Table of Contents

Introduction

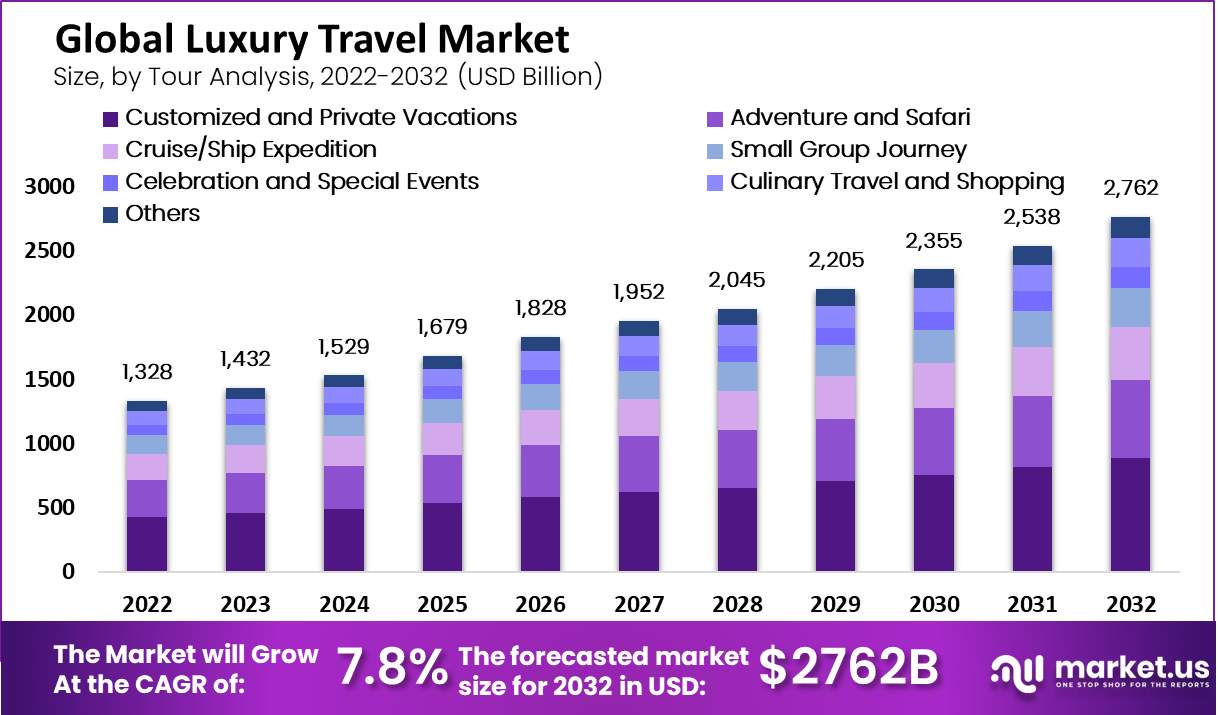

The Global Luxury Travel Market size is expected to be worth around USD 2,762 Billion by 2032 from USD 1,328.10 Billion in 2022, growing at a CAGR of 7.80% during the forecast period from 2023 to 2032.

Luxury travel refers to high-end tourism experiences that offer exclusivity, personalization, and premium comfort. It encompasses bespoke itineraries, five-star accommodations, private jet services, and unique cultural or adventure experiences tailored to meet the sophisticated tastes of affluent travelers. Unlike standard tourism, luxury travel emphasizes customization, exclusivity, and access to experiences that are often unavailable to the general public, including luxury safaris, private yacht charters, and exclusive culinary journeys curated by renowned chefs.

The luxury travel market is growing significantly, driven by several key factors. Rising disposable incomes, particularly among the affluent middle class in emerging markets like China, India, and Southeast Asia, are bolstering demand for high-end travel experiences. Moreover, the increasing trend of “experiential travel” where consumers seek meaningful, once-in-a-lifetime adventures and cultural immersions is also fueling growth.

Technological advancements have enhanced personalization capabilities, allowing luxury travel providers to curate seamless and tailored experiences through data analytics and AI-driven customer insights. Additionally, the expansion of premium offerings such as boutique hotels, high-end cruise liners, and sustainable luxury resorts is broadening the appeal and accessibility of the luxury travel sector.

The luxury travel is largely influenced by evolving consumer preferences toward exclusivity and immersive experiences. High-net-worth individuals (HNWIs) and aspirational middle-class consumers seek curated travel options that offer privacy, luxury, and authentic cultural engagement. The demand is particularly strong in regions such as Europe, North America, and Asia-Pacific, where travelers are not only looking for relaxation but also adventure and well-being experiences like wellness retreats, adventure tourism, and eco-luxury getaways. Post-pandemic, the appetite for travel has rebounded, with consumers placing greater value on quality and safety, making exclusive, private, and controlled travel environments more desirable.

The luxury travel market presents substantial opportunities for growth and innovation. One prominent opportunity lies in sustainability, as affluent travelers increasingly seek eco-conscious options that do not compromise on luxury. Developing eco-luxury resorts and promoting sustainable travel packages can attract this growing segment. Another opportunity is the integration of technology in luxury travel experiences leveraging virtual reality (VR) for pre-trip planning, AI for personalized itineraries, and blockchain for secure transactions can significantly enhance the customer experience. Additionally, as the demand for unique experiences continues to rise, destinations that can offer authentic cultural exchanges, wellness tourism, and adventure travel, especially in under-explored regions, stand to gain considerably.

Key Takeaways

- Luxury travel market projected to reach USD 2,762 billion by 2032 from USD 1,328.10 billion in 2022, with a CAGR of 7.80%.

- Millennials dominate luxury travel, accounting for 67.4% of revenue in North America and Europe

- HNWIs are major contributors to market growth, particularly in water-based luxury travel

- 73% of luxury travelers prefer sustainable accommodations, driving green practices in luxury hotels globally

- Asia-Pacific destinations like Japan are gaining popularity due to luxury accommodations and cultural experiences.

- Europe leads the global luxury travel market, with the region recording a valuation of USD 448.9 billion in 2022.

Luxury Travel Statistics

- Luxury wellness retreats saw a 21% increase in bookings worldwide in 2023 .

- 73% of luxury travelers prefer sustainable accommodations.

- 40% of global luxury travelers are now millennials, driven by cultural immersion.

- The luxury train travel market saw a 17% rise in demand for exotic journeys

- Oman saw a 35% increase in high-end tourist arrivals in 2023.

- Only 5% of travelers plan to reduce their travel budget despite inflation

- 34% of consumers say their financial situation negatively impacts their willingness to travel.

- 69% of travelers are willing to spend more if their vacation supports the local community.

- Nearly 25% of global travelers plan to travel more frugally in 2023.

- 38% of travelers cook their own meals to reduce vacation costs.

- 84% of travelers plan to spend more on travel in 2023 compared to 2022.

- Flying midweek saves travelers an average of $90 domestically and $140 internationally.

- 85% of North American travelers and 73% globally are most concerned about inflation and rising costs.

- U.S. businesses expect a 33% increase in their international travel costs in 2023.

- 33% of U.S. businesses must reduce travel per employee by over 20% to meet 2030 sustainability goals.

- 71% of U.S. businesses expect full travel spend recovery by the end of 2024.

- To manage travel costs, 59% of businesses choose cheaper lodging, 58% negotiate rates, and 56% pick lower-cost flights.

- 49% of travelers plan to spend more due to missed vacations during the pandemic.

- The top priority for travelers is dining (34%), followed by suitable accommodations (32%) and all-inclusive options (28%) .

- 63% of travelers use deals and travel strategies to save money.

- 69% of millennials use technology to save money while traveling.

- 23% of travelers prioritize low prices when booking hotels, and 21% value refund policies.

- 60% of travelers consider “getting the right price” the most crucial feature of online travel sites.

- The travel and tourism industry is expected to generate $916 billion by the end of 2024.

- Air travel numbers are projected to reach 4 billion passengers by 2024.

- 74% of travelers are willing to pay for sustainable travel options.

- 68% of people feel more positive after taking a vacation.

- 61% of travelers plan their trips in advance to get better deals.

- 60% of business trips are extended for personal vacation time.

- 55% of travelers want to book trips to “escape reality”.

- 46% of female travelers are concerned about safety when traveling solo.

- 40% of travelers aged 18-33 choose vacation spots based on their “Instagrammable” appeal.

- 38% of solo travelers spend $1,000 to $2,000 per trip.

- 31% of travelers plan vacations six or more months in advance.

- 26% of people book vacations three to six months ahead.

- 20% of travelers prioritize cultural activities when traveling.

- 17% of U.S. travelers subscribe to travel-related services.

- 10% of travelers seek pet-friendly vacations.

- 84% of U.S. travelers are aged 40 or older .

- 75% of American travelers prioritize visiting new places.

- 70% of American travelers consider cleanliness a top factor when choosing accommodations.

- 51% of Americans travel primarily to rest and relax.

- Notable acquisitions like Accor’s $1.2 billion deal with Ennismore and Hyatt’s $53 million purchase of Mr & Mrs Smith.

- Strong post-pandemic recovery, with luxury hotel ADRs up 15% globally in 2023 compared to 2019.

Emerging Trends

- Personalized and Experiential Travel : High-net-worth individuals increasingly seek bespoke travel experiences tailored to their unique preferences. This trend emphasizes exclusive, immersive activities, such as private cultural tours, personalized wellness retreats, and bespoke culinary journeys.

- Sustainable Luxury Tourism: Affluent travelers are prioritizing eco-friendly options without compromising on luxury. This includes stays at eco-conscious resorts, sustainable safaris, and carbon-neutral private jet services, reflecting a growing demand for responsible luxury travel.

- Digital Nomadism and Remote Work Solutions: The rise of remote work has led luxury travel brands to offer long-stay packages with office amenities. Upscale hotels and resorts are creating spaces that blend work and leisure, enabling guests to seamlessly transition between professional commitments and relaxation.

- Health and Wellness Retreats: Post-pandemic, luxury travelers are focusing on physical and mental well-being. High-end resorts now offer specialized wellness programs, such as holistic detox plans, mindfulness sessions, and access to medical experts, integrating health with luxury hospitality.

- High-Tech, Contactless Experiences: Luxury travel is becoming increasingly digitized, with high-tech solutions enhancing guest convenience and safety. From app-based concierge services to biometric check-ins and personalized AI recommendations, technology is elevating the luxury travel experience while minimizing direct contact.

Top Use Cases

- Private Jet and Yacht Charters: Elite travelers often prefer the convenience and exclusivity of private jets and yachts. These charters offer personalized itineraries, flexibility in scheduling, and ultra-luxurious amenities, providing seamless and private travel experiences.

- Exclusive Cultural Immersion Tours: Luxury travelers seek authentic, high-end cultural experiences, such as private museum tours, local artisan workshops, or VIP access to historical sites. These personalized excursions create a deep, immersive connection to the destination, often unavailable to the general public.

- Ultra-Luxury Safari Expeditions: Safaris catered to affluent travelers go beyond wildlife observation, offering exclusive lodges, gourmet dining, and private guides. This use case combines adventure with luxury, ensuring guests experience the wilderness with maximum comfort and exclusivity.

- Wellness Retreats and Holistic Escapes: High-net-worth individuals increasingly opt for wellness vacations, featuring personalized wellness programs, detox regimens, and access to medical professionals. These retreats are designed to rejuvenate both body and mind, blending luxury hospitality with health-focused services.

- Long-Stay Villas and Residences: For extended vacations or remote work, luxury clients choose exclusive villas and residences offering full-service amenities, privacy, and customized experiences. These properties often come with dedicated staff, including chefs and butlers, ensuring a home-away-from-home feel with elevated comfort and luxury.

Major Challenges

- Sustainability and Environmental Impact: Luxury travel often involves resource-intensive activities, like private jet travel or exclusive resorts in remote locations, which can have substantial environmental impacts. The challenge is to balance luxury with sustainability, requiring investments in eco-friendly practices and carbon offset initiatives.

- Economic Uncertainty and Geopolitical Instability: Economic downturns, inflation, or geopolitical tensions can directly affect the luxury travel sector as even affluent travelers may limit spending. Political unrest or changing regulations in popular destinations can also disrupt travel plans, impacting market demand.

- Health and Safety Concerns Post-Pandemic: While demand is recovering, health and safety remain top concerns for luxury travelers. Brands must invest in robust hygiene measures, contactless technologies, and medical facilities on-site to reassure guests and ensure compliance with global health standards.

- Talent Shortages in Hospitality Services: Providing luxury experiences requires skilled staff, from personal butlers to specialized guides. However, talent shortages and high turnover rates in the hospitality industry make it challenging to maintain consistent service quality, affecting guest satisfaction and brand loyalty.

- Technological Adaptation and Cybersecurity Risks: As luxury travel becomes more digitalized, ensuring seamless tech integration and protecting client data is critical. The challenge lies in adopting advanced technologies like AI and biometric check-ins while simultaneously safeguarding against cybersecurity threats, which are especially concerning for high-profile clients.

Top Opportunities

- Sustainability and Green Innovation: As global regulations and consumer expectations increasingly favor sustainable practices, companies that prioritize green innovation—like eco-friendly products and renewable energy solutions—can capture new markets and build brand loyalty.

- Digital Transformation and AI Integration: Investing in digital transformation initiatives, particularly those integrating AI for automation and predictive analytics, allows businesses to optimize operations, enhance customer experience, and create scalable growth models.

- E-commerce and Omnichannel Strategies: With the continuous rise of online shopping, businesses can expand their reach and revenue streams by developing seamless omnichannel experiences that integrate physical and digital retail to meet customers wherever they are.

- Health and Wellness Market Expansion: The increasing focus on health and wellness presents opportunities for businesses in sectors such as food, fitness, and healthcare to innovate and introduce new products tailored to the needs of a more health-conscious consumer base.

- Personalization and Customer-Centric Services: Leveraging data analytics to offer personalized products and services can differentiate brands and foster deeper customer relationships, translating into higher customer retention and lifetime value.

Key Player Analysis

- TUI Group: TUI Group is one of the world’s largest tourism companies, generating over €16.5 billion in revenue in 2023. The company offers a comprehensive portfolio of luxury travel experiences, including high-end resorts, private tours, and luxury cruises. TUI’s extensive global reach and expertise in creating curated travel packages make it a leader in the industry, particularly for those seeking all-inclusive luxury holidays.

- Butterfield & Robinson Inc.: Known for its expertise in active and luxury travel, Butterfield & Robinson (B&R) focuses on bespoke biking and walking tours in some of the most scenic regions around the globe. Catering to high-end clientele, B&R delivers immersive and personalized adventures with high attention to detail, blending physical activity with cultural exploration and exclusive accommodations, ensuring a truly unique travel experience.

- Abercrombie & Kent USA, LLC: Abercrombie & Kent (A&K) is a pioneer in luxury and adventure travel, offering exclusive tours and private expeditions across 100+ countries. With a revenue exceeding $500 million, A&K provides a variety of high-end travel experiences, including safaris, cultural tours, and polar expeditions. Their focus on premium service and access to remote, unique destinations positions them as a leader in the ultra-luxury segment.

- Cox & Kings Ltd.: Established in 1758, Cox & Kings is one of the oldest and most prestigious travel companies globally. It specializes in luxury and tailor-made tours, offering everything from cultural excursions to luxury train journeys and bespoke safaris. With a legacy of over 250 years, the company combines historical expertise with modern luxury, ensuring that every trip is meticulously crafted for an elite experience.

- Scott Dunn Ltd.: Scott Dunn is renowned for its personalized luxury travel services, emphasizing family-friendly and adventure holidays tailored to individual needs. The company provides bespoke itineraries that include private villas, chalets, and access to exclusive events and destinations. With offices in the UK, USA, and Singapore, Scott Dunn has a strong international presence, allowing it to cater to affluent travelers seeking unique and luxury-centric experiences worldwide.

Recent Developments

- In 2023, Hyatt Hotels Corporation announced it will acquire London-based platform Mr & Mrs Smith, which offers direct bookings to over 1,500 boutique and luxury properties worldwide. Hyatt will purchase the platform for £53 million in cash.

- In 2023, Hilton expanded its luxury hotel offerings by adding nearly 400 boutique properties from the Small Luxury Hotels of the World (SLH) collection. These properties are now available on Hilton’s booking platforms, including Hilton.com and the Hilton Honors app.

- In 2024, Travel + Leisure Co. revealed plans to acquire the vacation ownership business of Accor for $48.4 million. The deal is expected to close in the first quarter of 2024 and will immediately boost the company’s earnings once completed.

Conclusion

The luxury travel market continues to thrive, driven by increasing consumer demand for unique, personalized, and high-end experiences that go beyond traditional tourism. This growth is fueled by the rising disposable incomes of affluent consumers, particularly in emerging markets, alongside a strong emphasis on exclusivity, wellness, and sustainability. The industry is increasingly integrating advanced technologies and data analytics to deliver bespoke services, while also focusing on eco-conscious practices to meet evolving consumer expectations. Despite global economic uncertainties and geopolitical tensions, the sector remains resilient, adapting through innovation and partnerships aimed at enhancing customer engagement and loyalty, positioning luxury travel as a robust and evolving market segment poised for sustainable long-term growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)