Table of Contents

Introduction

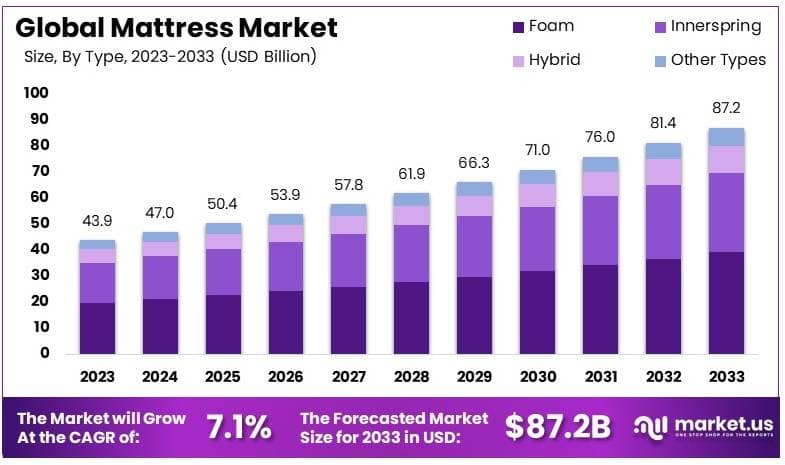

The Global Mattress Market is projected to expand from USD 43.9 billion in 2023 to approximately USD 87.2 billion by 2033, achieving a compound annual growth rate (CAGR) of 7.1% over the forecast period from 2024 to 2033.

A mattress is a large, rectangular pad designed to support a reclining body, used as a bed or as part of a bed. Mattresses may consist of a quilted or similarly fastened case, usually of heavy cloth, that contains materials such as hair, straw, cotton, foam rubber, or a framework of metal springs. Mattresses are also available in air-filled and water-filled varieties. Over time, the materials and technologies in mattress production have evolved to improve comfort, durability, and support.

The mattress market encompasses the manufacturing and sale of mattresses, including a diverse array of types such as innerspring, foam, latex, and hybrid mattresses, along with specialty beds like air and waterbeds. This market serves both residential and commercial sectors, providing products for individual households, hospitality businesses, healthcare facilities, and other institutional settings where sleep surfaces are needed.

The growth of the mattress market is driven by several key factors including increasing awareness among consumers about the importance of good sleep and the impact of sleep quality on overall health. Advances in mattress technology, such as memory foam and eco-friendly materials, cater to growing consumer demands for comfort and sustainability.

Additionally, the expansion of the real estate and hospitality sectors globally supports the continued demand for mattresses. Urbanization trends and rising disposable incomes also contribute significantly to market expansion.

Demand in the mattress market is sustained by the continual need for replacement mattresses in household and commercial settings, as well as by first-time buyers entering the market. The increase in health consciousness among consumers has heightened demand for premium mattresses that offer better sleep quality and health benefits.

The proliferation of online retailing and the convenience of direct-to-consumer sales channels have made it easier for consumers to explore, compare, and purchase mattresses, further stimulating market activity.

Opportunities within the mattress market lie in the innovation of sleep technologies and the customization of products to meet individual health needs, such as mattresses designed for back pain relief or sleep disorders. The integration of smart technology in mattresses, including sleep tracking and automated adjustment features, presents a significant growth avenue.

There is also potential in expanding to emerging markets where increasing urbanization and improving economic conditions are likely to boost consumer spending on home furnishings. Companies can leverage these trends by enhancing product portfolios and expanding distribution channels to include both online and brick-and-mortar stores.

Key Takeaways

- The global mattress market, valued at USD 43.9 billion in 2023, is projected to double, reaching USD 87.2 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 7.1%.

- Foam mattresses captured 45% of the market in 2023, favored for their comfort and body-conforming qualities that enhance sleep experience.

- Household use was the primary driver in 2023, representing 78% of the market, fueled by consumers’ increased focus on home comfort and sleep quality.

- Offline sales channels led distribution in 2023 with a 68% share, as many consumers prefer to test mattress options in person before purchasing.

- Asia-Pacific led regional growth with a 38% market share, amounting to USD 16.68 billion in 2023, driven by rising urbanization and disposable income in the region.

Mattress Statistics

- Around 69% of online shoppers preferred mattress-in-a-box options due to COVID-19 concerns.

- The U.S. hosts approximately 9,134 bed and mattress store businesses.

- About 32% of younger consumers seek hypoallergenic mattresses to reduce allergy risks.

- Nearly 50% of individuals under 35 use sleep-tracking devices to monitor sleep quality.

- Tempur-Pedic leads in customer satisfaction among major brands with a score of 881 out of 1,000.

- Purple ranks as the highest-rated bed-in-a-box brand with a satisfaction score of 875.

- Around 20 million mattresses are discarded annually in the U.S., which equals over 50,000 mattresses per day.

- Roughly 59.9% of surveyed U.S. adults find mattress disposal inconvenient.

- Up to 90% of mattress materials can be recycled, though actual recycling rates are low.

- Most mattresses last 7 to 10 years, with some extending beyond that range.

- 78% of U.S. adults consider a comfortable mattress vital for a romantic bedroom ambiance.

- Surveys show that 52% of U.S. adults sleep on queen-size mattresses, while 25.1% prefer king or California king.

- 34.7% of U.S. adults sleep on foam mattresses, 30.3% on innerspring, and 7.6% on hybrid mattresses.

- Sleeping on a hard mattress can increase poor sleep chances by 78%.

- About 6.2% of U.S. adults primarily sleep on air mattresses, and they rate their sleep quality slightly higher than average.

- Annually, around 990 injuries and 340 deaths in the U.S. result from fires originating in mattresses or bedding.

- Mattress type is a priority for 27.6% of U.S. adults when choosing accommodations, who also report an extra hour of sleep on average while traveling.

- An average used mattress can contain up to 10 million dust mites, although this does not significantly add to mattress weight.

- About 38.4% of adults make their bed daily, while 15.8% never do.

- U.S. adults typically rotate or flip their mattress every six months, though 29.6% never do.

- The U.S. sees nearly 36 million mattress sales each year.

- While innerspring mattresses are the most purchased, memory foam is preferred by 66% of consumers.

- Over 75,000 Americans work in the mattress industry, with the most common role in manufacturing.

- More than 54% of consumers now buy mattresses online instead of in-store.

- The U.S. discards around 50,000 mattresses each day.

- Despite more than 75% of mattress materials being recyclable, only about 5% are actually recycled.

- With typical markups, profit margins in the mattress industry range between 40-50%.

- A mattress sold for $1,000 may cost only $600-700 to manufacture and distribute.

- Women account for 48% of mattress purchases, and couples jointly decide in 34% of cases.

- There are an additional 16,000 mattress retail locations across the U.S.

- Approximately 600 mattress companies are involved in design and manufacturing in the U.S. as of 2024.

- The average American spends about $754 on a new mattress.

- In 2024, the mattress sector employs 75,050 people, with manufacturing jobs growing at 4.1% from last year and a 1.7% annual growth rate over five years.

Emerging Trends

- Sustainable and Eco-Friendly Materials: Consumers are increasingly demanding eco-friendly options, prompting manufacturers to adopt sustainable practices. This includes using organic and biodegradable materials, such as natural latex, organic cotton, and bamboo, as well as introducing certifications like GOTS (Global Organic Textile Standard) and CertiPUR-US to assure customers of environmental and health standards.

- Smart Mattress Technology: Technological advancements are transforming mattresses into sophisticated sleep solutions. Smart mattresses now incorporate IoT features, enabling users to monitor sleep quality, temperature, and even body position adjustments via mobile apps. This trend is especially popular among tech-savvy consumers looking to optimize their sleep health through data-driven insights.

- Direct-to-Consumer (DTC) Model Expansion: The DTC model is gaining momentum as online mattress brands leverage e-commerce to reach consumers directly, bypassing traditional retail channels. Leading brands like Casper have driven this trend, making mattress-in-a-box options a convenient and cost-effective choice. However, many DTC brands are now also opening physical showrooms to provide a tactile experience for customers.

- Customization and Personalization: Consumers are seeking mattresses tailored to their specific sleep needs, leading to a rise in customizable mattresses that allow adjustments in firmness, support, and temperature regulation. This trend appeals to buyers interested in personalized health and wellness solutions, with options to adapt to different body types and sleep preferences.

- Growth of the Sleep Economy: The mattress industry is benefiting from the broader “sleep economy,” encompassing products and technologies aimed at improving sleep quality. From smart bedding accessories to sleep-tracking devices, consumers are willing to invest in products that promise better rest, with the sleep economy projected to reach unprecedented market value in 2024. This trend aligns with increased awareness of the impact of sleep on health and productivity

Top Use Cases

- Pressure Point Relief: Memory foam mattresses are particularly beneficial for alleviating pressure points, making them ideal for individuals suffering from body aches, neck pain, or back pain. These mattresses conform to the body’s shape, providing targeted support and reducing stress on critical areas.

- Temperature Regulation: Mattresses like the Amerisleep AS3, designed with cooling technologies such as Bio-Pur® foam, excel in maintaining a cooler sleep environment. This feature is essential for hot sleepers who require a mattress that helps dissipate body heat effectively, ensuring a comfortable and restful night’s sleep.

- Motion Isolation: For those who share a bed, mattresses offering excellent motion isolation, such as the Amerisleep AS3, ensure that movements from one sleeper do not disturb the other. This quality is highly valued by couples, providing undisturbed sleep even when one partner moves or exits the bed.

- Spinal Alignment and Support: High-resilience (HR) foam mattresses are recommended for individuals needing robust back and joint support. These mattresses are denser and firmer, providing an even weight distribution that helps maintain proper spinal alignment and relieve.

- Eco-friendly Options: Natural latex mattresses are an excellent choice for environmentally conscious consumers. Extracted from the sap of rubber trees, latex is biodegradable and offers properties like antimicrobial resistance and hypoallergenic benefits, making it both a sustainable and healthy choice.

Major Challenges

- Economic Constraints on Consumer Spending: Economic pressures, including high interest rates and inflation, have dampened consumer spending, particularly on discretionary items like mattresses. In recent years, mattress sales volumes have seen declines, with unit sales contracting by approximately 8% and market value shrinking by nearly 7%. These constraints underscore the industry’s reliance on consumer confidence, which is susceptible to economic fluctuations.

- Supply Chain Disruptions and Raw Material Shortages: The supply chain for critical mattress materials, especially polyurethane foam, faces ongoing disruptions due to price volatility and limited availability of chemical inputs. For instance, shortages of specific materials have led to higher production costs and extended lead times. This challenge compels manufacturers to seek alternative suppliers or materials to stabilize production and avoid significant price increases.

- Sustainability and Recycling Obstacles: With the growing emphasis on sustainability, mattress recycling has become both a regulatory focus and a customer expectation. However, the recycling process is complex and costly due to the varied materials used in mattresses, such as foam, springs, and adhesives, which are challenging to separate and recycle efficiently. Recycling operations have processed hundreds of thousands of mattresses annually, yet the high costs and limited recycling capacities create substantial barriers to fully sustainable practices.

- Increased Competition and Market Saturation: The mattress industry has become highly competitive, with both traditional brands and online direct-to-consumer startups competing for market share. As companies compete on features, pricing, and marketing, the pressure to differentiate without significantly eroding profit margins is a growing concern.

- Shifting Consumer Preferences Toward Health-Focused Products: Consumer demand is shifting toward mattresses that promise better sleep and health benefits. The market is seeing a trend towards premium, ergonomic, and eco-friendly options, driven by a greater focus on sleep quality as a component of overall health. This demand is expected to drive annual industry growth, estimated at nearly 6% through the next decade, as consumers increasingly prioritize sleep health. However, meeting these demands requires significant investment in innovation and materials, posing challenges for maintaining affordability.

Top Opportunities

- Health and Wellness Focus: Consumers are increasingly prioritizing health-related benefits in their purchases, which is propelling demand for mattresses designed to improve sleep quality and reduce physical discomfort. Mattresses offering orthopedic support, pressure relief, and enhanced ergonomics are particularly appealing to health-conscious buyers, positioning wellness-oriented products as a strong growth area within the market.

- Growth in E-Commerce and Direct-to-Consumer Models: Online mattress sales are seeing substantial increases, driven by the convenience of e-commerce platforms, flexible return policies, and new “bed-in-a-box” delivery options. The rise of direct-to-consumer brands has helped to reshape purchasing behavior, with more consumers opting for the ease and accessibility of online shopping. This shift offers significant opportunity for market expansion, particularly among tech-savvy and younger demographics.

- Expansion in Emerging Markets: Emerging markets are seeing rapid growth in mattress demand due to rising urbanization, growing disposable incomes, and an increase in homeownership. For example, the expansion of housing and hospitality industries across Asia, Latin America, and parts of the Middle East is creating a strong base for new mattress sales, especially as consumers in these regions upgrade from basic to higher-quality products.

- Innovation in Smart Mattresses: Technological advancements have made it possible to offer “smart” mattresses with integrated features like sleep tracking, temperature control, and adjustable firmness levels. These innovations cater to a growing segment of consumers interested in personalized sleep experiences and enhanced comfort. Smart mattresses align with the broader trend toward connected home devices and provide an additional value proposition that appeals to tech-focused consumers.

- Sustainability and Eco-Friendly Materials: As environmental awareness rises, there is growing interest in eco-friendly mattresses made from sustainable materials, such as organic latex and recycled fibers. This shift is being embraced by consumers who prioritize environmentally responsible purchasing, especially in mature markets. Sustainable mattresses not only reduce environmental impact but also attract buyers willing to invest in products that align with their values on environmental and social responsibility.

Key Player Analysis

- Tempur Sealy International, Inc. Tempur Sealy, a market leader with a diverse portfolio of brands, holds around 15% of the U.S. market share. Known for its high-quality memory foam and hybrid mattresses, Tempur Sealy serves both luxury and mid-range segments, focusing on sleep health and product innovation. The company has expanded globally, reinforcing its brand presence and offering mattresses suited for a variety of sleep preferences.

- Serta Simmons Bedding LLC : As one of the largest mattress companies in the U.S., Serta Simmons controls several well-known brands and occupies roughly 14% of the U.S. market. The company’s product offerings range from budget-friendly to premium mattresses, including the popular Beautyrest line. Serta Simmons focuses on sustainable materials and recently expanded its distribution network to enhance market reach.

- Sleep Number Corporation: Sleep Number is renowned for its customizable “smart beds,” which allow users to adjust firmness and track sleep quality through integrated technology. The company’s innovative approach attracts tech-savvy consumers interested in health and wellness. With an extensive retail presence, Sleep Number holds a significant share in the U.S. market and consistently sees demand from consumers seeking personalized sleep solutions,

- Kingsdown, Inc.: Kingsdown is a key player in the premium segment, known for handcrafted mattresses that emphasize luxury and durability. The company caters primarily to affluent customers, offering a range of customizable options. Kingsdown’s high-quality standards and focus on ergonomics have helped solidify its reputation as a luxury mattress provider, particularly in North America and Asia.

- Spring Air International: Known for its affordable mattresses and strong presence in mid-tier markets, Spring Air has a growing international footprint. The brand is popular in both residential and commercial sectors, particularly among hotels and healthcare facilities. Its competitive pricing and quality have enabled steady growth, especially in the hospitality industry.

Recent Developments

- In 2023, Serta Simmons Bedding, LLC (SSB), a major player in the sleep industry, celebrated the opening of a cutting-edge, 500,000-square-foot manufacturing facility in Wisconsin. This new plant, which produces Serta, Beautyrest, and Simmons mattresses, preserves over 300 jobs in Rock County and is positioned to add more as SSB aims to regain market share.

- In 2024, the International Sleep Products Association (ISPA) published its 2023 Mattress Industry Trends Report, offering critical data on the performance and shifts within the mattress market, serving as a key resource for manufacturers and suppliers.

- In 2024, DreamCloud, known for its mid-range mattresses, is expected to maintain its Black Friday discounts near 50%, as last year, delivering strong value to price-conscious customers.

- In 2024, the FTC blocked Tempur Sealy International, Inc.’s planned $4 billion acquisition of Mattress Firm, aiming to prevent reduced competition in the mattress retail sector.

Conclusion

The global mattress market is set for robust growth as consumer preferences evolve toward health, sustainability, and convenience. This market is strongly influenced by rising awareness of the importance of quality sleep, with consumers increasingly investing in mattresses designed to enhance comfort and support overall well-being. Technological advancements, particularly in smart mattresses that offer sleep tracking and customizable firmness, are attracting a tech-savvy audience eager for personalized sleep solutions. Additionally, expanding e-commerce channels and the direct-to-consumer model have made purchasing mattresses more accessible, appealing especially to younger consumers seeking convenience and flexibility.