Table of Contents

Introduction

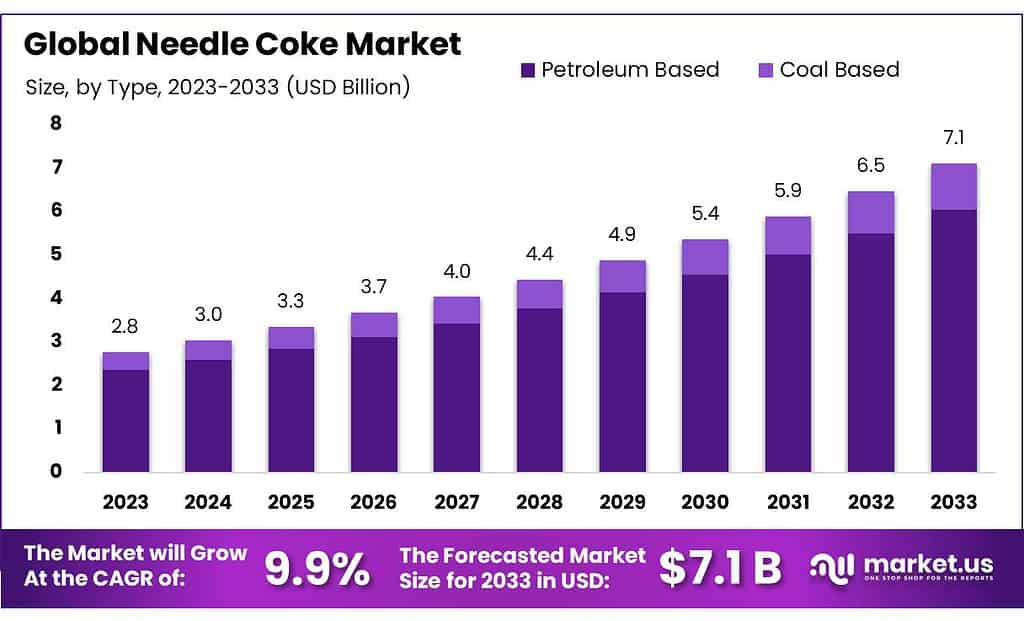

The global needle coke market, valued at USD 2.77 billion in 2023, is projected to reach USD 7.1 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.9% during the forecast period. Needle coke, a specialized form of petroleum coke, plays a crucial role in the production of graphite electrodes, which are essential in electric arc furnaces for steelmaking. It also finds increasing use in lithium-ion batteries, particularly in electric vehicles (EVs) and renewable energy storage systems. This growing demand, especially driven by the steel and automotive industries, is a key factor propelling the needle coke market forward.

Several growth drivers contribute to the expanding market. The booming electric vehicle (EV) sector has significantly increased the demand for lithium-ion batteries, with needle coke serving as a vital component in battery anodes. The adoption of EVs and hybrid electric vehicles (HEVs) is further expected to surge, leading to a greater need for high-performance batteries, which boosts needle coke consumption. Additionally, the rise of electric arc furnaces in steel production has amplified the demand for graphite electrodes, directly benefiting the needle coke market. These furnaces are used extensively due to their environmental benefits and efficiency in steel recycling.

However, the needle coke market faces challenges, particularly related to fluctuating raw material prices and stringent environmental regulations. The volatility in crude oil prices directly impacts the cost and availability of petroleum-based needle coke, which dominates the market due to its superior quality. Moreover, stringent regulations aimed at reducing carbon emissions create operational hurdles for needle coke manufacturers, who are pressured to adopt cleaner and more sustainable production methods. The high costs associated with meeting these regulatory requirements may pose barriers to market growth, particularly in regions where environmental compliance is strictly enforced.

Recent developments in the market underscore the continued efforts to enhance production capacity and efficiency. For instance, in 2023, Indian Oil Corporation invested over $170 million in expanding its needle coke production capabilities, while Mitsubishi Chemical increased its output to meet growing global demand. These expansions are aimed at addressing the increasing need for needle coke in both steelmaking and energy storage industries.

December 2020: Mitsubishi Chemical established a wholly-owned subsidiary in Singapore named Mitsubishi Chemical Holdings Asia Pacific Pte. Ltd. (MCHAP). This new entity focuses on risk management, regional representation, and regulatory compliance in the Asia-Pacific market, a key region for needle coke demand. August 2020: Phillips 66 announced plans to reconfigure its San Francisco Refinery in Rodeo, California. This shift focuses on producing renewable fuels, moving away from crude oil, which could impact its needle coke production derived from petroleum.

Shell has been investing heavily in sustainable energy solutions, which could indirectly influence its role in the needle coke market, particularly with a focus on alternative sources of energy storage like lithium-ion and sodium-ion batteries. Sumitomo has been actively involved in expanding its operations in the graphite electrode market, leveraging its position in the steel industry, which is a significant consumer of needle coke. The company focuses on ensuring a stable supply chain and enhancing production capacity for high-quality graphite electrodes.

Needle Coke Statistics

- Based on OilChem’s data, China’s needle coke supply totaled 521,100 tonnes in the first half of 2024, down 9.53% year-on-year, while the combined consumption reached 4266,00 tonnes, up 0.67% year-on-year, which led to narrowing supply and demand gap.

- The consumption from graphite electrode field accounted for 37.82% of the total, and that from lithium battery anode material field occupied 62.18%, according to OilChem.

- In June 2024, China’s oil-based needle coke imports were 6,353 mt, down 40% MoM but up 23% YoY; coal-based needle coke imports were 3,931 mt, down 41% MoM and 30% YoY.

- Global demand for synthetic graphite is expected to exceed 3 million tonnes by 2025 from 2,296,000 tonnes in 2022, with more than 80% of demand coming from electrodes and battery anodes

- From April to June, Affected by the upward market price in the early stage, the market started to grow to more than 50%, the supply of goods increased, the price of petroleum coke decreased,

- According to incomplete statistics of Baichuan Yingfu, the production capacity of needle coke in China will be about 2.29 million tons in 2021, and the new production capacity will be 570000 tons.

- The total output from January to December was 1082900 tons, an increase of 98.00% over the same period in 2020, including 586900 tons of cooked coke, an increase of 54.08% over 2020, and 496000 tons of raw coke, an increase of 190.56% over 2020.

- The price will rise in 2021, among which the oil series cooked Coke will increase by 61.02%. By the end of December

- In terms of new devices, it is planned to add 440000 tons of capacity in 2022.

- Graphite electrode: according to incomplete statistics, the new capacity of graphite electrodes in 2021 is about 170000 tons

- The chemical oxygen demand (COD) removal rate of the coking wastewater reached 97.7%.

- Briefly, the needle coke derived by the co-carbonization of coal liquefaction pitch and anthracene oil had a lower content of mosaic structure of 14.17%, ideal carbon crystal content of 82.67%, and true density of 2.296 g cm-3.

- Saudi Arabia under its Vision 2030 goals, aims to have EVs account for 30% of all on-road, in-kingdom vehicles by 2030.

- The raw coke is calcined at about 1000° to 1500° C. in a rotary kiln.

- In 2017, the production capacity of graphite electrodes was largely released, and the total demand for needle coke was 328,700 tons, with a sequential growth of 128.29% in graphite electrodes and 27.47% in lithium cathode.

- The continuous rapid expansion of graphite electrodes slowed down in 2018, and the total demand for needle coke reached 572,300 tons, with a sequential growth of 73.75% in graphite electrodes and 71.64% in lithium cathode.

Emerging Trends

- Increased Demand in Lithium-Ion Batteries: Needle coke, a high-purity form of petroleum coke, is gaining traction due to its critical role in manufacturing anode materials for lithium-ion batteries. The booming electric vehicle (EV) market, which is projected to grow significantly, is driving this demand. According to a report by the International Energy Agency (IEA), global sales of electric vehicles are expected to reach around 30 million units annually by 2030, significantly boosting the need for high-quality needle coke.

- Growth in Graphite Electrode Production: Needle coke is essential for producing graphite electrodes used in electric arc furnaces for steelmaking. As the steel industry transitions towards more sustainable practices and increased production, the demand for needle coke in this sector is rising. The World Steel Association reports that global crude steel production increased by 3% to 1.95 billion tonnes in 2023, highlighting the growing need for high-quality electrodes.

- Technological Advancements: New technologies in the production of needle coke are emerging to enhance its quality and efficiency. Innovations are focused on improving the processing methods to produce needle coke with better consistency and performance. The American Chemical Society (ACS) notes that recent advancements include improved coking processes that enhance the material’s purity and structural properties, making it more suitable for high-performance applications.

- Environmental Regulations and Sustainability: Stricter environmental regulations are influencing the needle coke industry. Producers are investing in technologies to reduce emissions and improve the sustainability of their operations. The U.S. Environmental Protection Agency (EPA) has introduced new guidelines for reducing greenhouse gas emissions from industrial processes, prompting needle coke manufacturers to adopt cleaner technologies.

- Supply Chain Challenges and Strategic Investments: The needle coke market faces supply chain challenges due to its reliance on specific feedstocks and the complex production process. To mitigate these issues, companies are making strategic investments in expanding production capacities and securing supply sources. For instance, in 2023, leading needle coke producers like Phillips 66 and Mitsubishi Chemical Holdings announced plans to increase their production capacities to meet the growing demand from the battery and steel industries.

- Market Consolidation and Strategic Partnerships: The needle coke industry is witnessing consolidation as companies seek to enhance their market positions through mergers, acquisitions, and strategic partnerships. These moves are aimed at leveraging economies of scale, improving technological capabilities, and accessing new markets. Recent examples include the merger of major needle coke producers to create more integrated supply chains and improve market stability.

Use Cases

- Graphite Electrodes for Steel Production: One of the primary uses of needle coke is in the production of graphite electrodes, which are essential in electric arc furnaces (EAF) used for steel manufacturing. Needle coke’s high thermal conductivity and low electrical resistance make it ideal for producing these electrodes. The demand for needle coke in this sector is increasing due to the growing global steel production, especially in Asia-Pacific, which accounts for over 65% of global steel output. Electric arc furnaces are preferred over traditional blast furnaces for their energy efficiency and lower carbon emissions.

- Lithium-Ion Batteries: Needle coke is also a key material in the production of anodes for lithium-ion batteries, which are used in electric vehicles (EVs) and portable electronics. The rising adoption of EVs globally, driven by the push for greener technologies, has significantly boosted the demand for high-quality needle coke. The demand is particularly strong in regions like China, Japan, and Europe, where the EV market is growing rapidly. As the world moves toward more sustainable transportation options, this application is expected to see continued growth.

- Specialty Carbon Products: Needle coke is used in various specialty carbon products, such as those needed for aerospace, nuclear applications, and silicon metal production. These high-performance materials benefit from needle coke’s excellent structural properties, which include high mechanical strength and resistance to extreme temperatures. This makes needle coke critical in industries that require advanced, durable carbon materials.

Major Challenges

- Raw Material Price Volatility: Needle coke is primarily derived from petroleum or coal-based feedstocks. The prices of these raw materials are highly volatile, influenced by fluctuations in global crude oil prices. This volatility creates uncertainty for manufacturers, impacting production costs and pricing strategies. For instance, rising crude oil prices can increase the cost of petroleum-based needle coke, making it less economically viable for certain applications.

- Environmental Regulations: Stricter environmental policies are imposing challenges on needle coke production, particularly for petroleum-derived products. The refining processes required to produce needle coke generate carbon emissions, and companies are under increasing pressure to adopt cleaner technologies. Regulatory constraints, especially in Europe and North America, make it difficult for producers to balance compliance with profitability. The shift towards greener production methods also requires significant investment.

- Supply-Demand Imbalance: The demand for needle coke, especially high-grade material, is rapidly increasing due to its applications in steel production and lithium-ion batteries. However, the supply of premium needle coke is struggling to keep pace, particularly as the electric vehicle market expands. This mismatch between supply and demand could lead to shortages, higher prices, and potential disruptions in downstream industries reliant on needle coke.

- Technological Limitations: Although advancements are being made in the production of needle coke, limitations in refining processes, especially for high-purity, super-premium grades, remain a challenge. These grades are crucial for industries such as EV batteries and aerospace, and inefficiencies in production can hinder the ability to meet the quality demands of these sectors.

Market Growth Opportunities

- Electric Vehicle (EV) Market: The rapid expansion of the EV industry is one of the primary growth drivers for needle coke. Lithium-ion batteries, which are essential for electric vehicles, rely heavily on needle coke for their anodes. As more countries push for greener energy solutions and stricter emissions regulations, the demand for EVs continues to rise, particularly in regions like China, Europe, and North America. This, in turn, is boosting the demand for high-quality needle coke.

- Growth of Electric Arc Furnaces (EAF): The steel industry is increasingly adopting electric arc furnaces (EAF) for steel production due to their energy efficiency and lower carbon emissions compared to traditional blast furnaces. EAFs use graphite electrodes, which are made from needle coke. As the global steel industry grows, particularly in Asia-Pacific, there is a rising demand for needle coke to support the production of these electrodes.

- Advances in Battery Technology: Needle coke is also crucial for the development of next-generation batteries. Researchers are exploring the use of needle coke in sodium-ion batteries, which could offer an alternative to lithium-ion batteries in certain applications. The potential for needle coke to be used in a broader range of battery technologies presents significant opportunities for market growth.

- Specialty Carbon Products: Beyond batteries and steel, needle coke is also used in the production of specialty carbon materials for aerospace, nuclear, and electronics industries. As these sectors expand, particularly with the increasing need for lightweight, high-strength materials, the demand for needle coke is expected to rise.

Key Player Analysis

Mitsubishi Chemical Holdings Corporation has been active in the needle coke sector, particularly focusing on producing coal-based needle coke. This product is essential in the manufacturing of graphite electrodes, primarily used in electric arc furnaces (EAFs) for steel production. As of October 2022, the company increased its production capacity at the Sakaide facility to 3.9 million tons per year, with about 70% of this output being exported to international markets. Mitsubishi’s coal-based needle coke stands out for its superior physical properties, such as low thermal expansion and electrical resistance, making it highly sought after in the steel and battery industries.

Phillips 66 is a leading global producer of premium needle coke, primarily used in the manufacturing of graphite electrodes for electric arc furnaces and as a key material in lithium-ion batteries. In 2023, the company continued its production at its Humber (UK) and Lake Charles (Louisiana) refineries, where it manufactures high-quality needle coke. Phillips 66 also strategically invested $150 million in NOVONIX, a company focused on producing synthetic graphite anode materials for batteries. By the end of 2023, NOVONIX was expected to ramp up production to 10,000 metric tons per year, with further expansion planned for 2025.

In 2023, Shell continued its focus on expanding its energy transition strategy, including its involvement in the needle coke sector, although needle coke is not a primary product in Shell’s portfolio. Shell’s global operations in refining and petrochemical industries indirectly support needle coke production, especially through its emphasis on producing high-quality petroleum products. These products contribute to the production of needle coke, which is essential in sectors like electric arc furnace (EAF) steel production and lithium-ion batteries for electric vehicles (EVs). Shell’s broader energy strategy in 2023 highlighted its commitment to low-carbon technologies, aligning with the growing demand for cleaner, more efficient materials like needle coke used in green energy applications.

Sumitomo Corporation is actively involved in the needle coke sector through its subsidiary, Petrocokes Japan Ltd., which is responsible for the manufacture and sale of petroleum-based needle coke. Needle coke is crucial for the production of graphite electrodes, which are primarily used in electric arc furnaces (EAFs) in steel production, as well as in lithium-ion batteries for electric vehicles. In 2023, Sumitomo Corporation continued to expand its needle coke business to meet the growing global demand, particularly driven by the rise in electric vehicle production and steel recycling industries.

In 2023, Indian Oil Corporation Ltd. (IOCL) made a significant move into the needle coke market by initiating the construction of a Grassroot Needle Coker Unit at its Paradip Refinery. This facility, with an investment of ₹1,268 crore, will have a production capacity of 56 kilotons per annum (KTPA) of calcined needle coke (CNC). The project is expected to reduce India’s dependency on imports of needle coke, which is essential for producing graphite electrodes used in electric arc furnaces for steel production and in lithium-ion batteries for electric vehicles. This initiative aligns with India’s “Atmanirbhar Bharat” (self-reliant India) vision, aiming to support the growing domestic industries reliant on high-quality needle coke.

Tokai Carbon Co. is a key player in the needle coke market, primarily involved in producing high-quality graphite electrodes essential for steel manufacturing in electric arc furnaces (EAFs) and for use in lithium-ion batteries. In 2023, the company expanded its needle coke production capacity to meet the growing global demand for graphite electrodes, which are crucial in steel recycling and the electric vehicle (EV) sectors. The company’s production is focused on providing consistent, high-performance materials, especially as global demand for steel and EVs rises.

Asbury Carbons Inc. has been a prominent player in the graphite and carbon materials sector since its founding in 1895. The company is heavily involved in producing needle coke, a critical raw material used in manufacturing graphite electrodes for steel production and as anode material for lithium-ion batteries. In 2023, Asbury focused on optimizing its product lines to meet the growing global demand for high-performance materials, particularly in electric vehicles and steel industries. Additionally, Asbury announced a price increase of up to 10% across its graphite and coke products starting in January 2024 to account for rising raw material and production costs.

In 2023, Essar Oil continued its strategic shift towards sustainable energy solutions by enhancing its refining operations, particularly through its Vadinar refinery in Gujarat, which is one of India’s most technologically advanced. While Essar is not heavily involved in direct needle coke production, the company’s refinery processes are critical in producing high-grade petroleum products, some of which are used as feedstocks for needle coke. Essar’s refining capacity stands at 20 million metric tons per annum (MTPA), with a significant portion of its output supporting industries like steel and electric vehicles, where needle coke plays a vital role. In 2024, Essar’s continued investments in refining efficiency and sustainability, including carbon capture initiatives, will further support industries reliant on needle coke.

HEG Limited, a key player in the global graphite electrode industry, relies heavily on needle coke as a primary raw material for its production of graphite electrodes, which are essential in electric arc furnaces used for steel production. In 2023, HEG expanded its production capacity from 80,000 tons to 100,000 tons per annum, making it the largest single-site producer of graphite electrodes globally. This expansion aligns with the growing global demand for steel, particularly in markets transitioning towards more electric arc furnaces for eco-friendly steel manufacturing.

Conclusion

The needle coke market is poised for substantial growth in the coming years, driven by increasing demand in key sectors like electric vehicles (EVs) and steel production. Needle coke, a high-quality carbon material derived from either petroleum or coal tar, is essential for manufacturing graphite electrodes used in electric arc furnaces and lithium-ion batteries. As global efforts toward decarbonization continue, the use of electric arc furnaces for steelmaking is expected to rise, further boosting demand for needle coke.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)