Table of Contents

- Introduction

- Editor’s Choice

- Luxury Goods Market Overview

- Revenue Generation Through Luxury Goods

- Statistics in Luxury Goods Sales

- Luxury Goods Brands Statistics

- Demographic Insights of Luxury Goods Consumers

- Consumer Purchasing Behavior and Trends

- Challenges Faced by the Luxury Goods Industry

- Laws and Regulations for Luxury Goods

Introduction

According to Luxury Goods Statistics, Luxury goods encompass high-quality, exclusive products like fashion items, automobiles, and fine wines, appealing primarily to affluent consumers seeking status and superior experiences.

This market relies heavily on brand prestige, craftsmanship, and a sense of exclusivity to attract and retain customers with high disposable incomes.

Distribution channels typically include company-owned boutiques, upscale retailers, and, increasingly, online platforms.

Challenges such as economic fluctuations and shifting consumer values towards sustainability are balanced by opportunities in digital innovation and expanding global markets.

Understanding these dynamics is crucial for navigating the competitive landscape and maintaining brand relevance in the evolving luxury goods sector.

Editor’s Choice

- The global luxury goods market revenue is projected to reach USD 418.89 billion in 2028.

- The forecast for 2027 shows online sales continuing to rise to 18.2%, while offline sales further decline to 81.8%. Reflecting an ongoing shift towards digital channels in the luxury goods market.

- The global luxury goods market is characterized by the presence of several prominent brands, each holding varying market shares. Leading the market is Chanel, with a 6% share.

- The global luxury goods market exhibits significant revenue contributions from various countries. The United States leads the market with a substantial revenue of USD 77,820 million.

- In 2022, the leading luxury brands worldwide were valued at significant figures. Reflecting their dominant market positions and strong consumer appeal. Louis Vuitton, originating from France, topped the list with a brand value of USD 124,273 million.

- When conducting online research before purchasing luxury goods, consumers exhibit a preference for various sources. Multi-brand full-price websites are the most favored, with 39% of respondents indicating they use these platforms for their research.

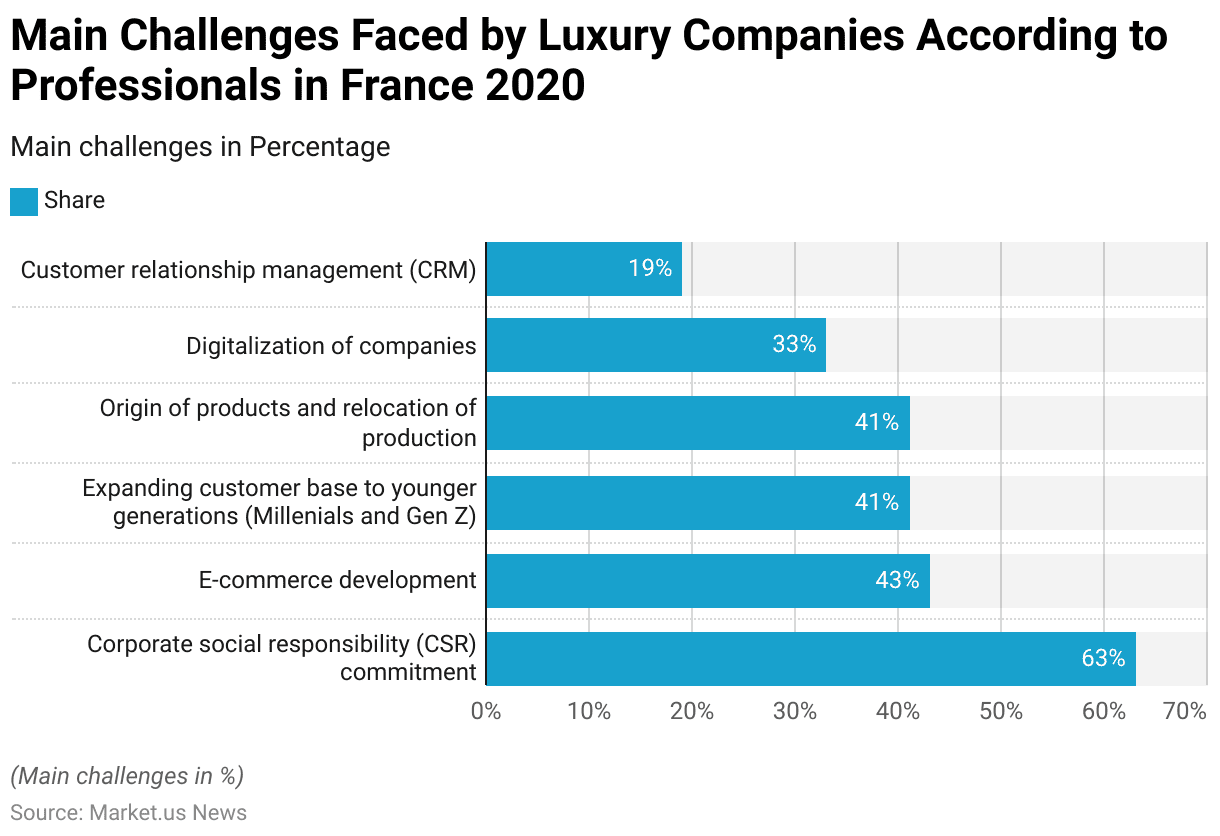

- In 2020, luxury companies in France faced several key challenges, as identified by industry professionals. The most significant challenge was the commitment to corporate social responsibility (CSR), highlighted by 63% of respondents.

Luxury Goods Market Overview

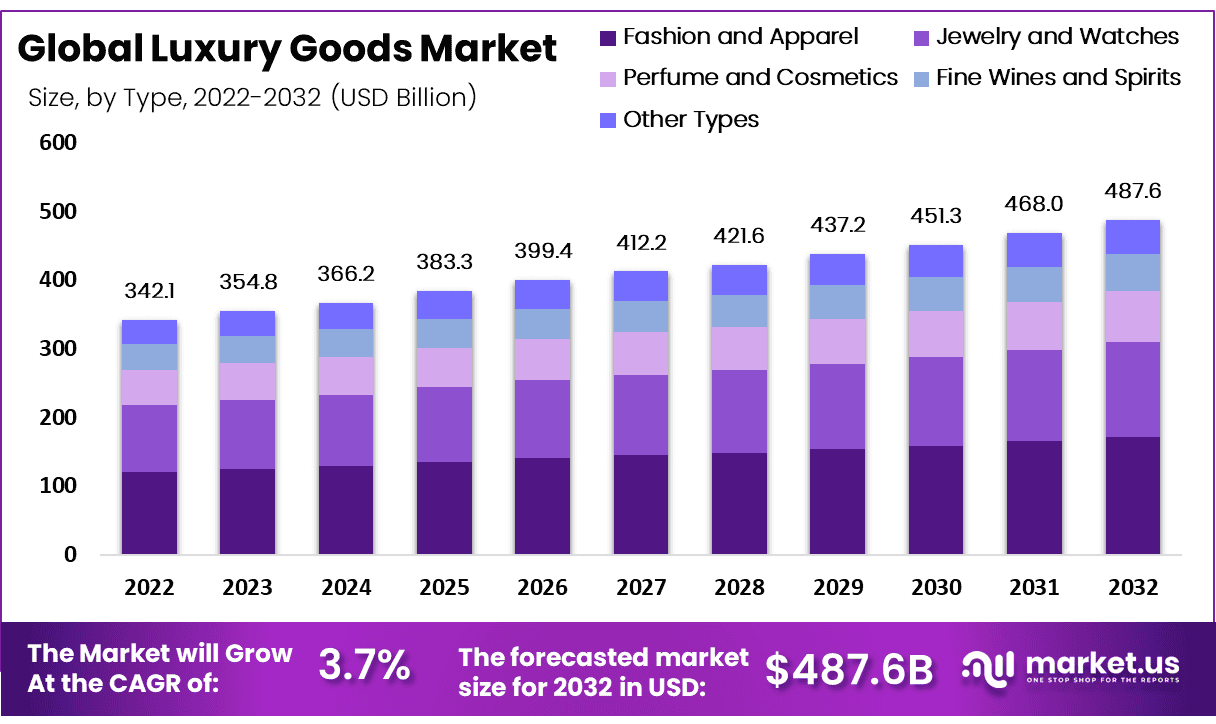

Global Luxury Goods Market Size

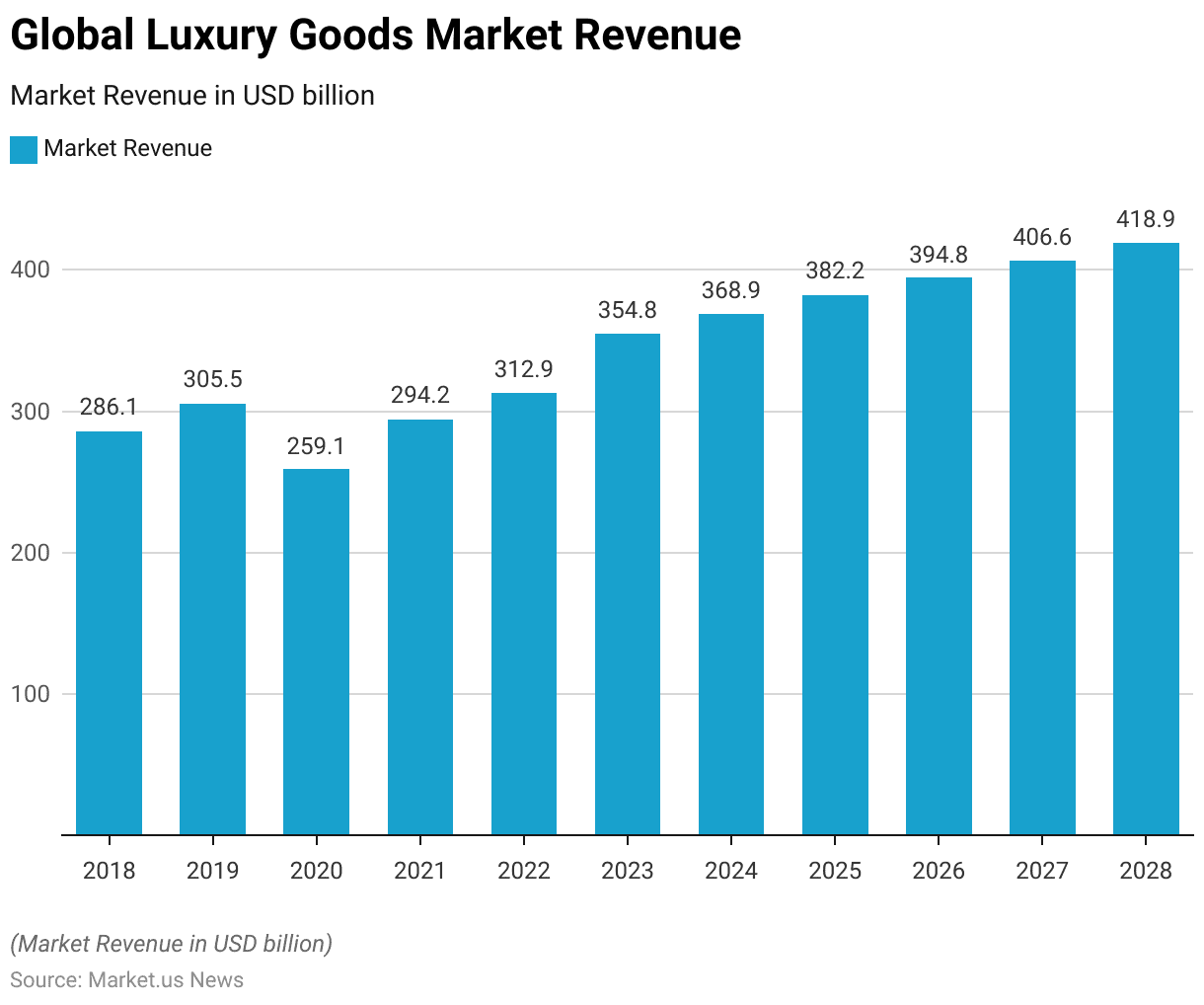

- The global luxury goods market has demonstrated a dynamic pattern of growth and resilience over the past several years at a CAGR of 3.22%.

- In 2018, the market generated revenues of USD 286.11 billion, which increased to USD 305.46 billion in 2019.

- The market’s expansion is forecasted to continue, with revenues reaching USD 394.75 billion in 2026, USD 406.55 billion in 2027, and USD 418.89 billion in 2028.

Luxury Goods Market Size – By Type

- The global luxury goods market, segmented by type, has exhibited notable trends and growth across various categories from 2018 to 2028.

- In 2018, luxury eyewear accounted for USD 19.0 billion, luxury fashion USD 90.58 billion, luxury leather goods USD 56.67 billion, Luxury watches and Jewelry USD 62.57 billion, and prestige cosmetics and fragrances USD 57.32 billion.

- By 2028, the luxury goods market is anticipated to see luxury eyewear at USD 23.3 billion, luxury fashion at USD 131.7 billion, and luxury leather goods at USD 92.37 billion. Luxury watches and jewelry at USD 84.82 billion, and prestige cosmetics and fragrances at USD 86.69 billion, demonstrating robust and sustained growth across all segments.

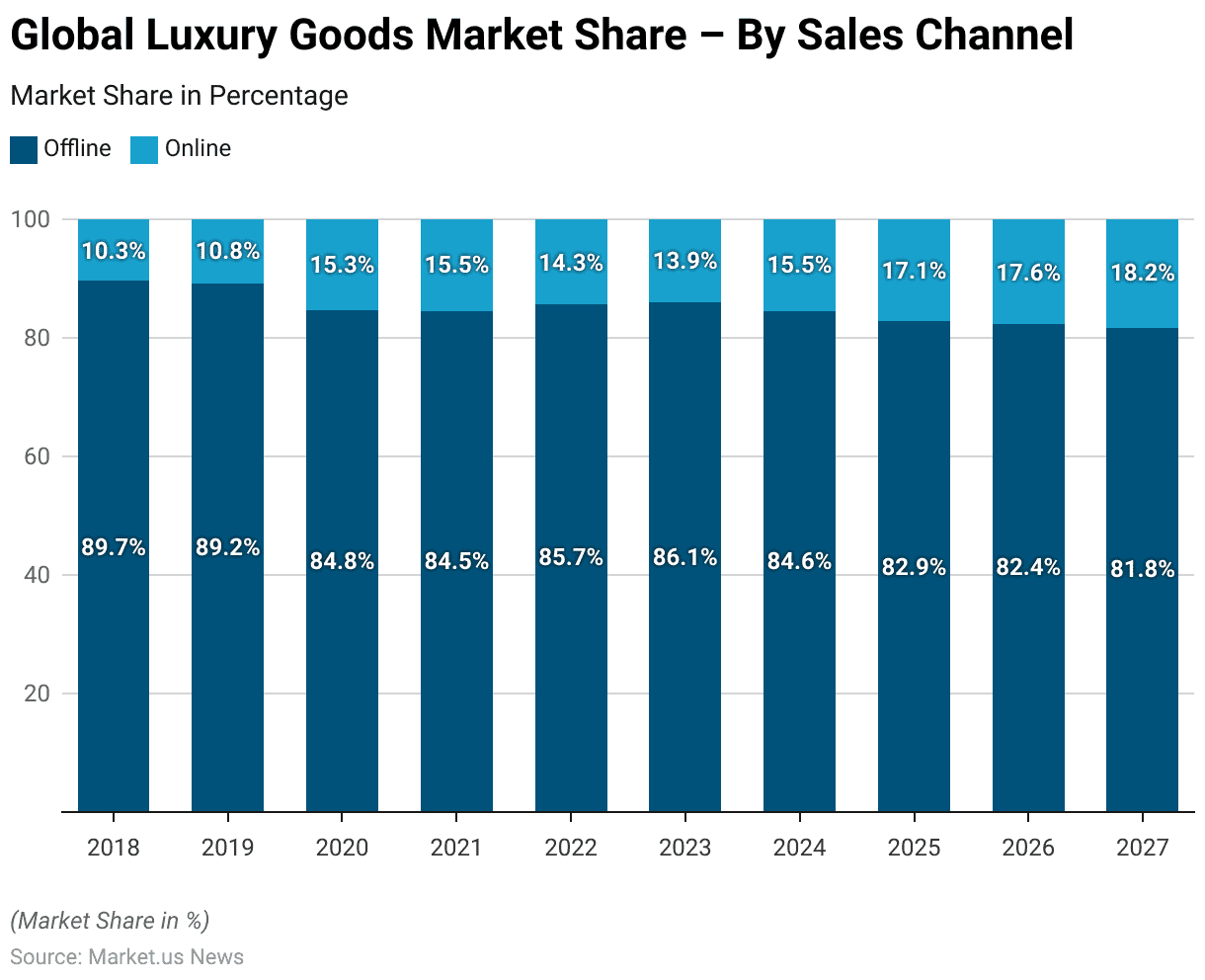

Luxury Goods Market Share – By Sales Channel

- The global luxury goods market share by sales channel has exhibited significant shifts between offline and online channels from 2018 to 2027.

- In 2018, offline sales dominated the market with an 89.7% share, while online sales accounted for 10.3%. This trend continued in 2019, with offline sales at 89.2% and online sales slightly increasing to 10.8%.

- The forecast for 2027 shows online sales continuing to rise to 18.2%, while offline sales further decline to 81.8%, reflecting an ongoing shift towards digital channels in the luxury goods market.

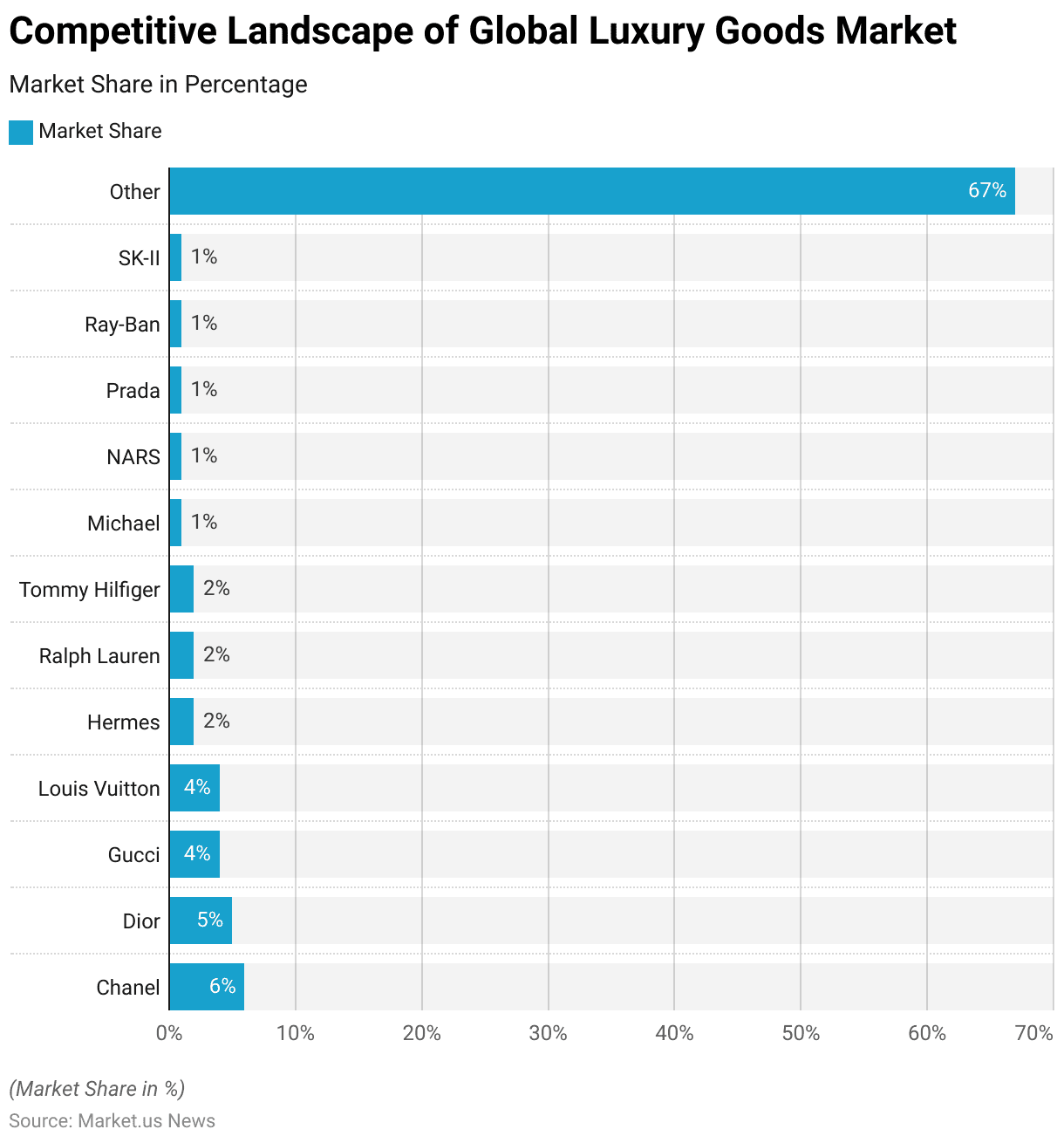

Competitive Landscape of Global Luxury Goods Market

- The global luxury goods market is characterized by the presence of several prominent brands, each holding varying market shares.

- Leading the market is Chanel, with a 6% share, followed by Dior at 5%.

- Gucci and Louis Vuitton each capture 4% of the market.

- Hermes, Ralph Lauren, and Tommy Hilfiger each hold a 2% share.

- Several other brands, including Michael, NARS, Prada, Ray-Ban, and SK-II, each account for 1% of the market.

- Collectively, these well-known brands comprise a significant portion of the market; however, a substantial 67% of the market is occupied by other brands. Indicating a highly fragmented and competitive landscape in the luxury goods sector.

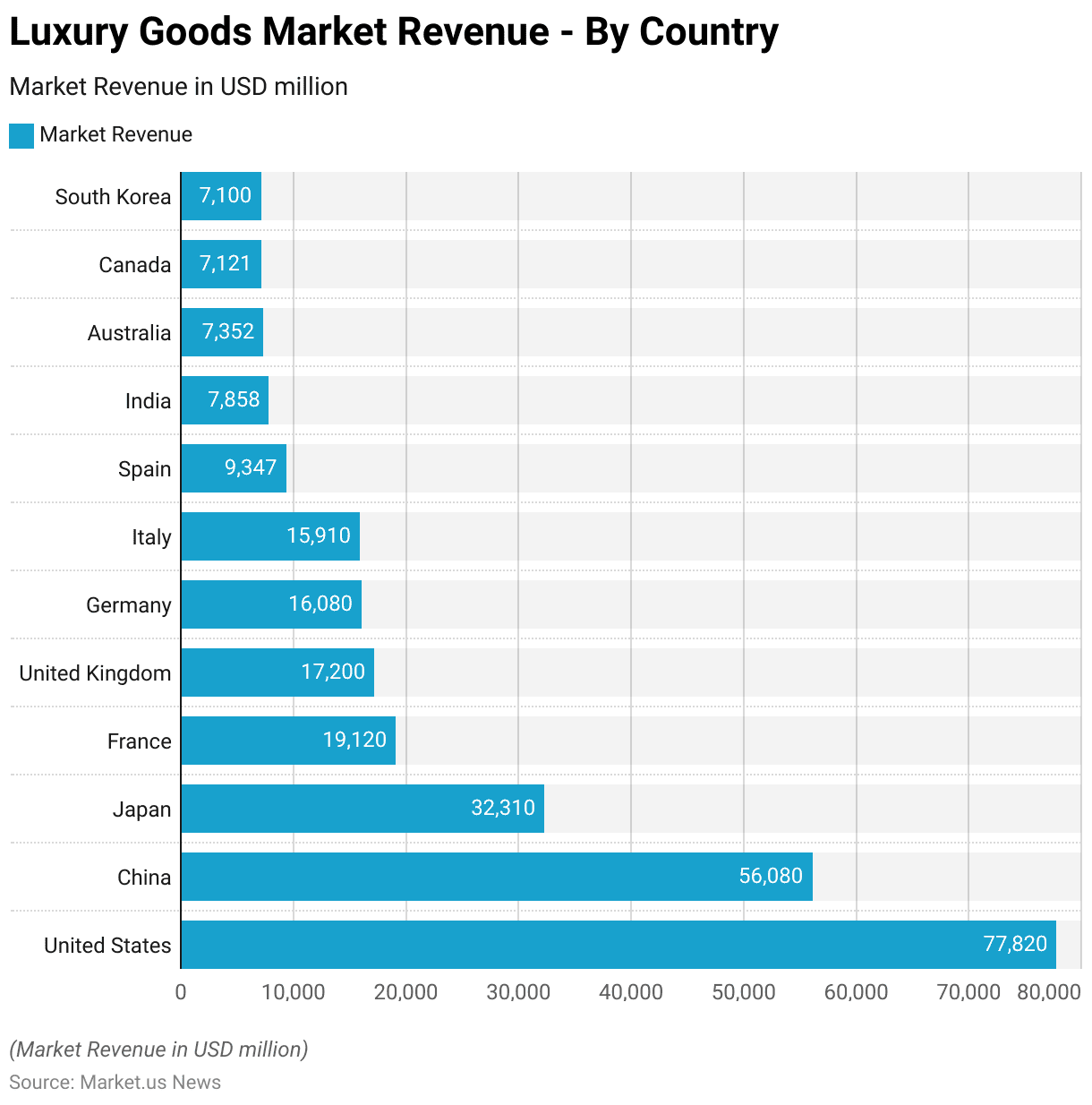

Global Luxury Goods Market Revenue – By Country

- The global luxury goods market exhibits significant revenue contributions from various countries.

- The United States leads the market with a substantial revenue of USD 77,820 million, followed by China with USD 56,080 million.

- Japan contributes USD 32,310 million to the market, while France generates USD 19,120 million.

- The United Kingdom and Germany follow closely with revenues of USD 17,200 million and USD 16,080 million, respectively.

- Italy also makes a notable contribution of USD 15,910 million.

- In Spain, the luxury goods market revenue stands at USD 9,347 million.

- India, Australia, and Canada contribute USD 7,858 million, USD 7,352 million, and USD 7,121 million, respectively. South Korea also holds a significant share with a revenue of USD 7,100 million.

Revenue Generation Through Luxury Goods

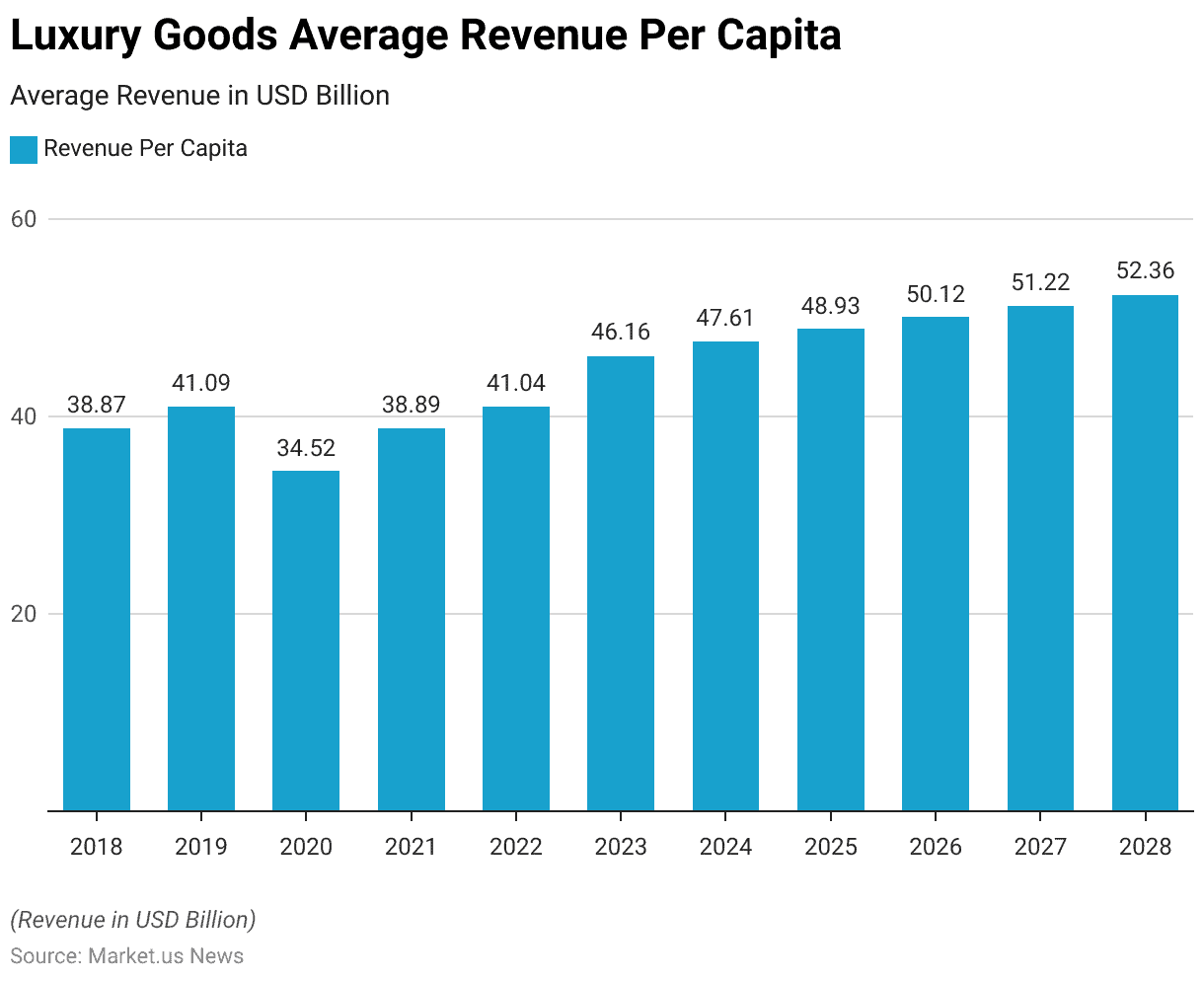

Luxury Goods Average Revenue Per Capita

- The average revenue per capita in the global luxury goods market has fluctuated. Yet there has been a generally upward trend from 2018 to 2028.

- In 2018, the average revenue per capita stood at USD 38.87, increasing to USD 41.09 in 2019.

- The year 2020 saw a dip to USD 34.52, likely due to the economic impacts of the COVID-19 pandemic.

- By 2026, it is anticipated to rise to USD 50.12, followed by USD 51.22 in 2027 and USD 52.36 in 2028.

Statistics in Luxury Goods Sales

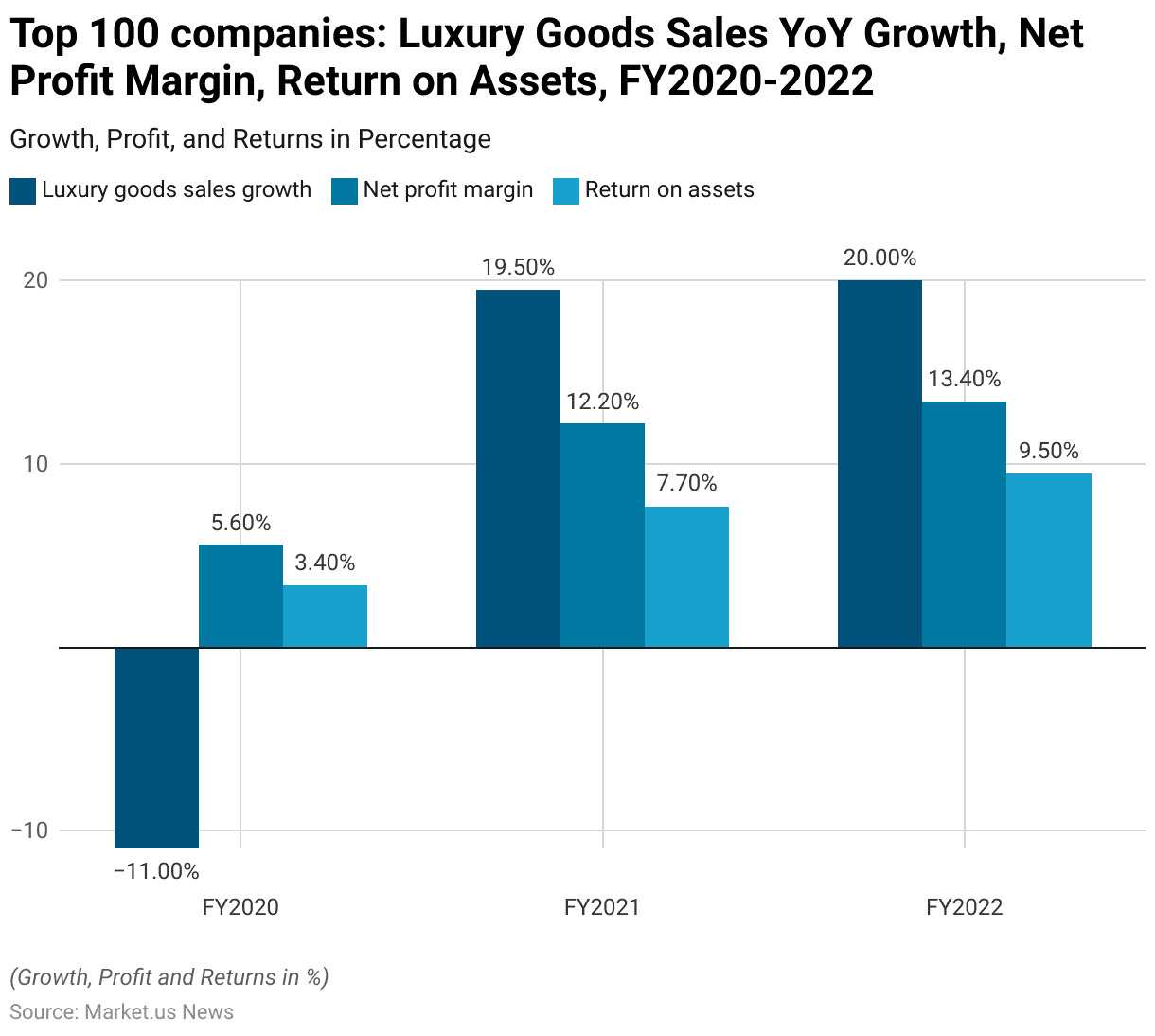

Luxury Goods Sales Growth, Net Profit Margin, And Return On Assets

- The top 100 companies in the luxury goods sector have exhibited significant fluctuations in key financial metrics from FY2020 to FY2022.

- In FY2020, the sector experienced a decline in luxury goods sales growth, recording a negative growth rate of -11%, largely attributable to the global disruptions caused by the COVID-19 pandemic.

- However, a strong recovery was observed in FY2021, with luxury goods sales growth rebounding to 19.50%, and this positive trend continued into FY2022 with a further increase of 20%.

- Net profit margins also demonstrated substantial improvement over this period. In FY2020, the net profit margin stood at 5.60%, but this figure more than doubled by FY2021, reaching 12.20%, and continued to rise to 13.40% in FY2022, reflecting enhanced profitability and operational efficiency within the sector.

- Similarly, the return on assets (ROA) saw a marked increase. In FY2020, the ROA was 3.40%, indicating modest returns relative to the assets employed. This metric improved significantly in FY2021, climbing to 7.70%, and further increased to 9.50% in FY2022.

Luxury Goods Brands Statistics

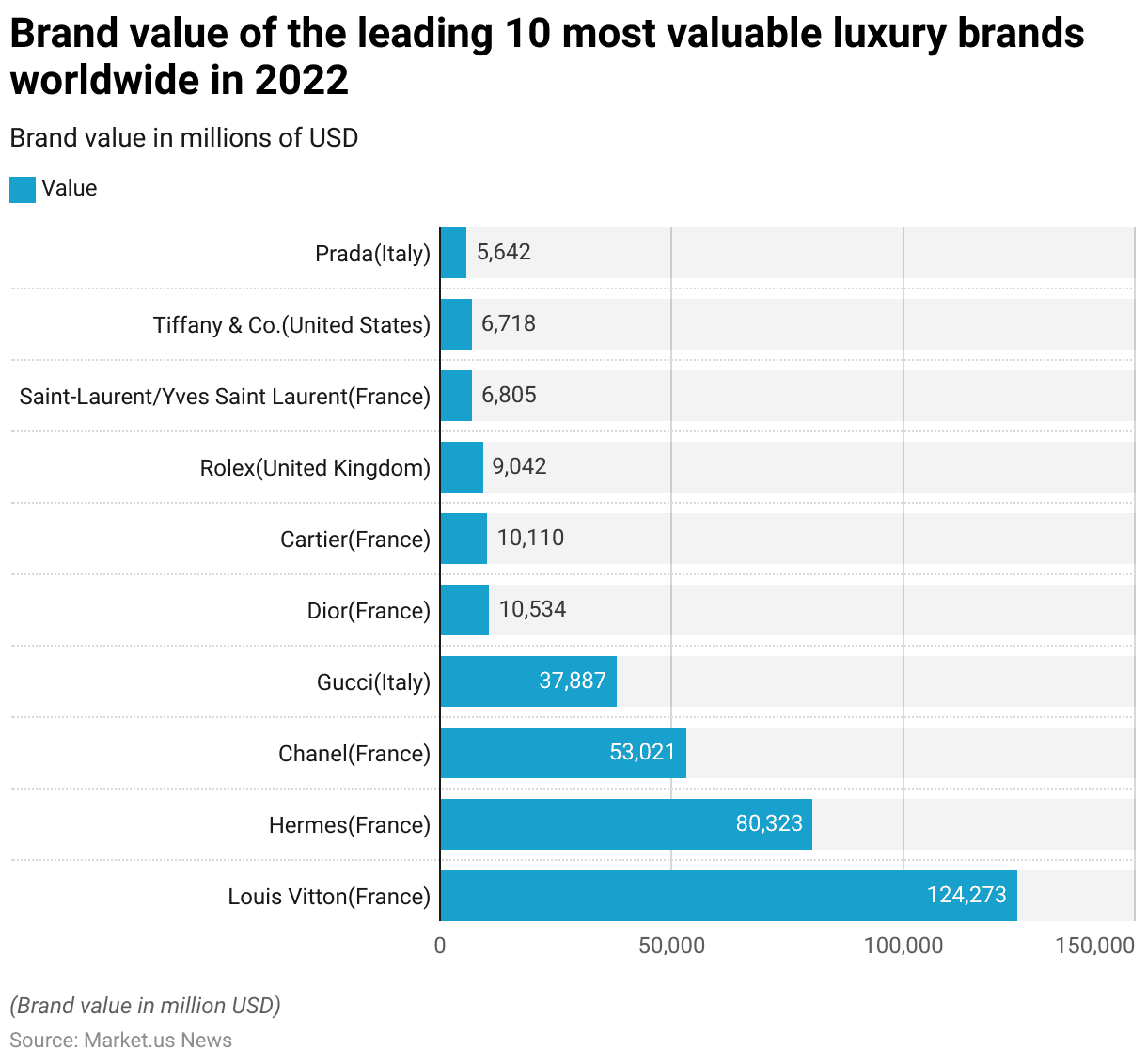

Brand Value of the Leading 10 Most Valuable Luxury Brands Worldwide

- In 2022, the leading luxury brands worldwide were valued at significant figures, reflecting their dominant market positions and strong consumer appeal.

- Louis Vuitton, originating from France, topped the list with a brand value of USD 124,273 million.

- Another French brand, Hermès, followed with a value of USD 80,323 million.

- Chanel, also from France, held the third position with a brand value of USD 53,021 million. Italian brand Gucci was valued at USD 37,887 million.

- Other notable French brands included Dior, valued at USD 10,534 million, and Cartier, with a brand value of USD 10,110 million.

- Rolex, from the United Kingdom, had a brand value of USD 9,042 million. Saint Laurent, also known as Yves Saint Laurent and originating from France, was valued at USD 6,805 million.

- Tiffany & Co., from the United States, held a brand value of USD 6,718 million, while Italian brand Prada was valued at USD 5,642 million.

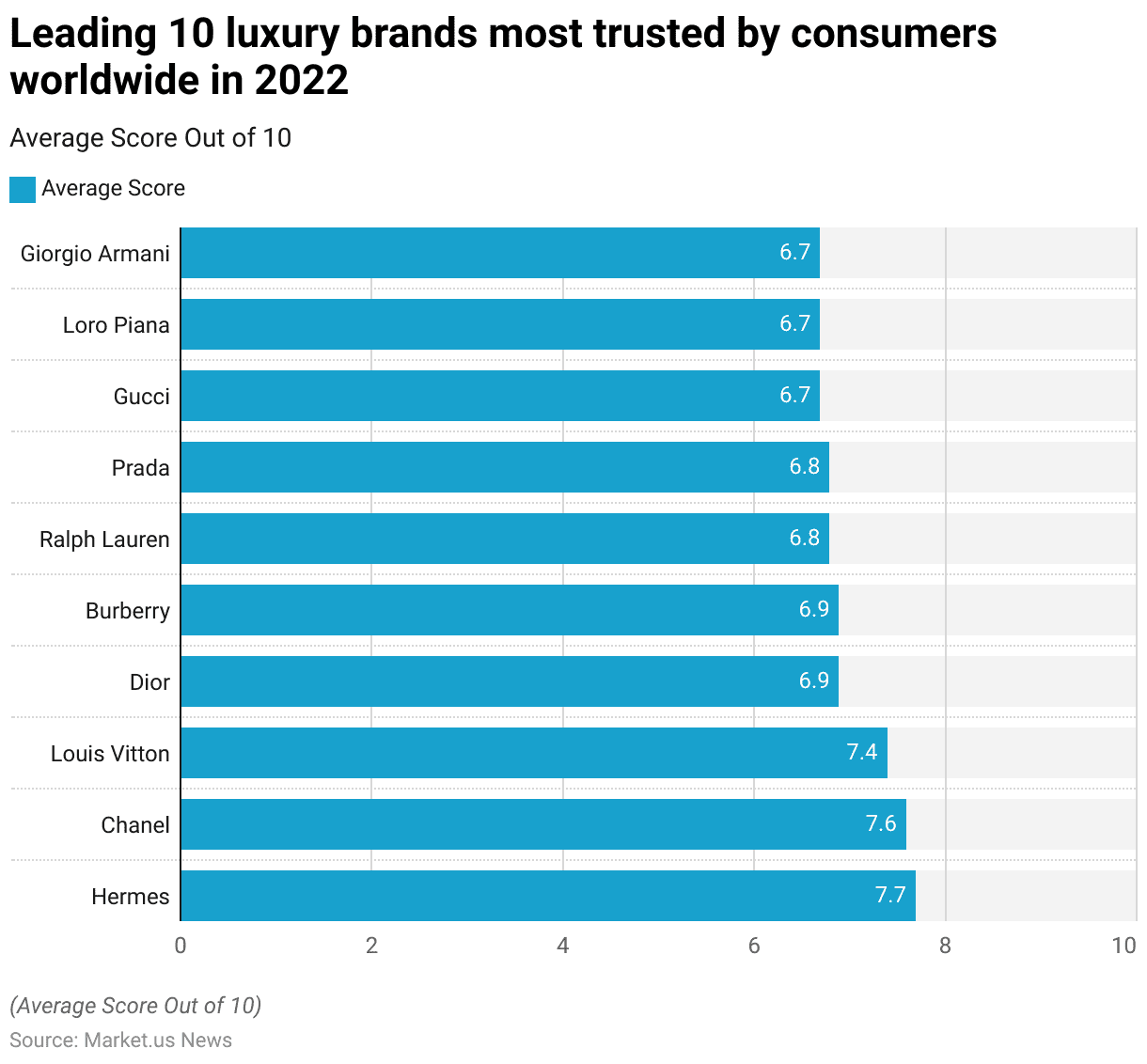

Leading 10 Luxury Brands Most Trusted by Consumers Worldwide

- In 2022, the most trusted luxury brands worldwide were ranked based on consumer trust, with scores reflecting their reliability and reputation.

- Hermès led the list with an average score of 7.7 out of 10, followed closely by Chanel with a score of 7.6.

- Louis Vuitton secured the third position with a score of 7.4.

- Dior and Burberry both achieved a score of 6.9, indicating strong consumer confidence.

- Ralph Lauren and Prada each garnered a score of 6.8, while Gucci, Loro Piana, and Giorgio Armani all received a score of 6.7.

Demographic Insights of Luxury Goods Consumers

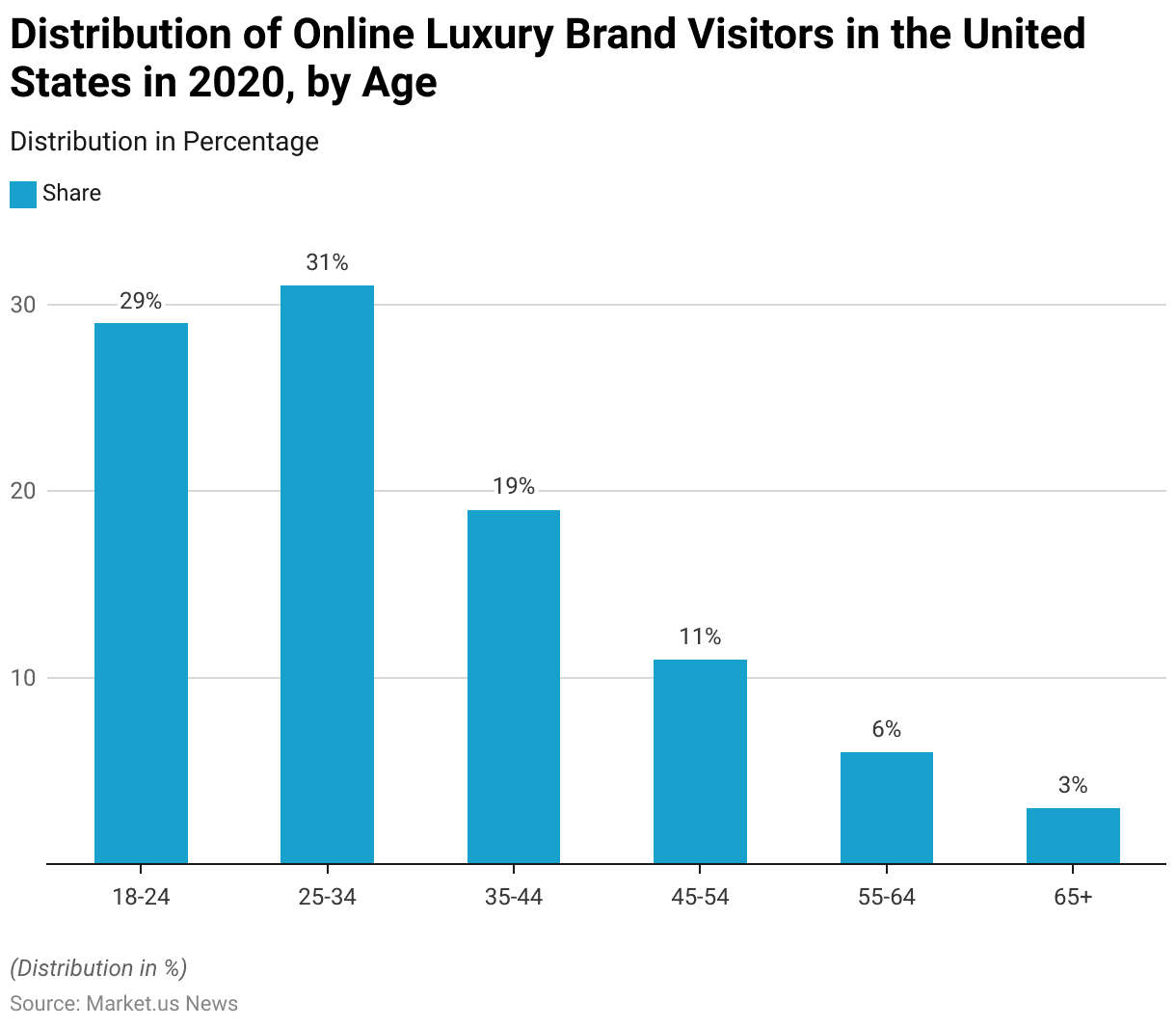

By Age

- In 2020, the distribution of online luxury brand visitors in the United States varied significantly across different age groups.

- The largest share of visitors came from the 25-34 age group, accounting for 31% of the total online audience.

- This was closely followed by the 18-24 age group, which comprised 29% of visitors.

- The 35-44 age group represented 19% of online luxury brand visitors.

- Those aged 45-54 accounted for 11%, while the 55-64 age group made up 6% of the audience.

- The smallest share of visitors, 3%, was from the 65 and older age group.

By Gender

- Women are increasingly embracing luxury purchases as symbols of personal and professional achievement, with a significant portion spending £50k+ annually, surpassing their male counterparts by 10%.

- Motivations such as signaling success (35%) and self-reward (33%) drive these purchases.

- Nearly two-thirds (62%) buy luxury items primarily for themselves, driven by the desire for self-indulgence and moments of happiness.

- Quality, craftsmanship, and durability define luxury for over 40% of women, who are also drawn to special promotions (40%), overseas luxury travel shopping (35%), and commemorating milestones (31%).

Consumer Purchasing Behavior and Trends

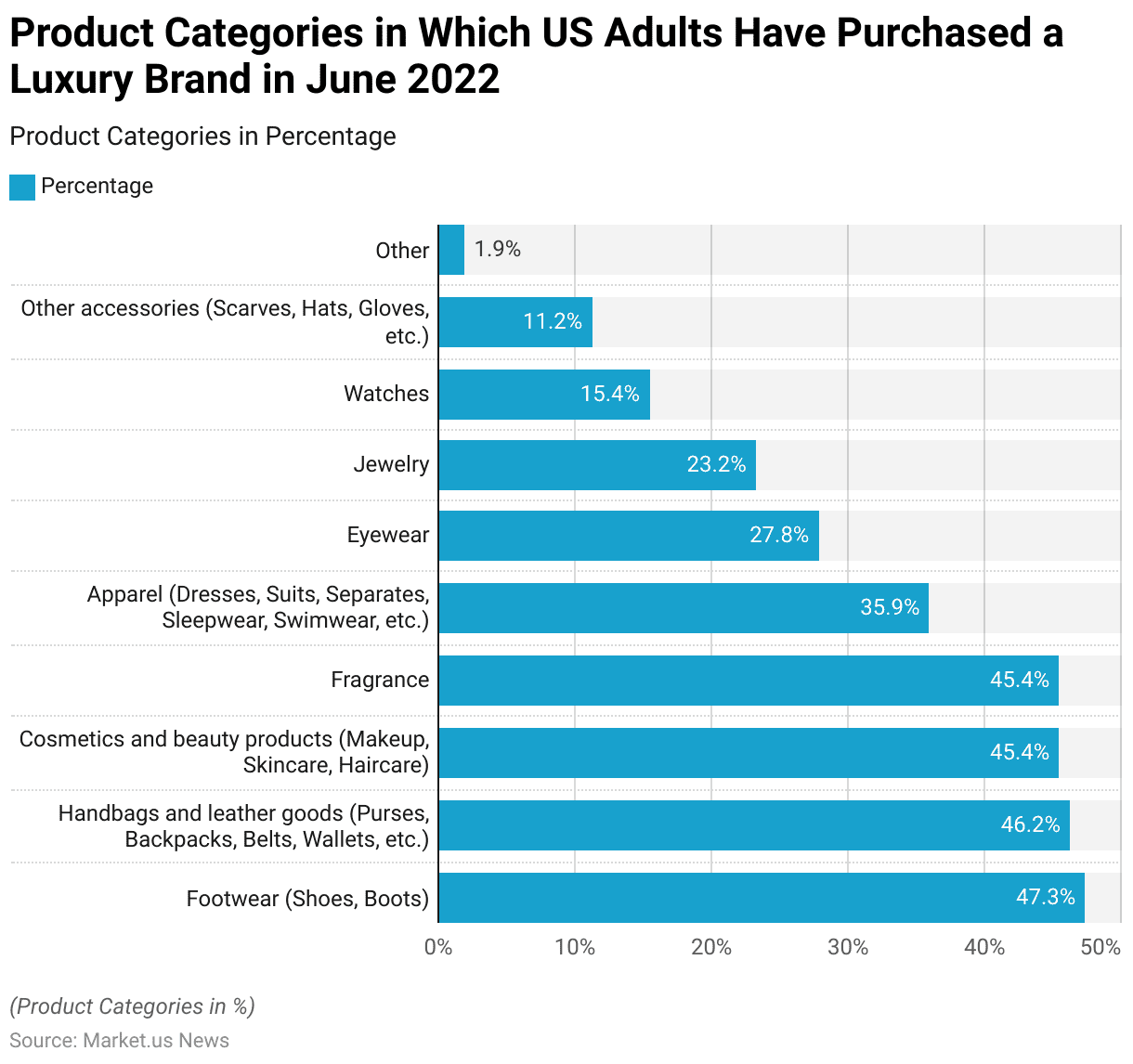

Popular Product Categories for Luxury Products

- In June 2022, US adults displayed a diverse range of preferences when purchasing luxury brands across various product categories.

- The most popular category was Luxury Footwear, including luxury shoes and boots, with 47.3% of respondents having made a purchase.

- Leather Handbags and leather goods, such as purses, backpacks, belts, and wallets, followed closely with 46.2%.

- Cosmetics and beauty products, encompassing makeup, skincare, and haircare, along with fragrances, each attracted 45.4% of respondents.

- Apparel, which includes Luxury apparel, dresses, suits, separates, sleepwear, and swimwear, was purchased by 35.9% of luxury consumers.

- Eyewear was chosen by 27.8%, while jewelry was purchased by 23.2% of respondents.

- Watches were a less common luxury purchase, with 15.4% of respondents, followed by other accessories, such as scarves, hats, and gloves, at 11.2%.

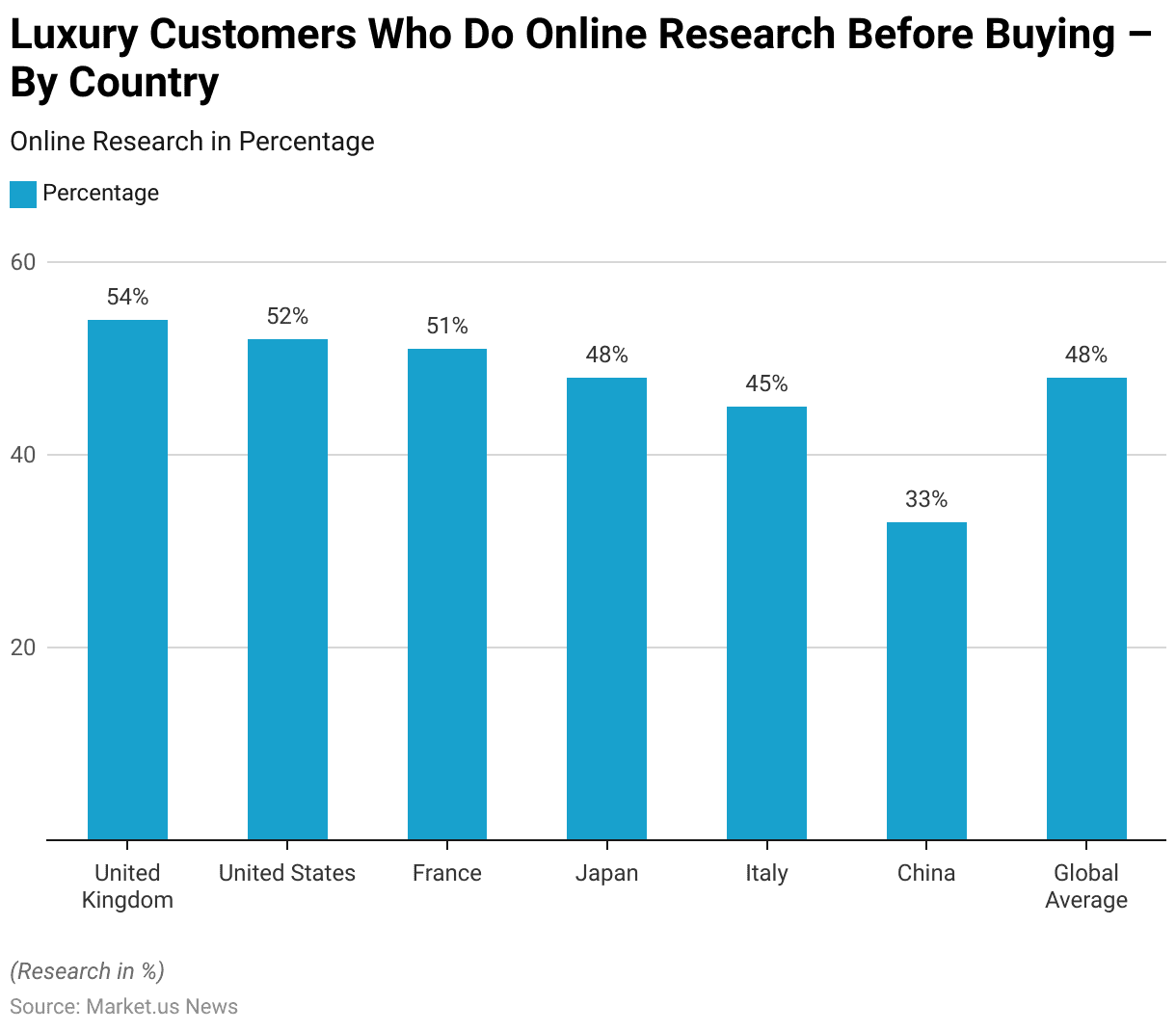

Luxury Customers Who Do Online Research Before Buying – By Country

- In the context of luxury shopping, a significant portion of customers engage in online research before making a purchase.

- In the United Kingdom, 54% of respondents indicated they conduct online research before buying luxury goods.

- This trend is closely mirrored in the United States, where 52% of luxury consumers research online before purchasing.

- In France, 51% of respondents follow this practice, while in Japan and Italy, the figures are 48% and 45%, respectively.

- China shows a lower percentage, with 33% of luxury customers conducting online research before buying.

- On a global scale, the average stands at 48%, highlighting the importance of online information and reviews in the luxury purchasing decision process.

Challenges Faced by the Luxury Goods Industry

- In 2020, luxury companies in France faced several key challenges, as identified by industry professionals.

- The most significant challenge was the commitment to corporate social responsibility (CSR), highlighted by 63% of respondents.

- The development of e-commerce was also a major concern, with 43% of professionals recognizing it as a critical issue.

- Expanding the customer base to include younger generations, specifically Millennials and Gen Z, and addressing the origin of products and relocation of production were each cited by 41% of respondents.

- Digitalization of companies was noted as a challenge by 33% of respondents, while customer relationship management (CRM) was identified by 19% of professionals.

Laws and Regulations for Luxury Goods

- The luxury goods industry is subject to various laws and regulations that differ by country. Impacting everything from import-export practices to sustainability commitments.

- In the United States, the Bureau of Industry and Security (BIS) has imposed strict export controls on luxury goods to countries such as Russia and Belarus. Requiring licenses for exports and re-exports to these nations due to geopolitical tensions.

- Similarly, the European Union has expanded its sanctions against Russia, banning the export of EU-made luxury items exceeding €300, including high-value products like designer clothing, accessories, pet accessories, and vehicles.

- In France, luxury brands must navigate stringent corporate social responsibility (CSR) requirements, emphasizing sustainability and ethical sourcing.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)