Table of Contents

Introduction

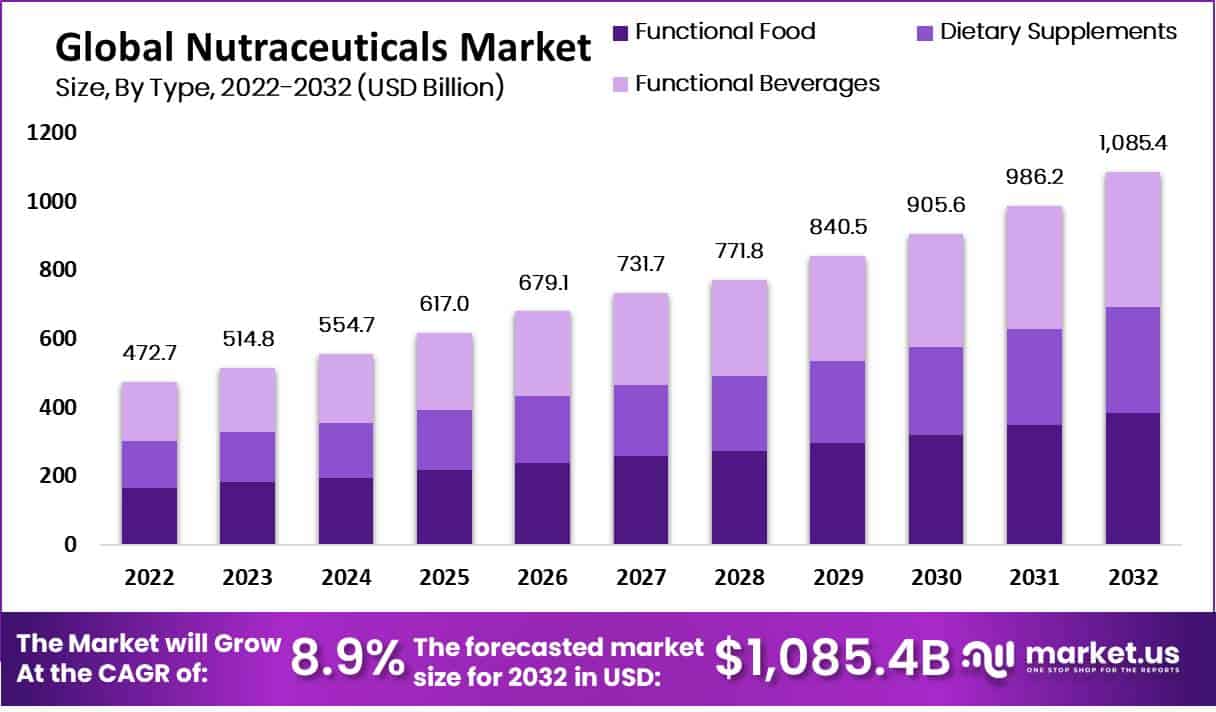

The global Nutraceuticals Market is witnessing robust growth, with its size anticipated to expand from USD 472.7 billion in 2022 to USD 1,085.4 billion by 2032, marking a compound annual growth rate (CAGR) of 8.9% during the forecast period from 2023 to 2032. This expansion is primarily driven by several key factors, including the increasing demand for functional foods and dietary supplements, advancements in product development, and the rising prevalence of chronic diseases and lifestyle-related disorders.

Functional foods and dietary supplements constitute the largest segments within the nutraceuticals market. The functional foods segment alone accounted for 37.65% of the market share in 2023, driven by technological innovations such as microencapsulation, which enhances the taste and bioavailability of health-promoting ingredients like omega-3 fatty acids. This technological progress, coupled with growing consumer awareness of health and wellness, has bolstered the market’s growth trajectory.

Moreover, the increasing prevalence of metabolic disorders, such as obesity and diabetes, has significantly influenced the demand for nutraceuticals. In the United States, for example, over 35% of the population in 19 states was classified as obese in 2022, up from 16 states in the previous year. This has spurred the consumption of dietary supplements aimed at weight management and overall health improvement.

The market is also experiencing substantial growth in response to the rising geriatric population, particularly in Europe and North America. In Europe, where over 21% of the population is aged 65 and above, the demand for health supplements to address age-related conditions such as arthritis and cardiovascular diseases is on the rise. This demographic shift is contributing to increased sales of nutraceutical products across the region.

However, the market faces several challenges that could impede its growth. One significant hurdle is the stringent regulatory environment governing the commercialization of nutraceutical products. Different countries have various regulatory frameworks to ensure product safety and efficacy, leading to time-consuming approval processes that can delay market entry. Additionally, the threat of counterfeit products poses a risk to consumer trust and market integrity.

Recent developments in the market include strategic mergers, acquisitions, and product innovations by key players to expand their market presence and meet evolving consumer demands. For instance, in 2022, Heinz partnered with The NotCompany to innovate plant-based food products using AI technology, enhancing their product portfolio and market reach. Similarly, Youtheory’s launch of new liquid dietary supplements post its acquisition by Jamieson Wellness Inc. highlights the ongoing trend of introducing diverse and high-quality nutraceutical products to cater to health-conscious consumers.

Functional Foods and Nutraceuticals Industry Statistics

- The functional food and nutraceutical industry is seizing the opportunity—389 firms in Canada generated $2.9 billion in revenues from these products in 2004/2005 and employed 13,000 people.

- The share of funds devoted to functional foods and nutraceuticals R&D was the lowest, 39%, among firms that only sell nutraceuticals.

- The most prescribed nutraceuticals were vitamins (40.7%), minerals (23.7%), enzymes (21.1%), proteins (8.8%), probiotics (4.2%), and herbals (2.0%).

- The most common reasons for consuming nutraceuticals were to maintain good health (70.0%) and healthcare professionals (57.85%) were the most approached source of information for nutraceuticals.

- Nearly half of the patients (46.5%) had an inadequate level of knowledge whereas more than two-thirds (71.5%) showed a moderate positive attitude towards nutraceutical use.

Diabetes Mellitus and CAM Use Statistics

- The number of people worldwide diagnosed with diabetes mellitus increased from 151 million in 2000 to 425 million in 2017.

- The prevalence of diabetes mellitus is predicted to further increase by 48% in 2045.

- Herbal products are the most commonly used CAM and 58.0% of the respondents opted for CAM as they believe in the efficacy of CAM to achieve better control of diabetes.

- Currently, over 400,000 RCTs are being conducted throughout the US and in 220 other countries.

- It was estimated that 49% of drugs approved by the FDA during 2005–2012 were based on “surrogate endpoints” rather than clinical outcomes.

Dietary Supplements Usage in the U.S Statistics

- The use of dietary supplements among U.S. adults increased by 10% over the past decade, new data from the 2018 CRN Consumer Survey on Dietary Supplements confirmed.

- The survey found that 75% of U.S. adults take dietary supplements.

- The majority of U.S. adults—87%—have overall confidence in the safety, quality, and effectiveness of dietary supplements, consistent with last year’s data and up from 84% in 2009.

- According to the 2018 survey, 78% of U.S. adults aged 55+ take dietary supplements, followed by those aged 35–54 (77%) and 18–34 (69%).

Emerging Trends

Personalized nutrition is becoming a dominant trend as consumers increasingly seek products tailored to their unique health needs and genetic profiles. Advances in genetic testing and AI-driven algorithms enable companies to offer customized nutraceutical solutions, optimizing health outcomes for individuals. This trend is expected to see significant growth as more consumers look for personalized dietary recommendations and supplements.

The plant-based movement continues to gain momentum, with a growing number of consumers opting for plant-based alternatives to meet their nutritional needs. This trend is driven by concerns over environmental sustainability, animal welfare, and personal health benefits. Innovative plant-based ingredients and products are expected to proliferate, catering to the demand for ethical and sustainable nutraceutical options.

Cognitive Health: As awareness of mental well-being increases, nutraceuticals targeting cognitive health are gaining popularity. Products aimed at improving memory, focus, and mood enhancement are expected to see significant growth. Scientific research supports the development of these products, which appeal particularly to younger demographics who prioritize mental wellness alongside physical health.

Microbiome Modulation: The understanding of the gut microbiome’s impact on overall health has expanded, leading to increased demand for products that support gut health. Nutraceuticals targeting specific strains of beneficial bacteria, prebiotics, and postbiotics are expected to grow, helping improve digestion, immunity, and mental well-being. This trend underscores the importance of the gut-brain connection in holistic health approaches.

Sustainable and Ethical Sourcing: Environmental sustainability and ethical considerations are influencing consumer choices in the nutraceutical sector. There is a rising demand for products made with sustainably sourced ingredients and transparent supply chains. Companies that adopt eco-friendly practices and responsibly source their materials are likely to attract environmentally conscious consumers.

Digitalization and E-Commerce: The digital revolution is transforming the nutraceutical industry, with e-commerce platforms and digital marketing channels providing new avenues for reaching consumers. Companies are leveraging data analytics, social media, and online platforms to engage with consumers, gather insights, and tailor their marketing strategies. This shift towards digital channels is driven by the convenience of online purchasing and the ability to access information instantly.

Immune Support: The COVID-19 pandemic has underscored the importance of immune health, leading to sustained growth in nutraceutical products aimed at supporting immune function. Consumers are seeking out vitamins, minerals, antioxidants, and herbal extracts to enhance their body’s defense mechanisms, making immune support a key area of focus in the industry.

Innovative Formulations and Delivery Systems: Advances in formulations and delivery systems are a significant focus within the industry. Innovative technologies such as nanoencapsulation and time-released capsules are being developed to enhance the bioavailability and efficacy of nutraceutical products. These advancements ensure that consumers receive the maximum health benefits from their supplements.

Aging Population: With an aging global population, there is an increasing demand for nutraceuticals that address age-related health concerns such as joint health, cognitive decline, cardiovascular health, and skin aging. Products targeting these areas are expected to see a rise, catering to the needs of older adults seeking to maintain their health and vitality.

Use Cases

Preventive Healthcare

- Cardiovascular Health: Omega-3 fatty acids, found in fish oil supplements, are widely used to reduce the risk of heart disease. Studies indicate that regular intake of omega-3 can lower triglyceride levels and blood pressure, contributing to heart health.

- Bone Health: Calcium and vitamin D supplements are crucial for bone health, particularly in aging populations. They help in maintaining bone density and preventing osteoporosis.

Digestive Health

- Probiotics and prebiotics are popular nutraceuticals used to promote gut health. These supplements help in maintaining a healthy balance of gut bacteria, which is essential for digestion and overall health.

- Probiotic Supplements: Products like Yakult and Activia are well-known for their digestive benefits. Probiotics help alleviate conditions like irritable bowel syndrome (IBS) and diarrhea.

Mental Health and Cognitive Function

- Nutraceuticals targeting brain health and cognitive function are gaining traction, especially among younger consumers who are increasingly focused on mental well-being.

- Cognitive Enhancers: Supplements containing ingredients like ginkgo biloba, omega-3 fatty acids, and ginseng are used to enhance memory, focus, and overall cognitive function.

- Mood Enhancement: Products designed to improve mood and reduce anxiety, such as those containing ashwagandha and CBD, are becoming more popular.

Immune Support

- Vitamins and Minerals: Supplements like vitamin C, vitamin D, zinc, and elderberry are widely used to boost immunity and protect against infections.

- Herbal Supplements: Echinacea and garlic supplements are also popular for their immune-boosting properties.

Weight Management

- Fiber Supplements: Products like glucomannan and psyllium husk help in weight loss by promoting satiety and improving digestion.

- Green Tea Extract: Known for its metabolism-boosting properties, green tea extract is a common ingredient in weight loss supplements.

Sports Nutrition

- Protein Supplements: Whey protein, casein, and plant-based protein powders are essential for muscle building and recovery.

- Branched-Chain Amino Acids (BCAAs): These are used to reduce muscle soreness and improve exercise performance.

Aging Population

- Joint Health: Glucosamine and chondroitin supplements are commonly used to alleviate joint pain and improve mobility in older adults.

- Eye Health: Supplements containing lutein and zeaxanthin are used to protect against age-related macular degeneration.

Major Challenges

Regulatory Complexities: The nutraceutical industry is subject to varying regulations across different countries, creating a complex landscape for manufacturers. Inconsistent regulatory frameworks can lead to difficulties in product approval and market entry. For example, the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have different requirements for health claims and ingredient approvals, making it challenging for companies to navigate compliance across regions.

Quality Control Issues: Ensuring the quality and safety of nutraceutical products is a major concern. The lack of standardized testing and certification processes can result in variations in product efficacy and safety. There have been instances of contamination and the presence of unlisted ingredients, which can harm consumer trust. Rigorous quality control measures and third-party testing are essential to maintain high standards and consumer confidence.

High Costs of Research and Development: Developing new nutraceutical products requires significant investment in research and development (R&D). The costs associated with clinical trials, ingredient sourcing, and product formulation can be prohibitive, especially for small and medium-sized enterprises (SMEs). Additionally, the time-consuming nature of R&D can delay the introduction of new products to the market.

Market Competition: The nutraceutical market is highly competitive, with numerous established players and new entrants vying for market share. Companies must continuously innovate and differentiate their products to stay ahead. This competition can drive up marketing and operational costs, putting pressure on profit margins. Moreover, the presence of counterfeit products in the market can undermine the reputation of genuine brands.

Market Growth Opportunities

Market Growth Opportunities in the Nutraceuticals Sector: The nutraceuticals sector is poised for substantial growth, driven by several key opportunities that industry players can leverage to expand their market presence and drive innovation. These opportunities include increasing consumer health awareness, the rise of personalized nutrition, advancements in biotechnology, and the growing popularity of plant-based products.

Increasing Consumer Health Awareness: As consumers become more health-conscious, there is a growing demand for products that offer health benefits beyond basic nutrition. This trend is particularly pronounced in the post-COVID-19 era, where people are more focused on boosting their immunity and overall wellness. Nutraceuticals that promote heart health, digestive health, and mental well-being are seeing increased adoption. This shift in consumer behavior presents a significant opportunity for manufacturers to develop and market products that cater to these health-focused needs.

Rise of Personalized Nutrition: The advent of personalized nutrition, driven by advances in genetic testing and AI, is revolutionizing the nutraceuticals market. Consumers are increasingly seeking customized solutions tailored to their health profiles. Companies that can provide personalized supplements and dietary recommendations based on genetic information and lifestyle data are likely to capture a significant share of the market. This approach not only enhances consumer satisfaction but also encourages brand loyalty.

Advancements in Biotechnology: Biotechnology is opening new avenues for the development of innovative nutraceutical products. Techniques such as microencapsulation and nanotechnology are being used to enhance the bioavailability and efficacy of nutraceutical ingredients. Additionally, the use of biotechnologically derived ingredients, such as probiotics and prebiotics, is gaining traction. These advancements enable the creation of more effective and targeted health solutions, thereby expanding the market potential.

Growing Popularity of Plant-Based Products: There is a significant shift towards plant-based diets, driven by concerns over sustainability, animal welfare, and health benefits. Plant-based nutraceuticals, including those derived from herbs, fruits, and vegetables, are becoming increasingly popular. This trend is particularly strong among younger consumers who are more environmentally conscious and health-oriented. Companies that focus on developing the plant-based nutraceuticals market can tap into this growing market segment and align with consumer preferences.

Recent Development

Herbalife Ltd., a global nutrition and wellness company, has shown significant activity in the nutraceuticals sector throughout 2023 and 2024. In the first quarter of 2023, Herbalife reported net sales of $1.25 billion, although this represented a slight year-over-year decrease from $1.22 billion in the same period in 2022. By the second quarter, net sales improved to $1.31 billion, showing a 3.8% increase from the previous year. This trend continued into the third quarter with sales reaching $1.30 billion, up from $1.25 billion in 2022. However, the fourth quarter saw a slight decline, with sales totaling $1.20 billion, down from $1.19 billion in the previous year.

Herbalife maintained its momentum, beginning the year with a first-quarter revenue of $1.30 billion, surpassing analysts’ expectations of $1.26 billion. The company’s earnings per share (EPS) for this quarter were $0.49, exceeding the forecasted $0.37. Herbalife’s consistent performance in the nutraceuticals market is driven by its diverse product offerings, strategic market expansions, and increasing consumer focus on health and wellness.

Nestlé S.A. has been significantly active in the nutraceuticals sector, focusing on health science and nutrition through innovative product offerings and strategic business initiatives. In 2023, Nestlé Health Science, a major division within the company, continued to expand its portfolio, particularly in the vitamins, minerals, and supplements category. Throughout the year, Nestlé invested in product innovation and market expansion, integrating advanced biotechnology and focusing on personalized nutrition solutions to meet consumer demand.

Nestlé reported organic growth of 7.2% across its various segments, with the nutraceuticals market division showing significant contributions due to the rising consumer focus on health and wellness. By April 2023, the company’s efforts in integrating new health products began to pay off, despite a slight decrease in total sales to CHF 22.1 billion compared to the previous year, due to foreign exchange impacts and other factors.

Danone has been actively advancing its presence in the nutraceuticals market sector through strategic initiatives and product innovations. Monthly performance highlights include several key developments. In January 2023, Danone launched new probiotic products aimed at enhancing gut health, leveraging its well-known brands such as Activia and Actimel. By March 2023, Danone expanded its plant-based product line, introducing nutrient-rich options under its Alpro and Silk brands, responding to the increasing consumer demand for plant-based nutrition.

Amway Corporation, a global leader in the nutraceutical sector, reported sales of $7.7 billion for the year ending December 2023. The company has been actively investing in its manufacturing capabilities and community initiatives. In January 2023, Amway began a significant investment of over $100 million in its facilities in Ada, Michigan, aimed at enhancing its nutritional tableting capabilities and pilot labs. By March 2023, the company saw a 6% increase in sales of its Nutrilite™ brand, driven by strong performance in Asia, particularly in China and South Korea. In July 2023, Amway announced a $127.6 million expansion plan for its West Michigan operations to further boost production capacity. By the end of the year, the company continued to focus on innovation and community engagement, laying the groundwork for sustained growth in 2024 and beyond

Conclusion

The nutraceuticals market is on a robust growth trajectory, driven by increasing consumer health awareness, advancements in biotechnology, and the rising popularity of personalized and plant-based nutrition. Despite challenges such as regulatory complexities and high R&D costs, the sector continues to innovate and expand, offering significant opportunities for growth. Companies like Danone and Amway are leading the way with substantial investments in research, manufacturing, and community engagement, underscoring the industry’s potential for future development. As consumer demand for health-enhancing products continues to rise, the nutraceuticals market is well-positioned to play a crucial role in global health and wellness