Table of Contents

Introduction

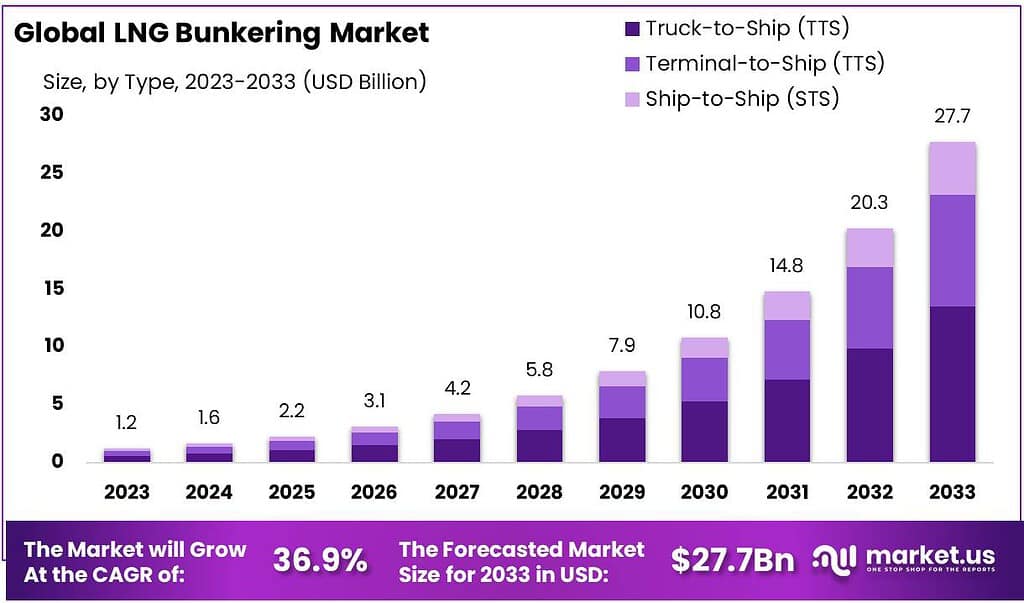

The global LNG Bunkering Market is projected to undergo a significant transformation, with its size anticipated to escalate from USD 1.2 Billion in 2023 to approximately USD 27.7 Billion by 2033, achieving a Compound Annual Growth Rate (CAGR) of 36.9% during the forecast period from 2024 to 2033. This rapid growth can be attributed to several factors, including the increasing adoption of stricter emissions regulations globally, which compels shipping companies to switch to cleaner energy sources like LNG. Moreover, the expansion of trade due to globalization continues to drive the demand for maritime transport, indirectly boosting the LNG bunkering infrastructure.

However, the market faces notable challenges, such as the high initial costs associated with setting up LNG bunkering stations and the technological advancements required to handle LNG safely. Recently, developments in the market have demonstrated a robust trend towards the establishment of international cooperation across various regions, aiming to standardize operations and enhance safety protocols, which are crucial for supporting LNG as a viable marine fuel. These elements collectively delineate the dynamic progression and the complexities inherent in the LNG Bunkering Market.

The landscape of LNG bunkering is actively evolving, with significant strides made by major industry players like Shell, TotalEnergies, Engie, and ENN Energy Holdings Ltd. These developments are primarily driven by global shifts towards cleaner energy sources and the maritime industry’s response to environmental regulations.

Shell has significantly expanded its operations, completing over 250 LNG bunkering operations in 2022 across 15 ports in 10 countries. In 2023, they marked a milestone with their 100th ship-to-ship LNG bunkering operation through their joint venture FueLNG. Additionally, Shell has been proactive in deploying new LNG bunkering vessels such as the New Frontier 2 in the Caribbean, enhancing their operational footprint and capacity.

TotalEnergies is another key player making impactful advancements. They have been focusing on increasing their LNG bunkering vessel fleet, aiming to meet the growing demand for cleaner marine fuels. This aligns with their broader strategy of transitioning towards more sustainable energy solutions.

Engie has been involved in several collaborations and projects that focus on expanding LNG infrastructure and availability. Their initiatives often involve partnerships with local authorities and other energy companies to develop comprehensive LNG bunkering solutions that cater to a global market.

ENN Energy Holdings Ltd. continues to invest in LNG infrastructure, particularly in Asia, where they are part of projects aimed at increasing the accessibility and efficiency of LNG bunkering operations. Their activities are pivotal in shaping the LNG landscape in one of the busiest maritime regions in the world.

Together, these developments underline a robust commitment to enhancing LNG bunkering capabilities globally, demonstrating a clear industry shift towards sustainable maritime fuel solutions.

Key Takeaways

- Market Growth: LNG bunkering market projected to reach USD 27.7 billion by 2033, with a CAGR of 36.9% from 2023’s USD 1.2 billion.

- Bunkering Methods: Truck-to-Ship (TTS) dominated with 48.6% market share in 2023, offering flexibility.

- Vessel Types: Container ships lead with 62.4% market share in 2023, driven by global trade reliance.

- Applications: Industrial & Commercial segment holds 68.3% market share in 2023, driven by cargo transport.

- Europe’s Dominance: Europe maintains 45.6% market share in 2023, driven by stringent regulations and sustainability initiatives.

LNG Bunkering Statistics

Global LNG Bunkering Market Dynamics

- LNG bunkering hit a record high in 2023 with 4.7 million cubic meters delivered globally, up 62% compared to 2022.

- By the end of March 2024, LNG bunkering sales had reached 1.9 million cubic meters, close to the total volume sold in 2022.

- Total LNG bunker sales could surpass 7 million cubic meters by the end of 2024.

- In 2023, 75% of new car carrier orders were for dual-fuel LNG engines.

- In 2023, ship-to-ship transfers accounted for 2.9 million cubic meters of LNG bunkering.

- Europe has 85 LNG bunkering ports, while Asia has 26, led by China, Japan, and South Korea.

LNG-Fueled Vessels

- The number of vessels using LNG as a marine fuel has been growing consistently by 20%-40% per annum since 2010.

- At the start of 2020, there were 175 LNG-fueled ships in operation, excluding the 600-strong LNG carrier fleet.

- Over 200 LNG-fueled ships were on order at the start of 2020.

- Ships using LNG as fuel account for 12.14% of all ships using alternative fuels and emission reduction technologies.

- There are 304 LNG fuel-powered ships in operation globally, including 289 newbuild ships and 15 retrofitted ships.

- Europe, America, and Norway operate 180 newbuild LNG-powered ships, accounting for 62.28% of all newbuild LNG-powered ships, with only 29 ships in Asia.

- LNG fuel has been applied in 16 types of ships, with container ships being the largest group, including 37 ships in operation and 172 ships on order.

Shanghai Port and Operations

- Shanghai Port registered a bonded LNG bunkering of over 260,000 cubic meters in 2023, marking a 98.5% surge year on year.

- Shanghai Port is China’s first and the world’s third port able to provide ship-to-ship bonded LNG bunkering with simultaneous operations.

- International shipping companies, including the CMA CGM Group and ZIM Integrated Shipping Services Ltd., have chosen Shanghai Port to refuel their tanks.

Singapore LNG Bunkering

- Singapore achieved its best-ever year for bunker sales in 2023, with total sales exceeding 51 million metric tons (mt).

- The Maritime and Port Authority of Singapore (MPA) reported that December’s sales represented an 18% increase from November and a 20% rise year-over-year.

- Throughout 2023, the average monthly bunker sales were approximately 4.25 million mt, culminating in an official total of 51,824,030 mt for the year, marking an 8% increase from the 47.9 million mt sold in 2022.

- Biofuels accounted for 524,000 mt and LNG for 111,000 mt of the total sales.

Emission Regulations and Environmental Impact

- The International Maritime Organization (IMO) reduced regulatory emission limits for SOx in Emission Control Areas from 1.0% to 0.1% as of January 2015.

- The emission limits for SOx outside the Emission Control Areas will be reduced from 3.5% to 0.5% as of January 2020.

- The operation of LNG-fueled ships can result in a reduction of nearly all emissions of SOx and particulate matter compared to ships powered with conventional fuels.

- LNG use can reduce CO2 emissions by up to 25% and NOx emissions by more than 80% compared to gasoil.

Emerging Trends

- Increased Adoption of LNG-Fueled Ships: As environmental regulations tighten, more shipping companies are transitioning to LNG-fueled vessels. This surge is driven by LNG’s lower emissions profile compared to traditional marine fuels, helping companies meet stricter emission standards.

- Growth in LNG Bunkering Infrastructure: There’s a significant expansion of LNG bunkering facilities worldwide. Ports are investing in permanent and mobile bunkering solutions to accommodate an increasing number of LNG-powered vessels, enhancing their operational efficiency and reach.

- Technological Innovations in Bunkering Equipment: Advances in technology are leading to the development of more efficient and safer LNG bunkering systems. Innovations include improved fuel transfer systems and the integration of digital tools for monitoring and managing the bunkering process.

- Strategic Partnerships and Collaborations: Companies within the maritime and energy sectors are forming partnerships to streamline operations and expand their service offerings. These collaborations often aim to develop new technologies and infrastructures, reducing the overall costs associated with LNG bunkering.

- Emergence of Bio-LNG and Synthetic LNG: The use of bio-LNG and synthetic LNG is becoming more prevalent as part of efforts to create a completely sustainable shipping industry. These fuels are compatible with existing LNG infrastructure and offer an even lower carbon footprint.

- Expansion in Emerging Markets: New markets in Asia and Africa are beginning to develop their own LNG bunkering capabilities. This trend is supported by growing maritime trade in these regions, alongside local and international investments in LNG infrastructure.

- Regulatory and Policy Support: Governments and international bodies are crafting policies that favor the adoption of LNG as a marine fuel. These policies include incentives for using LNG, regulations facilitating the construction of bunkering facilities, and guidelines that ensure safety and environmental compliance.

Use Cases

- Container Shipping: Major container shipping companies are increasingly turning to LNG to power their fleets. LNG not only helps reduce greenhouse gas emissions but also meets new environmental standards like those set by the International Maritime Organization (IMO). For instance, Maersk Line has integrated LNG-powered vessels into their fleet to reduce carbon emissions substantially.

- Cruise Ships: The cruise industry is adopting LNG to minimize environmental footprints and enhance fuel efficiency. LNG-powered cruise ships can significantly reduce emissions of sulfur oxides and particulate matter, making them more environmentally friendly compared to ships using traditional heavy fuel oil.

- Bulk Carriers: LNG is being used in bulk carriers that transport commodities like coal, grain, and iron ore. These carriers benefit from LNG’s lower emission characteristics, helping shipping companies comply with global sulfur cap regulations enforced by the IMO.

- Ferries: LNG is particularly advantageous for ferries, which often operate within or near coastal and protected areas where emissions regulations are strictest. By switching to LNG, ferries can operate more cleanly, reducing pollution in environmentally sensitive regions.

- Tankers: LNG tankers, which transport liquefied natural gas itself, are also adopting LNG as a fuel for propulsion. This not only utilizes the cargo being transported but also sets a standard in demonstrating LNG’s viability as a primary fuel source.

- Offshore Support Vessels: For vessels supporting offshore drilling and wind farm operations, LNG offers an efficient and cleaner fuel alternative. These vessels benefit from reduced emissions and the ability to comply with stringent environmental regulations in protected marine areas.

- Short-sea Shipping: LNG is gaining traction in short-sea shipping routes, which involve the transport of goods over relatively short distances. This sector benefits from LNG’s cost-efficiency and the reduced environmental impact, supporting frequent and regular shipping services.

Major Challenges

- Infrastructure Costs: Developing the necessary infrastructure for LNG bunkering involves high initial costs. This includes the construction of specialized LNG terminals and storage facilities, as well as modifications to ports to accommodate LNG operations. These costs can be prohibitive, particularly in ports where traffic does not justify the investment.

- Regulatory Hurdles: The regulatory environment for LNG bunkering is complex and can vary significantly by region. Navigating these regulations, which cover safety, environmental standards, and operational protocols, requires significant time and expertise, potentially slowing down the implementation and expansion of LNG bunkering services.

- Supply Chain Complexity: Managing the LNG supply chain poses significant challenges due to its highly volatile nature. LNG requires a controlled temperature and pressure to remain in its liquid form, necessitating specialized handling and storage solutions, which complicates logistics and increases operational risks.

- Technological Challenges: While LNG is a cleaner alternative to traditional marine fuels, the technology required for its effective and safe use is still evolving. Challenges include improving the efficiency of LNG engines and developing reliable LNG fuel systems that can be easily integrated into existing vessel designs.

- Market Readiness and Adoption: Despite the environmental benefits of LNG, there is hesitation within parts of the maritime industry due to the current lack of widespread infrastructure and the perceived risks associated with LNG. Convincing stakeholders of the long-term economic and environmental benefits of switching to LNG requires overcoming significant inertia and skepticism.

Growth Opportunities

- Expansion into New Regions: As environmental regulations become stricter globally, new markets are opening up for LNG as a marine fuel. Regions without established LNG infrastructure offer substantial growth potential for companies willing to invest in developing these necessary facilities.

- Technological Advancements: Innovation in LNG technology, such as improved fueling systems and more efficient LNG engines, presents opportunities for growth. These advancements can make LNG bunkering more accessible and cost-effective, attracting more shipping companies to adopt LNG.

- Increased Regulatory Support: Many governments are implementing policies that encourage the use of cleaner energy sources, including LNG. Incentives such as tax breaks, subsidies, or lower port fees for LNG-fueled ships can significantly boost the demand for LNG bunkering services.

- Strategic Partnerships: By forming partnerships with other companies and stakeholders in the maritime and energy sectors, LNG bunkering providers can enhance their operational capabilities and expand their market reach. Collaborations can lead to shared technological innovations, expanded service offerings, and improved supply chain logistics.

- Integration with Renewable Energies: There is a growing trend to integrate LNG operations with renewable energy sources. For example, using bio-LNG or synthetic LNG made from renewable sources can further reduce the carbon footprint of maritime operations and enhance the sustainability profile of LNG as a marine fuel.

Key Players Analysis

Shell has significantly advanced its LNG bunkering capabilities by deploying its third vessel, “New Frontier 2,” in the Americas, adding to its fleet of 12 bunker vessels. This expansion supports the company’s global LNG supply network. Additionally, Shell, in collaboration with Crowley Maritime, is set to construct the largest LNG bunker barge in the U.S., enhancing its capacity to provide cleaner energy solutions for maritime customers.

TotalEnergies continues to grow its LNG bunkering network with recent significant developments. The company completed its first LNG bunkering operations for dual-fuel vessels owned by the Angelicoussis Group in Rotterdam, marking a milestone in its support for maritime decarbonization. Moreover, TotalEnergies has expanded its LNG deliveries to Asia through new contracts, securing medium-term outlets and reinforcing its global supply network.

Engie has made significant strides in the LNG bunkering sector through its joint venture, Gas4Sea, which includes partners Mitsubishi Corporation and NYK Line. The initiative’s flagship vessel, Engie Zeebrugge, stationed at the port of Zeebrugge, Belgium, provides ship-to-ship LNG bunkering services, marking a critical development in Northern Europe’s LNG supply infrastructure. This vessel has a capacity of 5,000 cubic meters and supports various shipping customers, contributing to the reduction of emissions in maritime transport.

ENN Energy Holdings Ltd. has expanded its LNG bunkering operations, particularly in China, enhancing the nation’s maritime fuel transition. Recently, the company completed the acquisition of an LNG terminal in Zhoushan, enabling it to provide robust LNG supply services to ships in the region. This acquisition supports ENN’s strategy to promote cleaner energy alternatives in maritime transport and aligns with China’s goals for reducing carbon emissions.

Gasum Ltd. has been actively expanding its LNG bunkering operations. In 2024, Gasum extended its long-term agreement with Equinor to supply LNG to Equinor’s dual-fuel vessels, using its bunker vessels Coralius, Kairos, and Coral Energy. Additionally, the LNG supply vessel Kairos, with a 7,500 m³ capacity, rejoined Gasum’s fleet, enhancing its bunkering capacity in Northwest Europe. Gasum successfully conducted its first ship-to-ship LNG bunker deliveries in Lübeck-Travemünde, Germany, marking a significant milestone in sustainable maritime fuel operations.

Equinor ASA has strengthened its presence in the LNG bunkering sector through a renewed long-term contract with Gasum. This partnership ensures the continuous supply of LNG to Equinor’s dual-fuel chartered fleet, supporting the company’s sustainability goals. The agreement includes additional services like cooling down and gassing up, reflecting a commitment to cleaner energy solutions. This collaboration contributes to Equinor’s ambition to become a net-zero emissions energy company by 2050.

Korea Gas Corporation (KOGAS) is expanding its LNG bunkering capabilities. In 2023, KOGAS introduced a new 7,500-cbm LNG bunkering vessel, Blue Whale, equipped with an advanced KC-2 membrane cargo system. This vessel, along with the existing SM Jeju LNG2, enhances KOGAS’s capacity to supply LNG to ships in Asia. Additionally, KOGAS aims to supply 1.36 million tons of LNG for ships by 2030, supporting South Korea’s shift towards cleaner marine fuels.

Harvey Gulf International Marine LLC has been a leader in LNG bunkering in the United States. The company operates the Harvey Energy, the first LNG-powered offshore supply vessel in America, and has developed a dedicated LNG fueling facility in Port Fourchon, Louisiana. Recently, Harvey Gulf announced the expansion of its LNG bunkering services to include dual-fuel vessel support, reflecting its commitment to sustainable maritime operations and reducing emissions in the Gulf of Mexico region.

Skangas, now part of Gasum, has significantly contributed to LNG bunkering in Northern Europe. The company operates the LNG bunker vessel Coralius, which has been active in the Baltic Sea and North Sea, providing ship-to-ship bunkering services. In 2024, Skangas further strengthened its position by increasing LNG deliveries, including its first ship-to-ship bunkering operations in Lübeck-Travemünde, Germany. This expansion supports Skangas’s goal of promoting LNG as a cleaner alternative to traditional marine fuels.

Gaslog Ltd. has been expanding its LNG capabilities significantly. Recently, they renewed a long-term contract with Seatrium for the repair and upgrading of their LNG carriers. This agreement, which also involves Shell, spans five years and includes options for further renewal. Additionally, Gaslog is building four new 174,000 cubic meters capacity LNG vessels, backed by BlackRock’s infrastructure fund, slated for delivery in 2024 and 2025. This expansion is part of Gaslog’s strategy to enhance its LNG fleet and services.

Crowley Maritime Corporation is leading in the U.S. LNG bunkering sector with significant projects underway. The company is constructing a 12,000 cubic meter LNG bunker barge, which will be the largest in the U.S., set for long-term charter with Shell on the East Coast. This barge, being built at Fincantieri Bay Shipbuilding, will support the growing LNG-fueled fleet in North America. Crowley’s efforts are pivotal in meeting the rising demand for LNG as a cleaner marine fuel.

Polskie LNG, part of the state-owned Gaz-System, is enhancing its LNG bunkering infrastructure in Poland. The Świnoujście LNG terminal is undergoing expansions to increase its regasification capacity and incorporate a new LNG bunkering facility. This development aims to position Poland as a significant player in the Baltic LNG bunkering market, supporting regional and international maritime traffic with cleaner fuel options.

Bomin Linde LNG GmbH & Co. KG has been actively expanding its LNG bunkering operations in Europe. The company recently completed a successful LNG bunkering operation in the German port of Rostock, where it supplied LNG to the chemical tanker Fure West. Additionally, Bomin Linde is constructing an LNG terminal in the Port of Hamburg to enhance its bunkering infrastructure. This terminal is part of their strategy to establish a robust LNG supply network across key European ports.

Eagle LNG Partners has been strengthening its position in the LNG bunkering market, particularly in North America. The company operates the Maxville LNG plant in Jacksonville, Florida, which is strategically located to support marine bunkering operations. Recently, Eagle LNG signed a long-term contract with Crowley Maritime to supply LNG for their dual-fuel ships. This partnership is a significant step towards expanding Eagle LNG’s influence in the maritime sector and promoting the use of cleaner fuels.

Titan LNG has been a key player in the LNG bunkering sector in Europe. The company operates multiple LNG bunkering vessels, including the FlexFueler001 and FlexFueler002, which facilitate ship-to-ship LNG bunkering in the Amsterdam-Rotterdam-Antwerp region. Recently, Titan LNG announced plans to launch a new LNG bunkering pontoon, the FlexFueler003, to further enhance its capacity and support the growing demand for LNG as a marine fuel. This expansion underscores Titan LNG’s commitment to providing sustainable fuel solutions in the maritime industry.

Conclusion

As the maritime industry progresses towards sustainability, LNG bunkering stands out as a pivotal element in this transformation. The industry is set to expand significantly, driven by stringent environmental regulations, technological advancements, and increasing global demand for cleaner maritime fuel solutions.

Despite facing challenges such as high infrastructure costs and complex regulatory environments, the opportunities for growth and innovation in LNG bunkering are substantial. Strategic investments in new regions, enhanced technological capabilities, and supportive regulatory frameworks are likely to further catalyze the adoption of LNG as a marine fuel. As the industry evolves, LNG bunkering not only promises a reduction in maritime emissions but also a more sustainable pathway for global shipping logistics.