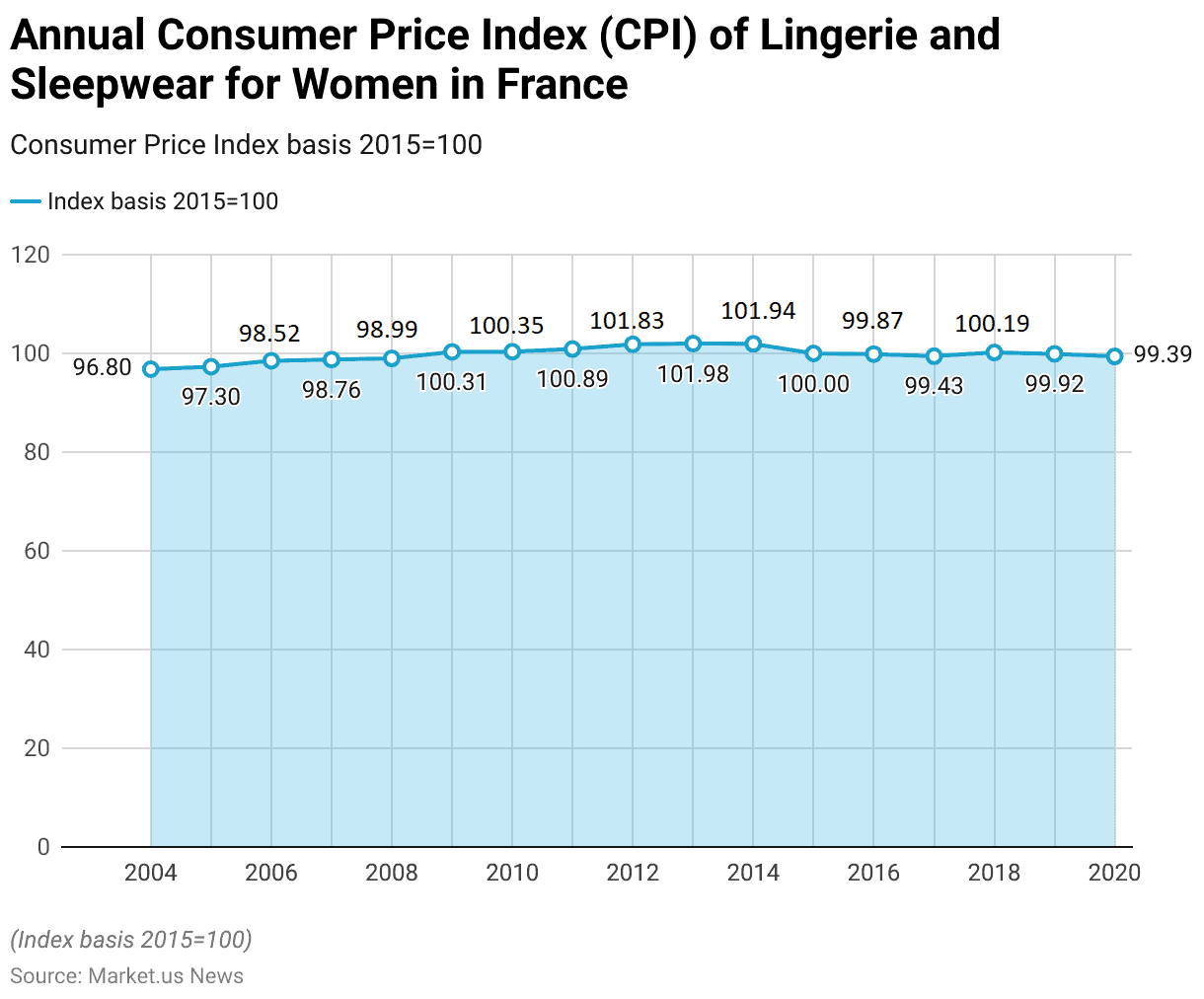

Annual Consumer Price Index (CPI) of Lingerie and Sleepwear for Women in France Statistics

- The consumer price index (CPI) of lingerie and sleepwear for women in France from 2004 to 2020 demonstrates a relatively stable pricing trend with moderate fluctuations.

- In 2004, the index stood at 96.8, increasing slightly to 97.3 in 2005.

- The following years saw gradual increases, with the index rising to 98.52 in 2006 and 98.76 in 2007. By 2008, the CPI reached 98.99, continuing its steady climb.

- In 2009, the index surpassed the 100 mark, reaching 100.31, which indicated a shift in the pricing level. The index remained relatively stable in 2010 at 100.35, followed by an increase to 100.89 in 2011.

- This upward trend continued through 2012 and 2013, with the CPI rising to 101.83 and 101.98, respectively. In 2014, the index remained nearly unchanged at 101.94.

- The base year of 2015 recorded a CPI of 100, establishing the index at a new standard. However, the following years saw slight declines, with the index dropping to 99.87 in 2016 and further to 99.43 in 2017.

- A minor recovery occurred in 2018, with the CPI rising to 100.19, but it fell again in 2019 to 99.92 and further to 99.39 in 2020.

- Overall, the CPI of lingerie and sleepwear for women in France remained stable, with only marginal increases and decreases. Reflecting moderate price changes in the market over the 16 years.

(Source: Statista)

Lingerie Preferences and Trends Statistics

Brand Preference of Lingerie Among Female Consumers in China – By Origin and Price Level Statistics

- In 2020, the brand preference for lingerie among female consumers in China was strongly oriented toward domestic brands.

- The largest share of consumers, 42.8%, preferred domestic affordable brands, indicating a significant demand for locally produced, budget-friendly options.

- Domestic high-end brands also captured a substantial market share, with 30.6% of consumers favoring them. Reflecting the rising appeal of premium local brands in the Chinese lingerie market.

- Foreign brands were less popular among consumers, with 16.2% preferring foreign affordable brands and only 4.1% opting for foreign high-end brands. This highlights the stronger presence of domestic brands in both the affordable and luxury segments.

- Additionally, 6.3% of consumers did not have a specific brand preference, indicating some flexibility or openness in brand selection.

- These figures suggest that local brands, especially affordable ones, dominate the Chinese lingerie market, while foreign brands cater to a smaller, niche audience.

(Source: Statista)

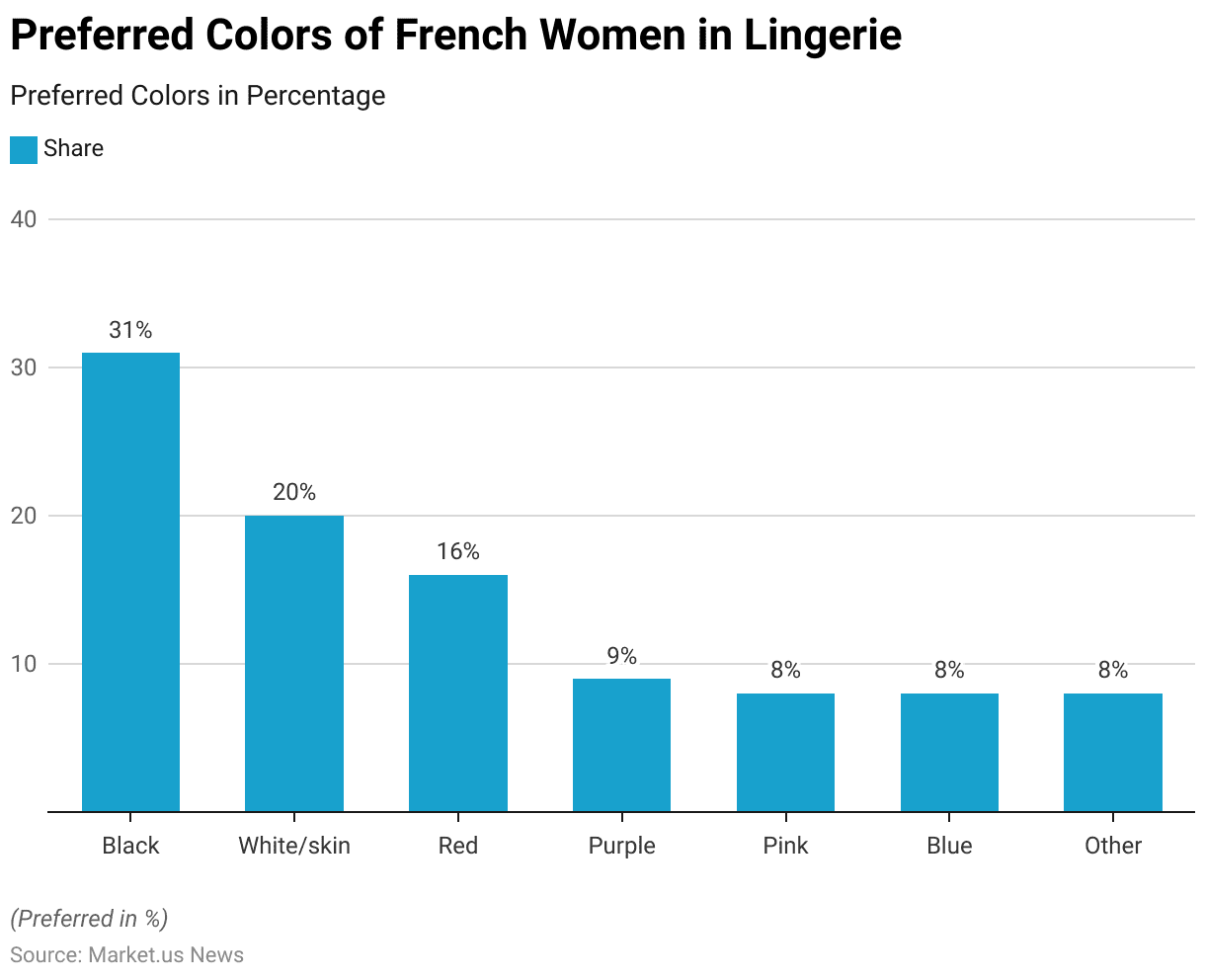

Preferred Colors of French Women in Lingerie Statistics

- In 2014, the favorite colors of lingerie among women in France revealed a clear preference for traditional and classic shades.

- Black was the most popular choice, with 31% of respondents favoring this color, reflecting its timeless appeal and association with elegance and sophistication.

- White or skin-toned lingerie followed, preferred by 20% of women, likely due to its versatility and suitability for everyday wear.

- Red was the third most favored color, with 16% of respondents selecting it, highlighting its association with boldness and passion.

- Purple, chosen by 9% of women, added a touch of luxury and creativity to their lingerie preferences.

- Pink and blue were each selected by 8% of respondents. Suggesting a balanced appeal of both soft, feminine tones and cooler, calming hues.

- Additionally, 8% of respondents favored other colors, showing some diversity in preferences beyond the main popular shades.

- These trends reflect a blend of practicality, tradition, and personal expression in lingerie color choices among French women in 2014.

(Source: Statista)

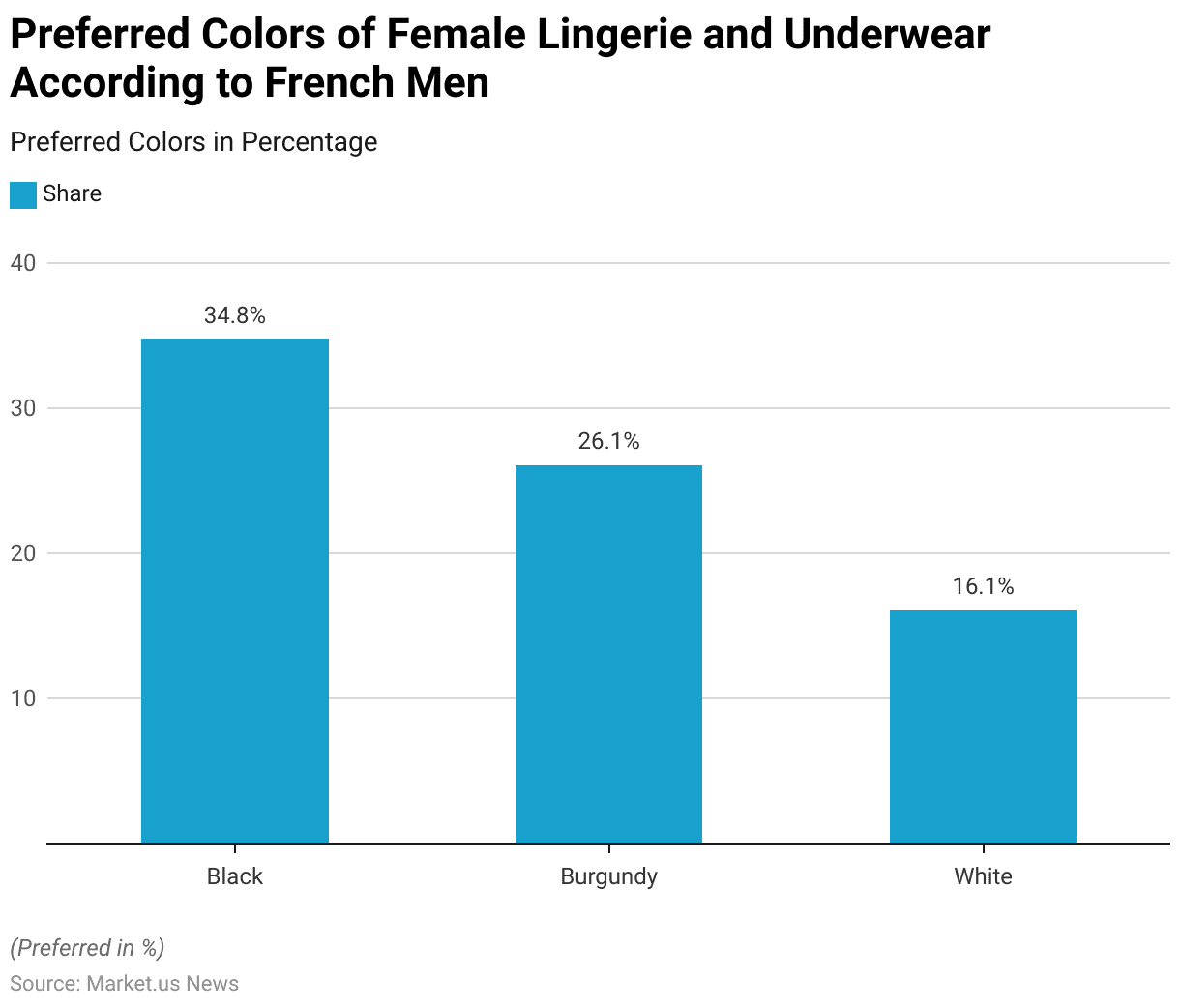

Preferred Colors of Female Lingerie and Underwear According to French Men Statistics

- In 2017, French men expressed clear preferences when it came to the colors of women’s lingerie and underwear.

- Black was the most favored color, with 34.8% of respondents indicating it as their top choice, reflecting its timeless allure and association with sophistication.

- Burgundy followed as the second most popular color, chosen by 26.1% of respondents, highlighting its rich and sensual appeal.

- White came in third, with 16.1% of French men preferring it, likely due to its classic and pure aesthetic.

- These preferences illustrate a strong inclination toward bold and elegant colors among French men about women’s lingerie choices.

(Source: Statista)

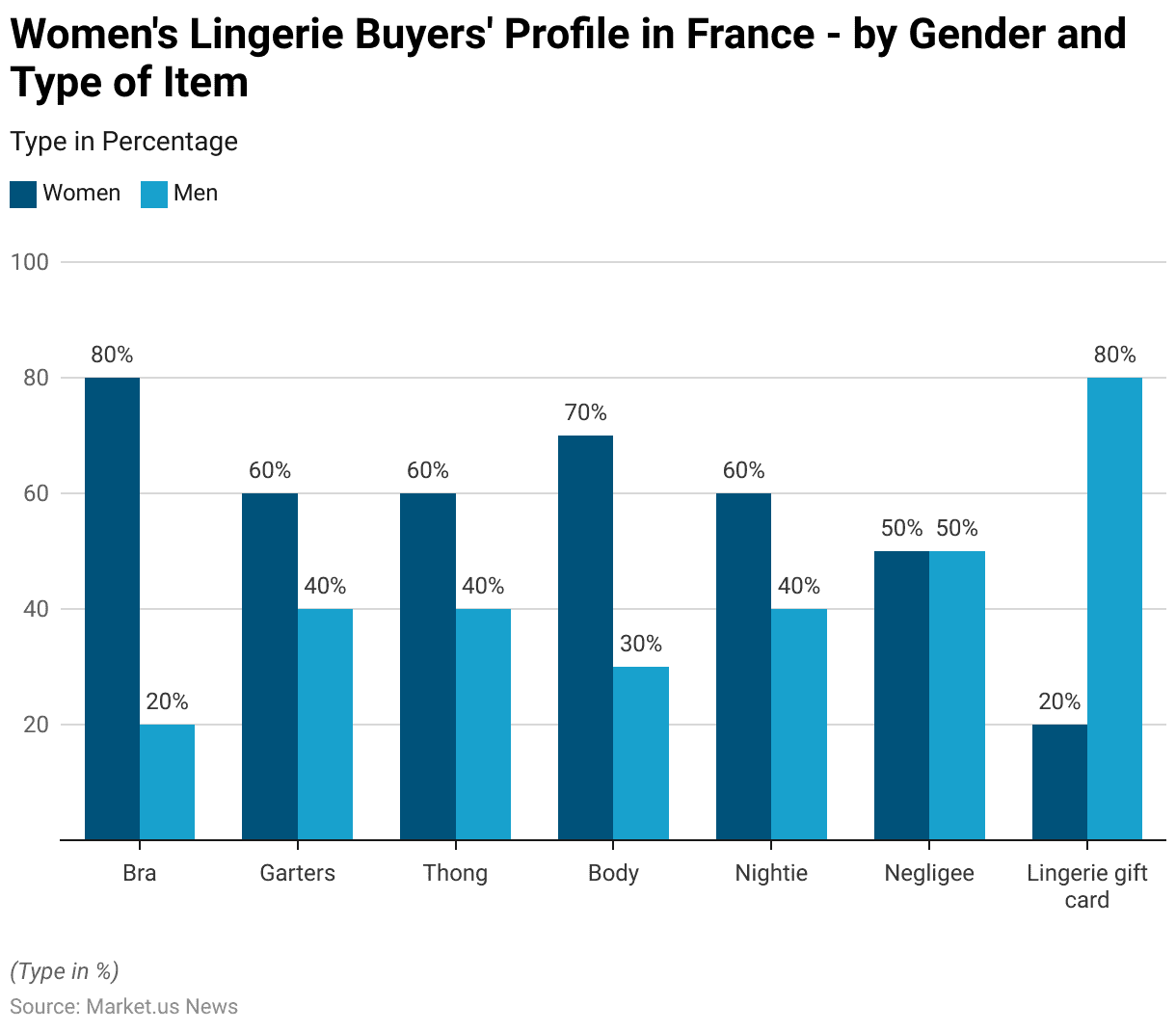

Women’s Lingerie Buyers’ Profile in France – by Gender and Type of Item Statistics

- In 2020, the profile of women’s lingerie shoppers in France revealed distinct gender preferences across various lingerie items.

- Women predominantly purchased bras, with 80% of bra shoppers being female, while only 20% were men.

- Similar patterns were observed with other items, such as garters, thongs, and nighties, where 60% of the shoppers were women and 40% were men.

- For body lingerie, the majority of buyers were also women, accounting for 70% of the shoppers, with men making up 30%.

- Negligees saw an equal split between male and female shoppers, with 50% of each gender purchasing this item.

- Interestingly, when it came to lingerie gift cards, the trend reversed, with 80% of the shoppers being men, highlighting that men were more likely to buy lingerie as gifts, while only 20% of women opted for gift cards.

- This data provides insights into the buying behaviors of men and women in the French lingerie market, with women generally being the primary consumers of lingerie items. In contrast, men played a significant role in purchasing lingerie as gifts.

(Source: Statista)

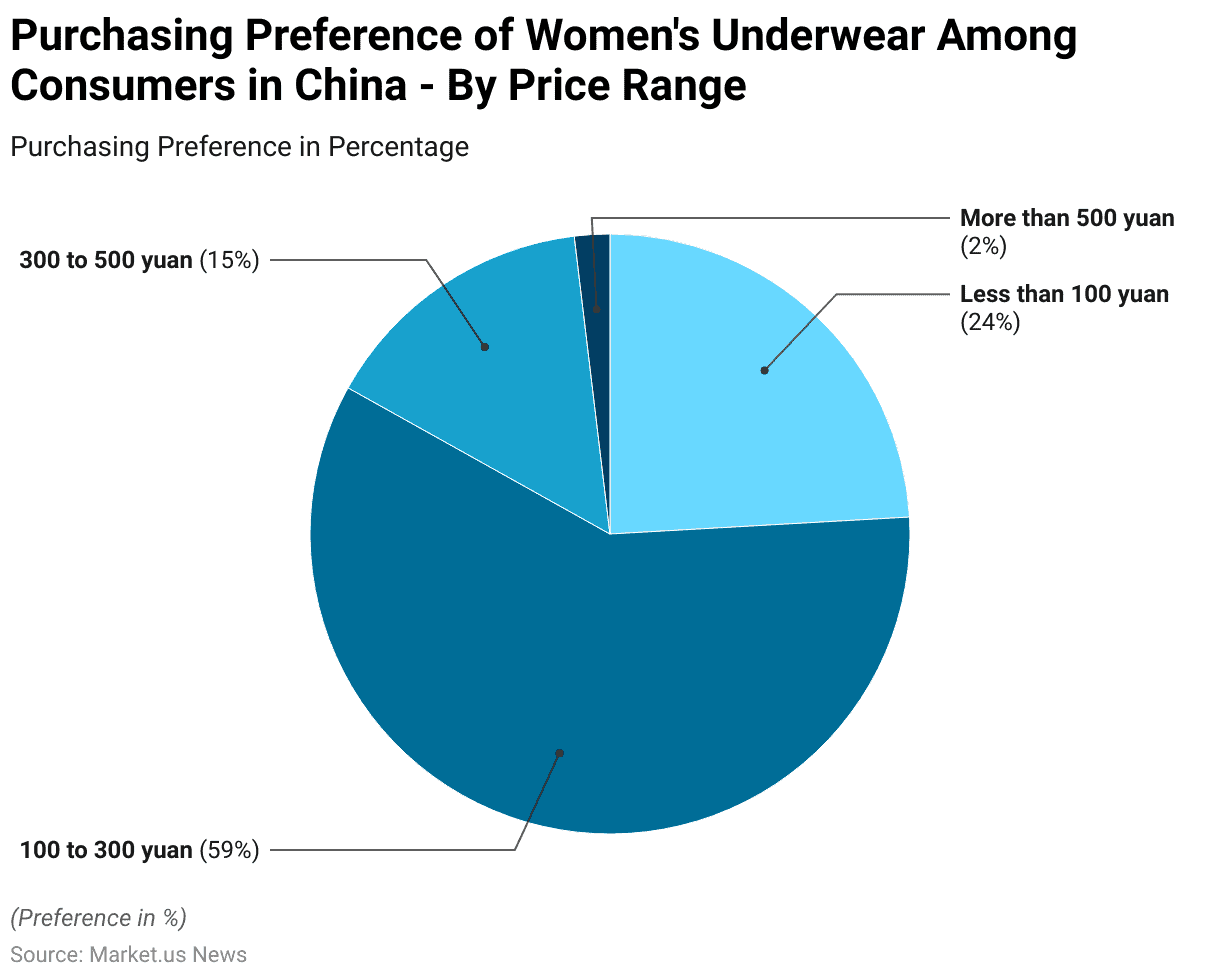

Purchasing Preference of Women’s Underwear Among Consumers in China – By Price Range By Lingerie Statistics

- In 2020, consumer preferences for purchasing women’s underwear in China varied significantly by price range.

- The majority of respondents, accounting for 59%, preferred to buy underwear in the price range of 100 to 300 yuan. This suggests a strong demand for mid-range products that likely offer a balance between quality and affordability.

- A considerable portion of consumers, 24.1%, opted for more affordable options priced below 100 yuan, indicating the presence of a price-sensitive market segment that prioritizes budget-friendly lingerie.

- In contrast, 15% of respondents showed a preference for underwear priced between 300 and 500 yuan, reflecting a niche market for higher-end products that offer premium materials or designer branding.

- At the luxury end of the market, only 1.9% of consumers preferred to purchase underwear priced above 500 yuan, suggesting that while there is some demand for premium and luxury lingerie, it remains limited to a small segment of the market.

- Overall, these preferences highlight the diversity in purchasing power and brand expectations among Chinese consumers in the women’s underwear market.

(Source: Statista)

Lingerie Brand Preferences Statistics

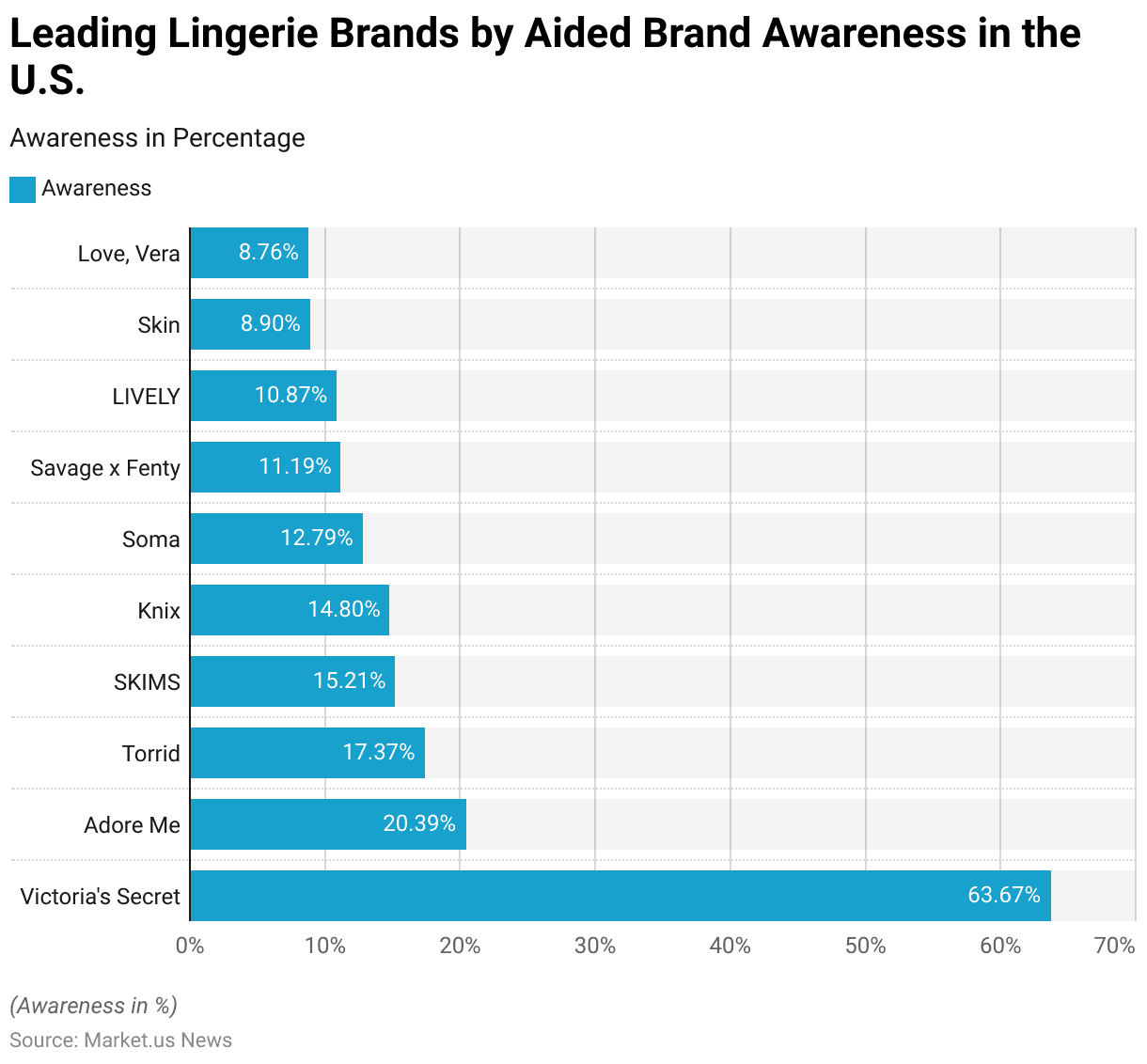

Leading Lingerie Brands by Aided Brand Awareness in the U.S. Statistics

- In 2023, aided brand awareness levels among lingerie brands in the United States revealed significant disparities, with Victoria’s Secret dominating the market. The iconic brand had an impressive aided awareness rate of 63.67%, far surpassing its competitors. This overwhelming recognition reflects Victoria’s Secret’s longstanding presence in the industry and its extensive marketing efforts.

- Following at a distance, Adore Me held the second-highest aided awareness at 20.39%, carving out a notable position in the market, particularly as a brand offering affordable yet stylish lingerie.

- Torrid, a brand catering to plus-size women, achieved an awareness level of 17.37%, reflecting its success in serving a specialized market segment.

- SKIMS, the shapewear and lingerie brand founded by Kim Kardashian, garnered 15.21% awareness, rapidly gaining traction due to its high-profile endorsements and innovative products.

- Knix, known for its focus on comfort and functional lingerie, had an aided awareness of 14.8%, appealing to consumers prioritizing practicality.

- Soma, another well-established brand, followed closely with 12.79% awareness, demonstrating its solid presence in the market. Savage x Fenty, the inclusive lingerie line by Rihanna, achieved 11.19% awareness, underscoring its growing influence and appeal to a diverse consumer base.

- Other emerging brands, such as LIVELY (10.87%), Skin (8.9%), and Love, Vera (8.76%), showed lower awareness levels, reflecting their relatively newer presence in the market.

- These brands, though smaller in recognition compared to industry leaders, are making their mark through niche offerings and distinct brand identities.

- Overall, the data reflects a highly competitive market, with Victoria’s Secret continuing to lead while newer and more diverse brands are gaining ground.

(Source: Statista)

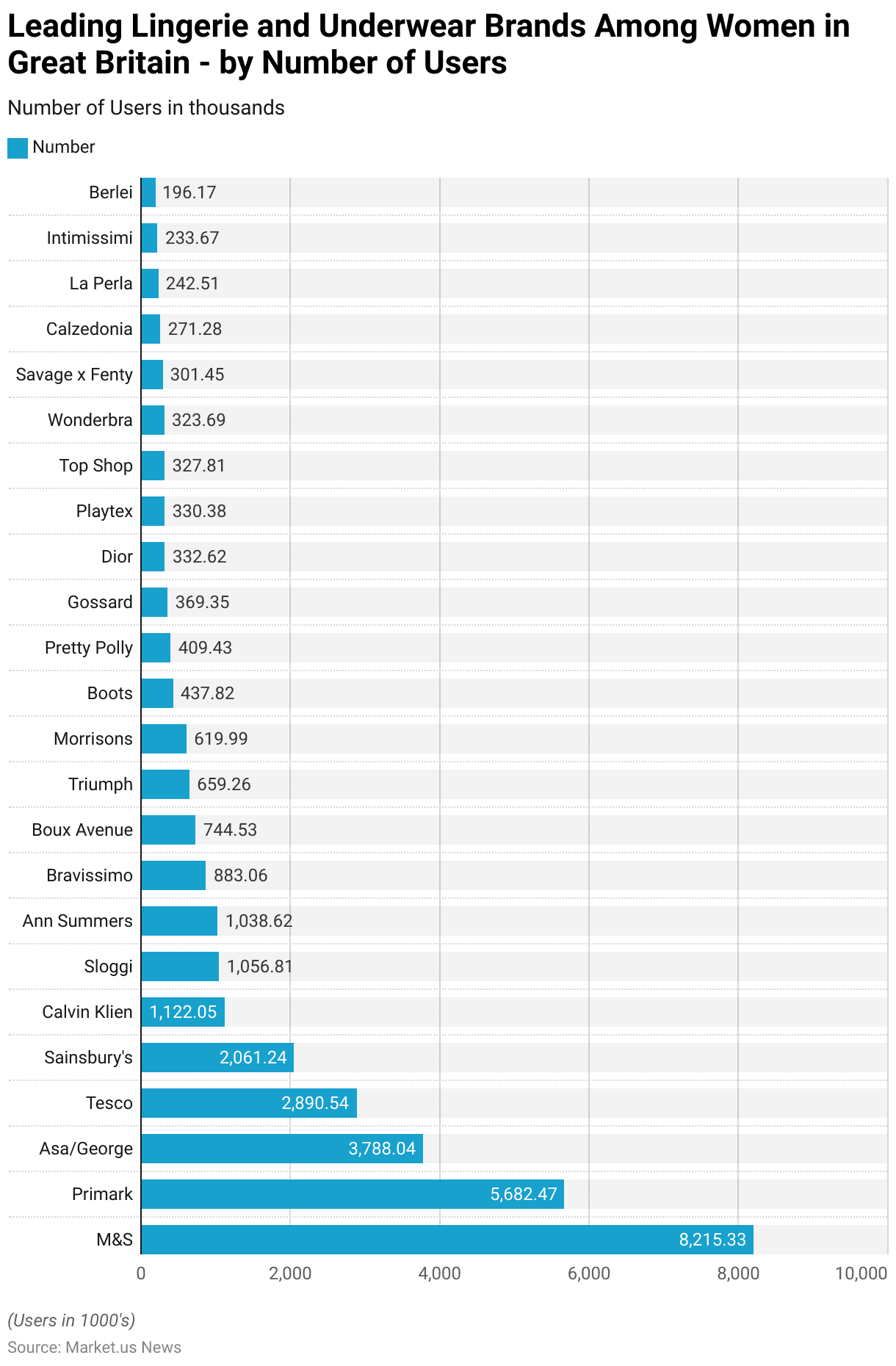

Leading Lingerie and Underwear Brands Among Women in Great Britain – by Number of Users Statistics

- In 2023, the leading brands of women’s lingerie and underwear in Great Britain showcased a diverse range of preferences among consumers, with some brands catering to mass-market needs and others focusing on niche segments.

- M&S (Marks & Spencer) emerged as the top brand, with 8.2 million users, reflecting its longstanding reputation for quality and affordable lingerie. Following M&S, Primark attracted 5.68 million users, and it is known for its budget-friendly offerings that cater to a wide audience.

- Asda/George, with 3.79 million users, and Tesco, with 2.89 million users, demonstrated the strong influence of supermarket brands in the British lingerie market, offering convenient and affordable options. Sainsbury’s also played a significant role, attracting 2.06 million users.

- Calvin Klein stood out among designer brands, with 1.12 million users, emphasizing its appeal as a premium brand. Similarly, Sloggi and Ann Summers attracted 1.05 million and 1.03 million users, respectively. Sloggi is known for its comfortable, everyday lingerie, while Ann Summers is recognized for its more provocative and intimate designs.

Moreover

- Bravissimo, focusing on fuller-bust lingerie, attracted 883,000 users, and Boux Avenue followed with 744,000 users, reflecting its growing popularity in the market. Triumph, another established lingerie brand, was favored by 659,000 users, while supermarket chain Morrisons appealed to 619,000 consumers with its affordable lingerie offerings.

- Boots, a well-known retailer, attracted 437,000 users, while Pretty Polly, with its iconic hosiery products, had 409,000 users. Gossard, another renowned lingerie brand, garnered 369,000 users, and luxury brands like Dior and La Perla attracted smaller but loyal consumer bases, with 332,000 and 242,000 users, respectively.

- Playtex, Top Shop, Wonderbra, and Savage x Fenty also captured the attention of several hundred thousand users, showing a strong presence in specific market niches. Other brands like Calzedonia, Intimissimi, and Berlei had smaller but notable shares, ranging from 196,000 to 271,000 users.

- This wide array of brands highlights the diverse preferences of British women when it comes to lingerie and underwear, ranging from affordable supermarket offerings to high-end designer and specialty products.

(Source: Statista)

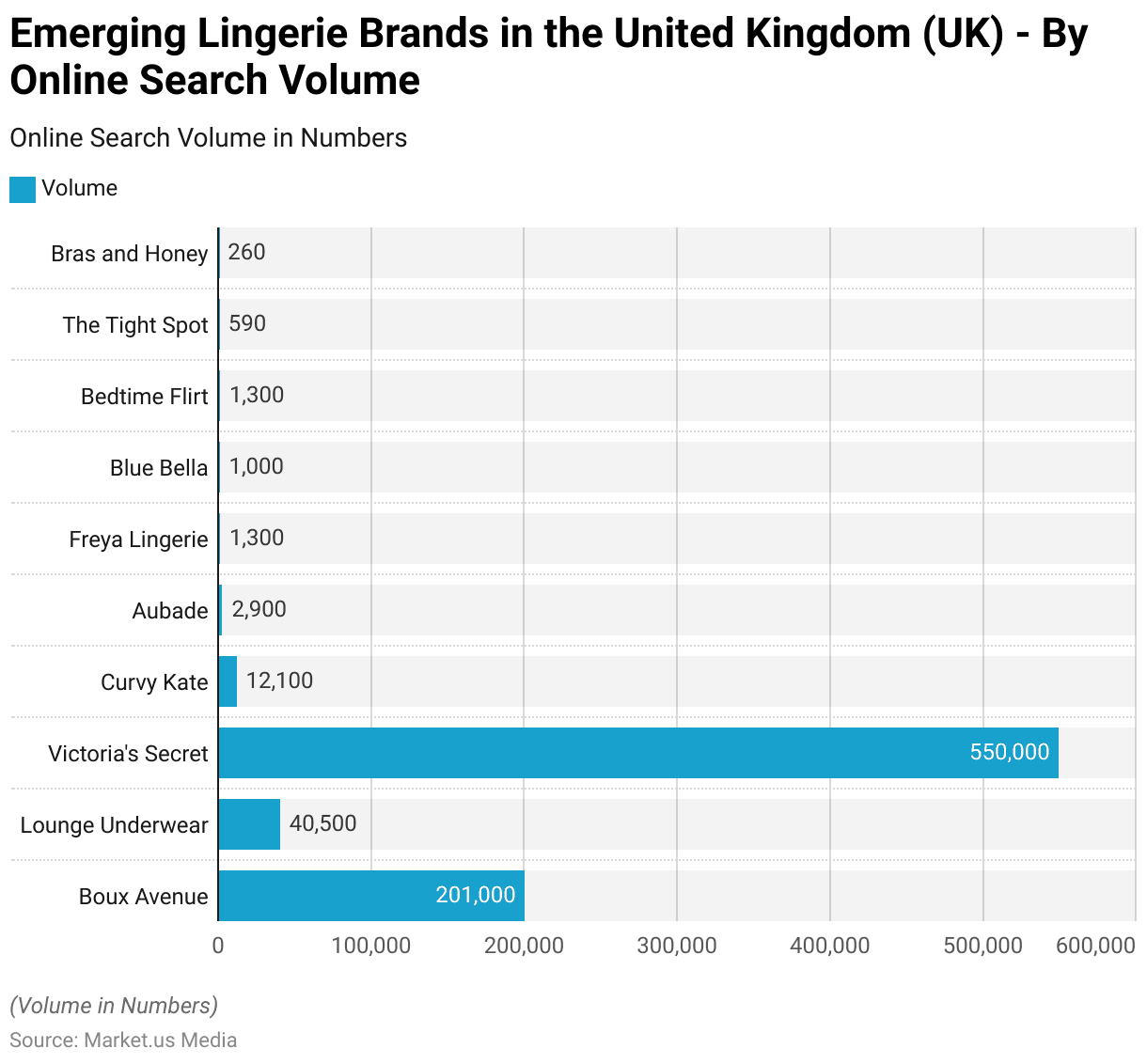

Emerging Lingerie Brands in the United Kingdom (UK) – By Online Search Volume Statistics

- In 2020, the online search volumes for lingerie brands in the United Kingdom highlighted both well-established and emerging players in the market.

- Leading the pack by a significant margin was Victoria’s Secret, with an impressive 550,000 searches, reflecting its strong global presence and continued dominance in the UK market.

- Boux Avenue followed as the second most-searched brand, with 201,000 searches. Known for offering a range of affordable yet stylish lingerie, Boux Avenue has become a popular choice among UK consumers.

- Lounge Underwear also garnered significant attention with 40,500 searches, demonstrating its rising popularity, particularly through its emphasis on comfort and trendy designs.

- Curvy Kate, a brand specializing in fuller-bust lingerie, had 12,100 searches, indicating strong interest in brands catering to specific body types.

- Aubade, known for its luxury French lingerie, registered 2,900 searches, appealing to a more niche market segment focused on high-end, sensual designs.

- Freya Lingerie and Bedtime Flirt each had 1,300 searches, with Freya catering to the fuller-bust market and Bedtime Flirt targeting consumers with a focus on romantic, intimate apparel. Bluebella, another luxury lingerie brand, generated 1,000 searches, reflecting its growing presence in the UK market.

- Smaller brands such as The Tight Spot and Bras and Honey had 590 and 260 searches, respectively, showing that while these brands have less recognition, they are still emerging players in the highly competitive UK lingerie market.

- These search volumes provide insight into the diverse range of preferences among UK consumers, from affordable and practical options to luxury and niche offerings.

(Source: Statista)

Sales Value of Women’s Lingerie on E-commerce Platforms Statistics

- From 2016 to 2020, the sales value of women’s lingerie on e-commerce platforms in China demonstrated consistent growth, reflecting the increasing popularity of online shopping in the country.

- In 2016, e-commerce sales of lingerie stood at 8.34 billion yuan, marking the beginning of a steady upward trend.

- The following year, in 2017, sales increased to 9.87 billion yuan, showcasing a growing shift toward digital retail channels for purchasing intimate apparel.

- This upward momentum continued in 2018, with sales reaching 12.3 billion yuan, representing a significant jump as more consumers embraced online shopping for convenience and access to a wider variety of lingerie products.

- The highest growth was observed in 2019, when sales surged to 14.44 billion yuan, highlighting the strength of the e-commerce market in China and the growing demand for lingerie.

- In 2020, while sales remained strong, there was a slight decrease to 13.37 billion yuan. This small dip could be attributed to a variety of factors, including market saturation or economic uncertainties related to the global pandemic.

- Nevertheless, the overall growth trajectory from 2016 to 2020 reflects the expanding influence of e-commerce in the lingerie sector, driven by increased internet penetration, consumer comfort with online shopping, and the availability of diverse lingerie brands and styles on digital platforms.

(Source: Statista)

Expenditure on Women’s Lingerie Statistics

- In 2020, the purchasing behavior of women in Great Britain, specifically for lingerie excluding bras and tights, varied significantly by expenditure.

- The majority of women, approximately 9.26 million, spent between 5 to 14 euros on lingerie, indicating a preference for affordable options.

- A significant portion, around 6.45 million women, spent less than 5 euros, further emphasizing the strong demand for budget-friendly lingerie products.

- At higher expenditure levels, 2.03 million women spent between 15 to 29 euros, showing a smaller but still considerable group willing to invest more in their lingerie.

- The number of women willing to spend between 30 and 49 euros decreased to 420,000, reflecting the diminishing size of the market as price points increased.

- For more premium purchases, only 121,000 women spent between 50 and 99 euros on lingerie, while the highest spending bracket, those spending more than 100 euros, accounted for just 67,300 women.

- This distribution highlights that, while most women in Great Britain in 2020 opted for affordable lingerie, a small segment was willing to invest in more expensive, possibly luxury, lingerie products.

(Source: Statista)

Recent Developments

Acquisitions and Mergers:

- L Brands sells Victoria’s Secret: In early 2023, L Brands completed the sale of Victoria’s Secret to Sycamore Partners for $525 million. This acquisition allows Victoria’s Secret to refocus on its core lingerie offerings and expand its online presence while adopting a more inclusive marketing strategy.

- Wacoal acquires the majority stake in Fashion Nova: In mid-2023, Wacoal, a leading lingerie brand, acquired a 70% stake in Fashion Nova, a popular fashion brand known for its body-positive marketing. The deal, valued at $250 million, is aimed at expanding Wacoal’s reach in the fast-fashion lingerie market.

New Product Launches:

- ThirdLove expands with a new inclusive sizing line: In 2023, ThirdLove launched a new line of bras and underwear featuring inclusive sizing, offering products in sizes from 30A to 48H. This move aims to cater to a broader audience and support body positivity, with sales projections anticipating a 25% increase in revenue.

- Savage X Fenty introduces eco-friendly lingerie: In late 2023, Savage X Fenty, founded by Rihanna, released a new eco-friendly lingerie collection made from sustainable materials. The launch aims to address consumer demand for environmentally responsible fashion, with initial sales surpassing $10 million within the first month.

Funding:

- Bamboobies raises $15 million for sustainable lingerie: In early 2024, Bamboobies, a brand known for its eco-friendly nursing bras and lingerie, secured $15 million in a funding round to expand its product line and marketing efforts. The funds will be used to enhance sustainable practices and increase brand awareness among new mothers.

- Bravissimo secures $5 million to expand offerings: In 2023, Bravissimo, a retailer specializing in bras for larger busts, raised $5 million to develop new product lines and enhance its online shopping experience. This funding will help the brand tap into the growing demand for stylish, supportive lingerie for curvier women.

Technological Advancements:

- Wearable technology in lingerie: By 2025, it is expected that 10% of lingerie will incorporate wearable technology, such as smart fabrics that monitor body temperature or heart rate, targeting health-conscious consumers.

- 3D printing for custom lingerie: Advances in 3D printing are projected to revolutionize the lingerie industry. By 2026, 20% of lingerie brands are expected to offer custom-fitted bras produced using 3D printing technology, allowing for more personalized products.

Conclusion

Lingerie Statistics: In conclusion, the global lingerie market demonstrates a dynamic and evolving landscape driven by factors such as consumer preferences for comfort, affordability, and style.

Across various regions, price sensitivity and brand loyalty shape purchasing behavior, while premium and niche markets continue to attract a smaller but dedicated customer base.

The rising demand for inclusive sizes, sustainable materials, and innovative designs indicates a shift toward more personalized and ethical choices.

As the market grows, both established brands and emerging players will need to adapt to these evolving trends to remain competitive in an increasingly diverse and discerning consumer environment.

FAQs

Lingerie refers to women’s undergarments, sleepwear, and intimate apparel, typically designed to be stylish, comfortable, and often provocative. It includes items like bras, panties, thongs, corsets, bodysuits, garters, and negligees.

Lingerie should generally be hand-washed or placed in a delicate garment bag if using a washing machine. Use cold water and mild detergent. Avoid using bleach, and always air-dry lingerie to maintain its elasticity and shape.

Lingerie is often more detailed, designed with finer fabrics like lace or silk, and can include elements like decorative trims, ribbons, or sheer panels. Regular underwear tends to prioritize function and comfort, using simpler materials like cotton or microfiber.

The most popular fabrics for lingerie include silk, satin, lace, cotton, and microfiber. Cotton is breathable and comfortable, ideal for everyday wear, while lace and silk are often used for more elegant or sensual pieces.

Yes, some lingerie items, such as bodysuits, slips, and bralettes, are designed to be versatile and can be styled as outerwear. Layering lingerie with blazers, jackets, or high-waisted pants is a popular fashion trend.