Table of Contents

Introduction

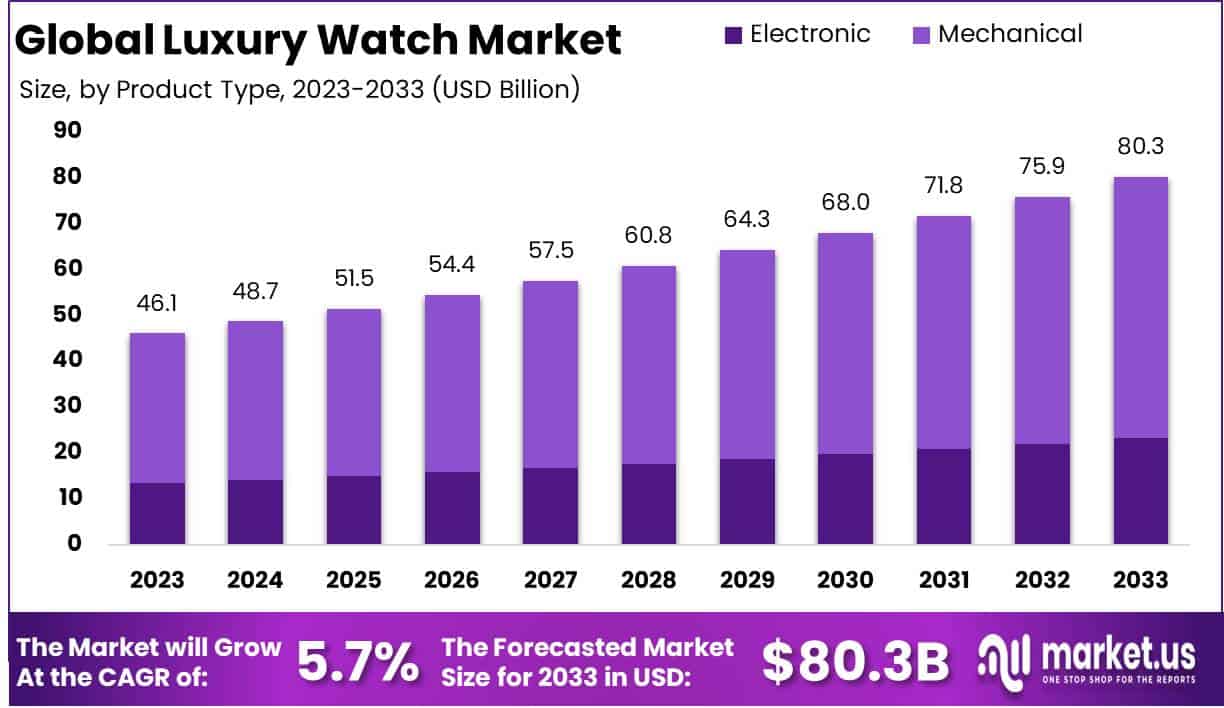

The global luxury watch market is projected to reach a valuation of USD 80.3 billion by 2033, up from USD 46.1 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2024 to 2033.

A luxury watch is a premium timepiece that exemplifies craftsmanship, precision, and aesthetic excellence. These watches are often produced by renowned brands, featuring high-quality materials such as gold, platinum, or fine leather, and they frequently include intricate mechanisms like automatic movements or advanced complications (e.g., perpetual calendars, moon phases).

Luxury watches go beyond mere timekeeping; they represent status, heritage, and personal style. They are perceived not only as functional accessories but also as investments, often appreciating in value over time, and are symbols of wealth, exclusivity, and refined taste.

The luxury watch market encompasses the global trade, manufacturing, and retail of high-end, often handcrafted timepieces, typically priced in the premium and ultra-luxury segments. It includes a diverse range of brands, from established Swiss watchmakers to new-age luxury houses and independent watchmakers offering bespoke designs.

The market serves affluent consumers who value brand heritage, exclusivity, and the intricate artistry of watchmaking. The distribution channels are primarily exclusive boutiques, authorized retailers, and high-end department stores, with digital platforms increasingly gaining traction among tech-savvy consumers. The sector is defined by both established brands such as Rolex, Patek Philippe, and Audemars Piguet, as well as emerging brands looking to offer distinct designs and innovative materials.

The luxury watch market’s growth is fueled by several factors. First, the increasing number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) globally continues to drive demand for exclusive luxury goods, including watches. Second, the trend of digital transformation in retail has allowed luxury brands to reach a broader audience, fostering brand awareness and attracting younger consumers, particularly in emerging markets such as China, India, and Southeast Asia. Third, the market benefits from a growing interest in vintage and collectible watches, spurred by auction houses and secondary marketplaces, which have elevated luxury watches as alternative assets.

Demand in the luxury watch market is primarily driven by affluent consumers who view luxury watches as status symbols, investments, or heirlooms. The growing trend of ‘quiet luxury,’ where understated yet high-quality timepieces are favored over ostentatious displays of wealth, also sustains demand. This aligns with the rise of conscious consumerism, where buyers prioritize timeless craftsmanship, ethical sourcing, and sustainability. Despite economic uncertainties, demand for luxury watches has shown resilience, as affluent consumers are less sensitive to economic downturns.

The luxury watch market offers significant opportunities for growth, particularly in digital channels and emerging markets. As e-commerce becomes more prevalent, brands that can effectively blend traditional exclusivity with digital convenience will have a competitive edge. Blockchain technology presents another opportunity, offering authenticity verification and transparent provenance, which is particularly relevant in the high-value watch segment.

Key Takeaways

- The global luxury watch market is set to expand from USD 46.1 billion in 2023 to USD 80.3 billion by 2033, registering a strong CAGR of 5.7% throughout the forecast period.

- The mechanical watch segment leads the product type category, accounting for 71.9% of the market share in 2023, fueled by a preference for traditional craftsmanship and exclusivity.

- The offline distribution channel remains dominant, holding a 69.5% share, as luxury watch buyers value in-person experiences for high-ticket purchases.

- The Asia-Pacific region commands the largest market share at 48.1%, driven by rising disposable incomes and growing brand awareness among affluent consumers.

- A 20% increase in luxury watch demand in India presents a significant growth opportunity, supported by an expanding middle and upper-middle class and heightened interest in luxury goods.

Luxury Watch Statistics

- Hong Kong emerged as the top importer of luxury watches, reaching USD 7.6 billion in 2023.

- Louis Vuitton ranked as the leading luxury watch brand globally, valued at USD 129.9 billion in 2023.

- The European luxury watch market is expected to grow by 4% by the end of 2024.

- China’s luxury watch market is anticipated to grow by 5% by the end of 2024.

- Import value of luxury watches has been fluctuating since 2003, when it reached USD 21.6 billion.

- In 2023, electronic watch components exports were 10.6 million units, while mechanical components exports were 6.3 million units.

Chopard produces around 75,000 watches annually. - Over 28,000 people work in Switzerland’s luxury watch sector as of 2023.

- Rolex holds a brand value of USD 9.3 billion, making it the most valuable luxury watch brand in 2023.

- Patek Philippe watches sold for over USD 1 million, maintaining its status as the most expensive luxury watch brand.

- The Citizen Watch Company employs 150 people, with women representing 59% of the workforce.

- First Watch has a total workforce of 10,000 employees, with women making up 52%.

- The second-hand luxury watch market reached USD 22 billion in 2023.

- Online sales of luxury watches increased by 23% in 2023, accounting for 30% of total sales.

- The average age of luxury watch buyers decreased to 34 years in 2023, down from 41 years in 2018.

- Women’s luxury watches saw a 15% increase in sales in 2023.

- Stainless steel watches accounted for 42% of luxury watch sales in 2023.

- Production time for high-end luxury watches ranged between 3-6 months in 2023.

- Switzerland’s watchmaking industry workforce reached about 59,000 people in 2023.

- Limited edition watches comprised 18% of luxury watch sales in 2023.

- The markup on luxury watches averaged between 35-45% in 2023.

- Mechanical watches outsold quartz watches at a ratio of 3:1 within the luxury segment in 2023.

- Instagram influenced 45% of millennial luxury watch purchases in 2023.

- The average retail price of luxury watches rose by 12% in 2023.

- Watch shows and exhibitions generated USD 3.2 billion in sales in 2023.

- Sustainability initiatives among luxury watch brands increased by 40% in 2023.

- Customization requests for luxury watches grew by 25% in 2023.

- Investment-grade watches appreciated by an average of 15% in value during 2023.

- Digital certificates and blockchain were used for 60% of new luxury watches in 2023.

- The waiting list for popular luxury watch models averaged 2-3 years in 2023.

- Titanium watches experienced a 30% increase in demand in 2023.

- Marketing expenditures by luxury watch brands averaged 12% of total revenue in 2023.

- The adoption of mobile authentication apps for luxury watches grew by 65% in 2023.

- Ceramic case materials became 28% more popular in 2023.

- Direct-to-consumer sales increased by 35% for luxury watch brands in 2023.

Emerging Trends

- Decline in Speculative Demand: The market has witnessed a downturn due to reduced speculative buying, particularly from cryptocurrency investors who previously purchased luxury watches for investment purposes. This shift has led to decreased prices and longer inventory turnover times.

- Introduction of New Collections: Brands like Patek Philippe are launching new collections, such as the Cubitus, to attract younger, urban consumers. This strategy aims to broaden their customer base amidst a challenging market environment.

- Growth in Emerging Markets: Countries like India are experiencing a significant increase in luxury watch demand. Swiss watch exports to India rose by 20% in value during the first seven months of 2024, highlighting the country’s growing importance as a luxury market.

- Resilience of Established Brands: Despite industry-wide challenges, brands such as Hermès have reported strong sales. Hermès’ revenue increased by 14% to €11.2 billion in the first nine months of 2024, attributed to their focus on exclusivity and timeless design.

- Emphasis on Vintage and Timeless Designs: There is a growing consumer interest in watches that combine vintage aesthetics with modern functionality. Brands are responding by reintroducing classic models, catering to enthusiasts who value traditional designs.

Top Use Cases

- Status Symbol and Personal Branding: Luxury watches are often seen as symbols of wealth and status, reflecting personal style and success. This perception significantly influences consumer behavior, driving the demand for high-end timepieces.

- Investment and Asset Appreciation: Certain luxury watches appreciate over time, making them viable investment pieces. For instance, the Rolex Daytona has historically seen its value increase in the resale market.

- Craftsmanship and Technical Excellence: Discerning consumers value the intricate craftsmanship and advanced mechanics of luxury watches. Brands like Patek Philippe are renowned for their complex movements and exceptional finishing.

- Limited Editions and Exclusivity: Limited-edition models create exclusivity, appealing to collectors and enthusiasts. For example, Audemars Piguet’s special editions of the Royal Oak Offshore attract attention for their unique design and scarcity.

- Gifting and Special Occasions: Luxury watches are popular gifts for significant milestones, such as weddings or anniversaries, serving as enduring mementos that mark important life events.

Major Challenges

- Fluctuating Demand in Key Markets: In March 2024, Swiss luxury watch exports experienced a 16.1% decline year-on-year, with Chinese imports dropping by 42%. This downturn is attributed to reduced consumer spending in China, a crucial market for luxury watches.

Impact of the Grey Market: The rise of second-hand and grey markets, especially in China, has led to increased availability of discounted luxury watches. This trend challenges brand exclusivity and affects profit margins, as consumers opt for more affordable alternatives. - Price Sensitivity Among Consumers: Post-pandemic price hikes have made luxury goods less accessible. Brands like Dior and Chanel increased prices by 66% between 2020 and 2023, leading to a 3% drop in average selling prices in the second quarter of 2024.

- Digital Transformation and E-commerce Integration: While online sales of luxury goods reached €49 billion in 2020, up from €33 billion in 2019, the shift to e-commerce requires significant investment in digital infrastructure and adaptation to new consumer behaviors.

- Sustainability and Ethical Concerns: Consumers increasingly demand transparency and sustainability in luxury products. The complex global supply chains of watchmaking pose challenges in tracing raw materials and ensuring ethical practices, necessitating industry-wide changes.

Top Opportunities

- Expansion in Emerging Markets: Countries like India are showing a significant increase in luxury watch demand. For instance, Swiss watch exports to India rose by 20% in value during the first seven months of 2024, highlighting the country’s growing importance as a luxury market.

- Growth of the Pre-Owned Segment: The pre-owned luxury watch market is expanding rapidly. In 2020, while sales in the firsthand watch market declined by 17%, pre-owned watch sales increased by 3%. This trend indicates a growing consumer interest in pre-owned luxury timepieces.

- Technological Integration: Luxury watchmakers are increasingly incorporating advanced technology into their designs, such as smartwatch functionalities. This fusion of traditional craftsmanship with modern tech appeals to a broader consumer base, enhancing market growth.

- Emphasis on Sustainability: Consumers are placing higher importance on sustainability and ethical practices. Brands that adopt eco-friendly materials and transparent manufacturing processes are likely to attract more customers, thereby boosting sales.

Direct-to-Consumer Sales Channels: The rise of e-commerce and online platforms allows luxury watch brands to reach consumers directly, reducing reliance on traditional retail channels. This approach can lead to increased profit margins and a more personalized shopping experience for customers.

Key Player Analysis

- Rolex SA: Rolex is a leading luxury watch manufacturer, renowned for its timeless designs and exceptional craftsmanship. In 2023, the brand achieved sales exceeding $10 billion, marking an 11% increase from 2022.

Rolex holds approximately 30% of the global luxury watch market share. - LVMH (Moët Hennessy Louis Vuitton) : LVMH is a conglomerate encompassing multiple luxury brands, including TAG Heuer, Hublot, and Bulgari. In 2023, its Watches & Jewelry division recorded revenue growth of 7%, contributing to the group’s total revenue of €86.2 billion. However, in the first nine months of 2024, this segment experienced a 5% decline, posting €7.53 billion in revenue.

- Patek Philippe SA: Patek Philippe is esteemed for its intricate complications and refined designs. While specific financial data is not publicly disclosed, the brand is recognized as one of the top-selling Swiss watch brands, contributing significantly to the luxury watch market.

- The Swatch Group Ltd. : The Swatch Group owns a range of watch brands, including Omega, Longines, and Tissot. In 2023, the group held approximately 19.4% of the Swiss watch market. Omega, one of its flagship brands, is renowned for its Speedmaster and Seamaster collections.

- Audemars Piguet: Audemars Piguet is celebrated for its Royal Oak collection and high-complication timepieces. While exact sales figures are not publicly available, the brand is recognized among the leading luxury watch manufacturers worldwide, contributing notably to the industry’s revenue.

Recent Developments

- In 2024, Rolex achieved a milestone by surpassing $10 billion in sales for the first time. This accomplishment solidified its position as the leading Swiss watch brand. According to a joint analysis by Morgan Stanley and LuxeConsult, Rolex produced 1.24 million watches in 2023, generating 10.1 billion Swiss francs (about $11.5 billion) in sales—an 11% increase compared to 2022. The analysts highlighted that Rolex’s current market share is the largest it has ever been.

- In 2024, Chanel took a strategic step in the luxury watch market by partnering with MB&F, an independent Swiss watchmaker, acquiring a 25% stake. This alliance is part of Chanel’s broader strategy to strengthen its presence in the high-end watch sector, signaling a major move in the competitive luxury space.

- In 2024, Cristiano Ronaldo also made headlines in 2024 by launching a new luxury watch line in collaboration with Jacob & Co. Named “Flight of CR7” and “Heart of CR7,” the collection includes models with 44mm cases, featuring design elements inspired by Ronaldo’s career. Priced at £45,000, these timepieces mark Ronaldo’s debut in the luxury watch market.

- In 2024, LVMH announced a significant sponsorship deal with Formula 1 in 2024. The luxury conglomerate signed a 10-year agreement, set to begin in 2025, as part of its expanding engagement in sports sponsorships. This move follows its commitment of around 150 million euros ($165.77 million) as a premium sponsor for the upcoming Paris Olympics.

Conclusion

The global luxury watch market is poised for steady growth, driven by rising demand from affluent consumers and expanding interest in emerging markets. Key trends include a blend of traditional craftsmanship with modern technology, a growing emphasis on sustainability, and the increasing appeal of pre-owned luxury watches. While the market faces challenges such as fluctuating demand and the influence of grey markets, established brands continue to maintain strong positions. Overall, the sector demonstrates resilience and adaptability, reflecting evolving consumer preferences and broader economic shifts.