Table of Contents

Introduction

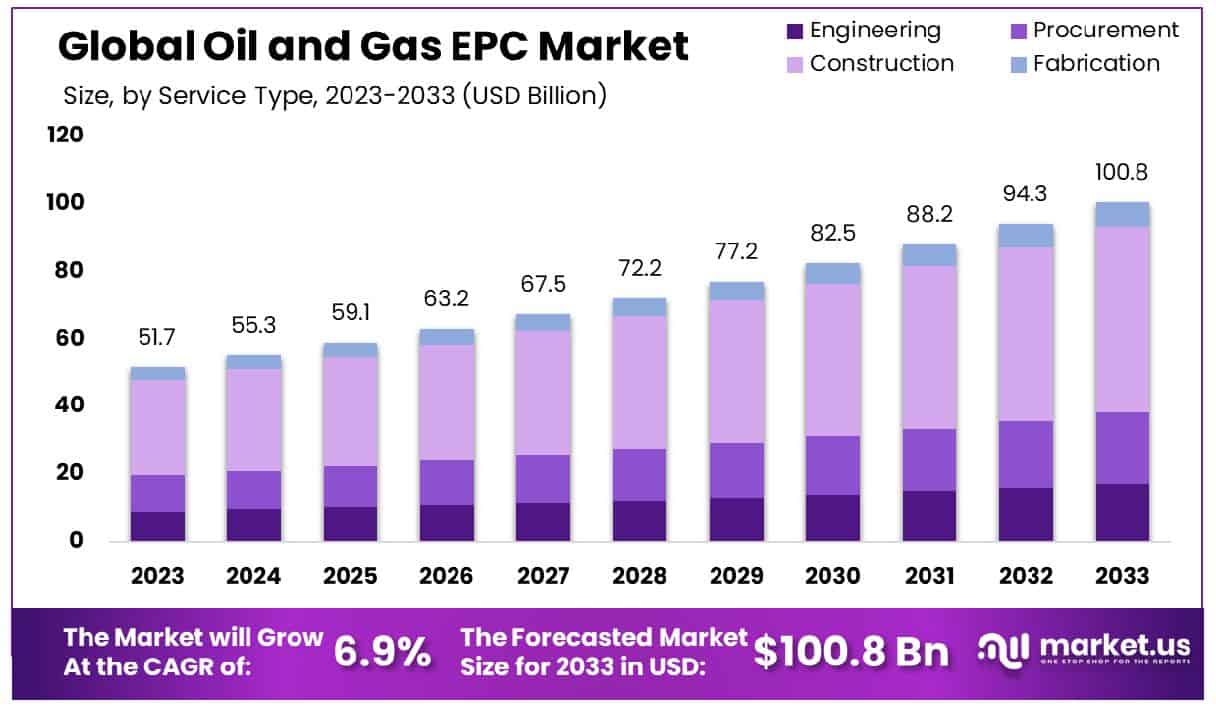

The Global Oil and Gas Engineering, Procurement, and Construction (EPC) Market is projected to experience significant growth over the next decade. The market size is estimated to expand from USD 51.7 billion in 2023 to approximately USD 100.8 billion by 2033, reflecting a compound annual growth rate (CAGR) of 6.9%. This growth can be attributed to several factors, including increased investments in oil and gas exploration activities and the adopting of advanced technologies for project management and execution.

However, the market faces challenges such as regulatory pressures related to environmental concerns and fluctuating oil prices, which may impede growth. Recent developments in the sector include a surge in mergers and acquisitions, enhancing service offerings, and geographical expansion of leading EPC companies. This dynamic landscape presents opportunities and hurdles for stakeholders in the oil and gas EPC market.

Bechtel Corporation, a leader in the Oil and Gas EPC market, has consistently secured new contracts and expanded its project portfolio globally. Recently, Bechtel has been involved in large-scale projects in North America and the Middle East, focusing on liquefied natural gas (LNG) and refinery expansions. The company’s strategic direction emphasizes enhancing operational efficiency and integrating advanced technology solutions to maintain its market leadership. Bechtel’s growth strategy also includes fostering strong partnerships and collaborations that leverage technological innovations to optimize project execution.

Fluor Corporation has made significant strides in restructuring its operations to enhance profitability and focus on its core competencies in the oil and gas sector. The company recently announced major contract wins in engineering and fabrication, which will likely boost its market position. Fluor’s focus on integrating sustainable practices and digital transformation initiatives into its projects positions it well to address the evolving demands of the industry. Moreover, Fluor’s commitment to safety and quality in project execution continues to be a key factor in its competitive advantage.

TechnipFMC stands out in the market for its technological advancements and integrated solutions in subsea and surface projects. The company has launched several new products aimed at improving operational efficiency and reducing environmental impact. Recent developments include the introduction of eco-friendly technologies that minimize carbon footprint and enhance energy efficiency. TechnipFMC’s strategy revolves around innovation and customer-centric solutions, which are critical in driving its growth in a competitive market.

McDermott International has recently emerged from a restructuring phase, focusing on strengthening its EPC services in key markets such as North America, the Middle East, and Asia-Pacific. The company has successfully secured new contracts, particularly in LNG and offshore projects, which are expected to significantly contribute to its revenue growth. McDermott’s approach includes leveraging its advanced technology platforms and project management expertise to deliver high-quality, cost-effective solutions to its clients.

Saipem S.p.A. has been actively expanding its presence in the renewable energy sector, alongside its traditional oil and gas operations, to align with global energy transition trends. The company has been part of several strategic alliances and joint ventures that enhance its service offerings in offshore wind and green hydrogen projects. Saipem’s focus on sustainability and innovation is evident in its project execution strategies, which prioritize environmental conservation and operational efficiency.

Key Takeaways

- Market Growth: The Global Oil and Gas EPC Market is projected to grow from USD 51.7 billion in 2023 to USD 100.8 billion by 2033, with a CAGR of 6.9%.

- North America leads the Oil and Gas EPC Market with 38.4%, totaling USD 19.8 billion.

- By Service Type: Construction dominates the service segment with 54.6% in the Oil and Gas EPC Market.

- By Type: Upstream EPC captures 42.6% of the market, reflecting significant project involvement.

- By Application: Onshore projects lead with 68.4%, showing a strong preference for applications.

- By End-Use: Exploration and production are major end-uses, constituting 43.2% of the market.

Oil and Gas EPC Market Statistics

- EPC companies involved in large-scale infrastructure projects significantly contribute to environmental impact. According to the United Nations Environment Programme, the construction sector consumes nearly 40% of global energy and is responsible for 36% of global CO2 emissions.

- For instance, incorporating energy-efficient systems, such as green building designs, can result in up to 30% energy savings in buildings, according to the International Energy Agency.

- Green technologies and innovation within the EPC industry in recent years. Building integrated photovoltaics (BIPV) is gaining traction, with an expected global market value of over $32 billion by 2024.

- With sustainability goals and offer substantial economic benefits, with energy-efficient buildings potentially yielding up to 50% energy cost savings.

- Global economic losses from natural disasters have increased by 151% over the past 20 years, with climate-related events accounting for a significant portion of these losses.

- A recent World Bank study estimates climate change could push more than 100 million people into poverty by 2030 without adequate adaptation measures.

- According to a recent study, the global cost of environmental damage amounts to a staggering $4.7 trillion annually, equivalent to 6.2% of the world’s GDP.

- According to recent studies, over 80% of the world’s population is exposed to hazardous levels of air pollution.

- Engineering progress has proved to be linear from 20 to 80%, with a slope that depends on the number of man-hours and ranges from 6 to 9%/month.

- 50% of the piping construction drawings (isometric drawings) must have been issued.

- 75% of the materials of all types (straight lengths, fittings, all grades) must have been delivered at the Site.

- JGC is one of the world’s leading major energy project contractors, with oil and gas, and LNG, accounting for 65% of its order book of 1.3 trillion yen (US$8.3 billion) at the end of 2023.

- Hyundai Engineering & Construction Co. Ltd. for the complex’s mixed-feed cracker that will be equipped to produce 1.65 million tonnes/year (tpy) of ethylene and related industrial gases.

- One notable matter involved the team successfully settling a claim exceeding US$200 million for the premature termination of an EPIC project for offshore oil platforms.

- Data-driven engineering can reduce the number of documents by up to 70% and increase project efficiency by up to 20%.

- In Q1 2023, 14,605 premises held a ‘C’ EPC rating, which was almost a fifth (18%) more than the 12,142 buildings that had a ‘B’ rating.

- Six in 10 UK developers (64%) think they will hit net zero emissions across all commercial buildings in their portfolios between 2031-2040.

- The biggest difficulty for UK developers in hitting the net zero goal is the high cost of constructing net zero buildings, with an average difficulty score of 3.9 out of 5.

Emerging Trends

- Increased Emphasis on Sustainability: There is a growing push for sustainability in the oil and gas sector, prompting EPC companies to adopt greener technologies and practices. This includes the integration of renewable energy sources into traditional oil and gas operations, as well as the implementation of projects aimed at reducing carbon emissions and environmental impact. Companies are increasingly adopting more efficient and less environmentally damaging techniques to comply with global sustainability standards.

- Digital Transformation: Digital technology is revolutionizing the Oil and Gas EPC market. The use of big data analytics, the Internet of Things (IoT), and artificial intelligence (AI) is becoming more prevalent, enabling companies to enhance operational efficiency and reduce costs. These technologies facilitate improved project management, design, and execution capabilities, offering real-time insights that help in decision-making and risk management.

- Modular Construction: Modular construction techniques are gaining traction in the oil and gas industry. This method involves assembling large segments of a facility remotely in a controlled environment, which are then transported to the site for final installation. Modular construction helps reduce construction time, lowers costs, and improves safety performance by minimizing the amount of on-site work.

- Integration of EPC Services: There is an increasing trend towards the integration of services under single EPC contracts, which allows for streamlined project management and execution. This approach reduces interfaces, lowers risks, and can lead to better cost and schedule control. Clients prefer dealing with a single entity that offers comprehensive services from project conception through completion, which simplifies communication and coordination.

- Local Content Requirements: Many countries are implementing local content regulations that require EPC projects to include a certain percentage of the local workforce, suppliers, and materials. This trend is driven by governmental policies aiming to boost local industries, improve skill levels, and retain more project value within the country. EPC companies must adapt to these requirements, which can involve strategic partnerships and investments in local capabilities.

Use Cases

- Large-Scale LNG Facility Construction: A notable use case involves the EPC management of large-scale liquefied natural gas (LNG) facilities. For instance, constructing an LNG plant typically requires an investment ranging from $5 billion to over $20 billion, depending on capacity and location. EPC firms provide integrated services that manage the complexity of engineering hundreds of thousands of components while ensuring compliance with stringent safety and environmental standards. For example, an EPC company might handle the installation of LNG train facilities that can process up to 8 million tons of LNG per year, utilizing advanced modularization techniques to reduce construction time by up to 25%.

- Offshore Oil Rig Construction: Another use case is the construction of offshore oil rigs. EPC contractors play a crucial role in designing and constructing offshore platforms, which can cost between $650 million and $4 billion, based on the rig’s size and depth of the oil field. EPC services include deep-sea engineering, procurement of specialized materials resistant to harsh marine environments, and managing complex logistics for transporting large structures to remote offshore locations. The comprehensive management capability of EPC firms can decrease overall project timelines by up to 15-20%, crucial for projects where every day of delay can cost millions in lost production.

- Pipeline Projects: EPC firms are also key in pipeline projects, essential for transporting oil and gas across vast distances. For instance, building a pipeline spanning 1,000 kilometers might involve investments of approximately $1 billion to $3 billion. EPC providers oversee the design, material procurement (like tens of thousands of pipes and fittings), and construction, ensuring that pipelines meet safety standards to prevent leaks and environmental damage. Their expertise can increase the efficiency of pipeline construction, improving material throughput by up to 10-30%, depending on the project’s scale.

- Refinery Expansion and Modernization: Refinery projects, especially expansions and modernizations, represent a critical use case for Oil and Gas EPC services. These projects, often valued between $500 million and $10 billion, require meticulous integration of new technologies into existing refinery setups. EPC companies manage everything from upgrading old units to installing new ones that increase capacity or allow the processing of different types of crude oil. Their involvement ensures that refinery downtime is minimized—often a critical factor that can save the refinery operators substantial revenue losses.

- Integrated Oilfield Developments: Comprehensive oilfield development is a sophisticated EPC use case, involving not just drilling and wellhead installations but also the infrastructure needed for the oil to be processed, stored, and transported. For a large oilfield, total development costs can range from $10 billion to $50 billion. EPC firms leverage their extensive capabilities in simultaneous engineering and construction phases to shorten the overall project duration, potentially reducing costs by 5-15% through efficiencies and economies of scale.

Key Players Analysis

Bechtel Corporation is a prominent entity in the Oil and Gas EPC (Engineering, Procurement, Construction) sector, renowned for its integrated project delivery approach. The company excels in constructing large-scale projects like refineries and LNG terminals. Utilizing advanced technologies and sustainable practices, Bechtel aims to reduce carbon emissions throughout the project lifecycle, ensuring efficient and environmentally responsible project execution.

Fluor Corporation is a leading global player in the Oil and Gas EPC (Engineering, Procurement, Construction) sector, leveraging extensive experience to execute complex projects across traditional and renewable energy markets. Specializing in large-scale ventures such as LNG facilities and pipelines, Fluor emphasizes sustainable, efficient solutions that cater to evolving global energy demands. Their projects, like the LNG Canada Export Facility and the Gladstone LNG project, underscore their capability in managing intricate operations and their commitment to environmental standards and community engagement.

TechnipFMC stands out in the Oil and Gas EPC sector for its comprehensive integrated EPC services (iEPCI™), focusing on subsea, offshore, and surface projects. The company is involved in groundbreaking projects like the Mero 3 HISEP® in Brazil, emphasizing carbon capture and storage technologies to enhance sustainability in hydrocarbon processing.

McDermott International is a significant global player in the Oil and Gas EPC sector, renowned for its comprehensive engineering, procurement, construction, and installation services. The company excels in delivering large-scale projects, including offshore oil production facilities and subsea pipelines, emphasizing sustainable and efficient solutions. With a strong presence in key energy markets worldwide, McDermott consistently secures major contracts like those with QatarEnergy for mega EPCI projects, demonstrating its capacity and strategic importance in the industry.

Saipem S.p.A. is a prominent Italian company providing integrated engineering, procurement, construction, and installation services primarily for the oil and gas industry. It has a strong track record in handling complex projects, including offshore platforms and subsea pipelines, and it’s actively involved in sustainable energy projects, such as offshore wind and carbon capture solutions. Saipem is recognized for its commitment to innovation and sustainability, aiming to reduce environmental impacts across its operations.

Petrofac, a leading service provider in the Oil and Gas EPC sector, specializes in designing, building, and operating facilities both offshore and onshore. They are renowned for managing extensive energy projects globally, enhancing local execution standards to global ones, which sets them apart in the industry. Committed to sustainable practices, Petrofac integrates energy transition strategies into its projects, aiming to meet the evolving energy demands of its clients while focusing on long-term sustainability and ethical business practices.

Wood plc is a key player in the Oil and Gas EPC sector, known for its robust project management and execution capabilities. The company focuses on complex midstream operations, ensuring energy supply security through sophisticated pipeline systems and advanced infrastructure, which includes hydrogen and carbon capture storage solutions. Wood’s approach combines high-level engineering with a commitment to sustainability and innovation in energy transition projects.

KBR, Inc. is a distinguished global leader in the Oil and Gas EPC sector, noted for its extensive capabilities in managing complex and large-scale projects. The company excels in delivering a wide range of services, including engineering, procurement, construction, and commissioning across various markets such as onshore oil and gas, LNG, and petrochemicals. KBR’s expertise also extends to innovative project solutions like the development of the world’s largest crude oil to chemicals project, demonstrating its commitment to leading-edge technology and sustainable project management. KBR’s operations emphasize safety, reliability, and environmental stewardship, contributing to its reputation as a trusted partner in the energy sector.

NPCC (National Petroleum Construction Company) is a major player in the Oil and Gas EPC sector, primarily known for its comprehensive capabilities in engineering, procurement, and construction. Based in the UAE, NPCC handles significant projects across the Middle East, including complex offshore and onshore developments. Recent activities include key contracts like ADNOC’s Hail & Ghasha project and major pipeline installations, demonstrating its expertise in managing substantial energy infrastructure projects.

Lamprell is a well-established provider in the Oil and Gas EPC sector, focusing on engineering, procurement, construction, and installation services. Since its inception in 1976, Lamprell has successfully completed a wide range of onshore and offshore projects, including complex process modules and living quarters for platforms. The company is noted for its robust capability in constructing and maintaining oil rigs and production facilities, driven by a strong commitment to safety and quality in project delivery.

SNC-Lavalin Group Inc., a major Canadian engineering firm, no longer directly operates in the Oil and Gas EPC sector as its oil and gas division was acquired by Kent, now known as an integrated energy services company. This strategic shift has expanded Kent’s capabilities in energy, chemicals, renewables, and low-carbon industries, positioning it to handle complex technical projects globally.

Worley is a major player in the Oil and Gas EPC sector, distinguished for its comprehensive project capabilities from initial concept through to completion and decommissioning. The company excels in delivering large-scale, complex projects that include engineering, procurement, and construction services across the energy transition and resources sectors. Worley’s global operations focus on integrating innovative technologies and sustainable practices to meet the evolving demands of the energy, chemicals, and resources industries.

Aker Solutions is a significant player in the Oil and Gas EPC sector, specializing in delivering integrated solutions that include engineering, procurement, and construction services. With a focus on facilitating low-carbon oil and gas production, the company also develops renewable energy solutions. Aker Solutions is deeply involved in projects that enhance the sustainability and efficiency of energy production, employing innovative technologies and digital solutions to meet the evolving needs of the global energy industry.

Larsen & Toubro (L&T) is a formidable force in the Oil and Gas EPC sector, recognized for its extensive capabilities in executing complex projects. The company delivers a full spectrum of services from engineering, procurement, and construction (EPC) to project management across the oil and gas industry. With notable expertise in both onshore and offshore projects, L&T is involved in the construction of pipelines, process platforms, and modular fabrication, often integrating advanced engineering and safety practices to enhance project efficiency and quality. Their projects often involve innovative construction techniques and stringent quality controls, positioning them as a leader in the industry.

Hyundai Engineering & Construction Co., Ltd. (Hyundai E&C) is a key player in the Oil and Gas EPC sector, with significant achievements in large-scale projects across the globe, particularly in the Middle East. Recently, Hyundai E&C was awarded a major contract for a petrochemical complex in Saudi Arabia, which includes constructing facilities to produce basic chemicals like ethylene. This project, part of the broader Amiral project co-developed by Aramco and TotalEnergies, underscores Hyundai E&C’s capacity to execute complex EPC projects and bolster its international presence.

Samsung Engineering Co., Ltd. is a prominent figure in the Oil and Gas EPC sector, recognized for its advanced engineering capabilities and project execution. The company has been actively involved in key projects such as the construction of a gas plant in Malaysia and the National EPC Champions initiative with Aramco in Saudi Arabia. These projects underline Samsung’s commitment to technological innovation and its ability to handle complex, large-scale projects. This expertise not only positions Samsung Engineering as a leader in the industry but also highlights its role in supporting local industry development and sustainable practices.

Mott MacDonald is a distinguished global engineering and consultancy firm with over 50 years of experience in the oil and gas sector. The company provides comprehensive solutions from initial concept to commissioning, specializing in a broad spectrum of services including advisory, feasibility studies, front-end engineering design, and project management. Mott MacDonald is renowned for its integrated approach to client challenges, emphasizing safety, innovation, and sustainability to optimize project outcomes across various onshore and offshore environments.

Jacobs Engineering Group Inc. plays a pivotal role in the Oil and Gas EPC sector, offering comprehensive engineering, procurement, and construction services. With a focus on innovative and sustainable project solutions, Jacobs has been involved in significant projects such as the engineering and construction of facilities for Suncor Energy and Oil Search. These projects highlight Jacobs’ expertise in integrating complex systems and delivering projects that meet high environmental and safety standards, helping to advance the energy sector towards more sustainable practices.

Conclusion

The Oil and Gas EPC sector is pivotal for the efficient execution and operation of projects within the industry. Engineering, procurement, and construction companies are central to transforming conceptual designs into fully operational facilities. Through their comprehensive service offerings, EPC firms not only streamline complex processes but also ensure that projects meet stringent safety, environmental, and quality standards while adhering to budgetary and timeline constraints.

As the oil and gas industry continues to face challenges such as fluctuating prices, environmental regulations, and technological advancements, the role of EPC companies becomes increasingly crucial. They not only drive innovation and efficiency but also support the industry’s adaptation to changing energy landscapes. Thus, EPC services will remain indispensable for the development and modernization of global oil and gas infrastructure, ensuring the sector’s growth and sustainability in the long term.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)