Table of Contents

Introduction

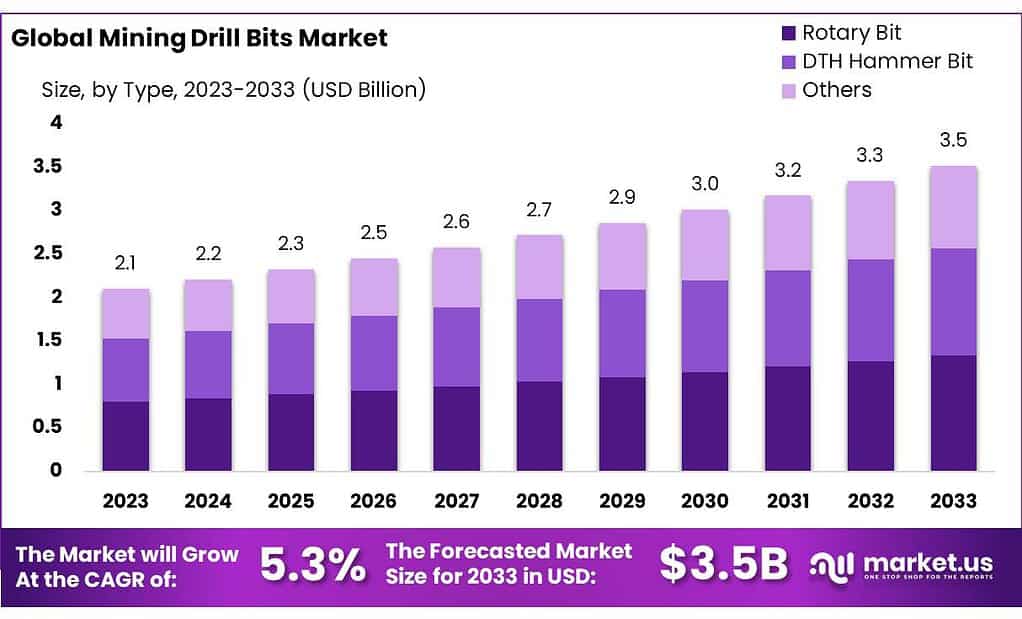

The Global Mining Drill Bits Market is poised for steady growth, expanding from USD 2.1 billion in 2023 to an estimated USD 3.5 billion by 2033, with a CAGR of 5.3% over the decade. This growth trajectory is underpinned by several key factors, including advancements in drill bit technology, increasing exploration activities, and rising demands for automation within the industry.

One of the primary growth drivers is the heightened demand for efficient drilling solutions, spurred by global mining expansion and technological innovations in drill bit designs. These enhancements are crucial for accessing deeper and harder rock formations more effectively. Moreover, the market’s evolution is closely tied to the broader industrial activities, such as infrastructure projects and the exploration of oil, gas, and rare earth elements, which continue to require extensive drilling operations.

However, the sector faces challenges such as stringent environmental and safety regulations which mandate the development of more eco-friendly and safer drilling technologies. These regulations have spurred the introduction of advanced materials like Polycrystalline Diamond Compact (PDC) and tungsten carbide, which are favored for their durability and efficiency.

Recent developments in the market also reflect a shift towards sustainability and increased efficiency, with major players introducing new technologies that promise longer service lives and better performance under diverse drilling conditions. The adaptation of these innovative products is essential for companies looking to enhance operational efficiencies and reduce costs.

Atlas Copco AB has recently introduced a new line of down-the-hole (DTH) hammers and bits aimed at enhancing productivity and extending wear life. This innovation is part of Atlas Copco’s broader strategy to strengthen its market position by improving the efficiency and durability of its mining equipment

Key Takeaways

- Mining Drill Bits Market size is expected to be worth around USD 3.5 Bn by 2033, from USD 2.1 Bn in 2023, growing at a CAGR of 5.3%.

- Rotary Bit segment held a dominant position in the mining drill bits market, capturing more than a 38.4% share.

- PDC (Polycrystalline Diamond Compact) Diamond held a dominant market position, capturing more than a 38.5% share.

- Diesel Operated Mining Drills held a dominant market position, capturing more than a 58.7% share.

- Rotary Mining Drill held a dominant market position, capturing more than a 33.4% share.

- Handhold Mining Drill held a dominant market position, capturing more than a 28.5% share.

- Liquid Filled drill bits held a dominant market position, capturing more than a 43.3% share.

- Below 8 inches held a dominant market position, capturing more than a 45.5% share.

- Surface Mining held a dominant market position, capturing more than a 64.5% share.

- Asia Pacific (APAC) stands as the dominating region, accounting for a substantial 37% of the market share, translating to USD 0.79 billion.

Mining Drill Bits Statistics

- Given that the bit cost is considered the most expensive part of a drilling operation, accounting for approximately 21% of total operating costs, it is vital to determine the ideal time to replace drill bits.

- Our diamond laboratory houses a 4,100 ton multi-axis anvil press that can achieve pressures and temperatures greater than 1 million psi and 2700°F (1482°C), respectively.

- Slides on conventional motor assemblies often account for up to 50% of drilling time, yet only 10 -15% of the distance drilled.

- The drilling industry has enjoyed the benefits of hybrid drill bits for 10+ years.

- Cutting tools are considered the most expensive tools during a drilling operation, accounting for an esti-mated 21% of total drilling costs.

- In 2019, the global mining industry employed over 10 million people.

- The mining industry in Australia employs over 240,000 people.

- The mining industry in Ghana employs over 28,000 workers directly and over 640,000 indirectly.

- The mining industry contributed $109.6 billion to Canada’s GDP in 2019.

- Ghana is Africa’s largest gold producer, with an output of 142 metric tons in 2019.

- The mining industry in South Africa contributes about 8% of the country’s GDP.

- China is the world’s largest producer of rare earth elements, accounting for over 80% of global production.

- The United States is the world’s largest producer of natural gas from shale, with a production of over 25 trillion cubic feet in 2019. Chile is the world’s largest copper producer, accounting for over a quarter of global production.

- The mining sector in Mexico contributes over 8% to the country’s GDP. Russia is the world’s largest diamond producer by volume, accounting for over a quarter of global production.

- India is the world’s third-largest coal producer, with an output of over 700 million tons in 2019.

- The mining industry in the Democratic Republic of Congo contributes over 20% to the country’s GDP.

- The mining industry in Zambia contributes about 12% to the country’s GDP.

Emerging Trends

Emerging trends in the mining drill bits market point towards significant advancements that are shaping the industry’s future. Automation and robotics are increasingly prevalent, with developments geared towards enhancing the compatibility of drill bits with autonomous drilling systems. This trend is driven by the need for greater efficiency and safety, reducing human involvement in hazardous mining operations.

Another critical trend is the integration of data analytics into drill bit technology, allowing for real-time monitoring of drilling performance. This technological integration facilitates more precise and efficient drilling operations, optimizing resource extraction and reducing operational costs.

Sustainability also plays a vital role, with growing demands for mining practices that minimize environmental impact. This includes developing drill bits that reduce waste and energy consumption during operations, aligning with global efforts towards environmental responsibility.

Material innovations continue to advance, with significant focus on Polycrystalline Diamond Compact (PDC) drill bits and tungsten carbide. These materials are favored for their durability and efficiency in penetrating hard rock formations, crucial for both oil and gas drilling and mineral mining.

Lastly, the geographic expansion of the market is evident, particularly in regions rich in natural resources like the Asia Pacific. This region leads in market share due to extensive mining activities and is propelled by continuous investments in mineral exploration and extraction.

Use Cases

- Exploration Drilling: Drill bits are crucial for obtaining core samples used to assess the composition, depth, and quality of mineral deposits. These samples help mining companies make informed decisions about potential mining sites. Diamond and PDC (polycrystalline diamond compact) drill bits are particularly valued for their ability to drill through hard rock formations, providing high-quality samples essential for exploration and geological surveys.

- Surface and Underground Mining: Different drill bits are used depending on the mining method. For surface mining, large-diameter top hammer bits are often used to drill blast holes in rock formations. In underground mining, more specialized drill bits like the extension drill rods are used for precision drilling in confined spaces, such as narrow vein mining operations where space is restricted and precision is paramount.

- Infrastructure Development: In the construction of tunnels and development of mining infrastructure, drill bits like the horseshoe and three-edge bits are employed to handle complex rock formations and high-power drilling requirements. These bits are designed to control the depth and angle of drilling, which is critical in ensuring the structural integrity and safety of the mining tunnels and passageways.

- Production Drilling: For the actual extraction of minerals, robust drill bits such as roller cone and DTH hammer bits are used. These bits are designed to handle the tough conditions of production drilling, where efficiency and wear resistance are key. Roller cone bits, for instance, are effective in breaking down hard materials and are essential in large-scale mining operations.

Major Challenges

The mining drill bits market faces several challenges that could affect its growth trajectory. One major challenge is the stringent regulatory landscape governing mining activities. Governments worldwide are imposing strict regulations to mitigate the environmental impact of mining, which includes the operation and effects of drilling. These regulations can limit drilling activities, especially in environmentally sensitive areas, and increase the cost of compliance for mining companies.

Another significant challenge is the wear and tear on drill bits due to the hardness of the materials they encounter. This not only affects the efficiency of the drilling process but also increases operational costs due to the frequent need for replacement and maintenance. Additionally, the market is experiencing a demand for innovation in drill bit technology, which requires continuous research and development investment to enhance performance and efficiency, further straining resources.

Furthermore, the mining drill bits market is also impacted by the fluctuating prices of raw materials used in manufacturing drill bits, such as tungsten carbide and steel. These fluctuations can affect production costs and profit margins for manufacturers.

Market Growth Opportunities

- Technological Innovations: Advances in drill bit technology, such as the development of fixed cutter and PDC diamond bits, are enhancing drilling efficiency and lifespan, which are critical for tough drilling conditions found in both oil, gas, and mining operations

- Geographic Expansion: Regions like Asia Pacific are witnessing substantial growth due to high mineral reserves and increasing mining activities, which in turn drives the demand for advanced drilling solutions. This region leads with a significant market share, attributed to rising investments in mining and resource extraction

- Renewable Energy Sector: The shift towards renewable energy sources is escalating the need for metals like lithium, cobalt, and rare earth elements, essential for manufacturing renewable energy technologies. This shift is expected to drive further demand for mining drill bits

- Automation and Digitalization: The mining industry’s ongoing digital transformation, including the adoption of automated drilling systems and real-time data analytics, offers significant potential for market growth. These technologies not only improve drilling efficiency but also reduce operational risks and enhance safety

- Sustainability Initiatives: As environmental concerns continue to grow, the industry is leaning towards developing sustainable and eco-friendly drilling solutions. This includes innovations aimed at reducing environmental impact and improving energy efficiency during mining operations

Key Players Analysis

Atlas Copco AB had a standout year in 2023, achieving record orders, revenues, and operating profits. This success is part of their long-term strategy, marked by significant investments in research and development aimed at continuous innovation in their product offerings, particularly in mining drill bits. Their focus on sustainable practices and advancing mining technologies positions them well for future growth in the mining sector.

Boart Longyear, as a seasoned player in the mining industry, continues to specialize in drilling services and products, including mining drill bits. Their strategy revolves around technological advancements and tapping into emerging market trends to enhance drilling performance and efficiency. Boart Longyear’s efforts to innovate and adapt to the evolving needs of the mining sector underscore their commitment to maintaining a competitive edge in the market.

Brunner and Lay Inc. has continued to innovate in the mining drill bits sector, with a significant development in 2024 involving the release of their new ‘Arrow’ straight hole drilling tools. These tools, which come in various thread styles including T38, T-45, T-51, and B-60, are designed to enhance the power of hydraulic powered top hammers and drilling rigs used in both surface and underground applications. This release underscores Brunner and Lay’s commitment to advancing drilling technology through rigorous in-house development and testing by their engineering and metallurgical teams.

Caterpillar Inc. remains a dominant force in the mining drill bits market, consistently driving innovation and maintaining a significant presence in the sector. As of 2023 and 2024, Caterpillar continues to leverage its extensive industry experience and technological prowess to enhance the efficiency and effectiveness of mining operations worldwide. Their focus on developing robust mining equipment, including advanced drill bits, supports their strategic position in the market, ensuring they meet the evolving needs of the mining industry.

Changsha Heijingang Industrial Co. Ltd. continues to play a significant role in the mining drill bits market, emphasizing innovation and reliability in its product offerings. The company specializes in the production of high-quality rock drilling tools and equipment, serving various sectors including mining, quarrying, and construction. In recent years, Changsha Heijingang has focused on expanding its market reach and enhancing product efficiency to meet the evolving demands of the industry.

Doosan Corporation, notably through its subsidiary Doosan Bobcat, has demonstrated significant growth and innovation in 2023. Doosan Bobcat is recognized for its advancements in manufacturing processes, particularly in the efficient use of automation technologies. In 2023, the company implemented an automated punch-press system in North Dakota, which significantly reduced energy consumption and improved production efficiency. This technological enhancement not only underscores Doosan’s commitment to innovation but also supports its growth in the competitive mining equipment market, contributing positively to its sales and workforce expansion across North America.

Epiroc AB has maintained a strong presence in the mining drill bits market in 2023 and 2024, focusing on sustainable mining practices and technological innovation. The company is committed to environmental stewardship and efficiency in resource extraction, aligning with global sustainability goals. Their drill bits are engineered for performance and durability, which helps to reduce operational costs and environmental impact in mining operations. Epiroc’s dedication to innovation in drill bit technology ensures they remain at the forefront of the mining equipment industry.

Glinik Drilling Tools continues to excel in providing specialized drilling solutions, particularly noted for their Roller Cone and PDC drill bits. In 2023, Glinik celebrated its longstanding expertise with over 140 years in the drilling market, emphasizing their tradition in producing high-quality, durable drilling products. The company’s products are tailored for various challenging applications, from mining to construction, demonstrating their capability in both innovation and customization of drilling tools to meet specific geological needs. Glinik’s focus on continuous improvement and customer-oriented solutions positions them as a key player in the global market for mining drill bits.

Joy Global Inc., now operating as Komatsu Mining Corp following its acquisition by Komatsu Ltd., has been integrating its operations to enhance its market offerings in mining solutions. This strategic move has allowed the company to leverage Joy Global’s expertise in high-productivity mining solutions with Komatsu’s broad range of mining equipment, providing a comprehensive suite of products and services to the mining industry. This integration aims to boost productivity and safety in mining operations through a combined approach to market challenges.

Komatsu Ltd. has been actively expanding its mining business, with the acquisition of Joy Global marking a significant step in broadening its capabilities and product offerings in the mining sector. Renamed Komatsu Mining Corp, this subsidiary is focused on continuing innovation in mining technology and equipment, aiming to offer a complete range of solutions from excavation to environmental controls. Komatsu’s strategic initiatives are expected to enhance service delivery and support to global mining operations, emphasizing safety and efficiency.

Liebherr has been actively enhancing its offerings in the mining drill bits sector, focusing on the integration of innovative technologies and efficiency in its operations. As of 2023 and 2024, Liebherr continues to deliver high-quality mining equipment, including advanced drill bit solutions, which are crucial for effective and efficient mineral extraction. The company’s commitment to innovation helps in addressing the increasing demands of the mining industry, ensuring reliability and performance in challenging mining conditions.

Metso Corporation, now known as Metso Outotec after its merger, has been focusing on expanding its capabilities in the mining drill bits sector through technological innovations and strategic restructuring of its business segments. In 2023, Metso reported strong financial performance with significant sales, reflecting its effective management and operational strategies. By 2024, Metso aimed to enhance its competitiveness and efficiency through structural adjustments within its Minerals equipment business, focusing on mining technologies that support critical mineral processing like lithium and gold, which are pivotal for the energy transition.

MICON Drilling GmbH continues to enhance its presence in the mining drill bits market by focusing on specialized drilling solutions tailored for the mining and construction sectors. In 2023 and 2024, MICON is committed to advancing its technological capabilities to meet the specific demands of its clients, ensuring high performance and reliability in their drill bits and drilling equipment. This focus supports MICON’s strategy to address the evolving challenges in the drilling industry, maintaining its reputation for quality and innovation in highly competitive markets.

Mitsubishi Materials Corporation has been proactive in expanding its mining drill bits operations, particularly through the construction of a new plant in Thailand, scheduled to begin operations in October 2025. This expansion aims to double the manufacturing capacity to meet the growing global demand for mining and civil engineering tools. Mitsubishi Materials is dedicated to enhancing its product offerings with high-performance materials, reflecting its commitment to sustainability and efficiency in resource use. The company’s emphasis on innovative drilling solutions and high-quality manufacturing standards positions it well within the competitive landscape of the mining drill bits market.

Robit Plc has solidified its position as a leading manufacturer of high-quality drilling consumables, including mining drill bits. In 2023, the company reported a 7% increase in sales, reaching €100 million, attributed to the launch of their innovative diamond button bits for top hammer drilling. This product offers enhanced durability and efficiency, catering to the evolving needs of the mining industry. Robit continues to focus on research and development to maintain its competitive edge in the market.

Rockmore International specializes in the production of premium percussive rock drilling tools, serving the mining sector with a comprehensive range of products, including threaded and tapered drill bits, DTH bits and hammers, and extension and tunneling rods. In 2023, the company expanded its manufacturing capabilities by opening a new facility in Austria, increasing production capacity by 20%. This strategic move aims to meet the growing global demand for high-performance drilling tools, reinforcing Rockmore’s commitment to quality and customer satisfaction.

Sandvik AB has maintained its leadership in the mining drill bits sector through continuous innovation and strategic product development. In 2023, the company introduced the Charger™ RR450 rotary drill bit, boasting up to a 90% increase in bit life compared to previous models, thereby enhancing operational efficiency for mining clients. Additionally, Sandvik’s focus on sustainability is evident in their research efforts to develop cobalt-free drill bits, aiming to reduce environmental impact and reliance on critical raw materials.

Universal Drilling Technique LLC, based in Ukraine, specializes in manufacturing a wide range of roller drill bits, with diameters ranging from 74.6 mm to 490 mm, catering to various drilling applications in the oil, gas, and mining industries. The company emphasizes quality and durability in its products, serving both domestic and international markets. Their commitment to innovation and customer satisfaction has solidified their position as a reliable supplier in the drilling tools sector.

Western Drilling Tools specializes in manufacturing high-quality drilling equipment, including mining drill bits. In 2023, the company expanded its product line to include advanced diamond-impregnated bits, enhancing drilling efficiency and durability in hard rock formations. This development aligns with the industry’s shift towards more robust and cost-effective drilling solutions. Western Drilling Tools continues to focus on innovation and customer satisfaction, maintaining its competitive edge in the mining sector.

Xiamen Prodrill Equipment Co., Ltd. is a leading manufacturer and supplier of rock drilling tools, serving the mining industry with products such as DTH hammers and bits, top hammer drilling tools, and overburden drilling systems. In 2023, Prodrill introduced a new range of high-efficiency button bits designed to improve penetration rates and reduce operational costs. The company’s commitment to quality and innovation has strengthened its position in the global mining equipment market.

Conclusion

Additionally, the shift towards renewable energy is increasing the demand for metals necessary for new technologies, which in turn drives the need for efficient and innovative drilling solutions. . As the industry continues to evolve, factors such as automation, digitalization, and sustainability efforts are expected to play critical roles in shaping the future of the mining drill bits market, ensuring its relevance and vitality in the global economic landscape.