Table of Contents

Introduction

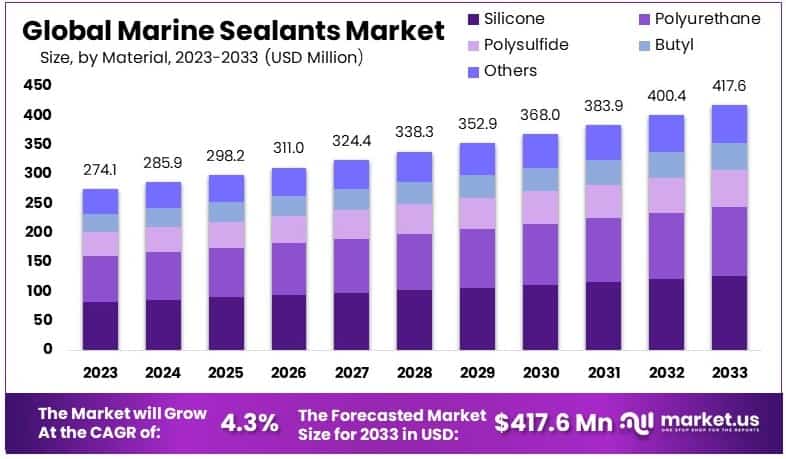

The Global Marine Sealants Market is projected to expand significantly, with the market size anticipated to increase from USD 274.1 Million in 2023 to USD 417.6 Million by 2033, achieving a Compound Annual Growth Rate (CAGR) of 4.3% over the forecast period from 2024 to 2033. This growth can be attributed to several factors, including increased investments in marine infrastructure and the rising demand for environmentally friendly sealants.

However, the market faces challenges such as stringent environmental regulations and the volatility in raw material prices, which could impede growth. Recent developments in the industry have seen advancements in the formulation of sealants that offer better durability and resistance to harsh marine conditions, addressing some of the key concerns in the sector. These innovations are crucial as they enhance the integrity and longevity of marine structures, contributing to the sustained demand for high-performance sealants.

Recent developments in the marine sealants market demonstrate robust activity among key players like 3M Company, Dow Inc., Sika AG, and Henkel AG & Co. KGaA. Each company has strategically focused on enhancing product offerings and expanding market presence through various initiatives.

3M has reinforced its commitment to innovation in marine sealants by focusing on formulations that offer fast curing times and strong, flexible adhesion suitable for both above and below the waterline applications. Their products, such as the 3M™ Marine Adhesive Sealant Fast Cure 4200FC, are designed for versatility, capable of bonding a wide range of materials and providing durable seals in harsh marine environments.

Dow Inc. continues to advance in the market with its focus on sustainable and high-performance solutions. The company has made significant strides in expanding its product line to meet the stringent environmental standards and durability demands of the marine industry. Dow’s emphasis on research and development aims to address the specific challenges faced by marine applications.

Sika AG has been active in expanding its footprint through strategic acquisitions, enhancing its product portfolio in the marine sector. The company’s marine sealants are noted for their high strength and resistance to harsh weather conditions, making them ideal for critical marine applications. Sika’s commitment to sustainability is also evident in their product innovations that aim to reduce environmental impact.

Henkel AG & Co. KGaA has been focusing on enhancing its adhesive technologies to provide more efficient, sustainable, and stronger marine sealing solutions. Their recent product launches emphasize durability and eco-friendliness, catering to the growing demand for environmentally sustainable marine products. Henkel’s developments highlight their dedication to technological advancements and sustainability in the marine sector.

Key Takeaways

- Market Value: The Marine Sealants Market was valued at USD 274.1 million in 2023, and is expected to reach USD 417.6 million by 2033, with a CAGR of 4.3%.

- By Material Analysis: Silicone accounted for 30.1% due to its superior durability and flexibility in harsh marine environments.

- By Application Analysis: The leading application was below water-line sealing, capturing 42.6% of the market due to critical demand for robust sealing solutions.

- By Marine Type Analysis: Cargo Ships led with 52.6%, as they require extensive sealant solutions for maintenance and integrity.

- By End-Use Analysis: Shipbuilding dominated at 72.4%, indicating strong demand in new ship construction and maintenance.

- Dominant Region: APAC held 34.5% of the market, fueled by the region’s strong shipbuilding industry and maritime activities.

Marine Sealants Statistics

Marine Sealants Industry Dynamics

- The total annual payroll for the Ship Building and Repairing industry (NAICS 336611) in the United States is $6,249,240 thousand.

- The total retail sales for the Ship Building and Repairing industry (NAICS 336611) in the United States is $25,099,590 thousand.

- The shipbuilding industry directly provides over 100,000 jobs across the United States and contributes over $40 billion to GDP.

- Nationally, the domestic shipbuilding and repair industry accounts for 393,390 jobs, $28.1 billion in labor income, and $42.4 billion to GDP. High-quality marine sealants are vital for repairs to extend the life of existing vessels.

Marine Sealants Economic Impact and Regional Contributions

- The economic impact of the shipbuilding and repair industry is present in all 435 congressional districts when considering direct, indirect, and induced impacts. Effective use of marine sealants helps maximize this impact.

- Each direct job in the shipbuilding and repairing industry results in another 2.67 jobs nationally. Marine sealants support these jobs by ensuring the reliability and safety of ships.

- Each dollar of direct labor income in the shipbuilding and repair industry results in another $1.82 in labor income in other parts of the economy. The marine sealant market contributes significantly to this economic multiplier.

- Each dollar of GDP in the shipbuilding and repair industry results in another $2.48 in GDP in other parts of the economy. Innovations in marine sealants drive growth in related industries.

- The average labor income per job in the shipbuilding and repair industry was approximately $92,770 in 2019, which is 49% higher than the national average for the private sector economy ($62,090). Workers in the marine sealant sector benefit from these higher wages.

Marine Sealants International Developments

- Brazil’s state-backed Merchant Marine Fund (MMF) has approved $1.3 billion to support local shipyards in delivering new orders and other waterways infrastructure. This investment includes advancements in marine sealant applications.

- The largest proportion of the funding, around $930 million, will be set apart for new builds and vessel repair projects. Effective marine sealants will be essential for these new constructions.

- Wilson Sons Shipyard in Guarujá will receive $853 million to support the construction of 10 Platform Supply Vessels (PSV) for CMN Offshore Brasil. High-performance marine sealants are crucial for the durability of these vessels.

- Detroit Brasil Shipyard will receive $116 million for the construction of two multipurpose PSVs for Starnav Maritime Services. The shipyard will utilize advanced marine sealants to ensure the vessels’ longevity.

Emerging Trends

- Eco-Friendly Innovations: There’s a growing shift towards environmentally friendly marine sealants driven by stricter environmental regulations and a rising awareness of sustainability issues in maritime operations. This includes the development of biodegradable and less toxic sealant options to minimize ecological impact.

- Advanced Formulations: Enhanced performance marine sealants are being developed to offer better durability and resistance to harsh marine conditions. Innovations include formulations that can withstand extreme temperatures and pressures, providing long-lasting seals to improve vessel maintenance and longevity.

- Regulatory Compliance: The marine sealants market is increasingly influenced by stringent regulatory standards aimed at improving safety and reducing environmental footprints. Compliance with these regulations is driving the adoption of high-quality, certified sealants that meet global safety and environmental guidelines.

- High-Performance Materials: There is a significant uptick in the use of high-performance materials like silicone, which dominate the market due to their superior properties, including excellent UV resistance, flexibility, and non-corrosive characteristics. These materials are particularly suitable for demanding marine environments.

- Expansion in Shipbuilding: As global shipbuilding activities expand, particularly in the Asia-Pacific region, there is an increased demand for marine sealants. This trend is supported by the rising volume of maritime trade and the need for new ships to meet international trade demands.

- Technological Integration: Technological advancements such as the integration of IoT and smart monitoring systems in sealant application processes are emerging. These technologies enhance the precision in sealant applications and maintenance, leading to better resource management and cost efficiencies.

- Market Expansion in Developing Regions: There is noticeable market growth in developing regions where maritime activities are expanding. This expansion is supported by improvements in local shipbuilding and repair industries, which in turn increases the demand for various types of marine sealants.

Use Cases

- Above Water-Line Sealing: Marine sealants are extensively used for sealing joints and assemblies exposed above the water line, ensuring they remain watertight under various weather conditions. This application is crucial for maintaining the integrity of deck equipment and superstructures which are subject to frequent wetting.

- Below Water-Line Sealing: Sealants designed for below water-line use provide critical waterproofing for hulls, preventing water ingress that can lead to serious damage. These sealants must withstand high pressures and constant exposure to saltwater, making them indispensable for the long-term durability of marine vessels.

- Deck to Hull Connections: Connecting the deck to the hull requires robust sealants capable of handling both the structural load and flexing due to waves and wind. These sealants help ensure the vessel’s rigidity and seaworthiness, preventing structural failures at sea.

- Window Bonding: Marine sealants are used to bond windows securely in place, ensuring they are watertight and resistant to the vibrations and stresses of maritime travel. This use case is vital for both the comfort and safety of vessel occupants.

- Port Hole Sealing: Similar to window bonding, sealing portholes requires durable sealants that prevent water entry, even under high pressure and adverse conditions found below the waterline.

- Engine Room Sealing: In the engine room, sealants are used to protect sensitive equipment from moisture and to ensure oil and fuel lines are impermeable. This application is critical for the safe operation of the vessel’s propulsion systems.

- Corrosion Prevention: Marine sealants also play a role in preventing corrosion by sealing off metal parts from exposure to saltwater and air. This extends the life of these components, reducing maintenance costs and improving vessel reliability

Key Players Analysis

3M Company is a key player in the marine sealants sector, offering a range of products designed for durability and reliability. Their flagship product, 3M™ Marine Adhesive Sealant 5200, is known for its strong, flexible bonds suitable for both above and below waterline applications. This polyurethane-based sealant is popular for boat building and repairs due to its exceptional resistance to weathering and vibration. In 2023, 3M continued to enhance its marine sealants portfolio, focusing on sustainability and performance to meet diverse marine industry needs.

Dow Inc. is also active in the marine sealants sector, providing advanced silicone and hybrid sealants known for their resilience in harsh marine environments. Recently, Dow expanded its production capacity at SAS Chemicals GmbH, strengthening its portfolio for high-performance façade and insulating glass applications. This expansion, set to operationalize in June 2024, underscores Dow’s commitment to innovation and sustainability in sealant technologies, supporting global market demands.

Sika AG is a prominent player in the marine sealants sector, offering specialized products like Sikaflex® for shipbuilding and yacht maintenance. These sealants are known for their durability, UV resistance, and effectiveness in harsh marine environments. In 2023, Sika reported record sales of CHF 11.24 billion, a 7.1% increase, driven partly by the successful integration of MBCC Group. This acquisition has strengthened Sika’s market position and expanded its product offerings in the construction and marine sectors.

Henkel AG & Co. KGaA is actively engaged in the marine sealants market with a focus on innovative adhesive technologies. Their products are designed for high-performance applications, ensuring longevity and reliability in marine environments. Recently, Henkel has emphasized sustainability in their product development, which is reflected in their latest financial report showing significant revenue growth. The company continues to expand its market presence through strategic innovations and sustainable solutions.

Bostik SA is a significant player in the marine sealants market, known for products like the 920 and 940A Marine Adhesive/Sealant, which offer robust UV resistance and durability in harsh marine environments. These sealants are designed for diverse applications, including sealing deck hardware and through-hull fittings. In 2023, Bostik highlighted its focus on sustainability and innovation in marine solutions, featuring products that comply with stringent environmental regulations and enhance performance and longevity in marine applications.

RPM International Inc. is a leader in specialty coatings and sealants, including marine applications. In fiscal 2023, RPM reported record net sales of $7.26 billion, an 8.2% increase from the previous year. The company’s marine sealants are part of a diverse portfolio that includes high-performance solutions for maintenance and repair. RPM’s strategic initiatives, such as the MAP 2025 plan, aim to achieve significant growth and operational efficiency, further strengthening their market position.

PPG Industries Inc. is a global supplier of paints, coatings, and specialty materials, including marine sealants. Their products are designed to withstand the extreme conditions of marine environments, offering protection against corrosion and weathering. PPG continues to innovate in the marine sector, focusing on advanced technologies that improve durability and performance. In recent years, PPG has expanded its product range and strengthened its market presence through strategic acquisitions and new product launches.

LORD Corporation, now a part of Parker Hannifin, specializes in innovative marine adhesives and sealants. Their products are designed to provide excellent adhesion, durability, and resistance to harsh marine environments. These solutions are essential for the construction and maintenance of various marine vessels, ensuring structural integrity and longevity. Recent developments have focused on expanding their product range and enhancing performance to meet the evolving needs of the marine industry.

Huntsman Corporation is a key player in the marine sealants market, offering advanced materials that enhance the performance and durability of marine vessels. Their products include high-performance adhesives and coatings that provide corrosion resistance and improve structural integrity in extreme marine conditions. In 2023, Huntsman reported significant revenues and continued to expand its market presence with innovative solutions like their polyurethane foams and textile enhancements, which offer protection against UV rays, stains, and fire.

Illinois Tool Works Inc. (ITW) is actively involved in the marine sealants sector through its diversified portfolio of industrial products. ITW provides high-quality adhesives and sealants designed for various marine applications, ensuring durability and resistance to water, UV exposure, and extreme weather conditions. The company continues to innovate and develop new products to meet the stringent demands of the marine industry, maintaining its position as a leading provider of industrial solutions.

Avery Dennison Corporation is actively engaged in the marine sector with its Supreme Wrapping Film™ range, which is specifically designed for above-the-waterline applications. These films offer robust protection and aesthetic enhancement for marine vessels. In 2023, Avery Dennison reported net sales of $8.36 billion and continued to expand its product offerings to meet market demands. The company focuses on sustainability and innovation, providing high-performance solutions for various industries, including marine applications.

H.B. Fuller Company is a prominent player in the marine sealants sector, offering a range of adhesive and sealant products designed for harsh marine environments. These products ensure durability and resistance to water and UV exposure, which are critical for marine applications. The company has been focusing on expanding its product line and enhancing its technological capabilities to meet the evolving needs of the marine industry. H.B. Fuller’s commitment to innovation and quality positions it as a key supplier in the marine sealants market.

Conclusion

In conclusion, the marine sealants market is poised for significant growth, driven by innovations in sealant technology and increasing global maritime activities. With advancements in eco-friendly and high-performance materials, alongside stringent regulatory requirements, marine sealants are becoming increasingly crucial in ensuring the structural integrity and longevity of marine vessels.

The diverse applications of these sealants, from above and below water-line sealing to critical uses in engine rooms, underscore their indispensable role in the maritime industry. As the sector continues to evolve, the demand for reliable and effective sealants is expected to surge, marking a promising future for the marine sealants market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)