Table of Contents

Introduction

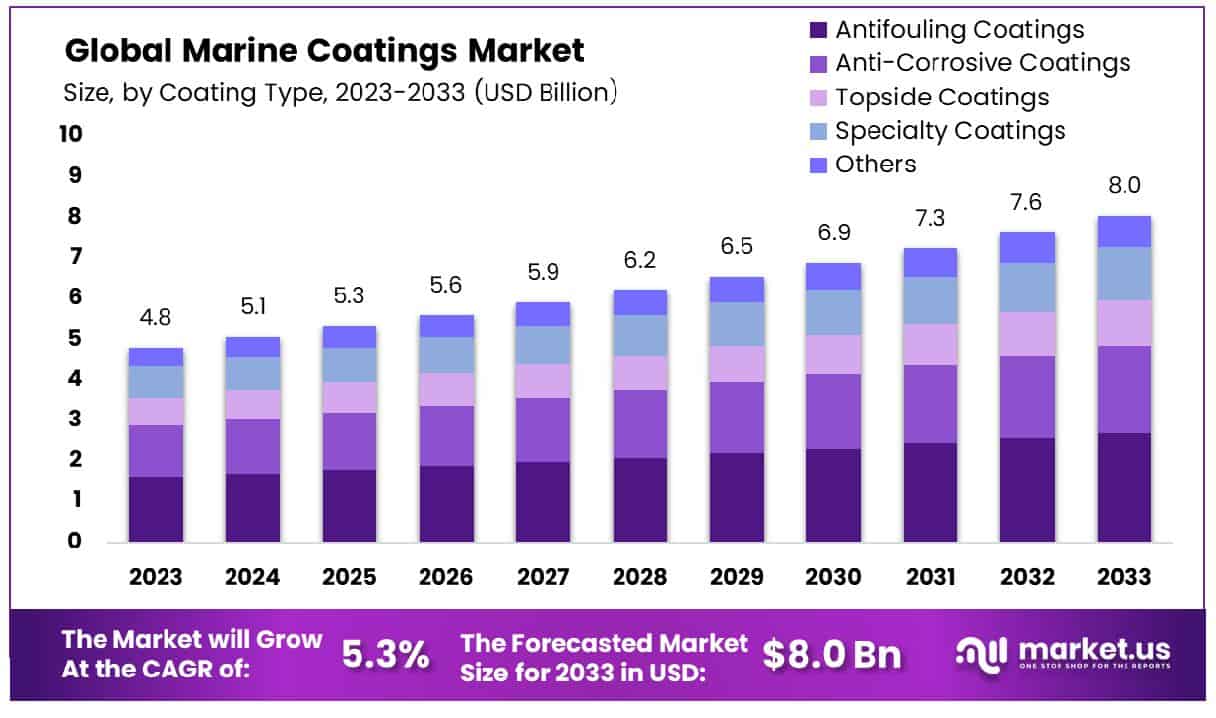

The global marine coatings market is poised for significant growth, projected to expand from USD 4.8 billion in 2023 to approximately USD 8.0 billion by 2033, with a compound annual growth rate (CAGR) of 5.3%. This growth trajectory is supported by a variety of factors, including heightened shipbuilding activities and an increased emphasis on sustainability within the shipping industry.

One of the primary drivers of this market is the rising demand for energy-efficient and environmentally friendly coating solutions. This demand is being further propelled by stringent environmental regulations and standards set by bodies such as the International Maritime Organization (IMO), which require ships to lower greenhouse gas emissions and improve their operational efficiencies. Marine coatings, such as biocide-free silicone-based fouling release products, play a crucial role in meeting these standards by reducing the drag on ship hulls, thereby improving fuel efficiency and reducing emissions.

However, the market faces challenges, including resistance to adopting new technologies and fluctuations in raw material prices. Despite these challenges, the industry continues to innovate with developments in coating technology that cater to the evolving needs of the marine sector.

Recent advancements in the market include the introduction of coatings that can significantly reduce the frictional resistance of ship hulls, thus lowering operational costs and enhancing the sustainability of marine operations. These innovations are crucial for shipowners looking to comply with new regulations and improve the efficiency of their fleets.

In summary, the marine coatings market is set on a growth path that leverages technological innovation and regulatory changes to offer improved solutions that enhance the operational efficiency and environmental compliance of the shipping industry.

Key Takeaways

- The Global Marine Coatings Market size is expected to be worth around USD 8.0 Billion by 2033, From USD 4.8 Billion by 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

- Asia-Pacific dominates the Marine Coatings Market with a 61.5% share, valued at USD 2.9 billion.

- Antifouling Coatings dominate 33.5% of the market by coating type.

- Container Ships hold a 35.6% share by application in the sector.

- Water-Based Coatings lead with 42.4% market share by technology.

- The Shipping Industry constitutes 45.6% of the market by end-use.

Production and Economic Data Statistics

- It is estimated that in total, approximately 29.8 million lbs. of polyurethane coatings for marine use were produced in North America in 2018.

- For the 12 months ending in April 2019, GDP grew from 2.2% to 3.1%, which is not bad, but not what many in the country had hoped for, especially since the United States is basically at full employment.

- The outlook for GDP during the remainder of 2019 is only expected to be ~2.0%, then falling to 1.9% during Q1 of 2020, and continuing to fall during Q2 to roughly 1.7%.

- Architectural coatings grew 3.4% in value in 2018, with volume growth of 2.5%. Sales are forecast to rise 3.1% in 2019, based on an anticipated volume growth of 2.5% and an increase in selling price of 0.6%, resulting in a volume of 832 million gallons valued at $12.8 billion.

Market and Sales Data Statistics

- Total construction spending exhibited year-over-year (yr/yr) growth of 3.8% in 2018 and is anticipated to grow by ~3% during 2019, due principally to moderately decelerating growth rates in residential and non-residential.

- Volume in 2018 finally matched the most recent peak, which occurred in 2013. Industrial OEM coatings are forecast to increase by 3.4% in value in 2019, with volume and pricing up 2.0% and 1.4%, respectively.

- In 2019, we are expecting a moderate increase in the value of special purpose coatings, from $5.2 to $5.4 billion, with gallons increasing from 157 to 162 million gallons.

- Going into 2019, we expect to see the price of crude stabilize in the $67–$70/barrel range. Looking at 2019, we expect to see an increase in the volume of protective coatings of 2.1% and an increase in value of 2.6%.

- Depending on a vessel’s type, class requirements, and operations dry dock intervals may vary from 12 to 60 or even 75 months.

Environmental and Performance Data Statistics

- At approximately a 64% share, antifouling/fouling release coatings were the largest portion of the marine coating market, followed by anti-corrosion and self-cleaning/self-polishing coatings.

- In one audit of leisure vessels sailing through that area, 71% of leisure vessels were harboring at least one non-native species.

- Discs of around 40mm in diameter are attached to a shaft, which is spun by a motor. When the spinning discs are submerged in a tank of water, the torque, or resistance to the motor, is measured.

- The discs used by the team are much smaller than the ~30cm discs, which have been more widely used in marine fouling studies.

- International Dataplan was introduced in 1977 and by the end of 1978, the computer contained over 4,000 reports for a total of 3,250 ships.

Emerging Trends

Sustainability and Environmental Compliance: There’s an increasing shift towards eco-friendly coatings that comply with stringent environmental regulations. The market is seeing a surge in the adoption of low-VOC and biocide-free coatings to meet these regulations, which aim to reduce harmful emissions and marine pollution.

Technological Advancements: Innovations in coating technology are central to the emerging trends. Products like silicone-based fouling release coatings are gaining popularity due to their ability to reduce fuel consumption and carbon emissions by minimizing friction and drag on ship hulls.

Increased Demand from Specific Sectors: The offshore oil and gas sector, along with the leisure and cruise ship markets, are driving demand due to increased activity and the need for specialized coatings that offer enhanced protection against harsh marine environments.

Geographic Shifts: Asia-Pacific continues to dominate the market due to robust shipbuilding activities, especially in countries like China and South Korea. This region is pivotal not only due to its manufacturing capabilities but also due to significant investments in maritime infrastructure.

Regulatory Influence: Compliance with new international standards and local regulations is prompting shipowners and manufacturers to invest in advanced coating solutions that not only enhance the performance and lifespan of vessels but also comply with global sustainability targets.

Use Cases

- Anti-Fouling Coatings: Applied primarily to the hulls of ships, these coatings prevent the accumulation of marine organisms such as algae and barnacles, which can increase drag and fuel consumption significantly. For instance, hull fouling can increase fuel consumption by up to 40%, illustrating the importance of effective anti-fouling coatings in reducing operational costs and environmental impact.

- Anti-Corrosion Coatings: These are used to protect the metal parts of ships and offshore structures from corrosion caused by saltwater and harsh marine environments. By forming a protective barrier, these coatings extend the service life of vessels and reduce the need for frequent repairs.

- Cargo Hold and Tank Coatings: In cargo holds and tanks, specialized coatings are applied to manage the effects of various chemically aggressive environments. These coatings are designed to be resistant to a wide range of chemicals and are essential for the safe transport and storage of diverse cargoes, including aggressive fuel mixtures.

- Deck Coatings: Decks are exposed to abrasive conditions and corrosive substances like salt water. High-performance deck coatings often include layers of primer, epoxy midcoat, and a durable topcoat to protect against physical and chemical damage, ensuring safety and durability.

- Ballast Tank Coatings: Ballast tanks are particularly susceptible to corrosion due to constant exposure to seawater. High-quality epoxy coatings are commonly used here to provide long-term corrosion protection, essential for maintaining the structural integrity of the tanks.

- Superstructure Coatings: The superstructure of a ship is exposed to various environmental factors that can cause rapid deterioration. Multi-layer coating systems that include zinc primer, epoxy coat, and a protective topcoat are used to provide comprehensive protection against corrosion and UV damage.

Major Challenges

- Environmental Regulations: Stricter environmental regulations are forcing the industry to innovate with less environmentally damaging products. This includes the development of coatings that reduce volatile organic compounds (VOCs) and other harmful emissions.

- Skills Gap: There is a notable skills gap in the marine industry, with a shortage of trained professionals in engineering and technical roles. This challenge is compounded by a lack of interest among younger generations in pursuing careers within these fields.

- Technological Advancements: The rapid pace of technological change presents both opportunities and challenges. The industry must continuously adapt to include new technologies such as autonomous shipping and increased digitization, which require significant investment in research and development.

- Supply Chain Disruptions: Global supply chain issues affect the availability and cost of raw materials needed to produce marine coatings. This can lead to increased production costs and delays in delivery times.

- Market Concentration: The marine coatings market is highly concentrated with a few major players dominating the industry. This concentration can stifle innovation and competitive pricing, making it difficult for smaller companies to compete.

- Decarbonization and Sustainability Goals: The industry is under pressure to support broader maritime decarbonization efforts. This includes developing products that contribute to reducing greenhouse gas emissions and improving the energy efficiency of ships.

Growth Opportunities

- Expansion in the Oil and Gas Sector: As the oil and gas industry continues to expand, particularly in offshore environments, there is a corresponding increase in the demand for marine coatings. These coatings are essential for protecting equipment used in harsh marine conditions, which is crucial for the longevity and efficiency of these assets.

- Innovations and R&D Investment: There’s a significant push towards innovation within the marine coatings industry, with increased investment in research and development. This is geared towards producing new technologies that enhance the performance of coatings in terms of durability, efficiency, and environmental impact. Developing coatings that meet these new standards can open up substantial market opportunities.

- Regulatory Compliance and Eco-Friendly Products: With stringent environmental regulations shaping industry standards, there is a growing demand for marine coatings that are low in volatile organic compounds (VOCs) and other harmful substances. Manufacturers are turning to water-based and lower-VOC formulations, which not only comply with regulations but are also more appealing to environmentally conscious consumers.

- Rise in Maritime Infrastructure Projects: The global increase in maritime infrastructure and shipbuilding, especially in the Asia-Pacific region, provides a robust growth environment for the marine coatings market. This region continues to lead due to its significant shipbuilding activities and the need for maintenance and repair operations that require high-quality coatings.

- High-Performance Coatings Demand: There is also an increasing call for high-performance coatings that can enhance the operational efficiency of vessels. These coatings help reduce fuel consumption by minimizing underwater hull resistance and improving the overall energy efficiency of ships.

- Naval and Maritime Tourism: The expansion in naval activities and a boost in maritime tourism also contribute to the growth of the marine coatings market. As the number of leisure boats and passenger ships increases, so does the need for durable and efficient coatings that can withstand the specific challenges posed by these environments.

Recent Developments

In 2023, BASF focused on innovations that support sustainability and performance in harsh marine environments. The company reported that its Coatings division, which includes marine coatings, saw increased earnings primarily due to price and volume growth despite challenging market conditions. This division contributed significantly to BASF’s overall performance, with substantial gains in EBITDA before special items in 2023. BASF has been implementing strategic measures to reduce production costs and enhance competitiveness. For instance, a cost-saving program initiated in 2022 continued through 2023, aiming to achieve annual savings of €1 billion by 2026, primarily at their Ludwigshafen site. This program is expected to bolster the profitability of their coatings operations, including marine coatings.

In 2023, Arkema demonstrated strong involvement in the marine coatings sector by continuing to develop and supply high-performance protective coatings for marine environments. These coatings are designed to enhance durability and reduce maintenance costs for marine vessels and offshore structures. Arkema’s portfolio includes anticorrosive primers and topcoat systems that provide long-lasting protection against harsh marine conditions. In 2023, the company achieved a solid financial performance with a reported EBITDA of €1.5 billion, despite a challenging economic environment. This success was partly attributed to the innovative high-performance solutions in its coatings segment, which continued to see strong demand and resilience. Looking forward to 2024, Arkema aims to further increase its EBITDA to between €1.5 billion and €1.7 billion, driven by the ramp-up of major industrial projects and an expected improvement in market conditions in the latter half of the year.

In 2023 Nippon Shokubai Co., Ltd. has been actively advancing its product offerings and technological innovations to meet the growing demands of the maritime industry. The company continued to develop high-performance coatings designed to protect marine vessels from harsh environmental conditions, thus enhancing their durability and efficiency. Nippon Shokubai has focused on environmentally friendly solutions, including biocide-free self-polishing coatings like their AQUATERRAS product, which reduces biofouling and minimizes environmental impact. This innovation not only contributes to lowering greenhouse gas emissions by reducing fuel consumption but also supports global efforts to protect marine ecosystems. The company’s ongoing commitment to sustainability and technological advancement positions it as a key player in the marine coatings market. In 2023, Nippon Shokubai reported consolidated sales revenue of approximately ¥392 billion, showcasing its strong market presence and financial performance.

In 2023, LG Chem has made significant strides in the marine coatings sector, focusing on sustainability and innovation. The company has been actively developing eco-friendly materials and high-performance coatings to meet the growing demand for sustainable solutions in the maritime industry. LG Chem’s advancements include the production of biocide-free, low-friction coatings that help reduce greenhouse gas emissions and improve the fuel efficiency of marine vessels. These innovations are part of LG Chem’s broader strategy to transform into a leading global science company, with an emphasis on environmental sustainability and technological leadership. In terms of financial performance, LG Chem reported consolidated revenue of KRW 33.7 trillion in 2023, marking a 31.8% increase from the previous year. The company’s operating profit also saw a substantial rise of 78.2%, reaching KRW 2.2 trillion. This growth was driven by strong market demand in North America and strategic investments in production facilities. Looking ahead to 2024, LG Chem aims to maintain its growth momentum by focusing on qualitative growth, securing technology leadership, and enhancing cost competitiveness.

Conclusion

In conclusion, the marine coatings market is poised for significant growth, driven by a combination of technological innovations, increased regulatory requirements, and expanding applications across various sectors. With the global shift towards more sustainable and efficient maritime operations, the demand for advanced marine coatings that offer enhanced protection and performance is rising. Innovations aimed at reducing environmental impact, such as low-VOC and biocide-free products, are setting new industry standards and opening up lucrative market opportunities.

Additionally, the ongoing expansion in shipbuilding, particularly in Asia, alongside the resurgence of maritime and offshore activities post-pandemic, further catalyzes the growth of this market. As stakeholders continue to navigate the complexities of environmental regulations and explore new technological frontiers, the marine coatings industry stands at the forefront of contributing to more sustainable and efficient global maritime logistics and infrastructure.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)