Table of Contents

Introduction

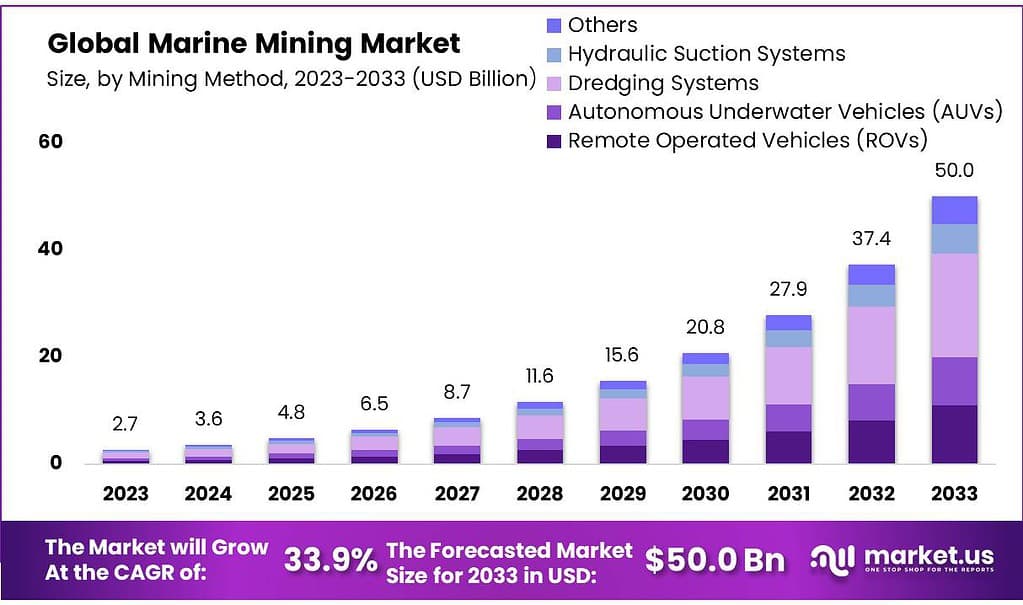

The global marine mining market is poised for unprecedented growth, projected to surge from USD 2.7 billion in 2023 to an estimated USD 50.0 billion by 2033, advancing at a remarkable compound annual growth rate (CAGR) of 33.9% during this period. This sector is critical for the extraction of valuable minerals from the ocean floor, encompassing a wide range of resources like polymetallic nodules, cobalt-rich ferromanganese crusts, and polymetallic sulphides which are essential for various industries including electronics and renewable energy technologies.

Recent developments highlight significant technological advancements and increasing exploration initiatives. For instance, new contracts have been awarded for exploring expansive areas like the Clarion Clipperton Fracture Zone and the Indian Ocean, with major players like China and the United Kingdom holding the most licenses for seabed mining. Moreover, advancements in remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) have improved the efficiency and environmental sustainability of mining operations, allowing for precise exploration and minimal ecological disruption.

Despite its potential, the marine mining market faces substantial challenges, primarily environmental and regulatory. The impact of seabed mining on marine ecosystems is a significant concern, with potential disturbances to benthic habitats and risks of biodiversity loss due to sediment plumes and chemical pollutants. The sector also grapples with the complexities of international regulatory frameworks, which are crucial for managing the environmental impacts and ensuring sustainable practices.

Recent developments in the marine mining market, particularly involving key players like Nautilus Minerals Inc., De Beers Marine Namibia, and Odyssey Marine Exploration, Inc., reflect significant technological advancements and strategic investments aimed at enhancing production capacities and exploring new mining areas.

Nautilus Minerals Inc. has faced financial challenges, notably escalating costs that led the company to seek protection from creditors after expenditures nearly reached $461 million. The company has been involved in exploring offshore areas in Papua New Guinea and Tonga, focusing on copper and gold-rich sites. However, these activities have proven technically demanding and financially intensive, indicating a turbulent period for the company.

De Beers Marine Namibia, on the other hand, has seen substantial investment and technological innovation in its operations. The company, a joint venture between the Namibian government and De Beers, launched the ‘Benguela Gem’—a state-of-the-art diamond recovery vessel. This vessel, representing an investment of $468 million, is the largest single investment in the marine diamond industry and is expected to add significantly to the annual diamond output. The ‘Benguela Gem’ is equipped with advanced systems to optimize performance and minimize environmental impact, featuring technologies such as a dynamic positioning system, a subsea crawling system, and a complex mission equipment designed to recover diamonds efficiently and sustainably.

Key Takeaways

- Marine Mining Market to reach USD 50.0 billion by 2033, growing at a CAGR of 33.9%.

- Dominant methods: Dredging Systems, ROVs, and AUVs.

- Polymetallic nodules and sulfides lead resource types.

- Deep-Sea Mining captured a 76.8% market share in 2023.

- Environmental challenges constrain market growth but spur sustainable practices.

- Asia Pacific commands a 74.6% market share, and North America and Europe show growth potential.

- As of 2023, the average depth of current marine mining exploration activities ranges from 800 meters to 6,500 meters below sea level.

- According to the International Energy Agency (IEA), the global demand for critical minerals like lithium, nickel, cobalt, and rare earth elements is projected to increase by at least 30% by 2040 to meet the growing demand for clean energy technologies.

- A single polymetallic nodule, commonly found in the Clarion-Clipperton Zone, can contain up to 28% manganese, 1.3% nickel, 1.1% copper, and 0.2% cobalt.

Marine Mining Statistics

- These deep sea resources are estimated to be valued between £6.232 trillion and £12.46 trillion, encompassing metals like cobalt, nickel, copper, and manganese found in forms such as nodules, seafloor massive sulfides, and cobalt-rich crusts.

- Deep sea mining involves extracting minerals and metals from the seabed, typically 200 to 6,500 meters deep.

- By 2030, it is projected that up to 10% of global production of minerals such as cobalt, copper, and zinc could be sourced from the ocean floor, potentially generating a global turnover of up to £8.441 billion.

- The International Seabed Authority (ISA) has issued 31 contracts for seabed mineral exploration, of which 30 are currently active.

- Contract Duration: Each contract lasts 15 years.

- Currently, about 85% of these materials come from Asia.

- Scientists estimate that deep-sea mining could cause a 50% reduction projected by 2050 the extinction of species living on or within the seabed.

- Analysts project the global deep sea mining market will reach £12.3 billion by 2030.

Sediment plumes can spread over 100 km from mining sites - Jobs created by the deep-sea mining industry are estimated at 15,000.

- Researchers estimate mining operations could disturb 8,000-9,000 square kilometres of seabed over a 30-year license period.

- China leads with 161,211.2 square kilometres, followed by the United Kingdom with 133,285.6 square kilometres.

- A study in Japan revealed a 43% decline in fish and shrimp populations within a year of mining activities.

- Deep sea mining is a subfield of experimental seabed mining that involves the process of removing mineral deposits and metals from the ocean’s seabed found at depths of over 200 meters.

- Polymetallic sulphide deposits can be found in areas of underwater volcanic activity, usually at depths of between 1000 and 4000 meters.

- Valuable minerals can be found on the sides of underwater mountains, with the most valuable deposits being found at depths of between 800 and 2,500 metres.

- high seas, international waters account for around 95% of the world’s habitats, and are home to an estimated 700,000 to 1 million different species.

Emerging Trends

- Technological Advancements: The deployment of artificial intelligence (AI) and autonomous systems is revolutionizing marine mining. AI applications are enhancing predictive maintenance, autonomous navigation, and route optimization, thereby increasing operational efficiency and safety. Underwater robotics and remotely operated vehicles (ROVs) are playing critical roles in exploration and resource extraction, minimizing human intervention and reducing the risk of accidents.

- Environmental and Regulatory Focus: As the industry grows, so does the scrutiny over its environmental impacts. The debate around the ecological disruption caused by seabed mining is intensifying, with concerns about habitat destruction and the potential loss of biodiversity. This has led to a push for tighter regulatory frameworks to ensure sustainable practices and mitigate environmental risks.

- Investment in Deep-sea Mining: Despite high initial costs and environmental challenges, substantial investments are being made in deep-sea mineral extraction technologies, signaling robust market potential. These investments are aimed at tapping into the vast reserves of critical minerals essential for electronics, energy, and construction industries, which are increasingly in demand due to global technological advancements and energy transitions.

- Shift Towards Cleaner Energy: The marine mining sector is also moving towards utilizing low-carbon technologies and integrating renewable energy sources like wind and solar power. This shift is part of the broader maritime industry’s trend towards decarbonization, aiming to reduce the carbon footprint of mining operations and align with global sustainability goals.

Use Cases

- Critical Mineral Supply: Polymetallic nodules found on the seafloor contain essential metals such as nickel, copper, and cobalt, crucial for manufacturing batteries, electronics, and renewable energy technologies. These nodules and other seabed deposits like cobalt-rich crusts and massive sulfide deposits are targeted to meet the rising demand for these critical minerals, particularly as global efforts to decarbonize intensify.

- Technological and Energy Applications: The minerals harvested from the ocean floor are vital for high-tech industries. For example, cobalt is used in superalloys for jet engines and batteries, nickel and copper are essential for electric vehicles, and rare earth elements are critical for advanced electronics and energy solutions.

- Environmental Impact Reduction: Compared to terrestrial mining, marine mining is viewed by some as having the potential to reduce the environmental impact on terrestrial ecosystems, which suffer from deforestation, pollution, and biodiversity loss due to land-based mining activities.

- Biodiversity Loss: The extraction processes can disrupt marine habitats and biodiversity, particularly affecting slow-growing species like corals and sponges that are unique to deep-sea environments.

- Ecological Disruption: Mining operations can create sediment plumes that smother marine life and disrupt the ecological balance, potentially leading to irreversible damage..

- Regulatory and Ethical Concerns: The sector faces significant regulatory hurdles and ethical concerns, including the impacts on global marine commons, which are areas beyond national jurisdiction and are supposed to be preserved for the benefit of all humankind.

Major Challenges

- Environmental Impact: One of the most pressing concerns is the potential damage to marine ecosystems. Mining operations on the seabed can disrupt habitats and the wider benthic community, which includes a variety of organisms like clams, mussels, shrimp, and tubeworms living around hydrothermal vents. The extraction process involves removing mineral-rich nodules or crusts, which can lead to the destruction of habitats that have taken millions of years to form. The disturbances create sediment plumes that may suffocate marine life, spread toxic metals, and disrupt the feeding and reproductive patterns of sea creatures.

- Sediment and Plume Disturbances: The mining processes generate plumes of fine sediment that can spread over vast areas, similar to air pollution on land, impacting marine species’ mobility, visibility, and reproduction rates. These plumes not only affect the immediate area but can have far-reaching effects on midwater ecosystems, which are crucial for connecting deep and shallow marine environments.

- Regulatory Challenges: The regulatory framework for deep-sea mining, particularly in international waters, is still under development and far from complete. This lack of comprehensive regulation leads to uncertainty about standards for environmental protection and sustainable mining practices. There is a global call for more robust and precautionary approaches to protect the high seas and the biodiversity they support.

- Technological and Operational Challenges: Deep-sea mining operations require sophisticated technology to operate in extreme conditions characterized by high pressure, low temperatures, and complete darkness. The technology to effectively monitor, manage, and mitigate the environmental impacts of these operations is still in its early stages of development, adding another layer of complexity to ensuring that mining does not irreversibly harm the marine environment.

- Social and Economic Concerns: There are also concerns about the social and economic impacts of deep-sea mining. These include potential conflicts with other marine users, such as fisheries and shipping lanes, and the risks posed to underwater cables and other infrastructure. The potential benefits of mining need to be weighed against these considerable risks, especially considering the long-term environmental consequences and the uncertainties surrounding the ecological impacts.

Market Growth Opportunities

- Depleting Terrestrial Mineral Deposits: As land-based mineral resources become scarcer, the demand for alternative sources like deep-sea minerals is expected to rise significantly. This is particularly relevant for metals such as silver, gold, copper, and cobalt, essential for electronics, renewable energy, and automotive manufacturing.

- Technological Advancements: Innovations in marine mining technologies, such as the development of deep-sea remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs), are enhancing the efficiency and feasibility of extracting deep-sea minerals. These advancements facilitate precise exploration, mapping, and extraction of mineral deposits in challenging deep-sea environments.

- Support for the Renewable Energy Transition: The transition to renewable energy is creating a surge in demand for minerals critical for the production of wind turbines, solar panels, and electric vehicles, such as cobalt, lithium, and rare earth elements. Marine mining is seen as a viable solution for supplying these essential components.

Key Players Analysis

Nautilus Minerals Inc., a pioneer in the marine mining sector, had ambitious plans to mine seabed massive sulphide deposits off the coast of Papua New Guinea with their Solwara-1 project. Originally celebrated as the first of its kind, the company faced multiple challenges including fierce community opposition, environmental concerns, and financial difficulties, culminating in bankruptcy in 2019. Despite the rich potential of seabed minerals, Nautilus struggled with operational and regulatory hurdles that led to the liquidation of its assets.

De Beers Marine Namibia, on the other hand, operates within the marine diamond mining sector and has demonstrated considerable success. The company, a joint venture between the government of Namibia and De Beers, is known for its innovative technologies in marine mining. De Beers Marine Namibia has developed specialized ships and equipment to recover diamonds from the seabed off Namibia’s coast, contributing significantly to the country’s diamond output and setting a high standard for environmental and economic sustainability in marine mining operations. Their activities reflect a robust model of extracting valuable resources while maintaining a commitment to environmental stewardship.

Odyssey Marine Exploration, Inc. has been actively involved in marine mining, focusing on the exploration and recovery of deep-sea minerals. Despite the industry’s challenges, including regulatory and environmental concerns, Odyssey continues to engage in various projects aiming to exploit seabed mineral resources. Their work highlights a commitment to advancing the technologies and methodologies within the marine mining sector, positioning themselves as a notable player in this emerging field as of 2023 and 2024.

Diamond Fields International Ltd. is prominently engaged in marine diamond mining, particularly off the coast of Namibia. The company has initiated Stage III of its operations with International Mining and Dredging Holding, focusing on intensive offshore marine diamond surveying, sampling, and trenching operations on its Namibian concessions. This phase represents a critical step in enhancing their production capabilities and underscores their ongoing efforts to develop and expand their marine mining activities.

DeepGreen Metals Inc., soon to be rebranded as The Metals Company, is spearheading initiatives to mine polymetallic nodules from the seabed in the Pacific Ocean. These nodules are rich in nickel, cobalt, and manganese—critical for electric vehicle batteries. The company emphasizes a lower environmental impact compared to traditional mining, citing no need for deforestation or tailings ponds. DeepGreen aims to start production by 2024, focusing on sustainable extraction methods to minimize the ecological footprint.

The Metals Company, previously known as DeepGreen Metals Inc., is exploring the seabed for polymetallic nodules essential for the green energy transition. With extensive environmental studies and partnerships with top marine scientists, the company is committed to responsibly developing seabed resources while minimizing impacts on marine ecosystems. It aims to leverage these nodules to address the critical shortage of nickel and cobalt needed for electric vehicles, asserting that seabed resources could meet significant global demand.

UK Seabed Resources Ltd., recently acquired by Norway’s Loke Marine Minerals from Lockheed Martin, is focusing on its deep-sea mining projects within the Clarion-Clipperton Zone (CCZ). The company holds two major exploration licenses in this zone, covering a vast area rich in polymetallic nodules containing valuable minerals like cobalt, copper, nickel, and manganese. With plans to begin mining activities by 2030, Loke aims to further investigate and develop these resources, emphasizing minimal environmental impact and sustainable mining practices.

Marine Mining Corp. is involved in the marine mining sector, specifically focusing on the exploration of polymetallic nodules in the Clarion-Clipperton Zone (CCZ). The company, along with other major players, holds exploration licenses issued by the International Seabed Authority (ISA), positioning it to capitalize on the high concentrations of cobalt, nickel, copper, and manganese found in these nodules. These minerals are crucial for various high-tech and renewable energy applications. The sector’s progress, including Marine Mining Corp.’s activities, is contingent on the development and enforcement of regulatory frameworks by the ISA, which are expected to be finalized by 2025.

China Minmetals Corporation (CMC) is actively engaged in the marine mining sector, with a focus on the exploration of polymetallic nodules. This includes a significant involvement in the Clarion-Clipperton Zone (CCZ), where the company has been exploring under contracts with the International Seabed Authority (ISA). In 2023, CMC has been particularly proactive in training initiatives, offering at-sea training opportunities for candidates from developing states as part of its commitment to responsible and sustainable oceanic exploration. These efforts underscore China Minmetals’ pivotal role in advancing deep-sea mining technologies and operational capabilities.

ION Engineering Group, meanwhile, does not have specific, publicly available year-specific details regarding its involvement in the marine mining sector for 2023 or 2024. For the latest and most precise information, directly accessing sector-specific reports or company releases would be recommended.

Marine Diamond Corporation Ltd. does not have publicly available detailed information specifically for 2023 or 2024. The company has historically been involved in marine diamond mining, a sector focused on the extraction of diamonds from seabed deposits. This involves specialized ships and technology capable of mining in offshore environments, primarily along coastlines where diamond deposits extend into the ocean. For the most accurate and recent information, examining industry-specific reports or updates directly from the company would provide the most insight into their current operations and plans.

Conclusion

In conclusion, the marine mining market represents a promising frontier for extracting valuable minerals essential for modern technologies and the renewable energy sector. With the terrestrial mineral resources dwindling, marine mining offers a viable alternative, potentially driving substantial economic growth and technological advancements.