Table of Contents

Introduction

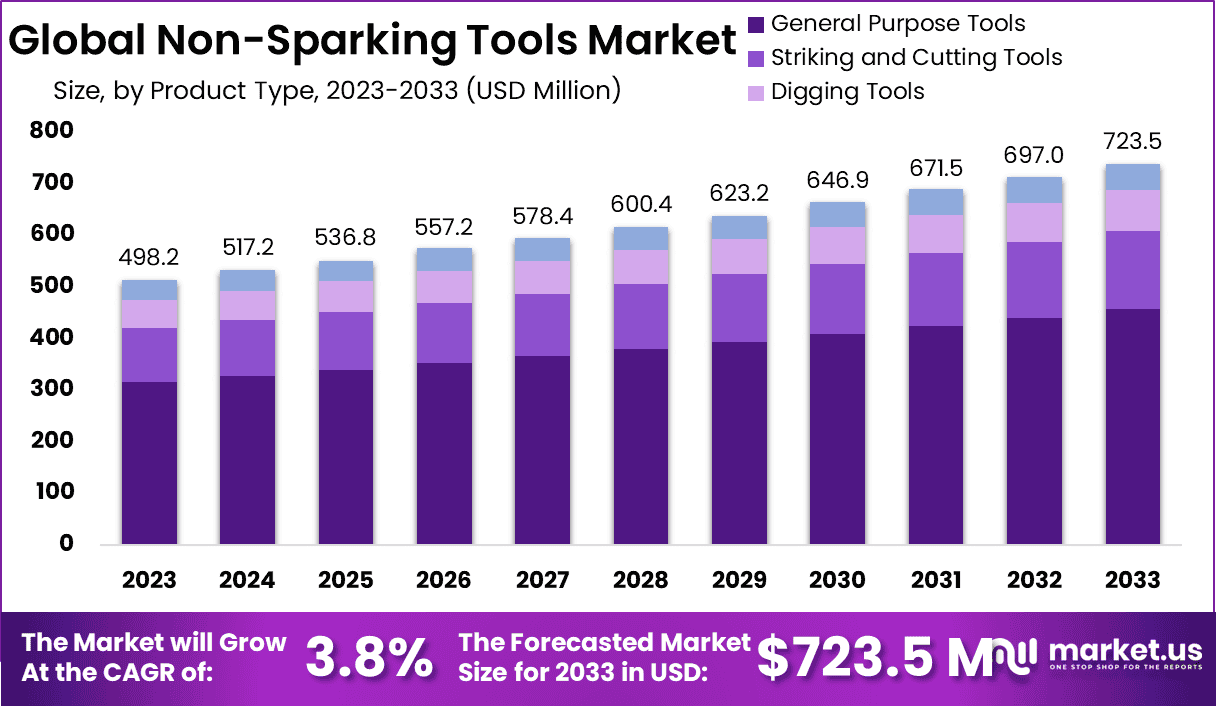

The Global Non-Sparking Tools Market is projected to reach a value of approximately USD 723.5 million by 2033, up from USD 489.2 million in 2023. This growth reflects a compound annual growth rate (CAGR) of 3.8% over the forecast period from 2024 to 2033.

The Non-Sparking Tools Market encompasses tools designed for use in environments where sparks could pose a safety risk, such as oil and gas facilities, chemical plants, and manufacturing units handling flammable materials. These tools, typically made from alloys like copper-beryllium or aluminum-bronze, are engineered to minimize the risk of generating sparks when struck against hard surfaces.

As a crucial part of safety protocols in hazardous environments, non-sparking tools are essential for preventing accidents, explosions, and ensuring compliance with safety standards. The market includes a wide range of tools such as hammers, wrenches, pliers, and screwdrivers, catering to industries where safety is a critical concern.

The growth of the Non-Sparking Tools Market is driven by several key factors, primarily the increasing emphasis on workplace safety and stringent regulatory frameworks. Industries such as oil and gas, petrochemicals, and mining are heavily regulated, requiring companies to adhere to safety protocols that often include the use of non-sparking tools.

Additionally, the rise in industrial activities, particularly in developing regions, is fostering demand as companies seek to minimize accident risks. Furthermore, technological advancements in materials and manufacturing processes are leading to more durable and efficient non-sparking tools, thus expanding the market’s reach and encouraging replacement purchases among end-users seeking to upgrade their safety equipment.

The demand for non-sparking tools is closely aligned with the health of end-use industries like oil and gas, mining, and chemical processing. As these sectors expand, either due to increased global energy demand or through investments in new infrastructure, the need for specialized safety tools increases proportionately. The demand is particularly strong in regions such as the Middle East, Asia-Pacific, and North America, where large-scale industrial projects and energy exploration activities are prevalent.

The Non-Sparking Tools Market presents substantial opportunities, especially as industries increasingly prioritize safety and risk management. Emerging markets in Latin America, Africa, and Southeast Asia are witnessing heightened investment in industries such as mining and oil & gas, creating a ripe environment for market expansion.

Additionally, there is a growing opportunity in the development of tools that offer both non-sparking and anti-corrosive properties, catering to the needs of industries operating in harsh environments such as offshore drilling and chemical processing.

Partnerships between manufacturers and industrial safety agencies could further enhance market penetration by aligning product offerings with the latest safety standards. As global industries become more safety-conscious, manufacturers that can innovate and offer customized solutions are well-positioned to capture market share and tap into these expanding opportunities.

Key Takeaways

- The Non-Sparking Tools Market is expected to see steady expansion, growing from USD 498.2 million in 2023 to USD 723.5 million by 2033, with a stable Compound Annual Growth Rate (CAGR) of 3.8%.

- Copper alloys dominate the raw materials segment, accounting for 41.0% of the market share, due to their superior spark-resistant properties, making them a preferred choice for non-sparking tool production.

- General Purpose Tools constitute 63.2% of the market, reflecting their broad application across a wide range of industrial sectors and highlighting their essential role in various safety-critical environments.

- Industrial end-users make up 68.4% of the market share, emphasizing the primary use of non-sparking tools within industrial settings where safety and compliance are paramount.

- Offline distribution channels remain dominant, capturing a 73.4% share, which indicates a strong preference for purchasing non-sparking tools through traditional retail outlets and specialized distributors.

- The Asia-Pacific (APAC) region holds a leading position with a 39.7% market share, driven by robust demand and a solid market presence for non-sparking tools across its industrial landscape.

Non-Sparking Tools Statistics

- In 2023, the oil and gas industry accounted for nearly 40% of non-sparking tool usage.

- Copper-beryllium alloys represent about 60% of materials used in non-sparking tools.

- The automotive industry saw a 15% increase in non-sparking tool adoption between 2022 and 2023.

- Approximately 75% of refineries worldwide use non-sparking tools as part of their safety protocols.

- The average lifespan of a non-sparking hand tool is estimated to be 5-7 years with proper maintenance.

- In 2023, there was a 20% increase in demand for non-sparking tools in the mining sector compared to the previous year.

- Non-sparking wrenches account for about 25% of all non-sparking tool sales.

- The chemical industry uses non-sparking tools in approximately 80% of its hazardous area operations.

- In 2023, there was a 10% increase in the development of new non-sparking tool alloys compared to 2022.

- The average cost of a non-sparking tool set is 3-5 times higher than its steel counterpart.

- Approximately 90% of offshore oil rigs use non-sparking tools in some capacity.

- The pharmaceutical industry saw a 12% increase in non-sparking tool adoption in 2023.

- Non-sparking hammers represent about 20% of the total non-sparking tool market.

- The aerospace industry accounts for approximately 8% of the global non-sparking tool market.

- In 2023, there was a 25% increase in online sales of non-sparking tools compared to 2022.

- The average hardness of non-sparking tools is about 30-35 on the Rockwell C scale.

- Approximately 65% of non-sparking tools are manufactured in countries with advanced metalworking industries.

- The food and beverage industry saw a 7% increase in non-sparking tool usage in 2023.

- Non-sparking screwdrivers account for about 15% of all non-sparking tool sales.

- The defense industry uses non-sparking tools in approximately 70% of its explosive ordnance disposal operations.

- In 2023, there was a 30% increase in the development of ergonomic designs for non-sparking tools.

- The average weight of a non-sparking tool is about 1.5 times that of its steel equivalent.

- Approximately 85% of large petrochemical plants have mandatory non-sparking tool policies in certain areas.

- The electronics industry saw a 9% increase in non-sparking tool adoption in 2023.

- Non-sparking pliers represent about 18% of the total non-sparking tool market.

- In 2023, there was a 15% increase in safety training programs related to the proper use of non-sparking tools in hazardous environments.

- The average cost of a non-sparking tool ranges from USD 50 to USD 300, depending on the type and material used.

- Non-sparking hammers are widely used in environments with flammable gases, with an adoption rate of around 90% in such settings.

- By 2024, it is estimated that over 70% of new vehicles will feature some form of non-sparking tool technology integrated into their designs.

Emerging Trends

- Increased Focus on Safety Regulations: The global demand for non-sparking tools is growing due to stricter safety regulations in industries like oil and gas, chemical processing, and mining. These regulations emphasize the need for tools that minimize the risk of igniting flammable materials, making non-sparking tools essential for compliance and safety.

- Technological Innovation in Materials: Manufacturers are increasingly utilizing advanced materials such as copper-beryllium and aluminum-bronze alloys, which offer superior durability and spark resistance. This trend is driven by the need for more reliable tools in hazardous environments, as well as the push for better performance in high-risk industries.

- Growing Adoption in APAC Region: The Asia-Pacific region is seeing significant growth in the non-sparking tools market, driven by the expansion of manufacturing and industrial activities in countries like China, India, and Japan. This region’s share of the global market is bolstered by rapid industrialization and a heightened focus on workplace safety.

- Shift Towards General Purpose Tools: General-purpose non-sparking tools, including wrenches, pliers, and screwdrivers, continue to dominate the market. These tools are versatile and widely used across different sectors, making them a key focus for both manufacturers and end-users seeking cost-effective safety solutions.

- Preference for Offline Distribution Channels: Despite the rise of e-commerce, the majority of non-sparking tools are still purchased through offline channels such as specialty stores and distributors. This trend is driven by the need for customers to physically inspect tools for quality, particularly in high-stakes industrial settings

Top Use Cases

- Oil and Gas Industry: Non-sparking tools are crucial in environments where flammable gases and hydrocarbons are prevalent, such as oil rigs and refineries. They are used in maintenance, pipeline installation, and routine repairs to prevent sparks that could lead to explosions. The demand for these tools is particularly high in offshore drilling operations, where even minor ignition sources pose significant safety risks.

- Chemical Manufacturing: In facilities that handle flammable chemicals, non-sparking tools are vital for tasks like transferring, mixing, and sampling hazardous materials. This sector relies on these tools to maintain compliance with stringent safety regulations, including those set by ATEX and OSHA. The use of non-sparking tools reduces fire hazards during processes involving volatile substances.

- Mining Operations: In mining, especially underground, the presence of explosive gases and dust requires tools that do not generate sparks. Non-sparking hammers, wrenches, and shovels help minimize the risk of accidental ignition during drilling and excavation. The tools are essential in environments where methane or coal dust could be ignited by a single spark.

- Aerospace and Aviation Maintenance: Non-sparking tools are used for assembling and maintaining aircraft in environments where fuel vapors might be present. These tools are applied in tasks like the installation of sensitive electronic components and in maintenance areas where the risk of ignition needs to be tightly controlled. This ensures safety during both routine and complex maintenance tasks

- Pharmaceutical Manufacturing: In the production of medicines, non-sparking tools play a role in environments with fine powders or solvents that are highly combustible. They are used for equipment repairs and maintenance within cleanroom environments to avoid contamination and accidental ignition. The precision and safety offered by these tools are critical for maintaining the operational safety standards in this industry

Major Challenges

- High Production Costs: Non-sparking tools are made from specialized materials like copper-beryllium, aluminum bronze, and other non-ferrous alloys. These materials are significantly more expensive than traditional steel, leading to a higher production cost. For instance, copper-beryllium tools can cost 30% to 50% more than aluminum bronze alternatives, making them less accessible for some companies.

- Limited Durability: The non-ferrous metals used in non-sparking tools have lower tensile strength compared to steel, which means they are more prone to wear and tear, especially in heavy-duty applications. For example, these tools need frequent replacement in high-stress environments, which increases maintenance costs for industries such as mining and chemical processing.

- Health and Safety Concerns: While non-sparking tools offer safety in terms of spark prevention, some materials, such as beryllium alloys, pose health risks if particles are inhaled over long periods. This is particularly a concern during manufacturing or grinding processes, which can generate fine dust, necessitating strict handling guidelines and safety equipment to mitigate risks.

- Specialized Usage Requirements: Non-sparking tools are not universally suitable for all hazardous environments. For instance, tools with high copper content cannot be used in the presence of acetylene gas due to the risk of forming copper acetylide, a highly explosive compound. In such cases, companies must seek specialized alloys, adding complexity and cost to the procurement process.

- Compliance with Diverse Safety Standards: The non-sparking tools industry must navigate varying regional safety standards such as the ATEX certification in Europe and OSHA guidelines in the United States. Achieving and maintaining compliance with these standards is crucial but adds to operational complexity and costs, especially for companies operating in multiple regions

Top Opportunities

- Expanding Demand in the APAC Region: The Asia-Pacific (APAC) region presents significant growth potential for non-sparking tools, driven by the rapid expansion of manufacturing and industrial activities in countries like China, India, and Japan. This region accounted for over 31% of the market share in 2022, and the demand is expected to continue rising as industries like automotive, electronics, and chemical manufacturing prioritize safety tools to meet regulatory standards.

- Increased Safety Regulations: Stricter global safety regulations across industries such as oil and gas, chemical processing, and mining are creating opportunities for non-sparking tool manufacturers. With industries aiming to reduce the risk of workplace accidents, there is a greater need for spark-resistant tools to ensure compliance with standards like ATEX in Europe and OSHA in the United States.

- Growth in the Construction Industry: The construction sector is witnessing consistent growth, especially in infrastructure projects and new residential developments. This trend boosts demand for non-sparking tools, particularly those used in environments where flammable materials like gases and dust are present. The market for such tools in construction is projected to grow as investments in infrastructure and urban development continue globally.

- Product Innovation and Material Advancements: Opportunities exist in developing new alloys and materials that enhance the durability and effectiveness of non-sparking tools. For example, innovations like the ACETILEX® alloy, which is suitable for acetylene environments, offer a competitive edge. These advancements can address specific safety challenges and help manufacturers differentiate their products in a market that values safety and performance.

- Shift Toward Online Distribution Channels: While offline sales remain dominant, the online distribution of non-sparking tools is growing as businesses seek convenient purchasing options and access to a broader range of products. This shift is supported by the increasing digitalization of procurement processes, especially in remote industrial operations. Online sales channels provide a cost-effective means for manufacturers to reach new markets and expand their customer base

Key Player Analysis

- Stanley Black & Decker (Facom): Stanley Black & Decker is a significant player in the non-sparking tools market, known for its wide range of high-quality tools under the Facom brand. The company is leveraging its global presence and strong distribution channels, which include offline and online retail. Recently, it sold its STANLEY Infrastructure business for $760 million, a move that aims to streamline its portfolio and focus on core tool segments.

- Ampco Metal SA:Ampco Metal, with over 100 years of experience, is a leader in manufacturing non-sparking, non-magnetic, and corrosion-resistant tools. Ampco’s products are used across industries like oil and gas, chemical processing, and aerospace. The company has a broad catalog with more than 2,200 tool types. It emphasizes custom manufacturing, catering to specific needs in hazardous environments.

- Snap-on Incorporated (Bahco): Snap-on, through its Bahco brand, offers a wide range of non-sparking tools known for durability and precision. These tools are particularly popular in the automotive and industrial sectors. Snap-on’s focus on innovation and high-quality manufacturing has positioned it well in the market. The company’s extensive distribution network and strong brand recognition contribute to its competitive edge.

- CS Unitec Inc: CS Unitec is recognized for its specialized non-sparking power tools, including saws, grinders, and drills. The company targets niche industrial applications where precision and safety are paramount. CS Unitec’s focus on providing advanced, spark-resistant tools makes it a key player in sectors like marine, construction, and energy, where safety regulations drive demand.

- EGA Master S.A: EGA Master, based in Spain, is known for its high-performance non-sparking tools and is a leading supplier to industries like oil and gas, mining, and pharmaceuticals. The company emphasizes innovation, including products designed for extreme conditions, such as ATEX-compliant environments. EGA Master’s dedication to safety and quality has made it a preferred choice for customers in over 150 countries

Recent Developments

- On December 15, 2023, Stanley Black & Decker announced a definitive agreement to divest its STANLEY Infrastructure segment, which includes its attachment and handheld hydraulic tools business, to Epiroc AB (Nasdaq Stockholm: EPIA). The transaction, valued at $760 million in cash, is aimed at allowing Stanley Black & Decker to focus on its core business operations while Epiroc seeks to strengthen its position in the hydraulic tools market.

- In 2024, the Mister Worker™ Blog highlighted the importance of non-sparking tools, also known as spark-resistant or ATEX tools, through an in-depth discussion with AMPCO Safety Tools®. The article emphasized the safety benefits of these tools, which are critical for use in hazardous environments. AMPCO specializes in producing non-sparking and non-magnetic hand tools such as wrenches, hammers, and screwdrivers.

- In March 18, 2024, Cisco completed its acquisition of Splunk in San Jose, California. This strategic move aims to enhance Cisco’s capabilities in providing improved visibility and insights across digital operations, thereby strengthening its position in the realm of digital infrastructure and cybersecurity.

- In 2023, on April 12, Emerson, headquartered in St. Louis, Missouri, and Austin, Texas, announced a definitive agreement to acquire NI (Nasdaq: NATI) at $60 per share, valuing the deal at $8.2 billion. Since Emerson already owned approximately 2% of NI’s shares, the effective purchase price amounted to $59.61 per share. NI is known for its advanced software-connected test and measurement systems that help accelerate product development across various industries, including semiconductors, electronics, and aerospace.

Conclusion

The non-sparking tools market is set for steady growth, driven by increasing safety concerns in hazardous environments such as oil and gas, chemical processing, and mining. The demand is primarily fueled by the need to prevent ignition risks, making these tools essential for various industrial applications. Key trends include a preference for durable copper-based alloys and the dominance of general-purpose tools, which are widely used across industries.

Additionally, the market benefits from regional strengths like the industrial expansion in the Asia-Pacific and strict safety regulations in North America and Europe. Despite challenges such as fluctuating raw material costs, the market’s focus on innovation and safety standards positions it well for continued advancement.