Table of Contents

Introduction

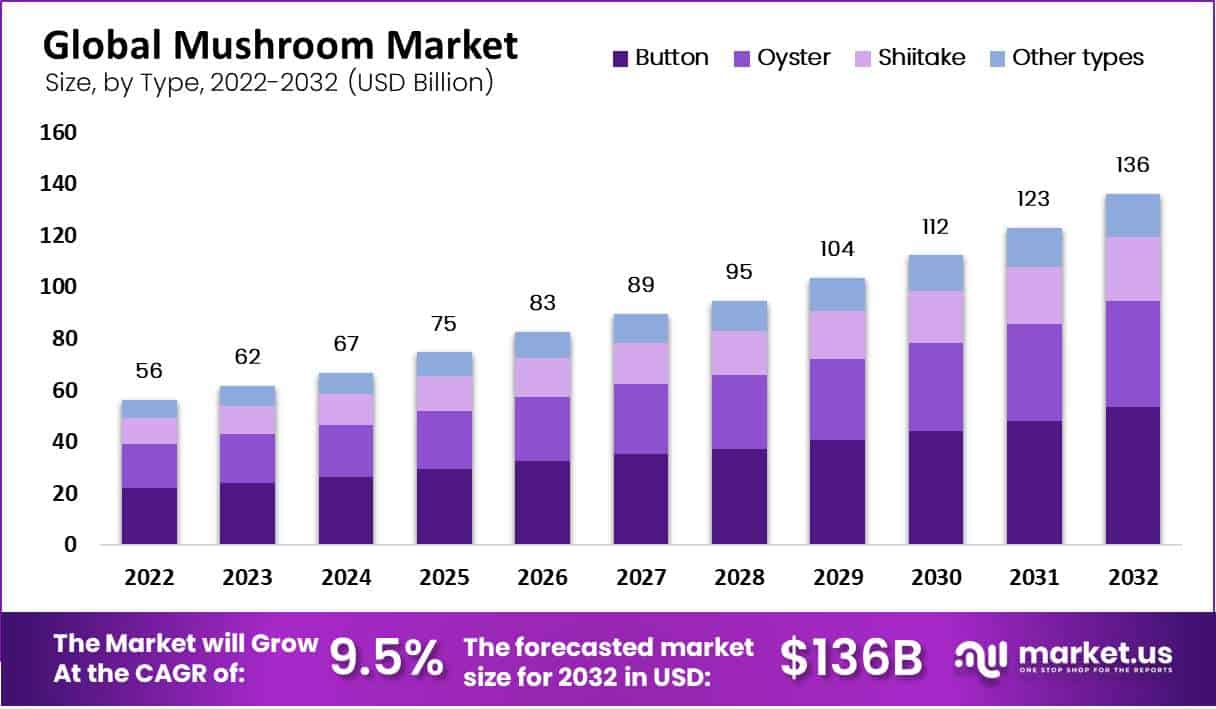

The global mushroom market is poised for significant growth, with market size projections reaching approximately USD 136 billion by 2032, up from USD 56 billion in 2022, reflecting a compound annual growth rate (CAGR) of 9.5% during the forecast period from 2022 to 2032.

Several factors are driving this robust expansion. The increasing popularity of mushrooms as a nutritious and versatile food source is a primary growth driver. Mushrooms are widely recognized for their health benefits, including high protein content and low-calorie count, making them an attractive option for health-conscious consumers and those following plant-based diets. The rising vegan population, especially in regions like North America and Europe, further fuels demand, as mushrooms serve as a key ingredient in vegan and vegetarian diets.

Technological advancements in mushroom cultivation and processing also play a crucial role. Investments in automation and sustainable cultivation practices have enhanced production efficiency and reduced costs, enabling higher yields and better-quality mushrooms. Innovations in packaging, such as modified atmosphere packaging, have addressed the challenge of mushrooms’ short shelf life, extending their freshness and appeal in the market.

Recent developments in the market include the rising demand for functional and medicinal mushrooms, driven by their purported health benefits. Regions such as Asia Pacific, with a rich heritage of using mushrooms in traditional medicine, are expected to dominate the market, holding a substantial share of 40% during the forecast period. Moreover, strategic collaborations and global expansion efforts by key players are shaping the competitive landscape, as companies seek to tap into emerging markets and broaden their consumer base.

Costa Group, with its extensive production network and strategic acquisitions, is well-positioned for global expansion. The recent acquisition by a consortium will likely enhance their operational capacity and market reach. Their focus on product innovation, particularly in blueberries, indicates a strong commitment to growth.

Drinkwater Mushrooms’ investments in sustainable cultivation and advanced production technologies position them as a forward-thinking player. Their efforts to form strategic partnerships are expected to bolster their market presence and distribution capabilities. Bonduelle Group’s expansion into mushroom products aligns with the growing consumer demand for plant-based and functional foods. Their continuous product innovation and new launches are key drivers of their market strategy, making them a significant player in the mushroom market.

CMP Mushroom’s focus on research and development, coupled with investments in smart automation, positions it as a leader in innovation within the market. Their efforts to enhance production efficiency and reduce costs are crucial for sustaining their competitive edge. Monterey Mushroom, Inc.’s strategic collaborations and focus on health-focused product development are capitalizing on the rising trend of functional foods. Their innovative approach to product offerings helps them maintain relevance in the dynamic market landscape.

Global Mushroom Production Statistics

- Estimated world mushroom production in 2018-19 was 43 million tonnes (MT).

- Major contributors to global production: Lentinula edodes (26%), Auricularia spp (21%), Pleurotus ostreatus (16%), Agaricus bisporus (11%).

- Flammulina velutipes account for 7%, P. eryngii for 5%, Volvariella volvacea for 1%, and others for 13%.

- The present world production of mushrooms is around 3.5 million tonnes according to FAO statistics.

- Global mushroom production as per FAO Statistics was estimated at 2.18 to 3.41 million tons over the last ten years (1997-2007).

Regional Production Data Statistics

- China, Japan, and India together account for over 97% of Asia’s mushroom production.

- The share of China in global mushroom production is 46%, which is about half of the world’s production.

- According to current Indian estimates, the mushroom production of India is about 1 lakh metric tons, which is about 3% of the world’s mushroom production.

- FAOSTAT mushroom production values for South Korea for 2019 are only 12% of the total mushroom production reported.

- The European Union’s mushroom production is about 27% of the world’s production.

Specialized Mushroom Data Statistics

- The mushroom export in China accounts for less than 5% of its total domestic production, with about half of it going to Asian countries.

- Hawaii’s producers primarily grow Oysters (57%), Agaricus species (15%), Shiitake (14%), and other specialty mushrooms (14%).

- The growth of Flammulina velutipes is sigmoid, and production seems to be stabilizing around 2.6 MT.

- Growth of Agaricus bisporus from 2007 to 2014 was around 2.4 million tonnes.

- Even today, button mushrooms contribute 98% of the total mushroom production of the USA.

Emerging Trends

Health and Wellness Focus: Mushrooms are increasingly recognized for their health benefits, including immune-boosting properties, cognitive enhancement, and nutritional value. Varieties like Lion’s Mane and Shiitake are particularly popular for their cognitive and immune-supporting effects.

Sustainable and Organic Cultivation: There is a growing trend towards organic mushroom farming as consumers become more aware of the health implications of pesticides and chemicals used in conventional agriculture. Sustainable farming practices are being adopted to meet this demand

Innovations in cultivation techniques, including controlled environment farming and genetic engineering, are improving production efficiency and expanding the variety of mushroom species available year-round.

Culinary Innovation: Mushrooms are being embraced as a versatile ingredient in a wide range of culinary applications. They are used as meat alternatives in dishes like mushroom-based burgers and steaks, appealing to both vegetarians and health-conscious consumers.

Growth of Online Retail: The online stores segment has seen significant growth, providing consumers with a convenient way to purchase fresh and packaged mushroom products. This trend is driven by promotional offers, customer reviews, and the ease of home delivery.

Increasing Popularity of Functional Foods: Mushrooms are being incorporated into various functional foods and supplements, catering to the growing demand for foods that offer health benefits beyond basic nutrition. Products like mushroom powders, extracts, and capsules are becoming more common in the market.

Rising Demand in the Food Service Sector: The food service sector, including restaurants and catering services, is a significant market for mushrooms. Chefs are increasingly using mushrooms to add depth and richness to their dishes, reflecting the growing consumer interest in diverse and healthful culinary experiences.

Technological Advancements: Advances in mushroom cultivation technology, such as smart automation and innovative packaging solutions, are helping to enhance production efficiency and extend the shelf life of fresh mushrooms. These technologies are crucial for meeting the rising demand and maintaining product quality.

Use Cases

Culinary Applications: Mushrooms are a staple in many cuisines worldwide due to their versatility and rich flavor profiles. They are commonly used in dishes such as soups, stir-fries, pizzas, and salads. For example, shiitake mushrooms are popular in Asian cuisine for their robust flavor, while button mushrooms are widely used in Western dishes for their mild taste and adaptability. According to a report by the Mushroom Council, the use of mushrooms in main meals has increased by 12% year-on-year from 2018 to 2023.

Meat Alternatives: Mushrooms are increasingly used as a meat substitute in various dishes, catering to the growing vegan and vegetarian population. Varieties like portobello and king oyster mushrooms are known for their meaty texture and are used in dishes such as mushroom burgers, steaks, and “pulled pork” sandwiches. This trend aligns with the rising demand for plant-based foods, which is expected to grow significantly as more consumers seek sustainable and health-conscious options.

Functional Foods: Mushrooms are recognized for their health benefits and incorporated into functional foods to enhance health and wellness. For instance, lion’s mane mushrooms are known for their cognitive benefits and are used in supplements and nootropic products. Similarly, reishi mushrooms are valued for their immune-boosting properties and are included in various health supplements. The use of mushrooms in functional foods is projected to grow as consumers increasingly seek natural health solutions.

Nutraceuticals: The nutraceutical industry utilizes mushrooms for their rich nutritional content, including vitamins, minerals, and antioxidants. Cordyceps mushrooms, for example, are used in supplements to enhance energy and athletic performance, while turkey tail mushrooms are recognized for their immune-stimulating and anticancer properties. This use case is particularly significant as the global nutraceutical market continues to expand.

Cosmetics and Skincare: Mushrooms are increasingly being used in the cosmetics and skincare industry due to their beneficial properties. Extracts from mushrooms like reishi and tremella are incorporated into skincare products for their anti-aging, moisturizing, and anti-inflammatory effects. The demand for natural and organic skincare products is growing, and mushrooms are becoming a key ingredient in this sector.

Environmental Sustainability: Mushroom cultivation is considered environmentally sustainable as it requires less land and water compared to traditional livestock farming. Additionally, mushrooms can be grown on agricultural waste products, contributing to waste reduction and sustainable farming practices. This aligns with the increasing consumer preference for eco-friendly and sustainable products.

Key Players Analysis

Costa Group is Australia’s largest supplier of mushrooms, producing a variety of white and brown Agaricus mushrooms. Their operations include state-of-the-art facilities in Mernda, Victoria; Monarto, South Australia; and Casuarina, Western Australia. Costa’s vertically integrated approach ensures control over the entire production process, delivering fresh mushrooms within 24 hours of harvest. The company’s recent $60 million expansion in Monarto aims to double production capacity and create 200 new jobs, further solidifying their market leadership in sustainable and quality mushroom farming.

Drinkwater Mushrooms, a family-run business founded in 1969, produces high-quality white and chestnut mushrooms in rural north Lancashire. The company supplies leading UK supermarkets and emphasizes sustainable practices by incorporating solar power to reduce its carbon footprint. Under Kenny Drinkwater’s leadership, the company continues to prioritize quality and local production, ensuring that its mushrooms meet high standards while maintaining a strong commitment to sustainability and innovation.

Bonduelle Group is a prominent player in the mushroom sector, primarily through its 50% stake in Coopérative Agricole France Champignon. Despite facing challenges due to market overcapacity and competition from cheaper producers, Bonduelle continues to support the co-op, focusing on promoting the French origin of its mushrooms and maintaining quality. The group markets these mushrooms through private-label contracts, emphasizing sustainable and high-quality production standards to meet European consumer demand.

CMP Mushroom focuses on producing high-quality mushrooms, leveraging advanced cultivation techniques and sustainable practices. The company is dedicated to innovation in mushroom farming, aiming to increase yield and improve efficiency. CMP Mushroom also emphasizes the importance of quality control throughout its production process, ensuring that their mushrooms meet the highest standards for consumers. They continually explore new markets and expand their distribution networks to enhance their market presence.

Monterey Mushrooms, Inc., founded in 1971 and headquartered in Watsonville, California, is a leading vertically integrated producer of mushrooms. The company operates across eight growing sites in North America, supplying over 200 million pounds of mushrooms annually. Despite recent challenges such as the pandemic and inflation, Monterey Mushrooms continues to innovate, recently enhancing the recyclability of its packaging with near-infrared sortable rPET materials. This move reflects their commitment to sustainability and reducing environmental impact.

Greenyard is a significant player in the mushroom industry, focusing on sustainable production and advanced cultivation technologies. The company enhances its supply chain by acquiring Mykogen Polska S.A., a leading manufacturer of mushroom substrates. This acquisition, valued at €93 million, supports Greenyard’s strategic goals by improving its connection with mushroom growers and expanding its market presence in Central and Eastern Europe. Greenyard’s investments reflect its commitment to high-quality and sustainable mushroom production.

The Mushroom Company, a processing facility located in Cambridge, Maryland, has been a leading producer of high-quality mushrooms since 1931. They offer a wide range of products, including canned, frozen, roasted, and seasoned mushrooms. The company partners with South Mill Champs to ensure top-tier product quality and innovation. They cater to various markets with custom-cut, packed items, private-label solutions, and in-house product development, emphasizing food safety and sustainability throughout their processes.

Monaghan Group is one of the largest mushroom producers globally, headquartered in Ireland. They focus on sustainable cultivation practices and innovative growing techniques to ensure high yields and top-quality produce. The company supplies fresh mushrooms to major retailers across Europe and North America, emphasizing eco-friendly practices and state-of-the-art technology in their operations. Monaghan Group’s commitment to quality and sustainability has solidified its position as a leader in the mushroom industry.

Shanghai Fengke Biological Technology Co., Ltd. is a leading producer of rare edible and medicinal fungi in China. The company operates large-scale production facilities in Shanghai, Qingdao, Hebei, and Chengdu, focusing on innovative and sustainable mushroom cultivation techniques. Known for products such as crab-flavored and white jade mushrooms, Fengke has earned numerous certifications, including global GAP and ISO9001. Their strategic expansion plans include building new factories in the United States to enhance their global presence and production capacity.

OKECHAMP S.A., headquartered in Poland, is a leading producer and processor of mushrooms in Europe. The company operates across various segments of the mushroom business, including substrate production, fresh mushroom cultivation, and processing into canned, frozen, and powdered forms. OKECHAMP emphasizes sustainability and innovation, utilizing advanced cultivation techniques. They recently completed a significant sale and leaseback transaction for their facility in Velden, the Netherlands, ensuring long-term operational stability and continued market leadership.

Conclusion

The mushroom market is experiencing significant growth, driven by increasing consumer demand for sustainable and nutritious food options. Mushrooms, known for their versatility, low environmental impact, and health benefits, are becoming a staple in various diets, particularly among vegetarians and vegans. Advancements in cultivation techniques and a growing focus on plant-based diets are further propelling the market. This expansion highlights the sector’s robust potential and the increasing consumer shift towards eco-friendly and healthy food choices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)