Table of Contents

Introduction

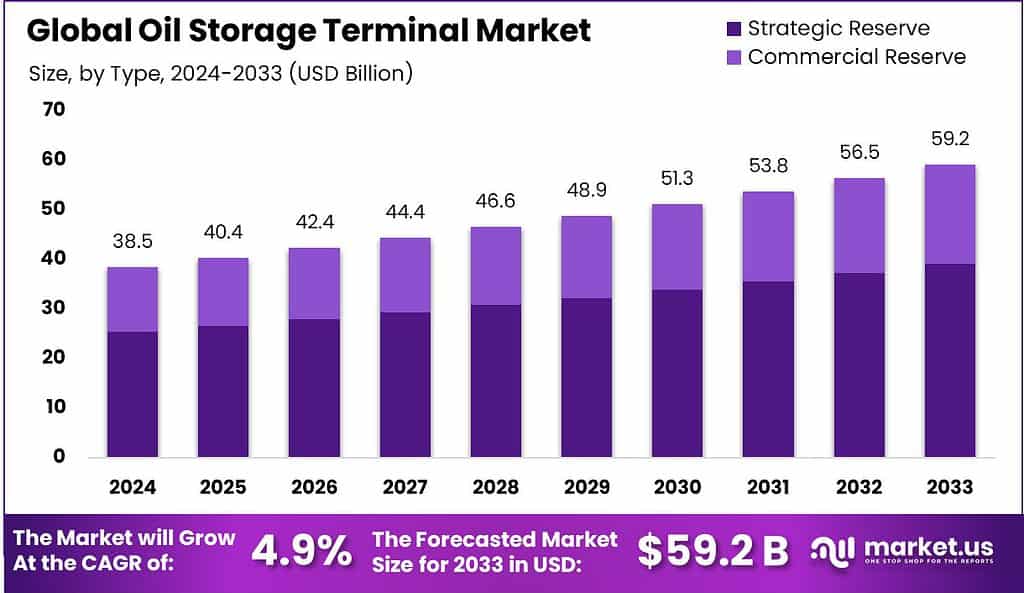

The global Oil Storage Terminal Market is poised for significant growth over the next decade, with projections indicating a rise from USD 38.5 billion in 2023 to USD 59.2 billion by 2033, at a compound annual growth rate (CAGR) of 4.9%. This expansion is fueled by the increasing demand for crude oil products across a variety of industries such as aviation, automobile, and chemicals, which necessitates expanded and more efficient storage solutions. Additionally, strategic reserves are being bolstered in several countries to mitigate the risks of energy shortages amidst global supply chain disruptions, further driving the construction and expansion of oil storage terminals.

However, the market faces notable challenges. The transition towards renewable energy sources and the push for reduced carbon emissions globally threaten traditional oil storage infrastructures. Investments in alternative fuels like hydrogen and electric vehicles, supported by governmental subsidies and extensive R&D, are anticipated to impact the demand for oil storage as these energies typically require different infrastructure.

Recent developments in the sector include technological advancements aimed at improving efficiency and safety. Companies are investing in digital integration and automation technologies for better monitoring and diagnosis of storage facilities. Additionally, significant infrastructure projects like ADNOC’s delayed opening of its crude oil caverns in Fujairah underline ongoing efforts to enhance storage capacities and flexibility in oil trading and logistics.

Brooge Energy Limited has been particularly active, with several strategic expansions. They recently completed their Phase II storage facility, significantly boosting their capacity by adding approximately one million cubic meters or 6.3 million barrels of storage. This expansion positions Brooge as the second largest independent storage operator in the region. The company also announced a feasibility study for a Phase III expansion project, which includes a substantial increase in storage capacity and refining capabilities. This Phase III facility aims to become operational by 2023 and would make Brooge the largest independent oil storage provider in Fujairah, with capabilities including advanced blending, heating, and transfer services.

Buckeye Partners L.P. remains a key player in the market, maintaining a strong presence through its extensive network of pipeline operations and storage facilities. Although specific recent developments were not highlighted in the latest data, Buckeye Partners traditionally engages in strategic acquisitions and infrastructure upgrades to enhance its service offerings in the oil storage sector.

Belco Manufacturing, while less prominently featured in recent specific expansions or technological upgrades, continues to be recognized for its robust manufacturing capabilities in the storage sector. The company plays a crucial role in supplying essential equipment and technologies for oil storage and handling, supporting the infrastructure needs of the broader market.

Key Takeaways

- The Global Oil Storage Terminal Market size is expected to be worth around USD 59.2 Billion by 2033, from USD 38.5 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

- Strategic Reserves dominated the Oil Storage Terminal Market with a 66.5% share.

- Fixed Roof tanks dominated the Oil Storage Terminal Market with a 37.6% share.

- Steel dominated the Oil Storage Terminal Market by material with a 48.8% share.

- Diesel dominated the Oil Storage Terminal Market by Product segment with a 26.4% share.

- Refineries dominated the Oil Storage Terminal Market with a 43.3% share.

- The Asia Pacific dominates the oil storage terminal market with a 42% share, valued at USD 16.2 billion.

Statistics

- statistical relationships between metals and Al were identified using the data distributed within the upper and lower 95% prediction interval.

- Moreover, 98.15% of the 54 sampling sites were enriched by at least one metal; site 36 in Huainan city exhibited the most significant.

- The Huaihe River is located between the Yellow River and the Yangtze River in eastern China, with a basin area of 270,000 km2.

- Moreover, 98.15% of the 54 sampling sites were enriched by at least one metal; site 36 in Huainan city exhibited the most significant.

- Garrels and Thompson (1962) first applied chemical modeling to geochemistry in 25 °C and one atmosphere total pressure.

- For small sample size (average ≤15 observations per group), normality testing methods are less sensitive about non-normality and there is chance to detect normality despite having non-normal data.

- The pay scale of the UPSC Combined Geo-Scientist salary ranges from INR 15,600 to 39,100.

- The grade pay that has been set for the post of UPSC Combined Geo-Scientist according to the 7th Pay Commission is INR 5,400.

- This year, the Commission has released 79 vacancies for the post of Geologist, 5 for Geophysicist, 15 for Chemist, and 3 for Junior Hydrogeologists.

- It has locations in more than 20 countries with largest concentration of terminals in the Netherlands, followed by China and the US. In 2018, Vopak’s revenues lay at €1.25 billion.

- The company rose from Ministry of Petroleum which secured and managed the country’s fuel. It operates oil assets in more than 30 countries, except for the 24 storage terminals (with a total capacity of 25.7Mcbm) which are mainly located in the Chinese homeland.

- Oil terminal utilization is also important. If an oil battery has 300kbbl of storage capacity but only 200k is contracted or used, revenues are a lot lower than they could be with a full storage.

Emerging Trends

- One notable trend is the increasing adoption of automation and digitization. This movement towards technology-driven operations allows terminal operators to enhance operational efficiency, reduce costs, and improve safety by minimizing human error. Technologies such as Internet of Things (IoT) and Artificial Intelligence (AI) are increasingly integrated to enable real-time monitoring of facilities, predictive maintenance, and more efficient inventory management.

- Environmental sustainability is also gaining prominence in the oil storage terminal industry. Market players are investing in renewable energy sources and implementing measures to minimize their carbon footprint. This includes the adoption of eco-friendly practices, such as using equipment that reduces emissions and designing terminals that incorporate green technologies.

- Safety and environmental compliance continue to be critical, driving investments in better risk assessment, mitigation, and emergency response capabilities. Enhanced safety protocols and training programs are being implemented to ensure compliance with regulatory standards and safeguard personnel, assets, and the environment.

- Another emerging trend is the development of resilient and risk mitigation strategies. Terminals are enhancing their resilience against various threats, including natural disasters and geopolitical disruptions, through redundant systems, contingency planning, and diversified supply chains. This is crucial for maintaining continuous operations and securing the infrastructure.

- Furthermore, the shift towards modular design is providing flexibility and scalability, allowing terminals to adjust more readily to market demands and regulatory changes. This approach not only streamlines construction processes but also offers cost savings and risk reduction during project development.

Use Cases

- Strategic Reserves: Oil storage terminals are crucial for maintaining strategic petroleum reserves. These reserves are used by countries to ensure energy security and stabilize supply in case of geopolitical issues or supply disruptions. For instance, the U.S. Strategic Petroleum Reserve is the world’s largest emergency oil store, with vast storage facilities in Louisiana and Texas.

- Blending and Quality Control: Terminals provide facilities for blending different grades of crude oil to meet specific refinery requirements and ensure consistent quality. This blending capability allows for the adjustment of oil properties to optimize refinery operations and meet product specifications.

- Operational Flexibility: Storage terminals offer operational flexibility to oil traders and companies. They enable the scheduling of shipments to optimize transport costs and timing. For instance, terminals at major ports like Rotterdam and Jebel Ali facilitate the global trade of oil by allowing for efficient import, storage, and re-export, tailored to fluctuating market demands.

- Supply Chain Efficiency: Positioned strategically near production sites, transport hubs, or consumption areas, oil storage terminals enhance the efficiency of the oil supply chain. They reduce transportation costs and time, while their connection to pipelines, railways, and ports facilitates the smooth flow of oil products in and out of the facilities.

- Emergency Response and Safety: Storage terminals are equipped with advanced safety and environmental protection measures. They implement rigorous safety protocols, emergency response strategies, and regular maintenance routines to manage risks associated with oil storage, including spills and fire hazards.

- Market Balancing: By allowing for the temporary storage of surplus production, terminals help in balancing oil markets. They can store oil when supply exceeds demand, and release it when the situation reverses, thus helping to stabilize prices.

- Technological Integration: Modern terminals increasingly employ advanced technologies such as automation, real-time monitoring systems, and digital platforms to enhance operational efficiency, safety, and regulatory compliance. These technologies also support environmental sustainability by improving energy efficiency and reducing emissions.

Major Challenges

- Regulatory Compliance: As regulations around safety and environmental protection become more stringent, oil storage terminals must invest heavily in compliance measures. This includes enhancing safety protocols, emergency response capabilities, and environmental protection measures to meet higher standards set by governmental bodies.

- Technological Integration: Adapting to new technologies is essential for improving efficiency and reducing operational costs. However, integrating these technologies into existing infrastructure requires significant investment and expertise. Advanced monitoring systems, remote control technologies, and automated processes are becoming increasingly important for optimizing operations and ensuring compliance.

- Economic Uncertainty: Fluctuations in oil prices and market demand pose financial risks. These uncertainties can affect investment decisions and the financial sustainability of storage operations. Terminals need to be adept at navigating these changes to maintain profitability and operational viability.

- Sustainability and Environmental Challenges: With growing concerns about climate change and environmental sustainability, terminals are pressured to reduce emissions and adopt cleaner technologies. This includes managing emissions and implementing measures to minimize environmental impacts.

- Security Risks: Cybersecurity is a growing concern, with terminals increasingly reliant on digital technologies for operational management. Ensuring robust cybersecurity measures to protect against potential attacks is critical.

- Natural Disaster Resilience: Terminals must also enhance their resilience against natural disasters like earthquakes and storms, which can cause significant damage to facilities and disrupt operations. Investing in disaster preparedness and robust infrastructure is key to mitigating these risks.

Top Opportunities

- Increased Global Demand: There’s an increasing demand for oil storage capacities globally, particularly in response to fluctuations in oil production and consumption rates. This demand is facilitated by the expansion of infrastructure in both emerging and developed economies, enhancing the need for robust storage solutions to support the complex logistics of oil distribution.

- Strategic Geographic Expansion: Significant market growth opportunities are present in regions like North America and the Asia-Pacific, where there’s a strategic focus on enhancing oil storage capabilities. For example, in the U.S., major projects are underway, such as the NOLA Oil Terminal in Louisiana, which reflects a substantial investment in expanding storage infrastructure.

- Technological Advancements: The adoption of automation and digitization is set to improve operational efficiencies and reduce costs in oil storage terminal operations. This includes advancements in tank design, monitoring systems, and automated operations that streamline processes and enhance safety and environmental compliance.

- Sustainability and Regulatory Compliance: There is a rising focus on integrating environmentally sustainable practices within terminal operations. This includes adopting technologies that minimize emissions and enhance energy efficiency, aligning with global environmental regulations.

- Investment in Infrastructure: The market is witnessing significant investment in the construction of new terminals and the expansion of existing facilities. This expansion is not only due to the need for additional capacity but also due to the strategic importance of creating highly efficient and technologically advanced storage solutions that can handle diverse types of crude and refined products.

Key Players

Actlabs Group has been a significant player in the geochemical services sector since its founding in 1987. The company has expanded its reach globally, with 15 laboratories across six countries, including Canada, Mexico, Colombia, Guyana, Burkina Faso, and Namibia. In 2023, Actlabs Group continued to offer a wide range of analytical geochemical services tailored for the mining industry. They provide essential services like sample preparation, fire assay, and various elemental analysis methods, ensuring high-quality results with excellent turnaround times.

ALS Limited, another major entity in the geochemical services market, delivers comprehensive analytical services across various industries. Their geochemical services include sophisticated testing and analysis critical for mining, environmental studies, and other industrial applications. ALS is known for its commitment to high standards and reliability, helping clients globally to make informed decisions based on accurate geochemical data.

Bureau Veritas Group has established itself as a key player in the geochemical services sector by offering a broad range of analytical packages tailored for exploration and mine site development needs. In 2023, the company emphasized its capacity in traditional Fire Assay, XRF fusion technology, and multi-element ICP-OES and ICP-MS techniques. Their global presence, supported by cutting-edge technologies, helps meet the low detection levels required for exploratory geochemistry, thus reinforcing their market leadership.

Capital Limited has not been specifically detailed in recent reports for their activities within the geochemical services sector for the years 2023 or 2024. For accurate and up-to-date information regarding their involvement and services in this area, I recommend consulting directly with company resources or specific industry reports that focus on their contributions to the geochemical services market.

Chinook Consulting Services Ltd. has significantly contributed to the geochemical services sector, particularly by offering comprehensive geological services tailored to upstream oil and gas operations. In 2023, they have expanded their geochemical analyses capabilities, incorporating advanced technologies like XRD, XRF, and FTIR for detailed examination of drill cuttings and core samples. These services are crucial in exploratory and appraisal stages, especially in unconventional resource plays, and aid significantly in field and reservoir evaluation, as well as in drilling and completions optimization.

For Enviros, there’s limited specific data from 2023 or 2024 detailing their direct involvement in the geochemical services sector available in the resources I accessed. For the most accurate and detailed information about Enviros’ current offerings and projects in geochemical services, contacting the company directly or accessing specialized industry reports would provide the best insights.

FLSmidth has made significant strides in the geochemical services sector in 2023, emphasizing its advanced analytical capabilities to support the mining industry. The company focuses on providing high-quality, precise geochemical analyses utilizing state-of-the-art analytical instrumentation, which has proven essential for optimizing mining operations and project development. FLSmidth’s analytical services include fire assay, carbon and sulfur analysis, and various instrumental finishes like ICP-OES, which are crucial for detailed mineralogical characterizations. This has contributed to a solid financial performance with an adjusted Mining EBITA margin of 10.8% in 2023, reflecting stable market conditions and successful integration of new mining technologies.

Fugro, on the other hand, offers specialized geochemical services focusing on providing detailed earth and material characterization to support complex infrastructure and development projects. While specific details for 2023 are not directly cited, Fugro’s historical emphasis on integrating geotechnical and geochemical data analysis to support engineering design and risk assessment likely continued through this period. Their work typically involves advanced onsite testing and analysis, contributing to sustainable and resilient project outcomes.

Intertek Group plc made notable strides in the geochemical services sector in 2023, solidifying its position in a market valued at around USD 1.15 billion. The company is recognized for its comprehensive geochemical services, including sample preparation and proficiency testing, essential for mineral exploration and environmental assessments. Intertek’s services are pivotal in providing detailed chemical analyses crucial for industries requiring rigorous environmental and quality standards. The firm’s expertise in handling diverse sample types enhances its efficiency and precision in geochemical analysis, catering to sectors like mining, environmental monitoring, and industrial manufacturing.

Fugro also continues to excel in providing geochemical services, leveraging its advanced analytical capabilities to support complex projects across various industries. The company specializes in in-field and laboratory-based geochemical services, offering detailed assessments of soil, water, and rock samples. Fugro’s work is vital in sectors such as oil and gas, where precise geochemical data are crucial for exploration and environmental monitoring. The firm’s commitment to integrating the latest technological advancements in its services ensures high-quality data that aid clients in making informed decisions regarding resource development and environmental management.

Schlumberger Limited continues to demonstrate robust capabilities in the geochemical services sector, particularly in 2023. The company has been focusing on integrating advanced analytical technologies to optimize the exploration and production of oil and gas. This integration allows for more precise geochemical analysis, crucial for identifying and evaluating potential hydrocarbon reservoirs. Schlumberger’s commitment to enhancing geochemical data quality not only supports its core oil and gas operations but also expands its utility in environmental monitoring and other industrial applications.

SGS SA had a strong performance in the geochemical services market in 2023, with a notable increase in its service capabilities and market reach. The company provides comprehensive geochemical analysis across a wide spectrum of industries, including minerals and mining, environmental science, and oil and gas. In 2023, SGS enhanced its analytical services by incorporating more advanced technologies, which allow for faster and more accurate geochemical assessments. This enhancement is part of SGS’s broader strategy to support sustainable and efficient resource development and compliance with environmental standards.

Shiva Analyticals & Testing Laboratories India has continued to strengthen its presence in the geochemical services sector in 2023 by providing comprehensive analytical testing solutions across a variety of industries, including pharmaceuticals, food and agriculture, and environmental sectors. Their services, leveraging a state-of-the-art laboratory in Bangalore, cater to detailed material, ores, and minerals testing. The lab is known for its rigorous adherence to quality standards and regulatory compliance, making it a trusted partner for businesses needing precise and reliable geochemical analysis.

Geochemic Ltd., details about their activities in 2023 or 2024 specifically in the geochemical services sector were not found in the available sources. For current and detailed information about their services and projects, direct contact with the company or accessing up-to-date industry reports would provide the best insights.

Conclusion

In conclusion, the oil storage terminal market is poised for robust growth, driven by increasing global energy demands and strategic industry shifts. With significant investments flowing into infrastructure enhancements and technological advancements, the sector is set to improve operational efficiencies and expand capacity. Furthermore, the push towards sustainability and compliance with tightening environmental regulations are shaping the operational strategies of these facilities.

As the market evolves, key players will need to adapt to these changes, leveraging advanced technologies and innovative practices to stay competitive and meet the complex requirements of the global energy supply chain. This dynamic landscape presents both challenges and substantial opportunities for growth and innovation within the oil storage terminal industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)