Table of Contents

Introduction

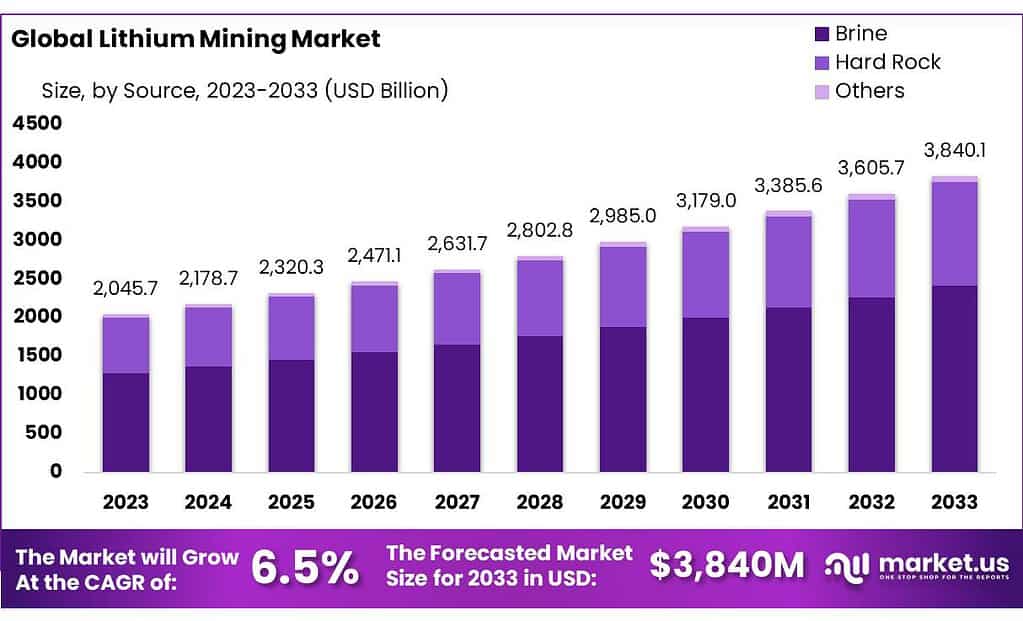

The Global Lithium Mining Market is projected to grow from USD 2045.7 million in 2023 to approximately USD 3840.1 million by 2033, advancing at a compound annual growth rate (CAGR) of 6.5% during the forecast period. This growth is driven by the increasing demand for lithium in various industries, particularly for electric vehicle (EV) batteries, glass and ceramics, and pharmaceuticals, along with its critical role in air treatment technologies.

Several factors are stimulating market expansion, including technological advancements in mining and extraction processes and a surge in the application of lithium across consumer electronics, where products like smartphones, smartwatches, and TVs have become ubiquitous. Additionally, the automotive sector’s shift towards electric vehicles, supported by governmental policies and subsidies, contributes significantly to this demand.

Challenges in the market stem from environmental concerns associated with lithium mining processes, such as water pollution and the disruption of ecosystems. Health hazards, including respiratory disorders from lithium dust, are also notable concerns. Furthermore, the scarcity of recycling setups for lithium-ion batteries makes recycling an expensive and less favorable option.

Recent developments highlight innovations aimed at reducing the environmental impact of lithium extraction and improving efficiency. For instance, new filtering technologies have been developed to enhance lithium ion recovery from brine solutions, significantly reducing the extraction time from several months to just a few hours.

Albemarle Corporation, a significant player in the lithium mining market, has recently made substantial investments and strategic partnerships to enhance its position and capacity in the lithium industry, essential for electric vehicle batteries and other energy solutions.

Key Takeaways

- Lithium Mining Market size is expected to be worth around USD 3840.1 Million by 2033, from USD 2045.7 Million in 2023, growing at a CAGR of 6.5%.

- Brine held a dominant market position, capturing more than a 63.3% share.

- Carbonate held a dominant market position, capturing more than a 44.2% share.

- Lithium Carbonate held a dominant market position, capturing more than a 58.3% share.

- Battery held a dominant market position, capturing more than a 72.3% share.

- Asia Pacific (APAC) Dominating the global landscape, Asia Pacific accounts for 38% of the market with a valuation of USD 781.4 million.

Lithium Mining Statistics

- Chile is second in rank but with more modest growth. Chilean production rose from 13,500 metric tons in 2013 to 44,000 metric tons in 2023.

- China, which also produces lithium from brine, has been approaching Chile over the years. The country increased its domestic production from 4,000 metric tons in 2013 to 33,000 last year.

- The Arcadia open-pit Lithium Project, situated 38 kilometers east of Zimbabwe’s capital city of Harare, is considered one of the world’s largest hard rock lithium resources.

- The project, owned by mining company Zhejian Huayou Cobalt, has measured lithium reserves of 42.3 million tons.

- The Chinese group plans to invest approximately $300 million into the project to develop the lithium mine and reprocessing plant, aiming to produce 4.5 million tons of ore and 50,000 tons of lithium carbonate equivalent, respectively.

- With all the top producers increasing output to cover the demand from the clean energy industry, especially for electric vehicle (EV) batteries, the lithium market has seen a surplus recently, which caused prices to collapse by more than 80% from a late-2022 record high.

- Information collected and provided by the US Geological Survey shows that global lithium production registered a dramatic surge in 2022, hitting 130,000 metric tons (MT) of lithium content (this data excludes U.S. production) which is over 20,000 MT more than in 2021 (107,000 MT).

- In 2022 this country extracted 61,000 MT of lithium (an increase of nearly 6,000 from 55,300 MT in 2021).

- China is also responsible for the production of around 75% of all lithium-ion batteries used worldwide.

- This nation witnessed a staggering increase of 234% in its lithium exports last year and hit a 10-year high production of 6,200 MT.

- In 2019 the production levels showed a staggering increase, hitting 2,400 MT. Then came COVID-19 and production fell to 1,700 MT but 2022 saw a recovery when Brazil’s production reached 2,200 MT.

- The Brazilian government plans to invest US$2.8 billion to increase the country’s lithium extraction capacity by the end of the decade.

- Australia produced 55,000 MT of lithium content last year, a significant increase from the previous year’s 44,000 MT.

- According the US Geological Survey (USGS), there are around 80 million tonnes of identified reserves globally as of 2019. That’s up almost 30% compared to a year earlier.

- Argentina has the world’s second-largest lithium reserves, totalling around 17 million tonnes.

- Although the US has the world’s fourth-largest lithium reserves, measured at 6.8 million tonnes according to the US Geological Survey, production activity in the country is minimal.

- Mine output from the country stood at 42,000 tonnes in the year – compared to second-placed Chile, which produced 18,000 tonnes.

- Australia’s mine reserves of lithium are second-only to Chile, totalling 2.8 million tonnes.

Lithium-ion battery supply chain, data from BloombergNEF suggests China controls 80% of the world’s raw material refining, 77% of the world’s cell capacity and 60% of the world’s component manufacturing.

Emerging Trends

Emerging trends in the lithium mining sector highlight the rapid evolution and expansion of the industry, driven by several key factors aimed at enhancing production capacity and sustainability.

One of the major trends is the introduction of advanced extraction technologies such as Direct Lithium Extraction (DLE). DLE offers increased efficiency by allowing the extraction of lithium from lower concentration brine sources, which were previously not viable. This method not only boosts the yield of lithium extraction but also presents a reduced environmental footprint, as it minimizes waste and greenhouse gas emissions.

The expansion of lithium production capacity is crucial given the growing demand from the electric vehicle (EV) industry and energy storage solutions. Global lithium production is anticipated to rise significantly, with a forecasted annual growth rate of 13.9% leading to a substantial increase in total production by 2030. This is in response to the accelerating shift towards electric mobility and the increased deployment of renewable energy technologies, which require substantial lithium inputs

Another significant trend is the exploration and development of unconventional lithium sources. These include geothermal and oilfield brines, which offer new opportunities for lithium supply but have not yet been exploited on a commercial scale. These sources are expected to become more viable with technological advancements and increased investment in research and development.

Environmental sustainability and the adoption of green technologies are also shaping the future of lithium mining. There is an ongoing shift towards more environmentally friendly lithium extraction methods and the reduction of carbon emissions across the supply chain. As the industry faces increasing scrutiny over its environmental impact, technologies that reduce water use and pollution are becoming crucial. The industry is also exploring lithium recycling as a sustainable source, which could provide an alternative supply of this critical raw material and mitigate environmental impacts

Use Cases

- Electric Vehicles (EVs): Lithium is a key component in the production of lithium-ion batteries used in EVs. The rapid growth of the EV market, supported by government incentives and substantial investments from automotive manufacturers, underscores lithium’s critical role in this sector. The energy density and efficiency of lithium-ion batteries make them preferred over other battery types for powering electric cars.

- Energy Storage Systems: Lithium batteries are vital for energy storage solutions, particularly for stabilizing the renewable energy supply from sources like solar and wind. These storage systems help manage the intermittency of renewable energy, thus enhancing grid stability and energy security.

- Consumer Electronics: From smartphones to laptops and smart home devices, lithium-ion batteries are integral to powering a wide range of consumer electronics. The demand for these products continues to drive significant lithium usage globally.

- Portable Power Tools and Medical Devices: Lithium batteries are extensively used in high-performance power tools and medical devices, benefiting from their lightweight and high-energy capacity, which is essential for portability and reliability in various. applications

- Aerospace and Military Applications: Lithium’s lightweight and high energy density characteristics are also leveraged in aerospace and military applications, where performance, efficiency, and reliability are paramount.

Major Challenges

- Environmental Impact: Lithium mining, especially from salt brines, involves extensive water usage and can lead to water pollution, affecting local ecosystems and communities. This environmental footprint is prompting a push towards more sustainable mining practices and technologies like Direct Lithium Extraction (DLE).

- Supply and Demand Imbalance: There is a potential supply deficit looming, with demand from the electric vehicle (EV) and renewable energy sectors expected to outstrip supply. Experts predict a substantial lithium supply gap by the 2030s, with figures ranging from 300,000 to 768,000 tonnes of lithium carbonate equivalent (LCE).

- Geopolitical and Economic Challenges: Lithium production is concentrated in a few countries, which could lead to geopolitical tensions and resource nationalism. For instance, major lithium-producing countries like Chile face political and regulatory uncertainty, which could hamper production expansion efforts.

- Technological and Operational Hurdles: While new mining and extraction technologies are being developed to improve efficiency and reduce environmental impacts, such as DLE and the use of geothermal or oilfield brines, these technologies are still in the early stages and have not been proven at commercial scales. This represents a technological challenge that the industry must overcome to meet growing demand sustainably.

- Community and Legal Challenges: Mining operations often face resistance from local communities and environmental groups, leading to legal challenges and delays in project approvals and developments. For example, mining projects like the Thacker Pass mine in the U.S. have encountered significant opposition and legal hurdles, which could slow down or halt mining activities.

Market Growth Opportunities

The lithium mining market is poised for significant growth, driven by several key factors that highlight the increasing importance of lithium in various industries, especially in electric vehicles (EVs) and energy storage solutions.

One of the primary drivers of this growth is the surge in electric vehicle sales, spurred by global efforts to adopt more sustainable and eco-friendly transportation solutions. Governments worldwide are offering incentives for EV adoption, which in turn increases the demand for lithium-ion batteries. Additionally, the demand for consumer electronics, which rely on lithium batteries, continues to rise as technology integrates more into everyday life, adding another layer of demand for lithium mining.

Geographically, Asia-Pacific is strategically positioning itself to be a major player in the lithium market, aiming for economic development through increased lithium supply and striving for self-reliance and carbon neutrality in battery manufacturing by 2050. This region, along with traditional lithium powerhouses like Australia and Chile, is expected to see significant capacity expansions.

Furthermore, the market is also benefiting from the development of more economical and efficient EV batteries, which are essential for the broader adoption of electric vehicles. Innovations in battery technology that reduce costs and charging times while increasing range are crucial for continuing the shift towards electric mobility

Key Players Analysis

Albemarle Corporation, a key player in the lithium mining sector, is making significant strides in enhancing its lithium production capabilities, particularly within the United States. In 2023, Albemarle received a substantial $90 million grant from the U.S. Department of Defense to support the expansion of domestic lithium mining and processing capabilities. This funding aims to boost lithium production for the nation’s battery supply chain, with a focus on reopening the Kings Mountain mine in North Carolina. This site is expected to become a major contributor to the U.S. lithium supply, with potential operational commencement by late 2026. Furthermore, Albemarle’s commitment to sustainable mining practices is evidenced by its adherence to the IRMA (Initiative for Responsible Mining Assurance) standards, ensuring responsible mining operations that minimize environmental impact while engaging local communities.

In 2023, FMC Corporation has navigated challenging market conditions effectively, maintaining robust adjusted EBITDA margins through strategic pricing and cost management. Looking forward to 2024, FMC anticipates a revenue range of $4.50 to $4.70 billion, marking a modest 2.5% increase from the previous year. The company expects to face some economic pressures in the first half of the year but foresees improvements in the latter half driven by new product growth and benefits from restructuring. Adjusted EBITDA for 2024 is projected to remain stable, reflecting both challenges and opportunities in the evolving market.

Galaxy Resources Limited, merged with Orocobre to form Allkem, has become a major player in the lithium sector, contributing significantly to the global supply of this critical metal. The company’s operations, particularly in the lithium-rich regions of Australia, underscore its pivotal role in the lithium market. This merger has expanded its capacity and influence, positioning Allkem well within the top ranks of lithium producers globally, as of 2024

In 2023, Ganfeng Lithium faced challenges with slumping profits due to declining lithium prices, which dropped over 80% from their peak in 2022. Despite these hurdles, Ganfeng remains committed to expanding its global presence in the lithium sector, particularly focusing on enhancing its production capacities and securing more reserves. The company is also investing in new projects like the Goulamina Lithium Project in Mali, aiming to increase its stake to 60%, thereby strengthening its resource control. For 2024, Ganfeng has secured a significant deal to supply lithium hydroxide to Hyundai, which marks a positive outlook for its operational results during this period. These moves are part of Ganfeng’s broader strategy to maintain its position as a leading provider in the rapidly growing battery materials market, despite the current price volatilities.

In 2023, Lithium Americas Corp continued to make significant strides in the lithium mining sector, particularly with the development of the Thacker Pass project in Nevada, which is notable for being the largest known lithium resource in North America. The company has been focusing on moving this project towards production with a targeted capacity of 40,000 tons per annum of battery-quality lithium carbonate. Financially, Lithium Americas managed to reduce its net loss significantly to $3.9 million in 2023 from $67.8 million in 2022, reflecting efficient management and the start of capitalization of project costs. Additionally, a pivotal $2.26 billion loan from the U.S. Department of Energy, confirmed in 2024, will support their expansion and operational capabilities significantly.

Livent has maintained its position as a key player in the lithium sector, known for producing high-quality lithium for various applications including electric vehicle batteries. The company focuses on sustainable practices and technological innovations to enhance its production processes and maintain a competitive edge in the rapidly growing lithium market. Livent’s strategic operations and expansion efforts continue to strengthen its market presence, adapting to the dynamic demands of the lithium industry. The specifics of Livent’s recent financial performance and strategic developments weren’t detailed in the search results, but they typically parallel industry trends of investing in capacity expansion and technological advancement to meet global lithium demand.

MGX Minerals Inc. has been actively engaged in the exploration of its GC Lithium Project in British Columbia. Throughout 2023, the company completed extensive geochemical sampling and geological mapping to support future drilling activities. Notably, the exploration results have been promising, with lithium assay values reaching up to 1.04%. These efforts underline MGX’s strategic focus on advancing its lithium assets, amidst broader ambitions to enhance its mineral resource projects including lithium, magnesium, and silicon, aiming to solidify its footprint in the lithium mining sector.

Mineral Resources Limited, on the other hand, continues to strengthen its position in the lithium mining industry through significant operational achievements and strategic expansions. As a major player, the company is well-known for its diversified mining services and direct involvement in the extraction and processing of lithium, which is critical for the burgeoning electric vehicle market. Their efforts are part of a broader strategy to capitalize on the increasing demand for battery materials, driven by the global shift towards electric mobility and renewable energy solutions. While specific year-wise data for 2023 or 2024 was not detailed in the immediate search, Mineral Resources’ consistent performance and strategic expansions typically reflect its robust engagement in the sector.

Nemaska Lithium has been actively progressing with its lithium projects, notably the Whabouchi mine in Quebec, which is one of the richest spodumene lithium deposits in the world. In 2023, the company focused on restructuring its operations and securing financing to move forward with its mining and hydroxide plant projects, aiming to become a significant player in the global lithium market as the demand for electric vehicle batteries continues to grow.

Nordic Mining ASA has seen substantial growth in its involvement in the lithium sector, primarily through its 16.3% ownership in Keliber Oy, which is advancing a lithium project in Finland. In 2024, Keliber’s project significantly increased its valuation following an updated definitive feasibility study. This study indicated a solid financial and technical outlook, improving the project’s net present value and internal rate of return, positioning Nordic Mining well in the European lithium market which is crucial for battery-grade lithium hydroxide production.

In 2023 and 2024, Orocobre Limited, now known as Allkem after merging with Galaxy Resources, solidified its position as a major global player in the lithium sector. This merger, finalized in August 2021, has created one of the top five lithium chemicals companies worldwide. The combined entity has enhanced its operational and financial capacity to accelerate the development of its key lithium projects, including the significant expansions at its Olaroz and Cauchari projects in Argentina, and the Naraha lithium hydroxide plant in Japan. This strategic move aims to leverage the rising demand for lithium, driven by the electric vehicle market.

Pilbara Minerals has been active in the lithium mining sector, focusing on its Pilgangoora Lithium-Tantalum Project in Western Australia. Known for producing spodumene concentrate, a primary source for lithium, the company is expanding its operations to meet the global demand for lithium, essential for batteries in electric vehicles and other technologies. Pilbara Minerals’ strategic initiatives and developments in extraction and processing technology aim to enhance their production capacity and efficiency, positioning them well in the competitive lithium market

In 2023 and 2024, Sichuan Tianqi Lithium Industries has solidified its status as a key player in the lithium market, particularly through advancements in environmental, social, and governance (ESG) performance. The company was recognized on the Fortune China ESG Impact List for its ESG governance, underscoring its commitment to sustainable practices. This recognition aligns with its strategic developments, such as expanding lithium production capacities to meet growing global demands, particularly from the electric vehicle sector.

Sociedad Química y Minera (SQM) continues to excel in the lithium mining sector, leveraging its extensive resources in the Atacama Desert, one of the richest lithium-bearing areas globally. SQM has been focusing on increasing its production capacity to meet the booming demand for lithium, essential for batteries in electric vehicles and various electronics. The company’s strategic initiatives aim to enhance efficiency and sustainability across its operations, positioning it well within the competitive landscape of the global lithium market

Tianqi Lithium has solidified its position as a leader in the lithium industry through notable achievements in environmental, social, and governance (ESG) initiatives. In 2023, the company was recognized for its superior ESG practices, making it onto the Fortune China ESG Impact List, which underscores its commitment to sustainable and responsible business practices. Throughout the year, Tianqi Lithium integrated its strategy of ‘changing the world with lithium’ into its operations, enhancing its ESG governance and promoting high-quality development. These efforts align with its business philosophy where economic interests do not override safety and environmental protection.

Wealth Minerals Limited is actively developing its lithium projects in Chile, emphasizing its Kuska Project in the Ollagüe Salar. This project is significant, with a positive preliminary economic assessment (PEA) estimating a pre-tax net present value (NPV) of US$1.65 billion and an internal rate of return (IRR) of 33%. The company aims to produce lithium carbonate using environmentally friendly direct lithium extraction (DLE) methods, supporting Chile’s national lithium strategy and emphasizing community and environmental considerations. These developments underline Wealth Minerals’ strategic position to capitalize on the burgeoning demand for lithium, driven by the global energy transition.

Conclusion

Environmental concerns, technological advancements in mining processes, and geopolitical factors are shaping the landscape in which lithium producers operate. Market expansion is further supported by strategic investments in regions like Asia-Pacific, aiming for carbon neutrality and self-reliance in battery production. Ultimately, the lithium mining industry’s ability to innovate and adapt will be crucial in meeting the soaring global demand and contributing to a more sustainable future.