Table of Contents

Introduction

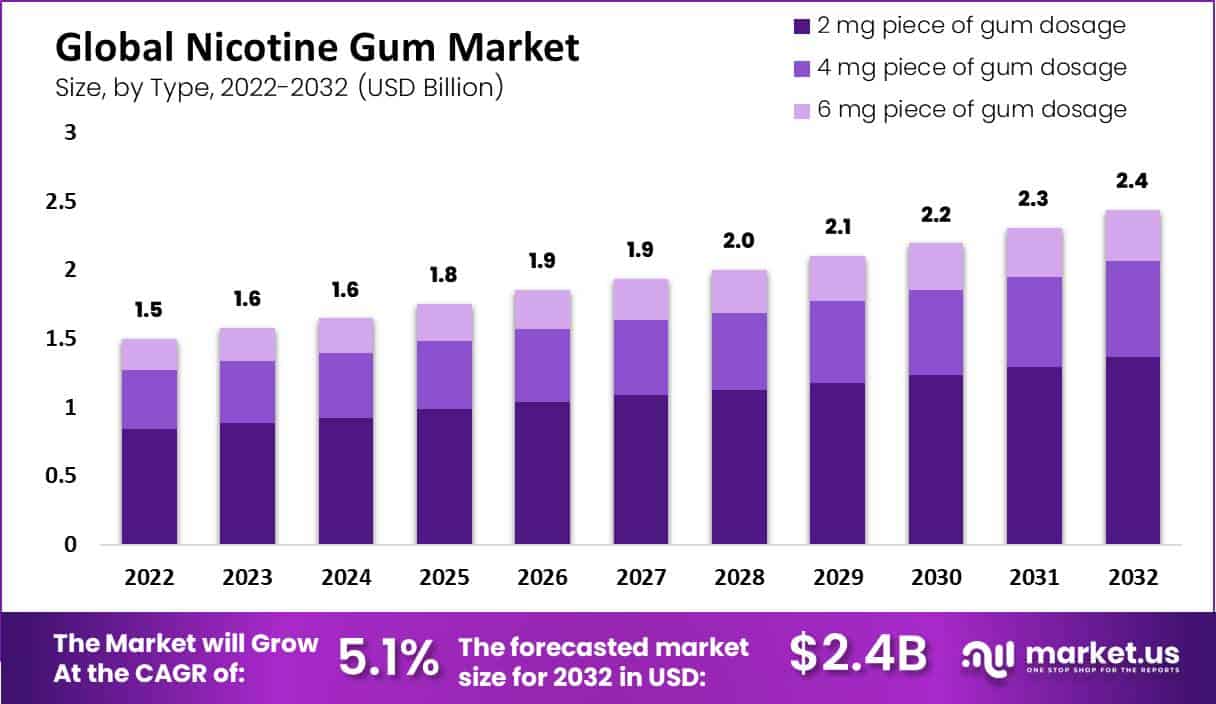

The global nicotine gum market was valued at approximately USD 1.5 billion in 2022 and is projected to reach USD 2.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.1% during the forecast period from 2023 to 2032. This growth is driven by several factors, including the increasing awareness of the health risks associated with smoking and the rising demand for nicotine replacement therapy (NRT) products to support smoking cessation efforts.

Nicotine gum, a widely used form of NRT, helps individuals quit smoking by delivering a controlled dose of nicotine to alleviate cravings and withdrawal symptoms. The market has seen a surge in demand due to government-led anti-smoking initiatives across the globe, promoting cessation programs and stricter regulations on tobacco consumption. These programs have contributed to the expansion of NRT products, including nicotine gum, in several regions, particularly in North America and Europe, which accounted for significant market shares in recent years.

A key market driver is the growing number of health-conscious consumers seeking smoking cessation solutions. For example, governments in countries like Japan have integrated NRT products, including nicotine gum, into national healthcare programs, making them accessible to the public under insurance coverage. Additionally, campaigns by organizations such as the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC) to reduce smoking-related illnesses further enhance the market’s growth prospects.

Challenges remain, however, with strict regulations governing nicotine products in some regions, which can limit their availability and accessibility. Moreover, the market is highly competitive, with major players like Johnson & Johnson, GlaxoSmithKline, and Perrigo Company plc vying for market share. This intense competition results in price pressure and necessitates innovation to maintain consumer interest. Despite these challenges, opportunities exist in the growing demand for alternative nicotine delivery methods, including nicotine gums in various flavors and dosages.

Recent developments include increased product innovations and strategic moves by key companies. For instance, Perrigo received FDA approval in 2023 for new nicotine-coated mint lozenges. Philip Morris International continues to expand its smoke-free product portfolio, including nicotine pouches and gums. These innovations align with consumer preferences for convenient and effective cessation products that offer enhanced user experiences.

GlaxoSmithKline has been a major player in the nicotine replacement therapy (NRT) space. Recent developments focus on expanding their portfolio of smoking cessation products, including nicotine gum. In 2023, the company increased investments in NRT product innovation to maintain its competitive position, leveraging the rising demand for health-conscious alternatives to smoking. They also emphasized collaborations to boost distribution channels for their products.

Fertin Pharma was acquired by Philip Morris International (PMI) in 2021 for approximately USD 820 million. This acquisition allows PMI to strengthen its presence in smoke-free products, including nicotine gum and pouches. Fertin Pharma, a leader in oral delivery systems, significantly expands PMI’s offerings beyond tobacco into health-focused segments like nicotine replacement therapies. Fertin continues to innovate in gum and tablet formulations, contributing to the development of NRT products.

Johnson & Johnson’s subsidiary Nicorette remains a key brand in the nicotine gum market. In March 2022, they launched a digital ecosystem to provide additional support for individuals attempting to quit smoking. This initiative includes educational resources and tools to complement their NRT product range, such as nicotine gum. The company continues to focus on digital health integration to enhance consumer engagement and support smoking cessation.

Statistics

- Mean plasma nicotine levels were higher with gum plus smoking than with either gum or smoking alone.

- After the final administration, mean levels with gum plus smoking were 39.5 (range 27.6-54.4) ng/ml vs. 19.6 (11.8-30.1) ng/ml with gum and 22.6 (6.6-36.6) ng/ml with smoking alone.

- Flavor options range from mint and cinnamon to various fruit flavors, and doses range from 2–6 mg, though it is most commonly sold in 2 and 4 mg strengths.

- Nicotine gum is commonly available in two strengths: 2 mg and 4 mg.

- Individuals who smoke their first cigarette at least 30 minutes after waking or smoke fewer than 25 cigarettes daily are recommended to use the 2 mg gum.

- Of 3,923 special intervention participants in the Lung Health Study who were offered nicotine gum to help them quit smoking, 1,080 (28.9%) were using nicotine gum 12 months after entry into the study.

- This group is comprised of 33.6% sustained nonsmokers, 54.5% intermittent smokers, and 19.2% continuing smokers. The average use of gum at 12 months is 7.3 pieces per day.

- Data on gum use beyond the first week of treatment were obtained from 117 gum users. Of these 40.2% were using 2 mg gum only, 24.8% were using 4 mg gum only and 35.0% were using a combination of both.

- Sustained abstinence rates at 4 months were 42/209 (20.1%) subjects in the Active group and 9/105 (8.6%) subjects in the Placebo group (p = 0.009).

- The present study investigated the efficacy of NRT to facilitate either smoking cessation or a reduction in smoking by 50% or more during a 6-month treatment period.

- Two NRT products were used, nicotine 10 mg inhaler and nicotine 4 mg gum.

- A UK-regulated disposable vape with the highest legal nicotine level (20mg/ml) contains 2 ml of liquid and 40mg of nicotine. This delivers, on average, about 20mg of nicotine to the user.

- A pack of 20 cigarettes contains 200 to 300mg of nicotine. This delivers, on average, 20 to 30mg of nicotine to the smoker.

- The researchers analyzed the responses of 3,516 9th and 10th graders who completed the survey between September 30 and December 14, 2021. Overall, e-cigarette use was the most prevalent among the respondents, with 9.6% of students reporting ever vaping and 5.5% vaping in the past six months.

- The use of oral nicotine products (not including nicotine pouches) was second most prevalent among the youth, with 3.1% of students reporting ever use and 1.4% reporting past six-month use.

Emerging Trends

- Growth in Demand for Nicotine Replacement Therapy (NRT): The nicotine gum market is seeing increased interest as part of smoking cessation efforts, driven by growing health awareness and government anti-smoking campaigns.

- Product Innovation: Companies are developing flavored gums and offering variations in nicotine strengths (2mg, 4mg) to cater to different levels of smokers.

- Rising Online Sales: E-commerce channels are expanding, making nicotine gum more accessible to a broader audience.

- Regional Growth: North America and Asia-Pacific are key growth regions, with stricter regulations on smoking and increasing awareness of health risks leading to higher demand.

- Increased Awareness of Health Risks: Public health campaigns emphasizing the dangers of smoking and the benefits of cessation products are driving nicotine gum sales.

- Higher Demand for Generic Options: As consumers seek cost-effective solutions, generic versions of nicotine gum are gaining popularity.

- Preference for Flavored Nicotine Gums: To improve user experience, flavored nicotine gums are becoming more common, particularly among younger demographics.

Use Cases

- Smoking Cessation: Nicotine gum is a primary tool for individuals trying to quit smoking. It helps reduce withdrawal symptoms like irritability, anxiety, and nicotine cravings by delivering controlled doses of nicotine to the bloodstream without the harmful substances found in cigarettes. Studies suggest that using nicotine gum can double the chances of quitting smoking successfully. For example, it may help up to 33% of smokers quit when used correctly over the recommended duration.

- Flexible Nicotine Replacement Therapy (NRT): Nicotine gum offers flexibility compared to other NRTs like patches. It allows users to adjust their nicotine intake according to their cravings, making it an ideal solution for those who need variable nicotine doses throughout the day. Nicotine gum can be used on demand. For the first six weeks of therapy, it’s advised to chew one piece every one to two hours, reducing this frequency over 12 weeks to gradually wean off nicotine.

- Portable and Discreet: The gum is small, portable, and can be used discreetly at work or in social situations, making it a convenient alternative for people with busy lifestyles.

- Harm Reduction: Safer Alternative to Smoking Nicotine gum eliminates exposure to the harmful chemicals found in cigarette smoke, such as tar and carbon monoxide, which can cause long-term health issues like lung cancer and heart disease.

- Support for Reducing Nicotine Dependence: The gum is designed to help users reduce nicotine dependency over time. Therapy is generally completed in three months, and users can switch from 4mg to 2mg as their cravings diminish.

- Cost-Effective: Nicotine gum is often more affordable than smoking or vaping. Over-the-counter options are available, and it can be significantly cheaper than continuing a smoking habit, with some brands offering bulk packs for convenience. These use cases show how nicotine gum is a versatile tool in smoking cessation, offering a flexible, accessible, and safer alternative to smoking or vaping.

Major Challenges

- Addiction Risk: Nicotine gum can lead to a new form of dependence. While it helps in reducing cravings, the nicotine present in the gum is still addictive. Prolonged use can result in a person becoming reliant on gum instead of cigarettes, making it hard to fully quit nicotine.

- Improper Usage: Many users struggle with the correct usage of nicotine gum. To be effective, the gum must be chewed in a specific way (the “chew and park” method), which can be confusing or inconvenient. Chewing it too quickly or swallowing it can lead to side effects like nausea, hiccups, or mouth irritation.

- Side Effects: Nicotine gum is associated with a range of side effects, including jaw discomfort, mouth soreness, and gastrointestinal issues. For some users, these effects make long-term use unpleasant or difficult to maintain.

- Psychological Dependency: Smoking is not only a physical addiction but also a deeply ingrained behavioral habit. While nicotine gum addresses the chemical aspect of addiction, it doesn’t fully tackle the behavioral or psychological triggers associated with smoking, such as stress relief or social routines.

- Limited Effectiveness for Heavy Smokers: For individuals who smoke heavily, lower doses of nicotine gum (2mg) may not be sufficient to control cravings, leading to either overuse or a higher likelihood of relapse. Adjusting to the proper dosage is crucial, but heavy smokers might still need stronger support like combination therapies.

Market Growth Opportunities

- Rising Health Awareness: The growing awareness of the harmful effects of smoking has led to an increase in the demand for smoking cessation products like nicotine gum. Government and non-governmental campaigns have significantly raised awareness, pushing more smokers to seek alternatives. As more individuals look for ways to quit smoking, the nicotine gum market is expected to grow at a projected compound annual growth rate (CAGR) of 4.1% to 5% through 2030.

- Innovation in Product Offerings: Opportunities exist for manufacturers to introduce new and improved products. Flavored nicotine gums, such as mint and fruit varieties, have gained popularity as they make the quitting process more enjoyable. Introducing sugar-free, organic, or natural ingredient-based gums could also cater to health-conscious consumers.

- Expansion in Emerging Markets: The nicotine gum market is witnessing rapid growth in regions such as the Asia-Pacific, particularly in countries like Japan and India, where smoking cessation campaigns are intensifying. These regions are expected to experience higher demand due to increasing awareness and stricter government regulations regarding tobacco use.

- Online Retail Growth: The rise of e-commerce has made nicotine gum more accessible, especially in regions where physical pharmacies are limited. Online sales channels have broadened the reach of nicotine gum, offering convenience and potentially higher profit margins for manufacturers.

- Combination Therapies: There is growing interest in combining nicotine gum with other nicotine replacement therapies, such as patches, to increase success rates for smokers trying to quit. This combination approach has been shown to improve cessation rates, providing an avenue for increased product use.

Key Player Analysis

In 2023, GlaxoSmithKline plc (GSK) continued its strategic efforts in the nicotine gum sector, aiming to expand its market reach and enhance product offerings. GSK, through its brand Nicorette, focuses on innovative smoking cessation products, including nicotine gums and lozenges, to support individuals looking to quit smoking. The company emphasizes innovation and consumer-centric approaches to develop products that meet the evolving needs of consumers who are striving to reduce or quit smoking.

In 2023, Fertin Pharma A/S continued to strengthen its position as a leader in the nicotine gum sector, primarily through its expertise in innovative oral delivery technologies. The company, known for its extensive experience in developing and manufacturing nicotine replacement therapy (NRT) products, has been instrumental in creating nicotine gums, lozenges, and other related products aimed at assisting smokers in quitting. Fertin’s approach combines over a century of confectionery expertise with sophisticated pharmaceutical techniques to deliver effective and consumer-friendly smoking cessation aids.

In 2023, Johnson & Johnson has continued to maintain a significant presence in the nicotine gum market, focusing on the development and distribution of nicotine replacement therapy (NRT) products like nicotine gums. This aligns with the broader industry trends where increasing health awareness and anti-smoking campaigns are boosting the demand for effective smoking cessation aids. Johnson & Johnson, renowned for its healthcare products, leverages its extensive distribution network to make nicotine gums accessible in various markets, particularly in North America, which remains a strong region for NRT products due to high consumer health consciousness and rigorous anti-smoking measures.

In 2023, Cambrex Corporation continued to enhance its presence in the nicotine gum market, focusing on the production of nicotine replacement therapy (NRT) products. As a significant player in the pharmaceutical manufacturing industry, Cambrex has utilized its expertise to support the growing demand for smoking cessation aids. The company’s involvement in the nicotine gum sector is part of a broader strategy to diversify its product offerings and respond to global health trends emphasizing the reduction of smoking rates.

In 2023, Perrigo Company plc made significant strides in the nicotine gum sector by expanding its product offerings to include nicotine-coated mint lozenges. These products, available in 2 mg and 4 mg dosages, received approval from the U.S. Food and Drug Administration and are marketed under retailer brands as alternatives to similar existing products. This move aligns with Perrigo’s strategy to bolster its portfolio in the consumer self-care market, particularly in over-the-counter health solutions that assist smokers in quitting or reducing their tobacco use.

In 2023, Reynolds American Inc. intensified its focus on the nicotine gum market by partnering with Pinney Associates to develop innovative nicotine replacement products. This collaboration is part of Reynolds’ broader strategy to diversify its offerings in the smoking cessation category, which also includes the nationwide expansion of its Zonnic brand nicotine gum. This move underscores Reynolds’ commitment to reducing the health impacts of tobacco through alternative products that aid in smoking cessation, aligning with broader public health goals to decrease smoking rates

In 2023, Dr. Reddy’s Laboratories Ltd. significantly expanded its presence in the nicotine gum market by acquiring the Nicotinell brand and related nicotine replacement therapy (NRT) portfolio from Haleon plc for £500 million. This strategic move aims to bolster Dr. Reddy’s offerings in the consumer healthcare segment, particularly in over-the-counter products. The acquisition includes various NRT products such as gums, lozenges, and patches, enhancing Dr. Reddy’s portfolio across more than 30 markets including Europe, Asia, Latin America, Australia, New Zealand, and Canada. This development is part of Dr. Reddy’s broader strategy to enhance its global consumer healthcare business and align with its goal of expanding access to health and wellness products worldwide

In 2023, Novartis International AG continued to enhance its position in the nicotine gum sector by maintaining a focus on innovation and market expansion. This aligns with the company’s broader strategy to extend its reach in the consumer healthcare market, particularly through over-the-counter (OTC) health solutions. Novartis’ commitment to increasing access to essential medicines and consumer health products is evident in its comprehensive range of offerings that assist individuals in managing their health, including those looking to quit smoking through nicotine replacement therapies like nicotine gum.

In 2023, Swedish Match AB, now a part of Philip Morris International (PMI), continued to enhance its focus on smoke-free products, including nicotine gums. This effort aligns with PMI’s broader strategy to transition adult smokers to smoke-free alternatives. Swedish Match’s products like General Snus have been positioned in the market as Modified Risk Tobacco Products (MRTPs), which they promote as lower-risk alternatives to smoking cigarettes. Their strategy includes promoting these products as part of a harm-reduction approach within regulatory frameworks like those in the U.S.

Conclusion

In conclusion, the nicotine gum market is poised for steady growth due to increasing health awareness and the rising demand for smoking cessation aids. As governments around the world intensify anti-smoking campaigns and promote healthier lifestyles, more individuals are turning to nicotine replacement therapies (NRT) like gum to quit smoking. This shift, coupled with ongoing product innovations such as flavored and sugar-free options, is expected to drive market expansion.