Table of Contents

Introduction

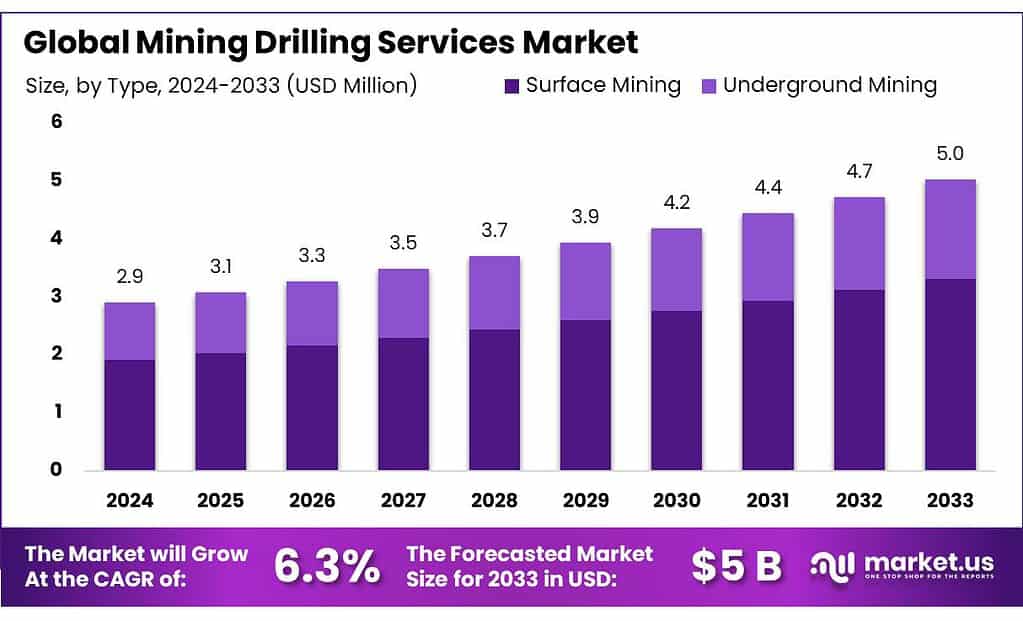

The global mining drilling services market is set for significant expansion, projected to grow from USD 2.9 billion in 2023 to USD 5.0 billion by 2033, with a compound annual growth rate (CAGR) of 6.3%. This growth is driven by increased investments in mineral exploration and mining operations, reflecting a robust demand for minerals essential for various industries including technology, construction, and energy.

Several key factors propel this market growth. The ongoing advancements in drilling technologies, such as directional drilling, enhance the efficiency and precision of accessing mineral deposits, especially in challenging locations. Additionally, the rise in commodity prices has renewed interest in exploration activities, further boosting the market. Surface mining dominates the market due to its cost-effectiveness and accessibility, making up a significant portion of the sector.

However, the market faces challenges, including environmental concerns and regulatory complexities that could hinder operations. Stricter global regulations on mining practices and the industry’s environmental impact demand more sustainable approaches and technologies. The geopolitical tensions and trade uncertainties also pose risks that could affect market stability and growth prospects.

Recent developments have seen companies like Major Drilling and Boart Longyear enhancing their fleets with new drills and technologies that improve safety and efficiency. These innovations are critical as the industry moves towards more environmentally responsible practices and seeks to optimize operational efficiency

Atlas Copco is making significant strides in integrating advanced technologies such as automation and real-time data monitoring into their drilling operations. These innovations are not only improving efficiency but are also setting new standards for safety and environmental sustainability in mining drilling services.

Key Takeaways

- Mining Drilling Services Market size is expected to be worth around USD 5.0 Bn by 2033, from USD 2.9 Bn in 2023, growing at a CAGR of 6.3%.

- Surface Mining held a dominant market position, capturing more than a 66.2% share.

- Directional Drilling held a dominant market position, capturing more than a 35.3% share of the mining drilling services market.

- Onshore drilling held a dominant market position, capturing more than a 87.8% share of the mining drilling services market.

- Metal held a dominant market position, capturing more than a 39.2% share of the mining drilling services market.

- Asia Pacific (APAC) leading the charge, capturing 37% of the market share, valued at approximately USD 1.09 billion.

Mining Drilling Services Statistics

- Company’s authorized capital stands at Rs 50.0 lakhs and has 36.16% paid-up capital which is Rs 18.08 lakhs.

- For the purposes of this pie chart, we have assumed that the annual revenues of all the other drilling contractors are 40% out of 100.

- The highest earner is Boart Longyear, having received 443 million USD in revenue solely from mineral exploration drilling services.

- The company announced an 11.8% revenue increase earned from mineral exploration drilling services, as well as an improvement in drill rig utilization when compared to the 2016 fiscal year.

- The contractor noted that this was a significant increase of 90 million USD. For the 2017 fiscal year, according to its financial summary, the size of the mineral exploration drilling fleet was 73.

- Layne Drilling reported significant consolidated revenue, of which 97 million USD were earned from mineral exploration drilling services alone.

- Next on the list is Orbit Garant – this company enjoyed an increase of 16.4% in mineral exploration drilling revenue, which totaled 96 million USD (125 million CAD).

- Tenth in the statistics is Explomin Perforaciones. The mineral exploration drilling revenue of the company totaled 58 million USD.

- Blasting is performed daily, with an average annual production of around 8.5 million cubic meters.

- The six Tamrock Pantera 1500 drilled 4.5-inch vertical and inclined boreholes with a length between 5 and 20 m using extension rods.

Emerging Trends

- Technological Advancements: The integration of modern technologies such as artificial intelligence (AI), the Internet of Things (IoT), and advanced data analytics is transforming mining drilling operations. These technologies enhance the precision and efficiency of drilling, optimize resource extraction, and reduce environmental impact. Companies are also adopting directional drilling due to its precision in accessing hard-to-reach mineral deposits, which minimizes environmental disruption.

- Increased Automation and Robotics: Automation is increasingly being implemented in drilling operations, allowing for remote and continuous operations which are crucial in hazardous environments. This not only improves safety but also increases operational efficiency. Robotics are used for repetitive and dangerous tasks, further reducing the risk to human operators.

- Sustainable and Green Mining Practices: There is a growing emphasis on reducing the environmental footprint of mining activities. This includes the use of renewable energy sources within drilling operations and efforts to minimize water and ground pollution. Companies are exploring eco-friendly drilling techniques and are more frequently evaluating their operations for environmental impact.

- Expansion in Emerging Markets: Regions such as Asia Pacific are experiencing significant growth due to the rich mineral resources and increasing demand for metals and minerals. This is driving advancements and investments in drilling technologies in countries like China, Australia, and India.

Use Cases

- Electricity Production: The rising global demand for electricity is propelling the growth of the mining drilling services market. Drilling services are critical for extracting coal and other minerals used in power generation. For instance, the ongoing consumption of electricity, which saw a 1.8% increase in the United States in 2022, underscores the continuous need for these services.

- Technological Enhancements in Drilling: Advancements in technology significantly influence the mining drilling services market. Companies are increasingly integrating artificial intelligence (AI), the Internet of Things (IoT), and advanced data analytics to enhance drilling precision and efficiency. These technological advancements not only optimize resource extraction but also contribute to environmental sustainability by reducing the operational footprint.

- Directional and Non-Directional Drilling: Directional drilling, which accounted for over 35.3% of the mining drilling services market in 2023, is preferred for its ability to access deposits in challenging locations with minimal environmental disruption. Conversely, non-directional drilling remains vital for straightforward operations where deposits are directly accessible, often used in large open-pit mines and for shallow deposits.

- Support for Construction Industry: Quarry operations are a significant part of mining drilling services, involving the extraction of building materials like limestone and sandstone. These materials are crucial for the construction industry, highlighting another vital use case for mining drilling services.

- Metal, Coal, and Mineral Mining: The mining drilling services market supports various sectors including metal mining, which is driven by global demands for iron, copper, and gold. This sector involves extensive use of both surface and underground mining techniques. Similarly, coal mining focuses on extracting coal primarily used for energy production, while mineral drilling services target a diverse range of non-metallic minerals critical for industrial and consumer products.

Major Challenges

- Volatile Commodity Prices: The prices of commodities such as coal, metals, and minerals are highly volatile. Fluctuations in these prices can directly impact the profitability of mining operations, making financial planning and investment in new drilling projects risky. When prices are low, mining companies may reduce their exploration and drilling efforts, which affects the demand for drilling services.

- Regulatory and Environmental Challenges: Mining operations are heavily regulated with stringent environmental standards. Compliance with these regulations can increase operational costs and delay project timelines. Drilling must adhere to environmental protection standards, which may involve additional procedures and technologies to minimize the ecological impact.

- Technological Advancements: While technological advancements offer opportunities for improved efficiency and safety, keeping up with these technologies requires significant investment. The integration of advanced technologies like AI, real-time data analytics, and automation into drilling operations can be costly, and there is also a skills gap in the workforce to manage these advanced technologies.

- Geopolitical and Economic Uncertainty: Global geopolitical tensions and economic uncertainties can disrupt mining operations and affect the global supply chains. This uncertainty can deter investment in new mining projects and affect the demand for drilling services.

- Operational Challenges in Remote Locations: Mining often takes place in remote and difficult-to-access locations, which poses logistical challenges. Transporting heavy drilling equipment and personnel to and from these sites can be costly and time-consuming.

Market Growth Opportunities

- Technological Advancements: There is a significant push towards the incorporation of new technologies such as automation, real-time data analytics, and artificial intelligence. These technologies are enhancing drilling accuracy, efficiency, and safety, making operations more cost-effective and less labor-intensive. The integration of these advanced technologies not only streamlines operations but also opens up new market opportunities for service providers who are willing to invest in innovation.

- Increasing Demand for Minerals: As global economies grow and develop, the demand for industrial minerals, precious metals, and basic metals continues to rise. This demand fuels the need for expanded mining operations and, by extension, drilling services. The search for new and deeper mineral deposits as existing reserves deplete is driving this demand, highlighting opportunities in exploration and extraction.

- Exploration in Remote and Challenging Areas: The depletion of easily accessible mineral reserves is pushing mining operations into more remote and geographically challenging areas. This shift demands sophisticated drilling services capable of operating in tough conditions, thus opening markets for specialized service providers. Companies equipped to handle these challenges are likely to find lucrative opportunities.

- Regional Market Growth: The Asia Pacific region, in particular, is experiencing robust growth due to its rich mineral resources and significant contributions to the regional economies. Countries like China, Australia, and India are leading in mining activities, which enhances the demand for drilling services in these areas. These regions’ focus on advancing mining infrastructure and exploration projects presents substantial growth prospects for the mining drilling services industry.

- Environmental and Sustainability Focus: There is a growing emphasis on sustainable and environmentally friendly drilling solutions. As the global focus on environmental impact deepens, opportunities arise for companies that can provide innovative, less invasive drilling technologies that minimize ecological disruption and adhere to stricter environmental regulations.

Key Players Analysis

Aban Offshore has been actively engaged in offshore drilling and production services, primarily focusing on the oil and gas sectors both in India and internationally. In recent years, they have operated various offshore drilling rigs, jack-up rigs, semi-submersible rigs, drill ships, and floating production units. Aban Offshore’s revenue showed a growth from 4.32 billion in 2022 to 4.42 billion in 2023, although the company faced challenges, marked by a significant increase in losses from the previous year.

Action Drill & Blast is known for its specialized services in drill and blast operations across the mining sector. The company offers comprehensive drilling and blasting services, which are crucial in the extraction of minerals. They operate with a focus on maximizing efficiency and safety, employing advanced technology and extensive expertise to manage complex blasting operations in mining environments. The specifics of their recent activities, including any significant projects or technological advancements, would require more detailed financial and operational data from their reports or industry publications.

In 2023, Atlas Copco celebrated a record-breaking year with unprecedented orders, revenues, and operating profits. This milestone was marked by significant advancements and contributions across its various business sectors, including mining drilling services. The company’s commitment to innovation and sustainable practices played a crucial role in achieving these outcomes, reinforcing its position as a leader in the industry.

Ausdrill, a renowned mining services company, continues to provide comprehensive drilling solutions across the mining sector. Specializing in drill and blast operations, Ausdrill supports numerous mining projects with a strong focus on efficiency and safety. The company’s expertise in handling complex mining conditions and its application of advanced technology ensure reliable and effective service delivery in the drilling sector. For more detailed updates on their recent activities or achievements, one would need to review their latest reports or official publications.

In 2023, Boart Longyear reported a year of growth in the mining drilling services sector, with revenue increasing by 1.2% over the previous year. This growth was driven by strong performances in their Drilling Services division, particularly in Latin America and the United States. Despite some challenges in the exploration tooling market due to a weak financing environment for junior mining companies, the company saw significant growth in specific product lines like TruScan and TruGyro. Their adjusted EBITDA also rose by 3.4%, reflecting effective cost controls and gains in price and volume within their Drilling Services.

Byrnecut Group has consistently demonstrated its prowess in the mining drilling services sector, notably through a series of comprehensive and technologically advanced underground mining projects across global locations. In 2023, Byrnecut continued to manage significant projects such as the Riverina and Kathleen Valley in Australia, emphasizing their capability in handling complex mining operations under varying geological conditions. Their work involves extensive services ranging from decline and lateral development to raise and box-hole drilling, showcasing their adaptability and commitment to safety and efficiency in mining operations.

In 2023, Dando Drilling International launched its innovative Infinity Range of drilling rigs. This new line features a modular and scalable design, allowing for flexibility in customization to meet specific client needs across mineral exploration, water well, and geotechnical drilling sectors. This approach not only speeds up the manufacturing process but also enhances rig safety and reduces environmental impacts. The Infinity Range reflects Dando’s adaptation to market demands, offering rigs that are both versatile and cost-efficient, capitalizing on the company’s long-standing engineering expertise to set new industry standards.

DDH1 Drilling, on the other hand, has not been specifically highlighted in the latest detailed updates for 2023 or 2024 in the resources reviewed. For precise and current information about DDH1 Drilling’s operations, activities, or financial performance, direct insights from the company’s reports or official communications would be required. This method ensures the most accurate and up-to-date representation of the company’s standing and developments in the mining drilling services sector.

In 2023 and 2024, Epiroc showcased its commitment to advancing the mining industry by introducing new digitalized and electrified technologies at the MINExpo 2024. This includes battery-electric drill rigs and large-capacity mine trucks with electric drivelines, reflecting Epiroc’s focus on sustainable mining solutions. The company reported a robust increase in orders and revenues, driven by strong demand in the mining sector, while construction-related demand remained weak. Epiroc’s strategic acquisitions, like ASI Mining, further bolstered its capabilities, particularly in automated mining equipment.

In 2023 and 2024, Geodrill Limited, a leading West African-based drilling company, reported significant financial and operational activities. Throughout 2023, the company faced some challenges, including cyclical downturns in drilling programs and aging receivables which impacted its financial performance. Despite these hurdles, Geodrill remained optimistic about its long-term growth prospects, leveraging its extensive experience and operational efficiency to navigate market fluctuations. By the second quarter of 2024, Geodrill achieved record revenues, driven by long-term contracts, underscoring the success of its strategic growth initiatives and robust demand for its services. The company continues to expand its geographical footprint, operating in regions such as Ghana, Cote d’Ivoire, Egypt, Mali, Senegal, and entering South American markets like Chile and Peru.

In 2023 and 2024, Helmerich & Payne, a prominent player in the drilling services sector, reported significant financial growth and strategic advancements. The company, renowned for its extensive fleet of super-spec rigs, focused on performance-based contracts and technological advancements to boost efficiency and reduce well costs. In fiscal 2024, they continued to innovate within their fleet, integrating more technology and improving operational efficiencies to enhance their service offerings. The focus remained on North American markets while also expanding their global footprint, particularly through new rig contracts and operations in strategic international markets.

In 2023 and 2024, Layne Christensen Company, operating as a subsidiary under Granite Construction, continued to offer advanced mineral and water drilling services across North and South America. Their focus on safety, technology, and environmental responsibility has maintained their reputation as a leader in providing high-quality mineral exploration services. Recent innovations include the development of the Automated Rod Manipulator for safer and more efficient drilling operations. As a part of Granite, Layne has expanded its service offerings, continuing its long history of excellence in the drilling industry.

Major Drilling Group International, known for its specialized drilling services, has been actively expanding its market presence through strategic acquisitions and leveraging technological advancements. In 2023, the company’s focus on enhancing operational efficiency and expanding its technological capabilities was evident through their acquisition of McKay Drilling. This acquisition is part of Major Drilling’s strategy to strengthen its service offerings and enhance its competitive edge in the market.

In 2023, NRW Holdings achieved record financial results amidst challenging conditions, such as cost inflation and labor shortages. The company expanded its capabilities across mining, civil, and technologies sectors, further diversifying its operations to better handle fluctuating market conditions. Significant contracts included a $1.6 billion mining services agreement, contributing to a substantial order book that positions NRW for continued growth in 2024. Their commitment to sustainability and safety remained strong, highlighted by their efforts to reduce the environmental impact of their operations.

In 2023 and 2024, Orica Mining Services has focused significantly on digital advancements and innovative technologies in the mining sector. They launched the Next Gen SHOTPlus™, a state-of-the-art software that enhances drill and blast operations with predictive modeling and intelligent blast design capabilities, highlighting their leadership in digital solutions for mining. This technology allows for more precise and efficient resource mobilization, which aligns with Orica’s strategic focus on sustainability and safety improvements in mining practices.

Perenti Group has been actively involved in mining drilling services, emphasizing their robust capabilities in underground and surface mining. They are recognized for their extensive expertise and strategic operations that focus on efficiency and sustainable practices. Their approach includes a strong emphasis on technological integration and operational excellence, ensuring they remain competitive and relevant in the dynamic mining industry.

In 2023, PT United Tractors Tbk (UT) experienced a year of robust financial performance, managing to increase its net revenue by 4% to Rp128.6 trillion compared to the previous year. Their Mining Contracting segment, operated through PT Pamapersada Nusantara (PAMA), was particularly notable, achieving a 14% revenue increase to Rp54.0 trillion.

This growth was supported by an 11% rise in coal production and a significant 21% increase in overburden removal volume. Despite challenges in the gold mining segment, which saw a revenue decrease due to lower gold sales, UT’s overall market presence remained strong due to its diversified operations across multiple segments, including construction machinery and energy.

Sandvik, another key player in the mining drilling services market, has not been specifically detailed in the latest data I accessed. For the most current and detailed information regarding their operations and financial performance, I recommend reviewing the latest reports directly from Sandvik or industry-specific publications. This will ensure the most accurate representation of their role and developments within the mining drilling services sector.

Conclusion

The mining drilling services market is on a robust growth trajectory, driven by the increasing demand for minerals and technological advancements in drilling techniques. The shift towards automation, artificial intelligence, and real-time data analytics is revolutionizing the industry, enhancing operational efficiencies and safety.

Regions like Asia Pacific are leading this growth due to significant mining activities and rich mineral reserves, which are pivotal for the economies of countries like China, Australia, and India. Furthermore, the push towards sustainable and environmentally friendly drilling operations aligns with global efforts to reduce ecological impacts, presenting additional opportunities for innovation and development in the sector. As the market continues to evolve, mining drilling services are set to play a critical role in the global mining industry’s response to the increasing demand for resources essential for modern technologies and infrastructure.