Table of Contents

Introduction

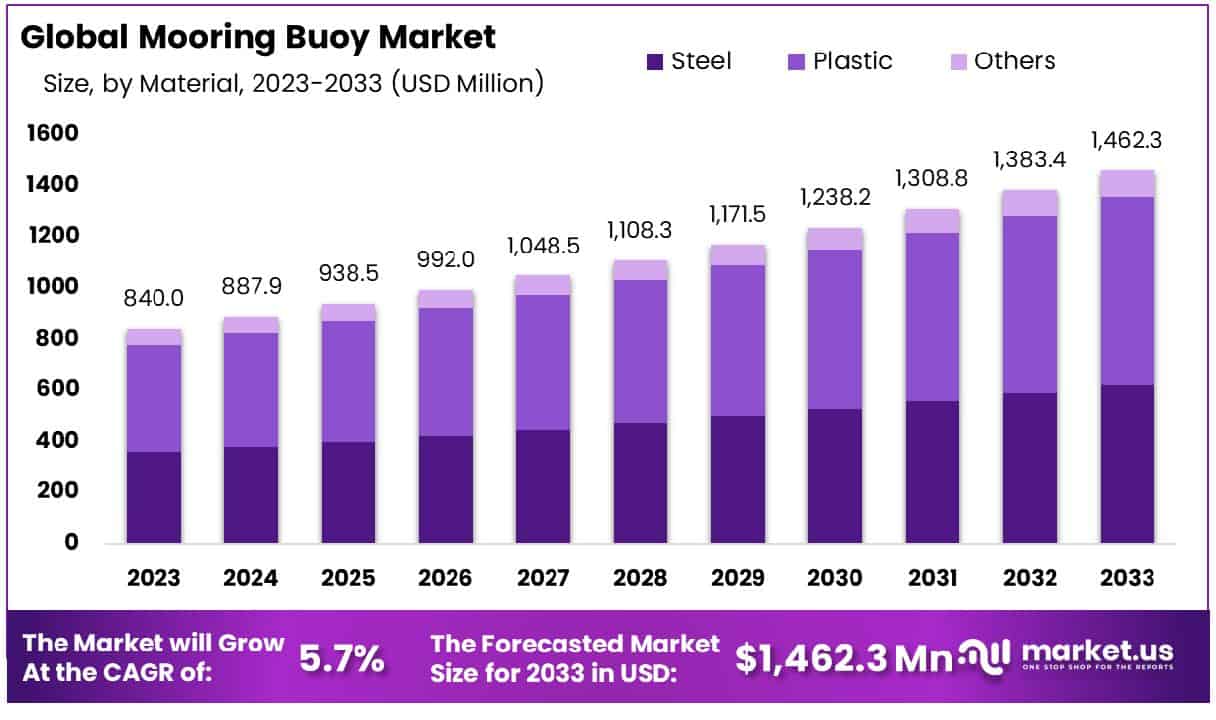

The global Mooring Buoy Market is poised for significant growth, projected to escalate from USD 840.0 million in 2023 to USD 1,462.3 million by 2033, achieving a CAGR of 5.7% over the forecast period. This expansion is underpinned by the intensifying maritime traffic and the expansion of offshore oil and gas exploration activities. The Asia Pacific region, in particular, is a major contributor to this growth, holding a dominant market share due to high demand across various end-user sectors like oil & gas and marine & defense.

Recent technological advancements and rising investments in eco-friendly and durable mooring systems, especially for offshore wind farms, are driving the market forward. However, challenges such as the high initial costs associated with installation and maintenance, along with stringent environmental regulations, pose constraints to market growth. These regulations are particularly stringent in areas close to sensitive marine habitats, where mooring activities may impact local ecosystems.

Trelleborg Marine Systems has been proactive in expanding its product portfolio to include advanced mooring solutions, catering specifically to the oil and gas sector. This strategic focus is aimed at consolidating its position in high-demand regions such as Asia Pacific, which is the dominant region in the global market due to the extensive deployment of mooring buoys in various end-user sectors.

Eval Marine and Steinsvik have been involved in technological innovations and have expanded their reach by ensuring compliance with regional regulations and adapting to the local market demands. Their efforts are geared towards enhancing operational efficiency and catering to the specific needs of the marine and defense sectors, which are significant segments within the market.

Fendercare Marine has continued to invest in new technologies and expand its global footprint. This includes strategic initiatives to enhance their service offerings across diverse geographic locations, with a particular focus on regions with growing industrial activities such as North America and Europe.

Key Takeaways

- Market Growth: The Global Mooring Buoy Market is projected to grow from USD 840.0 Million in 2023 to USD 1,462.3 Million by 2033, at a CAGR of 5.7%.

- Asia Pacific holds 44.1% of the mooring buoy market, valued at USD 370.4 million.

- By Material: Plastic materials dominate marine buoy production, comprising 50.4% of the materials used.

- By Location: Coastal areas are the preferred location for deploying marine buoys.

- By Senser Integration: Sensor-integrated buoys account for 55.4% of all marine buoy types.

- By End-Use: The oil & gas sector represents the largest end-user of buoys, comprising 58.4% of usage.

Mooring Buoy Statistics

- Moored buoys are normally relatively large and expensive platforms. They can vary from a few meters in height and breadth to over 12 meters.

- Measurements from the mooring include surface variables (wind, air, and sea surface temperature, salinity, air pressure), as well as subsurface temperatures down to a depth of 500 plus meters.

- Drifting buoys are generally attached to some form of drogue or sea anchor, are easy to deploy, are relatively inexpensive to operate, and reliably measure the atmosphere and ocean surface conditions, for an average of 18 months.

- Ice buoys are equipped with low-temperature electronics and lithium batteries that can operate at temperatures down to -50°C.

- NDBC submits hourly TAO Refresh data onto the GTS under the SSVX08 KWNB header in World Meteorological Organization (WMO) FM18-BUOY alphanumeric format and also in BUFR format under header ISSD/G08.

- According to a recent study by the United Nations, more than 60% of the total global population will be residing in urban areas by the end of 2050, which will spike energy demand and lead to an increase in offshore exploration activities, driving up the demand for mooring buoys.

- Global aquaculture production has increased by 527% from 1990 to 2018, and global food fish consumption has increased by 122% in the same period. This trend is expected to continue, leading to increased deployment of mooring buoys for navigation and safety in the aquaculture industry.

- The buoy carries approximately 15 to 20 kilograms of load, and it sustains three (3) solar panels and a 12-V battery. This device has a long battery life and uses idle mode between continuous samples to conserve power.

- The scientific design for the global surface drifting buoy array originally called for 1250 buoys to be maintained worldwide in order to calibrate Sea Surface Temperature satellite data.

- Datawell Directional WaveRider Mk III buoy was redeployed on 26 February 2021, at which time the magnetic declination at the site was 0.63° east, changing by 0.19° east per year. Wave direction is reported following the nautical convention, meaning that the direction is where the waves come from, measured clockwise from magnetic north.

- The U.S. Department of Energy (DOE), along with NOAA, announced a $3 million prize competition to generate innovation in marine energy-powered ocean observing platforms.

Emerging Trends

- Technological Advancements: Significant drivers in the mooring buoy market include technological innovations. The integration of the Internet of Things (IoT) and sensor technologies is enhancing operational efficiency by enabling real-time monitoring and data collection. This trend is increasingly prevalent, with manufacturers focusing on smart and connected buoy systems that offer improved performance and reliability.

- Material Innovations: An increasing emphasis on using eco-friendly materials in buoy manufacturing is observed, aiming to reduce environmental impact. High-performance alloys and composites are being developed to enhance the strength and durability of mooring buoys, making them more suitable for challenging marine environments.

- Geographical Expansion: Considerable growth in the market is witnessed in regions such as Europe and North America, driven by increasing investments in offshore wind energy and the offshore oil and gas sector. Additionally, regions such as Latin America and the Middle East & Africa are also showing significant interest due to their expanding offshore industries.

- Strategic Market Initiatives: Key players in the market are engaging in strategic initiatives such as new product developments, partnerships, and acquisitions to enhance their market presence. Notable companies like Sealite and Gisman are leading with a broad product portfolio and strong brand stability.

- Market Challenges: Despite the growth, the market faces challenges such as high initial investment costs and technical limitations in extreme environments. Moreover, environmental concerns related to the disposal of old buoys and intense competition among manufacturers pose further challenges.

Use Cases

- Maritime Shipping and Tankers: Mooring buoys are extensively used in the shipping industry, especially for single-point mooring (SPM) systems. These systems are crucial for the transfer of oil and gas from tankers at offshore locations, minimizing the need for extended pier structures. The buoys allow tankers to moor offshore and facilitate the direct transfer of cargo to pipelines on the seabed, which is particularly important for very large crude carriers (VLCCs) that require deep water and significant maneuvering space.

- Recreational Boating and Marinas: For recreational marinas, mooring buoys provide a simple and quick method for boaters to secure their vessels, especially in busy or congested areas. This system enhances safety by reducing the risk of anchor-related accidents and preventing damage to sensitive underwater habitats.

- Environmental Research and Monitoring: In oceanographic research, mooring buoys are used to support instrumentation for monitoring environmental conditions such as water velocity, salinity, and temperature. These buoys can be equipped with various sensors and are anchored in strategic locations to collect long-term data sets.

- Diving and Marine Conservation: Mooring buoys are also significant in marine conservation efforts, particularly in protected areas. They help to prevent anchor damage to coral reefs and other sensitive ecosystems by providing divers and boats with fixed points to moor, thus avoiding the need to drop anchors that could disrupt the marine environment.

- Operational Efficiency: The use of mooring buoys speeds up the process of docking and undocking, particularly for large vessels that would otherwise require more complex and time-consuming mooring procedures. This efficiency is vital in high-traffic areas and contributes to smoother logistical operations.

- Safety and Reliability: Mooring buoys provide a stable and reliable point of attachment, reducing the likelihood of accidents associated with anchor drag and other common issues related to traditional anchoring methods. Regular inspections and maintenance ensure that these systems remain safe for all users.

Key Players Analysis

Trelleborg Marine Systems specializes in providing resilient mooring buoys that are designed for low maintenance and easy handling. Their buoys are noted for their durable construction, featuring a closed-cell polyethylene foam core that is thermo-laminated around a steel frame, ensuring flexibility and impact resistance. The foam core is protected by a high-performance elastomer skin, making the buoys self-fendering and capable of retaining buoyancy even if the outer skin is punctured. These features make Trelleborg’s mooring buoys a preferred choice in modern marine applications, offering a reliable and efficient solution for temporary and remote mooring needs.

Eval Marine focuses on the production of mooring buoys particularly suited for terminal applications. Their mooring buoys, such as the model 00761, are crafted from blow-pressed polyethylene, ensuring durability and effectiveness in marine environments. These buoys are characterized by a biconical shape with a polyurethane foam interior, designed to offer stability and reliability for mooring operations at terminals. Eval’s approach to mooring solutions reflects a commitment to quality and functionality in marine equipment, catering to essential mooring needs with precision-engineered products.

Steinsvik, a seasoned player in the aquaculture industry, has extended its expertise into the mooring buoy sector, particularly through its advanced aquaculture mooring solutions. Their products, including robust mooring plates designed to withstand significant maritime forces, highlight their commitment to durable and reliable aquaculture infrastructure. Steinsvik’s focus on customer-centric developments and rigorous R&D efforts underscores its reputation in both aquaculture and maritime industries.

Fendercare Marine, on the other hand, has established itself in the mooring buoy sector by offering a wide range of marine equipment that includes advanced mooring solutions. Their expertise spans the provision of mooring buoys, which are integral for securing marine vessels safely. Known for their commitment to safety and reliability, Fendercare provides comprehensive services that support maritime operations globally, ensuring that they meet the stringent demands of the marine industry.

Evergreen Maritime, a leading entity in the mooring buoy sector, specializes in manufacturing a broad range of buoys, including Anchor Pendant Buoys, suitable for various marine applications. These buoys are known for their robust construction, featuring resilient PE foam laminated around a central steel member, enhancing durability and functionality. They are offered in various configurations, both standard and customized, to meet specific industry needs, such as differing water depths and conditions.

Almarin is engaged in the design, manufacture, and supply of mooring buoys, specializing in aids to navigation for marine applications. Their offerings include the A700 mooring buoy, which is notable for its adaptability to various marine conditions, constructed from rotomolded polyethylene and capable of being fitted with internal metallic structures for enhanced functionality. The B1250M and B1600M models are specifically designed for terminal applications, highlighting Almarin’s focus on durable materials like polyethylene and galvanized steel, ensuring reliability and longevity in harsh maritime environments.

BW Offshore is a prominent provider of floating production services to the offshore oil and gas industry, focusing extensively on floating production storage and offloading (FPSO) units. The company boasts a robust portfolio in engineering, procurement, construction, installation, and operation of FPSOs, complemented by extensive experience and technical competence. Particularly, BW Offshore specializes in advanced mooring systems like the Submerged Turret Production (STP) buoy, a technology that has seen widespread adoption for its reliability in deepwater anchoring of FPSOs.

Petróleo Brasileiro S.A., commonly known as Petrobras, is actively engaged in the mooring buoy sector through its deployment of the FPSO Guanabara MV31. This Floating Production Storage and Offloading (FPSO) unit operates in the Mero field of Brazil’s Santos Basin, featuring advanced spread mooring systems designed by SOFEC. Capable of processing significant amounts of crude oil and gas daily, this FPSO highlights Petrobras’s capability to manage extensive offshore oil production and storage operations under challenging conditions.

Bumi Armada Berhad, a Malaysian-based international offshore energy facilities and services provider operates in the mooring buoy sector. They focus on the engineering, procurement, construction, installation, and operation of FPSO units. Similar to Petrobras, Bumi Armada utilizes mooring systems to anchor their FPSOs at strategic offshore production sites, enhancing their ability to manage and process hydrocarbons effectively in various water depths.

Yinson Holdings Berhad excels in the mooring buoy sector through its comprehensive management of Floating Production Storage and Offloading (FPSO) units. Yinson employs a robust model encompassing the design, construction, ownership, leasing, and operational management of FPSO units. These specialized vessels are instrumental in offshore oil and gas production, processing hydrocarbons directly at the source before storage and eventual offloading. This strategic approach allows Yinson to effectively serve as an integral production partner to major oil producers, facilitating the efficient extraction and processing of underwater hydrocarbons.

Altera Infrastructure has a significant presence in the mooring buoy sector, focusing on the operation of FPSO units. These units are central to Altera’s service offerings, which include the management of complex mooring systems that anchor these floating production facilities in place, crucial for stable and efficient hydrocarbon processing at sea. The company’s expertise in managing such assets underlines its capability to support the energy sector’s needs for extracting and processing oil and gas from offshore fields.

Bluewater Energy Services has established itself as a leader in the mooring buoy sector, particularly excelling in the design and delivery of Catenary Anchor Leg Mooring (CALM) buoy systems. Over the past four decades, the company has refined its technology to support both offshore and nearshore operations, offering a range of buoys that cater to various needs, from deepwater operations to complex environments like ice-infested waters. These systems are not only robust and reliable but also designed for flexibility and minimal maintenance, accommodating multiple product transfers including hydrocarbons and liquefied petroleum gases.

Century Energy Services Ltd. (CESL) has significantly bolstered its position in Nigeria’s energy sector by expertly managing the mooring of the Floating Storage and Offloading (FSO) unit ELI Akaso. This FSO, capable of storing up to 2 million barrels of oil, is a pivotal component in CESL’s strategy to optimize hydrocarbon evacuation, storage, and offtake processes. The operation showcases CESL’s commitment to enhancing infrastructure to meet the increasing demands of the oil and gas industry. This initiative not only addresses the logistical challenges faced by local oil producers but also sets a benchmark for future infrastructural developments within the sector.

MTC Engineering, recognized for its innovative engineering solutions, has recently expanded its operations into the mooring buoy sector. Notably, the company was awarded a significant contract by Petron Malaysia for the fabrication and installation of PLEM and subsea marine equipment, including a Single Point Mooring (SPM) buoy. This project underscores MTC Engineering’s capability in handling complex marine and subsea installations, marking a key milestone in their extension into maritime infrastructure necessary for energy and marine sectors.

Conclusion

The mooring buoy market is set to expand significantly, driven by increased demand in the offshore oil and gas sectors and rising investments in naval defense, particularly in North America. Europe is also showing growth, fueled by investments in offshore wind energy, aiming to meet green energy targets.

Additionally, the Asia-Pacific region is poised to dominate the market, spurred by increasing industrial activities and the development of port infrastructure, which is boosting the demand for mooring buoys. Key players in the market are focusing on innovations and technological advancements to meet the growing needs of this industry

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)