Table of Contents

Introduction

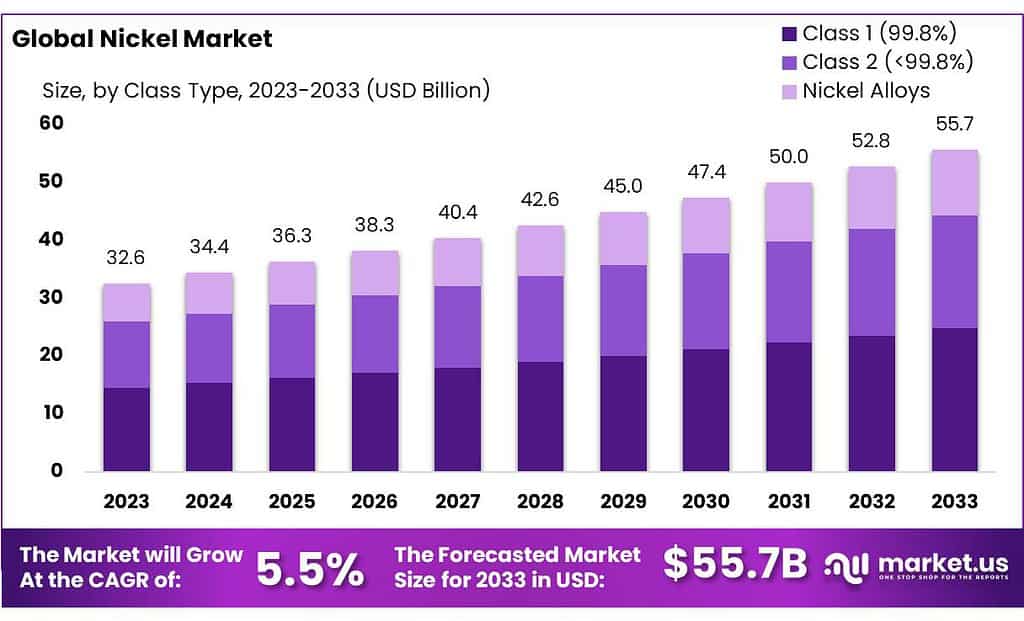

The global nickel market is poised for significant growth, with its size projected to reach approximately USD 55.7 billion by 2033, up from USD 32.6 billion in 2023, reflecting a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2023 to 2033. This growth can be attributed to several factors, including the increasing demand for nickel in the production of stainless steel, which accounts for a substantial portion of its consumption. Furthermore, the rising popularity of electric vehicles (EVs) has led to heightened interest in nickel due to its critical role in lithium-ion batteries. However, the market faces challenges such as fluctuating prices driven by geopolitical tensions and environmental regulations impacting mining operations.

Recent developments indicate that advancements in nickel processing technologies are improving extraction efficiency and reducing costs, which may further enhance market dynamics. In addition, several countries are investing in nickel exploration and production, particularly in regions like Indonesia and the Philippines, where substantial reserves exist. These trends suggest a robust future for the nickel market, despite the challenges posed by market volatility and regulatory pressures. Overall, the combination of rising demand from various industries and ongoing technological advancements positions the nickel market for a promising trajectory in the coming decade.

Anglo-American is a significant player in the nickel market, particularly through its operations in Brazil. The company has focused on sustainable practices and recently announced a USD 300 million investment aimed at increasing nickel production to meet growing demand, especially from the EV sector. This commitment to sustainability, combined with strategic investments, positions Anglo American favorably in a market that is increasingly leaning towards responsible sourcing.

BHP continues to be a formidable force in the nickel market, driven by strategic acquisitions. The company’s recent agreement to purchase a nickel project in Canada for USD 500 million highlights its ambition to enhance its portfolio. BHP’s extensive experience and resources allow it to navigate market fluctuations effectively, ensuring long-term growth and stability in its nickel operations.

Eramet is focusing on innovation within the nickel market, having launched a new product specifically tailored for the battery industry. This move demonstrates the company’s strategic alignment with the growing demand for nickel in electric vehicles. Eramet’s emphasis on developing high-quality products positions it as a key player, particularly as the transition to greener technologies accelerates.

Key Takeaways

- The global nickel market is set to grow from USD 32.6 billion in 2023 to USD 55.7 billion by 2033, at a 5.5% CAGR.

- Class 1 (99.8%) nickel held a dominant market position, capturing more than a 44.6% share.

- Stainless steel consumed about 70% of global nickel production in 2023, driving demand in the construction, automotive, and consumer goods sectors.

- Asia Pacific holds 46.6% of the global nickel market share, valued at USD 15.1 billion, driven by China and Indonesia.

- Transportation & Defense used over 22.1% of global nickel in 2023, crucial for vehicles and defense equipment due to its durability.

Nickel Statistics

- The highest nickel content in the limonite zone is 4.00% and in the saprolite zone is 3.97%

- Meanwhile, the average nickel content in the limonite zone is 0.91% and in the saprolite zone is 1.20%

- The average depth of high-grade saprolite ore is 24 meters.

- It’s the only U.S. coin that is called by its metal content—even though the metal alloy in a nickel is only 25 percent nickel.

- Since then, nickel prices have decreased, and have remained between a low of 8,299 U.S. dollars per metric ton and a high of 18,584 U.S. dollars per metric ton between 2016 and 2021.

- It is forecast that the price of nickel will amount to more than 17,000 U.S. dollars per metric ton in 2025.

- Today’s price of a Nickel is ₹1,367/KG and is witnessing a stable trend of 0%.

- The world’s nickel resources are currently estimated at almost 350 million tons.

- Indonesia. Indonesia is the world’s largest nickel producer, with reserves of 21 Mt, accounting for 20.6% of the global total.

- According to the International Energy Agency (IEA) predictions, demand for nickel will rise significantly, by around 65%, by the end of this decade.

- Russia’s production stood at 220kt in 2022 and fell by 0.5% to 218.9kt in 2023.

Emerging Trends

- The nickel market is currently experiencing several emerging trends that are shaping its future. One of the most significant trends is the growing demand for nickel in the electric vehicle (EV) industry. As automakers increasingly shift towards EV production, the need for high-quality nickel for lithium-ion batteries is surging. Reports indicate that the demand for nickel in battery applications could reach over 1 million tons by 2030, reflecting a substantial increase from current levels.

- Another notable trend is the focus on sustainable mining practices. Companies are investing in technologies that minimize environmental impacts and promote responsible sourcing. For instance, several firms are adopting circular economy principles by recycling nickel from old batteries and other sources, which can help reduce reliance on primary production and lower carbon footprints.

- Additionally, there is a growing emphasis on nickel supply chain diversification. Geopolitical tensions and regulatory changes have prompted companies to explore new sources of nickel outside traditional regions. Countries in Africa, such as the Democratic Republic of the Congo, are emerging as key players, given their substantial nickel reserves. This shift is expected to enhance supply security and stabilize prices.

- Finally, advancements in nickel processing technologies are improving extraction efficiencies and reducing costs. Innovations such as hydrometallurgical processes are gaining traction, allowing for more sustainable and economically viable methods of nickel production.

Use Cases

- Stainless Steel Production: Nickel is a critical alloying element in stainless steel, which accounts for about 70% of global nickel demand. Approximately 8% to 12% nickel is added to steel to enhance its corrosion resistance and strength. The stainless steel market is expected to grow at a CAGR of around 6% over the next five years, driving further nickel demand.

- Electric Vehicle Batteries: Nickel is essential in lithium-ion batteries, which power electric vehicles (EVs). Nickel-rich batteries, such as nickel manganese cobalt (NMC) and nickel cobalt aluminum (NCA), are preferred for their high energy density. By 2030, the demand for nickel in battery applications is projected to exceed 1.5 million tons annually, driven by the expected increase in global EV sales, which could reach 26 million units by 2030.

- Aerospace and Defense: Nickel-based superalloys are crucial in the aerospace industry due to their high strength and resistance to extreme temperatures. These alloys are used in turbine engines and other critical components. The global aerospace materials market, including nickel alloys, is forecasted to reach USD 24 billion by 2026, indicating strong growth prospects.

- Chemical Processing: Nickel is utilized in various chemical processes, particularly in the production of hydrogen through water electrolysis. Nickel-based catalysts are effective in facilitating these reactions. The green hydrogen market is projected to grow rapidly, potentially reaching USD 199 billion by 2030, with nickel playing a vital role in this transition to cleaner energy sources.

- Coinage: Nickel is used in coin production due to its durability and resistance to corrosion. Countries like the United States and Canada use nickel in their coins, contributing to a stable demand. Although the percentage of nickel used in coinage has decreased, it remains a reliable application for the metal.

Major Challenges

- The nickel market faces several significant challenges that could impact its growth trajectory. One major issue is the volatility of nickel prices. Over the past few years, prices have fluctuated widely, with recent averages around USD 25,000 per ton. Such unpredictability can hinder investment decisions and planning for producers and consumers alike, making it difficult for companies to forecast revenues accurately.

- Another challenge is environmental and regulatory pressures. Mining operations often face strict regulations aimed at minimizing environmental impact. For instance, in 2021, Indonesia implemented a ban on raw nickel exports to encourage processing domestically, leading to supply chain disruptions. Companies must navigate these regulatory landscapes, which can increase operational costs and limit access to resources.

- Supply chain disruptions also pose a significant threat. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, causing delays and increased shipping costs. A report from McKinsey noted that logistics costs surged by 30% during the pandemic, affecting the overall nickel supply chain.

- Additionally, the market is witnessing increasing competition from alternative materials. For example, researchers are exploring the use of lithium iron phosphate (LFP) batteries, which reduce dependence on nickel. As these technologies advance, they may erode demand for nickel in battery applications.

Market Growth Opportunities

- The nickel market presents several compelling growth opportunities that could drive its expansion in the coming years. One of the most significant opportunities lies in the booming electric vehicle (EV) sector. With global EV sales projected to reach 26 million units by 2030, the demand for nickel in battery production is expected to increase significantly. Reports suggest that nickel demand from batteries could grow to over 1.5 million tons annually, highlighting the potential for substantial market growth.

- Another opportunity is the rising focus on renewable energy storage solutions. As the world shifts toward cleaner energy sources, the need for efficient energy storage systems will rise. Nickel-based batteries, such as those used in grid storage applications, are becoming increasingly attractive due to their high energy density. The energy storage market is expected to reach USD 350 billion by 2030, providing a robust avenue for nickel consumption.

- Additionally, advancements in nickel recycling technologies offer a promising growth avenue. The global nickel recycling market is projected to grow at a CAGR of 8% from 2023 to 2030. As companies adopt circular economy practices, recycling nickel from spent batteries and industrial waste can reduce dependence on primary sources, leading to a more sustainable supply chain.

- Furthermore, emerging markets in Asia, particularly India and Southeast Asia, present significant opportunities for nickel consumption. As these regions industrialize and their middle classes expand, the demand for stainless steel and other nickel-containing products is expected to rise. The Asia-Pacific region is forecasted to account for over 60% of global nickel consumption by 2033.

Key Player Analysis

Anglo-American Plc is a key player in the nickel sector, primarily through its operations in Brazil. The company is focused on expanding its nickel production to meet the growing demand from the electric vehicle industry. Recently, Anglo-American announced a USD 300 million investment to enhance its production capacity and implement sustainable mining practices. This commitment not only positions the company to capitalize on rising nickel prices but also aligns with global trends toward greener technologies and responsible sourcing.

BHP is a major force in the nickel market, actively expanding its portfolio to strengthen its position. The company recently acquired a nickel project in Canada for approximately USD 500 million, which is expected to enhance its production capabilities. BHP emphasizes sustainable practices and technological innovation, ensuring efficient operations while addressing environmental concerns. With increasing demand for nickel driven by electric vehicle production and other applications, BHP is well-positioned to benefit from market growth while maintaining its commitment to sustainability.

Glencore is a significant player in the nickel sector, operating multiple mines globally, including in Canada and Australia. The company focuses on producing high-grade nickel products, essential for stainless steel and battery applications. Recently, Glencore has committed to increasing its nickel production to meet the surging demand from the electric vehicle market. By investing in sustainable practices and innovative extraction technologies, Glencore aims to enhance efficiency while minimizing environmental impacts, positioning itself as a leader in the transition to greener technologies.

IGO Ltd. is an important company in the nickel market, primarily engaged in mining and producing nickel from its operations in Western Australia. The company has recently increased its focus on sustainable mining practices, aligning with global demands for responsible sourcing. IGO’s nickel production is critical for battery applications, particularly as electric vehicles gain popularity. With a strategic emphasis on growth and sustainability, IGO aims to expand its nickel output to support the increasing demand, ensuring it remains competitive in a rapidly evolving industry.

Independence Group NL (IGO) is a key player in the nickel sector, operating primarily in Australia. The company is known for its Nova nickel-copper project, which produces high-quality nickel concentrate essential for battery and stainless steel applications. IGO focuses on sustainable mining practices and has implemented initiatives to reduce its environmental impact. With the increasing demand for nickel driven by electric vehicle production, IGO is well-positioned to expand its operations and contribute to the growing market while maintaining its commitment to sustainability.

Jinchuan Group International Resources Co. Ltd. is a prominent player in the nickel sector, with operations focused on mining and processing nickel in China and overseas. The company is known for its substantial nickel reserves and production capabilities, particularly from its flagship Jinchuan mine. Jinchuan is actively expanding its exploration efforts and investing in new technologies to enhance production efficiency. With the growing demand for nickel driven by the electric vehicle industry, Jinchuan aims to strengthen its market position while promoting sustainable practices in its operations.

Lundin Mining Corporation is an influential player in the nickel sector, primarily known for its operations in Canada and Portugal. The company produces nickel through its Eagle Mine, which is recognized for its high-grade nickel output. Lundin is focused on sustainable mining practices and aims to reduce its environmental footprint while increasing production efficiency. With the rising demand for nickel, particularly for electric vehicle batteries, Lundin Mining is well-positioned to expand its operations and contribute significantly to the global nickel market.

Metallurgical Corporation of China Ltd. (MCC) is a significant entity in the nickel sector, involved in mining, processing, and metallurgy. The company operates several nickel projects, primarily in China and Africa, focusing on developing high-quality nickel resources. MCC emphasizes technological innovation and sustainable practices in its operations to meet global standards. As demand for nickel continues to rise, especially from the electric vehicle and renewable energy sectors, MCC is well-positioned to leverage its resources and expertise to expand its market presence.

MMC Norilsk Nickel is one of the world’s largest producers of nickel and palladium, primarily operating in Russia. The company is renowned for its extensive mining and metallurgical facilities, which enable it to produce high-grade nickel used in stainless steel and batteries. Norilsk Nickel is also committed to sustainable practices, aiming to reduce its environmental impact through advanced technologies and responsible resource management. With the growing demand for nickel driven by electric vehicles, Norilsk Nickel is strategically positioned to enhance its production and support global market needs.

Norilsk Nickel, formally known as MMC Norilsk Nickel, is a leading player in the global nickel market, known for its significant production capabilities in Russia. The company specializes in mining and refining nickel, copper, and other metals, supplying high-quality nickel for various industrial applications, including electric vehicle batteries. Norilsk Nickel emphasizes sustainability, investing in projects to reduce emissions and improve operational efficiency. As global demand for nickel continues to rise, particularly in the renewable energy sector, Norilsk Nickel is well-positioned to meet these challenges and expand its market influence.

Nornickel, officially known as MMC Norilsk Nickel, is a leading global producer of nickel, operating primarily in Russia. The company specializes in mining and refining high-quality nickel and other precious metals, playing a crucial role in the global supply chain. Nornickel is committed to sustainability and innovation, investing in technologies to reduce environmental impacts and improve efficiency. With the rising demand for nickel driven by electric vehicles and green technologies, Nornickel is well-positioned to enhance its production capabilities and meet market needs effectively.

Rio Tinto is a major player in the nickel sector, with operations primarily in Australia and Canada. The company produces nickel through its underground mines, focusing on high-quality nickel that serves both the stainless steel and battery markets. Rio Tinto emphasizes sustainable mining practices and has set ambitious targets to reduce its carbon footprint. With increasing demand for nickel fueled by the electric vehicle industry, Rio Tinto aims to expand its production and innovate its processes, ensuring a competitive position in the evolving market landscape.

Sherritt International Corporation is a significant player in the nickel sector, known for its operations in Canada and Cuba. The company focuses on producing high-quality nickel and cobalt through its innovative hydrometallurgical processes, which allow for efficient extraction and minimal environmental impact. Sherritt is committed to sustainability, actively seeking ways to enhance its operations while reducing carbon emissions. As demand for nickel rises, particularly in electric vehicle batteries, Sherritt is well-positioned to meet market needs and capitalize on growth opportunities in the industry.

South32 Ltd. is an important company in the nickel market, operating primarily in Australia and South Africa. The company produces nickel from its operations at the Cerro Matoso mine, focusing on high-quality output for stainless steel and battery applications. South32 emphasizes sustainability and is working on initiatives to reduce its environmental footprint and improve operational efficiency. With the increasing demand for nickel driven by the electric vehicle industry, South32 is strategically positioned to expand its production and enhance its competitive edge in the market.

Sumitomo Metal Mining Co., Ltd. is a key player in the nickel sector, primarily engaged in mining and refining operations in Japan and overseas. The company produces high-quality nickel, essential for stainless steel and battery applications, particularly in electric vehicles. Sumitomo is committed to sustainable practices, focusing on reducing environmental impacts through advanced technologies and efficient resource management. With increasing global demand for nickel, Sumitomo Metal Mining is well-positioned to enhance its production capabilities and meet the needs of a rapidly evolving market.

Vale SA is one of the largest producers of nickel globally, with operations primarily in Brazil and Canada. The company focuses on producing high-grade nickel products, essential for various applications, including batteries for electric vehicles. Vale is actively investing in sustainable mining practices and technologies to minimize its environmental footprint, aligning with global trends toward greener energy solutions. As demand for nickel continues to rise, particularly in the EV sector, Vale is strategically positioned to expand its production and strengthen its market presence.

Conclusion

In conclusion, the nickel market is set to experience robust growth in the coming years, driven by increasing demand from key sectors such as electric vehicles and renewable energy storage. With projections indicating that the global nickel market could reach approximately USD 55.7 billion by 2033, the industry’s prospects appear promising. However, challenges such as price volatility, environmental regulations, and geopolitical tensions must be carefully navigated.

Companies that invest in sustainable practices, innovation in recycling technologies, and diversification of supply chains are likely to position themselves advantageously in this evolving landscape. As the world transitions towards greener technologies and more sustainable production methods, the nickel market stands to benefit significantly, making it an area of keen interest for investors and industry stakeholders alike.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)