Table of Contents

Introduction

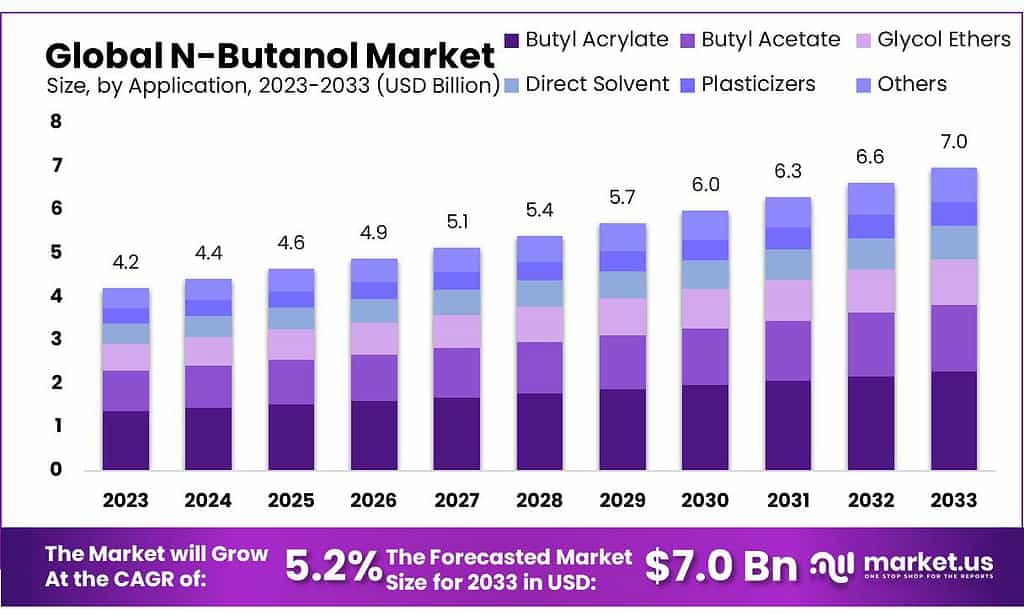

The global N-butanol market, valued at USD 4.2 billion in 2023, is projected to reach USD 7.0 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.2% during the forecast period. N-butanol, also known as normal butanol or n-butyl alcohol, is a four-carbon alcohol with versatile applications across various industries including chemicals, paints and coatings, pharmaceuticals, textiles, and plastics.

One of the primary drivers of market growth is the increasing demand for N-butanol in the production of butyl carboxylates, which are essential in manufacturing plasticizers, surfactants, and lubricant additives. These compounds enhance the flexibility, viscosity, and performance characteristics of various products such as adhesives, sealants, and personal care items. Additionally, N-butanol is extensively used as a solvent in the paints and coatings industry, contributing to improved adhesion, durability, and gloss of paints and varnishes. This segment is expected to maintain a significant share of the market, driven by robust growth in the construction and automotive industries.

Another key factor fueling the market expansion is the application of N-butanol as a fuel additive and lubricant. It is blended with gasoline to enhance octane ratings and reduce emissions, and its high boiling point and lubricity make it ideal for automotive lubricants and metalworking fluids. Furthermore, advancements in manufacturing processes and the shift towards bio-based N-butanol production to meet sustainability goals are expected to create new opportunities for market growth.

However, the N-butanol market faces several challenges. Fluctuating raw material prices and stringent environmental regulations pose significant hurdles. The production of N-butanol involves the hydroformylation of propene, a process sensitive to changes in the prices of feedstocks like propylene and natural gas. Additionally, regulatory policies aimed at reducing volatile organic compound (VOC) emissions impact the market, necessitating continuous innovations and compliance efforts from manufacturers.

Recent developments in the market include strategic partnerships and expansions by major players to strengthen their market presence and improve supply chain efficiencies. For instance, collaborations between companies like TASNEE and SABIC have enhanced the supply of N-butanol, thereby boosting its availability for downstream applications such as butyl acrylate production. Moreover, investments in research and development are focusing on improving the production processes and discovering new applications for N-butanol, further driving the market growth.

Key Takeaways

- Market Growth: The n-butanol market is to reach USD 7.0 billion by 2033, growing at 5.2% CAGR from USD 4.2 billion in 2023.

- Application Dominance: Butyl Acrylate leads with a 32.8% market share, crucial in coatings and adhesives, followed by Butyl Acetate.

- Production Processes: Oxyhydrogenation of Propylene dominates with a 60.3% market share, emphasizing efficiency in synthesis.

End-Use Sectors: Paints and Coatings sector holds over 35.4% market share, highlighting N-butanol’s importance. - Regional Analysis: Asia-Pacific dominates, with over 48.4% market share in 2023, driven by industrial growth and demand.

Butanol Uses and Applications Statistics

- A 50% solution of butanol in water has been used since the 20th century to retard the drying of fresh plaster in fresco painting.

- Butanol at 85 percent concentration can be used in cars conceived for gasoline (petrol) without any change to the engine (unlike 85% ethanol).

- Stable and highly efficient combustion could be achieved in n-butanol/diesel DFDI mode, while the ITE could increase by 2.8%; NOx and Soot emissions decreased by 82% and 79%.

- The higher content of n-butanol up to 90% on diesel fuel demonstrated.

- The Energy Independence and Security Act in 2007 mandates the use of 36 billion gallons of renewable fuel by 2022 corresponding to roughly 17% of the projected transportation fuel for light-duty vehicles.

Experimental Conditions and Results Statistics

- Tests were carried out in 250-mL Erlenmeyer flasks under moderate agitation using a 1:16 (sunflower meal/water) or 1:10 (poultry offal meal/water) solid-to-liquid ratio.

- Three factors were evaluated, pH (6.3–9.7), temperature (50–70 °C), and enzyme concentration (0.5–5.5% v/v), with 6 axial points and 3 repetitions of the center point, totaling 17 runs.

- Cells cultured in YPD (1% yeast extract, 2% peptone, 2% glucose, and 2% agar) were incubated in a 500-mL Erlenmeyer flask containing 100 mL YPD broth at 30 °C and 200 rpm for 12 h.

- Fermentations were carried out in triplicate under semi-anaerobic conditions in 2 mL Eppendorf tubes containing 2 mL of medium with a minimal amount of headspace.

- Experimental investigations were conducted in a CVC by varying n-butanol ratio and injection pressures of 80, 100, and 120 MPa were employed. Additionally, the injector nozzle diameter varied between 0.28 and 0.33 mm.

Analytical Techniques and Observations Statistics

- For free amino acid determination, amino acids were extracted with 0.1 M HCl under agitation for 30 min.

- Colorimetric method using 4-dimethylaminobenzaldehyde in 10.55 mol/L sulfuric acid (H2SO4). Samples were read at 590 nm.

- Producing mixtures of n‐butanol (17 %), sec‐butanol (14 %), and ethyl acetate (66 %) rather than the usual 90 %+ selectivity to n‐butanol.

- Tridentate PNP ruthenium complexes such as also produce sec‐butanol and, in optimized conditions (120 °C, 10 mol% NaOEt base), achieve 71 % selectivity to this butanol isomer.

- With lower crude protein contents than those observed in this study: 37.50% in sunflower meal and 47.80% in poultry offal meal.

Emerging Trends

Increased Demand for Bio-Derived N-Butanol: There is a growing trend towards the use of bio-based N-butanol, primarily due to environmental concerns and the push for sustainability. Bio-derived N-butanol, produced through fermentation processes using microorganisms like Clostridium acetobutylicum, offers a renewable alternative to petroleum-based butanol. This trend is driven by the need to reduce greenhouse gas emissions and the volatility of crude oil prices. According to the International Energy Agency (IEA), the global demand for biofuels is expected to increase significantly, with bio-butanol playing a crucial role in this growth.

Expansion in the Transportation Sector: N-butanol is increasingly used as a biofuel and in various transportation-related applications such as brake fluids, ignition engines, and marine fuels. This trend is bolstered by the rising production in the automotive, aerospace, and marine industries. For example, the commercial aviation sector alone is projected to be worth USD 1.7 trillion by 2030, which will drive the demand for high-performance fuels like N-butanol.

Growing Applications in Construction and Coatings: The construction and coatings industries continue to be major consumers of N-butanol. This alcohol is a critical solvent in the production of paints, varnishes, adhesives, and sealants. The rapid urbanization and infrastructure development, particularly in regions like Asia-Pacific, are contributing to the increased demand for high-quality coatings and construction materials that utilize N-butanol.

Technological Advancements in Production: Innovations in production technologies are making N-butanol manufacturing more efficient and cost-effective. Advances in fermentation technology for bio-derived N-butanol and improvements in the hydroformylation process for chemical synthesis are reducing production costs and environmental impacts. Companies are also focusing on expanding their production capacities and enhancing the sustainability of their processes.

Market Dynamics and Regional Growth: The Asia-Pacific region is expected to lead the growth in the N-butanol market due to its rapid industrialization and infrastructure expansion. Countries like China and India are at the forefront, driving demand for N-butanol in various applications such as solvents, intermediates, and coatings. This regional growth is supported by increased investments in sustainable chemical production and the development of renewable resources.

Use Cases

The solvent in Paints and Coatings: N-butanol is widely used as a solvent in the formulation of paints and coatings. Its ability to dissolve a variety of chemical compounds makes it essential in the production of high-quality paints, varnishes, and coatings. This helps improve the flow and leveling properties of the paint, ensuring a smooth finish. The global demand for paints and coatings was valued at around USD 160 billion in 2021 and is projected to grow significantly, indicating a strong use case for N-butanol in this sector.

Chemical Intermediate: N-butanol serves as a crucial intermediate in the synthesis of other chemicals. It is a primary feedstock for producing butyl acrylate and butyl acetate, which are used in making adhesives, sealants, and various plasticizers. Butyl acrylate alone is expected to grow at a CAGR of 5.5% from 2021 to 2028, reflecting the increasing demand for N-butanol as a chemical intermediate.

Biofuel Component: With the rising focus on renewable energy sources, N-butanol is being used as a biofuel. Its properties make it suitable as a gasoline additive, improving fuel efficiency and reducing emissions. The International Energy Agency (IEA) has noted that global biofuel demand is set to increase by 28% between 2021 and 2026, with bio-butanol playing a significant role in this growth.

Lubricant Additive: N-butanol is used in the formulation of lubricants, especially for automotive and industrial applications. Its high boiling point and ability to reduce friction enhance the performance of lubricants. The global lubricants market was valued at approximately USD 120 billion in 2020, and with ongoing industrial growth, the demand for effective additives like N-butanol is expected to rise.

Pharmaceutical Applications: In the pharmaceutical industry, N-butanol is utilized in the synthesis of various drugs and as an extraction solvent. Its effectiveness in extracting specific compounds makes it valuable in drug formulation processes. The global pharmaceutical market was valued at USD 1.42 trillion in 2021, highlighting the extensive use of solvents like N-butanol in this sector.

Food and Beverage Industry: N-butanol is used in the food and beverage industry as a flavoring agent and in the extraction of essential oils. Its role in enhancing flavors and preserving food products underscores its importance. The food additives market, which includes flavoring agents, was valued at USD 55.53 billion in 2020 and is expected to grow, showcasing the potential use of N-butanol in this industry.

Textile Industry: The textile industry employs N-butanol in dyeing and finishing processes. Its solvent properties help in the effective application of dyes and finishes, improving the quality and durability of textiles. The global textile market was valued at USD 993.6 billion in 2021, indicating significant potential for N-butanol in this sector.

Major Challenges

Fluctuating Raw Material Prices: The production of N-butanol largely depends on the availability and cost of propylene, which is a petroleum derivative. The volatility in crude oil prices significantly impacts the cost of propylene, and subsequently, the production cost of N-butanol. For instance, geopolitical tensions and supply chain disruptions can cause abrupt price changes, making it difficult for manufacturers to maintain stable pricing.

Environmental and Regulatory Pressures: N-butanol production involves processes that emit volatile organic compounds (VOCs), contributing to environmental pollution. Regulatory bodies such as the Environmental Protection Agency (EPA) in the United States and the European Environment Agency (EEA) have stringent regulations to control VOC emissions. Compliance with these regulations often requires significant investment in cleaner technologies and pollution control measures, increasing operational costs.

Competition from Bio-Based Alternatives: While there is a growing interest in bio-based N-butanol due to its renewable nature, it faces competition from other bio-based solvents and fuels. The development and adoption of alternative bio-based chemicals can pose a threat to the N-butanol market. Innovations in bio-based production methods are essential to keep N-butanol competitive against these alternatives.

Health and Safety Concerns: N-butanol is classified as a hazardous chemical, with exposure risks including respiratory issues, skin irritation, and potential long-term health effects. Ensuring safe handling and storage requires strict adherence to safety protocols, which can be costly and complex. This poses a challenge, especially for smaller manufacturers who may struggle with the financial and logistical aspects of maintaining high safety standards.

Supply Chain Disruptions: Global supply chains for chemicals like N-butanol are susceptible to disruptions caused by natural disasters, political instability, and pandemics. For example, the COVID-19 pandemic highlighted vulnerabilities in global supply chains, causing delays and increased costs for raw materials and finished products. Maintaining a resilient supply chain is critical but challenging, requiring strategic planning and investment.

Market Growth Opportunities

Expansion in Biofuel Market: The increasing demand for sustainable energy sources provides a significant growth opportunity for N-butanol as a biofuel. As countries aim to reduce carbon emissions, bio-butanol is being recognized as a viable alternative to conventional fuels due to its lower emission levels and higher energy content. The global biofuel market is expected to grow significantly, with the International Energy Agency predicting a 28% increase in demand by 2026.

Growth in the Construction Industry: N-butanol’s use in the production of high-quality paints, coatings, adhesives, and sealants makes it a valuable chemical in the construction industry. With the construction sector expanding, especially in emerging economies like China and India, there is a growing need for durable and efficient building materials. The global construction market is projected to reach USD 15.5 trillion by 2030, driven by urbanization and infrastructure development.

Rising Demand in the Automotive Industry: The automotive industry is another significant driver for N-butanol, used in brake fluids, lubricants, and as a fuel additive. With the global automotive market set to grow, particularly with the increase in electric vehicle (EV) production, the demand for high-performance chemicals like N-butanol is expected to rise. The EV market alone is projected to reach 145 million units by 2030, according to the International Energy Agency.

Increasing Use of Pharmaceuticals: N-butanol is used as a solvent and intermediate in pharmaceutical production. The global pharmaceutical market is expected to grow from USD 1.25 trillion in 2020 to USD 1.7 trillion by 2025. This growth presents an opportunity for N-butanol manufacturers to supply the pharmaceutical sector with essential solvents and intermediates needed for drug formulation and production.

Technological Advancements in Production: Advancements in production technologies, particularly in bio-based N-butanol, offer new growth avenues. Innovations in fermentation processes and the development of cost-effective production methods can enhance the scalability and economic viability of bio-derived N-butanol, making it more competitive against traditional petroleum-based products.

Recent Developments

BASF SE, a leading chemical company, has made significant strides in the N-butanol sector throughout 2023 and into 2024. In January 2023, BASF’s production focused on scaling up their sustainable manufacturing processes for N-butanol to meet rising global demand. By March 2023, they reported a 0.8% increase in sales from their petrochemicals division, with N-butanol being a significant contributor. Mid-year, in June 2023, BASF expanded its production capacities in Asia, particularly focusing on their Verbund site in China to enhance local supply and reduce logistics costs. By the end of 2023, BASF had invested heavily in research and development, increasing their R&D expenses by 7.9% compared to the previous year, to innovate greener and more efficient production techniques.

Dow Inc. has made significant advancements in the N-butanol sector throughout 2023 and into 2024. In January 2023, Dow increased its N-butanol production capacity in response to rising global demand, particularly focusing on enhancing its facilities in North America. By March 2023, the company reported a slight increase in N-butanol prices due to high inflation in the U.S., coupled with a strategic decision to boost production to meet market needs. In the second quarter, specifically in April 2023, Dow faced a tight supply market, which saw the prices of N-butanol rise due to improved industrial production activities. This trend continued into June, although demand from the construction sector was lower than anticipated.

Eastman Chemical Company has made significant contributions to the N-butanol sector throughout 2023 and into 2024. In January 2023, Eastman increased its production capacity for N-butanol to meet the rising global demand, especially in the coatings and chemical industries. By April 2023, the company reported a substantial increase in quarterly revenue to $2.31 billion, driven by strong demand for N-butanol as a solvent and chemical intermediate. In mid-2023, specifically in July, Eastman continued to see robust sales with a reported earnings per share (EPS) of $2.15, surpassing the market consensus by $0.15. This performance was supported by strategic investments and operational efficiencies.

In 2023, Eastman Chemical Company agreed to sell its Texas City Operations to INEOS Acetyls, a subsidiary of INEOS Group, for approximately $500 million. This transaction included the 600-kilotonne acetic acid plant and associated third-party activities. The sale was structured to receive around $415 million at closing, with the remainder in installments over the following two years. The deal was finalized in December 2023.

Conclusion

The global N-butanol market is poised for steady growth, driven by its diverse applications in industries such as paints and coatings, adhesives, and plasticizers. This growth is largely attributed to the rising demand in the construction, automotive, and pharmaceutical sectors, where N-butanol is used extensively as a solvent and intermediate chemical.

Technological advancements and a shift towards bio-based N-butanol are also contributing to market expansion. Bio-based N-butanol production, driven by sustainability goals, is expected to mitigate some of the environmental impacts associated with traditional petroleum-based production methods. Additionally, strategic partnerships and expansions by key industry players are enhancing production capabilities and supply chain efficiencies.