Table of Contents

Introduction

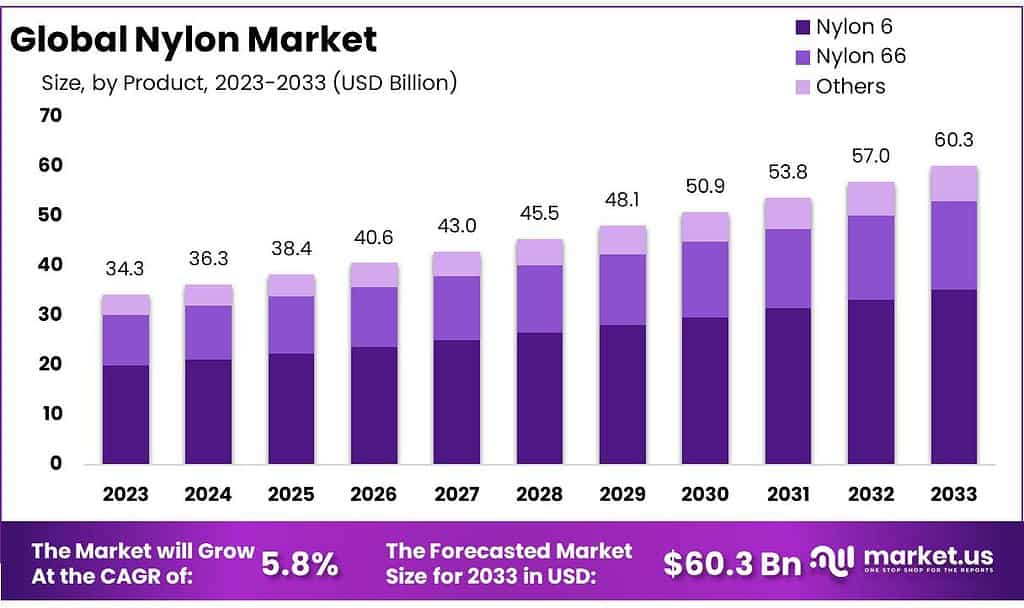

The global Nylon Market, encompassing the production, distribution, and trade of nylon materials and products, is projected to experience significant growth. The market size is expected to increase from USD 34.3 billion in 2023 to approximately USD 60.3 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.8% during this period. This growth is driven by several factors, including technological advancements, shifts in consumer preferences, and regulatory developments.

One of the primary growth drivers is the increasing demand for nylon in the automotive industry. Nylon composites are utilized for their mechanical properties, including high strength, durability, and resistance to heat and chemicals. These materials contribute to vehicle weight reduction and improved fuel efficiency, essential for meeting environmental regulations and consumer demands for sustainability. The automotive sector accounted for over 36% of the global revenue in 2023 and is expected to maintain its dominance due to continuous innovations in nylon applications for automotive parts.

The Asia-Pacific region holds the largest market share, driven by the availability of low-cost raw materials and labor, along with robust economic growth in countries like China and India. This region accounted for more than 45% of the global market revenue in 2023. The increasing automotive production, coupled with the rising demand from the electronics and packaging industries, propels the market growth in this region. Major players are setting up production facilities in Asia to cater to the growing demand and reduce reliance on imports.

Technological advancements are also pivotal in driving the market. Innovations such as BASF’s Ultramid Endure, a glass fiber-reinforced PA66, showcase the industry’s shift towards developing materials that withstand higher thermal loads and offer better processability. These advancements not only enhance product performance but also align with environmental goals by enabling more efficient and sustainable manufacturing processes.

However, the market faces several challenges. Fluctuations in raw material prices due to geopolitical tensions and supply chain disruptions pose significant risks. Additionally, the industry must navigate evolving environmental regulations that demand sustainable practices and products. Companies are responding by investing in research and development to create bio-based and recyclable nylon products, aiming to reduce their environmental footprint and meet regulatory standards.

Recent developments in the market include strategic initiatives by key players such as BASF SE, AdvanSix Inc., and LANXESS Corporation. These companies are expanding their product lines and engaging in mergers and acquisitions to strengthen their market positions. For instance, BASF’s investment in a new plant for hexamethylenediamine, a raw material for nylon-66, highlights the industry’s focus on scaling production capacities to meet future demand.

Nylon Market Statistics

- Fiber markets represented 55% of the 2010 demand with engineering thermoplastics being the remainder.

- Nylon 6 yarn has good fatigue resistance, it can withstand tens of thousands of double flexures, and under the same test conditions, it is 7-8 times higher than cotton yarn and dozens of times higher than viscose yarn.

- Even if it is immersed in 10% caustic soda solution at 100°C for 100 hours, the fiber strength will be reduced very little.

- The strength of optical fibers decreased by 23%, and the strength of non-optic fibers decreased by 50%.

- Nylon 6 yarn has a glass transition temperature of 47 °C. Nylon 6 yarn is a synthetic yarn that is typically white, although it can be dyed in a solution bath before manufacture to provide a variety of colors. It has a density of 1.14 gm/cc and tenacity that ranges from 6 to 8.5 gm/den.

- Drying before processing is highly recommended: 6-12 h at 80-90°C. Target moisture content should be a maximum of 0.1%.

- The moisture content should be a maximum of 0.2%. The maximum permissible drying temperatures lie in the range of about 80 to 110°C.

- when the fiber is stretched by 3-6%, the elastic recovery rate is close to 100%, and when the fiber is stretched by 10%, it is 92-99%.

- the elasticity of polyester yarn is The recovery rate is 67%, 56% for acrylic yarn, 45-50% for nylon yarn, and only 32-40% for viscose yarn.

- The nylon 6 yarn has a 2.4 % water absorption capacity.

- It has a density of 1.14 gm/cc and tenacity that ranges from 6 to 8.5 gm/den. It has a 215 °C melting point and, on average, can tolerate heat up to 150 °C.

- Nylon-6 filament yarn has 100% recovery at 4% extension.

- The nylon type was not effective against most pistol and rifle bullets, let alone the heavy 20 mm and 30 mm autocannons Axis powers were often armed with.

- nylon was only 14% of the residential side of the market and 20% overall.

- For many years, polyester was only 10% of the market.

- latest stats place polyester at 65% of the residential market. Similarly, triexta (which has chemical similarities to polyester) accounts for 15% of the market.

Emerging Trends

Sustainability and Bio-Based Nylons: With increasing environmental awareness, there is a significant shift towards sustainable materials. Companies are investing in the development of bio-based nylons made from renewable resources. For instance, Lululemon Athletica’s collaboration with Genomatica to create plant-based nylon for their products exemplifies this trend. This move not only caters to environmentally conscious consumers but also aligns with regulatory demands for sustainable manufacturing processes.

Technological Advancements: Technological innovations are crucial in enhancing the performance of nylon products. Advanced nylon composites are being developed to improve mechanical properties, wear resistance, and thermal stability. BASF’s Ultramid Endure, a glass fiber-reinforced PA66, is designed to withstand higher thermal loads and offers better processability, making it ideal for automotive applications. Such advancements are pivotal in replacing traditional materials like steel, thereby reducing vehicle weight and enhancing fuel efficiency.

Automotive Industry Demand: The automotive sector continues to be a major driver for the nylon market, accounting for a significant share of global revenue. Nylon composites are extensively used in manufacturing various automotive components such as hydraulic clutch lines, cooling systems, and air intake manifolds. The demand for lightweight vehicles to improve fuel efficiency and reduce emissions is pushing the automotive industry towards increased use of nylon.

Regional Market Dynamics: The Asia-Pacific region dominates the nylon market, driven by low-cost raw materials, labor, and increasing economic power. Countries like China and India are major contributors, with China accounting for a substantial portion of production and consumption. This region’s growth is also fueled by robust automotive and electronics sectors. In contrast, developed markets like North America and Europe focus on high-quality, premium nylon products, reflecting changing consumer preferences towards more sustainable and advanced materials.

Market Diversification and Expansion: Key players in the nylon industry are expanding their product lines and geographical reach. Companies like BASF SE and LANXESS Corporation are investing heavily in R&D and forming strategic alliances to enhance their market presence. This includes developing new production facilities and acquiring smaller companies to broaden their market portfolio. For instance, BASF’s new plant for hexamethylenediamine in Germany aims to boost nylon-66 production, meeting the rising demand for high-performance nylons.

Challenges and Opportunities: The nylon market faces challenges such as fluctuating raw material prices and stringent environmental regulations. However, these challenges also present opportunities for innovation and development of eco-friendly products. Companies are focusing on creating recyclable nylons and improving supply chain efficiencies to mitigate the impact of these challenges.

Use Cases

Automotive Industry: Nylon is extensively used in the automotive sector for manufacturing various components. In 2023, the automotive application segment accounted for over 36% of the global nylon market revenue. Key applications include:

Engine Components: Nylon is used to replace metal parts in the engine compartment due to its lighter weight and high resistance to heat and chemicals. This contributes to vehicle weight reduction, improving fuel efficiency, and reducing emissions. Interior and Exterior Parts: Components such as headlamp bezels, air intake manifolds, fuel caps, and door handles are made from nylon composites due to their strength and durability.

Textile Industry: Nylon is a staple material in the textile industry, valued for its strength, elasticity, and abrasion resistance. The global textile market utilizes nylon for a variety of applications, including:

Apparel: Nylon is used in sportswear, hosiery, and intimate wear due to its smooth texture and moisture-wicking properties. In 2023, the global market for nylon in textiles was valued at approximately USD 14 billion.

Packaging Industry: The packaging sector relies on nylon for its barrier properties and strength. Nylon films are used in food packaging to enhance shelf life by providing a barrier against oxygen and moisture.

Flexible Packaging: Nylon films are widely used in flexible packaging solutions, which accounted for a significant portion of the USD 34.3 billion global nylon market in 2023.

Electrical and Electronics Nylon is utilized in the electrical and electronics industry for its insulating properties and durability. Cable Insulation and Connectors: Nylon is used to insulate electrical wires and cables, protecting against mechanical damage and environmental factors.

Circuit Boards and Electronic Components: Nylon is also used in the manufacturing of circuit boards and various electronic components due to its high dielectric strength and heat resistance.

Industrial Applications Nylon is employed in various industrial applications due to its mechanical properties. Mechanical Parts: Gears, bearings, and bushings are often made from nylon because of its wear resistance and low friction properties. Chemical Processing: Nylon’s chemical resistance makes it suitable for use in tanks, valves, and piping systems in chemical processing industries.

Sporting Goods: Items like tennis rackets, fishing lines, and camping gear often incorporate nylon for its strength and lightweight nature.

Household Items: Products such as toothbrush bristles, kitchen utensils, and zippers are commonly made from nylon due to their durability and flexibility.

Major Challenges

Fluctuating Raw Material Prices: The cost of raw materials used in nylon production, such as adipic acid and hexamethylenediamine, is subject to significant volatility. This fluctuation is often due to geopolitical tensions, supply chain disruptions, and changes in crude oil prices, which are a primary input in the production of nylon. For instance, the price volatility of crude oil, which saw significant swings in recent years, directly affects the cost structure of nylon manufacturers.

Environmental Regulations: Stricter environmental regulations are imposing additional compliance costs on nylon manufacturers. These regulations aim to reduce the environmental impact of nylon production, which involves high energy consumption and greenhouse gas emissions. For example, the European Union’s REACH regulations mandate stringent controls over chemicals used in the production process, increasing operational costs for compliance.

Sustainability Concerns: The push towards sustainability is a double-edged sword for the nylon industry. While there is growing demand for sustainable and bio-based nylons, transitioning to these alternatives involves significant R&D investments and changes in manufacturing processes. The development of bio-based nylon, although promising, is still in its nascent stage and faces challenges in achieving cost parity with traditional nylon.

Competition from Alternative Materials: Nylon faces intense competition from other materials such as polyester, which is often cheaper and more versatile. This competition is particularly fierce in the textile industry, where polyester has gained substantial market share due to its cost advantages and similar properties to nylon. The challenge is further compounded by advancements in alternative materials that are perceived as more environmentally friendly.

Technological Challenges: Advancing technology in nylon production requires continuous investment in new manufacturing processes and equipment. The industry must innovate to improve nylon’s properties and reduce production costs. However, the capital-intensive nature of these technological upgrades can be a barrier for many manufacturers, particularly smaller firms.

Market Growth Opportunities

Automotive Industry Expansion: The automotive sector remains a crucial driver for nylon demand. As the industry continues to shift towards lightweight and fuel-efficient vehicles, the use of nylon in automotive parts such as engine components, interior trim, and exterior panels is expected to grow. This demand is fueled by nylon’s properties, including high strength, durability, and resistance to heat and chemicals. The global push for electric vehicles (EVs) also presents a significant opportunity, as EV manufacturers seek materials that enhance vehicle efficiency and performance.

Growth in the Electronics Sector: Nylon is increasingly used in the electronics industry for its insulating properties and mechanical strength. With the rise of smart devices and the Internet of Things (IoT), the demand for durable and lightweight materials in electronic components is growing. Nylon is used in connectors, circuit boards, and other electronic parts, providing a robust market opportunity as technology continues to advance and expand globally.

Sustainable and Bio-Based Nylons: There is a growing trend towards sustainability in various industries, including textiles and automotive. The development and adoption of bio-based nylons offer significant growth potential. Companies are investing in research to produce nylon from renewable resources, such as plant-based feedstocks, which appeal to environmentally conscious consumers and comply with stringent environmental regulations. For instance, bio-based nylon 11 and nylon 610 are gaining traction in the market due to their reduced carbon footprint and biodegradability .

Medical and Healthcare Applications: The medical industry presents new growth opportunities for nylon, particularly in the production of medical devices and components. Nylon’s biocompatibility, flexibility, and strength make it suitable for various medical applications, including surgical instruments, catheters, and prosthetics. The increasing demand for advanced medical devices and the growth of the healthcare sector globally are expected to drive the use of nylon in this field.

Innovations in Textile Applications: The textile industry continues to innovate with nylon, leveraging its properties for high-performance fabrics. Nylon’s use in sportswear, activewear, and outdoor gear is expanding due to its durability, moisture-wicking capabilities, and elasticity. The rise in health and fitness trends globally is boosting demand for such high-performance textiles, providing a significant market opportunity for nylon manufacturers .

Recent Developments

In the nylon sector, BASF SE has been actively involved in developing and enhancing its product offerings throughout 2023 and into 2024. In January 2023, BASF began expanding its production of nylon 6.6 at its Freiburg plant, a strategic move to meet the growing demand for high-performance engineering plastics used in automotive and electronic applications. This expansion is expected to significantly boost the company’s output capacity by mid-2024.

In the nylon sector, Honeywell International Inc. has shown consistent growth and innovation throughout 2023 and into 2024. The company, under its Performance Materials and Technologies segment, focuses on producing high-performance materials, including nylon, for various applications such as automotive, electronics, and industrial uses.

In January 2023, Honeywell reported a monthly sales revenue of approximately $900 million from its Performance Materials and Technologies segment. By March 2023, this figure increased to $950 million, reflecting a 5.6% growth due to heightened demand in automotive and industrial applications. The upward trend continued through the year, with sales reaching $1 billion in June 2023, driven by new product introductions and expanding market applications.

Ascend Performance Materials, the largest fully integrated producer of nylon 6,6, has focused on expanding its capabilities and product offerings in 2023 and 2024. In January 2023, Ascend started increasing its production capacity for nylon 6,6 building blocks and polymers by 10 to 15 percent to meet the rising global demand. This expansion includes key intermediates like adipic acid and hexamethylene diamine (HMD), crucial for nylon 6,6 production.

In the nylon sector, Solvay S.A. demonstrated solid performance throughout 2023 despite a challenging macroeconomic environment. In the first quarter of 2023, Solvay focused on expanding its high-performance polymer portfolio, particularly in the automotive and electronics industries. By March 2023, the company reported a steady increase in the demand for its specialty nylon products used in lightweight automotive components and durable electronics casings.

April 2023 saw Solvay implementing strategic cost-saving initiatives that began to yield results, contributing to a stable EBITDA despite market pressures. The second quarter highlighted a robust performance in their specialty polymers division, with monthly sales averaging around €400 million, reflecting a consistent demand in both the automotive and consumer electronics sectors.

Conclusion

The global nylon market is poised for significant growth, driven by increasing demand across various industries such as automotive, textiles, and electronics. This growth is primarily fueled by the material’s excellent mechanical properties, including high strength, durability, and heat resistance, making it ideal for automotive applications where lightweight and fuel-efficient components are essential. Asia-Pacific leads the global market, accounting for more than 45% of the total revenue, thanks to the region’s low-cost raw materials, labor, and supportive government policies. China and India, in particular, are key contributors to this dominance due to their large-scale production and consumption of nylon.