Table of Contents

Introduction

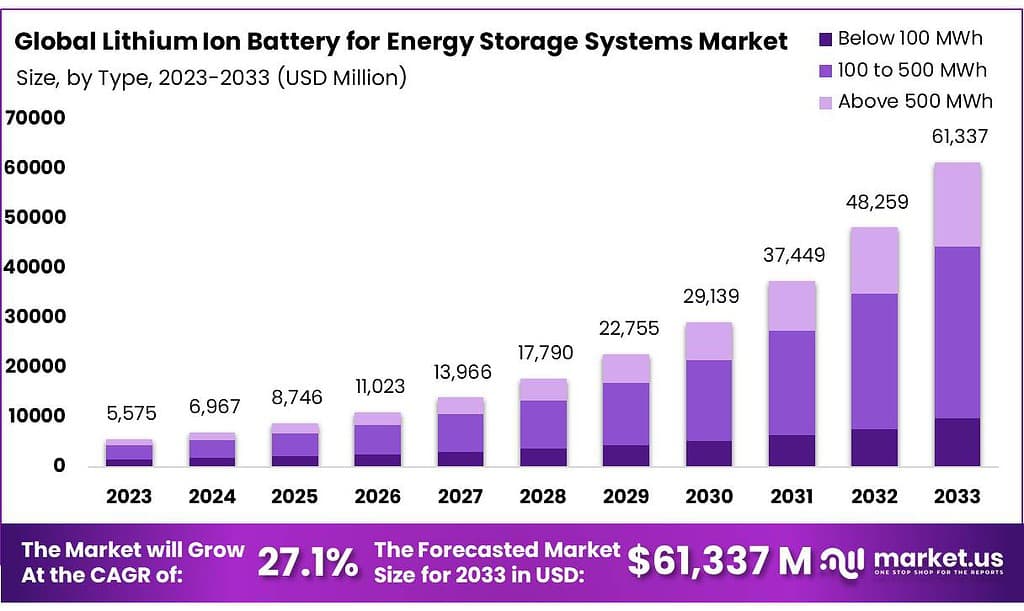

The Lithium Ion Batteries for Energy Storage Systems Market is poised for rapid expansion, with its value projected to surge from USD 5,575.3 million in 2023 to approximately USD 61,337 million by 2033. This represents a remarkable compound annual growth rate (CAGR) of 27.1% over the forecast period from 2024 to 2033.

Several factors are driving this growth. There is an increasing demand for renewable energy sources, which necessitates effective energy storage solutions like lithium-ion batteries to manage intermittent energy supplies such as solar and wind. Moreover, technological advancements and decreasing costs of lithium-ion batteries enhance their attractiveness in energy storage applications.

However, the market faces challenges, particularly in managing the safety risks associated with battery storage. Issues such as thermal runaway, where excessive heat leads to fires, remain significant concerns that require robust management strategies. Recent incidents in South Korea and other parts of the world underline the importance of safety measures in battery storage deployments.

Recent developments in the lithium-ion batteries for energy storage systems market, focusing on major players like BYD Co. Ltd., Panasonic Corporation, Toshiba Corporation, Samsung SDI Co., Ltd., Tesla Inc., LG Energy Solution Ltd, Hitachi Energy Ltd., GS Yuasa International Ltd., Saft, Narada Power Source Co., Ltd., Contemporary Amperex Technology Co., Limited., BAK Power, Morrow, Other Key Players, reveal significant strategic initiatives, particularly in new product launches and expansion investments.

BYD Co. Ltd. is actively enhancing its lithium-ion battery technology and expanding its application areas. The company, along with other key players, is investing heavily in research and development to increase the energy density of batteries and reduce the use of expensive and scarce materials like cobalt, which ultimately decreases the cost and enhances the performance of lithium-ion batteries.

Panasonic Corporation recently announced the opening of a new production plant within its Wakayama Factory in western Japan. This facility is focused on manufacturing advanced, larger 4680 cylindrical lithium-ion batteries, showcasing Panasonic’s commitment to leading in energy storage solutions through significant technological advancements.

This market is dynamically evolving with increasing installations, significant investments, and continuous technological advancements, indicating a strong growth trajectory supported by both economic incentives and regulatory support.

Key Takeaways

- The global lithium-ion battery market for energy storage systems market was valued at USD 5,575.3 million in 2023.

- The global lithium-ion battery market for energy storage systems market is projected to reach USD 61,337 million by 2033 with an estimated CAGR of 27.1%.

- Among battery Types, Lithium Iron Phosphate (LFP) accounted for the largest market share of 51.4%.

- Among capacity, the 100 to 500 MWh accounted for the majority of the market share with 51.5%.

- Based on connection Battery Type, on-grid accounted for the largest market share in 2023 with 73.3%.

- By end-use, the Utility is anticipated to dominate the market in the coming years. In 2023, it accounted for the majority of the share of 75.0%.

- Asia Pacific is expected to hold the largest global lithium-ion battery market for energy storage systems market share with 43.9%of the market share.

Lithium Ion Batteries for Energy Storage Systems Statistics

- Lithium-ion batteries are extensively used in stationary energy storage, constituting over 70% of such systems globally.

- The theoretical capacity of lithium metal oxide or lithium iron phosphate cathodes is less than 200 mAh⋅g−1.

- Lithium-ion batteries dominate with 90% of U.S. storage capacity.

- Lithium and lead batteries operate best between 68°F and 90°F.

- Voltage per Cell: Nominal voltage stands at 3.7 volts per cell, enabling customizable battery pack voltages in 3.7-volt increments.

- Storage Temperature: Recommended storage temperature ranges from -20°C to 60°C, with capacity loss minimized below 20°C.

- Manufacturers’ Nominal Life of Li-ion ESS: 15 years

- Annual Static Degradation Rate: 5%

- Rated Power of Li-ion ESS: 5 MW

- Installed Capacity of Wind Farm: 54.4 MW

- Number of Wind Generators: 64

- Storage System Capacity: 2.5 MWh

- Frequency Regulation Dead Band: ±0.04 Hz

Emerging Trends

- Advanced Lithium-Ion Technologies: A significant focus is on improving lithium-ion batteries to enhance their energy density and longevity. Innovations include the development of lithium-sulfur, lithium-air, and other high-energy-density batteries. Efforts are also being made to incorporate safer and more sustainable materials.

- Sodium and Other Alternative Chemistries: As the demand for lithium increases, the industry is exploring alternative battery chemistries such as sodium-ion, which offers cost advantages and reduced environmental impact. This shift is partly driven by the need to alleviate the pressure on lithium supplies and to provide more diverse energy storage solutions.

- Battery Recycling and Second-Life Applications: The recycling of lithium-ion batteries and their use in second-life applications is becoming increasingly important. This not only supports the circular economy but also addresses the environmental impact of battery disposal. Companies are developing technologies to improve the efficiency and effectiveness of battery recycling processes.

- Integration with Renewable Energy Systems: Lithium-ion batteries play a crucial role in the integration of renewable energy sources by storing excess energy and balancing supply and demand. This is particularly important as the global energy grid transitions to more sustainable but intermittent energy sources like wind and solar.

- Solid-State Batteries: Research and development are ramping up in solid-state battery technologies, which promise higher energy densities, faster charging times, and improved safety profiles over conventional lithium-ion batteries. While still primarily in the developmental stage, these batteries are expected to begin impacting markets within the next decade.

- Thermal Energy Storage and Distributed Systems: Innovations in thermal energy storage and distributed storage systems are emerging as crucial trends. These technologies allow for more efficient management of energy loads and enhance the flexibility and resilience of the energy grid.

Use Cases

- Grid Management: Lithium-ion batteries are integral in managing and stabilizing the electrical grid. They provide essential services like frequency regulation, peak shaving, and load leveling, which are crucial for integrating renewable energy sources into the grid. These systems help manage the variability and intermittency of renewables like solar and wind by storing excess energy and dispatching it when needed.

- Commercial Applications: In the commercial sector, lithium-ion BESS is used for on-site generation load shifting, where excess energy generated from renewables is stored and used later, reducing reliance on grid power during peak demand periods. This not only helps in cutting down energy costs but also aids in managing energy consumption more efficiently.

- Industrial Applications: For industrial uses, lithium-ion batteries contribute to energy savings, carbon reduction, and enhanced grid stability. They support the integration of renewable energy, helping industries shift towards more sustainable operations and reduce greenhouse gas emissions.

- Utility-Scale Storage: At the utility scale, lithium-ion BESS plays a crucial role in ensuring a consistent and reliable energy supply. They store energy during periods of low demand and release it during peak times, helping to balance supply and demand and stabilize the grid.

- Residential Applications: Homeowners use lithium-ion batteries in conjunction with solar panel systems to increase energy independence, manage electricity costs, and provide backup power during outages. This is becoming particularly relevant as more regions experience erratic weather conditions that can lead to frequent power disruptions.

Key Players Analysis

BYD Co. Ltd. is actively advancing in the Lithium Ion Battery for Energy Storage Systems sector with its next-generation energy storage system, the MC Cube-T. This system showcases BYD’s commitment to leveraging high-capacity, long-lasting blade battery technology. The MC Cube-T, featuring a compact design and an enhanced energy capacity of 6.432 MWh, represents a significant step forward in optimizing energy storage solutions. BYD’s innovations are crucial for supporting sustainable energy developments, highlighting its role as a leader in new energy vehicle markets and energy storage.

Panasonic Corporation is a major player in the lithium-ion battery market for energy storage systems, known for its significant contributions to battery technology and production. The company focuses on developing advanced battery solutions that are essential for various applications, including electric vehicles and renewable energy storage systems. Panasonic’s expertise in battery technology helps drive the expansion and efficiency of the global energy storage market, ensuring reliable and effective energy solutions for a wide range of industrial, commercial, and residential applications.

Toshiba Corporation is actively enhancing its presence in the Lithium Ion Battery for Energy Storage Systems sector. The company has developed a new generation of its SCiB™ batteries, focusing on safety and longevity, which use lithium titanium oxide. These batteries are notable for their quick charging capabilities and operational resilience, making them ideal for applications requiring high energy input and output, such as industrial equipment and energy storage systems. Toshiba’s innovations are contributing significantly to advancing carbon neutrality through efficient and reliable energy solutions.

Samsung SDI Co., Ltd. is a key player in the energy storage sector, known for its advanced lithium-ion battery technologies. The company is focusing on enhancing the performance and safety of its batteries, crucial for applications in energy storage systems. Samsung SDI’s batteries are integral to various sectors, from electric vehicles to large-scale energy storage, providing high energy density and efficiency. The company’s continuous innovation and expansion in battery technology play a vital role in the global transition to renewable energy.

Tesla Inc. is at the forefront of the Lithium Ion Battery for Energy Storage Systems market with its innovative Megapack product. The Megapack is designed for utility-scale projects and boasts up to 3 megawatt hours (MWh) of storage capacity. This product streamlines the installation of large-scale battery storage, reducing the time and cost compared to traditional power plants. Tesla’s Megapack has been instrumental in projects like the 182.5 MW Elkhorn Battery, highlighting its significant impact on enhancing grid reliability and supporting renewable energy integration.

LG Energy Solution Ltd is a key player in advancing lithium-ion battery technology for energy storage systems. The company focuses on producing high-quality batteries that support a range of applications from electric vehicles to large-scale energy storage solutions. LG Energy Solution is committed to innovation and sustainability, continuously working on improving battery efficiency and capacity to meet the growing demand for reliable and environmentally friendly energy storage.

Hitachi Energy Ltd. is making significant strides in the lithium-ion battery market for energy storage systems, particularly focusing on enhancing grid stability and renewable energy integration. Their solutions are designed to support the increasing reliance on renewable energy sources, providing essential storage capacity to balance and manage energy loads effectively. Hitachi Energy’s advanced battery storage solutions are pivotal in transitioning towards more sustainable and efficient energy systems.

GS Yuasa International Ltd. is deeply involved in developing and deploying lithium-ion batteries across various sectors, including renewable energy projects and grid stabilization efforts. Recently, they have been selected to provide a substantial 290 MWh lithium-ion battery storage system for ENEOS Corporation in Japan, aimed at enhancing power grid capabilities and supporting the country’s carbon neutrality goals. GS Yuasa’s technology is notable for its high safety standards and reliability, catering to both industrial needs and large-scale energy storage applications.

Saft, a subsidiary of Total, specializes in advanced lithium-ion energy storage solutions tailored for high-demand applications such as grid support and renewable energy integration. With a focus on safety, longevity, and high performance, Saft’s technology supports a variety of projects, including a significant deployment in Finland where their systems provide frequency regulation and backup power for a wind farm. Their Intensium Max 20 High Energy containers exemplify this capability, offering large-scale energy storage solutions that are both efficient and reliable.

Narada Power Source Co., Ltd. is recognized for its robust lithium-ion battery solutions, particularly in energy storage systems (ESS) that cater to renewable energy and grid stability. Their batteries are designed for high performance in diverse applications, ranging from commercial to industrial-scale projects. Narada’s focus extends to enhancing the efficiency and reliability of energy storage, demonstrating a commitment to advancing battery technology that supports sustainable energy transitions.

Contemporary Amperex Technology Co., Limited (CATL) continues to lead in the lithium-ion battery market for energy storage systems. CATL has introduced the TENER energy storage product, described as the world’s first mass-producible 6.25 MWh storage system that offers zero degradation in performance for the first five years. This innovation highlights CATL’s commitment to enhancing energy density and efficiency, significantly improving the utility of large-scale storage systems in renewable energy applications and grid support.

BAK Power is actively participating in the energy storage sector but specific details about their recent activities or contributions to the lithium-ion battery market were not available from the current search.

Morrow has been engaged in the energy storage market, though specific, recent highlights of their work in the lithium-ion battery sector for energy storage systems were not found in the latest search data. More targeted information may be needed to provide a detailed update on Morrow’s contributions or developments in this field.

Conclusion

The Lithium Ion Battery for Energy Storage Systems (BESS) market is poised for substantial growth, driven by the increasing demand for renewable energy integration, advancements in technology, and the global shift towards sustainable energy practices. As industries and residential consumers alike seek reliable and efficient energy storage solutions, lithium-ion batteries stand out for their versatility, high energy density, and decreasing cost profiles.

Challenges such as safety concerns and the need for improved recycling processes persist, but ongoing innovations and supportive policies are likely to propel market expansion. Moreover, the diversification of battery technologies, including the development of alternative chemistries, offers potential for further market evolution. Overall, the lithium-ion battery market for energy storage systems is expected to continue its significant role in facilitating the transition to a more resilient and low-carbon energy future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)