Table of Contents

Introduction

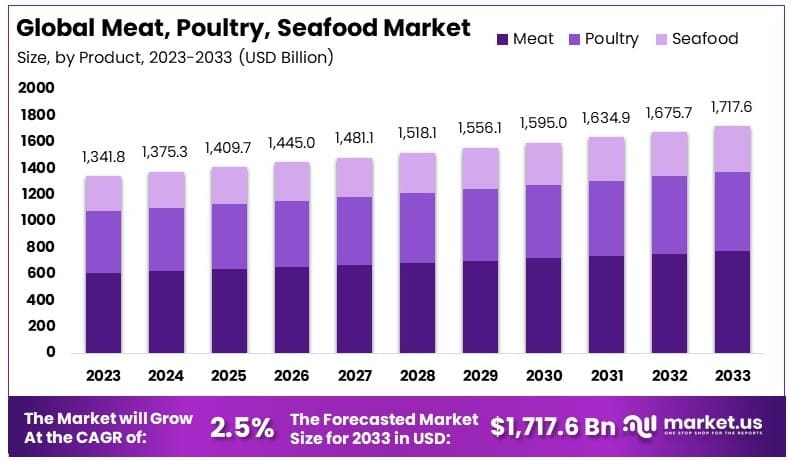

The global meat, poultry, and seafood market pivotal components of the global food industry, is anticipated to undergo substantial growth over the coming decade. As of 2023, the market is valued at USD 1,341.8 Billion, with projections suggesting an expansion to USD 1,717.6 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 2.5% during the forecast period from 2024 to 2033. This growth can be attributed to factors such as rising global demand fueled by increasing population and income levels, particularly in emerging economies.

However, the market faces significant challenges, including stringent regulatory environments concerning food safety and animal welfare, as well as the increasing consumer shift towards plant-based alternatives amid growing health and environmental concerns. Developments have seen advancements in packaging technologies and a surge in export opportunities, particularly in regions with stringent quality standards, which have provided new avenues for market expansion. These dynamics underscore the complexities and opportunities within the meat, poultry, and seafood industry, necessitating strategic approaches to leverage growth potentials while mitigating inherent risks.

Recent developments in the meat, poultry, and seafood industry highlight strategic moves by major companies like Tyson Foods, JBS, and others, focusing on acquisitions and market expansion to bolster their global footprints and product portfolios.

Tyson Foods, Inc. has been particularly active, completing significant acquisitions to strengthen its international presence and product range. In a notable expansion, Tyson acquired the Thai and European operations of BRF S.A. for $340 million. This acquisition includes production facilities in Thailand, the Netherlands, and the United Kingdom, enhancing Tyson’s capacity to produce and innovate with value-added protein products aimed at retail and foodservice customers across Europe and Asia.

JBS USA, another key player, has also expanded through strategic acquisitions to enhance its product quality and supply chain efficiency. It recently entered into an agreement to acquire assets from TriOak Foods, a move aimed at securing a consistent supply and improving the efficiency of its pork production capabilities across several U.S. facilities.

These movements underscore a strategic focus on international expansion, product diversification, and the enhancement of supply chain efficiencies, which are crucial for maintaining competitive advantage in the global meat, poultry, and seafood market.

Key Takeaways

- Market Value: The Meat, Poultry, Seafood Market was valued at USD 1,341.8 billion in 2023, and is expected to reach USD 1,717.6 billion by 2033, with a CAGR of 2.5%.

- By Product Analysis: Meat led with 45%; it remains a staple diet component globally, reinforcing its market position.

- By Type Analysis: Conventional products dominated with 65%, reflecting widespread availability and lower price points compared to organic options.

- By Form Analysis: Frozen products accounted for 55%, highlighting their convenience and longer shelf life.

- By Distribution Channel Analysis: Supermarkets & Hypermarkets dominated with 42.6%, underscoring their pivotal role in consumer accessibility.

- Dominant Region: APAC held 46.2% of the market, driven by increasing consumption rates and expanding retail sectors.

Meat Market Statistics

Production

- The U.S. meat industry directly employs more than 500,000 people.

- The industry generates nearly two million additional jobs along the value chain.

- There are 835 federally inspected livestock slaughter plants in the U.S.

- Annually, meat packers process 33.6 million head of cattle, 587,000 calves, 129.9 million hogs, and 2.23 million sheep and lambs into over 55 billion pounds of beef, pork, lamb, and veal.

- In 2020, chicken meat production was approximately 99.8 million metric tons, forecasted to reach 103.4 million metric tons in 2023.

- To produce 103.4 million metric tons of chicken, approximately 59.4 million chickens are needed.

- U.S. consumers spend only 4.8 percent of per capita disposable income on food consumed at home.

Trade

- In 2022, bovine meat was the world’s 162nd most traded product, with a total trade value of $29.2 billion.

- The top exporters of bovine meat in 2022 were the United States ($4.32 billion), Netherlands ($2.86 billion), Australia ($2.72 billion), Canada ($2.55 billion), and Ireland ($2.02 billion).

- The top importers of bovine meat in 2022 were the United States ($4.85 billion), Germany ($2.36 billion), Netherlands ($2.18 billion), Italy ($2.18 billion), and Japan ($1.95 billion).

- Between 2021 and 2022, the exports of bovine meat grew the fastest in the Netherlands ($294 million), Poland ($213 million), Spain ($197 million), Pakistan ($131 million), and Ireland ($105 million).

Export/Import

- In 2022, the U.S. exported 3.02 billion pounds of beef, 6.3 billion pounds of pork, 7.2 billion pounds of chicken products, and nearly 640 million pounds of turkey.

- U.S. beef has been exported to 135 countries, U.S. pork to 124 countries, and U.S. chicken to 165 countries.

- The top export market for U.S. fish and seafood in 2023 was China, with exports valued at $1.04 billion.

- The European Union was the third largest market, with exports valued at $1.03 billion.

- Japan imported $656.95 million worth of U.S. fish and seafood in 2023.

- The compound average growth rate for U.S. fish and seafood exports from 2014 to 2023 was -1.2%.

Poultry Statistics

Production

- Poultry processors handle 9.34 billion chickens and 227.6 million turkeys annually, producing over 50 billion pounds of chicken and turkey products.

- In 2023, poultry production and sales in Canada increased, attributed to higher demand and product prices, recovering from the 2022 avian influenza outbreak.

- Poultry farmers produced 1.6 billion kilograms of chicken, turkey, and stewing hens, marking a 3.6% increase.

- Total Canadian chicken production rose 3.3% year over year to 1.4 billion kilograms in 2023.

- Egg production increased by 2.0% to 883.9 million dozen eggs in 2023.

Trade

- In 2022, poultry meat was the world’s 125th most traded product, with a total trade value of $35.9 billion.

- The top exporters of poultry meat in 2022 were Brazil ($8.95 billion), United States ($5.43 billion), Poland ($4.41 billion), Netherlands ($2.99 billion), and Germany ($1.26 billion).

- The top importers of poultry meat in 2022 were China ($3.76 billion), Germany ($2.51 billion), France ($2.05 billion), United Kingdom ($1.86 billion), and Netherlands ($1.69 billion).

Export/Import

- Between 2021 and 2022, Brazil saw the highest growth in poultry meat exports, increasing by $1.95 billion.

- Between 2021 and 2022, China saw the highest growth in poultry meat imports, increasing by $668 million.

- The U.S. broiler meat exportable supplies were constrained as production grew by less than 1% in 2021.

- Mexico was the largest market for U.S. poultry meat, with exports valued at $1,331 million in 2021, a 35% increase from 2020.

- Exports to China were $879 million in 2021, a 16% increase from 2020, primarily driven by demand for chicken paws.

- Total U.S. poultry exports were valued at $5,250 million in 2021, a 24% increase from 2020.

Seafood Statistics

Production

- Over the past two decades, per capita consumption of seafood in the U.S. has ranged from 14.6 pounds per person in 1997 to a record high of 16.5 pounds in 2004 and 2006.

- By 2018, U.S. annual consumption of fish and shellfish had decreased to 14.9 pounds per person.

- The production of farm-raised fish and shellfish in the U.S. in 2017 was about 633 million pounds, worth $1.5 billion.

- The amount of fish and shellfish harvested from the wild annually in the U.S. is more than 10 times greater than the amount produced by domestic aquaculture farms.

Trade

- Seafood is the most highly traded commodity in the global food system, with trade doubling in both quantity and value between 1998 and 2018.

- The annual value of the international trade of seafood is USD $151 billion.

- In 2014, the leading foreign suppliers of seafood to the U.S. were China, Canada, India, Thailand, Vietnam, and Indonesia, with about two-thirds of the edible seafood imported coming from these six countries.

Export/Import

- In 2023, the total export value of U.S. fish and seafood was $5.18 billion.

- The total volume of U.S. fish and seafood exports in 2023 was 1.28 million metric tons.

- Over 80% of the catch landed in the U.S. in 2017 was finfish, and the rest was shellfish.

- Shrimp is the leading fresh or frozen product imported into the U.S., followed by freshwater fillets and steaks, salmon, tuna, groundfish (cod, haddock, and hakes), crabs and crabmeat, frozen fish blocks, squid, and lobster.

Emerging Trends

- Plant-Based Alternatives: As consumer preferences shift towards more ethical and sustainable food choices, plant-based alternatives to meat, poultry, and seafood are gaining popularity. These products are being developed to mimic traditional flavors and textures, attracting not only vegetarians but also meat-eaters looking for healthier options.

- Lab-Grown Meats: Cultured or lab-grown meat is a groundbreaking trend. This technology involves growing meat from animal cells in a lab, reducing the need for livestock farming and thereby lessening the environmental impact. This method promises a future of meat production with significantly lower carbon emissions and land use.

- Traceability and Transparency: Consumers increasingly demand to know the origin of their food. Traceability technologies, such as blockchain, are being adopted across the supply chain to enhance transparency, allowing consumers to track the journey of their food from farm to fork.

- Enhanced Packaging Solutions: Innovations in packaging, such as smart labels that monitor freshness, and biodegradable packaging materials, are improving food safety and sustainability. These technologies help in extending shelf life and reducing plastic waste, addressing environmental concerns.

- Ethnic Flavors and Products: There is a growing consumer interest in diverse, ethnic cuisines which is influencing product offerings in the meat, poultry, and seafood sectors. Manufacturers are introducing products with ethnic flavors and spices to cater to the palate of a culturally diverse customer base.

- Aquaculture Innovations: With the depletion of natural fish stocks, aquaculture is expanding, using advanced methods to enhance efficiency and sustainability. Innovations include improved feed compositions, better disease management practices, and environmentally friendly farming techniques.

- Regenerative Agriculture: This trend involves practices that regenerate the soil and increase biodiversity rather than deplete it. In the meat sector, it includes holistic grazing practices that mimic natural ecosystems, which can improve soil health, enhance water retention, and sequester carbon.

Use Cases

- Food Service Supply: Meat, poultry, and seafood are essential components in food service, including restaurants, catering, and fast food chains. They rely heavily on the supply of various meats for menu items, with a significant demand for portion-controlled and pre-marinated options to expedite preparation and reduce waste.

- Meal Kits and Ready-to-Cook Products: The rise of home cooking and convenience food has led to increased sales of meal kits and ready-to-cook products. These often include pre-portioned and seasoned meat, poultry, or seafood items, designed to simplify meal preparation for consumers.

- Health and Fitness Products: Protein-rich foods like meat, poultry, and seafood are crucial for dietary supplements and fitness meals tailored for athletes and individuals involved in heavy physical activities. These products are often marketed as high-protein, low-fat options that support muscle building and recovery.

- Pet Food Industry: High-quality meats, poultry, and seafood are key ingredients in pet food for both domestic and exotic animals. This market segment demands specific types of meats that are safe and nutritious for animals, contributing significantly to the growth of the premium pet food market.

- Processed Snacks: Jerky, sausages, and seafood snacks are popular in the processed snack market. These items utilize various meat and seafood products, offering convenience and long shelf life as high-protein snack options.

- Culinary Tourism: Authentic local cuisines featuring traditional meat, poultry, and seafood dishes are a significant draw for culinary tourists. This use case highlights the cultural value of these products in enhancing the travel experience and supporting local economies.

- Innovative Gourmet Products: High-end restaurants and gourmet stores often seek rare and exotic meat, poultry, and seafood products to create unique dining experiences. These include luxury items like wagyu beef, wild-caught salmon, and organic poultry, catering to an upscale market segment.

Key Players Analysis

Tyson Foods, Inc., a leading company in the meat, poultry, and seafood sector, reported a second-quarter revenue of $13.07 billion for 2024, slightly below analyst estimates. The company has recently invested in its production capabilities, including a capital expenditure of $1.2 billion to $1.4 billion for plant upgrades and new technology. Additionally, Tyson Foods completed the acquisition of Williams Sausage Company, expanding its product portfolio. This strategic move aligns with Tyson’s focus on innovation and capacity expansion to meet growing market demands.

JBS S.A., a major player in the meat, poultry, and seafood industry, continues to expand its global footprint. In 2023, JBS reported a significant revenue of $85.9 billion, driven by strong performance in its North American and South American operations. Recently, JBS acquired the European plant-based protein company, Vivera, for €341 million, enhancing its alternative protein portfolio. This acquisition supports JBS’s strategic goal to diversify its product offerings and strengthen its presence in the fast-growing plant-based protein market.

Cargill, Incorporated, a major player in the meat, poultry, and seafood sector, recently completed the acquisition of Owensboro Grain Company, a soybean processing facility, to enhance its North American oilseeds network. This acquisition aligns with Cargill’s strategy to increase production capacity to meet rising demand in food, feed, and renewable fuel markets. In its 2023 annual report, Cargill reported robust financial performance and continued investment in innovation and sustainability, reaffirming its commitment to providing high-quality agricultural solutions globally.

BRF S.A., a leading global food company, has expanded its presence in the pet food market by acquiring Hercosul, a prominent Brazilian pet food manufacturer. This strategic move aims to make BRF one of the largest players in Brazil’s pet food market by 2025. In 2023, BRF reported an annual revenue of 53.62 billion BRL, with the acquisition expected to boost its diversification efforts and strengthen its market position.

Hormel Foods Corporation, a global branded food company, reported second-quarter fiscal 2024 revenue of $5.88 billion. The company has launched several new products, including Planters® salt and vinegar cashews and Hormel® Gatherings summer-themed trays, and reintroduced Skippy® peanut butter products in Canada. Hormel continues to focus on supply chain modernization and portfolio optimization. Recent strategic moves and robust advertising investments underscore Hormel’s commitment to enhancing its market position and expanding its product offerings.

Marfrig Global Foods S.A., a leading meat and food processing company, has expanded its product portfolio and market reach through recent strategic initiatives. In 2023, Marfrig reported strong revenue growth driven by its operations in North and South America. The company completed the acquisition of a significant stake in BRF S.A., aiming to enhance synergies and operational efficiencies. This acquisition aligns with Marfrig’s strategy to strengthen its position in the global meat industry and diversify its product offerings.

Smithfield Foods, Inc., a leading pork producer, continues to expand its global footprint and product portfolio. In 2024, Smithfield reported strong revenue growth driven by increased demand for pork products. The company recently announced a major investment in a new processing facility in the United States to enhance production capacity. Smithfield’s strategic focus remains on innovation and sustainability, aiming to meet the growing consumer demand for high-quality, responsibly sourced pork products.

Thai Union Group PCL, a leading seafood producer, reported sales of THB 136.2 billion in 2023, a 12.5% decline from the previous year due to lower sales volumes and decreased demand across categories. The company plans a capital investment of THB 4.0-4.5 billion in 2024, focusing on new facilities for ready-to-eat products, protein hydrolysates, and wet pet food. Thai Union is also divesting its stake in Red Lobster by the end of 2024 to streamline operations and focus on core businesses.

Charoen Pokphand Foods PCL (CPF), a leading agro-industrial and food conglomerate, continues to strengthen its global presence. In 2023, CPF reported a revenue of THB 580.39 billion, driven by its diversified operations in livestock and aquaculture. Recently, CPF acquired a 43.3% stake in Lotus’s Malaysia and Lotus’s Thailand, expanding its retail footprint. This acquisition supports CPF’s strategy to enhance its integrated food business and supply chain, aligning with its goal to be a leading sustainable agro-industrial and food company.

Mowi ASA, the world’s largest producer of farm-raised Atlantic salmon, reported record-high revenues of EUR 1.36 billion in Q3 2023, driven by increased volumes and favorable salmon prices. The company plans to harvest 500,000 tonnes of salmon in 2024, marking a new milestone. Mowi continues to emphasize sustainability, being named the world’s most sustainable animal protein producer by Coller FAIRR for the fifth consecutive year.

Beijing DQY Agriculture Technology Co., Ltd., a leading egg producer in China, focuses on sustainable agriculture and innovation. The company integrates modern farming technologies to enhance productivity and ensure high-quality products. Recently, Beijing DQY has expanded its operations to include organic and free-range eggs, catering to the growing demand for healthier food options in China. Their commitment to sustainability and innovation positions them as a key player in the agricultural sector.

Sanderson Farms, in 2022, was acquired by a joint venture between Cargill and Continental Grain for $4.5 billion. This acquisition combined Sanderson Farms with Wayne Farms to form Wayne-Sanderson Farms, headquartered in Oakwood, Georgia. The newly formed company operates numerous processing plants across several states and continues to focus on producing high-quality, affordable poultry products. Sanderson Farms had reported sales of $3.56 billion in fiscal 2020 and employed around 17,000 people before the merger.

Grupo Bimbo, the world’s largest baking company, continues to expand its global reach. In 2023, the company reported robust revenue growth, driven by strategic acquisitions and product innovations. Recently, Grupo Bimbo acquired St. Pierre Groupe, a leading supplier of bakery products in the UK, to enhance its presence in the European market. This acquisition aligns with Bimbo’s strategy to strengthen its portfolio and expand its footprint in new regions, further solidifying its position as a global leader in the baking industry.

SeaPak Shrimp & Seafood Company, known for its top-selling frozen shrimp products, is celebrating its 75th anniversary with new packaging and an updated logo. The company recently launched the Coastal Inspired Coconut Cod, a product featuring wild-caught cod with a crispy coconut breading, and introduced the gluten-free Lighthouse Selections line to meet the demand for healthier seafood options. SeaPak’s commitment to sustainability includes responsible sourcing and regular coastal cleanups.

Nichirei Corporation, a major player in the food processing industry, reported a revenue of $5.0 billion in 2023. Recently, Nichirei acquired InnovAsian Cuisine Enterprises, purchasing a 51% stake to expand its footprint in the U.S. frozen foods market. This acquisition aligns with Nichirei’s strategy to strengthen its presence in the Asian foods segment and enhance its global market reach.

Conclusion

In conclusion, the meat, poultry, and seafood industries are integral to global food systems, offering a range of products that meet diverse dietary and cultural demands. These sectors are adapting to changing consumer preferences, technological advancements, and environmental challenges, evidenced by trends such as the rise of plant-based alternatives, advancements in aquaculture, and innovations in traceability and packaging.

As the industries continue to evolve, they will play a critical role in addressing food security while striving for sustainability and efficiency. The future of these sectors will likely see further integration of innovative practices that balance production with environmental stewardship, ensuring the continued availability of these vital food resources worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)