Table of Contents

Introduction

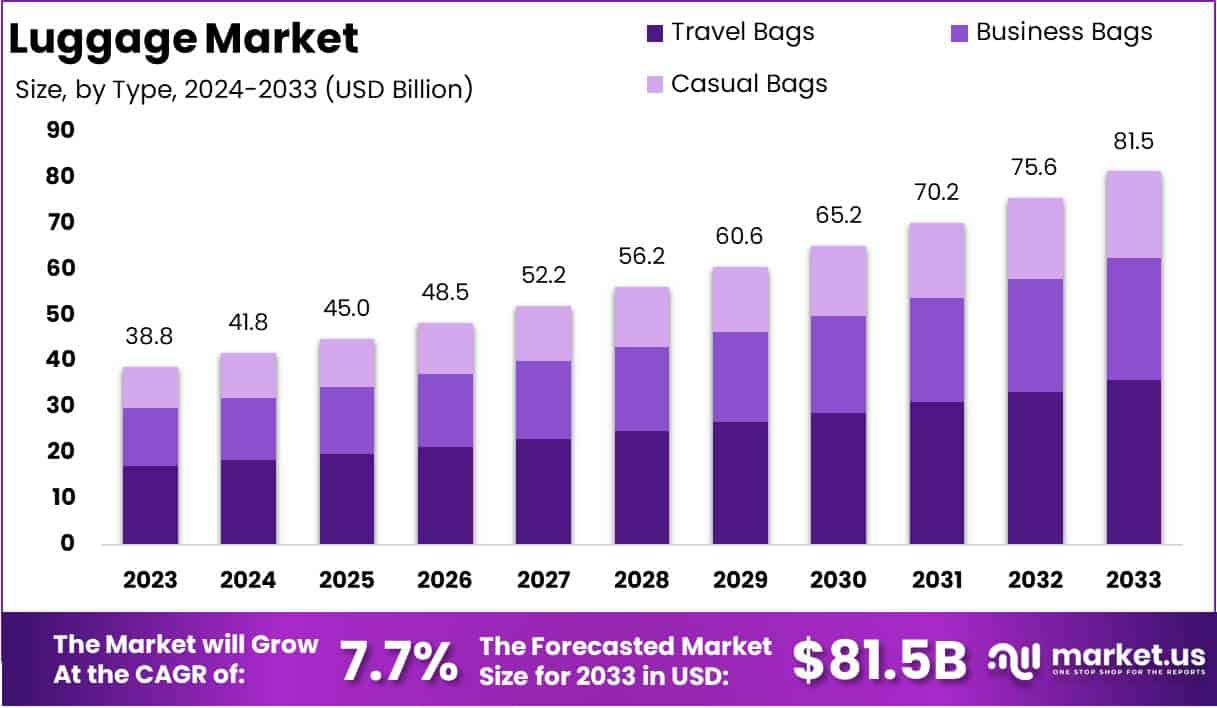

The Global Luggage Market is projected to grow significantly, with its value estimated to reach approximately USD 81.5 billion by 2033, up from USD 38.8 billion in 2023. This represents a compound annual growth rate (CAGR) of 7.7% during the forecast period of 2024 to 2033.

Luggage refers to a range of bags, cases, and containers designed for carrying personal belongings during travel or daily activities. These products include suitcases, backpacks, duffel bags, and briefcases, each tailored to specific purposes, from long-haul international trips to everyday commuting. Modern luggage is not only functional but often reflects individual style, incorporating features like durable materials, lightweight designs, and even smart technologies to enhance user convenience.

The luggage market encompasses the production, distribution, and sales of various types of luggage for diverse consumer needs. It serves a broad spectrum of end-users, including tourists, business professionals, students, and outdoor enthusiasts. This market is dynamic, driven by evolving consumer preferences, technological advancements, and the globalization of travel. It spans across several channels, from traditional retail stores to rapidly growing e-commerce platforms, catering to both mass-market and premium segments.

The growth of the luggage market is fueled by several key factors. A primary driver is the resurgence of global travel and tourism, as people resume leisure and business trips post-pandemic. Additionally, increased urbanization and a rise in disposable income have led to greater spending on travel accessories. Innovation plays a crucial role, with smart luggage gaining traction for its tech-savvy features, such as GPS tracking and USB charging, which appeal to a digitally connected consumer base.

Demand in the luggage market is shaped by both functional needs and lifestyle trends. Business travelers seek professional, durable products, while leisure travelers prioritize lightweight, stylish options. The growing awareness of environmental issues has also spurred demand for sustainable luggage made from recycled or biodegradable materials. Furthermore, as remote work leads to more frequent short trips, there is a noticeable uptick in demand for compact, multi-purpose bags.

The luggage market presents several growth opportunities for industry players. Companies can capitalize on the increasing popularity of e-commerce to expand their customer base and offer personalized shopping experiences. The shift toward sustainable practices provides a chance to innovate with eco-friendly products, appealing to environmentally conscious consumers. Additionally, the premium and luxury luggage segments remain lucrative, driven by a consumer desire for high-quality, stylish products that combine aesthetics with functionality.

Key Takeaways

- The global luggage market is expected to grow from USD 38.8 billion in 2023 to USD 81.5 billion by 2033, reflecting a CAGR of 7.7% over the forecast period.

- Travel bags accounted for 44.2% of the market share in 2023, driven by increasing tourism and personal travel.

- Soft-sided luggage dominated the market with a 61.8% share in 2023, owing to its lightweight and versatile design.

- Offline distribution channels captured 66.2% of the market in 2023, as consumers continued to prefer in-store shopping experiences.

- North America led the market in 2023 with a 35.5% share, supported by a robust tourism industry and high consumer spending.

Luggage Statistics

- The U.S. luggage market will generate $29.57 billion in revenue in 2024.

- Non-luxury luggage will account for 68% of total sales in 2024.

- Black luggage accounts for 40% of global sales, making it the most popular color.

- Blue luggage represents 30% of global purchases.

- Gray luggage accounts for 20% of the global market.

- Red luggage constitutes 10% of global sales.

- Carry-on spinner suitcases dominate the market with 60% of total sales.

- Medium-sized expandable suitcases account for 25% of the market.

- Large hardside suitcases represent 10% of total sales.

- Travel backpacks make up 5% of the luggage market.

- Checked luggage prices range from under $100 to nearly $1,400.

- The RIMOWA Original Cabin, at $1,430, is the most expensive suitcase in the analysis.

- The July Carry-On Light is the lightest suitcase in the analysis, weighing 3.9 lbs.

- 73.5% of travelers prefer zipper locks for their luggage.

- 38.4% of travelers use padlocks for luggage security.

- 18% of travelers opt for latch-lock systems without zippers.

- 52% of passengers prefer carry-on baggage for air travel.

- 48% of passengers check in luggage during flights.

- The average checked luggage weight for domestic U.S. flights is 45 lbs (20.4 kg).

- The U.S. moving industry generates over $18 billion annually.

- Americans move approximately 11 times in their lifetime.

Emerging Trends

- Integration of Smart Features: Modern travelers are increasingly seeking luggage equipped with smart functionalities such as GPS tracking, USB charging ports, and digital locks. These innovations enhance convenience and security, aligning with the growing demand for tech-savvy travel solutions.

- Sustainability and Eco-Friendly Materials: There is a notable shift towards environmentally conscious products, with manufacturers utilizing recycled and sustainable materials in luggage production. This trend reflects a broader consumer movement towards sustainability in purchasing decisions.

- Customization and Personalization: Consumers are favoring luggage that can be tailored to individual tastes, including options for monogramming and unique designs. This personalization trend caters to the desire for distinctive and individualized travel accessories.

- Rise of Direct-to-Consumer (DTC) Brands: The market has seen an influx of DTC luggage companies offering high-quality products at competitive prices. These brands often leverage online platforms to engage directly with consumers, bypassing traditional retail channels.

- Preference for Lightweight and Durable Materials: Travelers are increasingly opting for luggage made from materials that offer both durability and reduced weight, enhancing ease of transport without compromising on strength. This trend is evident in the growing popularity of hard-shell suitcases constructed from advanced polymers.

Top Use Cases

- Travel and Tourism: Luggage plays a crucial role in facilitating the transportation of personal belongings during vacations and business trips. Travelers rely on suitcases, carry-ons, and travel bags designed for convenience and durability.

- Business and Professional Use: Professionals require specialized luggage such as briefcases and laptop bags to organize and protect work-related items like documents and electronics. This use case emphasizes functionality and style, catering to a corporate audience.

- Sports and Outdoor Activities: Sports enthusiasts and adventure seekers use backpacks and duffel bags designed to carry equipment and gear. These bags are built for durability and tailored to specific sports or outdoor needs.

- Student and Academic Use: Students frequently use backpacks to carry books, laptops, and other school supplies. These bags are designed for comfort and practicality, often featuring compartments for various academic tools.

- Everyday and Casual Use: Luggage in the form of tote bags, sling bags, and casual backpacks is widely used for daily activities such as shopping, commuting, and short trips. This segment focuses on versatility and style for routine use.

Major Challenges

- Supply Chain Disruptions: Global events, such as the COVID-19 pandemic, have caused substantial disruptions in manufacturing and distribution networks. These disruptions have led to delays and increased costs, affecting the timely delivery of products to consumers.

- Rising Raw Material Costs: The cost of materials like polycarbonate and aluminum, essential for luggage production, has been increasing. This escalation pressures manufacturers to either absorb the costs, reducing profit margins, or pass them on to consumers, potentially decreasing demand.

- Intense Market Competition: The luggage market is highly competitive, with numerous brands vying for market share. This competition necessitates continuous innovation and marketing efforts, which can strain resources, especially for smaller companies.

- Counterfeit Products: The proliferation of counterfeit luggage undermines brand reputation and leads to revenue losses. Consumers purchasing counterfeit products may experience inferior quality, which can diminish trust in legitimate brands.

- Environmental Concerns: There is a growing demand for sustainable and eco-friendly luggage options. Manufacturers face the challenge of sourcing sustainable materials and implementing environmentally friendly production processes, which can be cost-intensive.

Top Opportunities

- Expansion of Global Travel and Tourism: With international travel recovering post-pandemic, there is a rising demand for a wide variety of luggage solutions. Companies can focus on lightweight and durable designs to cater to frequent travelers.

- Adoption of Smart Luggage Technologies: Consumers are increasingly interested in innovative features like GPS tracking, built-in scales, and USB charging. This presents an opportunity for brands to differentiate their offerings with tech-enhanced products.

- Shift Towards Sustainable Materials: Growing environmental awareness has led to a demand for eco-friendly luggage. Brands adopting recycled or biodegradable materials can tap into this segment while enhancing their sustainability credentials.

- Growth of E-commerce Platforms: The rise of online shopping offers luggage brands a direct channel to reach customers. This enables businesses to expand their reach, provide personalized services, and leverage data to improve customer experience.

- Rising Demand for Premium and Luxury Luggage: There is a noticeable shift towards high-end, stylish luggage that offers both functionality and aesthetics. Targeting this segment can be profitable, especially for brands that emphasize quality and exclusivity.

Key Player Analysis

- Samsonite International S.A. : Samsonite is a global leader in the luggage industry, offering a wide range of products under various brands, including Samsonite, American Tourister, and Tumi. In 2023, Samsonite’s net sales reached approximately USD 3.9 billion, with the Samsonite brand accounting for USD 1.85 billion, American Tourister contributing USD 654.5 million, and Tumi generating USD 878.6 million.

- Tumi Holdings, Inc. : Acquired by Samsonite in 2016, Tumi operates as a premium brand within Samsonite’s portfolio. In 2023, Tumi’s net sales were USD 878.6 million, reflecting its strong presence in the high-end luggage segment.

- American Tourister : Also under Samsonite’s umbrella, American Tourister caters to the mid-market segment with affordable and durable luggage options. In 2023, the brand reported net sales of USD 654.5 million, indicating its significant role in Samsonite’s overall revenue.

- Delsey : Delsey is a French luggage manufacturer known for its innovative designs and lightweight products. In 2023, Delsey achieved a revenue of EUR 250 million and aims to reach EUR 300 million in 2024, focusing on expanding its market presence, particularly in China.

- Rimowa : A German luxury luggage brand owned by LVMH, Rimowa is renowned for its high-quality aluminum suitcases. While specific revenue figures are not publicly disclosed, Rimowa holds a market share of approximately 1% in the global luggage market, reflecting its niche positioning in the premium segment.

Recent Developments

- In 2024, Yatra Online, Inc. (NASDAQ: YTRA), India’s largest corporate travel services provider, announced the acquisition of Globe All India Services Limited (Globe Travels) through its subsidiary, Yatra Online Limited. The deal, valued at INR 1,280 million (~USD 15.25 million), is set to strengthen Yatra’s leadership in corporate travel services.

- In 2023, VistaJet, the global leader in business aviation, unveiled a premium travel collection in collaboration with Italian luxury brand Valextra. The partnership combines timeless design with exceptional functionality, perfectly complementing VistaJet’s Global 7500 aircraft and enhancing the travel experience for business and leisure.

- In 2024, Samsonite launched its Luggage Trade-In Campaign, promoting sustainability in partnership with DUYTAN Recycling. From April 1 to May 31, customers can trade in any brand of luggage at Samsonite stores or participating retailers for a discount of 30% to 50% on new Samsonite products.

- On October 24, 2024, Vela Software Spain S.L. reaffirmed its commitment to data privacy with an updated privacy notice. The notice outlines the company’s practices for collecting and managing personal data through its website and digital platforms, ensuring compliance with global privacy standards.

- In 2024, SITA, a leading air transport technology provider, expanded into the operations-as-a-service market by acquiring ASISTIM, a specialist in airline flight operations. This acquisition underscores SITA’s mission to help airlines navigate operational challenges and enhance the overall air travel experience.

Conclusion

The global luggage market is poised for substantial growth, driven by several key factors, including the resurgence of travel and tourism, increased urbanization, and evolving consumer preferences. As more people resume leisure and business trips, the demand for durable, lightweight, and versatile luggage continues to rise. Innovations such as smart luggage with features like GPS tracking and USB charging ports are gaining popularity, catering to tech-savvy travelers.

Moreover, the shift towards sustainability is influencing purchasing decisions, with consumers seeking eco-friendly products made from recycled or biodegradable materials. Companies that prioritize sustainable practices and offer personalized solutions are well-positioned to capture market share. As e-commerce grows, brands are also leveraging online platforms to reach wider audiences and provide tailored shopping experiences. The market’s dynamic nature presents ample opportunities for players to innovate and differentiate their offerings to meet the diverse needs of modern travelers.