Table of Contents

Introduction

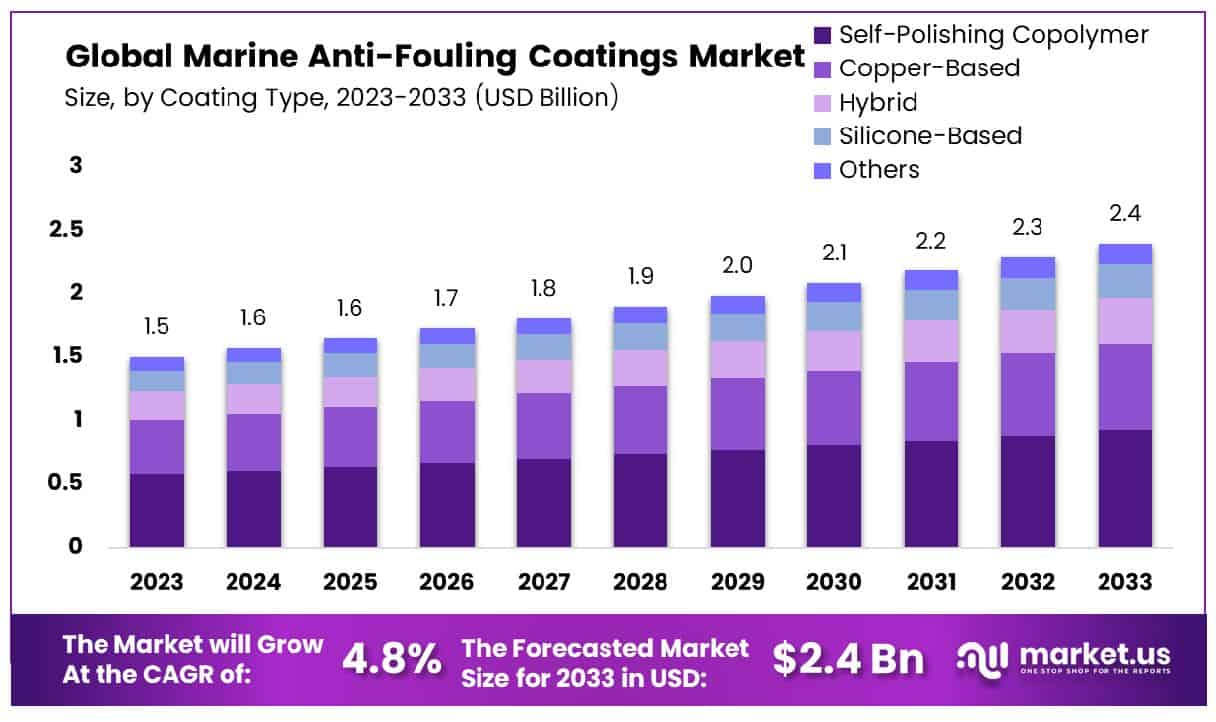

The Global Marine Anti-fouling Coatings Market, with an anticipated growth from USD 1.5 billion in 2023 to around USD 2.4 billion by 2033, is poised for a steady expansion at a Compound Annual Growth Rate (CAGR) of 4.8% over the forecast period from 2024 to 2033. This market is driven by the increasing demand to mitigate the detrimental effects of marine organism growth on vessels, which significantly impacts fuel efficiency and maintenance costs. However, the market faces challenges, primarily due to stringent environmental regulations governing the chemical composition of these coatings.

Recent developments have underscored innovation in eco-friendly solutions, where major industry players are focused on developing coatings that reduce environmental impact while enhancing performance. This shift is propelled by the global push towards sustainability and stricter marine preservation laws, influencing product development and market dynamics.

AkzoNobel has made headlines with its recent launch of a new bio-based anti-fouling coating in early 2024, designed to offer enhanced protection against barnacles and algae while complying with stringent environmental standards. This product innovation is part of AkzoNobel’s commitment to sustainability and its strategy to capture a larger share of the eco-conscious segment of the market.

PPG Industries responded to competitive pressures through a strategic acquisition in late 2023, where it purchased a smaller competitor known for its advanced silicone-based marine coatings. This move not only broadened PPG Industries’ product portfolio but also strengthened its technological capabilities in producing long-lasting and environmentally friendly coatings.

Hempel A/S launched a significant funding initiative towards research and development in 2024, investing USD 30 million to enhance its existing product lines and explore new anti-fouling technologies that meet the evolving regulatory landscapes and customer needs in maritime industries.

Jotun has been actively expanding its global footprint by establishing a new production facility in Asia-Pacific in mid-2023. This facility is strategically positioned to meet the growing demand in one of the most dynamic maritime regions, focusing on supplying advanced anti-fouling coatings that cater to a wide array of marine vessels.

Sherwin-Williams Company has introduced a breakthrough in anti-fouling technology with its patented coating that significantly reduces drag on large vessels, launched in the second quarter of 2024. This innovation improves fuel efficiency and positions Sherwin-Williams as a leader in high-performance marine coatings.

Key Takeaways

- Market Growth: The Global Marine Anti-fouling Coatings Market size is expected to be worth around USD 2.4 Billion by 2033, From USD 1.5 Billion by 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

- The Asia-Pacific marine anti-fouling coatings market holds a 61.5% share, valued at USD 0.9 billion.

- By Coating Type: Self-polishing copolymer dominates with a 38.6% market share in coatings.

- By Technology: Water-borne technology is preferred, holding 41.5% of the market segment.

- By Vessel Type: Cargo Ships lead vessel types, comprising 31.5% of the total.

Marine Anti-fouling Coatings Market Statistics

- During the application process, due to the lower dry film thickness, paint volume was reduced by 18%, resulting in a significant reduction and coating application time.

- For the energy sector in the United States, the estimated cost of biofouling at power plants is about $50 billion per year, primarily for cleaning heat exchange systems.

- In marine environments, biofilms thinner than the width of a human hair can increase drag on a ship by 22%.

- Copper has become the biocide of choice in most antifouling paints, 95% of which still rely on biocides to kill organisms.

- Typically, 20-50% by weight of all antifouling paint is copper or copper oxide.

- These are expensive, synthesized organic biocides and account for up to 5% by weight of current antifouling paint formulations.

- Currently, an estimated 2,920 tonnes of microplastic pollution is released into the oceans annually, just from leisure boat coatings, in Europe alone.

- If the bottom of the ship is fouled up to 5%, fuel consumption will increase up to 10%; if the bottom of the ship is fouled

up to 50%, and fuel consumption will increase by up to 40%. - Even minor microfouling can decrease vessel efficiency by 10 – 16%; macrofouling and result in a loss of 86% of a vessel’s cruising speed, contributing to delays across the marine shipping industry.

- The main driver for container ship owners is to meet shipping’s carbon emissions targets call for a reduction of greenhouse gases (GHGs) by at least 50% by 2050 compared with 2008, and for at least a 40% reduction in the carbon intensity of international shipping by 2030 relative to 2008.

- To Make it more effective than standard coatings while using 95% less biocide compared with self-polish coating technology.

- The current annual consumption of DDTs used in anti-fouling paint is 250 tons/yr globally.

- Marine biofouling, the undesirable colonization of man-made structures immersed in seawater by biotic and abiotic compounds, can increase a ship’s fuel consumption by up to 40% and reduce its speed by up to 20%.

- Biomimetic antifouling coatings inspired by shark skin can reduce microfouling settlement by 77% compared to smooth surfaces. Artificial surfaces with an engineered roughness index (ERI) of 9.5, similar to shark skin, show this 77% reduction.

- Other artificial surfaces with lower ERI values also reduce fouling, such as 2-μm-diameter circular pillars (ERI=5.0) which reduce fouling by 36%, and 2-μm-wide ridges (ERI=6.1) which reduce fouling by 31%.

- A more complex patterned surface with 2-μm-diameter circular pillars and 10-μm equilateral triangles (ERI=8.7) reduces spore settlement by 58%.

- Marine field tests showed that antifouling coatings containing Scutellarin and Houttuynia additives reduced fouling adhesion by 17.24% and 35.92% respectively.

Emerging Trends

- Eco-friendly Innovations: There is a significant shift towards developing anti-fouling coatings that are less harmful to marine ecosystems. The trend is driven by stringent global environmental regulations and a growing industry commitment to sustainability. This includes the use of biodegradable materials and the reduction of harmful biocides in coatings.

- Advanced Material Technology: The integration of nanotechnology and the development of micro and nano-capsule technology are revolutionizing anti-fouling coatings. These technologies enhance the longevity and effectiveness of coatings by improving their release mechanisms, which can more effectively prevent the attachment of organisms without frequent reapplication.

- Increased Durability and Efficiency: There is a growing demand for coatings that offer extended lifespans and improved fuel efficiency. This is particularly important for reducing the operational costs associated with dry-docking and the maintenance of marine vessels. Enhanced durability also means that ships can operate for longer periods without the need for recoating, which is both cost-effective and environmentally advantageous.

- Customizable Solutions: Customization of anti-fouling coatings to suit different types of vessels and navigational environments is becoming more prevalent. Companies are focusing on tailored solutions that can cater to specific types of ships, waters, and fouling challenges, providing more targeted and effective protection.

- Regulatory Compliance: As regulations around marine operations tighten, the demand for coatings that comply with both current and anticipated environmental laws is rising. This trend is pushing manufacturers to continually adapt and innovate to meet these regulatory demands while still providing effective anti-fouling solutions.

Use Cases

- Commercial Shipping: For commercial vessels, which often travel long distances across various marine environments, anti-fouling coatings are essential. These coatings can reduce fuel consumption by up to 40% by preventing hull fouling, which otherwise increases drag significantly. The application of these coatings helps maintain the speed and fuel efficiency of freighters, tankers, and container ships, which is critical given that fuel can account for up to 50% of a vessel’s operational costs.

- Naval and Coastguard Fleets: Military ships require high operational readiness and optimal performance. Anti-fouling coatings are used extensively to ensure that these vessels maintain speed and maneuverability without the added weight and resistance caused by marine growth. This is crucial for patrolling, rescue operations, and during strategic defense maneuvers.

- Pleasure Crafts and Yachts: For smaller vessels such as yachts and pleasure crafts, anti-fouling coatings are used to maintain aesthetic appeal and performance. These coatings prevent the growth that can cause damage to the vessel’s surface and potentially decrease the resale value. Regular maintenance using these coatings can prolong the structural integrity and appearance of these high-value vessels.

- Aquaculture: In aquaculture, anti-fouling coatings are applied to cages and nets used for fish farming. These coatings prevent biofouling, which can obstruct water flow and light, affecting the health and growth rate of the farmed species. Effective anti-fouling solutions can increase the productivity of aquaculture operations by ensuring better water quality and reduced maintenance costs.

- Offshore Oil Rigs and Wind Farms: Structures like oil rigs and offshore wind turbines are also susceptible to fouling, which can corrode components and increase maintenance costs. Anti-fouling coatings help protect these structures from the harsh marine environment, ensuring durability and reducing the frequency of costly repairs and replacements.

- Underwater Sensors and Equipment: Anti-fouling coatings are also crucial for protecting underwater sensors and equipment used in marine research, oil exploration, and environmental monitoring. Ensuring that these devices remain free from biological growth is essential for obtaining accurate data and reliable operation.

Key Players Analysis

AkzoNobel is a leader in the marine anti-fouling coatings sector, renowned for its innovative solutions like the Intersleek product line, which includes the industry’s first biocide-free antifouling coating. They have further advanced their technology with the development of a UV-LED-based fouling prevention solution, which combines surface protection with UV light-emitting diodes to prevent biofouling on underwater surfaces. This eco-friendly approach not only enhances ship performance but also significantly reduces environmental impact.

PPG Industries has made significant advancements in the marine anti-fouling coatings sector with their PPG SIGMA SAILADVANCE NX coating, which offers ultra-premium performance, minimizing speed loss and enhancing fuel efficiency. This technology, utilizing a unique binder formulation, ensures linear polishing and controlled biocide release, thereby maximizing protection against a broad spectrum of fouling conditions and achieving substantial CO2 savings. PPG’s focus on sustainable solutions is evident in their development of advanced coatings like SIGMAGLIDE 2390 and NEXEON 810, which prioritize environmental benefits alongside operational efficiency.

Hempel A/S has enhanced its range of antifouling coatings with the launch of new products like Globic 7000, offering substantial fuel savings and effective protection for up to 60 months against both hard and soft fouling. These products are designed for diverse operational conditions, including slow steaming and extended idle periods, thereby supporting modern maritime operational needs.

Jotun has made significant strides in the marine anti-fouling coatings sector with its SeaQuantum product line, which includes variants like SeaQuantum Ultra S and SeaQuantum X200. These products are designed to reduce fuel consumption and carbon emissions through enhanced hull performance, offering up to 14.7% in fuel savings and reducing speed loss to as low as 1%. Jotun’s coatings are tailored for various operational needs, ensuring long-term reliability and effectiveness in preventing fouling.

Sherwin-Williams Company offers a range of marine anti-fouling coatings such as the Seaguard® Ablative Antifoulant and SeaVoyage™ Copper Free Antifoulant, designed for various marine environments. These products are engineered to provide long-lasting protection against fouling and are suitable for steel vessels operating under diverse conditions. The coatings maintain a bio-active surface throughout their life, ensuring consistent performance and compliance with environmental standards.

Nippon Paint Marine has pioneered innovative antifouling solutions like the A-LF-Sea and FASTAR coatings. These products significantly reduce fuel consumption and CO2 emissions by lowering frictional resistance and adhering to stringent environmental standards. A-LF-Sea uses advanced hydro-gel and rheology control technologies to achieve a 15% reduction in frictional resistance, translating into a 10% reduction in fuel consumption. Similarly, FASTAR incorporates a nano-domain binder technology that optimizes biocide release, ensuring efficient and long-lasting antifouling performance.

Chugoku Marine Paints excels in developing anti-fouling coatings like the SEAFLO NEO Z series, which offers low friction and high performance for up to 90 months, employing advanced hydrolysis technology. This technology ensures a smooth surface, contributing significantly to fuel efficiency and reducing CO2 emissions, thus meeting stringent environmental standards.

Kansai Paint Co., Ltd. has innovated in the marine coatings market with its TAKATA QUANTUM series, a silyl polymer hydrolysis type of antifouling paint. This product is distinguished by its long-lasting antifouling properties, environmental friendliness, and its ability to significantly enhance fuel efficiency over extended periods. TAKATA QUANTUM has gained global recognition and is licensed in 18 countries, ensuring broad international standards compliance and adoption.

RPM International Inc. is recognized in the marine anti-fouling coatings sector through its subsidiary, Pettit Marine Paint, which leads globally in water-based antifouling paints. These high-performance products are designed to enhance the operational efficiency of vessels by reducing fuel consumption and are known for their eco-friendliness.

Boero Group, through its Boero Yacht Coatings, provides high-performance marine antifouling coatings like Magellan 630, which is a copper-free, self-polishing paint. This product is tailored for high-speed vessels and is environmentally compliant, optimizing fuel consumption and reducing emissions, ensuring effectiveness in both fresh and saltwater conditions.

BASF SE is actively engaged in the marine anti-fouling coatings sector, focusing on enhancing performance and sustainability. Their coatings are designed to protect various marine vessels against corrosion and fouling, which are critical for maintaining the efficiency and longevity of the ships. BASF’s approach integrates advanced additives to improve the durability and functionality of its coatings, ensuring they meet the specific demands of the marine industry while also emphasizing environmental safety.

KCC Corporation is distinguished in the marine anti-fouling coatings sector for its high-performance coatings designed to improve sailing speed and reduce fuel costs. These coatings prevent marine organisms from attaching to ship hulls, optimizing operational efficiency. KCC’s products are tailored to meet the rigorous demands of the shipbuilding industry, ensuring durability and protection against harsh marine environments.

The Chemours Company collaborates with Plastocor-international to research anti-fouling solutions, particularly for energy markets. This partnership reflects their commitment to developing advanced coatings that prevent fouling on marine infrastructure and energy-related equipment, underscoring a proactive approach towards environmentally responsible solutions.

Conclusion

The Marine Anti-fouling Coatings Market is a critical sector that significantly enhances the efficiency, longevity, and operational capabilities of marine vessels and structures. By preventing the accumulation of harmful marine organisms, these coatings not only safeguard the structural integrity of marine assets but also contribute to considerable economic savings in terms of fuel consumption and maintenance costs.

With the industry moving towards more sustainable and environmentally friendly solutions, the development of advanced, eco-conscious anti-fouling coatings is set to drive market growth. As regulatory frameworks continue to evolve and the demand for higher performance and eco-friendly products increases, the marine anti-fouling coatings market is well-positioned for robust growth and innovation in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)